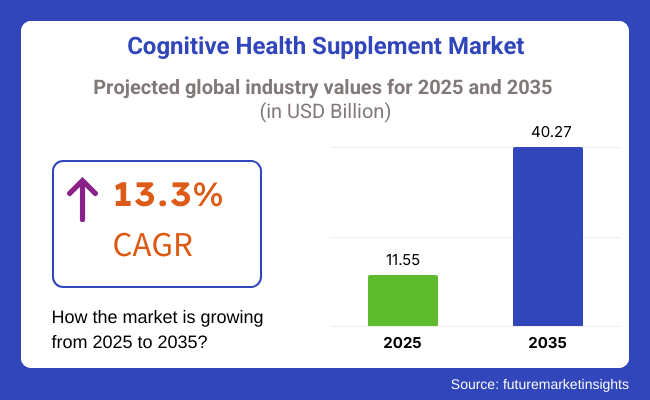

The cognitive health supplement market is poised to occupy a significant place in the gross industry, with an expected revenue of USD 11.55 billion in 2025. The industry is set to grow at a compounded annual growth rate of 13.3% during the projected time of 2025 to 2035. The ultimate worth is anticipated to be USD 40.27 billion by 2035.

Brain health supplements have managed to win a wide acquaintance as the citizens have started to intensively emphasize mental health, mental clarity, and cognitive function. As people become more aware of diseases like Alzheimer's and dementia, the demand for brain-boosting supplements is climbing. The increased popularity of nootropics and functional ingredients that are used to improve memory, concentration, and mental tasks.

The primary reason for the growth is an older population alongside the rising incidence of stress-related cognitive decline. People favor preventive health care, so there has been a greater usage of supplements that contain omega-3 fatty acids, ginkgo biloba, phosphatidylserine, and adaptogens. The other side is the selling of supplements that are designed for personalization, as well as the introduction of new ideas in the area of cognitive health.

The growth is coped with a wide range of food products, infections, and health care materials. In terms of public health awareness, the companies that sell supplements are changing to easier product formats, e.g., gummies, powders, and ready-to-drink beverages. The digital health platforms that have become prevalent with the advent of AI technology have improved the involvement of consumers and have driven the demand for products.

This industry faces some challenges. There are arguments about the claims and effectiveness of the supplements, which cause obstructions for the makers. Furthermore, the consumers believe that cognitive supplements are not always effective and that factors might be related to the adoption rates. Nonetheless, these barriers could be overcome by the reinforcement of scientific validation and evidence from clinical trials on the ingredients used in the formulations.

Nevertheless, this sector has been given a wide chance to grow. More and more people suffering from burnout and cognitive fatigue push the need for even more performance-enhancing supplements. The recently emerged concept of biohacking is not only health but also brain training, thus really boosting the cognitive supplement industry. Moreover, the growth of biotechnology and neuroscience is likely to introduce more powerful brain health products that are completely based on scientific evidence.

Explore FMI!

Book a free demo

In the period 2020 to 2024, the cognitive health supplement market was developing robustly through increasing awareness of brain and mental performance as well as increased demand for specialist dietary solutions. Growing aging populations, rising numbers of cognitive decline cases, and increased stress levels were driving consumer demand for supplements to enhance memory, concentration, and mental clarity.

Supplements with active ingredients such as omega-3 fatty acids, nootropics, Bacopa monnieri, Ginkgo biloba, and adaptogens gained momentum. Empirical data from research supporting the effectiveness of the active ingredients against improving cognitive well-being and shielding against neurodegenerative disease underpinned acceptability.

Gene testing and analysis of microbiota-based genetic nutrition offered tailored solutions for cognitive well-being. Quality variation in the product, regulatory ambiguity, and varying efficacy across different consumer segments constrained wider penetration.

Over the next few years, up to 2025 to 2035, the cognitive health supplement market will change significantly with advancements in neuroscience and biotechnology that bring new ingredients and formulations. Product innovation with AI assistance and ongoing real-time health tracking will render supplementation more specific and targeted.

Nano-enabled bioavailability and liposomal delivery systems will yield optimal cognitive supplement potency. Growing consumer demand for natural and plant-based ingredients will result in the development of clean-label, vegan, and organic cognitive products. Governments will implement more transparent cognitive health claim regulations, which will reinforce consumer confidence. Cognitive-enhanced fortified foods and functional drinks will create new opportunities. Strategic alliances among biotech companies and supplement manufacturers will fuel innovation and consolidation in the industry, increasing product variety and industry size.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Ongoing growth with growing awareness of cognitive health and aging population. | Fast growth by biotech and personalized nutrition. |

| Concentration, memory, and mental acuity. | Growing interest in stress management, neuroprotection, and brain longevity. |

| Omega-3, nootropics, Ginkgo biloba, Bacopa monnieri, and adaptogens. | Expanded category with bioengineered ingredients, plant-based, and functional beverages. |

| High demand in North America and Europe; growing interest in Asia-Pacific. | Worldwide expansion with regional product formulations and targeted marketing. |

| Splintered regulation of health claims and safety of supplements. | Stricter guidelines on cognitive health claims and supplement effectiveness. |

| Pharmacies, health food stores, and online sites. | Omnichannel platforms include direct-to-consumer, e-commerce, and subscription. |

| Genetic testing and microbiome profiling influencing product development. | Product formulation with AI, real-time monitoring of health, and nanotech delivery. |

| Greater competition between nutraceutical companies and supplement manufacturers. | Mergers and strategic partnerships leading to consolidation. |

| Improving memory, mental sharpness, and stress management as objectives. | Long-term brain well-being, cognitive longevity, and customized benefits are priorities. |

The sales of cognitive health supplements are rapidly growing, owing to rising awareness regarding brain health, demographic aging, and mental performance requirements. Consumers from different segments are opting for nootropics, adaptogens, and omega-3 supplements in order to improve focus, memory, and overall brain performance.

Aging consumers emphasize clinically tested and natural products to prevent cognitive decline. White-collar workers seek stress relief and mental acuity-boosting supplements, which typically come in the form of convenient capsules and drinks.

Students, with academic pressure, choose cheap and quick-acting supplements. Athletes combine physical performance and mental enhancer supplements, preferring nootropic formulas. Healthcare professionals prescribe based on science and patient conditions.

The most notable industry trends are increasing interest in plant-based and organic products, personalized nutrition, and research-driven formulations, and thus, efficacy and transparency are paramount criteria for buying. The market is moving towards clinical-strength, premium, and sustainably sourced cognitive health supplements.

The industry is on the rise based on the increasing consumer awareness of brain health and aging-related cognitive decline. However, regulatory restrictions on promoting health claims, ingredient safety, and efficacy can be a major challenge. In order to avoid legal and reputational risks, Businesses have to comply with the global supplement regulations, perform clinical studies, and get the necessary licenses.

Ongoing production instability has been witnessed due to chain disruptions, including shortages of essential ingredients such as omega-3 fatty acids, adaptogens, and nootropics. Ineptness in acquiring and dealing with raw materials could bring about price volatility. Companies need to widen the supplier base, back the sustainable production initiatives, and carry out strict quality control checks to maintain the same product standards.

The rivalry between pharmaceutical substitutes and the vending of traditional supplements is also rising. Companies have to capitalize on new innovations such as personalization, unique branding, and expansion of online sales, as well as direct-to-consumer distribution channels, which will help increase reach and improve convenience.

The recession in the economy and changes in consumer purchase habits could also impact the growth. By prioritizing education for consumers, affordability of the product, and scientific support, along with the ability to remain flexible when there are changing consumer demands and regulation requirements, businesses can achieve long-term success and sustainability.

Based on the type of supplements, the Cognitive Health Supplements Market can be divided into Omega-3 Fatty Acids and Ginkgo Biloba, and both of these segments are expected to witness growth over the coming years owing to the growing awareness among consumers about the preservation of brain health and prevention of cognitive decline.

By type, it has been observed that the Omega-3 Fatty Acids segment will lead the industry and will have a 28.77% value share in 2025. The brain uses these omega-3 fatty acids, DHA and EPA, for proper brain functioning, memory retention, and protection of neurons. Industry leaders like Nordic Naturals, Nature Made, and Carlson Labs are launching new lines of sustainably sourced, high-purity fish oil and algae-based products as alternatives for vegans and vegetarians. Another reason for the increasing demand is the fact that studies conducted by the National Institutes of Health (NIH) show that Omega-3 supplements can help reduce inflammation and brain aging.

The Ginkgo Biloba segment is expected to register a steady growth rate owing to its neuroprotective effects on the brain and its ability to promote improved blood circulation. Ginkgo Biloba supplements are among the most popular herbs for preventing memory loss, so Ginkgo Biloba supplements make up a big part of the share of these ingredients. By contrast, companies including Nature's Bounty, NOW Foods, and Herbalife are using clinical studies backing up its benefits to broaden their portfolios.

Recent studies have indicated that Ginkgo Biloba extracts can slow the progression of neurodegenerative diseases, leading to an increase in the number of health-conscious consumers interested in the plant. The increasing scientific validation and consumer demand for natural cognitive enhancers will remain the main driving force behind the continued growth of both product categories.

Based on form, the report segments the cognitive health supplements market into capsules and tablets, which are commonly used as they are convenient, bioavailability, and consumer preference. The Capsule segment is expected to capture a 32.5% share in 2025, as capsules have higher absorption potential and are easier to swallow.

Unlike tablets, which must be broken down in the body before their nutrients can be released, capsules made of gelatin or plant materials dissolve quickly, making them especially useful for cognitive health formulations. Brands such as Nordic Naturals, Thorne , and Nature’s Bounty specialize in encapsulated Omega-3s, Ginkgo Biloba, and herbal nootropics precisely due to their greater efficiency and lower additives. The growing demand for vegan and vegetarian supplementary products is also contributing to the growth of plant-based capsule sales.

The tablet segment is also anticipated to possess a significant share due to its cost-effectiveness, longer shelf life, and accurate dose. The share for tablets in 2025 is projected to be 30.5%, significantly attributed to their accessibility in pharmacies and drugstores. Other cognitive supplements, including Centrum from Pfizer and Schiff’s Neuriva, take the tablet approach to deliver multivitamin combinations that include B-complex vitamins, magnesium compounds, and antioxidants that help optimize the brain. These are the sustained-release tablets, which capture nutrients far better, making them a popular choice for long-term management of brain health.

Over the coming years, capsules and tablets will maintain their stronghold in the cognitive health supplement market, with the former being a front-runner due to their high absorption capacity and the increasing consumption of clean-label formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.1% |

| UK | 7.5% |

| France | 6.9% |

| Germany | 7.3% |

| Italy | 6.7% |

| South Korea | 8.4% |

| Japan | 7.8% |

| China | 9.2% |

| Australia | 7.0% |

| New Zealand | 6.5% |

The market for cognitive health supplements in the USA is expected to register a growth rate of 8.1% during 2025 to 2035. Increasing consumer education regarding brain health and preventive healthcare is driving demand for nootropics as well as brain-enhancing products. Brands such as Onnit, which is headquartered in the USA and produces Alpha Brain, have helped fuel mainstream acceptance of cognitive health supplements. The growing incidence of neurodegenerative diseases like Alzheimer's and the preventive attitude of millennials and Gen Z towards mental performance has further fueled growth.

Strong research and innovation also benefit the market, driven by a well-established dietary supplement industry. Amazon and brand websites have facilitated easy accessibility of these products for consumers. USA consumers are increasingly drawn to plant-based and adaptogenic ingredients such as lion's mane mushroom and ashwagandha, which are diversifying product offerings. The competitive landscape encourages rapid innovation and customization, with many brands introducing subscription plans and smart supplement regimens to achieve long-term cognitive benefits.

The UK cognitive health supplement market is projected to grow at a CAGR of 7.5% during 2025 to 2035. Proactive wellness and stress management trends are compelling consumers towards functional foods and natural nootropics. Local UK brands such as Heights and Mind Lab Pro have risen to the top with premium products combining clinically supported ingredients and eco-friendly packaging. Growing stress and, mental fatigue, concerns related to work are impacting supplement consumption across age groups.

Furthermore, the UK government's efforts to enhance mental health consciousness have indirectly increased the demand for cognitive support products. There is a combination of conventional herbal treatments, such as ginkgo biloba, and new developments in the form of phosphatidylserine-enriched supplements. Product availability is significantly contributed by retail chains such as Holland & Barrett, in addition to online platforms that enable direct-to-consumer sales. The growth is further driven by clean label trends, as customers prefer transparency and allergen-free ingredients, leading the brands to emphasize ingredient purity and sourcing.

France is expected to register a CAGR of 6.9% during the period 2025 to 2035. French consumers are increasingly seeking supplements that ensure mental clarity and stress resistance, particularly in stressful urban settings. Local players such as Arkopharma have introduced herbal-based cognitive supplements, taking advantage of France's affinity for natural health remedies. Aging populations and fears of cognitive impairment have turned brain health into an increasing concern.

Additionally, French pharmacies, which enjoy the reputation of being trustworthy and accessible, remain prominent distribution networks for cognitive supplements. The French regulatory framework emphasizes the safety and effectiveness of the product, hence prompting brands to emphasize science-validated formulations. Supplements such as omega-3 fatty acids and bacopa monnieri are on the rise based on their connection with cognitive support. The cultural preference for holistic well-being and balanced living also promotes the incorporation of cognitive supplements into everyday lifestyles, especially among working adults and the elderly.

Germany is anticipated to expand at a CAGR of 7.3% from 2025 to 2035. The drivers of growth are high health literacy and a preference for preventive medicine. German players like Doppelherz have added brain health-oriented products to their portfolios, targeting both the elderly and working professionals. Customers are focusing on mental sharpness and stress reduction, driving the demand for adaptogens and brain-enhancing vitamins.

Germany has robust pharmacy retail and health food stores, together with increasing online retailing channels. Functional foods such as ginseng and L-theanine have become well-known for cognitive support benefits. Germany's strict quality controls urge brands to make investments in certification and clinical evidence, which serves to increase trust among consumers. Furthermore, consumer demand for vegan and allergen-free products remains on the up, which fuels innovation in formula and packaging. Growing job stress and a heightened emphasis on mental health throughout all demographics further support expansion.

Italy is forecasted to grow at 6.7% CAGR from 2025 to 2035. Growing populations of elderly persons, as well as more people seeking wellness, drive the consumption of cognitive support products. Italian companies such as Named and ESI have added the following products, which are memory- and concentration-enhancing supplements with common Mediterranean herbal ingredients, including olive leaf extract and sage.

Cultural emphasis on naturally occurring treatments underlies the prevalence of plant-derived cognitive supplements. Pharmacies and para-pharmacies continue to be the main sales points, although online channels are growing fast. Italian consumers are especially open to supplements that target stress management and sleep, which indirectly enhance cognitive function. There is a preference for multi-formula products that target multiple wellness objectives, including cognition and energy. As more public health initiatives surround aging and brain function, Italian consumers are slowly incorporating cognitive supplements into their daily care routines.

South Korea is poised to expand at a strong CAGR of 8.4% during the period 2025 to 2035. South Korea has a highly health-conscious population that is actively looking for functional supplements to improve concentration and memory, particularly among students and working professionals. Brands like NutriOne and CJ CheilJedang in Korea have introduced innovative brain health supplements that tend to employ traditional ingredients like ginseng, which is famous for its nootropic effects.

The emergence of K-beauty and K-health trends has also impacted the development of cognitive supplements, with a strong emphasis on aesthetics, functionality, and convenience. Distribution is dominated by e-commerce, with Coupang and Gmarket providing a vast range of products. South Korea's regulatory framework encourages high-quality standards, which instill consumer confidence. Additionally, the use of AI and tech-based personalization in choosing supplements is becoming increasingly popular, especially among tech-savvy younger generations who prioritize customized wellness solutions.

Japan's cognitive health supplement market is expected to expand at a CAGR of 7.8% from 2025 to 2035. Japan's aging population and cultural focus on longevity have created a strong interest in cognitive health. Top Japanese brands such as FANCL and DHC have created focused supplements that enhance memory and mental acuity, frequently using traditional ingredients like matcha and DHA-enriched fish oils.

Convenience is dominant in product form, with most consumers opting for easy-to-consume forms such as powders and soft gels. Cognitive ingredient-fortified functional foods also have extensive acceptance in Japan. The push by the government to encourage healthy aging also fuels demand, and the FOSHU (Foods for Specified Health Uses) certification lends authenticity to product labeling. Moreover, Japanese consumers are extremely brand-loyal and prefer clean-label, minimalistic formulations, which has led manufacturers to focus on purity and scientific support in product development.

China's cognitive health supplement market is projected to expand at the highest CAGR of 9.2% during 2025 to 2035. Growing urbanization, academic stress, and increasing aged populations have resulted in high demand for brain-improving supplements. Domestic Chinese brands such as BY-HEALTH and Tongrentang have ridden this trend, combining traditional Chinese medicine (TCM) with contemporary nootropics to attract a wide range of consumers.

Internet shopping behemoths like Alibaba and JD.com are instrumental in facilitating supplement sales with convenience and vast product availability. Consumers prefer products with ginkgo biloba, ginseng, and other classic herbs for cognitive benefits. Furthermore, China's regulatory development towards enhanced safety standards has enhanced consumer confidence. Young students and professionals are significant consumers who look for greater productivity and mental concentration. The growth is helped by government support policies for the care of the elderly, thus driving demand for food supplement and nutrition that mitigate age-related cognitive decline.

Australia's cognitive health supplements market will grow at a CAGR of 7.0% between 2025 and 2035. Demand for cognitive enhancers is increasing due to increasing mental health awareness and an aging population. Australian companies such as Swiss and Blackmores dominate with varied products, be it plant-based or sustainably sourced nootropics. Customers value supplements that aid memory, mental energy, and stress resilience.

Retail pharmacies and health food outlets lead sales by a large margin, but online sales are increasingly making inroads. Transparency is what matters most to Australian consumers, so traceability and the source of ingredients are key selling points for leading brands. Omega-3, curcumin, and Rhodiola rosea are highly popular ingredients. Preventive supplementation is promoted through the wellness culture in Australia, further bolstered by health-aware millennials. Clean labels and low levels of additives are common due to consumer requirements.

New Zealand is set to expand with a CAGR of 6.5% from 2025 to 2035. People are finding natural wellness solutions more appealing and are making a demand for cognitive support supplements. Domestic companies like Go Healthy and Thompson's use indigenous plants like New Zealand blackcurrants, which possess brain-supportive antioxidants.

Pharmacies, supermarkets, and web-based retailers alike help make product availability widespread. New Zealand's focus on sustainability and clean-label products aligns with consumer values, which causes brands to highlight organic and non-GMO formulations. Mental health programs and increasing interest in work-life balance also support the inclusion of cognitive supplements into everyday living. The smaller population base in the country creates a niche but expanding industry built upon quality and effectiveness over quantity.

The cognitive health supplements market is on an exponential growth path, increasingly underpinned by the rising awareness regarding consumer issues in brain health, cognitive decline associated with old age, and the enhancement of mental performance. Demand has been further fueled by the growing interest in nootropics, adaptogens, and plant-based cognitive enhancers that are believed to improve memory, concentration, and overall mental well-being.

Leading players, such as Nature's Bounty, Nestlé Health Science, Onnit, Pure Encapsulations, and Neurohacker Collective, back their science with formulations and clinical research while also offering a wide variety of supplements. Startups and niche players are disrupting the industry by providing personalized nootropic stacks, AI-based recommendations for supplements, and bioavailable formulations to grab user attention.

Key offerings include omega-3 oils, herbal extracts such as Ginkgo biloba and Bacopa monnieri, amino acids like L-Theanine and Acetyl-L-carnitine, and synthetics formulated into nootropics meant for memory assistance, stress relief, neuroprotection, and cognitive longevity. More companies will focus on vegan, allergen-free, and organic products to meet the increasing demand on the ground and customer perceptions of clean-label and natural products. Scientific validation, ingredient innovation, regulatory compliance, and direct-to-consumer (DTC) marketing are some strategic factors in shaping this competition.

Digital health platforms, subscription models, and influencer-driven marketing are some approaches these companies are using to expand their potential growth. On the back of rising demand from students and professionally increasing interest among aging populations in cognitive health supplements, there are partnerships happening between biotech firms, AI-enabled cognitive health monitoring, and formulation advancements to create a competitive advantage.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Nature’s Bounty | 18-22% |

| Nestlé Health Science | 14-18% |

| Onnit | 10-14% |

| Pure Encapsulations | 8-12% |

| Neurohacker Collective | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Nature’s Bounty | Deals in very inexpensive cognitive boosters in omega-3s, ginkgo biloba, and B-vitamin formulations, firmly establishing a retail and e-commerce presence. |

| Nestlé Health Science | Invests into science-backed nootropics and medical nutrition solutions with the use of the world's best-acquired research centers to perfect these products (ex: Mind Lab Pro). |

| Onnit | The company is associated with performance-driven nootropic supplements, whose flagship namesake product is Alpha BRAIN, marketed to suit athletes, professionals, and high-performance individuals. |

| Pure Encapsulations | Offers clinically tested, hypoallergenic, high-purity supplements, including phosphatidylserine, acetyl-L-carnitine, and bacopa monnieri extracts. |

| Neurohacker Collective | Makes premium quality multi-ingredient nootropic stacks such as Qualia Mind, emphasizing scientific research, bioavailability, and neuroplasticity support. |

Key Company Insights

Nature's Bounty (18-22%)

A top-level market player in budget cognitive supplements, it boasts a wide retail network and benefits from that brand equity from vitamins and supplements.

Nestlé Health Science (14-18%)

Broadening its nootropic and brain health portfolio, it has invested in scientific research and strategic acquisitions, such as Mind Lab Pro.

Onnit (10-14%)

The product became famous, hyping the Alpha BRAIN, a clinically tested nootropic endorsed by athletes and celebrities alike, including Joe Rogan, with emphasis on mental performance as well as memory enhancement.

Pure Encapsulations (8-12%)

This is a well-respected company with trusted practitioners, recognized for third-party testing of high-purity cognitive health formulations devoid of artificial additives.

Neurohacker Collective (6-10%)

Innovating through Qualia Mind, a high-end, evidence-backed nootropic mix emphasizing bioavailability, mental clarity, and neuroplasticity support.

Other Key Players

The industry is expected to generate USD 11.55 billion, driven by rising consumer awareness about brain health, aging populations, and increasing demand for nootropic supplements.

The market is projected to reach USD 40.27 billion by 2035, growing at a CAGR of 13.3%.

Key players in the market include Nature’s Bounty, Nestlé Health Science, Onnit, Pure Encapsulations, Neurohacker Collective, BrainMD Health, NOW Foods, Jarrow Formulas, Life Extension, Thorne Research.

North America leads the market due to high consumer spending on health and wellness, strong distribution networks, and a growing elderly population.

Nootropics, omega-3 fatty acids, herbal extracts (such as Ginkgo biloba and ashwagandha), and vitamins dominate the market.

It's classified as Omega-3 Fatty Acids, Ginkgo Biloba, Vitamins and Minerals, Herbal Supplements, and Probiotics and Prebiotics.

It's classified as Chewable, Capsule, Tablet, Powder, and Liquid.

It's classified as Pharmacies and Drugstores, Specialty Health and Wellness Stores, Hypermarkets/Supermarkets, and Online Retailers.

It's classified as Memory Support, Focus and Concentration Improvement, Boosting Cognitive Performance, Stress and Anxiety Management, and Mood Enhancement.

It's divided into North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East and Africa.

Calcium Caseinate Market Analysis by End Use Application and Functionality Through 2025 to2035

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.