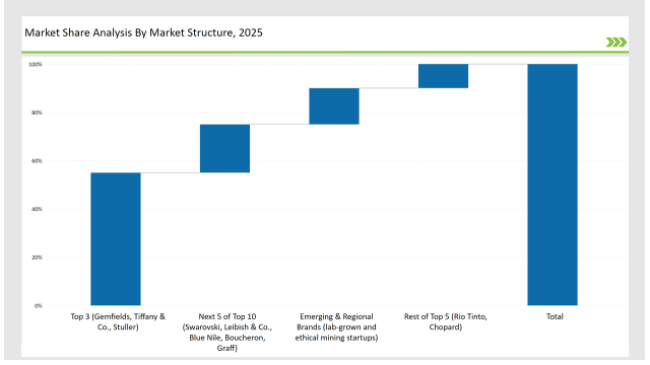

The global demand for colored gemstones is booming, primarily due to the need for brightness of colors, extraordinary rarity, and responsible sourcing by consumers. Among these, gem market leaders Gemfields, Tiffany & Co., and Stuller command market share premia through better-quality stones plus environmentally responsible source activities, covering the total for 55%.

More narrowly concentrated on geography-based and master craftsmen production lines of differently designed stones with important cultural messages are held to be of value by 30%, followed by new generation, custom-specific or lab-based new entrant offerings valued at around 15%.

Explore FMI!

Book a free demo

| Global Market Share2025 | Industry Share (%) |

|---|---|

| Top 3 (Gemfields, Tiffany & Co., Stuller) | 55% |

| Rest of Top 5 (Rio Tinto, Chopard) | 10% |

| Next 5 of Top 10 (Swarovski, Leibish & Co., Blue Nile, Boucheron, Graff) | 20% |

| Emerging & Regional Brands (lab-grown and ethical mining startups) | 15% |

The colored gemstones market in 2025 is moderately fragmented, with a mix of global suppliers and regional miners contributing to industry dynamics. While key players like Gemfields and Tiffany & Co. hold a notable share, a significant number of independent gemstone traders and artisanal miners add to the market’s diversity. This fragmentation fosters product variety, price competition, and increasing demand for ethically sourced stones.

50% is made up of luxury jewelry brands and specialty gemstone retailers, targeting exclusivity and high-value buys. E-commerce comprises 25% driven by the increased consumer confidence in buying products online and the ability to virtually try them on. Auction houses and private collectors account for 15% which focuses on rare and investment-grade stones. Direct-to-consumer brands and independent jewelers account for the remaining 10%, focused on customization and affordability.

The color gemstones have sapphires, rubies, emeralds, among others.Sapphires dominate the industry at 40% due to their flexibility, in addition to them having a myriad of symbolic roles.Rubies hold 25%, which feature because of how rare they appear, in their deep red color; the emerald also features, 20%. Other gemstone varieties like aquamarine, and spinel tourmaline that hold 15%, as sales rise to collectors or designers.

For colored gemstones, 2024 has been the year of change: sustainability, customization, and the digitalization of the market. The leaders for this upcoming year are as follows:

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Gemfields, Tiffany & Co., Stuller |

| Market Share % | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Rio Tinto, Chopard |

| Market Share % | 10% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional miners, lab-grown startups |

| Market Share % | 35% |

|

Brand |

Key Focus Areas |

|---|---|

|

Gemfields |

Ethical sourcing and transparency programs |

|

Tiffany & Co. |

Sustainable colored gemstone collections |

|

Stuller |

Accessibility and innovation in gemstone cutting |

|

Rio Tinto |

Investment-grade colored gemstones |

|

Swarovski |

Lab-grown synthetic gemstones |

|

Emerging Brands |

Traceable, lab-grown, and custom gemstones |

The colored gemstones market will continue to grow steadily, driven by sustainability, digital transformation, and evolving consumer preferences. Brands will continue to expand into ethical mining, lab-grown alternatives, and unique gemstone designs. Partnerships with high-fashion brands, auction houses, and influencers will further elevate consumer interest, while blockchain authentication will enhance traceability and trust in the market.

Leading players such as Gemfields, Stuller, and Tiffany & Co. collectively hold around 55% of the market.

Regional suppliers, including Sri Lankan and Burmese gemstone traders, contribute about 30% of the market.

High-end boutique designers and niche gemstone brands hold approximately 10% of the market.

Private labels, including department store exclusives, hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Porcelain Tableware Market Trends - Growth & Demand Forecast 2025 to 2035

Toothpaste Market Trends - Growth, Sales & Forecast 2025 to 2035

Snus Market Growth - Demand, Sales & Forecast 2025 to 2035

Sexual Enhancement Supplements Market Analysis – Trends & Forecast 2025 to 2035

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Luxury Fine Jewellery Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.