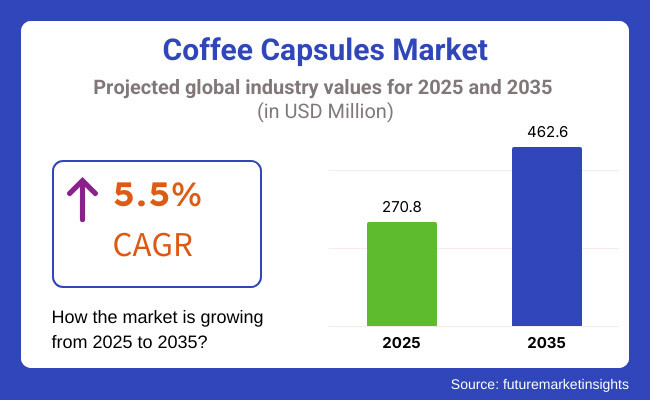

The Coffee Capsules Market is projected to experience significant growth between 2025 and 2035, driven by the increasing consumer preference for convenient, high-quality coffee solutions. The market is expected to be valued at USD 270.8 million in 2025 and is anticipated to reach USD 462.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.5% over the assessment period.

One major factor contributing to market expansion is the growing adoption of single-serve coffee machines. Consumers increasingly seek convenience, consistency, and premium-quality coffee experiences, leading to a rising demand for coffee capsules. The expansion of specialty coffee culture and the influence of global coffee chains are also accelerating the popularity of capsule-based brewing systems. Moreover, advancements in sustainable packaging, such as compostable and recyclable capsules, are further shaping the market landscape.

The market is segmented based on Material Type and End Use. The material segment includes Plastic, Bio Plastics, and Others (Fabric, etc.), while the end-use segment consists of Commercial and Household applications.

Amongst these, Plastic-based coffee capsules are the largest in the material type segment now because they are cheap, resistant, and possess better barrier characteristics that keep the coffee fresh and fragrant. Bio-plastics, however, are likely to see growing demand as consumers and governments drive for environmentally friendly substitutes. In the End Use segment, Household usage is the most dominant, driven by the expanding penetration of single-serve coffee makers in residences.

Household consumers are looking for convenient and mess-free brewing options; hence capsules are the preferred option for home coffee brewing. The commercial market, comprising offices and cafes, is also expanding but at a relatively more moderate rate than household penetration.

Explore FMI!

Book a free demo

The demand for coffee capsule is strong in North America due to the strong consumer perception for convenience and increasing demand for premium and specialty offerings in coffee segment. The United States and Canada are primary markets High single-serve coffee brewers are ubiquitous in both homes and offices, particularly Keurig and Nespresso.

Growing environmental awareness and laws prohibiting single-use plastics in the region led to demand for recyclable or compostable capsules from consumers. As the demand for sustainability continues to rise, a number of coffee companies are investing in biodegradable materials and aluminum capsules with better recyclability. Also, rising e-commerce platforms are driving the direct-to-consumer model for sale of coffee capsule market which helped the market growth.

Europe is a major contributor to the coffee capsules market, with top demand emanating from Germany, France, Italy, and the United Kingdom. The continent has an embedded coffee culture, with increasing uptake of single-serve coffee makers, particularly in urban homes. Italy, as a capital for espresso drinking, has a robust market for premium, aluminum-based coffee capsules that maintain flavor and freshness.

In Germany and France, the market is demonstrating growing demand for organic and fair-trade coffee varieties in environmentally friendly capsules. Still, strict European Union regulations for packaging waste and plastic reduction are compelling manufacturers towards sustainable options. Several European coffee companies have been reacting by launching compostable capsules that are manufactured from bio-based materials like plant fibers or cornstarch.

The most rapid growth in the market for coffee capsules is expected in the Asia-Pacific region due to rising coffee consumption in countries such as Japan, China, South Korea, and India. Demand for Western-style coffee culture, along with urbanization and the growing middle class population is driving demand for high-quality, convenient coffee solutions.

As more consumers purchase single-serve coffee machines, demand for coffee capsules increases, and China is emerging as an ever more important coffee market. As palates are growing more sophisticated in South Korea and Japan, where consumers are drinking high-end coffee in greater numbers, capsule coffee systems are gaining traction, especially among younger consumers. Yet the region faces an environmental challenge: single-use coffee capsules create plastic waste.

Challenge

Environmental Impact of Single-Use Capsules

The top problem of the coffee capsules market is the environmental impact of single-use capsules. Plastic and aluminum capsules are notoriously wasteful, and this has raised consumer and regulatory concern.

Multiple countries are imposing strict regulation regarding packaging waste and recyclability, compelling coffee companies to spend in green packaging solutions. However, the use of fully biodegradable or recyclable capsules without sacrificing coffee freshness and quality is a challenge that requires considerable investment in research and development.

Opportunity

Growth in Premium and Sustainable Coffee Capsules

Rising adoption for premium and specialty based coffee is anticipated to significantly drive growth in coffee capsules market. Demand for high quality sustainably sourced and organic coffee products is spurring innovation in capsule formulation. Separately, sustainability trends are driving brands to produce green versions like compostable capsules made of plant-based and bio-materials or recyclable aluminum capsules.

From 2020 to 2024, the market for coffee capsules grew very fast due to increasing consumer preference for convenience, premiumization of coffee consumption, and the widespread adoption of single-serve brewing systems. Increased home-based consumption of coffee, particularly during and following the COVID-19 pandemic, greatly contributed to the sale of coffee capsules, with top brands launching different flavors, blends, and specialty brews.

Between 2025 and 2035, the coffee capsules industry will experience a revolutionary change propelled by AI-enabled personalization, circular economy activities, and the next generation of sustainable materials.

The use of intelligent brewing equipment, block chain-supported coffee traceability, and bioengineered capsule materials will redefine convenience and environmental stewardship in the business. The rising emphasis on minimizing carbon footprint will speed up the transition to refillable, biodegradable, and water-dissolvable capsule technologies.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Tighter regulations on single-use plastics, greater emphasis on compostable and recyclable packaging, and extended producer responsibility (EPR) policies |

| Technological Advancements | Oxygen-barrier capsule designs, bio-based compostable materials, and nitrogen-sealed freshness preservation. |

| Industry Applications | Home brewing, office coffee solutions, and specialty coffee companies. |

| Adoption of Smart Equipment | Digital capsule reading, QR-code-based traceability, and nitrogen-sealed packs for longer freshness. |

| Sustainability & Cost Efficiency | Transition towards aluminum, compostable, and recyclable capsules; new refillable capsule systems.. |

| Data Analytics & Predictive Modeling | AI-facilitated demand forecasting, RFID-based inventory management, and coffee recommendation with personalization. |

| Production & Supply Chain Dynamics | Disruptions due to COVID-19, increased costs of raw material, and advanced automation in the manufacture of capsules. |

| Market Growth Drivers | Home coffee drinking-led growth, premiumization of single-serve coffee, and demand for green packaging. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Complete bans on non-recyclable capsules, carbon taxation for high-emission packaging, and circular economy mandating. |

| Technological Advancements | AI-enabled brewing optimization, self-regulating flavor extraction, and block chain-secured coffee traceability. |

| Industry Applications | Expansion into AI-integrated smart brewing, carbon-negative capsule production, and fully dissolvable capsule technologies. |

| Adoption of Smart Equipment | IoT-enabled brewing systems, real-time capsule freshness alerts, and AI-powered taste customization. |

| Sustainability & Cost Efficiency | Water-soluble and edible capsules, AI-driven lifecycle optimization, and fully zero-waste capsule schemes. |

| Data Analytics & Predictive Modeling | Quantum-enhanced predictive modeling, block chain-enabled sustainability audits, and AI-powered supply chain analytics. |

| Production & Supply Chain Dynamics | AI-harmonized decentralized capsule manufacture, 3D-printed capsules with biodegradability, and real-time authentication secured through blockchain. |

| Market Growth Drivers | Smart brewing technology with AI, closed-loop recycling of capsules, and next-generation biodegradable capsules. |

The United States coffee capsules market is growing owing to rising demand for easy, single-serve coffee options. The increasing trend of premium and specialty coffee blends and shifting consumer interest in home brewing has driven the adoption of coffee capsules.

Major companies are promoting sustainable and recyclable capsule systems, with green issues compelling manufacturers to cut down on plastic use. The increased growth of e-commerce and subscription coffee services is also fueling market growth, turning coffee capsules into a choice for American consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

The UK coffee capsules market is growing gradually on account of the increasing demand for premium, and sustainable coffee products. Home coffee consumption, accelerated by the work-from-home trend, has even increased sales of premium and compatible coffee capsules.

Due to the recent stringent environmental regulations on single-use plastics, eco-friendly and compostable coffee pods are also becoming more mainstream. The growth of private-label brands and direct-to consumer coffee capsule subscription services is also driving the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

Consumers are increasingly looking for high-quality and convenience experiences, which is helping to drive strong growth in the European Union coffee capsules market. The booming market is primarily led by Germany, France and Italy with strong move towards aluminum and compostable capsules in consideration of strict EU sustainability regulations.

Increasing adoption of private-label coffee capsule brands, which are cheaper alternatives to premium capsule platforms, also backs the market. The presence of aggressive distribution channels like supermarkets and online shops aids in the market growing.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.7% |

Japan's coffee capsule market is growing because of increasing demand for convenience and specialty coffee blends. The nation's vibrant café culture and high standards for quality coffee have contributed to a greater need for compatible and Nespresso-type capsules.

Precision and consistency are important to Japanese consumers, and single-serve capsule machines are an appealing way to prepare coffee. Sustainability is becoming increasingly important as well, with large brands bringing biodegradable and recyclable capsule alternatives to Japan's strict waste management regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The market for coffee capsules in South Korea is growing very fast with rising demand for high-end and home-brewed coffee varieties. The popularity of specialty coffee culture and at-home brewing patterns inspired by cafés is boosting the sales of coffee machines and capsules compatible with them.

Customers are also turning to organic and single-origin coffee products, and therefore customized capsule blends are increasing in size. Also, leading brands are spending on eco-friendly packaging options, such as paper-based and biodegradable capsules, to match government policies aimed at plastic waste reduction.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

plastic is the most common material composed for the production of capsules as it can add strength, airtight seals, or compatibility with several brewing systems. Unlike traditional coffee brewing methods, plastic capsules enable a quick and easy brewing, ensuring uniform quality and taste. Also capitalizing on the rise in single-serve coffee has been the use of plastic capsules, allowing consumers to place more emphasis on convenience and preparation time.

In recent years the discovery of effective plastic capsule technologies such as oxygen-barrier coatings, recyclable polypropylene blends and precision-molded constructions has driven the market increased, ensuring coffee stays optimally preserved while at the same time increasing sustainability efforts.

Adoption has also been spurred by innovations like intelligent coffee capsule solutions, RFID-based freshness monitoring, block chain-supported supply chain transparency, and AI-based brewing suggestions, enabling an optimized consumer experience.

Initiatives such as closed-loop collection programs, use of biodegradable additives, partnerships between coffee companies and waste management companies to create plastic capsule recycling programs have created maximum market growth, enhancing environmental stewardship and circular economy adaptation.

Increasing adoption of hybrid material capsules such as hand in cap with plastic-aluminum composites and bio-based polymers before improving yield characterized the market growth, which had heightened sustainability premium without compromising the performance of capsule and brewing efficiency.

Despite such enhancements in freshness, biocompatibility, and economic viability, plastic capsules are hampered by environmental concerns about plastic waste, legal restrictions on single-use plastics, and public demand for greener alternatives. However, advancements in bio-degradable plastic formulations, chemical-free recycling processes or compostable plastic shape for capsules are rendering ecological sustainability, effectiveness, and regulations compliance better, influencing consistently growing need for plastic-based coffee-based capsules world-wide.

Sustainable consumers, high-end coffee companies and other green businesses have adopted bio-plastics for compostable, bio-degradable coffee capsule systems. Bio-plastics offer fewer footprint on the sustainability front as compared to standard plastic capsules, plus decompose sooner.

This trend follows new-styled injected cups and producers of bio-plastic capsules when consumers of coffee are looking for sustainable choices. Studies indicate that over 60% of environmentally conscious consumers choose biodegradable or compostable types of coffee capsules, ensuring a healthy demand for this market segment.

Market demand has been further fortified with growth of new-age bio-plastic capsules which are known to lower dependency upon fossil fuel based plastics and better end of life biodegradability such as seaweed based polymers, PLA material based sugarcane, and compostable blends of corn starch.

This full relaunch came with carbon-free coffee capsule manufacturing, which includes renewable energy-driven manufacturing, bio-based material sourcing, and zero-waste manufacturing practices, allowing for wider adoption and harmony with global sustainability ambitions.

The emergence of bio-plastic capsule industry alliances, including agreements between coffee companies, bio-material technology firms, and waste disposal companies, has maximized market expansion, facilitating scalable solutions to large-scale biodegradation and industrial composting.

The incorporation of consumer awareness campaigns, including home-composting manuals, government-sponsored incentives, and retailer-led eco-labeling of green products, has stabilized market growth, facilitating increased public knowledge and the adoption of bio-plastic coffee capsules.

In spite of sustainability gains, lower carbon impact, and governmental compliance, the bio-plastics industry is confronted by drawbacks including higher cost of production, sparse industrial composting facilities, and consumer confusion regarding bio-degradable products.

Nevertheless, new technologies in enzymatic breakdown technology, sophisticated material science for home-compostable bio-plastics, and mass-scale bio-capsule recycling networks are enhancing affordability, accessibility, and rates of adoption, guaranteeing further growth for bio-plastic-based coffee capsules globally.

The commercial segment is one of the largest consumers of coffee capsules, as various commercial segments including businesses, hotels, and cafes are increasingly investing in single-serve brewing solutions as part of their operations. Unlike traditional batch brewing, the commercial coffee capsules guarantee efficiency, uniformity quality, and less waste.

The rise in demand for high-quality, barista-style coffee in office spaces, co-working facilities, and hospitality locations has led to adoption, as companies are seeking easy and inexpensive ways to ensure employee and guest satisfaction. According to industry studies, over 65% of all office coffee consumed is now based on the single-serve capsule format, thus providing solid repeat demand for this category.

Despite advantages in quality control, efficiency, and low waste, the commercial market faces challenges: sustainability concerns surrounding mass disposal of capsules, regulatory scrutiny on single-use plastics in the corporate world, and higher per-unit cost compared to bulk coffee brewing.

However, new developments in fully compostable capsules, reusable capsule systems, and corporate recycling initiatives are updating to become more sustainable, cost-effective, and regulatory compliant, underpinning growth in commercial coffee capsule use worldwide.

The household market showed very strong market acceptance, particularly among working professionals, home-based professionals, and coffee lovers who wish to enjoy premium coffee in their own homes. Single-serve capsules provide convenience, reduced preparation time, and more consistent taste than traditional brewing methods.

With increasing preference for personalized coffee consumption, such as for variety types of coffee such as specialty blends or limited-edition caffeine or types that works with a specific machine, the penetration of household coffee capsules has been driven by a desire for both variety and convenience.

The household segment still inhabits sustainability issues on single-use waste, increased expense compared to ground coffee, and machine reliance despite the convenience, quality assurance, and machine affinity positives. However, recent innovations in refillable capsule goods, machine-composting systems and home-recycling collection systems are improving environmental sustainability, price affordability and customer satisfaction, ensuring households will continue to use coffee capsules in increasing numbers around the world.

| Company Name | Estimated Market Share (%) |

|---|---|

| Nestle Nespresso | 25-30% |

| Lavazza | 12-16% |

| Gourmesso | 8-12% |

| Gloria Jean's Coffees | 6-10% |

| Bestpresso Coffee | 5-9% |

| Dunkin Brands | 5-9% |

| Starbucks Corporation | 4-8% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nestle Nespresso | Premium coffee capsules and machines, focusing on sustainability initiatives. |

| Lavazza | Provides a range of coffee capsules with sustainable sourcing and recyclable materials. |

| Gourmesso | Specializes in low-cost, compatible capsules with organic and Fairtrade alternatives.. |

| Gloria Jean's Coffees | Provides specialty coffee capsules with diverse flavor options. |

| Bestpresso Coffee | Focuses on budget-friendly, high-quality espresso capsules. |

| Dunkin Brands | Produces coffee capsules featuring classic Dunkin’ flavors for home brewing. |

| Starbucks Corporation | Offers premium coffee capsules compatible with various single-serve coffee machines. |

Key Company Insights

Nestle Nespresso (25-30%)

Nespresso, as a market leader, dominates the coffee capsule market with its high-end coffee products and innovative brewing systems. The company has been investing a lot in sustainability efforts, such as aluminum capsule recycling programs and carbon-neutral production of coffee.

Lavazza (12-16%)

Lavazza is another well-known participant in the capsule coffee market with a wide line of blends placed strongly on sustainable themes. It continues to push the boundaries in its product portfolios with biodegradable capsules and high-quality selections of coffee.

Gourmesso (8-12%)

It's known for low prices and usability in Nespresso machines, with Gourmesso focusing its expertise on organic and Fairtrade-certified capsules. The organization has been strengthening its portfolio by adding new trends in flavors as well as innovative eco-friendly packages.

Gloria Jean's Coffees (6-10%)

A prominent brand in the specialty coffee category, Gloria Jean's sells coffee capsules with distinctive flavors and blends. The company is targeting retail as well as direct-to-consumer channels, expanding its market presence.

Bestpresso Coffee (5-9%)

Bestpresso stands out for offering affordable coffee capsule options while continuing to produce high-quality espresso blends. The company has been working on building its distribution network to expand its reach among more customers.

Dunkin Brands (5-9%)

Dunkin' has made a successful entry into the coffee capsule segment with its best-selling flavors in single-serve packets. The company continues to innovate with new coffee blends that cater to consumer trends for smooth and bold coffee tastes.

Starbucks Corporation (4-8%)

Starbucks has used its brand image to launch premium coffee capsules that appeal to coffee lovers. The company emphasizes premium sourcing, sustainable sourcing, and distinctive flavor profiles to distinguish itself in the market.

Other Key Players (25-30% Combined)

The coffee capsule market also includes several emerging and regional players, contributing to the industry’s dynamic growth. Some noteworthy competitors include:

The overall market size for coffee capsules market was USD 270.8 Million in 2025.

The coffee capsules market is expected to reach USD 462.6 Million in 2035.

The increasing consumer preference for convenient, high-quality coffee solutions fuels Coffee Capsules Market during the forecast period.

The top 5 countries which drives the development of Coffee Capsules Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of material, plastic to command significant share over the forecast period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.