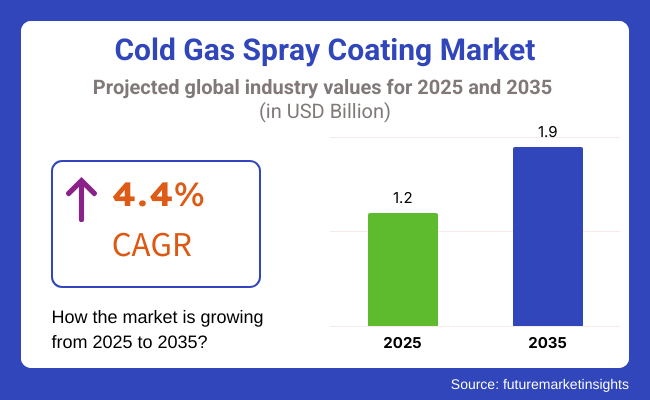

The cold gas spray coating market is expected to grow at a healthy CAGR for the forecast period. The market is forecasted to grow to USD 1.2 billion over the course of 2025 due to increasing demand in various sectors, including aerospace, automotive, and healthcare.

This growth is driven by the increasing demand for superior coatings with high-performance characteristics, including excellent corrosion protection, thermal protection and improved durability. Cold gas spray coating is garnering attention as the first two industries look for higher-performance surface modification techniques that do not alter material properties during deposition.

The global market was expected to surpass USD 1.9 billion by 2035, at a CAGR of 4.4% during the forecast period. This continuous growth can be ascribed to the increasing technological advancements in cold spray systems, the introduction of novel coating materials, and the rising focus on sustainability.

The ability to repair and restore damaged components with minimal thermal stress has become an attractive solution for a variety of applications in the coat gas spray coating. Rising R&D expenditures and partnerships between leading companies are also likely to fuel innovations in this sector. The cold gas spray coating market will continue to be an integral part of advanced manufacturing because as keep looking for maximum efficiency and longevity.

Explore FMI!

Book a free demo

The cold gas spray coating market is expected to grow more than 8% CAGR between 2020 and 2024 due to its rising adoption in the aerospace industry for component maintenance and repair. Industries embraced the technique for its potential to improve corrosion resistance and prolong the life of vital components. Also, the medical sector started to incorporate cold gas spray coatings into dental implants and orthopaedic prostheses which can benefit from their biocompatibility and durability.

The market is still with massive growth potential for the 2025 to 2035 period, and it is estimated to reach USD 1.9 billion in 2035. This trend is projected to be driven by technological developments that result in more efficient and cost-effective coating experiences. The transportation sector, including aerospace and automotive industries, is expected to adopt cold gas spray coatings in a bid to enhance fuel efficiency and lower emissions.

Additionally, the Military & Aerospace Applications segment is expected to contribute towards the growth of this market owing to the usage of these coatings for its components so as to improve their efficiency and functioning. Aging population and the ensuing increase in demand for such medical implants and devices are anticipated to boost the usage of cold gas spray coatings in the medical sector as well.

| Key Drivers | Key Restraints |

|---|---|

| Increasing demand for high-performance coatings in aerospace and automotive industries | High initial investment and operational costs |

| Growing adoption of cold spray technology for component repair and restoration | Limited awareness and technical expertise in emerging markets |

| Advancements in 3D printing and additive manufacturing | Challenges in coating complex geometries with uniform thickness |

| Rising emphasis on sustainability and eco-friendly coating solutions | Limited availability of specialized feedstock materials |

| Expanding applications in the medical and electronics sectors | Regulatory challenges and stringent industry standards |

| Reduced thermal stress and minimal oxidation during the coating process | Slower adoption in traditional manufacturing industries |

Impact of Key Drivers

| Key Drivers | Impact |

|---|---|

| Increasing demand for lightweight and durable coatings in aerospace and automotive industries | High |

| Advancements in additive manufacturing and 3D printing technologies | High |

| Superior coating properties, including corrosion resistance and thermal protection | High |

| Growing emphasis on eco-friendly and sustainable coating solutions | Medium |

| Expanding applications in healthcare, electronics, and defense sectors | Medium |

| Ability to repair and restore high-value components with minimal heat impact | High |

Impact of Key Restraints

| Key Restraints | Impact |

|---|---|

| High initial setup and operational costs | High |

| Limited awareness and adoption in small-scale industries | Medium |

| Challenges in achieving uniform coating on complex geometries | Medium |

| High dependency on specialized powder materials | High |

| Regulatory challenges and stringent industry standards | Medium |

| Slower integration in conventional manufacturing processes | Medium |

During the forecast period, high-pressure cold gas spray coating will dominate the market as industries look for performance in harsh conditions, durability, and adhesion strength. Due to its ability to improve wear resistance and extend the lifespan of components that are essential in operating environments. This technology will be in high demand across heavy industrial, aerospace, and defense applications.

As manufacturers increasingly invest in high-pressure systems to increase accuracy and efficiency and these systems will continue to be preferred for mission-critical applications. On the other hand, cost-conscious industries that need coatings made of softer materials will favor low-pressure cold gas spray coating. Technology for Low Pressure Technology for the medical and electronics sectors, Lower pressure technology enables coatings to be applied at lower temperatures with no adverse effects.

Like in the case of cold gas spray coatings, end-use industries will continue to broaden their laundry list of needs through ease of manufacturing and service life extensibility. The aerospace and automotive sectors, in particular, will fuel increased demand, as they look for lightweight, corrosion-resistant solutions to enhance fuel efficiency and lower maintenance costs. Cold spray coatings will be adopted to improve the reliability of circuit boards and semiconductor components in the electronics and electrical industry.

Oil and gas companies will use these coatings to minimize downtime by applying them to equipment and environments that are subjected to harsh conditions. Implant coatings and other biomedical applications that assure increased durability and biocompatibility will see growth in the medical sector. Applications in a range of industries, including heavy machinery and utilities, will support market expansion even more.

Strong growth of the cold gas spray coating market in aerospace, defense, and the automotive industry will be responsible for the growth of the cold gas spray coating market in the USA Demand will also be driven by ongoing investments into advanced manufacturing and repair technologies, as industries increasingly concentrate on lightweight and corrosion-resistant coatings. The defense sector continues to be a key driver, employing cold gas spray in the maintenance of aircraft and the enhancement of weapon systems.

The rise of end-user preference & sustainability will drive industries towards eco-friendly coating solutions. Research institutes and companies will continue to innovate, improving the efficiency and performance of coatings. The growing demand for refurbishment of components in industrial machinery will again propel supplementary market growth.

The cold gas spray coating market in Canada will grow steadily owing to its robust aerospace and oil & gas sectors. The increasing need for high-performance coatings to extend the life of important gear will provide an impetus for adoption. The automotive industry will also be a contributing factor, as manufacturers search for ways to combat corrosion in extreme weather conditions.

These government initiatives supporting innovation and sustainability would lead businesses to invest in advanced coating technologies. Innovation will be further accelerated through collaboration between sectors, including universities and industries. As industrial activities increase, more and more cold gas spray coatings will be used for the repair and restoration of equipment.

Their use for cold gas spray coating will also grow in the UK, especially in industries such as aerospace, defense, and transportation. The growing requirement of lightweight coatings, especially in the automotive sector, will supplement the demand by offering sustainability and emissions reduction. The defense contract will continue the work with a focus on advancing repair and maintenance solutions, as well as legacy military aircraft and other aging naval equipment.

New opportunities are likely to emerge as renewable energy capacity is expanded, especially as components are coated for wind turbine construction. Manufacturers will narrow down on increasing efficiency and cost-effectiveness with improving R&D activities. Cold spray coatings will also find application in the medical industry for implants and surgical instruments.

As the aerospace and automotive sectors expand in France, the French cold gas spray coating market will expand. Companies will turn to this technology to become more fuel-efficient and spend less on maintenance. Defense is expected to invest in advanced coating solutions because these solutions improve overall aircraft and military equipment performance. The transition to electric vehicles will also drive demand for lightweight and highly wear-resistant coatings.

Research institutions will work with manufacturers to come up with sustainable solutions, in accordance with the sustainability goals of France. Moreover, cold spray coatings in the medical and electronics sectors will also be used for high-precision applications that demand biocompatibility and durability, which will drive the growth of the market.

Germany will experience significant growth in the cold gas spray coating market in Germany owing to its established industrial base that encompasses automotive and engineering. The shift to electric mobility will make automated electric battery and motor components drive the demand for advanced coatings. Cold spray coatings will remain important to the aerospace manufacturing sector in increasing durability and lowering repair costs.

The electronics industry will also expand as businesses implement coatings in semiconductor production. Eco-friendly coating materials will drive R&D for sustainable manufacturing practices. Cold gas spray will be more widely used in industrial machinery and heavy equipment manufacturing to restore and prolong component life and help reduce operational costs.

One of the most important industries in South Korea is the high-tech electronics industry, and this is expected to create increased demand for cold gas spray coatings. Semiconductor makers will lead the way, leveraging coatings to boost durability and conductivity. In particular, the aerospace sector will continue investing in these cold spray solutions for both aircraft maintenance and lightweight materials.

The transition of the automotive sector towards electric vehicles will additionally support market development with coatings, whereas improving battery and structural efficiency. Environmentally friendly coating solutions are also driven by government-backed R&D initiatives. Cold-gas spray coatings will be key to improving systems longevity and efficiency as industrial automation increases.

There will be a huge demand for cold gas spray coating in Japan as the industries are looking towards high-tech manufacturing and need advanced materials. In the aerospace domain, adoption will grow to increase asset longevity and minimize maintenance actions. Demand for coatings in semiconductor and circuit board manufacturing will be driven by electronics sales. Automakers, spurred by the electric vehicle push, will adopt cold gas spray coatings to optimize battery and motor performance.

There will be benefits for robotics and automation, using coatings for wear-resistant components. In this new era, the need for state-of-the-art storage systems will take precedence, leading the way to the combination of sustainable technologies, in which cold spray coatings will be key to developing new material waste reduction systems and improving the conservation of components.

Industrial sector growth and infrastructure developments are driving the growth of China's cold gas spray coating market along with increasing applications in the aerospace and automotive sectors. The shift towards electric vehicles will increase demand for advanced coatings that have the potential to enhance the efficiency of batteries and other critical components. These include the defense and aviation industries, which will invest heavily in cold spray technology to make aircraft and military equipment more durable.

The consequence will be more adoption, spurred by China’s focus on semiconductor and electronics manufacturing. It will also promote the adoption of eco-friendly coatings in various industries. Growing government initiatives to promote green technology and sustainable manufacturing will further give a boost to the market. The medical sector will also be an important supplier, using coatings for implants.

The cold gas spray coating market in India is expected to record steady growth as a result of fast industrialization and rising adoption of these coatings in aerospace and automotive industries. Cold spray coatings will be used for maintaining aircraft and weapon systems. The auto industry's shift toward electric mobility will, along with other coatings improvements, mobile battery efficiency, and corrosion resistance, drive market growth.

Coatings such as these will become more prevalent in the electronics and semiconductor industries to strengthen component durability. The initiatives by the government to promote Make in India and sustainability will serve as a propeller for domestic manufacturing and technology for cold gas spray. Rental of heavy machinery will create new opportunities in infrastructure development.

Tier 1 players dominated the cold gas spray coating market, accounting for almost 90% share of the total market in 2024. The coating efficiency and performance have been improved as industry leaders, such as Oerlikon Metco and Sulzer Metco, have continuously invested in R&D.

Their core focus on aerospace and automotive sectors fueled the demand for advanced coating solutions. They aligned their partnerships and dove into collaborations with major players in the market during this month, which would ultimately place them in a lead position in the landscape of computer technology. Mass manufacturing capabilities and robust distribution networks solidified their dominance.

Leading players in the cold gas spray coating market in 2024 included Air Products and Chemicals, ASB Industries, Bodycote, Saint-Gobain and Curtiss-Wright Corporation. These players were able to strengthen their position in the market due to their domain expertise, innovative product portfolio and global presence.

Amongst the various suppliers that aided different sectors was Air Products and Chemicals, which offered the necessary gases and equipment required for cold gas spray systems, ensuring that the spray processes were highly efficient. ASB Industries was a provider of advanced coating systems for aviation and defense, offering high-durability and corrosion-resistant coatings. Bodycote also provided thermal processing services, such as cold gas spray coating, to improve component life and minimize wear in aerospace and oil and gas applications.

The company (Saint-Gobain) used cold gas spray technology to enhance material properties without exposing to thermal stress and provided anti-corrosion as well as wear-resistant coatings in hostile conditions. Hence, Curtiss-Wright Corporation employed cold gas spray technology to achieve high performance coatings for components to enhance strength and enhance service life in critical applications.

Cold gas spray coating is popular because it coats without causing heat damage, thus suitable for aerospace, automotive, and electronics applications.

Aerospace, automotive, oil & gas, electronics, and medical sectors apply cold gas spray coatings for increasing durability, corrosion protection, and thermal protection.

Cold gas spray has improved adhesion, zero thermal effect, and the capacity to refurbish worn parts, which makes it better than most conventional coatings.

The market will continue to grow with the development in additive manufacturing, growing use in electric vehicles, and increased demand for green coatings.

It is segmented into High Pressure, Low Pressure

It is segmented into Transportation, Aerospace, Automotive, Electrical & Electronics, Oil & Gas, Utility, Medical, and Others

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.