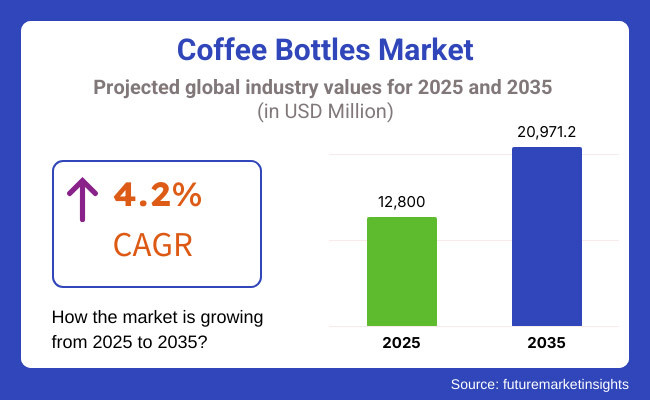

The Coffee Bottles Market is expected to witness significant growth between 2025 and 2035, driven by increasing consumer demand for ready-to-drink (RTD) coffee beverages. The market is projected to be valued at USD 12,800 million in 2025 and is anticipated to reach USD 20,971.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.2% throughout the forecast period.

One major factor contributing to the market’s expansion is the growing preference for convenience-based coffee consumption. Busy urban lifestyles, the rising influence of café culture, and the increasing trend of premium cold brew and specialty coffee products have fueled the demand for bottled coffee. Additionally, advancements in sustainable packaging, such as the adoption of recyclable and biodegradable bottle materials, are influencing consumer choices and shaping the industry’s future.

The market is segmented based on Material Type and Capacity. The material segment includes Glass, Plastic, Paperboard, and Others (Metal), while the capacity segment comprises Up to 50 ml, 51 to 200 ml, 201 to 500 ml, 501 to 1,000 ml, and Above 1,000 ml.

Of these, Plastic-based coffee bottles are on top because of their lightness, affordability, and longevity. The trend of on-the-go consumption coupled with rising investments in PET (polyethylene terephthalate) recyclable bottles has further accelerated the supremacy of plastics. Glass bottles, however, are only slowly coming into focus, particularly in the premium sector of coffee, because they offer greater product protection and appeal to environmentally-aware consumers.

Capacity-wise, 201 to 500 ml bottles dominate the market because they suit consumer needs for single-serve or personal-sized RTD coffee. This size category is especially favored by working people and younger consumers who are looking for instant, ready-to-consume coffee drinks that do not require preparation.

Explore FMI!

Book a free demo

North America is a high-value market for coffee bottles, led mainly by the growth in demand for ready-to-drink (RTD) coffee drinks and increasing demand for environmentally friendly packaging alternatives. The United States and Canada are the core markets where on-the-go lifestyle and busy life have driven adoption of bottled coffee.

Large beverage players, such as Starbucks, Dunkin', and Coca-Cola (owner of Costa Coffee), are going all out to increase their RTD coffee product offerings due to increasing consumer demand. Also, with tough environmental laws and a big sustainability drive, most brands are turning towards recyclable glass and aluminum coffee bottles to reduce plastic waste. The quick growth of direct-to-consumer sales and e-commerce has further increased the demand for bottled coffee in the region.

The coffee bottles market in Europe is world largest segment, driven by robust coffee culture in Europe and growing consumer preferences for high-end and functional ready-to-drink (RTD) coffee beverages. Germany, France, Mexico, England and Italy have relatively high demand for cold brew and specialty type coffees packaged in eco-friendly bottles.

" Packaging waste is a significant challenge for a sustainable European market, with governments and other regulatory agencies imposing strict reduction targets. This has generated a demand for reusable glass and biodegradable materials for bottles. European coffee companies are following suit with plant-based packaging and minimalist bottles to reach green consumers. On a regional basis, healthy consumers are driving the demand for organic, dairy free and fortified bottled coffee products.

Coffee Bottles Market Segment by Region: North America (United States, Canada and Mexico) Europe (Germany, France, UK, Russia and Italy) Asia-Pacific (China, Japan, Korea, India and Southeast Asia) South America (Brazil, Argentina, Colombia) Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa) The Asia-Pacific region is expected to be the fastest-growing market for coffee bottles due to its growing urbanization, rising disposable incomes, and increasingly Westernized coffee consumption.

Among top markets for this segment, RTD coffee is gaining traction in places like China, Japan, South Korea, and India, particularly among the younger audience with preferences for premium, convenient coffee. Japan is a vending machine culture, however, and there is already a packaged coffee bottled market in place, with major companies offering a wide range of flavors and functional items.

A burgeoning café culture and a health-conscious population in India and China are leading consumers to seek high-quality bottled coffee with natural ingredients and low sugar content. Environmental problems linked to single-use packaging are, however, causing governments and coffee businesses to seek eco-friendly replacements in the form of refillable and recyclable coffee bottles.

Challenge

Sustainability and Packaging Waste

Environmental contribution of packaging litter is one of the most consequential challenges in the coffee bottles business. Plastic bottles' extensive consumption causes pollution and results in higher regulatory pressures along with consumer intolerance towards non-reusable materials.

Governments are following stricter regulations for minimizing plastic intake and promoting more sustainable packaging arrangements. However, transitioning to biodegradable, recyclable, or reusable bottles while maintaining cost efficiency and product quality poses a challenge for manufacturers, requiring significant investment in alternative packaging materials.

Opportunity

Expansion of Premium and Functional RTD Coffee

Increasing demand for premium, health-oriented, and functional RTD coffee has a high growth opportunity in the coffee bottles market. Consumer demand is shifting toward high-quality packaged coffee that includes organic ingredients, plant-based milk alternatives, and added functional benefits such as protein, probiotics, or adaptogens.

Eco-friendly and aesthetically pleasing packaging can also serve as a strong differentiator, with brands introducing unique bottle materials to attract conscious consumers. These Trends, if leveraged can propel high-quality, sustainable, and functional packaged coffee products to significantly better positions in the changing market, Businesses than take advantage of these trends will have the opportunity to compete through differentiated products.

The coffee bottles market saw considerable growth from 2020 to 2024, driven by rising consumer demand for ready-to-drink (RTD) coffee, urbanization, and changing preferences for premium and functional beverages. The shift toward convenience-oriented coffee consumption led to an uptick in the production and distribution of bottled cold brew, nitro coffee, and coffee blended with plant-based ingredients. The COVID-19 pandemic also accelerated home coffee drinking, which increased demand for bottled coffee as a grab-and-go option.

The period from 2025 to 2035 will see the coffee bottles market transformed by sustainability mandates, AI-driven personalization, and next-generation beverage packaging. Plant-based, energy-fortified, and nootropic-infused coffee bottles will architect consumer choices in catering to health- and performance-oriented lifestyles. An additional block chain secured supply chain transparency will only further bolster consumer confidence in the ethically sourced coffee.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stringent regulations for sugar content, caffeine caps, and recyclability packaging standards.. |

| Technological Advancements | Nitrogen-infused coffees, smart freshness-tracking tops, and self-chilling bottles. |

| Industry Applications | RTD coffee for convenience, premium cold brew, and plant-based coffee blends. |

| Adoption of Smart Equipment | AI-powered consumer analytics, digital sales platforms, and nitrogen-sealed bottle preservation.. |

| Sustainability & Cost Efficiency | Transition to recyclable PET, glass, and aluminum; innovative biodegradable bottle substitutes.. |

| Data Analytics & Predictive Modeling | AI-driven consumer behavior analysis, demand forecasting, and customized product suggestions.. |

| Production & Supply Chain Dynamics | COVID-19 disruptions, increased demand for locally sourced coffee, and fluctuating raw material costs. |

| Market Growth Drivers | Convenience-driven coffee consumption, premiumization, and sustainability awareness drive growth.. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Forced biodegradable packs, block chain-transparency in sourcing, and caps on CO₂ emissions. |

| Technological Advancements | IoT-based freshness sensing, self-warming bottles, and AI-powered taste personalization. |

| Industry Applications | Expansion to AI-personalized coffee drinks, nootropic-infused drinks, and function health-focused bottle coffee. |

| Adoption of Smart Equipment | Intelligent vending machines with biometric identification, app-enabled bottle personalization, and smart coffee dispensing kiosks. |

| Sustainability & Cost Efficiency | Large-scale implementation of reusable bottles, seaweed-based biopolymer packaging, and refillable coffee stations. |

| Data Analytics & Predictive Modeling | Quantum computing-enabled supply chain optimization, block chain-backed sustainability audits, and AI-driven coffee profile customization. |

| Production & Supply Chain Dynamics | AI-optimized coffee sourcing, decentralized 3D-printed bottle production, and real-time block chain tracking of supply chains. |

| Market Growth Drivers | Customization enabled by AI, eco-friendly packaging of the future, and the emerging trend of functional coffee blends. |

The coffee bottle market in the USA is growing as consumers increasingly search for ready-to-drink (RTD) coffee due to their fast-paced lifestyle and demand for portable caffeinated beverages. In this case, increasing demand for cold brew and specialty bottled coffee has led to demand for higher-quality and more sustainable packaging.

There are attempts with big players by targeting glass and recyclable PET bottles to achieve sustainability goals. Market growth is further driven by growth in e-commerce & retail distribution channels and a shift towards health-oriented & functional coffee drinks.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.0% |

The growth in the UK market for coffee bottles is propelled by an ongoing on-the-go coffee culture and strong reference demands for premium RTD coffee brands. Bottled coffee demand is being driven by health-conscious consumers, with organic, plant-based and sugar-free increasingly popular.

Sustainability initiatives are also driving the market, with businesses launching biodegradable and lighter packaging to comply with plastic waste reduction regulations. The growing penetration of RTD coffee products at the retail level will be driven by the increasing shelf space provided by supermarket and convenience stores.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

The European union coffee bottles industry is growing at a considerable rate aided by the strong café culture and rising need of high quality RTD coffee drinks. The market is being driven by Germany, France and Italy, with consumers who are willing to pay for high quality cold brews and specialty coffee blends, in eco-friendly containers.

Tough EU rules on single-use plastics are forcing manufacturers to move to glass and aluminum bottles. Additionally, the increasing consumption of functional coffee beverages with added vitamins and energy-boosting ingredients is driving the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

Japan's ready-to-drink coffee category is growing due in part to the strong coffee culture and increased demand for premium RTD coffee products. And in Japan, consumers have shifted toward ready-to-drink forms of canned and bottled coffee, prompting manufacturers to constantly experiment with new brewing methods and flavor types.

There is also a focus on high-quality, low-sugar, and functional coffee products with added collagen and probiotics influencing markets. There are other emerging initiatives in sustainability, however, as recyclable PET bottles as well as aluminum containers are available in greater numbers in retail and vending channels.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

The market is driven by the rapid growth of café culture in South Korea, increasing consumption of high-end RTD coffee, and the growing demand for specialty cold brew coffee. Trendy bottled coffee brands are becoming very popular thanks to the rising popularity of Korean pop culture and SNS trends.

The market also sees a shift towards minimal and sustainable packaging, with the top players now rolling out eco-friendly glass bottles and plant-based plastics. The shift toward at-home and remote-work consumption of coffee is also driving demand for bottled substitutes of the bean.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The glass bottle is the fastest growing segment in the coffee bottle market: it offers premium packaging solutions to both specialty and RTD coffee brands. Unlike traditional plastic packaging, glass bottles preserve products better, create an upscale look, and cater to environmentally conscious consumer sentiment. The rising popularity of premium cold brew coffee, nitro coffee and artisanal RTD products has propelled glass bottle usage in the space, with brands competing to use high-end packaging in a bid to attract selective consumers.

Premium black and white coffee drinks, from specialty coffee brands with glass-bottled cold brews and craft coffee infusions to small-batch, single-origin RTD drinks, are driving market demand and delivering premium coffee offerings to consumers.

The rapid adoption of smart packaging technologies, such as those supported by QR codes on storytelling, NFC supported freshness monitoring, and AI-enabled consumer engagement platforms have bode well for the adoption, while providing stronger brand-consumer interactions in the space (glass bottle space). Glass recycling schemes from producers implemented bottle returns, sustainable sourcing of materials, and closed loop processes to further optimize market expansion and ensure alignment with global sustainability targets.

Incorporation of light glass bottle designs in the market with optimized utilization of materials because light designs practically require better portability and sturdiness for sustained convenience without compromising sustainability has also enriched the bottom line of the market.

While the glass bottle category benefits from premiumisation, enhanced product protection, and environmental sustainability, it is vulnerable due to higher production costs as well as breakages and logistical complexities. However, advances in tempered glass packaging, biodegradable glass, and reuse initiatives have since improved durability, cost-efficiency, and sustainability, promising continued growth for glass-bottled coffee products worldwide.

Due to low-cost, lightweight and easily transportable packaging solutions, plastic bottles have seen prevalent uptake throughout all aspects of the market, from mass-market RTD coffee suppliers, through to retailers of bottled beverages in convenience and corner stores and consumers who are on-the-go. Plastic bottles provide superior durability and cost-effectiveness when compared to glass bottles, making them the product best suited to mass production and widespread consumer adoption.

RTD coffee performances like flavored iced coffees as well as protein-enhanced coffee beverages and milk-based coffee mixes have fueled the plastic container fad, whereby producers choose low-cost packing with mass-market distribution in consideration. According to the research, over 60% of the coffee drinkers prefer RTD coffee in plastic bottles due to their lightweight and resealable nature and the trend will escalate the demand for this segment further.

Increase in Single-Serve Coffee Bottles Formats with Spill-Resistant Closures, Light Weight Portability, and Ergonomic Grip Structures Have Further Augmented Marketplace Demand to Assure Convenient Usage by Time-Pressed, Data-Driven Consumers on the Move. The inclusion of sustainable alternatives to plastic like bio-based PET, recycled HDPE and plant-derived polymers has further enhanced adoption thereby ensuring sustainable packaging solutions for plastic bottle market.

Measures such as closed-loop recycling initiatives through collaborations between brands and local businesses alongside creative recycling programs have also achieved high market growth for plastic bottle upcycling, guaranteeing greater incorporation of the circular economy in coffee packaging.

Furthermore, the emergence of hybrid material solutions, such as the application of plastic-glass composite bottles, biodegradable polymer coatings, and recycled resin reinforcements has bolstered market growth by offering enhanced product sustainability and packaging innovation.

While there are some strengths of plastic bottles including cost-effectiveness, longevity, and mass production - there are also some problems faced by the plastic bottle market today such as environmental concerns and plastic pollution, regulatory actions against single-use plastics (SUP), and consumer pressuring to switch to sustainable substitutes.

However, emerging innovations in biodegradable plastics, a new phase of recycling technology, and efforts to establish returnable plastic bottles will all improve sustainability, reduce the impact of waste, and still allow plastic-bottled coffee beverages to grow worldwide.

The 201 to 500 ml range has become one of the most popular capacity ranges in the coffee bottles market, providing the ideal balance between single servings and convenience-driven packaging. In contrast to smaller capacities, these bottles offer enough volume for a satisfying coffee experience, while still being portable and affordable for mass consumers.

Growing need for RTD coffee drinks with functional ingredients, energizing formulas, and plant milk infusions has driven uptake of mid-capacity bottles, driven by consumer desires for variety and convenience in a coffee purchase. Though benefitting from its strengths in equilibrated volume, convenience to the consumer, and mass appeal, the 201 to 500 ml category also has challenges like mounting pressure from smaller-sized single-serve packs, price sensitivity from bulk-sized products, and changing consumer preferences for personalized serving sizes.

Yet, new innovations in resalable cap technology, dual-compartment bottle package formats, and portion-controlled dispensing systems are enhancing consumer experience, guaranteeing sustained market growth for mid-scale coffee bottle products globally.

The 501 to 1,000 ml category has picked up robust market acceptance, especially among family pack coffee purchasers, bulk coffee buyers, and café chains selling take-home RTD coffee solutions, as bigger bottles offer cost efficiency, convenience, and longer periods of consumption. In contrast to smaller-sized packages, these sizes address multi-serving requirements, allowing value-driven purchasing for regular coffee consumers.

The upsurge in demand for home coffee solutions with cold brew concentrate bottles, flavored-coffee blends, and dairy-added RTD coffee jugs prompted adoption of bigger bottle sizes, with consumers demanding extended-use packs for everyday coffee consumption.

Although its cost advantage, multi-serving convenience, and longer consumption appeal, the 501 to 1,000 ml segment has some of its own challenges, including refrigeration space constraints, portion control issues, and less portability than smaller pack types.

Nevertheless, new developments in resalable bulk coffee containers, temperature-controlled bottle technologies, and portion-controllable dispensing systems are enhancing user convenience, paving the way for ongoing growth for large-format coffee bottle products globally.

The Coffee Bottles Market is witnessing significant growth driven by rising consumer demand for ready-to-drink (RTD) coffee and premium packaging solutions. The increasing preference for sustainable, aesthetically appealing, and durable packaging materials is pushing companies to innovate with glass and recyclable plastic bottles.

Advancements in bottle design, lightweight packaging, and tamper-proof sealing are also influencing market trends. The growing trend of cold brew and specialty coffee is further boosting demand. Key players in the market are focusing on product differentiation, eco-friendly solutions, and strategic collaborations to enhance their market share.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Berlin Packaging | 18-22% |

| Graham Packaging Company | 15-19% |

| Vetropack | 12-16% |

| Stoelzle Glass Group | 10-14% |

| Burch Bottle & Packaging | 7-11% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Berlin Packaging | Supplies high-quality, custom-designed coffee bottles with sustainability-focused packaging. |

| Graham Packaging Company | Produces lightweight and recycled plastic coffee bottles with increased durability and eco-friendliness.. |

| Vetropack | Produces high-quality glass bottles for coffee brands with a focus on recyclability and aesthetics. |

| Stoelzle Glass Group | Produces high-end glass packaging solutions for cold brew and RTD coffee brands. |

| Burch Bottle & Packaging | Provides extensive stock and custom glass and plastic bottles for coffee packaging solutions.. |

Key Company Insights

Berlin Packaging (18-22%)

Being a market leader, Berlin Packaging provides a wide variety of coffee bottle options, with emphasis on customization and sustainability. The company works together with coffee companies to create creative bottle designs that improve product visibility and shelf space.

Graham Packaging Company (15-19%)

A major player in the plastic coffee bottle segment, Graham Packaging prioritizes light weighting and eco-friendly materials. The company is known for developing high-barrier, resalable, and shatter-resistant bottles for RTD coffee brands.

Vetropack (12-16%)

A glass coffee bottle specialist, Vetropack offers high-quality, reusable, and recyclable packaging solutions to premium coffee brands. Its strong focus on sustainable packaging makes it a go-to partner for environmentally friendly companies.

Stoelzle Glass Group (10-14%)

As a leading player in the premium glass bottle sector, Stoelzle Glass Group provides stylish and resistant packaging solutions for premium coffee brands. The group is betting on sustainable manufacturing technologies to boost its market positioning.

Burch Bottle & Packaging (7-11%)

A key supplier of glass and plastic coffee bottles, Burch Bottle & Packaging caters to small and mid-sized coffee brands with customizable packaging options. The company’s extensive stock of packaging solutions provides flexibility for brands looking for quick turnaround times.

Other Key Players (25-35% Combined)

Several regional and emerging companies contribute to the coffee bottle market, offering both standard and bespoke packaging solutions

The overall market size for coffee bottles market was USD 12,800 Million in 2025.

The coffee bottles market is expected to reach USD 20,971.2 Million in 2035.

Increasing consumer demand for ready-to-drink (RTD) coffee beverages fuels Coffee Bottles Market during the forecast period.

The top 5 countries which drives the development of Coffee Bottles Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of material type, glass and plastic to command significant share over the forecast period.

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

North America PET Blow Molder Market Growth - Forecast 2025 to 2035

Liquid Capsule Filling Machines Market Trends – Growth & Forecast 2025 to 2035

Label Printers Market Analysis - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.