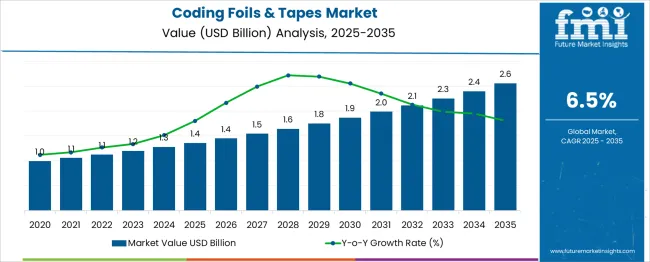

The Coding Foils & Tapes Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Coding Foils & Tapes Market Estimated Value in (2025 E) | USD 1.4 billion |

| Coding Foils & Tapes Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The coding foils and tapes market is experiencing steady growth driven by increasing demand for high quality product labeling, secure packaging, and brand differentiation across industries such as food and beverages, cosmetics, and pharmaceuticals. Rising emphasis on anti counterfeiting measures and compliance with stringent labeling regulations has enhanced the adoption of advanced coding solutions

echnological advancements in heat transfer, foil durability, and substrate compatibility have further supported performance efficiency and aesthetic appeal. The shift toward automated packaging lines in manufacturing has also fueled demand for coding foils and tapes that deliver consistent quality at high speeds.

Sustainability initiatives are encouraging the development of eco friendly foil formulations and recyclable substrates, aligning the market with evolving corporate social responsibility goals. With brands seeking both functional and visual excellence in product presentation, the market is expected to maintain a positive growth trajectory in the coming years.

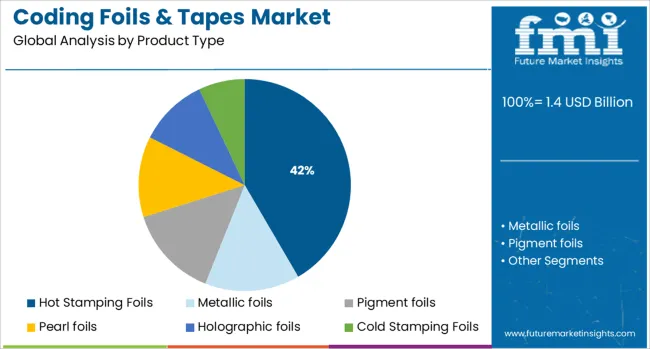

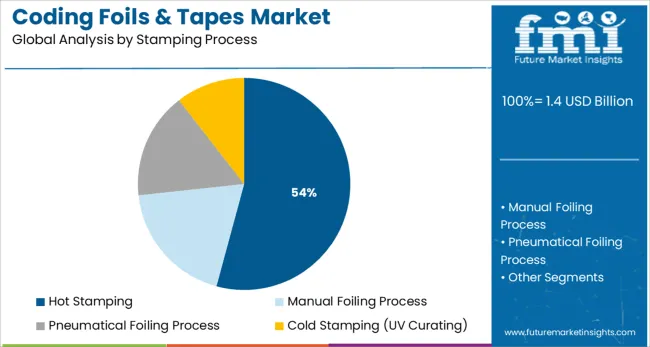

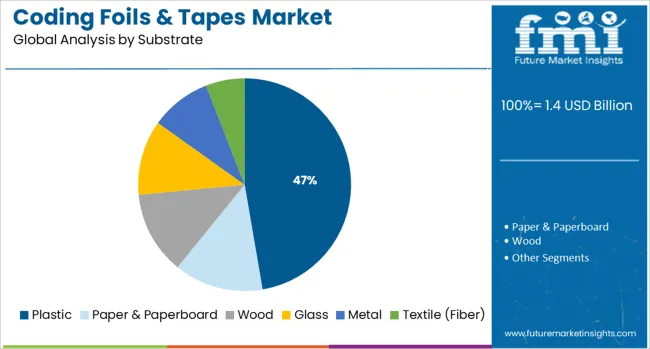

The market is segmented by Product Type, Stamping Process, Substrate, and End Use Industry and region. By Product Type, the market is divided into Hot Stamping Foils, Metallic foils, Pigment foils, Pearl foils, Holographic foils, and Cold Stamping Foils. In terms of Stamping Process, the market is classified into Hot Stamping, Manual Foiling Process, Pneumatical Foiling Process, and Cold Stamping (UV Curating). Based on Substrate, the market is segmented into Plastic, Paper & Paperboard, Wood, Glass, Metal, and Textile (Fiber). By End Use Industry, the market is divided into Cosmetics, Food & Beverages, E-Commerce & Logistics, Packaging, Automotive, Electronics, Textiles, and Other Consumer Goods (pen, invitation cards, toys, books etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hot stamping foils segment is expected to hold 41.60% of the total market revenue by 2025 within the product type category, establishing itself as the leading segment. This growth is being driven by its ability to deliver sharp, durable, and visually appealing prints on a variety of materials.

The process ensures resistance to abrasion, chemicals, and fading, making it suitable for both decorative and functional applications. The compatibility of hot stamping foils with high speed production lines further enhances their adoption in mass production environments.

Continuous improvements in pigment formulations and metallic finishes have strengthened the segment’s position by meeting both branding and compliance requirements.

The hot stamping process segment is projected to account for 54.20% of the total market revenue by 2025, positioning it as the most dominant process type. This is attributed to its precision, versatility, and ability to produce high definition, long lasting markings without the use of inks or solvents.

The method is compatible with a wide range of substrates, supports intricate designs, and requires minimal maintenance compared to alternative processes.

Its effectiveness in enhancing product aesthetics while ensuring tamper resistance has made it the preferred choice for industries where quality and durability are paramount.

The plastic substrate segment is anticipated to represent 47.30% of the total market revenue by 2025 within the substrate category, making it the leading choice. This dominance is linked to the widespread use of plastic materials in packaging and product manufacturing, where strong adhesion and print clarity are essential.

Plastic substrates offer durability, lightweight properties, and versatility, making them suitable for diverse industrial applications. The ability to pair with advanced foils and withstand high temperature processing has further reinforced their adoption.

With ongoing innovation in recyclable and biodegradable plastic materials, this segment is expected to maintain its leadership while aligning with environmental sustainability goals.

Some of the key players operating in the global Coding Foils & Tapes market are -

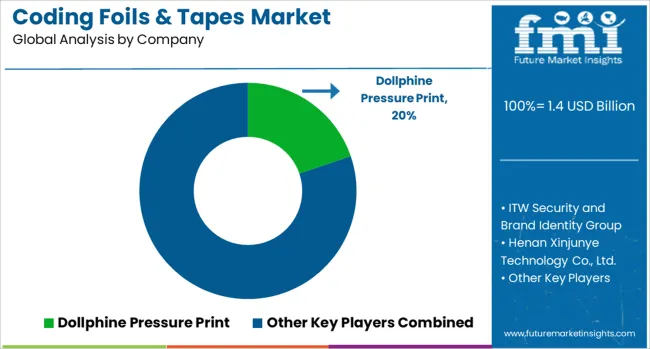

AG Foil s.r.o., Dollphine Pressure Print, ITW Security and Brand Identity Group, Henan Xinjunye Technology Co., Ltd., PB Holotech (I) Pvt. Ltd., KURZ Group, AG FOIL EUROPE s.r.o., Xinxiang Fineray Tech Co., Ltd., Foilmakers Australia (Milford Astor Group), Interfilms India Pvt Ltd., Rasik Products Private Limited, Crown Roll Leaf, Inc., UNIVACCO Foils Corporation, BRIDGE Foils (China), API Group, MAG Plastics (India), Rainbow Plastics India Limited, Shine Star Speciality Coaters Pvt Ltd., KOLON Industries, Inc., Murata Kimpaku Co., Ltd., Nakai Industrial Co. Ltd., OIKE & Co., Ltd., Nakajima Metal Leaf, Powder co., ltd., Samhan Co., Ltd., Katani Co. Ltd., Washin Chemical Industry co., ltd. and others.

Key Developments, Mergers, and Acquisitions

Exhibit 3 represents the tier classification of the companies considered in this article. Company annual reports were used as resources for calculating the revenue share of the coding foils and tapes market.

Cold stamping is expected to grow at a higher CAGR during the forecast period due to its increasing applications and late entry into the market. The hot stamping market in APEJ is anticipated to be the fastest growing, with India and China contributing significantly.

Textiles & cosmetics is expected to grow at the highest CAGR in all end-use sectors. Manufacturers are increasingly investing in research & development to launch creative and attractive coding foils & tapes.

The research report presents a comprehensive market assessment and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, applications, and industries.

The global coding foils & tapes market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the coding foils & tapes market is projected to reach USD 2.6 billion by 2035.

The coding foils & tapes market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in coding foils & tapes market are hot stamping foils, metallic foils, pigment foils, pearl foils, holographic foils and cold stamping foils.

In terms of stamping process, hot stamping segment to command 54.2% share in the coding foils & tapes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Coding Foils & Tapes Providers

Emboss Coding Machine Market

Medical Coding Market

Wet Ink Coding Machines Market

Marking and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Marking and Coding Equipment

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Computer Assisted Coding Software Market Analysis by Solution, Deployment, Application, and Region Through 2035

Tipping Foils Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in the Tipping Foils Industry

Flexible Lighting Foils Market

Metallic Hot Stamping Foils Market

Dialysis System Powder Dissolver Market Size and Share Forecast Outlook 2025 to 2035

Cloud Data Encryption Solutions Market Size and Share Forecast Outlook 2025 to 2035

Coal Mine Ventilation Fans Market Size and Share Forecast Outlook 2025 to 2035

Cordless Handheld Cultivator Market Size and Share Forecast Outlook 2025 to 2035

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA