The cognitive diagnostics market is valued at USD 120.3 billion in 2025. As per FMI's analysis, the market will grow at a CAGR of 8.0% and reach USD 259.7 billion by 2035.

FMI analysis showed that the cognitive diagnostics or Cognitive Diagnostics industry made great progress in 2024, mainly due to quicker use of AI in neurodiagnostic tools and a stronger emphasis on finding diseases early. Companies have incorporated machine learning to enhance the precision of cognitive impairment diagnoses, further driving demand from healthcare providers. Additionally, FMI believes that regulatory approvals for AI-based diagnostics spurred adoption rates among hospitals and labs.

In 2024, the laboratory testing sector continued to be at the forefront, capturing a large share of the industry's revenue. FMI analysis indicates that significant investments concentrated on improving precision diagnostics, particularly in the detection of Alzheimer's and dementia. Furthermore, collaborations between tech companies and healthcare institutions led to AI-based tools going mainstream.

Looking forward to 2025 and beyond, FMI projects that rising investments in real-time cognitive testing and personalized medicine will fuel growth. Cloud-based cognitive testing solutions will further accelerate growth. With technology advancing to make diagnostics more accessible, the industry is likely to experience robust growth through 2035.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 120.3 Billion |

| Industry Value (2035F) | USD 259.7 Billion |

| CAGR (2025 to 2035) | 8.0% |

Explore FMI!

Book a free demo

The Cognitive Diagnostics industry is poised for steady growth, fuelled by AI-driven technologies and the growing demand for early diagnosis of neurological conditions. FMI research indicated that diagnostic labs and healthcare professionals will gain better accuracy and efficiency, while conventional diagnostic techniques stand to become obsolete. FMI believes that continued investment in precision medicine and cloud-based testing will continue to spur industry growth up to 2035.

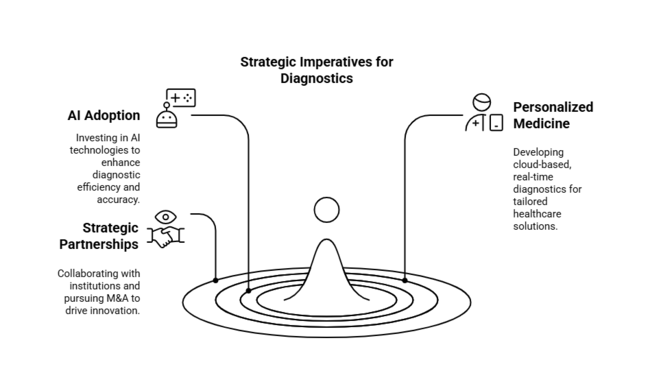

Accelerate AI-Driven Diagnostics Adoption

To improve efficiency and accuracy, we should first invest in AI-enabled Cognitive Diagnostics products. Partnering with technology companies and incorporating machine learning into current operations will give the competitive advantage.

Catch Up with Personalized Medicine Trends

Firms need to meet the growing demand for personalized cognitive testing by building cloud-based, real-time diagnostics. Being regulatory compliant and working with current healthcare systems will be essential for successful industry penetration.

Broaden Strategic Partnerships and M&A

Establishing strong collaborations with research institutions, healthcare organizations, and technology companies will drive innovation. CEOs need to consider mergers and acquisitions to centralize expertise, broaden service portfolios, and hasten the commercialization of future diagnostic technologies.

| Risk | Probability & Impact |

|---|---|

| Regulatory Challenges in AI Diagnostics | High Probability-High Impact |

| Data Privacy & Security Concerns | Medium Probability-High Impact |

| High Implementation Costs for Providers | Medium Probability-Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| AI-Powered Diagnostics Integration | Invest in R&D for machine learning-driven cognitive testing |

| Regulatory Compliance & Certification | Strengthen engagement with regulatory bodies for approvals |

| Expansion of Digital Testing Solutions | Develop and launch cloud-based cognitive assessment tools |

To stay ahead in the competition, executives need to accelerate AI integration in neurological diagnostics to remain ahead of changing healthcare needs. FMI research discovered that regulatory approvals are speeding up, providing an opportunity for early movers to establish dominance in AI-based precision testing.

Businesses need to invest in cloud-based solutions, regulatory expertise, and strategic collaborations with healthcare providers. FMI believes that early movers will set industry standards, while late movers will lose competitive advantage.

FMI analysis found that 84% of people involved worldwide considered accuracy in cognitive diagnostics important, especially for spotting neurodegenerative diseases like Alzheimer's and Parkinson's early on. AI automation posed a significant threat, with 78% citing advanced machine-learning technologies to enhance diagnostic precision.

Regional Differences

The regions are adopting AI-driven diagnostics

Divergent ROI Perceptions

While 74% of USA stakeholders reported strong ROI from AI-based diagnostics, only 42% of Japanese healthcare providers were convinced of cost savings, highlighting regional disparities in AI adoption economics

Consensus

Regional Preferences

Shared Challenges

90% of stakeholders identified the rising costs of AI deployment as a significant challenge, with software licensing expenses increasing by 25% year over year, further straining adoption efforts.

Regional Differences

Manufacturers

Distributors

According to FMI research, 76% of global diagnostic providers are looking to invest in AI-based cognitive testing in the next five years.

Regional Focus Areas

Regulatory Impact

Strategic Insights

According to the FMI, companies should adapt their AI solutions according to the region; high-performance models would be preferred by companies in the USA, while regulatory compliance with AI in Western Europe and cost-effective solutions in Japan and South Korea. Players across industry verticals need to match local industry realities to attain optimum adoption and commercial success until 2035.

| Countries | Key Regulations & Certifications |

|---|---|

| United States | The FDA regulates AI-based Cognitive Diagnostics products, requiring them to get either 510(k) clearance, De Novo approval, or Pre- Industry Approval (PMA) before they can be sold. HIPAA imposes strict data security and privacy standards for AI-based diagnostics, keeping patient data safe. The Centers for Medicare & Medicaid Services (CMS) established rules for reimbursement under which AI products would be eligible for insurance coverage. Moreover, certain states, like California, mandate AI-specific health regulations aimed at transparency and reducing bias. |

| United Kingdom | AI-powered diagnostics as a medical device must comply with regulatory requirements established by the Medicines and Healthcare Products Regulatory Agency (MHRA). The UK GDPR legislation mandates severe privacy and security protocols for AI models processing patient information. NHS Digital has to ensure that AI tools used for diagnosing patients follow strict buying and security rules before they can be used in the public health system. The AI and Digital Health Regulation Act of 2024 requires that AI systems used in healthcare must be clear about how they work and must work to remove any bias in medical decisions. |

| France | Clinical environments require the deployment of AI-based neurological diagnostics with Haute Autorité de Santé (HAS) certification. The Commission Nationale de l'Informatique et des Libertés (CNIL) applies the discipline of AI ethics and patient data protection regulations. AI-based diagnostic devices marketed in France must comply with the EU Medical Device Regulation (MDR). The government also introduced an AI-Specific Reimbursement Pilot Program to assess how AI-based diagnostics can be incorporated into the national healthcare reimbursement regime. |

| Germany | AI diagnostic devices need to be approved by the Federal Institute for Drugs and Medical Devices (BfArM) according to strict clinical validation regulations. The DiGA Fast Track Process allows AI-based neurological diagnostics to be reimbursed within the German healthcare system. The EU Medical Device Regulation (MDR) and GDPR need to be complied with by AI-based medical solutions. The KI- Strategie (AI Strategy 2024) promotes the use of AI but also requires explainability and bias audits for healthcare use. |

| Italy | The Ministry of Health and the Italian Medicines Agency (AIFA) regulate AI-based Cognitive Diagnostics approvals. The healthcare system requires all AI-based medical diagnostics to comply with EU MDR before implementing them. Certain Italian regions enforce additional independent AI adoption policies, resulting in varying regulatory requirements across the nation. The AI & Digital Transformation Plan 2025 will ensure AI integration in public healthcare with additional validation requirements. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) requires that AI Cognitive Diagnostics products undergo thorough clinical testing to ensure they are safe and effective. The Digital Health Sandbox Program provides expedited approval for AI diagnostics, promoting innovation without compromising safety. South Korea's K-Data Law mandates strict patient data protection regulations for AI model training. The government provides incentives for AI adoption, but firms must navigate complex regulatory approval processes. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) allows AI-based cognitive diagnostics, but only after requiring thorough clinical testing before they can be sold. The Japan Agency for Medical Research and Development (AMED) funds AI-driven cognitive health programs but has strict performance requirements. Japan's regulatory environment has stringent AI testing requirements, which makes it one of the most difficult scenario s for the deployment of rapid AI healthcare. |

| China | AI-based neurological diagnostics need approval from the National Medical Products Administration (NMPA). The cybersecurity law requires AI diagnostic devices that hold patient information to store it locally, preventing cross-border data flow. Investment from the government in the Healthy China 2030 strategy has accelerated the development of AI-based healthcare, yet regulatory barriers remain significant, especially regarding foreign AI medical devices' access to the Chinese market. |

| Australia & New Zealand | The Therapeutic Goods Administration (TGA) in Australia regulates AI Cognitive Diagnostics tools in conformity with the Medical Device Regulatory Framework. Medsafe in New Zealand regulates AI-based medical devices with stringent compliance controls. AI diagnosis tools are required to comply with the privacy requirements of both nations' Data Protection Acts. Healthcare promotes the adoption of AI, yet compelled clinical validation remains a regulatory norm. |

| India | The Central Drugs Standard Control Organization (CDSCO) regulates Cognitive Diagnostics AI-based tools in India under the Medical Device Rules. India is yet to establish regulations for mainstream AI in healthcare, but the Digital Personal Data Protection Act is enough to ensure patient data protection for AI models. Approval from the Health Ministry is needed for AI-driven diagnostics before their use in clinical environments, and India's move toward AI implementation in healthcare is slowly establishing its regulatory environment. |

Positron Emission Tomography (PET) and PET/CT are projected to lead the cognitive diagnostics industry with a robust CAGR of 9.2% from 2025 to 2035. This growth is primarily driven by the increasing adoption of PET scans for early detection of Alzheimer's disease, dementia, and other cognitive disorders. As healthcare providers continue to prioritize early diagnosis and personalized treatment plans, PET’s ability to detect subtle changes in brain activity and structure at the molecular level is crucial.

Furthermore, advancements in hybrid PET/CT technology, which combines anatomical and functional imaging, are enhancing the diagnostic accuracy, making PET a key tool in precision medicine. This segment is expected to see significant investments in the coming years, solidifying its position as a cornerstone in neurodiagnostics.

In addition to its growing diagnostic potential, PET imaging is gaining prominence due to its high sensitivity and non-invasive nature. The segment is witnessing rising demand as hospitals and diagnostic centers strive to improve the accuracy of cognitive impairment diagnoses, particularly for Alzheimer's and other neurodegenerative diseases.

Mild Cognitive Impairment (MCI) is rapidly emerging as the fastest growing indication in cognitive diagnostics, boasting a projected CAGR of 8.2% from 2025 to 2035. This growth is propelled by the increasing recognition of MCI as a precursor to Alzheimer’s and other forms of dementia. As the global aging population rises, the demand for early detection of MCI becomes more critical to mitigating long-term healthcare burdens.

With advancements in diagnostic technologies such as imaging, biomarker testing, and neuropsychological evaluations, MCI is now more identifiable and treatable. The focus on early intervention to slow or prevent disease progression will drive continued expansion for this indication.

The identification and management of MCI are becoming central to the treatment of Alzheimer’s and dementia, creating significant opportunities for healthcare providers. The industry for diagnostic tools that can accurately assess MCI is rapidly evolving, with key players in the neurodiagnostic space innovating to meet this growing need. As such, MCI diagnostics are poised to take a leading position in cognitive healthcare, attracting increased investments.

Home care settings are projected to become the fastest growing end user segment in cognitive diagnostics, with a CAGR of 8.7% from 2025 to 2035. The growth in this segment reflects a broader shift towards decentralized healthcare, where individuals are seeking more accessible and flexible diagnostic solutions outside traditional clinical settings.

The rise of home-based cognitive screening tools, such as digital assessments and remote monitoring technologies, has revolutionized the ability to conduct early-stage cognitive impairment tests at home. This is particularly valuable for aging populations who may have limited access to healthcare facilities. As technology advances, home care settings are becoming an essential part of the healthcare ecosystem.

The growing preference for home care diagnostics is further fueled by the desire for cost-effective, non-invasive, and user-friendly solutions. Rapid home screening tests are gaining traction, allowing patients and caregivers to monitor cognitive health regularly. This trend is expected to result in a paradigm shift in cognitive diagnostics, with more patients opting for home-based solutions as part of a wider effort to reduce healthcare costs.

The cognitive diagnostics industry in the USA is expected to grow at a CAGR of 8.4% from 2025 to 2035. Due to sophisticated healthcare infrastructure, substantial R&D investment, and high penetration rates of AI-based diagnostic solutions, in this space, United States acts as a industry leader. The USA. dominates the North American region with a total industry share of around 26.8%.

AI-based diagnostics for high-risk devices are getting a new set of rules from the FDA, allowing approvals for devices that use machine learning to assess cognitive function. Driving Factors: Aging populations & rising prevalence of neurodegenerative diseases such as Alzheimer’s and Parkinson’s. Additionally, reimbursement policies from CMS and private payers are expanding access to neurological diagnostics by hospitals and clinics.

The cognitive diagnostics industry in the United Kingdom from 2025 to 2035 is expected to grow at a CAGR of 7.9%. The UK government has actively backed the use of AI-based neurological diagnostics in their National Health Service (NHS) by providing research funding and speeding up the approval of digital health solutions.

The MHRA governs AI-powered diagnostic devices, and firms must comply with rigorous data privacy legislation under UK GDPR. Increasing awareness on early detection of dementia and cognitive impairments is anticipated to spur the growth of these technologies. However, constraints on NHS budgets and the slow adoption of public health care can limit industry expansion.

Forecasts indicate a CAGR of 7.5% for the Cognitive Diagnostics industry in France between 2025 and 2035. Strong government support and incentives for research have positioned the nation at the forefront of AI-based healthcare innovation in Europe. The nation has achieved quality certification for AI-driven neurological diagnostics, adhering to high standards of clinical validation.

France’s graying population and rising burden of neurodegenerative diseases like Alzheimer’s are driving demand. The EU's own Medical Device Regulation (MDR) adds further regulatory complexity, but France's focus on health care AI and its National Strategy for AI incentivize growth.

The cognitive diagnostics industry in Germany is expected to grow from 2025 to 2035 with a CAGR of 8.2%. The strong healthcare system, high use of digital health solutions, and the quick approval process for digital health apps help create a well-developed industry for neurological diagnostics in Germany. Germany holds a share of 5.1% in the global industry.

A broad set of rules with strict approvals makes sure that AI-based neurological diagnostics are safe and effective. Aging demographics and the increasing incidence of dementia at a national level help propel growth, along with the country's efforts to adopt AI in healthcare. The private insurance sector in Germany is facilitating adoption as well.

The Italy Cognitive Diagnostics industry is anticipated to grow at a CAGR of 7.1% from 2025 to 2035. An aging population and an increasing focus on AI in healthcare are driving the industry's slow but steady evolution. Italy is slowly addressing the early diagnosis of cognitive disorders by implementing AI-based diagnostics in the public healthcare system, which is under the Ministry of Health (Servizio Sanitario Nazionale-SSN).

However, regional variations in healthcare infrastructure and slow adoption of digital health technologies add to potential challenges. AI-driven diagnostic tools also need to comply with the EU’s MDR requirements, which can create regulatory hurdles for industry access.

The industry in South Korea is expected to grow at a CAGR of 8.5% during the period 2025 to 2035. Strong government support for digital healthcare innovation has already made South Korea a leader in AI-enabled medical care. The initiative is being supported by the Ministry of Food and Drug Safety (MFDS), which has created channels for the accelerated approval of AI-enabled diagnostics, resulting in broad adoption throughout the nation.

South Korea's aging population and high prevalence of cognitive diseases in the country are bolstering demand for early diagnosis. In South Korea, the Digital Health Sandbox Program accelerates commercialization of the AI-based diagnostic solution, making it one of the fastest-growing countries in the neurological diagnostics market.

The industry in Japan is expected to be 7.8% CAGR between 2025 and 2035. Japan's super-aging population is driving an increasing prevalence of dementia and similar conditions, thereby heightening the need for neurological diagnostics. The Pharmaceuticals and Medical Devices Agency (PMDA) in Japan rigorously regulates AI-based Cognitive Diagnostics solutions.

Japan is heavily investing in AI healthcare innovation, but its adoption is slow due to concerns about high prices and over-engineering. AI programs for healthcare-driven by government and reimbursement policies, as well as cognitive testing-will drive acceleration, particularly in the hospitals and nursing homes.

China’s sale is anticipated to record a value of USD9.46 billion by 2030. With government-backed campaigns such as Healthy China 2030, China is emerging as a significant industry in AI-enabled healthcare. China has a market share of 9.5% in the global industry. The National Medical Products Administration (NMPA) regulates AI-powered neurological diagnostics and ensures that devices comply with domestic medical device regulations.

A rapidly growing, aging population with increasing cognitive disorders is driving the demand for early detection solutions. But strict data localization laws in China make entry for global AI players exceptionally tough: localized AI must be trained, and cybersecurity regulations must be followed.

The industry in India is estimated to grow at a compound annual growth rate of 8.7% between 2025 and 2035.India holds a share of around 6.4% in the global industry. Factors such as increasing healthcare digitization, rising awareness about early diagnoses of cognitive disorders, and increasing private healthcare expenditures are expected to drive the industry during the forecast period.

Though AI-based diagnostics are regulated within the purview of the Medical Device Rules of the Central Drugs Standard Control Organization (CDSCO), India is still shifting toward a comprehensive AI healthcare framework. Government initiatives like the NDHM are accelerating AI adoption, but challenges remain in terms of affordability and access. The private sector is leading the growth in numbers.

Several leading companies in the cognitive diagnostics sector compete through innovation, pricing strategies, and strategic partnerships. Companies are investing in AI-based diagnostic solutions, biomarker-based testing, and advances in neuroimaging to gain a competitive edge. Pricing is a differentiator, with companies having tiered offers for hospitals, clinics, and home consumption.

They plan to grow by entering emerging markets and partnering with research institutions. Mergers and acquisitions drive technological integration, while partnerships with pharmaceutical companies enhance diagnostic precision. Leading companies are heavily investing in research and development (R&D) for early-stage Alzheimer's and dementia diagnostics, driving industry expansion. Competition intensity is steep, inducing ceaseless development and globalization.

Industry Share Breakdown

IBM (IBM Watson Health)

Google Health (DeepMind, Alphabet Inc.)

Microsoft (Nuance Communications, Azure AI)

NVIDIA (Clara AI)

Siemens Healthineers

GE Healthcare

The rise in neurological disorders, advancements in AI-based diagnostic technology, and increased use of brain imaging technologies are driving the sector.

Growing healthcare investments, early disease detection programs, and advancements in diagnostic imaging and lab testing will all contribute to strong growth.

Major players are Cognetivity Neurosciences, Cognivue, Inc., Google Health (DeepMind, Alphabet Inc.), Cogstate Ltd., Cambridge Cognition Ltd., IBM (IBM Watson Health), Diadem srl, NVIDIA (Clara AI), C₂N Diagnostics, Siemens Healthineers, Roche Diagnostics, Abbott Laboratories, GE Healthcare, Janssen Pharmaceuticals, and Biogen Inc.

Brain imaging tests, especially MRI and PET scans, are likely to see maximum growth as they are most effective in early-stage neurological tests.

The industry is projected to reach USD 259.7 billion by 2035, driven by increasing adoption in hospitals, neurology clinics, and home care settings.

The industry is segmented intobrain imaging tests, magnetic resonance imaging (MRI), computerized tomography (CT), positron emission tomography (PET) and PET/CT, laboratory testing, cerebrospinal fluid (CSF), blood tests, mental status testing, mini-mental state exam (MMSE), Montreal cognitive assessment (MoCA), rapid home screening tests, neuropsychological testing, electroencephalogram (EEG), cognitive function & behavioral tests, neuropsychiatric inventory questionnaire (NPI-Q).

The industry is segmented intoalzheimer’s disease, attention deficit/hyperactivity disorder, dementia, epilepsy-related cognitive dysfunction, mild cognitive impairment, parkinson’s disease-related cognitive dysfunction, stroke-related cognitive dysfunction, traumatic brain injury, others.

The industry is fragmented intohospitals, neurology clinics, cognitive behavioral therapy centers, rehabilitation centers, academic and research institutes, diagnostic imaging centers, home care settings.

The industry is studied acrossNorth America, Latin America, Europe, South Asia, East Asia, Oceania, The Middle East and Africa (MEA).

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.