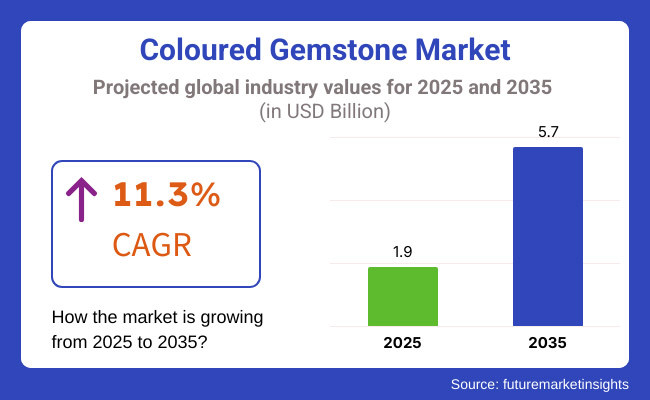

The global coloured gemstone market is poised for substantial expansion, increasing from USD 1.9 billion in 2025 to USD 5.7 billion by 2035. The market is expected to grow at a CAGR of 11.3% from 2025 to 2035.

Growing consumer preference for unique and rare stones, coupled with growing attraction to gemstone investments, pushes the demand for coloured gemstones and other luxurious stones. Increased treatment innovation and growing awareness for ethical sources would probably provide a good upswing to the market, while more complex trends could also emerge with the recent developments in synthetic gemstones, which provide an affordable substitute to most consumers.

Moreover, synthetic gemstones provide a cheaper alternative to natural stones on a large scale. The combination of luxury brands scheduled with the inclusion of coloured gemstones into their respective collections is also a concern that would spike the market demand.

Out of the recent trend of merging wearables into technology and making them fashionable, precious stones such as diamonds and sapphires add charm to smart watches and fitness trackers making them pieces of glamour.

Coloured gemstones are not only attractive but they have important symbolic meanings, lending the wearers a sense of personalization through their pieces. The transformation between the tech and jewellery industry will further shape itself with more exciting designs and collaborations.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the coloured gemstone industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 11.9% |

| H2 (2024 to 2034) | 11.1% |

| H1 (2025 to 2035) | 12.1% |

| H2 (2025 to 2035) | 10.7% |

The CAGR exhibits a fluctuating trend, initially increasing by 119 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. Further, a slight increase of 121 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external growth. Growth declines in H2 (2025 to 2035) with a 107 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

Securing Luxury and Rarity: Unveiling The Forces of the Growing Demand for Coloured Gemstones

As the demand for distinctive and extremely valued jewellery has increased, premium gemstones known for their uniqueness and quality have gained consumer attraction. This is because the luxury jewellery industry depends on coloured gemstones as the main options for engagement rings, high-end accessories, and investment pieces.

They have become so attractive for the elevated companies that traders have already begun incorporating them into their collections. The coloured gemstone market works with different gemstones fitting all luxury and investment needs in both retail as well as auction. Fabulous glare and rarity attach great demand for coloured gemstones among sales motivators in the market.

Most common coloured gems include sapphires, rubies, emeralds, and fancy-coloured diamonds. Aptly described as naturally occurring gems, some are now increasingly becoming famous because of price and ethical considerations. Natural or synthetic offer alternatives and hence compatibility for different consumer segments.

Gemstone manufacturers and jewellery brands are being forced to launch all kinds of collections, given the growing demand for such collections to cater to the swarm of other consumers. This development is indicative of good growth opportunities for players operating in the coloured gemstone market in the coming years.

Synthetic stone has a burgeoning market, and this exerts a high impact on the demand for natural-coloured gemstones

Popularity is a keen to synthetic coloured gemstones due to their price, often-named ethical origins, and technological advances in gemstone creation. They take care of their environmental footprint whilst providing access to fine quality with the eye-pleasing beauty that evokes interest to the wearer those seekers of authenticity and utility should now be looking elsewhere.

Synthetic stones take many forms, including lab-created sapphires, emeralds, and rubies, with different-coloured gemstone-like properties. They include cost-effective options, being consistent in quality, although environmentally safe. Brands that promote ethically sourced and eco-friendly gemstones are creating awareness and a push towards synthetic alternatives.

2020 to 2024 Global Coloured Gemstone Sales Outlook Compared to Demand Forecasts from 2025 to 2035

From 2020 to 2024, demand for coloured gemstones grew at a modest 4.3% CAGR. The initial downturn was due to the pandemic; a rebound in luxury consumption and a pivot to online jewellery sales kept the market afloat. Due to the coloured diamonds, other stones such as rubies and emeralds are beginning to pick up in bridal and fashion pieces.

Fast-forward to 2025, and things appear to be optimistic for the market showing a forecasted 11.3% CAGR through 2035. With education campaigns and active social media support, consumers are becoming more aware of gemstones than ever. They're willing to pay for a piece that tells a story, whether it's a rare natural sapphire or a lab-grown diamond with a carbon-neutral footprint.

The big players are catering to this trend. They are offering custom designs, collaborating with ethical mines, coupled with offerings like appraisals or repairs to engage the deal. The top five companies-Tiffany & Co., Cartier, and the emerging lab-grown leaders are expected to dominate the market and acquire a huge portion of market share by 2035.

The top-tier companies such as De Beers, Tiffany & Co, and Bulgari have a combined market share of about 60%. These brands flaunt their legacies, international outreach, and expertise with both natural and synthetic stones making them high contenders in the competition. They are not just selling gemstones, but they're also selling trust, luxury, and elevated designs featuring colour diamonds with companion stones such as emeralds and opals. They're leading the current market scenario due to their increasing R&D activities and marketing influence.

The middle-tier companies, such as Pandora and Swarovski, share 25% to 35% of the market share. They thrive by enticing the everyday buyer with affordable yet trendy pieces, often employing synthetic or lower-grade natural gems. Regional strength and smart distribution deals keep them competitive, especially in fast-growing markets like Asia and the Middle East.

Then there’s the smaller tier-niche brands and local artisans like Gemfields, Brilliant Earth, and Chatham Created Gems. With 5%-15% of the market, they cater to specific crowds: ethical shoppers, collectors, or budget buyers. These players punch above their weight by focusing on traceability, unique cuts, or hyper-local appeal. Together, these tiers keep the market dynamic, buoyed by rising demand and a mix of natural and synthetic offerings.

| Countries | Population (billions) |

|---|---|

| USA | 345.4 |

| United Kingdom | 68.3 |

| India | 1,432.6 |

| China | 1,425.9 |

| UAE | 9.5 |

| Countries | Estimated Per Capita Spending (USD) |

|---|---|

| USA | 4.2 |

| United Kingdom | 3.5 |

| India | 1.8 |

| China | 2.3 |

| UAE | 6.1 |

At USD 4.20 per capita, the USA leads due to its obsession with luxury and custom jewellery. High earners snap up coloured diamonds for engagement rings, while mid-range buyers opt for synthetic options.

The UK’s USD 3.50 per capita reflects a taste for heritage pieces and sustainable gems, driven by urban wealth and a strong retail scene.

With USD 1.80 per capita, India’s market is fueled by cultural love for gemstones in weddings and festivals, though lower incomes keep spending modest.

China’s USD 2.30 per capita ties to its growing middle class and appetite for status symbols like rare coloured diamonds.

The UAE tops out at USD 6.10 per capita, a nod to its wealthy expats and tourists who splurge on high-end gems in Dubai’s glittering malls.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.7% |

| United Kingdom | 4.2% |

| India | 6.3% |

| China | 5.9% |

| UAE | 5.4% |

The CAGR of the USA market will remain at 4.7% throughout 2035 due to enormous consumer spend and elaborate retail infrastructure. The coloured diamonds reflect great market demand, with increasing popularity in bridal jewellery for shades such as fancy yellow and pink. Big names such as Kay Jewelers and Zales have been key players that have capitalized on this opportunity by offering customized jewellery solutions.

The United Kingdom is expected to hold a CAGR rate of 4.2%, revealing an environment combining time-honoured craftsmanship in jewellery making with modern sustainability concerns. Established districts in London, particularly in Hatton Garden, are crucial, with substantial demand from natural sapphires and emeralds in heritage-inspired designs. A great tilt toward ethical consumption can be observed in the consumer shift, adhered to even by big corporations like Boodles while very much matched with the rise of synthetic alternatives in places, such as Manchester and Bristol.

India is considered to be among the fastest-growing markets, attributing a growing CAGR of 6.3%, highly influenced by a perpetual unwinding of the cultural tradition of gemstones with aggressive economic advancement. Up until now, any kind of traditional function or festival, such as Diwali, would see immense demand for natural stones like rubies, emeralds, and garnets, priced according to their attributes. Jaipur is the world's hub for gemstone craft and trade that stands tall for both internal consumption as well as exports due to its proximity to the sources of natural stones.

China’s coloured gemstones market is forecast to grow at a CAGR of 5.9% and there is a tussle between luxury consumption and industrial-scale synthetic production. Affluent consumers in urban centres such as Shanghai and Beijing have a high appetite for rare natural coloured diamonds, usually worn in conjunction with cult relics, such as jade, as a social status hallmark. Meanwhile, Guangdong is known as a manufacturing hub, producing synthetics that compete on price with both domestic and export markets.

The UAE is expected to post a CAGR of 5.4%, buoyed by its branding as the world's luxury and trade hub. Dubai, with its vast shopping malls, attracts a wealthy tourist and expatriate clientele, which favours high-value natural gemstones for bespoke jewellery. Local demand among high-net-worth individuals is characterized by a preference for elaborate multi-gemstone designs that are most often custom-made through established firms like Damas.

| Segment (Product Type) | CAGR (2025 to 2035) |

|---|---|

| Coloured Diamond | 5.6% |

The market for coloured diamonds is projected to grow with a CAGR of 5.6%, establishing a cornerstone for the market of luxury gemstones. Natural-coloured diamonds are very rare and make up less than 0.1% of global diamond production; this is reflected in their premium valuation, where auction scenarios fetch out multibillion-dollar prices for exceptional specimens.

With gemological refinements like advanced color grading and general precision cutting fast gaining acceptance in both retail and investment markets, leading jewellers have embedded them in modern designs such as rose gold settings to meet the changing taste of consumers.

| Segment (Product Format) | CAGR (2025 to 2035) |

|---|---|

| Natural | 4.8% |

The natural gemstones segment is supposed to expand at a CAGR of 4.8%, based on inherent worth and geologic provenance. Sourcing from prime regions, Madagascar for sapphires, Colombia for emeralds, and Australia for rare coloured diamonds-remains very important, albeit supply remains constrained by environmental regulations and limited deposits.

The demand generated by consumers is fueled by certification from established centres such as the Gemmological Institute of America (GIA), which proves provenance and quality, notably for high-value transactions. This segment caters mostly to wealthy buyers and collectors who dwell on rarity and opportunity for long-term investment.

The coloured gemstones market has been very competitive, characterized by strategy differentiation and major investments in innovation.

The market is expected to grow at 11.3% CAGR between 2025 and 2035.

The industry stood at USD 1.9 billion in 2025.

The market is projected to reach USD 5.7 billion by 2035.

South Asia is expected to grow at a 13.2% CAGR during the forecast period.

Major players De Beers Group, Tiffany & Co., Bulgari, Pandora, and Gemfields among others.

Coloured Diamonds and Others are the key segments driving market growth.

The product format segment is segregated into Natural and Synthetic.

The market spans across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.