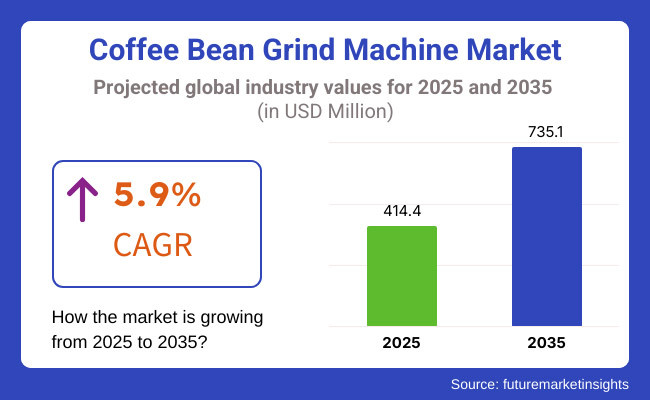

The Coffee Bean Grind Machine Market is expected to experience steady growth between 2025 and 2035, driven by the increasing consumer preference for freshly ground coffee and the expanding café culture worldwide. The market is projected to reach USD 414.4 million in 2025 and is anticipated to grow to USD 735.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.9% throughout the forecast period.

One of the key drivers contributing to market expansion is the growing popularity of specialty coffee and home brewing. Consumers are becoming more knowledgeable about different grind sizes and their impact on coffee flavor, leading to increased demand for high-quality grinding machines. Additionally, coffee shop chains and independent cafés are investing in advanced grinding solutions to ensure precision and consistency in coffee preparation, further fueling the adoption of coffee bean grind machines across various sectors.

The market is segmented based on Product Type and Machine Type. The product type segment includes Electric Burr, Electric Blade, Manual, and Other Product Types, while the machine type segment consists of Fully Automatic, Super Automatic, and Semi-Automatic machines.

Coffee grinders (Electric Burr Coffee Bean Grinders lead the worldwide average as they provide better grinding precision, consistency and coffee aroma retention. Unlike blade grinders, burr grinders crush coffee beans between two rough surfaces, giving ground coffee a most uniform grind size, which is essential for proper coffee extraction. Burr grinders are extremely in demand for home users, as well as commercial operation, because they offer more control over grind coarseness which is vitally important for different brewing techniques, including espresso, French press, and pour-over.

In terms of types of machines, Fully Automatic Coffee Bean Grind Machines lead, used on the majority of commercial and high-end home use. An all-in-one machine does everything from grinding to brewing to milk frothing and is therefore very convenient for customers who are looking for a seamless coffee-making experience. Rising investment towards high-end coffee solutions and the birth of new intelligent kitchen appliances & tableware are expected to continue to dominate this segment over the forecast period.

Explore FMI!

Book a free demo

With the presence of strong coffee culture, rise in demand for specialty coffee and increased consumer preference for home brewing, North America is a key market for coffee bean grind machines. The United States and Canada have gone coffee-nerd bonkers investing in top-end grinders to make barista quality coffee at home.

The well-established café market in the region also offers a strong commercial end-user that includes specialty coffee houses, roasteries, and restaurants that have committed to investing in high-performance grinding systems.

Additionally, smart kitchen appliances have paved the way for grind machines to achieve precision control, preset programming, and mobile app-friendly models. Increasing sustainability trends are also shaping the market, as North American manufacturers focus on energy-saving and long-lasting grinding machine designs to reduce waste and maximize performance.

Europe dominates in market share of coffee beans grinds machines owing to the rich tradition of consuming coffee and increasing demand for high-quality espresso and filter coffee. Countries like Italy, Germany, France, and the UK are at the forefront of this movement, which is primarily due to their preference for freshly ground coffee over pre-ground coffee.

Soaring customers in Europe spend big on burr grinders - the kind that allows full control over the size of the grind to hit the maximum extraction of coffee flavor. The growing use of semi-automatic and automatic coffee machines in residential and commercial areas is significantly increasing the need for upscale grind machines.

Sustainability concerns have also compelled European builders to construct grind machines with more sustainable materials, energy efficient motors and recyclable components, to perform in accordance with strict environmental standards under the EU.

The upcoming demand for coffee bean grind machines is anticipated to witness extraordinary growth in the Asia-Pacific region, owing to escalating coffee consumption, urbanization, and the growth of middle-class population. This has opened up the market for these kinds of machines in several nations like China, Japan, South Korea, and Australia, as a result, we see a lot of these specialty coffees and home brewing enthusiasts causing the demand for the machines that would provide the grind that fits their individual coffee preferences.

For, its burr grinders that deliver on the precision elements most highly regarded in the Japanese-style coffee market-consistent grind settings, and so forth-while both South Korea and China are moving more and more towards smart grinding solutions that are highly integrated with the espresso machine.

This is further born out by the popularity of home brewing methods, such as pour-over, French press and espresso, that require a specialty grinder to complement them. But the pocket still dictates this region, and many people are looking for mid-range and entry-level grind machines over high-end professional machines.

Challenge

High Cost of Advanced Grind Machines

High price range of high-end machines: The flagship level professional coffee grinder machines with precision burr grinders, digital interfaces as well as programmable settings pose a challenge. High-end grind machines have either yet to make their way down to a consumer level or are often priced out of the reach of casual tea or coffee drinkers.

Commercial Capabilities Grind Machines by their nature are expensive and require investment from the coffee shop and business-level users so low cost without sacrificing quality is a must for the manufacturers.

Opportunity

Integration of Smart Technology

The integration of smart technology presents a significant opportunity for the coffee bean grind machine market. Consumers are increasingly seeking grind machines with digital controls, Bluetooth or Wi-Fi connectivity, and AI-driven customization options. Smart grinders that allow users to adjust grind size, track grinding consistency, and receive maintenance alerts via mobile applications are gaining traction.

Additionally, advancements in quiet motor technology, precision dosing, and eco-friendly designs are further enhancing product appeal. Manufacturers that leverage smart features and sustainable materials while maintaining affordability are likely to gain a competitive edge in the evolving coffee equipment market.

Between 2020 and 2024, the coffee bean grind machine market experienced steady growth, fueled by the rising global coffee culture, increasing home-brewing trends, and expanding specialty coffee consumption. The demand for high-precision grinding machines surged as consumers and businesses sought consistency in grind size to enhance coffee quality. The proliferation of third-wave coffee movements, emphasizing freshly ground coffee for optimal flavor extraction, significantly boosted the adoption of burr grinders over blade grinders.

Between 2025 and 2035, the coffee bean grind machine market will undergo significant transformation, driven by AI-powered precision grinding, sustainable material innovations, and the integration of personalized coffee profiling. The shift toward fully automated smart coffee grinders, capable of self-adjusting grind size based on bean variety, roast level, and humidity, will redefine convenience and quality.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter hygiene and safety regulations, material compliance for food contact, and noise level restrictions.. |

| Technological Advancements | IoT-enabled smart grinders, titanium and diamond-coated burrs, and zero-retention grinding mechanisms. |

| Industry Applications | Specialty coffee shops, home baristas, office coffee solutions, and commercial espresso preparation. |

| Adoption of Smart Equipment | App-controlled grind settings, real-time maintenance alerts, and digital dosing precision. |

| Sustainability & Cost Efficiency | Low-noise and energy-efficient models, eco-friendly grinder materials, and sustainable burr compositions. |

| Data Analytics & Predictive Modeling | IoT-based grind consistency monitoring, app-driven coffee profiling, and grind retention tracking. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, increased raw material costs, and localized manufacturing strategies. |

| Market Growth Drivers | Growth fueled by specialty coffee trends, increased at-home brewing, and demand for precision grinding. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Energy efficiency mandates, blockchain-based sourcing verification, and recyclability standards for grinder components. |

| Technological Advancements | AI-driven burr calibration, quantum-enhanced particle distribution analysis, and fully automated grind profiling. |

| Industry Applications | Expansion into AI-personalized coffee ecosystems, robotic coffee stations, and smart home brewing systems. |

| Adoption of Smart Equipment | Biometric-based grind profiling, gesture-controlled coffee grinding, and fully integrated smart coffee ecosystems. |

| Sustainability & Cost Efficiency | Recyclable and biodegradable grinder components, circular economy-driven refurbishing programs, and energy-harvesting grinder technology. |

| Data Analytics & Predictive Modeling | AI-enhanced grind customization, quantum-based extraction optimization, and blockchain-backed quality assurance for burr longevity. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized 3D-printed grinder components, and real-time component tracking with blockchain. |

| Market Growth Drivers | AI-powered personalized grinding, quantum-enhanced grind quality optimization, and the expansion of sustainable grinder innovations. |

Rising demand for freshly ground coffee either in homes and commercial venues is driving growth of the USA coffee bean grind machine market. As specialty coffee culture has blossomed, consumers are paying for extra quality in high-performance grinders, whatever their grind size target, whether espresso, French press or pour-over.

Increasingly, coffee chains, independent cafes and premium home brewing trends are contributing to demand determination. Moreover, some technology-based burr grinders that come with digital controls and noise reduction are in demand in the market, as many consumers want to improve coffee extraction and maintain flavor consistency.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.7% |

Growing adoption for home brewing and artisanal coffee is leading to growth of UK coffee bean grind machine market. As consumers increasingly turn to electric burr grinders and smart grinding solutions to ensure uniform grind quality for a range of brewing methods.

The uptick in coffee shops, specialty roasters and cafés that are embracing commercial-grade grinders is also driving demand. This is ultimately leading product innovation and adoption towards energy efficient and low waste grinding solutions by conscious consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

The EU coffee bean grind machine market is growing due to strong coffee culture and increased home consumption of premium coffee. Countries such as Germany, Italy, and France are leading the market, driven by specialty coffee trends and a preference for freshly ground coffee.

Smart, automated, and precision-controlled grinders are gaining traction, while the expansion of café chains, local roasters, and high-end espresso machines is driving commercial grinder demand. Sustainability and energy efficiency regulations are also influencing manufacturers to develop eco-friendly and long-lasting grinder models.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.1% |

Japan's coffee bean grind machine market is witnessing steady growth with the popularity of specialty coffee and traditional brewing methods like hand-drip and siphon coffee. Japanese consumers prefer precision grinding and compact, design-oriented grinders that can fit into modern kitchen spaces.

The growing demand for quiet, efficient, and high-performance burr grinders in home and café settings is influencing product trends. Moreover, technological innovations, such as smartphone app-controlled grind size changes, are picking up steam in the Japanese market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

The coffee bean grind machine market of South Korea is growing fiercely, supported by the red-hot café culture and growing demand for coffee brewed at home. Retailers are luring customers to buy high-precision, adjustable grind setting electric burr grinders.

The social media influence and café look are also fueling demand for fashionable, high-performance grinders. South Korea's emphasis on intelligent kitchen appliances has resulted in the creation of app-operated, AI-enabled coffee grinders that optimize the brewing process.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

The electric burr grinder is the fastest-growing category in the coffee bean grinding machine industry thanks to greater grinding consistency, adjustable settings, and lower heat generation than grinding techniques. Burr grinders use a uniform grinding action for the optimal particle size for brewing methods, whether it is espresso, French press or pour-over coffee (as opposed to electric blade grinders).

Electric burr grinders have increasingly become popular in response to the increasing demand for premium coffee experiences among people who drink specialty coffee. According to research data, burr grinders are preferred by home and commercial baristas over 70% of the time because they offer better control during grinding, retaining the coffee bean flavor better making them high demand in the market.

Then, the availability of commercial charity burr grinders, which is responsible for different grind setting adjustments in multi-steps, with low-retention designs and built-in scales to allow accurate dosing, has promoted its strengthened market growth, ensuring more accurate grinding for premium coffee retailers and cafes.

Adoption has also been made easier and smoother with the inclusion of digital burr grinder technology, such as AI-powered grind size adjustment, automatic brew suggestions and Bluetooth integration for settings synchronization. Green burr grinder models have energy-efficient motors, recycled products, and noise reduction technology that is tailored to maximize market growth and ensure compliance with sustainability practices and environmentally friendly manufacturing.

These innovations include high-tech motors with low-speed and high-torque grinding mechanisms that ensure zero heat transfer that leads to loss of flavors and optimization of coffee aromas preservation, with maximum and increasing market potential.

Despite its advantages with grind consistency, customizability, and flavor preservation, the electric burr market has barriers to entry like higher up-front costs, maintenance difficulty, and consumer preference for affordability. However, advancements in smart grind automation, improved burr material durability, and AI-based grind profiling are adding to usability, longevity, and effectiveness, ensuring continual global market growth for burr-based coffee grinding solutions.

Machines are available today that grind your coffee beans and brew the coffee automatically or fully automatically, which have become popular among busy professionals, commercial coffee business and coffee bulk service personnel by automating the entire brewing process from grinding to extraction.

Fully automatic machines can grind, dose, and brew your coffee with the mere press of a single button, giving you the utmost convenience as a coffee lover and, compared to their semi-automatic or manual counterparts. Flourishing demand for high-quality coffee performed without the use of human hands and featuring automatic grind size control, built-in tamping and milk frothing systems has boosted sales of fully automatic grind machines.

Smart automatic coffee brewers are taking the market by storm due to their touchscreen interface, programmed coffee recipes, and adjustable grind-to-brew ratios. The growth of the smart automatic coffee brewers is further consolidating market demand for customized brewing with catering for the needs of a wide audience base.

Adoption has once more been qualified by the introduction of IoT-enabled coffee brewers, which allow full remote control over get brewing, access to smartphone applications and cloud-stored recipe space, providing for greater control and efficiency for operators in the grind-to-brew space.

Double-boiler technology with dual source of heating, grind pressure profiling and self-cleaning functions have become an everyday standard used in market-grade totally automatic machines to the maximum which tilts the market expansion towards more business and coffee chain production of coffee that can be a professional espresso and high quality co-lattes.

The implementation of environmentally friendly coffee machine designs, with energy-efficient heating units, biodegradable water filtration technology, and returnable coffee capsules, has stabilized market growth, ensuring compatibility with international eco-sensitive consumer tastes.

Despite its benefits in terms of convenience, automation, and grind-to-brew efficiency, the fully automatic category is beset by problems like high initial costs, complicated maintenance, and restricted user intervention in manual brewing methods. New developments in AI-based flavor profiling, sensor-guided grind optimization, and self-improving brewing algorithms, however, are enhancing usability, personalization, and long-term machine efficiency, guaranteeing further market growth for fully automated coffee grinding solutions across the globe.

Electric Blade Grinders Maintain Market Demand as Affordable and Compact Coffee Grinding Solutions The electric blade grinders category has become one of the most convenient choices for home consumers, providing an easy and inexpensive way to grind coffee beans without intricate settings. Blade grinders, unlike burr grinders, employ high-speed spinning blades to cut beans, making them a great choice for everyday coffee consumers who value convenience.

The rising demand for compact and affordable coffee grinding solutions, featuring one-touch operation and multi-purpose functionality, has fueled adoption of electric blade grinders, as users prioritize cost efficiency over precision grinding. Studies indicate that over 50% of first-time coffee grinder buyers opt for blade models due to their affordability, ensuring steady market demand.

Even with its benefits in cost-effectiveness, portability, and convenience, the electric blade market has drawbacks in inconsistent grind particle size, loss of flavor from heat generation, and restricted compatibility with brewing methods. Nevertheless, recent developments in pulse grinding technology, dual-speed motor control, and noise-reducing blade technologies are enhancing efficiency, consumer satisfaction, and competitive market advantage, guaranteeing long-term uptake of electric blade grinders globally.

The segment of semi-automatic coffee bean grind machines has seen robust market acceptance, especially among specialty coffee aficionados and baristas who want a compromise between automation and manual intervention. In contrast to fully automatic machines, semi-automatic machines enable users to manually adjust grind size, tamping pressure, and extraction time, allowing for more customization in coffee preparation.

The increasing need for hybrid coffee grinding and brewing technology, with programmable shot timing, PID temperature control, and adjustable grinder settings, has spurred adoption of semi-automatic machines, as consumers desire more hands-on control over their coffee-making process.

In spite of its strengths in customization, professional-level brewing, and user convenience, the semi-automatic category has its drawbacks in the form of a higher learning curve, greater maintenance needs, and longer preparation time than fully automatic options. Yet, new developments in AI-guided brewing advice, digital pressure profiling, and integrated grinder automation are enhancing user experience, accuracy, and efficiency, guaranteeing ongoing growth for semi-automatic coffee grinding solutions globally.

The Coffee Bean Grind Machine Market is experiencing steady growth driven by rising consumer interest in freshly ground coffee and premium coffee experiences at home. Increasing demand for specialty coffee, along with advancements in grind precision and automation, is fueling market expansion.

Consumers seek customizable grind sizes for espresso, French press, and drip coffee, leading to the development of smart grinders with digital controls and burr technology. Key market players are focusing on innovation, durability, and affordability to cater to both home users and commercial establishments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| KitchenAid | 20-25% |

| Baratza | 18-22% |

| Capresso | 12-16% |

| BLACK+DECKER | 10-14% |

| Hamilton Beach | 8-12% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| KitchenAid | Manufactures high-performance burr and blade coffee grinders with a focus on durability and precision. |

| Baratza | Specializes in high-end burr grinders with advanced grind settings and commercial-grade features. |

| Capresso | Produces affordable and mid-range coffee grinders, catering to home coffee enthusiasts. |

| BLACK+DECKER | Offers budget-friendly blade grinders with user-friendly features for everyday coffee grinding. |

| Hamilton Beach | Develops entry-level and mid-range coffee grinders, prioritizing affordability and ease of use. |

Key Company Insights

KitchenAid (20-25%)

As a dominant player in the market, KitchenAid offers premium coffee grinders with robust construction and precision grinding. The company emphasizes user-friendly designs and high-quality burr technology to enhance grinding consistency for different brewing methods.

Baratza (18-22%)

A leader in specialty coffee grinding, Baratza provides high-end burr grinders with customizable grind settings for espresso and drip coffee enthusiasts. The brand is widely favored by coffee professionals and home baristas, known for its durability and repairable parts.

Capresso (12-16%)

Capresso targets mid-range coffee grinders that balance performance and price. Capresso provides burr and blade grinders to casual coffee users who are looking for an improvement from pre-ground coffee.

BLACK+DECKER (10-14%)

The popular brand of kitchen appliances, BLACK+DECKER, offers low-end blade grinders that are compact, low-priced, and convenient. The brand appeals to cost-sensitive consumers seeking instant and easy grinding solutions.

Hamilton Beach (8-12%)

Hamilton Beach has a range of affordable electric coffee grinders. The focus is on ease of use, with such aspects as one-touch operation and removal of grinding chambers, which is appealing to newcomers.

Other Key Players (20-30% Combined)

The coffee bean grind machine market is also supported by a mix of emerging brands and regional manufacturers, including:

The overall market size for coffee bean grind machine market was USD 414.4 Million in 2025.

The coffee bean grind machine market is expected to reach USD 735.1 Million in 2035.

The increasing consumer preference for freshly ground coffee and the expanding café culture worldwide fuels Coffee bean grind machine Market during the forecast period.

The top 5 countries which drives the development of Coffee bean grind machine Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of product type, electric burr to command significant share over the forecast period.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.