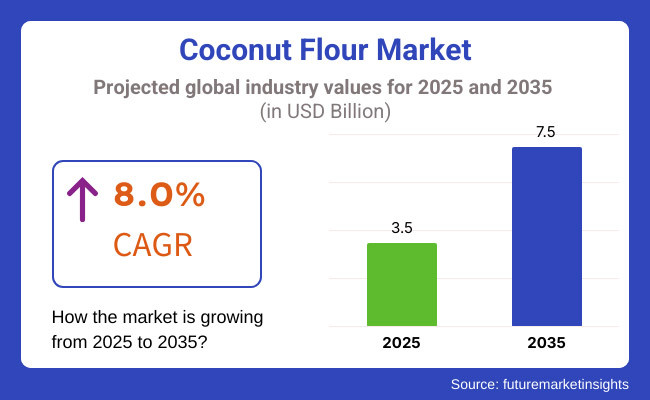

Global coconut flour market revenue will reach USD 3.5 billion in 2025. From 2025 to 2035, the demand for coconut flour is expected to increase at a CAGR of 8.0%, with the market value reaching USD 7.5 billion by 2035. This growth is driven by increasing consumer interest in gluten-free and grain-free solutions and the increased utilization of coconut-based solutions in health-oriented food patterns.

Coconut flour, which is produced from dehydrated coconut meat, has also gained a significant pace as a wholesome, and convenient food ingredient for baking and food processing. It is popular among gluten-free, keto, and paleo dieters because it has high fibre content with very little in the way of carbohydrates.

With that in mind, the manufacturers are riding the wave of popularity through expanding their manufacturing capacities and more of the organic, non-GMO, and sustainably sourced product varieties hitting the industry. Large-scale manufacturers, however, have also been investing in innovative processing techniques to optimize the process and maintain the quality of the product, while key players such as Bob's Red Mill and Nutiva are expanding the product range to cater to a health-conscious audience.

The industry is driven by several factors. The rising awareness regarding food allergy and intolerance has led the consumers towards the allergen-free and low-processing ingredients and coconut flour is a viable potential replacement for wheat and other grain flours.

The rising interest in plant-based diets and the clean-label trend has also encouraged companies to flaunt product's inherent benefits, such as its high fiber, protein and healthy fat content. Likewise, increasing e-commerce platforms and retail connections have also improved access to products, making it easier for consumers to incorporate product into their regular diet.

Despite being relatively early in its development, the industry has also faced some challenges. The volatile raw material supply - driven largely by erratic weather patterns in the coconut-producing countries such as the Philippines, Indonesia and Sri Lanka - can impact both production costs and supplies.

In addition, product has its own unique properties, such as high absorbency, which require recipe adjustments, limiting its widespread popularity within mainstream baking applications. Another task that the manufacturers are facing in terms of maintaining competitive pricing is dealing with volatility in price due to fluctuations in transport costs and in the supply chain.

The coconut flour industry priorities innovation and sustainability. Brands, striving to please ethically engaged consumers, are touting sustainable farm practices, eco-friendly sourcing and fair-trade certification. Companies like Anthony’s Goods and King Arthur Baking Company launched products of organic product, promoting the cross article that increases transparency in the supply chain.

With consumers becoming increasingly cognizant of nutritious food, including a clean-label, and less processing, the industry growth is expected to continue with steady growth. As manufacturers are spending cash on distort, research, and commodity methods - truly, since product may be produced in new formulations and revolutionize the way most processed foods are made, it is going to increasingly entrench itself is a staple of the health-food industry.

The industry is on the positive growth rate as a result of the increase in gluten free, high fiber, and plant based food products. The fanners and suppliers carry on organic and sustainable farming, which guarantees the high quality of raw materials. End-users of product rise to the occasion as they are finding it in more and more grocery stores, health food shops, and online stores.

The aforestated customers are interested in the same coconut flour nutritional benefits (probiotic bacteria), products that are easy to use, and the flexibility that product provides in the recipes of baking, cooking, and dietary supplements.

The main things that influence buying decisions are organic certification, price, and the nutritional aspects of the product such as the high fiber or low carb contents. The industry is characterized by trends like transparent-label products, blended product variants, and an increased application in keto and paleo diets, thereby becoming a thriving segment in the functional food sector.

The table below presents a comparative assessment of the semi-annual CAGR variations for the global industry from the base year (2024) and the current year (2025). This analysis highlights shifts in growth trends, offering valuable insights into revenue realization patterns and overall industry trajectory. The first half of the year (H1) spans from January to June, while the second half (H2) includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| 2024 to 2034 (H1) | 7.5% |

| 2024 to 2034 (H2) | 8.0% |

| 2025 to 2035 (H1) | 7.6% |

| 2025 to 2035 (H2) | 8.2% |

In the first half (H1) of the decade from 2025 to 2035, the coconut flour market is projected to grow at a CAGR of 3.9%, followed by an improved growth rate of 4.1% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is expected to rise to 4.2% in the first half and further accelerate to 4.5% in the second half. The sector observed a 10 BPS increase in H1 and a 20 BPS rise in H2.

Regional Adaptation Strategies

The global industry is witnessing a shift towards regional adaptation strategies as manufacturers cater to diverse consumer preferences and dietary habits. In North America and Europe, demand for organic and gluten-free product is surging, driven by health-conscious consumers and regulatory standards promoting clean-label ingredients.

In contrast, Asia-Pacific markets, particularly in countries like India, Indonesia, and the Philippines, are experiencing increased local consumption due to the availability of raw materials and traditional uses in baking and cooking. Latin America is emerging as a high-potential industry, with consumers embracing product as a cost-effective and nutritious alternative to wheat flour.

Manufacturers are aligning their product formulations, distribution channels, and branding strategies to meet regional expectations. The growing penetration of e-commerce platforms is further enabling companies to customize offerings based on consumer demand in specific regions, ensuring greater industry reach and acceptance across varying economic and culinary landscapes.

Pricing Changes as per Application

The pricing dynamics of product are increasingly influenced by its diverse applications in the food, bakery, and health & wellness sectors. In the bakery industry, where product is used as a gluten-free alternative, premium pricing is justified due to specialized processing and high consumer demand for functional ingredients.

Conversely, in bulk applications such as animal feed and food processing, lower-grade product is priced competitively, making it an affordable alternative to traditional grain-based flours. The rising popularity of product in sports nutrition and plant-based protein products is also driving pricing variations, with manufacturers launching high-protein product variants at premium rates.

Fluctuations in coconut supply, production costs, and regional demand further impact price points, leading to strategic price adjustments. To remain competitive, manufacturers are employing tiered pricing strategies, offering both standard and high-quality organic product to cater to different consumer segments.

Packaging Strategies

Innovative packaging strategies are becoming a key differentiator in the global industry, with manufacturers focusing on convenience, sustainability, and extended shelf life. The rising consumer preference for resealable and eco-friendly packaging is driving brands to adopt biodegradable pouches, recyclable paper-based bags, and reusable containers.

Vacuum-sealed and moisture-resistant packaging is also gaining traction to maintain product freshness, particularly in humid regions where product is prone to clumping. The demand for single-serve and portion-controlled packaging is increasing, especially in urban markets where on-the-go consumption and home baking are on the rise.

Manufacturers are also leveraging transparent packaging to highlight product quality and reinforce trust among health-conscious consumers. In response to growing e-commerce sales, companies are optimizing packaging for online distribution, ensuring durability and minimal wastage during transit. These evolving packaging strategies are enhancing consumer convenience while reinforcing brand identity and sustainability commitments in the competitive industry.

Global product sales increased steadily from 2020 to 2024. Consumers are preferring grain-free and gluten-free products. This has been among the major industry growth drivers over the past few years. With increasing awareness of digestive health and food intolerance, product has emerged as a favorite among health-conscious consumers, particularly those on ketogenic, paleo, and vegan diets. In the future, demand will increase at a quicker rate as more individuals adopt natural and minimally processed foods.

Product demand in the next ten years (2025 to 2035) is anticipated to develop at a prominent growth rate. Clean label trends are influencing the producers towards developing non-GMO and organic types of product. Expansion of application bases due to intensified uptake in protein-enriched food, baked food, and snack products is supporting its strength of use bases.

More funds have been deployed to advance in manufacturing and packing improvements, leaving the industry approaching positive sustainable expansion through the upcoming ten years.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing need for product as a grain-free alternative for baking purposes. | Used a lot in snacks, protein chocolates, and other items. |

| High demand in North America and Europe due to people being health-conscious and preferring keto diets. | High growth rates are experienced in Asia-Pacific and Latin America as consumers become more attracted to the products. |

| Less consumer awareness outside niche health and organic food segments. | Widespread consumption fueled by supermarket expansion, e-commerce sales growth, and greater consumer understanding. |

| High production expense and limited ability to process hinder industry development. | Processing technological gains and spending in coconut-production areas increase efficiency in supply. |

| Consumption largely confined to bakery and confectionery, further consumed in smoothies and as a coating. | Development for functional food, dairy replacement, and protein-hungry use. |

| Organic and Non-GMO product becomes more acceptable, though at a premium still preventing its use on a mass level. | Better supply chains and economies of scale lower the price of organic product. |

| Coconut yields influence raw material prices and availability. | Implementation of sustainable sourcing programs and climate-resilient agriculture enhances supply stability. |

The retail segment is likely to remain a major contributor to the global coconut flour market, and e-retailers are estimated to hold 35% of the total retail sales. The soar in E-commerce platform adoption is fuelled by digital convenience, competitive pricing, and access to niche organic and specialty brands. With a range of non-GMO, gluten-free, and organic coconut flour options that might not be widely available in brick-and-mortar stores, consumers are not only turning to online shopping for convenience but are also looking for other better options, usually with a stricter ingredient policy.

Baked products are the most lucrative application of product, accounting for nearly 40% of the industry share. Increasing demand for gluten-free, grain-free, and high-fiber baking has propelled the use of product in bread, muffins, cookies, and cakes. Over 1 in 133 Americans are diagnosed with celiac disease, and growing numbers are embracing gluten-free diets, so alternative flours are being demanded.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.7% |

| Japan | 3.3% |

| China | 1.5% |

| Germany | 7.0% |

| Australia | 9.8% |

In the USA, the demand for product in baking and cooking is increasing as more people are using gluten-free and high-fiber alternatives, which is fueling the growth of the coconut flour market in the USA As gluten intolerance and celiac disease become more common, many consumers are choosing product as a healthy alternative to wheat flour.

Product is also low in carbohydrates and high in protein and good fats; this has also contributed to an increase in demand based on the popularity of ketogenic, paleo, and low-carb diets. Meanwhile, in the USA, growth is further fueled by increasing awareness regarding organic and plant-based food products and a growing bakery industry. The USA industry is expected to expand at a 3.7% CAGR during the forecast period, according to FMI.

Growth Factors in USA

| Key Drivers | Details |

|---|---|

| Increased Need for Gluten-Free Items | The rising incidence of gluten intolerance and celiac disease has led to increased demand for gluten-free flour substitutes such as product. |

| Tremendous Growth of Low-Carb and Keto Diets | Product is low in carbs and high in fiber, making it a favorite among keto, paleo, and low-carb dieters. |

The industry size in Japan is expanding with the increasing consumer preference for healthier and gluten-free, as well as low-carb food options. In Japan, the growing awareness of dietary nutrition is leading consumers to gravitate toward functional food & organic food products, such as coconut flour. The rise of Western-style baking and the combination of diets such as plant-based and ketogenic have only enhanced its demand.

Undoubtedly, Japan's emphasis on food innovation, coupled with a burgeoning demand for premium-quality health foods, has driven the use of product in bakery, confectionery, and traditional dishes. Another complex that increases the accessibility of products is the e-commerce sector. FMI anticipates Japan's industry to grow at a 3.3% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Managing Demand Increase in Gluten-Free Products | In Japan, a growing awareness of gluten intolerance and digestive health has led an increasing number of consumers to look for gluten-free versions of what they used to eat. |

| The Rise of Low-Carb, Keto Lifestyle | One reason it has been widely used in ketogenic and low-carb diets is its low carbohydrate content and high fiber. |

The health-conscious population in China has been increasing, which is driving the coconut flour market in China. As an increasing number of consumers are on the lookout for nutritious substitutes, product has become popular in bakery, confectionery, and traditional Chinese medicine cuisines.

The growth of e-commerce marketplaces and even premium health food stores has made this option more accessible. Demand is also being fueled by China's burgeoning vegan and ketogenic communities. The government's promotion of healthier food products and functional ingredients also drives the growth of the industry. FMI anticipates China industry to grow at a 1.5% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Increasing Health Awareness | Demand for nutritious and clean-label flours such as product is being driven by consumers focused on drinking and eating healthier alternatives. |

| Increasing Industry for Gluten-Free Products | The need for gluten-free alternatives is also being driven by increased awareness of gluten intolerance and digestive health problems. |

The demand for coconut flour in the German industry is on the rise. After a boom as hoarding took hold, German shoppers are now turning to plant-based, wholefood alternatives to wheat flour for baking and cooking. The industry is driven by the expanding vegan and keto communities, as well as a growing inclination toward organic and natural food content.

This has also led to increased access to product, as it can be found in regular supermarkets and online, furthering the expansion of this industry. Germany stands out as a rapidly growing industry in Europe, with a notable CAGR of 7.0% projected between 2025 and 2035, according to FMI.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Upsurge in Demand for Products Free from Gluten | The rising cases of celiac disease and gluten intolerance are boosting the demand for coconut flour. |

| The Rise of Vegan and Plant-Based Diets | Germany has one of Europe's largest vegan populations, creating a high demand for plant-based alternatives. |

The Australian coconut pharmacy industry is witnessing growth due to increasing health awareness, a growing incidence of gluten intolerance, and the rising trend of plant-based and keto diets. Australian consumers are looking for nutrient-dense, low-carb, and gluten-free products for baking and cooking, and coconut flour fits the bill.

The growth is also driven by a well-established organic food sector in the country and the presence of product in supermarkets and specialty health stores, as well as online platforms. Moreover, the rising popularity of global culinary trends and the consumer demand for sustainably produced natural food products are positively influencing the growth of the industry. The Australian industry is expected to expand at 9.8% CAGR during the forecast period, according to FMI.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Growing Demand for Gluten-Free Products | The increasing prevalence of gluten intolerance and celiac disease is increasing demand for product. |

| Keto and Low-Carb Diets Are Growing Popular | These days health-conscious consumers looking to manage their weight are turning to low-carb, high-fiber substitutes. |

The global coconut flour market is very competitive, and prominent companies leverage innovation, sustainability, and supply chain rationalization to propel industry share. The demand for gluten-free, organic, and minimally processed product is driving companies to invest in better production methods and expand offerings.

Industry leaders are focused on sourcing their products sustainably. They work on making their products unique. Companies are partnering with each other to help each other go to the top. Companies are also taking retailers with them to make supplies convenient. Companies that have strong distribution networks and advanced processing capabilities will be super competitive in the industry.

In addition to product quality, pricing strategies and certifications such as USDA Organic, Non-GMO, and Fair Trade are playing a crucial role in industry positioning. Businesses are becoming visible in direct-to-consumer and e-commerce channels to take advantage of changing buying habits. Brands that focus on transparency, traceability, and ethical sourcing will be more likely to win consumer trust and long-term industry relevance.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Celebes Coconut Corporation | 25-30% |

| Nutiva Inc. | 15-20% |

| Bob's Red Mill Natural Foods | 10-15% |

| Primex Coco Products | 8-12% |

| The Coconut Company | 5-10% |

| Other Players | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Celebes Coconut Corporation | Conducts production in large amount for industrial and retail use. |

| Nutiva Inc. | Focuses on clean-label product for health-conscious consumers. |

| Bob's Red Mill Natural Foods | Works in producing natural and gluten-free foods. Offers non-GMO product of high quality. |

| Primex Coco Products | Focus on bulk product manufacturing. |

| The Coconut Company | Organic coconut-based products. Target niche markets with premium offerings. |

Key Company Insights

Celebes Coconut Corporation (25-30%)

Known for possessing an enormous supply chain, enormous production capability, and commitment to organic certification.

Nutiva Inc. (15-20%)

Actively expanding its coconut flour business to meet rising demand for clean-label ingredients.

Bob's Red Mill Natural Foods (10-15%)

This is an established brand in gluten-free products, with high brand recognition and quality sourcing.

Primex Coco Products (8-12%)

It is making a firm base in the industry by focusing on food manufacturers as well as retail consumers.

The Coconut Company (5-10%)

A rapidly growing company in the organic and specialty food industry, specializing in sustainable and fair-trade product manufacturing.

Other Key Players (20-30% Combined)

The market is segmented into retail and industrial.

The market is segmented into snack foods, baked products, animal feed, and extruded products.

The market is segmented into low fat high fibre flour, medium fat flour, and whole full fat flour.

The market is segmented into wet process and fresh-dry process.

The market is segmented into organic and conventional.

The market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is expected to reach USD 3.5 billion in 2025.

The industry is projected to reach USD 7.5 billion by 2035.

Key companies include Celebes Coconut Corporation, Nutrisure Ltd., Nutiva Inc., Bob's Red Mill Natural Foods, Primex Coco Products, The Coconut Company, Connecticut Coconut Company, Van Amerongen & Son, Healthy Traditions, and Smith Naturals.

Australia, growing at a CAGR of 9.8%, is expected to see the fastest growth.

Baked items majorly use these products.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coconut Derived Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Coconut Oil Moisturizing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coconut Water Cosmetics Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Water-Based Formulas Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Coconut Water Market Size, Growth, and Forecast 2025 to 2035

Coconut Milk Products Market Trends – Size, Demand & Forecast 2025-2035

Coconut Milk Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Coconut Sugar Market By Form, Nature, Application and Region - Forecast from 2025 to 2035

Coconut Oil Market Insights - Growing Applications & Industry Expansion 2025 to 2035

Coconut Wraps Market Outlook – Growth, Demand & Forecast 2025 to 2035

Competitive Overview of Coconut Syrup Industry Share

Coconut Cream Market – Growth, Demand & Dairy Alternatives Trends

Coconut-Free Skincare Market Growth – Size, Trends & Forecast 2024-2034

Coconut Fatty Acids Market

Complex Coconut Sugar Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Cooking Coconut Milk Market Share & Industry Leaders

Cooking Coconut Milk Market – Growth, Demand & Culinary Applications

Packaged Coconut Water Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA