The collapsible sleeve containers market is scored a lucrative market in terms of reusable and space-saving durable bulk containers for industries that require packaging for logistics. These containers are very helpful in optimizing the benefits of storage and transportation by restricting the empty containers to a lower volume, which decreases shipping cost, and increases warehouse efficiency.

It is owing to the rising need for sustainable and cost-efficient bulk packaging, increasing adoption for returnable packaging systems, and development in weightless yet durable materials like polypropylene and high-density polyethylene (HDPE) that drives the growth of the market. Moreover, increasing e-commerce activities and supply chain optimization initiatives are also supporting market growth.

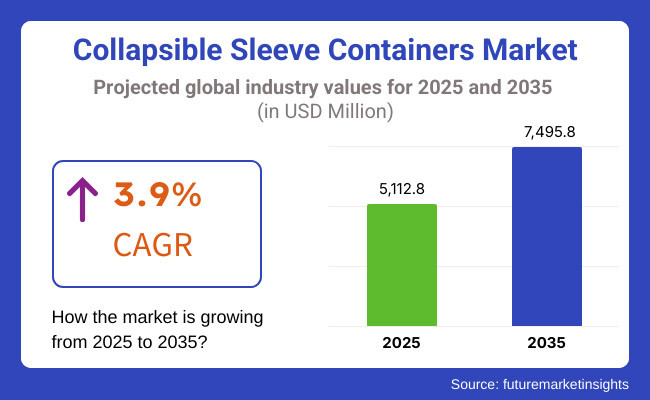

The competitive landscape of the collapsible sleeve containers market provides a detailed overview of key companies operating in the global collapsible sleeve containers marketing 2025, and picks up momentum over the coming decade, with about USD 5,112.8 million sales of collapsible sleeve containers projected for 2025 and an estimated CAGR for the global collapsible sleeve containers market of 3.9% over the forecast period, with the global collapsible sleeve containers market pegged at about USD 7,495.8 million sales by 2035.

This expected CAGR underscores the rising demand for sustainable and reusable packaging solutions, increased automation in warehousing, and expansion of international trade and logistics. Moreover, innovations in recyclable materials and smart tracking technologies incorporated into collapsible containers are anticipated to boost the market growth.

Explore FMI!

Book a free demo

The North American collapsible sleeve containers market is on the rise owing to the growing industrial and retail logistics in the region, and the implementation of strict sustainability regulations with firm uptake of reusable packaging solution. The demand for cost-effective returnable bulk packaging is growing among automotive and agricultural and FMCG (fast-moving consumer goods) sector in the United States and Canada. In addition, in order to increase market demand, the continuous development of automation and warehouse storage optimization.

Europe accounts for a significant share of the market, with Germany, France and the United Kingdom being leader of sustainable logistics and supply chain innovations. Rather, stringent environmental regulations in European Union (EU) countries as well as efforts toward circular economy are among several factors contributing to growth in the market, by stimulating the use of reusable and recyclable packaging. Moreover, rise in cross-border trade and the demand of modular and flexible packaging solutions from the manufacturing and retail industries is further supporting the market growth.

Asia Pacific region holds the largest potential for the collapsible sleeve containers market due to rapid industrialization, rapid e-commerce activities, and expansion of the automotive and agriculture sectors in China, India, and Japan. Rising emphasis on cost-effective and reusable packaging solutions for export-oriented sectors and surging investments in smart logistics infrastructure in the region have accelerated the demand for collapsible sleeve containers. Furthermore, increasing governments activities for environmentally friendly and less packaging practices are likely to further propel market growth.

Challenges

High Initial Investment and Logistics Constraints

High initial investments required for producing long-lasting and fully reusable sleeve containers is a major hindrance to the growth of collapsible sleeve containers market. Moreover, the lack of awareness and reverse logistics infrastructure in developing regions restricts widespread uptake. Heavy and bulky rigid plastic sleeve containers are also more expensive to transport, taking a toll on cost-effectiveness for long-haul supply chains.

Opportunity

Growth in Sustainable Packaging and Supply Chain Optimization

As the demand for environmentally friendly and cost-efficient packaging solutions rises, collapsible sleeve containers become a popular choice for single-use plastic crates and cardboard packaging. Durable, reusable, and space-saving packaging solutions are being adopted by industries including automotive, retail, e-commerce, agriculture, and pharmaceuticals. Moreover, innovations in lightweight materials, RFID tracking for inventory management and foldable container automation are making logistics more efficient and enabling lower carbon footprints.

The period that extends from 2020 to 2024 was a period for increased adoption of collapsible sleeve containers in industrial logistics, automotive parts transport and retail distribution. Costs remained high, the supply chain was not standardized, and recycling capabilities were limited, which slowed penetration into small and medium (SME) enterprises.

Between 2025 to 2035, the market was anticipated to experience a transition to biodegradable and smart collapsible sleeve containers. Automation, IoT-based tracking and intelligent warehouse management advancements will drive supply chain efficiency in 2022. Customizable, lightweight, and modular sleeve containers will also address changing e-commerce, agricultural, and pharmaceutical supply chain requirements.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with packaging waste reduction laws |

| Technology Innovations | Development of foldable and stackable sleeve containers |

| Market Adoption | Growth in automotive, retail, and industrial logistics |

| Efficiency & Performance | Weight and bulkiness impacted transportation costs |

| Market Competition | Dominated by logistics packaging firms (ORBIS, DS Smith, Schoeller Allibert) |

| Sustainability Trends | Initial shift toward durable and reusable packaging |

| Consumer Trends | Demand for cost-effective, reusable transport packaging |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates promoting reusable and recyclable sleeve containers |

| Technology Innovations | Advancements in biodegradable, lightweight, and RFID-enabled smart containers |

| Market Adoption | Expansion into pharmaceuticals, e-commerce fulfillment, and automated warehouses |

| Efficiency & Performance | Adoption of ultra-light, collapsible, and AI-optimized warehouse storage solutions |

| Market Competition | Rise of startups focusing on eco-friendly, modular, and automation-compatible sleeve containers |

| Sustainability Trends | Large-scale adoption of recyclable, compostable, and IoT-integrated collapsible containers |

| Consumer Trends | Growth in customized, space-saving, and automation-ready sleeve containers for diverse industries |

The market for United States collapsible sleeve containers is growing steadily, with the increasing need for efficient and cost-effective bulk packaging solutions across a variety of sectors such as logistics, automotive, and retail industry. The growing emphasis on supply chain optimization and reusable packaging solutions is driving the market growth.

The significant presence of leading e-commerce companies and strict sustainability regulations promoting packaging waste reduction and operational efficiency are driving businesses to adopt collapsible sleeve containers. Moreover, introduction of lightweight and durable materials are expected to support adoption of these containers in the USA

Moreover, the growing automotive industry that uses returnable packaging for transporting car parts is further instrumental to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The USA collapsible sleeve containers market is projected to grow in reaction to the growing sustainable and cost effective packaging solutions. Environmental regulations lead logistics and retail industries to take up reusable bulk containers.

Growing emphasis on efficient warehouse management, coupled with the rise of e-commerce, continues to positively influence the uptake of collapsible sleeve containers. In addition, circular economy initiatives and government-driven sustainability programs are driving companies to adopt returnable and reusable packaging solutions.

The growing food and beverage industry, which demands anaerobic clones type bulk packing that is space-and-hygiene friendly, is also driving the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The reported market in Europe also benefits from new EU sustainability regulations, including packaging recycling targets and new disposable bans, as the EU collapsible sleeve containers market is continuing to grow steadily as demand for more reusable alternatives increases and cross-border trade continues to grow within Europe. The EU’s push to reduce single-use plastics is prompting companies to adopt collapsible sleeve containers as an environmentally friendly option.

Sustainable bulk packaging solutions are mainly being adopted in the automotive, pharmaceutical, and industrial sectors in leading economies such as Germany, France, and Italy. Increasing penetration of third-party logistics (3PL) service providers adopting returnable transit packaging is also driving market growth.

The use of new lightweight and recyclable materials for sleeve containers is making them easier and more cost-efficient to use while making them more durable towards the rigors of supply chain operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.6% |

Implementation of automation coupled with optimized space requirement and sustainable packaging demands are boosting the market for collapsible sleeve containers in the country. Market demand is driven by the increasing adoption of returnable packaging solutions, especially in the automotive and electronics industries.

The demand of efficient and eco-friendly material handling in Japan which has strong logistics infrastructure and stringent waste management policies is expected to propel the Japan collapsible sleeve container market growth. Furthermore, the rising need for space-efficient and retractable storage systems in urban distribution centers is boosting the market growth.

In addition, the increasing use of collapsible packaging for warehouse and in-transit storage applications is being driven by the expansion of Japan’s retail and e-commerce industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The market for collapsible sleeve containers in South Korea is expected to grow at a lucrative rate owing to the growth of segment of the manufacturing, automotive and logistics industries. Demand for collapsible bulk containers is being driven by the country’s move toward sustainable packaging solutions and the growing uptake of smart logistics practices.

Government regulations mandating waste minimization and circular economy practices are prompting companies to lean towards reusable and returnable packaging options. Moreover, the growing e-commerce sector in South Korea, in addition to the growing demand for space-efficient warehouse management systems, is contributing to the market growth.

The increasing demand for hygienic and light-weight packaging solutions from food and pharmaceutical industry will also aid in the adoption of collapsible sleeve containers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

The 48x40x30 collapsible sleeve container, in particular, has seen solid demand since it provides a strong return on space, weight and stack ability. These containers maximize space effectiveness, making them suitable for businesses that need low-cost bulk storage and transportation options without taking up much warehouse space.

Traditional corrugated boxes, collapsible sleeve containers work in tight spaces and have a wide range of sizes, which makes them popular with manufacturers in automotive, retail, and industrial logistics applications, with the 48x40x30 size being the most common as they are lightweight and easy to handle. Naturally collapsible, they ensure empty container volume remains as minimized as possible, cutting costs associated with return freight. They also fit standard pallet sizes making them easy to include in the current supply chain and logistics practices driving demand further more for this type of box.

These containers are made with high-density polyethylene (HDPE) and polypropylene (PP), which are durable and recyclable materials, which address growing environmental concerns. Initially the cost on investment may seem on the higher side as compared to traditional packaging but over pipeline benefits of cost savings, sustainable approach, and operational enhancement has driven 48x40x30 collapsible sleeve containers to emerge as the potential option in supply chain enhancement.

The 48x40x34 folding sleeve container market has started to gain momentum as industries look for high-capacity packaging alternatives that still offer flexibility. These containers were found to be able to hold more than the 48x40x30 variant and are better suited for carrying bulky items without compromising structural integrity.

Collapsible sleeve containers of size 48x40x34 are used in many industries like pharmaceuticals, agriculture and electronics for handling products with different sizes specifications. These buttons allow for the customizability of sleeve heights, while familiar reinforced corners enhance durability and ensure that containers will hold up to the demanding nature of transportation and storage.

These containers retain their collapsible agility to minimize storage footprint when not in use, despite the larger sizing. Their strong construction reduces product damage risks during transit, presenting them as a cost-effective, protection-oriented packaging choice for businesses. Now as e-commerce and global trade continue to grow, the need for 48x40x34 collapsible sleeve containers will continue to be a growing demand for better logistics efficiency across multiple industries.

The demand for block pallets in the collapsible sleeve container market is likely to be strong, owing to their higher load-bearing capacity and superior structural strength. A multi-directional pallet is another version of pallet utilization, where forklifts can swipe through the sides of the pallet (any four sides) in order to ease material handling in distribution and warehousing centers.

Vast use of block pallets in applications from automotive manufacturing to food distribution all the way to your local warehouse absolutely justifies why block pallets matter. These stacks are made of durable materials -typically wood, plastic, or metal - that provide a stable base for stacked product and a stable platform for transport, minimizing product loss. While block pallet construction allows for load distribution, making block pallet suitable for industries where container handling is constant and recyclability.

Although block pallets might have a higher initial price than stringer pallets, in the long run they can be very cost-effective in regards to their durability and low maintenance. The growing attention on automation in logistics and warehouse operations has also accelerated the adoption of block pallets since their identical dimensions enable them to fit into automated storage and retrieval systems (AS/RS) more easily. Block pallets will be just as important in collapsible sleeve container applications as industries place greater focus on load efficiency and durability.

Stringer pallets are well known due to the cost benefits across the entire collapsible sleeve container applications. Parallel stringer pallets use stringers that offer a light weight and solid foundation for goods transportation. Their design is such that it allows for two-way and partial four-way forklift access, which is ideal in warehouses, retail distribution, and light industrial.

Stringer pallets are preferred by businesses operating in consumer goods, agriculture, and pharmaceuticals owing to their cost-effectiveness and excellent ease of handling. Constructed of wood, which is often a less costly option than block pallets in these disposable or limited-use shipping applications, they are a cost-effective solution for medium-weight shipments providing maximum load capacity.

Stringer pallets might not be as fully durable as block pallets but development in pallet fortification innovations have made strides in improving their design. Stringer pallet designs have also incorporated plastic or metal reinforcements in an effort to extend the life of the pallet as well as help the load remain stable. Stringer pallets will remain an invaluable option in logistics and supply chain management where businesses are looking to folds sleeve containers with a high-quality yet cost-effective option.

The collapsible sleeve containers market is positively influenced by the increasing demand for device-efficient, economical, and re-usable bulk packaging solutions across industries such as automotive, food & beverage, pharmaceuticals, retail, and logistics. The reason for this is that these containers provide durability, ease of storage, and lower shipping costs, making them the all-time preferred types of supply chain optimizations and sustainable packaging initiatives. Growing implementation of returnable packaging solutions to reduce waste and carbon footprint is also favoring the market growth.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Schoeller Allibert | 18-22% |

| ORBIS Corporation (Menasha Corporation) | 14-18% |

| DS Smith Plc | 12-16% |

| IPL Plastics | 10-14% |

| Rehrig Pacific Company | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Schoeller Allibert | Develops heavy-duty collapsible sleeve containers for automotive, agriculture, and logistics industries. |

| ORBIS Corporation | Specializes in returnable sleeve containers with foldable, lightweight designs for supply chain efficiency. |

| DS Smith Plc | Provides fiber-based and plastic collapsible sleeve solutions with a focus on sustainable packaging. |

| IPL Plastics | Manufactures customized collapsible bulk containers for retail and industrial applications. |

| Rehrig Pacific Company | Offers high-durability collapsible sleeve containers for distribution and warehousing logistics. |

Key Market Insights

Schoeller Allibert (18-22%)

Schoeller Allibert leads the market with heavy-duty, reusable collapsible sleeve containers designed for efficient storage and transport. The company focuses on automotive, industrial, and agricultural applications, integrating high-strength materials for long-term use.

ORBIS Corporation (Menasha Corporation) (14-18%)

ORBIS is a key player in returnable and reusable packaging solutions, providing lightweight, easy-to-handle collapsible sleeve containers. The company targets retail, food & beverage, and warehouse automation industries.

DS Smith Plc (12-16%)

DS Smith specializes in fiber-based and plastic collapsible sleeve containers, offering sustainable and recyclable solutions for e-commerce, logistics, and FMCG (fast-moving consumer goods) sectors.

IPL Plastics (10-14%)

IPL Plastics manufactures customized, collapsible bulk containers tailored to specific industrial, retail, and food supply chain needs. The company is investing in innovative designs for enhanced stack ability and cost reduction.

Rehrig Pacific Company (8-12%)

Rehrig Pacific provides high-durability collapsible sleeve containers for distribution and logistics applications, with a focus on warehouse automation and material handling.

Other Key Players (26-32% Combined)

The overall market size for collapsible sleeve containers market was USD 5,112.8 million in 2025.

The collapsible sleeve containers market is expected to reach USD 7,495.8 million in 2035.

The growth of the collapsible sleeve containers market will be driven by increasing demand for space-efficient and reusable packaging solutions, advancements in lightweight and durable materials, and rising adoption in logistics and retail industries for cost-effective storage and transportation.

The top 5 countries which drives the development of collapsible sleeve containers market are USA, European Union, Japan, South Korea and UK.

48x40x34 collapsible sleeve containers to command significant share over the assessment period.

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

MOPP Packaging Films Market Insights - Growth & Forecast 2025 to 2035

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.