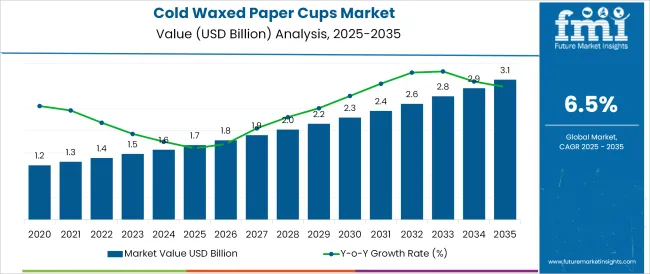

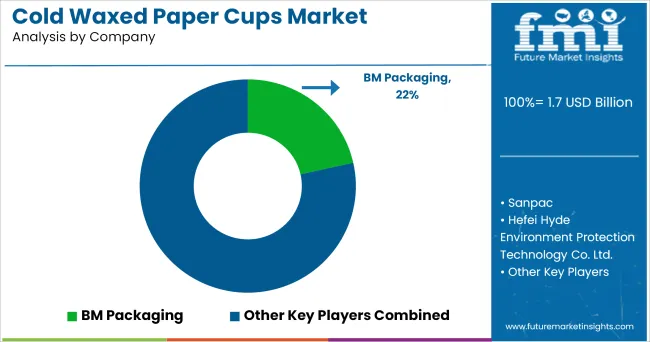

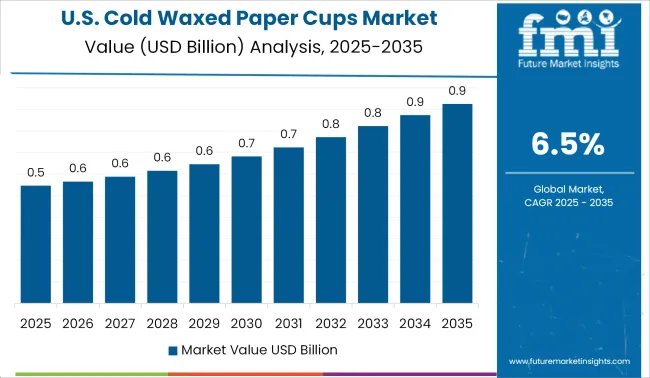

The Cold Waxed Paper Cups Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The cold waxed paper cups market is witnessing sustained growth, supported by the rising demand for sustainable and disposable beverage packaging solutions in quick-service restaurants and outdoor events. Industry publications and corporate sustainability reports have highlighted increased adoption of eco-friendly alternatives to plastic-lined cups, with waxed coatings providing effective moisture resistance for cold drinks.

Consumer awareness of single-use plastic waste reduction and regulatory actions banning non-biodegradable packaging have further boosted the market for wax-coated paper cups. Manufacturers have expanded product portfolios with various cup capacities and wall configurations to meet the needs of different beverage providers.

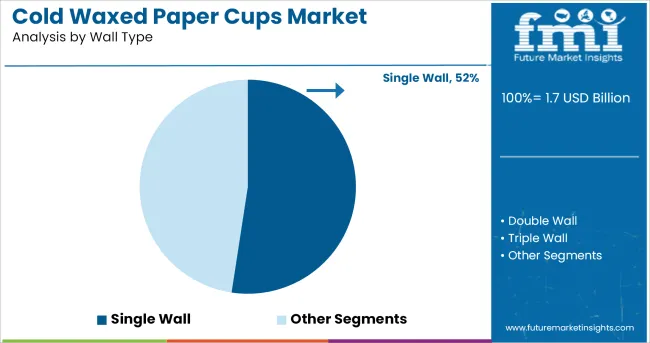

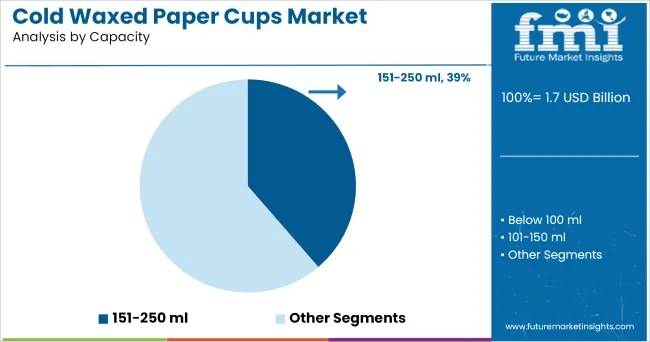

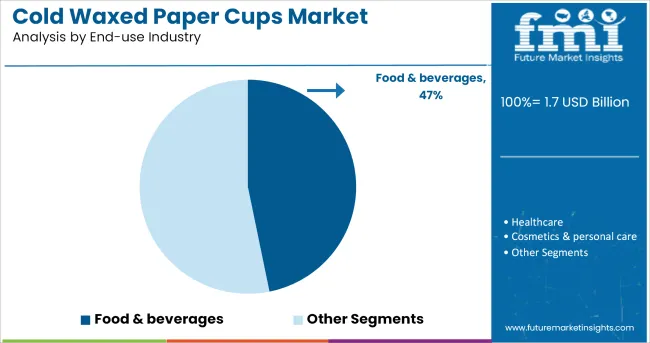

Supply chain improvements and local manufacturing initiatives have strengthened product availability in key markets. Looking ahead, the market is expected to benefit from innovations in plant-based wax coating and increased partnerships between packaging suppliers and foodservice chains. Segmental growth is led by Single Wall configurations, the 151-250 ml capacity range, and the Food & Beverages end-use industry, reflecting core consumption patterns in cold drink service environments.

The market is segmented by Wall Type, Capacity, and End-use Industry and region. By Wall Type, the market is divided into Single Wall, Double Wall, and Triple Wall. In terms of Capacity, the market is classified into 151-250 ml, Below 100 ml, 101-150 ml, and Above 250 ml. Based on End-use Industry, the market is segmented into Food & beverages, Healthcare, Cosmetics & personal care, Chemical industries, and Automotive industries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Single Wall segment is projected to contribute 52.4% of the cold waxed paper cups market revenue in 2025, maintaining its position as the leading wall type. This segment’s growth has been driven by its cost-effectiveness and suitability for serving cold beverages where insulation is less critical.

Beverage service outlets have widely adopted single wall cups for serving juices, sodas, and iced teas, where a lightweight and easily disposable cup meets both operational and environmental requirements. Production simplicity and reduced material usage have made single wall configurations the preferred choice for high-volume applications.

Manufacturers have introduced durable wax coatings that prevent condensation and leakage, enhancing the performance of single wall cups in cold drink service. Retailers and event organizers have also preferred single wall designs for their compact storage and lower unit costs. As consumption of on-the-go beverages continues to rise, the Single Wall segment is expected to sustain its leading role in the market.

The 151-250 ml capacity segment is projected to hold 38.7% of the cold waxed paper cups market revenue in 2025, positioning it as the dominant capacity range. Growth of this segment has been driven by its versatility across a wide range of beverage offerings, including soft drinks, iced coffees, and fruit juices.

Quick-service restaurants, cafés, and food stalls have preferred this capacity for serving standard cold beverages, balancing portion size with cost-effectiveness. Consumer convenience trends have reflected a preference for mid-sized portions, particularly for beverages consumed on the move.

Additionally, foodservice chains have standardized cup sizes to streamline supply chain management and inventory control, supporting widespread adoption of this capacity range. Manufacturers have optimized cup designs in this segment to enhance stack ability, reduce waste, and maintain structural integrity during use. As casual dining and takeaway beverage consumption grows, the 151-250 ml segment is expected to remain a core product offering in the cold waxed paper cups market.

The Food & Beverages segment is projected to account for 46.8% of the cold waxed paper cups market revenue in 2025, maintaining its leadership among end-use industries. Growth in this segment has been driven by the widespread use of waxed paper cups across cafes, fast-food chains, and catering services, where disposable and eco-friendly beverage containers are essential for operational efficiency.

Beverage service providers have increasingly replaced plastic-lined cups with waxed paper alternatives to meet sustainability goals and comply with regulatory mandates on single-use plastics. Industry partnerships between packaging companies and foodservice brands have expanded the adoption of cold waxed paper cups, particularly in standardized beverage offerings.

Consumer demand for hygienic and disposable drinkware in dine-in and takeaway settings has further supported segment growth. As the foodservice industry continues to expand its outdoor dining, delivery, and quick-service models, the Food & Beverages segment is expected to drive consistent demand for cold waxed paper cups across global markets.

Cold waxed paper cups have become the most prominent solution for drinking any kind of cold beverage. These cups are consumer-friendly and can be taken anywhere. The rising number of quick- full service restaurants across the globe has led to strong sales and demand for cold waxed paper cups.

Cold waxed paper cups are made from paper-based materials and to prevent the contents from soaking through the paper, cold waxed paper cups are commonly coated or lined with plastic or wax. Disposables are preferred over reusable cups as customers become more sanitation and hygiene awareness. Cold waxed paper cups come in a range of sizes, shapes, and textures which is favouring the growth of the cold waxed paper cups market.

Cold waxed paper cups are widely used in the food & beverage sector due to their lightweight, cost-effectiveness, biodegradability, and ability to provide air resistance, internal strength, and stiffness. They also don’t need to be cleaned and can be easily tossed after usage.

Aside from that, there has been an increase in the influence of westernization in developing regions, as well as an increase in fast food consumption. Furthermore, as compared to plastic and foam competitors, cold waxed paper cups are substantially more biodegradable and require less time to degrade.

Producers or manufacturers in the market are developing new tactics, such as enhanced substrate technology, to minimise grease and oxygen contamination of packaged food items. This is expected to boost demand for cold waxed paper cups around the world.

The rising use of PET and PP based containers has increased the demand for cold waxed paper cups as these materials come under thermoplastic which is reversible and can be reshaped and reheated.

Paper cups are cost-effective, thermal resistance, durable and well-suited for dry and wet products and the key players in the market are using these materials more for the target market which is projected to bolster the sales in the forecast period.

As the cold waxed paper cups are single-use and they are ultimately thrown after the use which is hindering the market. Additionally, other cups made of wood, aluminium and others are restricting the growth of the cold waxed paper cups market.

A few of the players actively participating in the cold waxed paper cups market consist of

In consideration of the income and changing lifestyles of people in the USA the growth in the beverages and cosmetics end-use industries is anticipated to propel the demand for cold waxed paper cups in the market.

Manufacturers in the USA are shifting towards the production of cold waxed paper cups. Therefore, the country is expected to experience higher demand for cold waxed paper cups.

The global cold waxed paper cups market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the cold waxed paper cups market is projected to reach USD 3.1 billion by 2035.

The cold waxed paper cups market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in cold waxed paper cups market are single wall, double wall and triple wall.

In terms of capacity, 151-250 ml segment to command 38.7% share in the cold waxed paper cups market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing Cold Waxed Paper Cups Market Share & Industry Trends

Cold Forging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Oil Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cold Plates Market Size and Share Forecast Outlook 2025 to 2035

Cold-Chain Sensor Encapsulators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cold-Pressed Fruit Extracts Market Size and Share Forecast Outlook 2025 to 2035

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Cold Water Swelling Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Laser Therapy Market Analysis - Size, Share & Forecast 2025 to 2035

Cold Mix Asphalt Market Size and Share Forecast Outlook 2025 to 2035

Cold Cuts Market Analysis - Size, Share, and Forecast 2025 to 2035

Cold Pain Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cold Formed Blister Foil Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA