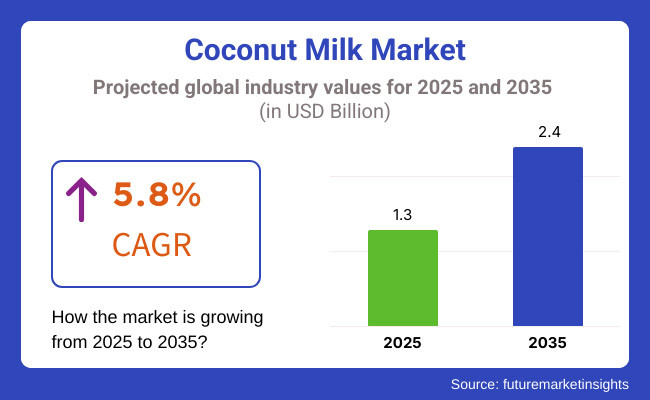

The global coconut milk market is set to reach USD 1.3 billion in 2025. The industry is poised to exhibit 5.8% CAGR from 2025 to 2035 and witness USD 2.4 billion by 2035.

Coconut milk, which is derived from the flesh of mature coconuts, is a flexible plant-based food ingredient, widely used in food and beverage, as well as personal care, products. Rich in fat and nutrients, it's widely sought after as a dairy alternative for lactose-free and vegan diets. With its greater content of healthy fats and vitamins and minerals, the product is used extensively in cooking, smoothies, and as a foundation for functional foods. Consumer tastes for natural, organic and vegetarian foods are the main driver of the market, with packaging trends and sustainability now also having an influence on shaping the industry.

The market has been immensely driven by the rising number of consumers turning lactose intolerant and the widespread veganism trend across the globe. Rich in nutrition, naturally sweet and dense and creamy in texture, the product is rapidly replacing dairy as the go-to for customers. However, suppliers are focusing on increasing production to meet the growing demand for preservative-free, organic, and fortified coconut milk products. Big players are developing better extraction processes, ensuring greater retention of coconut's natural taste and nutritional constituents.

The rise in popularity of ready-to-drink coconut-based beverages, cooking applications, and dairy-free dessert recipes has driven manufacturers to diversify their product range. An increasing popularity of natural products is driving product developments. Functional drinks, sports nutrition and probiotic-fortified products are also using more and more coconut milk, which has been popular with the health-conscious consumer.

With consumers seeking out sustainable and ethical choices, companies are promoting organic, fair-trade-certified products. Its worldwide demand has also been bolstered by the increasing use of coconut milk in Asian cuisine and food trends around the world. Innovation will continue to drive the market, with the product sales accelerating for low-fat, protein-fortified, and sugar-free products. Through the growth of e-commerce and specialty health food stores, products are expected to be more available in the market which will help their presence in the global scenario.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | H1 |

|---|---|

| Year | 2024 to 2034 |

| CAGR | 6.0% |

| Particular | H2 |

|---|---|

| Year | 2024 to 2034 |

| CAGR | 6.4% |

| Particular | H1 |

|---|---|

| Year | 2025 to 2035 |

| CAGR | 6.1% |

| Particular | H2 |

|---|---|

| Year | 2025 to 2035 |

| CAGR | 6.5% |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 6.0%, followed by a slightly higher growth rate of 6.4% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 6.1% in the first half and remain stable at 6.5% in the second half. In the first half (H1), the sector witnessed an increase of 10 BPS, while in the second half (H2), the business experienced growth of 10 BPS.

Growing Demand for Fortified and High-Protein Products

Consumers are increasingly seeking nutrient-dense dairy alternatives, leading to a surge in demand for fortified and high-protein milk. With a rising focus on functional nutrition, manufacturers are introducing the product enriched with added vitamins, minerals, and plant-based proteins to enhance its health benefits. The demand for fortified milk with calcium, vitamin D, and omega-3 fatty acids is particularly high among consumers transitioning from dairy to plant-based alternatives. Manufacturers are investing in advanced processing techniques to improve the texture and protein content of the product, making it a viable alternative to cow’s milk for protein-conscious consumers. Additionally, brands are launching sports nutrition-focused coconut milk beverages to cater to the fitness segment. This trend is reshaping product innovation, ensuring higher nutritional value while maintaining the clean-label and natural appeal that consumers prefer.

Rising Popularity of The product in Premium Culinary Applications

The product is no longer limited to traditional Southeast Asian cuisine-it is now widely embraced in global gourmet and premium culinary segments. With the rise of fusion cuisine and high-end plant-based dining, the product is becoming a key ingredient in luxury desserts, dairy-free sauces, and barista-style beverages. Leading food manufacturers and chefs are experimenting with coconut milk-infused gourmet ice creams, artisanal cheeses, and specialty baked goods, elevating its presence in the premium food category. The expansion of the product in fine dining, specialty coffee, and high-end bakery products has prompted manufacturers to focus on premium extraction techniques that enhance creaminess and flavor depth. Additionally, food service providers are increasingly incorporating organic, cold-pressed, and aged product variations to cater to a growing base of discerning consumers seeking sophisticated plant-based alternatives.

Increased Application of The product in Functional and Fermented Products

The rising consumer preference for gut health and probiotic-rich foods is fueling the demand for fermented products. The market is witnessing a surge in coconut milk-based yogurts, kefir, and probiotic beverages, as consumers become more aware of the benefits of fermented plant-based foods. Companies are developing naturally fermented products using live bacterial cultures to enhance digestive health. This trend is particularly strong in North America and Europe, where functional food categories are expanding rapidly. Additionally, the product is being integrated into fermented nut-based cheeses and cultured dairy alternatives, creating new growth opportunities. Manufacturers are focusing on extending shelf life, enhancing probiotic potency, and optimizing texture in these products, ensuring that the product remains a key ingredient in the evolving functional food and beverage market.

Expansion of Shelf-Stable and Ready-to-Drink Coconut Milk Beverages

The growing demand for convenience and portability is driving the expansion of shelf-stable and ready-to-drink (RTD) beverages. As on-the-go consumption trends increase, manufacturers are investing in longer shelf-life processing technologies such as UHT (ultra-high temperature) treatment and aseptic packaging. These advancements have led to the rise of coconut milk-based coffee drinks, smoothies, and energy-boosting formulations, catering to busy consumers looking for healthy, dairy-free beverage options. Leading brands are also experimenting with flavored and functional drinks, incorporating ingredients like turmeric, matcha, and adaptogenic herbs to enhance their appeal. The growth of digital grocery platforms and e-commerce has further fueled the accessibility of shelf-stable products, making it easier for consumers to stock up on convenient, nutrient-rich beverages that fit into their fast-paced lifestyles.

Through the upcoming decade (2025 to 2035), expectations are that the product demand will grow. Market growth has been mainly prompted by the rise in consumer demand for dairy substitutes, growing vegan communities, and the growing awareness of the product's nutritional value. Pressure on the category has occurred due to the presence of organic, clean-label and fortified products. Generally, this should be the beverage trend based on coconut milk, dairy alternatives, and plant-based yogurt that remained popular trends from the years 2020 to 2024. Companies have concentrated on increasing their portfolio of products in low-fat, sugar-free, and protein-enriched variants for health-oriented consumers. The industry also experienced the fast growth of e-commerce and retail networks, which placed the product in front of an international industry.

Forward to 2025 to 2035, the demand might increase as the product gets used in functional drinks, sports supplements, and other dairy substitutes. As more people become vegan, and sustainable sourcing becomes increasingly popular, the product will continue to be popular in the developing plant-based dairy segment.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Rising demand for plant-based dairy substitutes from the growing vegan and lactose-intolerant consumer segment. | Broader usage of the product across mainstream dairy substitutes on the back of innovation in taste, texture, and nutritional enhancement. |

| Increase in coconut milk-based beverages, desserts, and ready-to-drink. | Extension into functional and high-protein milk types targeted towards health-focused consumers. |

| Supply chain issues, such as unstable coconut harvests and processing limitations, influenced prices. | AI-powered supply chain management and advanced agricultural methods increase production stability and cost-effectiveness. |

| Clean-label and organic milk were more in demand as consumers asked for natural ingredients. | Stronger regulatory standards and certification build consumer trust in organically produced and sustainably sourced milk. |

| Increasing usage in foodservice and vegetarian food innovation, particularly in fusion foods and Asian foods. | Growth in the product use in nutraceuticals, cosmetics, and infant food due to enhanced health benefits and formulation advancements. |

| Deforestation and labor concerns fueled the call for ethical sourcing. | Blockchain traceability and regenerative coconut farming methods increase sustainability and adherence to ethical sourcing. |

The demand for coconut milk powder is driven by the growing popularity of gluten-free products with high solubility, improved ease of use, and long shelf life in food and beverage applications. This powder is preferred in HoReCa (Hotels, Restaurants and Cafés) due to its ease of storage, requiring little to no refrigeration, and can be reconstituted to whatever consistency is preferred or is desired.

Manufacturers further enhance formulations by reducing clumping and increasing solubility and fortified products with mineraloids such as calcium and vitamins such as vitamin D to target health-conscious customers and coconut milk powder, which is rapidly expanding in accordance with the growing trend of plant-based and dairy-free diets, is keeping pace in the sectors of baking, confectionery and instant beverage mixes companies such as Nestle and Anthony's Goods are focusing on organic and non-GMO variants of coconut milk powder to address clean label requirements.

Due to the rising preference for clean-label, chemical-free, and sustainability-sourced products among consumers, the organic category is witnessing rapid growth. As health-conscious and environmentally aware consumers seek food free from pesticides, synthetic fertilizers, and GMOs, organic coconut milk has become popular. Plant-based milk products are projected to dominate the industry throughout the projection period owing to the growing trend of veganism, lactose intolerance, and the popularity of plant-based diets. Organic milk is available from brands, including Native Forest, Thai Kitchen, and Trader Joe's, which appeal to consumers seeking non-GMO, fair-trade, and USDA-certified organic products. Organic milk is most popular in North America and Europe due to higher consumer awareness and regulatory standards.

The food & beverages manufacturing industry is the largest end-user of the product, fueled by its extensive application as a plant-based substitute in food and beverage products. The growing trend of dairy-free and vegan diets has considerably boosted demand for the product as a primary ingredient in foods like dairy alternatives, desserts, soups, and bakery products. The product is very much preferred for its richness and inherent sweetness, rendering it a good substitute for the usual dairy used in products designed for lactose-intolerant and health-related consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

| UK | 5.1% |

| China | 7.6% |

| Germany | 2.7% |

| Japan | 5.3% |

As per FMI, the USA industry is anticipated to grow at 6.3% CAGR during 2025 to 2035. The reason is primarily due to the increasing consumer demand for plant-based diets and lactose intolerance. The product is a favorite dairy alternative for smoothies, coffee, and baking. Businesses are responding to demand by expanding product lines, including organic and fortified varieties, targeting health-conscious and vegan-friendly consumers.

Growth Drivers in the USA

| Key Drivers | Description |

|---|---|

| Growing Demand for Plant-Based Alternatives | Some customers are going for dairy-free products due to health concerns. |

| Widespread Use in Food & Beverage | The product is applied extensively in recipes, smoothies, and coffee. |

| Organic & Fortified Products Availability | Healthier product offerings increasingly incorporate Organic and fortified products into the brand portfolio. |

The UK industry will register a growth rate of 5.1% CAGR from 2025 to 2035, as per FMI, due to increasing demand for free-from foods and the plant-based eating trend. The product is now omnipresent in British kitchens, for conventional cooking, and as a dairy substitute in beverages and baked items. Supermarkets and health food stores are also adding lines of the product with fortifications and added flavors to their offerings. Besides this, growing consumer awareness about the nutritional benefits of the product, which is lactose-free and rich in nutrients, is fueling consumer demand for its use.

Growth Drivers in the UK

| Key Drivers | Description |

|---|---|

| Growing Trend towards Dairy-Free Diet | Consumer demand is fueled by consumers actively seeking alternatives to traditional dairy milk. |

| Growth of Vegan & Health-Focused Consumers | Green vegetable diets are driving the product demand. |

| Retail Availability Growth | Increasing numbers of coconut milk products are on supermarket shelves. |

As per FMI, China's industry will record a healthy CAGR of 7.6% from 2025 to 2035 and is among the world's fastest-growing markets. The impetus to growth is increased by health consciousness, food diversification, and demand for functional drinks. The product is increasingly becoming popular in Chinese traditional confectionaries and modern usage. In addition, lactose intolerance has long been common in the Chinese industry, and plant-based alternatives such as the product are a relief. Governments are introducing RTD beverages primarily for urban residential consumers who need convenience and healthy lifestyles.

Growth Drivers in China

| Key Drivers | Description |

|---|---|

| Health Consciousness On The Rise | Consumers are shifting towards vegetative and functional drinks. |

| Prevalence of Lactose Intolerance | More than half of the population favors dairy substitutes. |

| Growth of Ready-to-Drink Milk Products | Urban consumers are drawn to convenient packaging and varied flavors. |

As per FMI, Germany's industry is expected to grow at a CAGR of 2.7% during 2025 to 2035, driven by the demand for sustainably produced and organic plant-based food items in Germany. Germans are extremely food-conscious and sensitive to sustainability; hence, they prefer clean-label milk. The presence of an organic food industry and regulation of the ingredients in the foods also promoted the use of the product. Germany's dairy substitute and beverage industry is consistently growing, and currently, the product is found among plant-based dairy foods such as yogurts and candies.

Growth Drivers in Germany

| Key Drivers | Description |

|---|---|

| Intense Demand for Organic & Eco-Friendly Products | Consumers prefer to drink milk if it comes from an ethical source. |

| Growth in Plant-Based Dairy Substitutes | The product is utilized increasingly in yogurts and desserts. |

| Well-Ruled Food Industry | High-quality food regulations drive clean labeling. |

As per FMI, Japan's industry is anticipated to grow at 5.3% CAGR from 2025 to 2035 as consumers develop a greater interest in healthy and functional foods. The product is used extensively in Japan, particularly for curries and desserts. Japanese consumers especially desire high-quality and less processed items, leading to rising demand for premium and organic milk offerings. The global food trend drivers, such as lactose-free and vegan diets, are further boosting industry growth. Key food and beverage players in Japan are constantly developing new coconut milk-based offerings that appeal to traditional and new consumer tastes.

Growth Drivers in Japan

| Key Drivers | Description |

|---|---|

| Increasing Adoption in Traditional Cuisine | The product is becoming increasingly visible in traditional Japanese curries and desserts. |

| Preference for Premium & High-Quality Products | Consumers are inclined towards organic and minimally processed milk. |

| Growing Demand for Vegan & Lactose-Free Diet | Soaring demand for plant-based foods is driving marketplace demand. |

The industry on an international level has proven to be an extremely competitive, primarily driven by consumer interest in plant-based and dairy-free substitutes. The increase in health-conscious consumer interest, coupled with the growing avenues for veganism in the economy, spurs the industry on diversification activities concerning organic, fortified, and flavored variants, among many others.

The industry is dominated by names like Vita Coco, McCormick, Goya Foods, and Thai Coconut Public Company through a much more extensive introduction of new products and distribution expansion, in combination with brand positioning. The establishments improve shelf life, texture, and nutritional aspects via more advanced processing technologies but satisfy the demand for clean labels and premium products.

The competitive arena is also influenced in many cases by regional producers and increasingly private-label brands that gain ground by their affordability or by what is expected from niche products. Strategic acquisitions and mergers, along with partnerships with major retailers and e-commerce platforms, will keep boosting competition, as will improvements in the supply chain. Sustainability and functional health benefits constitute the main pillar of consumers' choices, and companies will maintain well-positioned avenues in the evolving industry by focusing on transparency, innovation, and ethical sourcing.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| The Vita Coco Company | 12-16% |

| McCormick & Company, Inc. | 10-14% |

| Goya Foods, Inc. | 8-12% |

| Celebes Coconut Corporation | 7-11% |

| Thai Coconut Public Company Ltd. | 6-10% |

| Other Companies (combined) | 35-45% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| The Vita Coco Company | A leading brand dealing in plant-based coconut beverages with a focus on sustainability and premium quality products, is as follows. |

| McCormick & Company, Inc. | Offers a solution for culinary milk with a clear emphasis on organic and clean label formats. |

| Goya Foods, Inc. | A company that makes coconut milk products with Latin American and Caribbean flavors and enjoys strong regional distribution. |

| Celebes Coconut Corporation | This deals in bulk and private-label production of organic coconut milk and its derivatives. |

| Thai Coconut Public Co. Ltd. | One of the major canned and UHT coconut milk producers in Asia that is gaining ground in the export industry. |

The Vita Coco Company (12-16%)

A market leader in plant-based coconut beverages, leveraging sustainable sourcing and premium branding.

McCormick & Company, Inc. (10-14%)

Expand its portfolio with organic and culinary products for global consumers.

Goya Foods, Inc. (8-12%)

Maintains strong brand recognition in Latin American markets, focusing on traditional product offerings.

Celebes Coconut Corporation (7-11%)

Specializes in bulk supply and private-label production, catering to food manufacturers and retailers.

Thai Coconut Public Co. Ltd. (6-10%)

A major exporter of coconut milk products with a diverse portfolio catering to food service and retail sectors.

Other Key Players (35-45% Combined)

The global industry is slated to reach USD 1.3 billion in 2025.

The industry is predicted to reach a size of USD 2.4 billion by the end of 2035.

Leading players include The Vita Coco Company, McCormick & Company, Inc., Goya Foods, Inc., Celebes Coconut Corporation, Thai Coconut Public Company Ltd., Danone S.A., Nestlé S.A., Edward & Sons Trading Co., Ducoco Alimentos S.A., and Pure Harvest Smart Farms.

China is slated to observe the fastest growth with CAGR of 7.6% during the study period.

Coconut milk powder is being widely used.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.