Color foodstuff is a natural alternative to artificial color dye, which is basically extracted from different plants and vegetables, herbs, fruit, spices shot more healthy & sustainable option than synthetic color dyes. Consumer scrutiny around what we eat continues to be prevalent, which means the demand for natural colours suitable for a variety of regulations and industry certifications continues to grow. Applications of coloring foodstuffs includes beverages, dairy, confectionery, baked goods, snacks and processed foods.

Besides being visually appealing,many of these natural colorants have additional health benefits, making them even more attractive to health-conscious consumers. Because of continuing developments in extraction technologies, stabilization methods, and a wider range of hues, the coloring foodstuffs market will continue to grow steadily up to 2035, industry experts say.

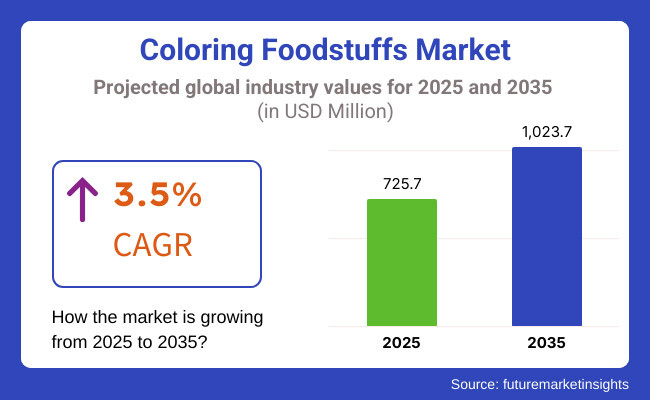

The global coloring foodstuffs market was valued at estimated USD 725.7 Million in 2025. The market is expected to grow at a compound annual growth rate (CAGR) of 3.5 % reaching approximately USD 1,023.7 Million by 2035. The growth is primarily attributed to the rising consumer demand for natural and transparent food labeling, and growing application areas for coloring foodstuffs.

Explore FMI!

Book a free demo

North America is a key market, with a developed food and beverage sector and an increasing focus on clean-label products. Consumer awareness of the advantages of natural colors has especially increased in the United States, which has driven manufacturers to utilize coloring foodstuffs in a range of products. Regulatory pressures and the move away from synthetic dyes in this region are also driving this demand.

Another important market is Europe, as it benefits from strict regulatory frameworks, a long standing tradition of using natural ingredients, and high consumer interest in sustainable and healthy food choices. Germany, France and Italy leads the revolution with new technologies in coloring of foodstuffs with a variety of natural color solutions for domestic and exports.

Asia-Pacific is anticipating the fastest growth in the coloring foodstuffs market owing to rapid urbanization, growing disposable incomes, and an expanding middle class. Consumer preference for healthy and natural food products is driving the demand for natural colors in countries such as China, India, and Japan. The coloring foodstuffs in the region is expected to represent a major increase in absorption in the following decade, propelled by the region's growing food processing industry and the rising orbit of worldwide health fads.

Challenges

Regulatory Compliance, Stability Issues, and High Production Costs

Global food safety regulations implemented by FDA (food and drug administration), EFSA (European food safety authority) and FSSAI (Food Safety and Standards Authority of India) can limit the growth of the coloring foodstuffs market. Given that consumers are moving away from synthetic food dyes, manufacturers want to make sure that, natural food colorants pass through the clean-label, allergen-testing and organic certification protocols.

Other important aspects are color stability; natural food colors (from fruits, vegetables, and plant extracts) are sensitive to heat, changes in pH, and oxidation and determine the shelf life and appearance of products. Besides, seasonal variation in the availability of the raw material, complexity in extraction, and the refinement to obtain the desired purity arises high production costs for the natural coloring foodstuffs compared to synthetic ones.

Opportunities

Growth in Clean-Label Trends, Functional Food Applications, and Plant-Based Innovations

Despite these challenges, the coloring foodstuffs market features tremendous growth prospects, primarily owing to the increasing demand for clean-label, plant-based, and functional food ingredients. Consumers are gravitating increasingly toward natural colorants instead of artificial dyes, especially in confectionery, dairy, beverages and plant-based meat alternatives.

Bohra points out that advances in microencapsulation and bioengineered pigments as well as even artificial intelligence-assisted color stabilization techniques are improving color longevity and solubility and increasing the competitiveness of natural colorants. The increased supply of vegan, organic, and fortified products assists the market expansion, also the advancements in superfood-based colors such as spirulina, beetroot, turmeric, and anthocyanins higher are contributing.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with clean-label requirements, organic certifications, and synthetic color bans. |

| Consumer Trends | Demand for natural, plant-based, and minimally processed food colorants. |

| Industry Adoption | High use in beverages, confectionery, and processed foods. |

| Supply Chain and Sourcing | Dependence on seasonal plant extracts and fruit-based colorants. |

| Market Competition | Dominated by traditional food colorant suppliers and natural ingredient manufacturers. |

| Market Growth Drivers | Growth fueled by clean-label consumer demand, rising plant-based food production, and regulatory bans on synthetic dyes. |

| Sustainability and Environmental Impact | Moderate adoption of organic and non-GMO color sourcing. |

| Integration of Smart Technologies | Early-stage use of microencapsulation for improved stability and color retention. |

| Advancements in Food Science | Development of heat-stable and pH-resistant natural food colors. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter traceability standards, sustainability mandates, and transparency in color sourcing. |

| Consumer Trends | Growth in bioengineered, functional, and AI-optimized food colors for personalized nutrition. |

| Industry Adoption | Expansion into alternative protein colorants, functional beverages, and bio-enhanced food pigments. |

| Supply Chain and Sourcing | Shift toward lab-grown natural pigments, sustainable algae-based colors, and vertical farming solutions. |

| Market Competition | Entry of biotech firms, AI-driven food science companies, and precision fermentation startups. |

| Market Growth Drivers | Accelerated by AI-based color optimization, next-gen bioengineered food pigments, and high-performance color stability solutions. |

| Sustainability and Environmental Impact | Large-scale adoption of carbon-neutral color production, regenerative agriculture for raw materials, and eco-friendly extraction methods. |

| Integration of Smart Technologies | Expansion into AI-driven natural pigment extraction, IoT-enabled quality control in food coloring, and smart supply chain tracking. |

| Advancements in Food Science | Evolution toward precision-fermented, cell-cultured, and adaptive color-changing food pigments. |

The USA market for the coloring foodstuffs is expanding at a moderate rate, poised to grow further in the coming years as the demand for natural and plant-based food colors continue to increase among consumers. A move away from synthetic additives and regulatory support for clean-label products are spurring market growth. Increasing adoption of natural colorants across the bakery, confectionery, and beverage industries is supporting growth further, with leading players investing in innovative extraction techniques to deliver stable and bright natural colors.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.6% |

The coloring foodstuffs market is growing in the United Kingdom region, as food manufacturers are switching to natural and organic ingredients, which is expected to meet the growing consumer preference.The market is witnessing growth because of the enforcement of stringent food safety regulations and the growing demand for allergy-free and non-GMO colorants. Moreover, the rising trend for plant-based and functional food will also hike the demand for natural color solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

The coloring foodstuffs market in the EU region is anticipated to grow steadily owing to stringent regulations on the artificial food colorants along with high consumer preference for clean-label products. The growing utilization of natural pigments ranging from fruits, vegetables, and spices in food and beverage formulations is auguring well for the market. The use of innovative microencapsulation and extraction techniques also increases the stability and shelf life of natural food colors, further driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.5% |

The demand for coloring foodstuffs in Japan is relatively slower compared to other regions, but the food industry in Japan has been focusing on the quality and safety of food products. Market growth is driven by the increasing demand for traditional and naturally colored food products, especially in applications such as confectionery, dairy and beverages. Meanwhile, new developments in food science and natural extraction techniques come to enhance the color stability of plant-derived foodstuffs, resulting in sustainable growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

The increasing inclination among users towards healthier and natural food ingredients is one of the key driving factors of the Coloring Foodstuffs industry in South Korea. Demand is also driven by the increasing use of natural colorants in K-beauty-inspired functional beverages, dairy and confectionery. The market is also being driven by efforts from the government to promote clean-label food innovations and a rapid shift towards plant-based diets across the globe.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

The Coloring Foodstuffs market is projected to grow not only due to the demand from End-use industries but also due to consumer preference over synthetic dyes and food colorants towards natural and plant-based food colorants.

Concerns about food safety, demand for clean-label transparent products, and harsh regulations on artificial colorants have prompted various industries such as bakery, confectionery, dairy, beverages, and processed foods to adopt fruit and vegetable-derived coloring ingredients. On the basis of Form, the market is segmented into Liquid, Powder and On the basis of Extract Type, the market is segmented into Fruits, Vegetables, Cereals, Herbs & Spices and Others Cocoa, Coffee, etc.

The larger market share of the powder segment can be attributed to the high stability, long shelf life, and ease of application of powdered colorants in dry formulations. These are extensively used as natural food colors for bakery products, powdered beverage mixes, instant soups, and snack seasonings where moisture resistance and overall blending is paramount.

The powdered food colorings are preferred by food manufacturers with functionalities such as high pigment concentration, prolonged usability, and resistance to processing under high-temperature conditions.

Finally, powdered colorants are more manageable for handling, storage, and incorporation into a variety of industrial and household food formulations. This trend along with a growing demand for healthy, plant-based, vegan, and organic food products is also likely to scale up the demand for fruit and vegetable based powder extracts in clean-label formulations.

There is strong demand for the liquid segment with applications in beverages, dairy products and confectionery coatings. On the other hand, liquid food colorings are soluble, offer smoothness, and intensity of coloring, therefore they are the right choice for juices, flavored milk, soft drinks, and textural and temperature modified food like gelatin and desserts.

Liquid natural colorants from fruits, vegetables and botanicals are increasingly used to replace synthetic dyes, due to the rise of functional beverages, sports drinks, plant-based dairy alternatives and more. Market growth is being fuelled by demand for cold-pressed, organic and non-GMO liquid food colorings in premium food and beverage categories.

The highest share of the market is held by the fruit-based extract segment as fruits offer bright natural pigments along with mild flavors and nutrients in several food applications. In beverages, confectionery, dairy products, and plant-based dessert applications, blackcurrant, pomegranate, cherry, and grape extracts are among the most popular fruit extracts used to improve colour and attract consumers.

As consumers are becoming increasingly health conscious and looking for better food options, the demand for fruit-derived colorings has been soaring, especially in children's snacks, organic candies, and fortified drinks. The use of fruit-based natural colorants is further being expanded by the growing availability of freeze-dried fruit powders and juice concentrates.

Additionally, high stability among the naturally bright colours offered from the vegetable extracts segment is driving strong growth of the segment during the forecast period. Extracts from carrot, beetroot, red cabbage, and spinach are used in soups, savoury snacks, plant-based meats, and sauces. As the popularity of vegan and plant-based diets continue to rise, food manufacturers are adding more vegetables based colorings to their product to enhance visual appeal and health benefits.

The cereal extract segment is emerging in niche category of bakery, breakfast cereals and health supplements and using natural pigments from wheatgrass, corn, rice provide light and neutral color tones. As consumers move in the direction of whole grain and fibrous products, cereal-derived natural colors are being adopted into, functional foods and fortified products.

The herbs & spices segment covers turmeric, paprika, saffron, and spirulina, that are used commonly in ethnic cuisines, spice blends, and natural seasoning mixes. There is an increasing demand for global flavors, particularly for organic condiments, we expect continuous growth in spice-derived natural colorants.

Demand for the others category which contains cocoa, coffee, and plant-derived polyphenols is on the rise, especially in premium chocolate, roasted coffee drinks, and functional food components. These colorants deliver bold, earthy colors and antioxidant benefits that make them a critical ingredient in clean-label and premium food formulations.

The coloring foodstuffs market is on the rise, owing to the growing demand for natural, plant-based food colorants, clean-label formulations, and regulatory-compliant alternatives to synthetic dyes. Through AI-based corresponding extraction optimization, eco-friendly colorants based on plant materials, and food-grade pigment stabilization, businesses are adding a great deal of added value towards intensifying color, stability, and additional functional properties.

Natural ingredient manufacturers, food additive suppliers, and plant-based color extraction firms are vital elements of the market, enabling progressive food-grade pigment processing technology, AI-fueled quality assurance, and sustainable food color sourcing.

Market Share Analysis by Key Players & Natural Food Color Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Givaudan (Naturex) | 18-22% |

| Chr. Hansen Holding A/S | 12-16% |

| Sensient Technologies Corporation | 10-14% |

| Döhler Group | 8-12% |

| Archer Daniels Midland Company (ADM) | 5-9% |

| Other Food Color Ingredient Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Givaudan (Naturex) | Develops AI-optimized plant-based color solutions, heat-stable natural food colorants, and organic pigment extractions. |

| Chr. Hansen Holding A/S | Specializes in fermentation-based food color production, AI-assisted pigment stability analysis, and clean-label food color innovations. |

| Sensient Technologies Corporation | Provides natural and organic food-grade colors with AI-powered formulation enhancement for improved stability and vibrancy. |

| Döhler Group | Focuses on fruit and vegetable-derived food colorings, AI-driven extraction process optimization, and clean-label food pigment innovation. |

| Archer Daniels Midland Company (ADM) | Offers sustainable plant-based color solutions, AI-powered natural pigment standardization, and regulatory-compliant clean-label formulations. |

Key Market Insights

Givaudan (Naturex) (18-22%)

Givaudan tackles the coloring foodstuffs market with high-performance natural food pigments, AI-driven extraction optimization, and heat-stable plant based food colorants.

Chr. Hansen Holding A/S (12-16%)

Chr. Hansen works for fermentation-derived and botanical food colors and makes sure that ingredients are AI-enhanced in terms of their stability, organic origin, and are clean nutritional labels that follow regulations.

Sensient Technologies Corporation (10-14%)

Offers fruit and vegetable-based food pigments; pigment concentration control via machine learning; enhanced formulations with improved shelf life.

Döhler Group (8-12%)

Döhler addresses sustainable sourcing of food colors, incorporating artificial intelligence in extraction processes and concentrated plant-based colorant formulations.

Archer Daniels Midland Company (ADM) (5-9%)

ADM creates natural liquid food dyes solutions with plant-based pigments of 100% purity, food-grade colour-stabilization powered by AI, clean label formulation technologies.

Other Key Players (30-40% Combined)

Several natural food color suppliers, botanical extract firms, and clean-label ingredient companies contribute to next-generation food coloring innovations, AI-powered pigment standardization, and sustainable plant-based food color solutions. These include:

The overall market size for coloring foodstuffs market was USD 725.7 Million in 2025.

Coloring foodstuffs market is expected to reach USD 1,023.7 Million in 2035.

The demand for coloring foodstuffs is expected to rise due to increasing consumer preference for natural and clean-label ingredients, growing regulations on synthetic food colors, and rising demand for plant-based and organic food products.

The top 5 countries which drives the development of coloring foodstuffs market are USA, UK, Europe Union, Japan and South Korea.

Powdered Colorants and Fruit-Based Extracts to command significant share over the assessment period.

Calcium Caseinate Market Analysis by End Use Application and Functionality Through 2025 to2035

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.