Cold-formed blister foil market is a high barrier multilayer aluminum compound packaging type which is commonly used package form in pharmaceutical and healthcare segment for packaging moisture and light sensitive drugs. It has also been observed that cold-formed blister foil is a disruptive technology with superior barrier properties against oxygen, moisture, and UV light, leading to a longer shelf-life of a drug and regulatory compliance.

It is pharmacy blister packaging that is driving the market, along with stringent regulations for drug safety and the increasing use of high-barrier materials for drug stability. Furthermore, developments in sustainable and eco-friendly cold-form foils also determine the trends in the industry.

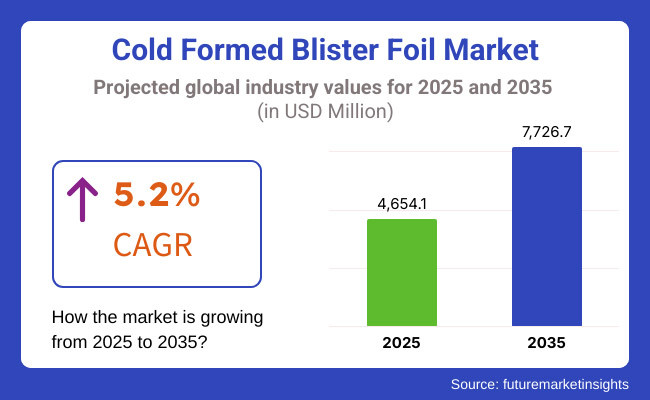

The cold formed blister foil market was worth USD 4,654.1 Million in 2025, and is expected to grow at a CAGR of 5.2%, to reach a value of USD 7,726.7 million by 2035.

The projected CAGR indicates increasing demand for secured pharmaceutical packaging, increased production of generic drugs, and innovations in blister packaging materials. Moreover, the demand for eco-friendly substitutes to classical aluminum-based foils is projected to drive the market development in future.

Explore FMI!

Book a free demo

The global cold-formed blister foil market due to the stringent regulations regarding the packaging of pharmaceutical products, increasing production of drugs, and demand for tamper-resistant and child-resistant foil packaging. Highly developed investments in advanced packaging technologies and sustainable pharmaceutical packaging in the United States and Canada are driving growth in North America. Increasing sales of over-the-counter (OTC) and prescription drugs further facilitate the market growth.

Pharmaceuticals are subjected to stringent rules from the European Medicines Agency (EMA) and other regulatory authorities to maintain packaging integrity in drug development. This is expected to propel the demand for high-barrier cold-formed foils. Also, sustainability initiatives supporting recyclable and eco-friendly packaging are to change the dynamics of the market.

The formed blister foil market in the Asia-Pacific region is expected to grow at the highest CAGR, owing to the growing pharmaceutical industry, increasing export of generic drugs, and rising healthcare expenditure by countries such as China, India, and Japan. Thanks to the rise of contract manufacturing organizations (CMOs) and supportive measures by governments to develop domestic drug industries. Moreover, the growth of the region’s market is primarily driven by rapid urbanization and awareness about safe drug packaging.

Challenges

High Material Costs and Sustainability Concerns

The durability of aluminum-based packaging materials is facing challenges in the cold-formed blister foil industry, ensuring limited recyclability. Cold-formed foil (CFF) offers excellent moisture, light, and oxygen barrier properties, yet its high weight and non-biodegradable nature pose problems in waste management. Then, there are strict pharmaceutical packaging regulations where compliance with global safety standards must be maintained at all times, which is a huge barrier for smaller manufacturers to enter the market.

Opportunity

Growth in Pharmaceutical Packaging and Sustainable Foil Alternatives

Growing need from the unit-dose pharmaceutical packaging industry is driving market growth, where cold-formed blister foil is used to provide optimal protection of moisture-sensitive drugs. Technological advancements, such as lightweight, recyclable, and hybrid foil laminates, also underpin sustainability innovations. The addition of intelligent/ smart packaging solutions, track-and-trace technologies, and biodegradability barrier coatings will further improve product differentiation and regulatory compliance.

From 2020 to 2024, the pharmaceutical cold blister packaging market is anticipated to witness steady growth owing to the growing need for extended life of drugs, tamper-proof packaging, and rising global healthcare needs. However, sustainability worries and expensive raw materials limited uptake in cost-sensitive markets.

A trend towards recyclable, bio-based, and lighter cold-formed foils is expected in 2025 to 2035. The increasing use of smart blister packaging with QR codes, RFID tracking, and real-time temperature monitoring will increase the security of products, reduce counterfeits, and enhance patient adherence. Moreover, changing regulations favoring sustainable packaging for pharmaceuticals will also create opportunities for investment in eco-friendly blister foil.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with US FDA, EU EMA, and WHO pharmaceutical packaging standards |

| Technology Innovations | Use of multi-layer aluminum-polymer cold-formed foil for high-barrier protection |

| Market Adoption | Growth in pharmaceuticals, nutraceuticals, and high-barrier drug packaging |

| Sustainability Trends | Initial efforts in reducing foil thickness and optimizing material usage |

| Market Competition | Dominated by global pharmaceutical packaging leaders (Amcor, Huhtamaki, Uflex, Tekni-Plex, Winpak) |

| Consumer Trends | Increased demand for moisture-sensitive drug protection and tamper-evident packaging |

| Regulatory Landscape | Compliance with US FDA, EU EMA, and WHO pharmaceutical packaging standards |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations promoting sustainable, recyclable, and biodegradable blister packaging |

| Technology Innovations | Advancements in lightweight, eco-friendly, and hybrid laminate foils with reduced environmental impact |

| Market Adoption | Expansion into biodegradable pharmaceutical packaging and smart track-and-trace blister packs |

| Sustainability Trends | Large-scale adoption of biodegradable films, recyclable foils, and sustainable cold-form packaging solutions |

| Market Competition | Entry of eco-friendly packaging startups focusing on bio-based alternatives |

| Consumer Trends | Growth in interactive blister packaging with patient engagement tools and anti-counterfeit measures |

| Regulatory Landscape | Stricter regulations promoting sustainable, recyclable, and biodegradable blister packaging |

The cold-formed blister foil market in the United States is growing rapidly, supported by the growing pharmaceutical industry and the increasing need for high-barrier packaging solutions. An increase in demand for tamper-evident and moisture-resistant packaging for solid-dose drugs is prop-directing market growth.

Strict FDA regulations on pharmaceutical packaging and serialization requirements for drug traceability are also driving the demand for cold formed blister foils. In addition, with the growing penetration of child-proof and adult-friendly packaging solutions, the United States is supporting product innovation.

Market growth is also being driven by the presence of leading pharmaceutical companies and packaging manufacturers, as well as growing investments in sustainable packaging materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

Increasing pharmaceutical production and rising high-barrier packaging demand to extend the shelf life of drugs driving the UK Cold Formed Blister Foil Market. In the United Kingdom, a stringent regulatory framework and the regulatory authority, the Medicines and Healthcare products Regulatory Agency (MHRA), are contributing to the increased demand for drug safety and compliance, and thus expect growth of the cold formed blister foil market.

Furthermore, the rising consumer inclination towards sustainable and recyclable packaging material is motivating innovations in sustainable blister foil packaging. This trend is further complemented by the boom in contract manufacturing organizations (CMOs) dedicated to pharmaceutical packaging, which bolsters the market growth.

The growth of personalized medicine and biologics requiring complex packaging solutions is also driving the increase in demand for advanced blister foil production technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The pharmaceutical packaging market is regulated strictly according to government regulations such as the EU Falsified Medicines Directive (FMD), which demands secure and traceable drug packaging, which is expected to propel the EU Cold Formed Blister Foil Market.

Germany, France, and Italy are significant countries in this region, with strong pharmaceutical industries that are investing in advanced-performance packaging that provides optimal medicine protection. Rising acceptance of cold-formed blister foil in over-the-counter (OTC) medications and dietary supplements is expected to boost demand.

Also, the EU's move for sustainable and less plastic waste is encouraging research for recyclable and biodegradable alternatives to pharmaceutical packaging. Market trends are further being influenced by the rising demand for child-resistant and anti-counterfeiting packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.6% |

The Japanese cold-formed blister foil market is driven largely by strict pharmaceutical packaging regulations and increasing emphasis on the implementation of advanced packaging technologies. Market growth is propelled by the increasing need for packaging solutions with an extended shelf life for prescription drugs and nutraceuticals.

High-barrier cold-formed blister foils are in high demand owing to the presence of major pharmaceutical companies with innovative drug formulations. Moreover, the increasing patient safety efforts in Japan, such as QR-coded and RFID-enabled blister packaging, have been accelerating the adoption of smart packaging solutions.

Another significant factor aiding market growth is the growing geriatric population and the rising propensity for unit-dose drug packaging to ensure medication adherence.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The cold-formed blister foil market in South Korea is flourishing owing to the booming pharmaceutical and nutraceuticals industry. Moreover, the country’s investments in advanced pharmaceutical packaging technologies along with regulatory supervision by the ministry of food and drug safety (mfds) is positively impacting the market growth.

Investments in high-barrier cold-formed blister foil are being driven by the rising need for export-quality packaging solutions that comply with international standards. Furthermore, market growth is being propelled by the increasing adoption of smart packaging solutions, such as tamper-evident and patient-friendly blister packs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

North America, the Middle East, and Africa hold a major share of the cold-formed blister foil market. At the same time, Asia Pacific and Europe are likely to exhibit the highest growth over the forecast period. Plastic foil is commonly used in the packaging of pharmaceuticals, electronics, and consumer goods, as it has excellent barrier properties against moisture and contaminants combined with a higher flexibility for shaping and forming. Plastic foil is easy to customize and transparent, which makes it suitable for various blister packaging applications where product visibility and branding are of great importance.

The new polymers, such as high-performance plastic foil, such as polyvinyl chloride (PVC), polyethylene terephthalate (PET), and polypropylene (PP), provide durability and upcycle recyclability to packaging.

While plastic foil is becoming more commonly used, the environmental threat of plastic waste and sustainability has encouraged producers to invest in alternative biodegradable and recyclable plastics. This is more than likely to bolster the innovation and will further help the market to expand between the cold-formed blister foil applications as the packaging industry shifts from metals to sustainable, eco-friendly materials.

Aluminum foil is the dominant material in cold-formed blister packaging because of its superior barrier properties, mechanical strength, and resistance to moisture, oxygen, and light. Aluminum foil is widely used in blister packaging in the pharmaceutical and healthcare sectors to prolong the shelf life of drugs by protecting them from environmental contamination, thus preventing loss of potency.

Unit-dose packaging in pharmaceuticals is a major contributing factor to the atmospheric growth of aluminum foil-based blister packaging, especially in the case of tablets, capsules, and sensitive formulations. Advanced cold-forming processes are increasingly being deployed by manufacturers to ensure aluminum foil can be ultra-formed to the desired shape without losing its structural integrity.

Despite its unmatched level of protection, aluminum foil is significantly more expensive than plastic equivalents, which creates problems for cost-sensitive sectors. On the other hand, growing trends of sustainable packaging alternatives and recyclability practices majorly aid the innovations for thinner and lightweight aluminum foils, decreasing material consumption with superior barrier performance. As pharmaceutical regulations focus on product safety and counterfeiting prevention, aluminum foil will remain a favored material in high-barrier blister packaging processes.

The increasing demand for protective pharmaceutical packaging is expected to keep the healthcare industry as the largest end-use segment in the cold formed blister foil market. Blister packaging is a critical component of the pharmaceutical sector to improve drug stability and dosage accuracy and prevent contamination, at the same time making cold-formed blister foils a key part of modern medicine packaging.

Stringent regulations imposed by regulatory bodies, such as the FDA and European Medicines Agency (EMA), regarding pharmaceutical packaging, are further expected to propel the demand for high-barrier cold-formed blister foils. The packaging of aluminum-based blister foils is adopted in the sector, which offers tamper evidence and child resistance packaging solutions, factors that drive the demand in conjunction with complying with safety criteria regarding the products.

The increasing geriatric population, as well as the prevalence of chronic diseases, have led to high prescription and over-the-counter (OTC) drug consumption, which in turn is anticipated to drive the cold-formed blister foils market. Moreover, the solids are projected to be released from the research as biologics and specialty drugs that demand greater protection to moisture and light; this is further fuelling the innovations in high-barrier blister foil packaging.

There is a shift towards eco-friendly packaging with recyclable and bio-based blister foils as pharma companies focus on sustainability. A dynamic and evolving healthcare packaging landscape ensures that cold-formed blister foils will always be a key substrate for both pharmaceutical and medical device packaging.

There is a great demand for anti-static, moisture-resistant, and tamper-proof packaging solutions to protect sensitive electronic components, which has made the electronics industry one of the major consumers of cold-formed blister foils on a global scale. Semiconductor chips, circuit boards, and microprocessors need high-barrier packaging to protect them from heat, moisture, and other environmental factors fuelling the degradation of their functions and longevity.

Cold-formed blister foils are used for the packaging of small and delicate electronic components since they offer higher durability and resistance to shocks and impacts, and thus, they store and transport the components safely. With the increasing prevalence of miniaturized electronic devices and wearables, the demand for blister foils has soared as they provide accurate product packaging without adding bulk.

With electronic components having global supply chains becoming more complex, the need for anti-counterfeiting measures in packaging is on the rise. To combat counterfeit electronics, manufacturers are integrating authentication MD and track-and-trace solutions into blister foil packaging (and blister cards) processes to ensure product authenticity and consumer trust. Additionally, as changing packaging requirements in the electronics sector will drive further improvements in the cold-formed blister foil technology, it will position itself as the go-to solution for high-precision protective packaging.

The global market for cold-formed blister foil is expanding rapidly, owing to rising high-barrier pharmaceutical packaging demand fueled by the growth in world-based pharmaceutical production, strict regulatory requirements, and an increase in unit dose medication packaging unit dose medication packaging. Cold-formed blister foils offer excellent protection against moisture, oxygen, and light, making them ideal for sensitive drugs, high-potency formulation, and biologics. The increasing emphasis on counterfeiting prevention and child-resistant packaging solutions is further supporting market growth.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Amcor Plc | 18-22% |

| Constantia Flexibles | 14-18% |

| UFlex Ltd. | 12-16% |

| Winpak Ltd. | 10-14% |

| Tekni-Plex Inc. | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Amcor Plc | Provides high-barrier cold-formed blister foil solutions with moisture, oxygen, and UV protection. |

| Constantia Flexibles | Specializes in pharmaceutical-grade aluminum-based blister foils with customizable barrier properties. |

| UFlex Ltd. | Offers cold-form foils with multilayer structures for enhanced drug stability and shelf life. |

| Winpak Ltd. | Develops high-performance cold-formed foils with a focus on sustainability and recyclability. |

| Tekni-Plex Inc. | Manufactures laminated cold-formed foils designed for high-barrier, tamper-evident pharmaceutical packaging. |

Key Market Insights

Amcor Plc (18-22%)

Amcor is a global leader in high-barrier cold-formed blister foil packaging, offering customized solutions for moisture-sensitive and high-potency drugs. The company is focusing on eco-friendly blister foils to support sustainable packaging initiatives.

Constantia Flexibles (14-18%)

Constantia Flexibles specializes in aluminum-based cold-form blister foils, providing exceptional barrier protection for pharmaceutical and nutraceutical applications. The company emphasizes customization and lightweight foil innovations.

UFlex Ltd. (12-16%)

UFlex is a key player in pharmaceutical cold-formed foil packaging, focusing on multi-layered laminate structures that enhance product shelf life and security. The company is expanding in emerging markets.

Winpak Ltd. (10-14%)

Winpak offers cold-formed foil solutions designed for high-barrier protection, child-resistant packaging, and compliance with global pharmaceutical regulations. The company is investing in sustainable and recyclable packaging solutions.

Tekni-Plex Inc. (8-12%)

Tekni-Plex provides advanced cold-form foils with enhanced durability and tamper-evident features. The company focuses on high-barrier solutions for biologics, vaccines, and temperature-sensitive drugs.

Other Key Players (26-32% Combined)

Several emerging and regional players are contributing to market growth with cost-effective and high-performance cold-formed blister foils, including:

The overall market size for cold formed blister foil market was USD 4,654.1 million in 2025.

The cold formed blister foil market is expected to reach USD 7,726.7 million in 2035.

The growth of the cold formed blister foil market will be driven by increasing demand for pharmaceutical packaging, advancements in barrier protection technologies, and rising regulatory compliance for enhanced drug safety and shelf life extension.

The top 5 countries which drives the development of cold formed blister foil market are USA, European Union, Japan, South Korea and UK.

Electronics Sector to command significant share over the assessment period.

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Reusable Packing Market Analysis – Size, Share & Forecast 2025 to 2035

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Polystyrene Packaging Market Analysis - Size & Growth Forecast 2025 to 2035

Paper Bubble Wrap Market Trends - Demand, Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.