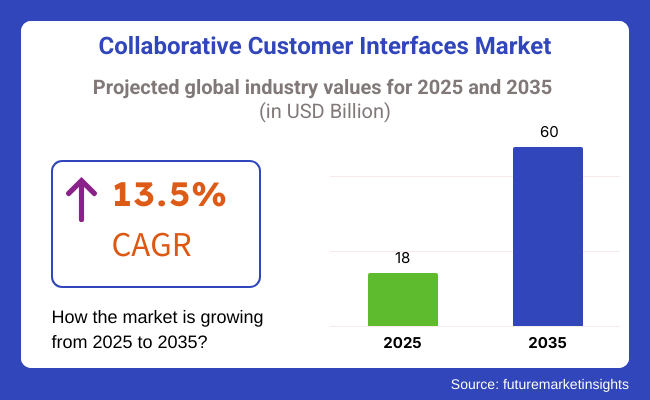

The collaborative customer interfaces market will reach USD 18 billion in 2025 and grow to USD 60 billion in 2035, with a CAGR of 13.5% throughout the forecast period. Organizations are adopting AI-enabled customer interaction platforms, real-time communication platforms, and cloud collaboration platforms to enhance customer engagement and experience. Investment in digital transformation, Omni channel support, and personalized AI interfaces will also contribute to industry growth.

Organizations apply cooperative customer interfaces to manage the automation of customers' interactions, boost service quality, and increase digital engagement strategies. The deployment of AI-fueled Chabot, blockchain-based secure transactions, and IoT-backed customer monitoring will enhance the efficiency of operations and instant user engagement.

The increasing deployment of AI-driven virtual assistants, cloud communications platforms, and personalized digital experiences is transforming customer interactions in industries. Businesses are employing machine learning, voice recognition, and real-time data analysis to enhance customer satisfaction and streamline service operations.

Explore FMI!

Book a free demo

The industry is shifting pretty fast as a result of the growing demand for better user experience, AI-powered automation, and fractured Omni channel interactions. The retail and e-commerce sectors see the main way to attract and retain customers with the help of personalized engagement and real-time product assistance, which is their number one priority for customer satisfaction and sales conversions respectively.

Healthcare providers are securing compliance, as well as easy access to these new technologies to ensure that they deliver a seamless patient experience. The banking and finance sector targets security first, as well as AI customer service, and, automation that brings together fraud detection and better client relationships.

The IT & telecommunications companies look for multichannel solutions with Chabot, voice assistants, and predictive analytics already included in them that would bring more customer engagement. Meanwhile, the automotive industry is focusing on cost-effective AI-integrated interfaces that empower the customer to interact with the company across the digital channel.

The transition of businesses toward digital strategies will necessarily lead to the expansion of the AI-pushed, user-friendly, and security-optimized customer interfaces, thus actively determining the further course of customer engagement in many industries.

| Company | Contract Value (USD Million) |

|---|---|

| Omnicom and Interpublic Group (IPG) | Approximately USD 13,200 - USD 13,300 |

| HubSpot and Clearbit | Approximately USD 400 - USD 450 |

In December 2024, Omnicom's planned acquisition of Interpublic Group (IPG) for approximately USD 13,200 - USD 13,300 million marked a significant consolidation in the advertising and marketing industry, aiming to enhance capabilities in collaborative customer interfaces and digital marketing solutions.

Earlier in September 2024, HubSpot acquired Clearbit for approximately USD 400 - USD 450 million to integrate advanced data enrichment features into its platform, providing users with enhanced customer insights. These developments reflect a trend towards integrating advanced data analytics and customer interface solutions to improve personalized customer engagement and streamline marketing efforts.

Between 2020 and 2024, the industry increased as companies focused on interaction, customization, and Omni channel communication. Voice assistants, real-time messaging, and Chabot powered by artificial intelligence (AI) improved customer experience (CX) on banking, healthcare, e-commerce, and retail websites.

The COVID-19 pandemic accelerated digital transformation, fueling adoption and demand for AI-fueled recommendation engines, video support, and conversational commerce. Firms embedded these interfaces into predictive data analytics and CRM platforms due to roadblocks in the form of interoperability, AI bias, and data privacy that restrained adoption.

GDPR and CCPA deployment accelerated AI ethics and safe data handling expenditures to protect trust in AI-driven customer interactions. Decentralized interaction platforms, quantum secure communication, and AI-driven hyper-personalization will dominate the industry during 2025 to 2035. Real-time sentiment analysis will be enhanced by AI-powered engines, and quantum computers will secure transactions and fraud protection.

In 2025 to 2035, AI-based hyper-personalization, quantum secure communication, and decentralized interaction platforms will define the industry. Sentiment analysis in real-time will be enhanced with AI-powered engines, and transactions and fraud defense will be protected by quantum computers.

Blockchain-supported identity management will provide enhanced privacy for data, and interactive AR/VR interfaces will facilitate immersive shopping and virtual support. Digital humans and holograms powered by AI will make conventional service channels obsolete. Sustainability initiatives will maximize digital resource utilization, and AI-based CX analytics will enhance predictive engagement and customer satisfaction.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Harsher data protection laws (GDPR, CCPA) demanded more security, encryption, and consent management on consumer interactions. | Blockchain-secured, AI-based customer interfaces provide real-time regulatory compliance, decentralized identity verification, and tamper-proof customer engagement metrics. |

| AI-based Chabot and virtual assistants accelerated real-time personalized consumer experiences on multi-digital interfaces. | AI-generational, auto-adaptive customer interfaces constantly tune into user patterns, predict the needs of the customer, and provide hyper-personalized engagements based on behavior and sentiment insight. |

| Businesses adopted cloud-enabled interfaces to put customer interactions all in one platform across voice, video, social media, and messaging channels. | AI-enhanced, real-time Omni channel ecosystems autonomously synchronize conversations, optimize AI-driven customer journeys, and provide predictive engagement for seamless brand interaction. |

| Businesses integrated voice assistants, gesture recognition, and AR/VR solutions to create immersive customer experiences. | AI-powered, multimodal customer interfaces leverage real-time voiceprint authentication, interactive holograms, and AI-driven emotion recognition for next-gen conversational commerce. |

| AI-driven Chabot improved customer service efficiency, reducing wait times and increasing resolution accuracy. | AI-native, autonomous virtual agents provide real-time, context-aware problem-solving, multilingual conversational AI, and predictive resolution automation for enhanced customer satisfaction. |

| AI-assisted sentiment analysis helped businesses tailor responses and improve customer satisfaction. | AI-driven, real-time, sentiment-driven user interfaces independently identify emotional signals, adjust response tone, and facilitate hyper-personalized, AI-enabled customer interactions. |

| AI-driven security mechanisms provided end-to-end encrypted communication to avoid data loss and fraud in customer interactions. | AI-born, quantum-safe collaborative interfaces independently identify attempts to spoof them, block identity spoofing, and enforce AI-powered real-time security measures for protecting customer information. |

| Increased interconnectivity enhanced real-time collaboration via effortless live chat, video calls, and virtual customer service. | AI-driven, 6G-based customer interaction platforms provide super-speed, real-time interactive engagement, AI-augmented visual communication, and virtual customer consultation immersion. |

| Enhanced customer interface platforms were optimized by organizations to minimize power consumption in data centers and increase eco-friendly digital engagement. | Green, AI-driven collaboration interfaces leverage cloud infrastructure that is green, AI-driven bandwidth efficiency, and digital interaction patterns that are green-friendly. |

| Companies examined blockchain-enabled customer interfaces for safeguarded transactions, digital verification of identity, and fraud protection. | Decentralized, AI-driven customer interaction platforms enable trust less, real-time validation of conversations, blockchain-linked loyalty schemes, and AI-driven smart contract automation for safe transactions. |

The industry is exposed to multiple risks, such as shifts in technology, cyber security issues, compliance with laws, and difficulties in industry. Primarily, the biggest threat is technological changes. In the face of AI, machine learning, and augmented reality becoming more popular, businesses have to amend their interfaces continuously.

Those who are not migrating to the latest innovations on time will be at risk of being outperformed by their rivals that provide more fun and individualized services. Cyber threats and privacy risks of data are also the major issues. The use of collaborative interfaces that communicate in real-time puts them at risk of cyber-attacks, breaches of data, and violation of compliance.

Companies, under the purview of strict regulations GDPR and CCPA, are manifestly required to assure the use of secure data handling and the provision of user consent mechanisms. The penalty for not adhering to these regulations is the possibility of legal action.

Another major risk is the issue of user acceptance and the level of engagement. Although collaborative interfaces do improve customer interaction and brand loyalty, a poor design, complexity or, lack of user-friendliness can lead to low engagement and high churn rates. Businesses are required to conduct usability tests, gather behavioral analytics to enhance the customer experience

Competitive industry strengths the risks even more. The tech companies and the startups which are developing and applying technologies, such as Chabot, voice assistants, virtual try-ons, and interactive dashboards, are in healthy competition. Companies must focus on distinctiveness, AI-based knowledge, and Omni channel integration for them to remain competitive and flourish in the industry.

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 9.8% |

| UK | 9.5% |

| European Union | 9.6% |

| Japan | 9.7% |

| South Korea | 9.9% |

The USA industry increases as companies make use of AI-based Chabot, virtual assistants, and real-time customer interaction solutions. Companies enhance customer experience, improve communication, and personalize interactions with cutting-edge customer interface solutions.

Industry expansion speeds up with Omni channel support needs, workflow automation, and interactive AI capabilities. The USA banking, retail, and technology industries utilize collaborative customer interfaces to maximize service efficiency and customer satisfaction. Enterprises are motivated by policy mandates to invest in AI-based and secure customer engagement solutions. FMI is of the opinion that the USA industry is slated to grow at 9.8% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| AI-Driven Engagement | Enterprises utilize Chabot and virtual assistants to enhance customer engagement. |

| Omni channel Support | Companies embrace seamless communication between devices. |

| Regulatory Compliance | Laws encourage investments in secure and efficient AI-powered solutions. |

The UK industry increases as companies embrace AI-powered customer interaction solutions and self-service solutions. Companies embrace interactive voice response (IVR), Chabot, and predictive analytics to improve customer support and reduce response time.

Cloud communication, real-time interaction, and AI-driven insights enable industry growth. Data privacy and secure customer interaction regulatory frameworks further prompt businesses to adopt collaborative customer interface technologies. FMI is of the opinion that the UK industry is slated to grow at 9.7% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| AI-Driven Support Systems | Businesses utilize Chabot and predictive analytics to communicate effectively. |

| Cloud-Based Interaction | Businesses utilize cloud communication for seamless interaction. |

| Data Privacy Regulations | Firm regulations enable secure AI-driven customer interactions. |

The European Union industry grows as companies embrace AI-based communication platforms, one-on-one customer interactions, and automated service solutions. Germany, France, and Italy lead the industry by integrating customer interaction solutions with retail, healthcare, and financial services.

The EU has strong data protection and privacy regulations, and businesses are spending on GDPR-compatible customer interface products. Machine learning and real-time analytics drive the growth of interactive customer engagement solutions in different industries. FMI is of the opinion that the European Union industry is slated to grow at 9.6% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| Data Security Regulations | GDPR-compliant engagement solutions need to be secure and AI-powered. |

| Machine Learning Integration | Artificial intelligence analysis enhances customer service based on time. |

| Industry Adoption | Interactive interfaces are used by retail, healthcare, and finance sectors. |

The Japanese industry increases as businesses implement AI-driven conversational interfaces, virtual assistants, and automated customer service features. Businesses develop new customer experience solutions to enhance service effectiveness, improve user experience, and build customer retention.

Japan's focus on technology innovation and digitalization drives the adoption of advanced customer interaction systems. The banking, telecom, and e-commerce sectors invest in artificial intelligence-based customer engagement platforms to enhance customer experience. FMI is of the opinion that the Japanese industry is slated to grow at 9.7% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI-Driven Assistance | Companies adopt virtual assistants to deliver efficient customer service. |

| Digital Transformation | Companies adopt automated platforms to optimize interactions. |

| Smart Connectivity Solutions | Technology firms develop real-time AI-based engagement solutions. |

The South Korea industry is growing at a competitive rate as companies implement AI-based engagement solutions, Chabot based customer service, and automated communication platforms.

Government-initiated digital transformation initiatives drive vertical-wise adoption of smart customer interaction technologies. Companies use voice recognition, real-time insights, and tailored AI recommendations to enhance customer experience. Cloud computing solutions and 5G networks also fuel industry growth. FMI is of the opinion that the South Korean industry is slated to grow at 9.6% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| AI-Driven Customer Engagement | Companies adopt automated interaction solutions to provide real-time support. |

| 5G and Cloud Technologies | Better connectivity fuels AI-powered customer experiences. |

| Government Digital Programs | Policies accelerate the use of state-of-the-art customer interaction solutions. |

The solution segment is led by the cloud-based deployment segment owing to the increasing demand from enterprises for scalable, cost-efficient, and remotely accessible solutions. Whenever an enterprise aspires to render a great customer experience with decreased investments in IT Controls, a Cloud-based collaborative customer interface that can help to have real-time sync of data, integrations, and AI-based automation is a perfect fit for the same.

Salesforce, Microsoft Dynamics 365, Zendesk, and Freshworks are key players, offering firms cloud-based customer interface systems that facilitate interaction through several digital touchpoints. Cloud solutions are flexible, and thus, companies are able to assign chatbots, video calls, screen share, and collaborative ticket systems to the customer so that they can approach the customer in an interactive and efficient way.

As companies transitioned to remote work environments and digital-first customer support strategies, the cloud-based vertical is even forecasted to retain a healthy share of the industry. E-commerce, banking, healthcare, and even telecommunications have all put cloud-based collaborative interfaces at the forefront of their cloud strategy for their real-time, AI-enabled customer engagement capabilities.

The on-premises deployment segment is still relevant, which is why the segment is growing considerably, owing to security, compliance, and data-related privacy requirements. On-premises customer interface solutions are popular among large enterprises and government agencies that process sensitive customer data as they allow for better control over data security and infrastructure.

SAP, Oracle, and Avaya, on the other hand, provide similar collaboration suites for enterprises in on-premise industries such as banking, healthcare, and defense, where GDPR, HIPAA, and ISO 27001 matter. The solutions offer greater customization, integration with legacy IT ecosystems, and improved control over software versioning and data protection strategies.

On-premises deployments generally entail greater initial investments for hardware and upkeep, but they remain attractive to organizations that prioritize data sovereignty, security, and performance stability.

In this era of increased competition, technology-backed shared customer interfaces are becoming the lifeblood of small and small businesses to address customer service, engagement, and retention needs. Budgets are tight, and most small businesses prefer cloud-based solutions, as these have helped them get enterprise-grade customer interaction tools with minimal investments in infrastructure.

Affordable, intuitive customer interface platforms, like those offered by HubSpot, Zoho, and Fresh works, empower small businesses to leverage technology and tools like AI chatbots, automated ticketing, and live chat solutions to provide superior customer satisfaction. Such solutions assist small businesses to compete with corporate giants by providing more personalized and efficient customer interactions.

Medium-sized companies need scalable and rich-featured cooperative customer interface solutions that help them manage their increasing customer bases. These businesses look for solutions that integrate themselves with CRM platforms, marketing automation tools & Omni channel communication systems.

Some examples of these providers include Salesforce, Zendesk, and ServiceNow, which include more advanced features like multi-channel support, customer analytics, workflow automation, and AI-powered insights for medium enterprises.

While medium enterprises are in the phase of expansion, they look for hybrid deployments that combine the flexibility of cloud solutions with the security of on-premises solutions, providing them with more control over their customer data management.

The industry is witnessing a rapid global trend as companies move toward digital-first engagement methods to better the interactions with their customers as well as streamline communications, thus enhancing the overall customer experience. Demand for AI-driven Chabot, cloud-based CRMs, and self-service portals increases further as more and more companies emphasize real-time, Omni channel collaboration.

The bulk of the industry is taken up by some of the industry leaders, such as Salesforce, Microsoft, Oracle, Zendesk, and HubSpot, in terms of intelligent automation, predictive analytics, and AI-powered customer support solutions. Start-ups and niche players are focusing on interactive voice response (IVR) systems, personalized recommendation engines, or real-time co-browsing tools, which typically result in increased engagement.

Emerging trends by which the industry evolves are advancements in conversational AI, natural language processing (NLP), and sentiment analysis, enabling context-aware interactions across multiple touchpoints and inclusion of seamlessness factors.

For instance, the two strategic factors-strengthening competition are a rise in digital customer service coupled with an increasing number of AI-powered interfaces and the huge demand for hyper-personalized experiences. Companies are leveraging real-time data analytics, API-driven integrations, and cloud-native customer engagement solutions to differentiate their footprints in an ever-evolving digital landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Salesforce | 20-25% |

| Microsoft Dynamics 365 | 15-20% |

| Oracle CX Cloud | 12-17% |

| Zendesk | 8-12% |

| HubSpot | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Salesforce | Provides AI-powered CRM, customer engagement analytics, and omnichannel customer interaction tools. |

| Microsoft Dynamics 365 | Develops intelligent customer relationship solutions, cloud-based engagement, and real-time collaboration. |

| Oracle CX Cloud | Specializes in predictive customer analytics, AI-driven automation, and personalized digital experiences. |

| Zendesk | Focuses on AI-powered chatbots, real-time support solutions, and self-service customer interaction tools. |

| HubSpot | Offers cloud-based customer engagement platforms, marketing automation, and AI-enhanced analytics. |

Key Company Insights

Salesforce (20-25%)

AI-enabled CRM, omnichannel communication tools, predictive engagement solutions all coupled with customer portals make Salesforce the leader in collaborative customer interface.

Microsoft Dynamics 365 (15-20%)

AI-assisted CRM by 365 Microsoft bot driven into real-time collaboration, while bestows cloud-based support with a highly optimized touch up toward customer interactionatic.

Oracle CX Cloud (12-17%)

Oracle CX Cloud specializes in AI-driven automation, predictive customer insights, and advanced digital engagement tools.

Zendesk (8-12%)

With a unique combination of chatbots powered by artificial intelligence, self-service interfaces, and solutions dedicated solely to automatic help, Zendesk seeks to elevate customer experience.

HubSpot (5-9%)

Cloud-enabled customer engagement plans, the driving of marketing automation, and AI-emphasizing analytics would be the functionalities offered by HubSpot.

Other Key Players (20-30% Combined)

The industry will continue to grow as businesses integrate AI, real-time data analytics, and cloud-based engagement solutions to optimize customer experience, satisfaction, and communication efficiency.

The industry is slated to reach USD 18 billion in 2025.

The industry is predicted to reach a size of USD 60 billion by 2035.

Cisco Systems, Inc., Oracle, Atlassian, Unblu Inc., Avaya Inc., Recursive Labs, KANA Software, OneDesk Inc., eGain, and SnapEngage are the key players in the industry.

South Korea, with a CAGR of 9.9%, is expected to record the highest growth during the forecast period.

Cloud-based solutions are among the most widely used in the industry.

By deployment type, the industry includes cloud-based and on-premises solutions.

By type of user, the industry covers small enterprises, medium enterprises, and large enterprises.

By end use, the industry includes banking, financial services, insurance, travel & hospitality, e-commerce, and real estate.

By region, the industry spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa. Key countries include the United States, Canada, Germany, Spain, the United Kingdom, Italy, France, BENELUX, Japan, China, India, South Korea, Brazil, Mexico, Argentina, South Africa, and Saudi Arabia.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.