The global collimating lens market is expected to witness a healthy compound annual growth rate (CAGR) in the coming years, driven by growing demand for high precision optical components across various industries, including automotive, medical, telecommunications, and aerospace.

Collimating lenses, which condense diverging light at a focal point to form a parallel light path, thus do play a key role in almost all systems requiring effective light projection, light collection as well as enhanced optical performance. Applications range from LiDAR systems used in self-driving cars and fiber-optic communication systems to medical imaging devices and spectroscopy instruments. Technological advancements in lens manufacturing methods, along with rising adoption of novel photonics technologies, are propelling the growth of this market.

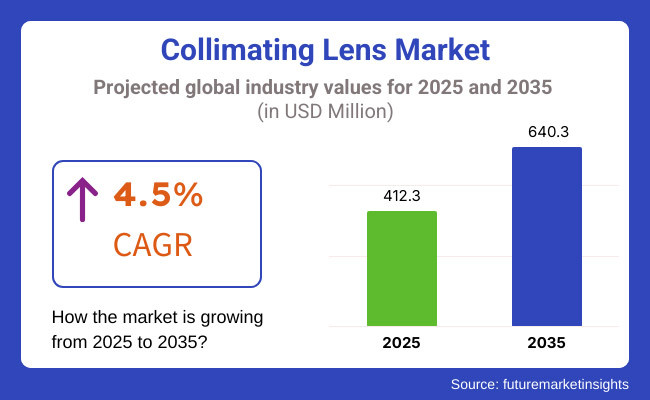

Furthermore, as industries demand higher accuracy, energy efficiency, and miniaturization in optical devices, the need for high-quality collimating lenses will continue to grow, driving steady growth through 2035. And the collimating lens market is worth USD 412.3 Million (in 2025). It is projected to expand at a CAGR of 4.5% between 2023 and 2035, reaching the value of USD 640.3 Million by 2035. Growth is driven by increasing need for advanced optical components in a variety of high-tech applications and continual technological advancements in lens design and manufacturing.

Explore FMI!

Book a free demo

North America is a prominent collimating lenses market, due to significant investments in autonomous vehicle technologies, advanced medical imaging systems, and telecommunications infrastructure. Among those is the United States, which has a strong base of high-tech industries reliant on precision optics - including LiDAR, laser communication systems, and research instrumentation. Region-wise, North America continues to be the most prominent region in the adoption of collimating lens technology, with constant innovations in photonics and optoelectronics.

Europe is another important market, underpinned by a strong industrial base and a large concentration of optical R&D. Germany, France, and the UK lead the pack for integrating collimating lenses into state-of-the-art automotive systems, optical sensors and scientific instruments. Moreover, with Europe already emphasizing renewable energy and sustainability, the need for precision optics in solar energy applications and advanced lighting systems has gained traction and this has contributed to the growth of the adoption of collimating lenses.

The Asia-Pacific market for collimating lenses is the fastest-growing market owing to rapid industrialization, expanding of telecommunications networks, and rising investments in consumer electronics. For high-end applications, countries like China, Japan and South Korea are at the forefront in adopting sophisticated optical components. In addition, the strong manufacturing hub in the region, along with the increasing adoption of autonomous vehicles, natural lasers processing systems, and LED lighting technologies, is expected to be a key factor driving the growth of the collimating lens market in Asia-Pacific.

Challenges

High Manufacturing Costs, Optical Alignment Complexity, and Intense Market Competition

The Collimating Lens Market also faces challenges, which stem from the high manufacturing costs of precision optics, advanced coating technologies, and strict quality control standards. Specialized materials like aspheric glass, fused silica, and polymer-based optics are used for manufacturing high-performance collimating lenses for lasers, LEDs, and fiber optics that increase the production cost. The alignment process during assembly and integration into optical systems is also complicated, particularly for applications requiring high beam uniformity with low optical aberration. Another challenge comes from strong competition from alternative beam19 shaping technologies such as diffractive optical elements (DOEs) and freeform optics which provide compact and cost-effective solutions in laser, LiDAR and imagining applications.

Opportunities

Growth in LiDAR, AR/VR, and Fiber Optic Communication

However, the collimating lens market also offers substantial growth potential owing to increasing penetration in LiDAR (Light Detection and Ranging) systems, augmented and virtual reality (AR & VR) displays, and high-speed fiber optic communication networks. Because laser-based sensing and imaging systems demand precise beam collimation, the growth of autonomous vehicles, robotics, and industrial automation is increasing demand for precise beam collimation. Furthermore, miniaturized collimating optics for wearable AR / VR headsets along with compact optical sensors are also creating new market segments. In addition, the growing 5G and next-gen optical fiber networks are stimulating innovation of high-haul optical signal transmission collimators as well.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with precision optical standards and laser safety regulations. |

| Consumer Trends | Increasing demand for high-precision optics in laser processing, imaging, and medical devices. |

| Industry Adoption | Used in industrial lasers, LED lighting, and fiber optic communication systems. |

| Supply Chain and Sourcing | Dependence on high-purity optical glass and precision-molded polymer lenses. |

| Market Competition | Dominated by traditional optical component manufacturers and specialized photonics firms. |

| Market Growth Drivers | Growth fueled by high-power laser applications, fiber-optic advancements, and automotive LiDAR demand. |

| Sustainability and Environmental Impact | Moderate adoption of low-reflection coatings and energy-efficient optics. |

| Integration of Smart Technologies | Early adoption of auto-focusing optical lenses and integrated laser collimators. |

| Advancements in Optical Engineering | Development of aspheric and achromatic collimating lenses for reduced aberration. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter quality certifications, environmental regulations for optical coatings, and lead-free lens materials. |

| Consumer Trends | Growth in miniaturized collimating optics for AR/VR, LiDAR, and biomedical imaging. |

| Industry Adoption | Widespread adoption in autonomous vehicle LiDAR, holographic displays, and space-based optical systems. |

| Supply Chain and Sourcing | Shift toward nano-optical fabrication, AI-driven lens design, and 3D-printed optical components. |

| Market Competition | Entry of nanophotonics startups, AI-driven optics developers, and smart imaging technology providers. |

| Market Growth Drivers | Accelerated by AI-powered optical processing, compact laser modules, and high-speed optical networking. |

| Sustainability and Environmental Impact | Large-scale use of recyclable lens materials, low-carbon optical manufacturing, and smart adaptive optics. |

| Integration of Smart Technologies | Expansion into AI-driven beam shaping, dynamic lens adjustments, and quantum optics-enabled collimation. |

| Advancements in Optical Engineering | Evolution toward meta-optics, tunable liquid lenses, and ultra-lightweight freeform optics. |

USA collimating lens market is in a steady growth stage due to the growing use in optical communication, automotive LiDAR and laser-based medical devices. In addition, the increase in augmented reality (AR) and photonic applications creating a need for high-precision optical components is also propelling the market growth. Moreover, the growth of the industry is being spurred by developments in lens manufacturing and their amalgamation with fiber optics.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

The collimating lens market in the United Kingdom is also focusing on high-quality optical components as the adoption of collimating lenses grows in industries such as aerospace, medical imaging & laser processing. Increasing application of laser-based technologies in defense and industrial automation is supplementing market demand. The long-term growth is further supported by investments in photonic technologies and R&D activities.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

The collimating lens market in Europe is fueled a variety of end-use industries that use optical products, laser technology, etc. The automotive industry’s turn toward enhanced driver assistance systems (ADAS) and LiDAR technology is a chief factor in market growth. Furthermore, Europe’s dominance in semiconductor manufacturing and precision optics is driving demand of collimating lenses for photonic applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

Japan's collimating lens market is expected to register moderate growth backed by the country leading the advanced optics precision engineering, and semiconductor manufacturing. The growth of various applications such as fiber-optic communication and biomedical devices that require high-quality optical components supports the market. In addition, reinforcing the growth of this industry, Japan already has a strong position in LiDAR and photonic technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The collimating lens market in South Korea is growing due to rising usage in telecommunications, automotive optics, and consumer electronics. The advances in photonics and fiber-optic communication systems in the country are driving the demand for high-precision collimating lenses. Government initiatives promoting optical innovation and semiconductor technology development also propels the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

Laser Light Sources and Glass-Based Collimating Lenses Drive Market Growth as Demand for Precision Optical Components Expands

The collimating lens market is witnessing robust growth due to the increasing dependence of industries on advanced optical systems for diverse applications, including laser, LED illumination, imaging and photonics-based solutions. Such an arrangement using a collimating lens can result in a near-perfect collimation of the light into a beam, which can minimize angular divergence and therefore create a more efficient system. The need for high-performance collimating lenses is only increasing with the growing adoption of optical sensing, fiber optics, laser processing, LiDAR, and high-precision medical devices. It covers the market by Light Source (LED, Laser, Others) & Material Source (Glass, Plastic, Others).

In terms of type, laser-based collimating lenses account for the largest share of the collimating lenses market, due to the growing adoption of laser optics in the fields of industrial automation, scientific research, healthcare, and consumer electronics. They are critical for applications in fiber optic communication, LiDAR technology, laser cutting, and medical imaging due to their high precision and narrow beam divergence.

Demand for collimating lenses with lower optical aberration and improved beam shaping is on the rise, as more industries utilize high-power lasers in industrial processing, 3D scanning, and laser-based projection systems. The burgeoning demand for autonomous vehicles, augmented reality (AR) and the fast adoption of laser-based measurement systems are also fuelling the growth of laser-based collimating lenses market.

Which are also displayed a notable segment in the market, especially in illumination systems, automotive lighting and display technologies. The lenses help to improve light uniformity and focus of the beam, leading to better performance in applications including LED headlights, street lighting, stage lighting, and medical lighting appliances. The growing use of smart lighting solutions and energy-efficient LEDs are projected to continue growing in the global lighting market, leading to a growing need for high-quality collimating lenses for LED applications.

The others segment includes the end users which consist of collimate lenses used across specialized light sources in the areas of UV lamps, IR emitters, and specialized photonic systems. These lenses are used for niche areas, like biotechnology, forensic imaging and laser spectroscopy.

Because of their excellent optical performance, longevity, and resilience to temperature fluctuations, glass-based collimating lenses account for the majority of the collimating lens market. Harsh environments, they deliver high accuracy and low optical aberration, meaning they typically are used for high-performance optical systems, medical devices, aerospace, and scientific instrumentation.

The growing need for high-quality optical glass lenses in folds where precision and clarity are critical, such as laser systems, heightens its demand further. The growing adoption of cutting-edge LiDAR-based navigation, remote sensing, and biomedical imaging technologies are further driving the adoption of glass collimating lenses for research and commercial applications.

Plastic grating-based collimating lenses continue to grow steadily, driven mainly by low-cost applications: consumer electronics, LED lighting, and automotive optics. These lenses are lightweight, inexpensive to produce, and easier to fabricate, thus suitable for large-scale manufacture for use in lighting, displays and compact optical devices. The continued advancement of high-performance polymer optics with greater durability and refractive properties will drive additional market share towards plastic-based collimating lenses, according to manufacturers.

Other includes specialized optical systems that utilize hybrid materials and other advanced composites. These elements allow higher light transmission and durability, meeting the requirements of high-end photonics, aerospace optics, and military-grade imaging.

Due to the rising need for precise optics, laser beam shaping, and imaging applications across a range of industries, including automotive, healthcare, aerospace, and telecommunications, the collimating lens market is expanding. To improve beam quality, optical efficiency, and wavelength accuracy, companies are also focusing on development of AI-based optical design, OPV and high-performance lens coatings and miniaturized collimation solutions. Optical component manufacturers, laser system providers, and photonics technology firms are all part of the market portfolio, all of whom play a crucial role in enhancing technology in collimating lens design, AI-powered (AI-assisted) alignment systems, and high-efficiency optical materials.

Market Share Analysis by Key Players & Collimating Lens Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Thorlabs, Inc. | 18-22% |

| Edmund Optics Inc. | 12-16% |

| Excelitas Technologies Corp. | 10-14% |

| IPG Photonics Corporation | 8-12% |

| Optikos Corporation | 5-9% |

| Other Optical Component Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thorlabs, Inc. | Develops high-precision collimating lenses for fiber optics, laser systems, and AI-optimized optical alignment solutions. |

| Edmund Optics Inc. | Specializes in customizable aspheric collimating lenses, high-efficiency optical coatings, and AI-powered beam shaping technologies. |

| Excelitas Technologies Corp. | Provides collimating lenses for medical imaging, LiDAR systems, and AI-assisted optical performance analysis. |

| IPG Photonics Corporation | Focuses on high-power fiber laser collimating optics, AI-driven wavelength optimization, and precision beam delivery systems. |

| Optikos Corporation | Offers optical metrology systems, AI-powered collimation testing, and high-performance collimating lens calibration services. |

Key Market Insights

Thorlabs, Inc. (18-22%)

Market Leader Thorlabs-precision optics for fiber lasers, biomedical and AI-powered optical systems.

Edmund Optics Inc. (12-16%)

Aspheric and achromatic collimating lenses designed with AI-powered precision with high-quality optical coatings.

Excelitas Technologies Corp. (10-14%)

Excelitas-mêmes AI-powered alignment and background tracking and LiDAR, medical imaging, and laser capabilities.

IPG Photonics Corporation (8-12%)

IPG specializes in collimating lenses for fiber lasers, beam delivery optimization, AI-controlled power stabilization, and enhanced precision across high wavelengths.

Optikos Corporation (5-9%)

Optikos assays optical testing and collimating lens calibration systems, delivering both AI-driven metrology accuracy and customizable beam correction solutions.

Other Key Players (30-40% Combined)

Several optical system manufacturers, laser component suppliers, and photonics technology companies contribute to next-generation collimating lens innovations, AI-powered optical design, and high-precision beam shaping. These include:

The overall market size for collimating lens market was USD 412.3 Million in 2025.

Collimating lens market is expected to reach USD 640.3 Million in 2035.

The demand for collimating lenses is expected to rise due to increasing applications in optical communication, LiDAR systems, and laser-based technologies, along with advancements in precision optics and growing adoption in automotive and industrial sectors.

The top 5 countries which drives the development of collimating lens market are USA, UK, Europe Union, Japan and South Korea.

Laser Light Sources and Glass-Based Collimating Lenses to command significant share over the assessment period.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.