The cold-forming foil industry is set to grow as pharmaceutical, food, and consumer goods manufacturers seek high-barrier, durable, and tamper-evident packaging. With increasing concerns about the safety of products, counterfeiting, and shelf life, cold-form foil continues to be preferred blister packaging and other high-end applications.

Manufacturers stress sustainability, material innovation, and digital security features to provide integrity to their packaging and comply with stringent regulatory guidelines. The industry will continue to move forward with 100% recyclable cold-form foils, lightweight barrier solutions, and anti-counterfeiting technologies to cater to ever-evolving consumer and industry needs.

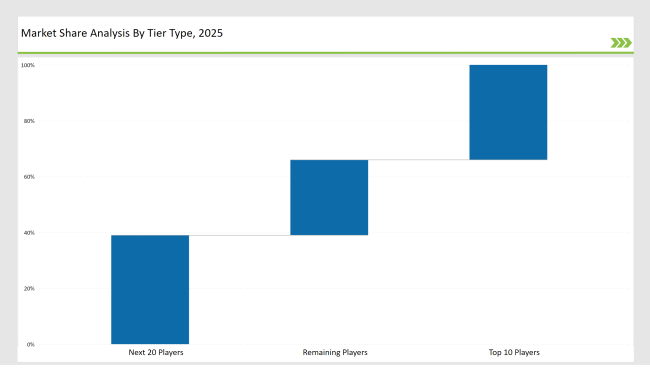

Almost 34% of the market is already controlled by Tier 1 players, including Amcor, Constantia Flexibles, and UFlex, which have been supported by massive production, material expertise, and long-standing partnerships with leading names in the pharmaceutical industry.

Tier 2 companies, including Winpak, Tekni-Plex, and Huhtamaki, corner 39% of the market by offering low-cost yet developed cold-form foil solutions for regional and specialized applications.

Tier 3 consists of regional and niche players specializing in sustainable cold form foils, high-performance barrier films, and smart packaging solutions, holding 27% of the market. These companies focus on localized production, enhanced recyclability, and innovative material science.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Constantia Flexibles, UFlex) | 16% |

| Rest of Top 5 (Winpak, Tekni-Plex) | 10% |

| Next 5 of Top 10 (Huhtamaki, Essentra, Carcano, FlexFilms, Clondalkin) | 8% |

The cold form foil industry serves multiple industries where product protection, extended shelf life, and sustainability are critical. Companies are investing in high-barrier laminates and advanced material science to meet industry demands.

Manufacturers are optimizing cold form foil solutions with material efficiency, sustainability, and tamper-proofing in mind.

Sustainability and security advancements are reshaping the cold form foil industry. Companies are adopting AI-driven quality control, smart authentication features, and greener material alternatives to improve performance and safety while reducing waste. They are also integrating blockchain technology for better traceability and authentication. Manufacturers are developing ultra-thin foils to enhance material efficiency without compromising protection. Additionally, firms are exploring bio-based coatings to improve sustainability and meet evolving regulatory standards.

Year-on-Year Leaders

Technology suppliers should focus on automation, sustainable materials, and security features to support the evolving cold form foil market. Collaborating with pharmaceutical, food, and consumer goods brands will drive innovation and adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Constantia Flexibles, UFlex |

| Tier 2 | Winpak, Tekni-Plex, Huhtamaki |

| Tier 3 | Essentra, Carcano, FlexFilms, Clondalkin |

Leading manufacturers are advancing cold form foil technology with sustainability-driven materials, security-enhanced designs, and AI-powered quality control.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched ultra-barrier, fully recyclable cold form foils in March 2024. |

| Constantia Flexibles | Developed lightweight laminates for enhanced pharmaceutical safety in April 2024. |

| UFlex | Introduced tamper-proof, anti-counterfeit foils with QR authentication in May 2024. |

| Winpak | Expanded sustainable foil offerings with low-carbon footprint aluminum in June 2024. |

| Tekni-Plex | Strengthened moisture-resistant cold form foil solutions in July 2024. |

| Huhtamaki | Released biodegradable, plant-based cold form foils in August 2024. |

| Essentra | Innovated high-security foils with embedded holographic elements in September 2024. |

The cold form foil market is evolving as companies focus on enhanced security, sustainability, and high-performance materials.

The industry will continue integrating AI-driven quality control, sustainable materials, and smart packaging security features. Although the sustainability standards continue to be pushed by regulators, it is foils that would be introduced towards recyclability and very low carbon by the manufacturers in a fast-track kind of manner. Anti-counterfeit measures will also be enhanced by the installation of blockchain-based tracking and digital authentication tools. Enterprises will work towards energy-saving manufacturing to lower carbon emissions. Additionally, firms will explore new material blends to improve the flexibility and durability of cold form foils.

Leading players include Amcor, Constantia Flexibles, UFlex, Winpak, Tekni-Plex, Huhtamaki, and Essentra.

The top 3 players collectively control 16% of the global market.

The market shows medium concentration, with top players holding 34%.

Key drivers include sustainability, anti-counterfeiting technologies, high-barrier materials, and regulatory compliance.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.