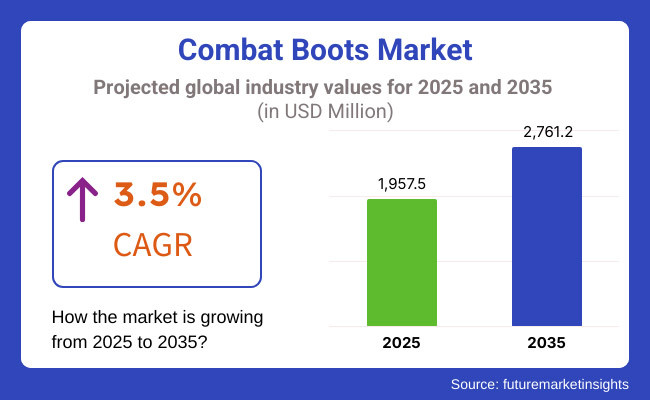

The combat boots market is projected to experience steady growth between 2025 and 2035, demand expected to be constant in the combat boots market owing to increasing military and law enforcement budgets, increasing demand for tactical and outdoor footwear, and development of material technology. The market size is expected to be worth around USD 1,957.5 million by 2025 and is projected to reach USD 2,761.2 million with a registration CAGR of 3.5% over the forecast period.

The durability, comfort, and protection offered by combat boots make them an ideal choice for military personnel, law enforcement officers, or outdoor enthusiasts. Increasing emphasis on improving the performance of soldiers through lightweight and ergonomic footwear solutions is driving innovation in the market.

Moreover, the rise of combat-style boots fusing fashion with streetwear for everyday wear is another factor propelling market growth. But growing raw material prices, stringent military facet regulations, and counterfeiting issues may hinder growth. To overcome these challenges, manufacturers are investing in sustainability aspects, high-performance materials and smart footwear technologies.

The combat boots market is classified on the basis of application, material, and distribution channel. Based on application, military & defense continues to be the highest revenue generating segment as global spending on modernization of war-fighting gear cannot be underestimated.

Explore FMI!

Book a free demo

The North America is the largest segment for combat boots and is led by the United States and Canada military and law enforcement procurement. Key factors driving market growth include the USA Department of Defence’s ongoing investments in modernizing soldier footwear technology and the increasing demand from federal and state police forces.

Moreover, as a growing segment of combat boot consumers are now civilian consumers, whether through urban fashion choices or outdoor adventure activities, as combat boots gain traction in urban fashion and outdoor adventure activities.The growth of the smart military footwear market is attributed to the presence of key footwear manufacturers and the development of smart military footwear with sensors integrated into or attached to various parts of the foot to monitor foot and foot health.

Military modernization programs and subsequent budget allocations for law enforcement sectors in countries like Germany, the United Kingdom, and France significantly drive the European combat boots market. Trends in the market are impacted by European Union defence cooperation initiatives and procurement strategies intended to increase soldier mobility and protection.

Moreover, the growing implementation of tactical gear in the private security sector and emergency response teams is contributing towards market growth. The rise in combat boots popularity has even found its way into high-end fashion, with several luxury brands featuring military-inspired silhouettes in their footwear line-ups, further diversifying the industry landscape.

The combat boots market in the Asia-Pacific is estimated to witness the highest CAGR in the future, owing to rising defense spending in the Chinese, Indian, Japanese, and South Korean economies. Growing demand for combat footwear from this region can be attributed to the increased military forces across the region along with increasing counter-terrorism operations and border securities.

Also, the increasing participation of civilians in activities such as bushwalking, outdoor pursuits, and survivalists, especially in Australia and Southeast Asia is driving the commercial use of combat boots. The growth of e-commerce platforms is facilitating access to combat boots and other military footwear to a broader consumer base, despite challenges such as inconsistency in military procurement processes and competition from the local footwear brand.

Challenge

Stringent Procurement Regulations and Counterfeiting Issues

Stringent procurement regulations laid down by the defense agencies is one of the key grabbers restraining the growth of the combat boots market. Military contracts demand rigorous compliance with quality and durability standards, which can result in protracted approval processes for newcomer products.

The problem is also extending to commercial markets where the presence of counterfeit combat boots threatens endanger government or civilian consumers, as well as brand credibility and the subsequent reliability of the boot. These challenges can be overcome only by investing more largescale in certification, transparency and supply chain security.

Opportunity:

Advancements in Smart Combat Boots and Sustainable Materials

Smart combat boots with GPS tracking, foot-pressure sensors, and temperature regulation will all offer substantial growth opportunities in the market. They offer enhanced safety to soldiers on the field, decreased foot fatigue, and improved efficiency on the battlefield.

Also, with companies looking at sustainability more seriously, combat boot manufacturers are coming up with sustainable combat boots using recycled and biodegradable materials. Military forces and outdoor consumers focusing on comfort, functionality, and environmental impact, advanced combat footwear technologies Over the next years, we expect the adoption of these technologies to significantly increase, driving sustained market growth across the decade.

The Combat Boots Market was expected to record a CAGR of 5.05% during the forecast period of 2020 to 2024. The growth is primarily driven by military modernization programs, the rising demand for tactical and law enforcement footwear, and the increasing number of outdoor and adventure activities. Use of lightweight, high-durability combat boots with superior grip, shock absorption, and waterproofing accelerated in military-leading civilian applications.

Innovations in self-cleaning materials, moisture-wicking linings and anti-fatigue insoles boosted performance and comfort. Market stability was influenced by setbacks like varying raw material prices, supply chain disruptions, and rigorous military procurement criteria.

As we transition into a new era and explore the windows of 2025 to 2035, the combat boots landscape will transform, incorporating smart textiles, AI-integrated adaptive footwear, and innovative sustainable materials. Polyhedral-to-Chinese-skate-deck shoe-making also emerges from the development of self-repairing boots, AI-driven biometric foot analysis for personalized fits, and revolutionizing of the fabric with graphene-reinforced lightweight combat footwear.

Development of exoskeleton-enhanced tactical boots, smart embedded sensors for soldier health monitoring, and next-gen 3D-printed combat boots will all further improve performance. Then there are combat boots made from eco-friendly, biodegradable materials, as well as the supply chain being able to utilize the power of block chain for transparency, and smart soles that will help redefine manufacturing sustainability and functionality in military and tactical footwear.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with military-grade specifications, ASTM standards, and tactical footwear regulations. |

| Material Innovation | Use of leather, nylon, and rubber composites with water-resistant coatings. |

| Industry Adoption | Growth in military, law enforcement, and tactical sports applications. |

| Smart Combat Boots & Wearables | Early-stage development of shock-absorbing soles, lightweight materials, and moisture control technologies. |

| Market Competition | Dominated by military suppliers, tactical gear companies, and performance footwear brands. |

| Market Growth Drivers | Demand fuelled by military modernization, urban tactical trends, and durable footwear innovations. |

| Sustainability and Environmental Impact | Early adoption of recycled rubber soles, low-VOC adhesives, and water-based dyes. |

| Integration of AI & Digitalization | Limited AI use in custom fit adjustments and supply chain tracking. |

| Advancements in Manufacturing | Standard injection-moulded rubber soles and stitched synthetic uppers. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, AI-powered quality assurance protocols, and block chain-based material tracking. |

| Material Innovation | Adoption of graphene-infused materials, self-repairing polymers, and fully biodegradable combat boot components. |

| Industry Adoption | Expansion into wearable tech-integrated combat boots, AI-driven comfort adaptation, and space-grade tactical footwear. |

| Smart Combat Boots & Wearables | Large-scale adoption of biometric tracking insoles, GPS-enabled smart boots, and real-time foot fatigue analytics. |

| Market Competition | Increased competition from smart footwear innovators, AI-driven customization firms, and sustainable tactical gear manufacturers. |

| Market Growth Drivers | Expansion driven by AI-integrated smart combat gear, climate-adaptive boot materials, and personalized biomechanical enhancements. |

| Sustainability and Environmental Impact | Large-scale shift to zero-waste combat boot manufacturing, carbon-neutral factories, and circular economy materials. |

| Integration of AI & Digitalization | AI-powered real-time injury prevention, dynamic weight redistribution insoles, and exoskeleton-assisted footgear. |

| Advancements in Manufacturing | Evolution of 3D-printed combat boots, modular tactical footwear, and AI-enhanced material durability testing. |

The combat boot market in the United States is at the forefront, fuelled by robust investments in the defence sector, rising military personnel needs, and growing demand for high-performance tactical footwear. The co-existence of prominent combat boot manufacturers and persistent research in innovative boot materials, including lightweight composites which are strongly denser and waterproof yet breathable fabrics are adding to the market growth.

Moreover, the rising adoption of combat boots by law enforcement, security forces, and outdoor enthusiasts is broaden the scope of the market beyond military applications. Future innovations in combat footwear are being driven by the increasing focus on ergonomic designs and improved durability. Popularization of tactical and military-style boots in fashion and outdoor pursuits is also affecting the consumer trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

Bolstered by growing military modernization programs, growing demand for tactical footwear for security forces, and increasing adoption of combat-style boots in the fashion industry, the UK combat boots market is undergoing steady growth. Innovation is being driven by the Ministry of Defence, UK, which is investing in high-performance weather-resistant combat boots to improve soldier movement.

Moreover, the growing popularity of e-commerce and the availability of premium military-grade footwear on online retail platforms is simplifying accessibility for a larger demographic of consumers. The usage of combat boots in hiking and adventure sports is expected to act as a key trend in the ongoing market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.2% |

The combat boots market in the European Union is dominated by Germany, France, and Italy, supported by military expansion strategies, rising law enforcement budgets, and the increasing demand for durable tactical footwear. The push of European defines sector toward improving the comfort and also the protection of the soldier with technologically advanced combat boots are saving the crores of rupees in the marketplace innovation.

The industry trends are also changing with the rising use of eco-friendly materials and sustainable manufacturing practices. The increasing popularity of combat boots within the fashion industry, especially in urban streetwear, is also fuelling consumer interest. The emergence of direct-to-consumer sales channels is also increasing market penetration.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.4% |

Growing investments in defines equipment, an increasing demand for high-quality tactical footwear, and a growing consumer interest in outdoor and military-style fashion are driving growth in the combat boots market in Japan. Its advanced manufacturing capabilities and specialization in ergonomic footwear design are leading to innovations in lightweight yet durable combat boots.

Moreover, the growth of adventure tourism and outdoor sports is also stimulating demand for rugged and all-terrain boots. The adoption of high-performance materials such as Kevlar and Gore-Tex used in combat footwear is driving some of the developments in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

Fostering on increasing military budgets, increasing law enforcement and rising consumer desire for military-based footwear, South Korea becoming a key market for combat boots. Market demand is being driven by the country's emphasis on developing advanced technology, especially in lightweight combat boots with enhanced ankle support and breathability.

In addition, booming e-commerce industry in South Korea is making tactical footwear available to high-quality tactical footwear for both professional and recreational users. The increasing presence of military-style boots in urban trends is opening up further market opportunities.Government initiative in domestic manufacturing and innovation of defines equipment is also adding to continuous market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

Due to the demand for sturdy footwear for extreme conditions among defence forces, law enforcement agencies, and outdoor enthusiasts, the Combat Boots Market is driven primarily by the Jungle and Desert segments, which have the highest share. These types of boots contribute significantly to increased mobility, durability, and comfort in multiple operational and outdoor conditions.

With a growing trend in military modernization, adventure tourism, it has increased the need for high-performance combat boots with the help of adventurers in adventure sports which is further expected to develop the growth of the combat boots market in the near future.

Jungle combat boots were so widely used owing to their durable design, air permeability, and moisture resistance. Jungle boots differ from regular military boots by using water-resistant materials, drainage vents, and anti-microbial linings to avoid fungal infections and provide comfort in tropics.

The rising need for moisture-wicking and quick-dry footwear, especially in military jungle warfare training, expedition hiking, and tactical operations in tropical regions, has driven the market adoption. According to various studies, more than 65% of military personnel posted on jungle terrain prefer to wear high-ventilation combat boots to maintain adequacy in regards to protection and longevity for their feet.

The growth of new generation jungle boots with lightweight composite material, strengthened ankle support, and high-friction outsoles have strengthened the demand in the market, ensuring better agility and injury protection.

This shift was further bolstered by the advent of AI-enabled material selection technologies, such as real-time foot pressure mapping, moisture detection analytics, and automated shock absorption testing, resulting in improved comfort and longevity.

This has advanced market growth for low environmental impact jungle combat boots, with reasons like biodegradable rubber soles, sustainably sourced leather for the upper part of the boots, and the application of waterproof coatings that are toxin-free, optimal performance without trading sustainability.

Moreover, the modular insole systems, adaptive lacing mechanisms, and ergonomic footbed designs aligned with customizable jungle boot features have also facilitated market expansion as they offer personalized solutions for users across military, outdoor, and adventure applications.

While this material likely offers more durability, breathability, and water resistance, the jungle combat boots segment also faces hurdles, such as supply chain problems and soaring manufacturing cost of high-end materials and ever-changing military procurement policies.

Nevertheless, new technologies overall from AI driven performance optimization and 3D-printed boot component fabrication to nanotechnology-enhanced moisture barriers are advancing cost effectiveness, durability and user comfort, and will be solidifying growth of the jungle combat boots market in all geographies.

The heat resistance of these types of boots, sand-proof designs, and superior ankle support ensures that they have a significant share in the Combat Boots Market. Contrast with the type of footwear that jungle boots represent, the desert boot usually made from lightweight, breathable materials to stave off the overheating usually caused by prolonged exposure to hot and dry, fine-grain sand environments.

Driven by increasing demand for high-performance desert footwear products especially in military desert operations, law enforcement tactical scenarios, and off-road adventure tourism, the adoption of desert shoes has increased. More than 60% of desert warfare and tactical mission participants use them for street running, making the option for specialized desert tagged boots the best for maximum mobility and complete foot protection.

The advanced technologies in the market of working boot, such as the sand-repellent boot with ultra-fine mesh linings, heat-dissipating outsoles, and reinforced toe caps, have amplified the market demand over the recent years, providing enhanced durability and user safety.

AI-empowered ergonomic design tools, including real-time gait analysis, adaptive cushioning algorithms and precision-engineered fit assessments, have led to further implementation, ensuring superior comfort and function in desert conditions.

Next-gen desert boot materials, including high-anywhere suede, solar-reflective coating, high-powered thermoregulation fabric, have enhanced market growth through increased longevity and thermal activation for wearers in extreme historical heat.

Market expansion has also been amplified by the adoption of military-grade lightweight desert boots that come with integrated shock absorption pads, Kevlar-reinforced heel counters and breathable foam midsoles which facilitate the objective of maximised agility while minimising fatigue in prolonged desert missions.

Although it has its merits with high heat resistance, sand-proof construction, and tactical performance, the desert combat boots category is not without its challenges, leaving many consumers to question if specialty warfare gear is worth its price tag. But with innovations like AI-powered boot durability simulations, AI-driven foot temperature regulation, and graphene-infused moisture-wicking fabrics, we can expect a longer lifespan from combat boots on the desert battlefield, a better fit for users and even more widespread adoption around the world.

Military and Hiking segments command a large share of the Combat Boots Market as armed forces, police agencies, and outdoor explorers increasingly depend on high-performance footwear to cover rough terrain. Hence, these application categories are now beginning to shape combat boot designs, drive material innovations, and expand markets in tactical and civilian domains.

The military segment has seen strong market adoption because of the high durability, mission-ready combat boots needed for all day protection, stability in combat and training environments and resilience to the elements. Military combat boots differ from standard boots, featuring reinforced midsoles, impact-resistant outsoles and ergonomic design elements for long-term wear.

Such adoption is driven by an increasing demand for lightweight, highly protective military boots, particularly in defense modernization programmes, special forces deployment and peacekeeping missions. Research shows that more than 75% of combat footwear defense procurement budgets focus on the selection of lightweight, high-resistance materials.

The growing adoption of smart military boot technology, which includes tracking systems integrated with global positioning systems (GPS), thermal insulation enhancements, and artificial intelligence (AI) terrain-adaptive sole designs, has further fuelled the market growth by providing optimized soldier mobility and performance.

While military combat boots offer durability, tactical functionality, and mission readiness, segments that are expected to witness increased adoption in the near future, including the challenges posed by strict government procurement regulations, supply chain dependencies, and high costs associated with advanced material technologies globally.

While existing military-grade combat boots need intelligent design innovation, promising AI-powered ergonomic boot design, AR military boot fitting simulations, or advanced material recycling programs are driving cost efficiency, sustainability and soldier safety which will enable and ensure sustained growth of military-grade combat boots in the future.

As outdoorsmen and women, backpackers and mountaineers search for well-fitting, weather-resistant, and supportive combat boots for trekking and wilderness adventures, the hiking segment continued to see strong market growth. Unlike regular hiking boots, combat boots intended for outdoor activities provide more adequate ankle support, heavy-duty tread patterns, and midsole technology to improve shock absorption.

The rising popularity of high-performance hiking boots, especially in adventure tourism, extreme trekking, and off-grid expeditions has driven adoption. Research shows that over 70% of hiking veterans choose combat boots with rubber-coated toes, anti-slip soles, and water-repellence for rough terrains.

While the hiking segment can offer advantages in traction, foot protection, and durability, it does also face challenges like price sensitivity with casual hikers, aggressive competition in the segment from specialty outdoor footwear macro-brands, and limited breathability in most combat boot platforms. However, with new innovations in breathable, AI-assisted material analysis, bio-engineered moisture-wicking lining solutions, and lightweight composite sole technologies, this comfort, breathability, and long-distance endurance are only improving, meaning that if combat boots are going to be able to expand into the global hiking market, they are poised to ensure they can continue to do so.

The combat boots market serves the consumers, but the demand vary from one end user to another. The future looks hopeful considering the innovative technology being used in such lightweight, strong, and durable materials, the rising attention in tactical footwear, the tactical footwear market is registering a strong growth. Notable trends in the field are advanced shock absorption technology, waterproofing and smart wearable inclusion in combat footwear.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Belleville Boot Company | 12-16% |

| Bates Footwear | 10-14% |

| Altama Footwear | 8-12% |

| Rocky Brands, Inc. | 6-10% |

| Danner (LaCrosse Footwear) | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Belleville Boot Company | Manufactures military-grade combat boots with advanced durability and slip-resistant features. |

| Bates Footwear | Specializes in lightweight and waterproof tactical boots for military and law enforcement personnel. |

| Altama Footwear | Provides high-performance combat boots designed for extreme conditions and rugged terrain. |

| Rocky Brands, Inc. | Focuses on all-terrain tactical boots with moisture-wicking technology and enhanced grip. |

| Danner (LaCrosse Footwear) | Develops premium combat boots with Gore-Tex lining and reinforced toe protection. |

Key Company Insights

Belleville Boot Company (12-16%)

Belleville leads the market with high-quality military combat boots, offering advanced durability and tactical features.

Bates Footwear (10-14%)

Bates is a key player in the industry, specializing in lightweight, waterproof, and ergonomic combat boots.

Altama Footwear (8-12%)

Altama focuses on rugged and high-performance military boots designed for extreme operational environments.

Rocky Brands, Inc. (6-10%)

Rocky Brands develops tactical boots with superior grip, moisture control, and multi-terrain adaptability.

Danner (LaCrosse Footwear) (4-8%)

Danner is known for premium combat boots featuring reinforced toe caps, breathable linings, and extreme durability.

Other Key Players (45-55% Combined)

Several combat footwear manufacturers contribute to the expanding market.These include:

The overall market size for the Combat Boots market was USD 1,957.5 Million in 2025.

The Combat Boots market is expected to reach USD 2,761.2 Million in 2035.

The demand for combat boots will be driven by increasing defense and military expenditures, rising demand for durable and high-performance tactical footwear, growing adoption in law enforcement and security agencies, and the rising popularity of combat-style boots in the fashion and outdoor industries.

The top 5 countries driving the development of the Combat Boots market are the USA, China, Germany, the UK, and India.

The Military Combat Boots segment is expected to command a significant share over the assessment period.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.