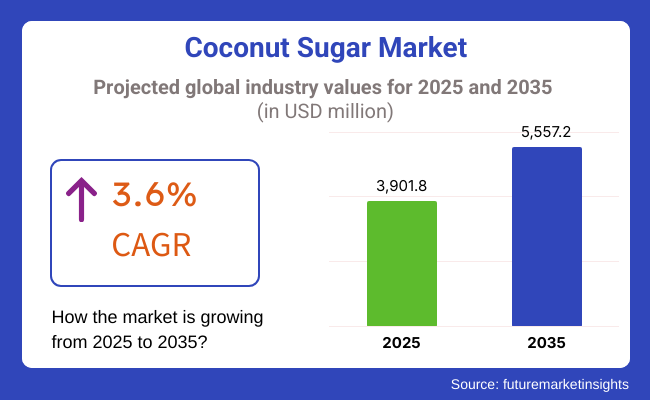

The coconut sugar market is set to rise, with a projection of USD 3,901.8 million by 2025. The total valuation of the market is likely to reach a valuation of USD 5,557.2 million by 2035. Consumers have been looking for new, better options than the refined sugars and have turned their attention to coconut sugar, which comes with the benefits of a lower glycemic index and essential minerals like iron, zinc, and potassium.

The rise of natural sweeteners in the food and beverage market has been one of the major reasons for coconut sugar's success. Manufacturers are using coconut sugar in a variety of products such as bakery items, candy, drinks, and yogurt to cater to consumers who are concerned about their health. The move to clean label and non-GMO food products is also making it easier for brands to use coconut sugar in place of sweeteners that are artificial.

Moreover, the sustainability aspect is another driving force behind the market expansion. The production of coconut sugar is viewed as more environmentally friendly when compared to traditional sugar production because it uses less processing and helps preserve ecosystems. This matches with the growing power of ethics as consumers turn to responsible and sustainably sourced products.

However, along with the plant's plant profit, it also has various issues to face. The coconut sugar price being relatively high as against the refined sugar and other sweeteners are likely to be the impacting factor in stealing the market. Furthermore, the difference in the flavor, texture, and availability of coconut sugar may cause the manufacturers to face challenges while they seek to introduce the coconut sugar to mass food production.

On the other hand, there are a number of opportunities for market expansion. The demand for coconut sugar in the functional food and beverage category, as well as in diabetic-friendly and keto-friendly diets is anticipated to rise in the near future which, in turn, will open up the new areas for growth. The increase in the investments in sustainable coconut farming will lead to better product availability, and also the improvements in supply chain efficiency in the coming years.

Explore FMI!

Book a free demo

The market is experiencing a growing demand based on health-driven consumers and growing natural sweeteners. With a low-glycemic index compared to table sugar, coconut sugar is seeing growth in the food & beverages, bakery, and organic sectors.

Food and beverage companies are adding coconut sugar to health-oriented products, weighing cost against sustainability. Retail consumers, while cost-conscious, are drawn to coconut sugar because of its perceived health advantages and natural image.

The bakery & confectionery industry is utilizing coconut sugar in clean-label and plant-based products. Organic food brands are highlighting certified organic and fairly traded coconut sugar, which is congruent with the growing trend of sustainable and fair-trade products. The HoReCa segment is embracing coconut sugar in health-oriented specialty menus. The industry is moving towards premiumization, sustainability, and new product applications.

Between 2020 and 2024, the market for coconut sugar experienced steady growth as consumers turned increasingly to natural and healthier types of sugar. With its low glycemic index and high nutrient levels, coconut sugar became sought after more and more as a replacement for white sugar in baked foods, beverages, and snack foods. Market expansion also supported the shift to plant-based, organic, and clean-label products. Ethical buyers sought coconut sugar as it was organic and less processed. Chocolates, granola bars, and specialty drinks with coconut sugar as an ingredient were launched by food and beverage manufacturers to cater to the changing consumption patterns. However, supply chain volatility, production at a high price, and uncertain product quality due to various origins of coconut sap served as drawbacks to market equilibrium.

The coconut sugar market is expected to grow at a very rapid pace owing to higher production efficiency and uniformity through technology development. Fair trade certification and eco-friendly coconut farming methods will increase market standing and customer trust. Functional and low-glycemic sweetener use will lead to high demand for coconut sugar to use in healthy beverages, plant-based desserts, and functional foods. Innovation in form for foods, i.e., stevia and monk fruit blend, will lead to improved taste with lower calorie content. AI marketing insights and nutrition targeting solutions will make product innovation possible. Foraying into new markets and partnerships with health-oriented players will increase reach.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Strong growth due to demand for natural sweeteners. | Growth accelerated by health trends and sustainable sourcing. |

| Higher demand for low-glycemic, natural sweetener substitutes. | High demand for functional benefits and clean-label. |

| Coconut sugar in snacks, beverages, and baking. | Growing use in functional foods, desserts, and specialty beverages. |

| High demand in North America and Europe and rising interest in Asia-Pacific. | Expansion abroad into emerging markets and customization at a local level. |

| Compliance with food safety and labeling requirements. | Natural sweetener and sugar reduction claim support. |

| Distribution via health food stores, supermarkets, and online. | Omnichannel distribution, direct-to-consumer and specialty. |

| Improved processing technologies and consistency of quality. | High technology supply chain management and artificial intelligence product development. |

| Specialty sweetener brand competition and coconut food product company competition. | Consolidation by acquisition and health brand alliance. |

The coconut sugar market is definitely on the rise due to the increasing issue of people's involvement in natural and organic sweeteners. But, along with the supply chain problems, the industry also has risks like climate change, seasonal variations, and dependency on particular regions where the coconuts grow. It is vital for the companies to take action by finding other sources, fostering the growth of environmental-friendly cultivators, and establishing alternative trading networks as measures to increase production and product availability stability.

Legal regulations and food safety criteria present obstacles that make it hard for companies to enter and grow in the market. Different global rules regarding the organic certificate, labeling, and allowable processing techniques make it difficult for businesses to find a way through the convoluted legal egregious. Following transparency, acquiring, and sticking to the developing food safety standards are the main ways for companies to win the trust of the community and to follow the norms

The majority of the people do not have idea of coconut sugar’s advantages as compared to the conventional sugar and even other natural alternatives. Marketing that aims for the health of the people, making the brand of the product health-oriented, and launching informative advertising campaigns are considered to be the main things to be set in motion in order to succeed at that and allow the consumption of coconut sugar in the standard market.

| Countries | CAGR (%) |

|---|---|

| USA | 5.2% |

| UK | 4.8% |

| France | 4.5% |

| Germany | 4.7% |

| Italy | 4.3% |

| South Korea | 5.1% |

| Japan | 4.6% |

| China | 5.5% |

| Australia | 4.9% |

| New Zealand | 4.4% |

The USA coconut sugar market between 2025 and 2035 is poised to witness a CAGR of 5.2%. The demand for organic and natural sweeteners, driven by health awareness, is boosting the market's growth. Companies like Big Tree Farms and Madhava are the key drivers for product development and supply chain establishment. An increase in keto and vegan diets is also the cause of coconut sugar usage because it has replaced normal sugars consumed in most foods and drinks. Online stores and retail outlets make it easily available, thus facilitating mass consumption.

The USA processing industry of the food sector easily incorporates coconut sugar in baked food, drinks, and snack foods. Increasing problems in the environment around sustainable production drive customers towards coconut sugar because it leaves a smaller carbon footprint. Increasing demand through clean-label products also drives growth because consumers are interested in less processing product availability. Finally, brand-retailer partnerships drive the level of awareness, thus making coconut sugar an accepted natural sweetener.

The UK market for coconut sugar will evolve at a growth rate of 4.8% during 2025 to 2035. Strong demand for organic and plant foods has prompted businesses to introduce coconut sugar into their product range. Established players like The Coconut Company and Groovy Food Company sell their organic coconut sugar as a refined sugar-free premium choice. Increasing instances of obesity and diabetes promote consumers towards lower glycemic index sweeteners, thus stimulating market expansion. The bakery and confectionery industries in the UK increasingly use coconut sugar as an ingredient for their products in place of traditional sweeteners.

Pressure from the regulatory side in terms of decreasing sugar content in processed foods has prompted food companies to seek substitutes in the form of coconut sugar. Internet retailing channels create very strong forces for market growth, and specialist health food stores and Amazon both retail different coconut sugar-based items. Moreover, the good environmental policies of the UK are accompanied by the eco-friendliness of coconut sugar, thus complementing the long-term demand.

The French coconut sugar market is projected to grow at a CAGR of 4.5% in 2025 to 2035. Organic and gourmet food is what French consumers are aiming for, and coconut sugar fits the consumer niche best that is looking for healthy food. Quality, sustainably sourced coconut sugar is the target of Alter Eco and Comptoirs & Compagnies to cover more consumers searching for fair trade. More natural sweetener cafes and bakeries translate to more market penetration.

The French initiative to cut down on the use of refined sugar is in line with the government's promotion of healthy diets. The incorporation of local coconut sugar in high-end chocolates and sweet dishes validates its market penetration. Online sales are a prime driver of increased sales, with consumers seeking increasingly organically grown and minimally processed products. The emphasis of the French market on artisanal and eco-friendly products ensures consistent growth in the next decade.

Germany's coconut sugar market will expand at a CAGR of 4.7% between 202 and 2035. Demand is fueled in the wake of nutritional quality in Germany's mature organic food market, led by the likes of Rapunzel Naturkost and Naturata. Growing demand for coconut sugar is also powered in the wake of the low glycemic index that is becoming more prominent in diabetic diets. Demand generated on account of growing vegan and plant-based diets is also driving the market, with coconut sugar widely used in substitute sweeteners.

German food producers blend coconut sugar into breakfast cereals, energy bars, and drinks. Retailers such as REWE and Edeka stock coconut sugar on their organic shelves, making it more available. High food standards in the country foster high-quality natural food, fueling market growth further. Germany's emphasis on sustainable consumption and sustainable sourcing commingles with the ethos of coconut sugar production as well.

The industry is set to record a CAGR of 4.3% during 2025 to 2035. Consumers, favoring natural and premium ingredients, are increasingly opting for coconut sugar integration into their lifestyle. Premium brands like Gusto Bio and Probios are gaining traction, and coconut sugar is becoming a premium substitute for conventional sweeteners. Increasing demand for organic desserts and vegan food is also contributing to stable demand.

Italian bakeries and confectioneries use coconut sugar more and more in their chocolates and pastries. The growing trend of following a healthy lifestyle keeps the market going continuously. Organic food stores and health food stores also sell very significantly. The initiative by the Italian government to encourage sustainable, environmentally friendly foods also supports the market for coconut sugar in the nation.

The Australian coconut sugar market is anticipated to reach a CAGR of 4.9% during 2025 to 2035. Growing demand due to the popularity of organic and plant-based diets drives demand. Popular brands like Loving Earth and The Source Bulk Foods retail coconut sugar as a better alternative to refined sugars. The growing use of coconut sugar as a baking ingredient, confectionery, and coffee drives market growth.

Higher consumer demand for bulk shops and health food shops is evidential proof of higher volumes of sales. Good reduced levels of sugar in foods by the government sector encourage the use of natural sweeteners like coconut sugar. Woolworths Online and Coles, online stores, offer easy access to the product. The value of sustainability in coconut sugar appeals to Australia's environmentally conscious consumer market with the constant increase in market demand.

New Zealand coconut sugar will grow at a 4.4% CAGR between 2025 and 2035. People are becoming more health-conscious and switching to coconut sugar as a healthier option compared to conventional sweeteners because of its low glycemic load and natural processing. Some of the leading players in the country are companies like Ceres Organics and Chantal Organics, which provide good quality coconut sugar to cater to the increasing demand.

New Zealand's mature organic and natural foods industry provides an easy place for coconut sugar to grow in the market. Demand from specialty coffee houses and artisanal bakery items continues to grow. The nation's emphasis on sustainability and ethics in consumerism also stimulates adoption because consumers seek out products with reduced environmental footprints. The growing grocery online market, such as Countdown and Farro Fresh, guarantees that the market is extensive.

By 2025, granular coconut sugar is expected to remain the leading segment in the market as it closely resembles traditional cane sugar. Due to its frequent use in various applications such as baking, beverages, and confectionery, this form continues to be a popular alternative for health-conscious consumers.

Growing natural and unrefined sweetener demand has encouraged the use of honey across food segments. Big Tree Farms and Madhava, among other big brands, have introduced Organic Crunchy Coconut Sugar into the marketplace, which specifically targets those seeking sustainable, low-GI alternatives.

Powdered coconut sugar is gaining traction in the food & beverage processing industry and particularly in the processed food industry as it has a fine texture, which allows it to blend into a variety of products and dissolve fast. This variant is popularly used in instant coffee blends, protein shakes, and desserts. Brands such as Nutiva and Terrasoul Superfoods have recently added powdered coconut sugar to their offerings in response to consumers and businesses looking for easy-to-dissolve sweeteners for all their applications.

On the basis of type, the market is segmented into organic coconut sugar and Coconut Sugar, with organic coconut sugar gaining popularity among consumers as a result of health and environmental issues.Enhancing those factors, the growing requirement for natural and chemical-free sweetening agents is pushing sales of organic coconut sugar significantly.

Consumers who want healthier substitutes for refined sugar are opting for organic varieties that lack synthetic pesticides and fertilizers. For the growing clean-label movement, brands such as Big Tree Farms, Nutiva, and Madhava offer certified organic coconut sugar. Expanding Global Organic Food Market: The global organic food market is expanding rapidly and is positively impacting the market of organic coconut sugar, especially among health-conscious buyers and vegans, paleo and keto dieters.

Classic Coconut Sugar is still universally available and is also generally cheaper than an organic option. It is mainly used in the manufacturing of food and beverages on an industrial scale, where budgetary limits are of the utmost importance. Coconut sugar, often considered a sustainable alternative sweetener, is widely employed in larger confectionery, bakery, and beverage formulations for its caramel-like flavor. Leading producers include Indonesia, the Philippines , and Thailand, which ship organic and conventional coconut sugar to global markets.

Another factor contributing to the growth of the market is organic products, thus resulting in the development of the overall coconut sugar market, which can either be classified as organic or conventional, depending on the segment of the market.

Coconut sugar market growth is steady due to consumer demand for natural, low-glycemic, and sustainable sweeteners. Health-conscious consumers are looking for substitutes for refined sugar, and coconut sugar is favored due to its minimal processing, mineral-dense, and environment-friendly production methods.

The market is ruled by Giants like Big Tree Farms, The Coconut Company, Madhava Natural Sweeteners, Nutiva, and Tradin Organic through the acquisition of organic certifications and fair-trade sources while diversifying their product portfolios. Start-ups and niche providers, to accommodate shifting consumer preferences, are bringing infused coconut sugars, flavored varieties, and blends with other natural sweeteners.

Key offerings in the market include pure coconut sugar, organic variants, flavored ones, and ingredient-grade coconut sugar that can be used in bakery, confectionery, beverages, and functional foods. Manufacturers emphasize sustainable sourcing, carbon-neutral production, and ethical supply chains to create brand appeal.

A competitive environment enables strategic factors to play, such as cost efficiency, regulatory compliance, and innovative packaging. These companies, taking advantage of direct-to-consumer (DTC) sales, expanding e-commerce, and forming partnerships with health food brands, are therefore penetrating the market. With the rise in interest in plant-based and alternative sweeteners, coconut sugar is expected to sustain growth, stimulating investments in scalability, product differentiation, and global distribution.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Big Tree Farms | 18-22% |

| The Coconut Company | 14-18% |

| Nutiva | 10-14% |

| Madhava Natural Sweeteners | 8-12% |

| Tradin Organic | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Big Tree Farms | Specializes in organic, fair-trade coconut sugar, with a strong emphasis on sustainable and ethical sourcing from Indonesian farmers. |

| The Coconut Company | Offers certified organic and natural coconut sugar, targeting health-conscious consumers and food manufacturers. |

| Nutiva | Focuses on organic, non-GMO coconut sugar, leveraging strong brand positioning in the natural food industry. |

| Madhava Natural Sweeteners | Provides low-glycemic coconut sugar, emphasizing clean-label, organic, and minimally processed sweetener alternatives. |

| Tradin Organic | A leading supplier of bulk organic coconut sugar, catering to food and beverage manufacturers globally. |

Key Company Insights

Big Tree Farms (18-22%)

The company is a pioneer in sustainable coconut sugar production, whereby the company works with thousands of small farmers to ensure fair trade and organic certification.

The Coconut Company (14-18%)

Strengthens its market position by offering organic coconut sugar for retail and industrial applications concentrated in Europe and North America.

Nutiva (10-14%)

The famous name in organic superfoods incorporates coconut sugar into its products, delivering health benefits and environmentally safe packaging.

Madhava Natural Sweeteners (8-12%)

Presents itself as a clean-label brand that promotes low-glycemia sustainability coconut sugars as an alternative to refined sugars.

Tradin Organic (6-10%)

Tradin is one of the key global suppliers of bulk organic coconut sugar to food and beverage manufacturers who are supporting sustainable and organic farming practices.

Other Key Players

The global coconut sugar market is set to rise with a projection of USD 3,901.8 million by 2025.

The total valuation of the market is likely to reach a valuation of USD 5,557.2 million by 2035.

Key players include Big Tree Farms, The Coconut Company, Nutiva, Madhava Natural Sweeteners, Tradin Organic, Wholesome Sweeteners, NOW Foods, BetterBody Foods, Cargill, Inc., and Ciranda, Inc.

China and the United States offer lucrative opportunities.

China and the United States offer lucrative opportunities.

Granular coconut sugar form is likely to remain preferred during the forecast period.

By product type, the market is classified into direct and indirect.

By form, the industry is classified into liquid and semi-liquid.

By application, the industry is classified into milk, dairy products, dairy alternatives, and others.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Industry Analysis from 2025 to 2035

Comprehensive Analysis of Dehydrated Onions Market by Variety, Form, End Use, Distribution Channel, and Country through 2035

Comprehensive Analysis of Europe Dehydrated Onions Market by Product Variety, Product Form, Processing Technology, End Use and Country through 2035

Comprehensive Analysis of ASEAN Dehydrated Onions Market by Product Verity, by Product form, by processing technology, by end Use and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.