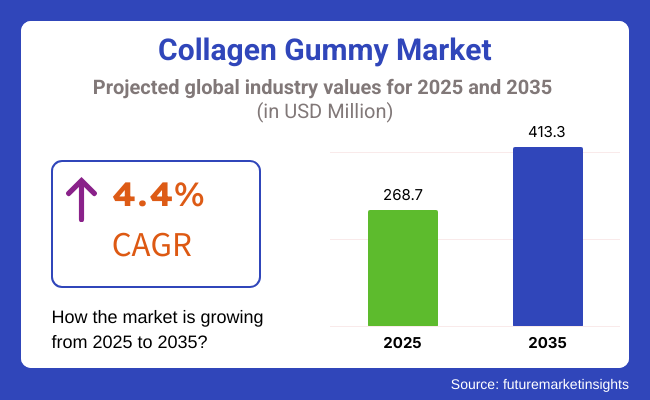

The global Collagen Gummy market is estimated to be worth USD 268.7 million in 2025 and is projected to reach a value of USD 413.3 million by 2035, expanding at a CAGR of 4.4% over the assessment period of 2025 to 2035

Collagen gummies offer a user-friendly alternative to traditional collagen supplements like powders and capsules. Their chewable format makes them easy to consume, appealing particularly to individuals who struggle with swallowing pills.

Additionally, the variety of flavors available enhances their palatability, making them a more enjoyable option for daily supplementation. This convenience and taste factor significantly contribute to their popularity, as consumers are more likely to incorporate them into their routines compared to less appealing forms.

The collagen gummy market has witnessed significant product innovation, with brands continuously developing new flavors, formulations, and added ingredients. This innovation includes the incorporation of vitamins, minerals, and other beneficial compounds that enhance the overall health benefits of the gummies.

By diversifying their offerings, companies cater to a broader audience and meet specific consumer preferences, such as vegan or sugar-free options. This dynamic approach not only attracts new customers but also encourages repeat purchases from existing users.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global collagen gummy market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 3.3% (2024 to 2034) |

| H2 | 3.9% (2024 to 2034) |

| H1 | 4.3% (2025 to 2035) |

| H2 | 4.9% (2025 to 2035) |

The above table presents the expected CAGR for the global collagen gummy demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 3.3%, followed by a slightly higher growth rate of 3.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 4.3% in the first half and remain relatively moderate at 4.9% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Personalization of Supplements

The trend of personalization in health supplements is reshaping consumer expectations, particularly in the collagen gummy market. As individuals become more aware of their unique health needs, they seek products that cater specifically to those requirements. Brands are responding by developing collagen gummies that target various concerns, such as enhancing skin elasticity, supporting joint health, or promoting hair and nail strength.

This tailored approach not only meets the diverse needs of consumers but also fosters a deeper connection between the brand and its customers. When individuals feel that a product is designed with their specific wellness goals in mind, it enhances their engagement and loyalty, ultimately driving repeat purchases and positive word-of-mouth recommendations.

Integration of Technology in Marketing

The integration of technology in marketing strategies is revolutionizing how collagen gummies are promoted. Brands are increasingly utilizing digital platforms, including social media and influencer partnerships, to reach a broader audience and engage with health-conscious consumers. Through targeted campaigns, companies can effectively educate potential customers about the benefits of collagen and the unique features of their products.

Engaging content, such as informative videos, testimonials, and interactive posts, helps to build brand awareness and trust. This tech-driven approach not only enhances visibility but also allows for real-time feedback and interaction with consumers, creating a dynamic relationship that can lead to increased sales and brand loyalty in a competitive market.

Focus on Holistic Health

The growing emphasis on holistic health and wellness is significantly influencing consumer preferences in the collagen gummy market. Many individuals are shifting their focus from merely addressing specific health issues to seeking products that contribute to their overall well-being. As a result, collagen gummies that offer multiple health benefits-such as promoting skin vitality, supporting joint function, and enhancing gut health-are becoming increasingly popular.

This trend reflects a broader understanding of health as an interconnected system, where various aspects of well-being are interrelated. Brands that successfully market their products as comprehensive solutions for holistic health are likely to resonate with consumers, driving demand and fostering a loyal customer base committed to long-term wellness.

Global Collagen Gummy sales increased at a CAGR of 3.6% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on collagen gummy will rise at 4.4% CAGR.

The rise of social media has transformed the way brands promote their products, particularly in the health and wellness sector. Influencers play a crucial role in this landscape by sharing their personal experiences with collagen gummies, highlighting their benefits and effectiveness.

Their authentic endorsements resonate with followers, creating a sense of trust and relatability. This organic promotion not only boosts brand visibility but also drives consumer interest, encouraging potential buyers to try collagen gummies based on the recommendations of trusted figures in their social circles.

The rapid expansion of e-commerce platforms has revolutionized the way consumers shop for collagen gummies. Online shopping offers unparalleled convenience, allowing consumers to browse a wide variety of products from the comfort of their homes.

E-commerce also provides competitive pricing, enabling consumers to find the best deals and discounts. Additionally, the ability to compare different brands and formulations easily empowers consumers to make informed purchasing decisions. This accessibility and convenience have significantly contributed to the growth of collagen gummy sales in the global market.

Tier 1 companies represent the industry leaders in the global collagen gummy market, boasting annual revenues exceeding USD 20 million and commanding a market share of approximately 40% to 50%. These companies are characterized by their high production capacities, extensive product portfolios, and robust distribution networks. They possess significant expertise in manufacturing and packaging across various formats, allowing them to cater to a wide range of consumer preferences.

Their strong brand recognition and established consumer bases further solidify their market dominance. Prominent players in this tier include Vital Proteins, NeoCell, and Youtheory, which have successfully leveraged their resources to innovate and expand their offerings in the collagen gummy segment.

Tier 2 companies consist of mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies have a notable presence in specific regions and significantly influence the local retail landscape. They are characterized by a strong understanding of consumer preferences and regional market dynamics, allowing them to tailor their products effectively.

While they may not possess the extensive global reach of Tier 1 companies, they often have good technology and ensure regulatory compliance. Notable companies in this tier include Garden of Life, Sports Research, and Nature's Way, which focus on niche markets and regional distribution strategies to maintain competitiveness.

Tier 3 comprises a large number of small-scale companies operating primarily at the local level, with revenues below USD 5 million. These companies typically serve niche markets and are oriented towards fulfilling specific local demands.

They often lack the extensive structure and formalization seen in larger competitors, resulting in a more unorganized market segment. Despite their limited geographical reach, Tier 3 companies can be agile and responsive to local consumer trends, allowing them to carve out unique positions within the market.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 62.0 million |

| Germany | USD 41.3 million |

| China | USD 33.1 million |

| India | USD 20.7 million |

| Japan | USD 8.3 million |

The increasing demand for collagen gummies in the USA is significantly driven by the aging population and a growing focus on preventative health. As the demographic shifts towards an older population, individuals are becoming more conscious of maintaining their health and vitality. They recognize the critical role collagen plays in promoting skin elasticity, joint health, and overall wellness. This awareness fuels the desire for convenient and effective supplements like collagen gummies, which cater specifically to their health concerns.

Simultaneously, American consumers are adopting a preventative approach to health, seeking solutions that help maintain well-being rather than merely addressing existing issues. Collagen gummies are positioned as proactive supplements that support skin and joint health, aligning perfectly with this preventative mindset and enhancing their appeal among health-conscious individuals.

The increasing demand for collagen gummies in Germany is significantly influenced by consumers' preference for natural ingredients and the availability of innovative product offerings. German consumers prioritize high-quality, clean-label products, leading many collagen gummy brands to source their ingredients from natural origins, such as marine or plant-based collagen. This focus on purity resonates with health-conscious individuals seeking effective supplements without artificial additives.

Additionally, the German market has witnessed a rise in multifunctional collagen gummies that combine collagen with vitamins, minerals, and herbal extracts. These innovative formulations cater to consumers looking for comprehensive health solutions that address multiple wellness needs. Together, these trends enhance the appeal of collagen gummies, driving their popularity among discerning German consumers.

In Japan, the cultural emphasis on beauty and skincare is deeply ingrained, with consumers prioritizing products that enhance youthful appearance. Collagen has long been celebrated in Japanese beauty culture for its vital role in maintaining skin elasticity, hydration, and overall radiance. This recognition has led to a growing interest in collagen supplements, particularly gummies, which are perceived as a convenient and enjoyable way to incorporate collagen into daily routines.

The appealing flavors and easy consumption of collagen gummies resonate with a beauty-conscious demographic, making them a popular choice for those seeking effective solutions to support and enhance their skin health.

| Segment | Value Share (2025) |

|---|---|

| Bovine Animals (Source) | 28% |

The increasing demand for bovine collagen gummies is significantly driven by the widespread availability of bovine collagen and its versatile applications. The large-scale cattle industry ensures a consistent supply of raw materials, allowing manufacturers to produce collagen gummies at scale without facing significant supply chain disruptions. This reliability is crucial in meeting the growing consumer demand for collagen supplements.

Additionally, bovine collagen's versatility enables its use in various formulations, including gummies, powders, and beverages. This adaptability allows brands to create a diverse range of products that cater to different consumer preferences and lifestyles. As a result, the combination of reliable sourcing and product versatility enhances the appeal of bovine collagen gummies in the global market.

The competition in the global collagen gummy market is intensifying as brands focus on innovation, quality, and consumer engagement. Companies are differentiating themselves by offering diverse formulations, including unique flavors and added functional ingredients like vitamins and minerals. Emphasizing natural and clean-label products, brands are catering to health-conscious consumers. Additionally, strategic partnerships with influencers and effective digital marketing campaigns are being employed to enhance brand visibility and consumer trust, ensuring they remain competitive in a rapidly evolving market.

For instance

The global Collagen Gummy industry is estimated at a value of USD 268.7 million in 2025.

Sales of Collagen Gummy increased at 3.6% CAGR between 2020 and 2024.

Vital Protein Co., Ltd., Gelita AG, Neocell Co., Ltd., Nature’s Bounty, Youtheory Co., Ltd. are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 25% over the forecast period.

North America holds 32% share of the global demand space for Collagen Gummy.

This segment is further categorized into Berry, Citrus, Tropical, and Other Flavors

This segment is further categorized into Bovine Animals, Porcine Animals, Marine & Poultry Animals, and Other Sources.

This segment is further categorized into Promoting Skin Health, Supporting Hair & Nail Health, Joint Health, Wound Healing, Bone Health, and Other Functionalities.

This segment is further categorized into Hypermarkets or Supermarkets, Convenience Stores, Specialty Retail Stores, Drug Stores and Pharmacy Stores, and Online Retail Channels.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

Lecithin and Phospholipids Market Analysis by Product Type, Form, Nature, Function and Application Through 2035

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.