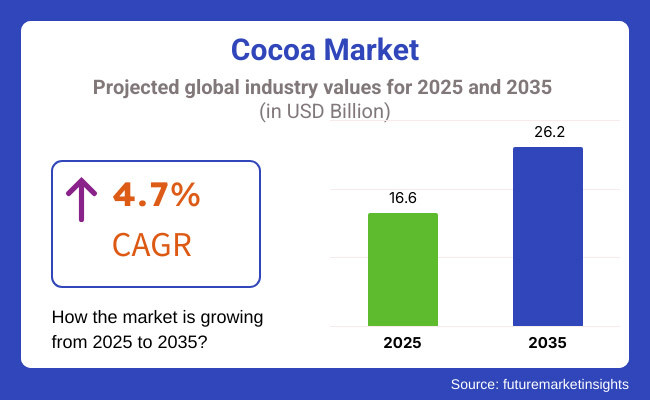

The global cocoa market is set to observe USD 16.6 billion in 2025. The industry is expected to register 4.7% CAGR from 2025 to 2035, reaching USD 26.2 billion by 2035.

Cocoa, which is abundant in antioxidants, flavonoids, and nutrients, is increasingly being utilized as an addition to functional food, cosmetics, and drugs. Growth of cocoa business is mainly driven by rising demand for natural ingredients in foods and beverages and the premium or artisanal chocolate market. As demand for cocoa ingredients continues to rise throughout confectionery, bakery, dairy, and beverage industries, manufacturers are increasing their production in proportion. To find their niche in the industry, companies like Barry Callebaut, Olam International and Cargill, are investing heavily in sophisticated processing technology to provide enhanced yield efficiency and sustainability.

In addition, there is a rising trend of vertical integration by companies to gain control over the supply chain from the procurement of cocoa beans to final products to ensure quality and cost savings. Demand from consumers for ethically produced and organic product is radically changing the scenario. Rising demand for sustainably produced and fair-trade product is encouraging the major players to embrace transparent supply chain systems. To address growing consumer demands, Mondelez International and Nestlé are investing seriously in farmer welfare initiatives for encouraging sustainable product farming and carbon footprint reduction.

With increasing pressure on deforestation-free product production, governments and industry stakeholders are working toward enforcing sustainability certifications such as Rainforest Alliance and UTZ. These regulatory developments are expected to shape the future trajectory of the industry, making sustainable sourcing a key determinant of competitive positioning. As consumer interest in healthier and premium products continues to rise, the industry is set to witness steady expansion over the next decade.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global industry. This analysis highlights crucial performance shifts and revenue realization patterns, providing stakeholders with a clearer vision of the industry's growth trajectory.

| Particular | H1 |

|---|---|

| Year | 2024 to 2034 |

| CAGR | 4.3% |

| Particular | H2 |

|---|---|

| Year | 2024 to 2034 |

| CAGR | 4.9% |

| Particular | H1 |

|---|---|

| Year | 2025 to 2035 |

| CAGR | 4.5% |

| Particular | H2 |

|---|---|

| Year | 2025 to 2035 |

| CAGR | 5.0% |

The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December. During the first half (H1) of the decade from 2025 to 2035, the industry is predicted to grow at a CAGR of 4.3%, followed by sustained momentum at 4.9% in the second half (H2). Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to remain at 4.6% in the first half and sustain its trajectory at 5.0% in the second half. In the first half (H1), the sector witnessed an increase of 20 BPS, while in the second half (H2), the business observed a marginal decline of 10 BPS.

Cocoa Liquor Standardization and Customization for Premium Applications

The global industry is witnessing an increasing demand for standardized and customized liquor formulations. As premium chocolate manufacturers seek precise flavor profiles, origin-specific product, and enhanced functional attributes, the need for tailored cocoa liquor blends is growing. Manufacturers are investing in refining fermentation techniques, optimizing roasting profiles, and implementing proprietary blending methods to ensure consistency in taste and texture. This trend is especially prominent in the premium and artisanal chocolate sector, where brands require high-flavanol, low-acid, or single-origin cocoa liquor to differentiate their products. Producers are also leveraging AI and sensory analysis technologies to replicate desired sensory attributes across batches, ensuring uniformity. The focus remains on balancing standardization with customization to cater to large-scale confectionery brands while meeting niche demands in the craft chocolate industry.

Re-Emergence of Cocoa Butter Substitutes in Price-Volatile Markets

Fluctuations in product prices have led to the resurgence of cocoa butter substitutes (CBS) derived from palm oil fractions, shea butter, and exotic fats. With cocoa butter prices experiencing volatility due to climatic uncertainties and geopolitical tensions in key producing regions, manufacturers are actively exploring partial or full replacements in specific product lines. This shift is particularly evident in mass-market chocolate and bakery applications, where cost efficiency is a priority. Producers are also investing in enzyme-modified fat solutions to enhance the melting behavior and texture of CBS, ensuring they mimic the butter’s properties. While regulatory challenges persist in certain markets regarding permissible usage percentages, manufacturers are strategically blending CBS with the butter to maintain authenticity while optimizing costs. This trend is shaping procurement strategies, influencing price negotiations, and redefining formulation flexibility in product-based industries.

Expansion of Product Derivatives Beyond Traditional Confectionery Applications

Product derivatives such as its powder, butter, and mass are witnessing increased utilization beyond traditional confectionery, penetrating the health, beauty, and functional food industries. The rising perception of product as an antioxidant-rich, mood-enhancing, and nutritionally beneficial ingredient has fueled its integration into dietary supplements, protein bars, and even nutricosmetic formulations. Manufacturers are responding by developing specialized extracts with enhanced polyphenol content, targeting segments such as anti-aging skincare and functional beverages. Cold-pressed and minimally processed powders with high flavonoid retention are gaining traction in the sports nutrition industry, where they serve as a natural energy enhancer. This diversification is not only expanding the industry for cocoa ingredients but also driving investments in specialized processing techniques that retain bioactive compounds while meeting regulatory standards for various applications.

Shift Toward Cocoa Shell Valorization for Sustainable Profitability

The increasing focus on waste minimization and resource efficiency is driving product manufacturers to explore novel applications for cocoa shells, a byproduct traditionally discarded or used as low-value feed. Shell valorization is gaining momentum, with manufacturers incorporating it into high-fiber food ingredients, natural colorants, and even sustainable packaging materials. Cocohell flour is emerging as a functional ingredient in bakery and snack products, offering dietary fiber enrichment and a mild flavor. Meanwhile, bioactive compounds extracted from shells are finding applications in the pharmaceutical and cosmetic sectors due to their potential anti-inflammatory and antimicrobial properties. The shift toward shell upcycling is not only enhancing profitability but also aligning with evolving regulatory frameworks promoting circular economy initiatives, positioning manufacturers as sustainability leaders in the industry.

At the present, this industry is bearing the hit of booming demand for premium chocolates, single-origin product, and high-flavanol products. Consumers are increasingly discerning about the quality and origin of the product they use and therefore tend to prefer products that are ethically sourced and certified.

Product demand is continuously experiencing growth because of its application in non-confectionery sectors: functional foods, nutraceuticals, and cosmetics. Health-conscious consumers increasingly prefer to use natural ingredients with antioxidant properties, thus gradually unlocking product's possibilities as a new ingredient in wellness and skincare formulations. This demand encourages manufacturers to invest in sustainable sourcing and innovative processing methods and retaining beneficial compounds.

Marketing strategies stressing purity and traceability, as well as nutritional value emphasizing product, drive consumer inclination. Most brands now have direct relationships with farmers and transparent supply chains, something the consumers are learning to trust. Increased per capita spending in emerging markets will ensure that product consumption continues to increase, hence strengthening its industry position as well as fostering long-term industry growth.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Rising demand for premium and organic products, driven by consumer preference for sustainable and ethical sourcing. | Expansion of climate-resilient farming and regenerative agriculture practices to ensure long-term sustainability. |

| Supply chain disruptions and price volatility impacted global product production and trade. | AI-driven supply chain optimization and blockchain-enabled traceability enhance transparency and stability. |

| Growing adoption of fair trade and direct trade practices to improve farmer livelihoods. | Government and industry-led initiatives strengthen farmer cooperatives and promote equitable profit distribution. |

| Increasing use of product in plant-based and functional foods due to changing dietary trends. | Using better techniques in product processing improves flavanol retention, increasing its utilization in health-oriented and nutraceutical uses. |

| Climate change risked crop output, for which agroforestry and resilient agriculture methods were invested. | The widespread adaptation of climate-resilient cocoa farming practices such as drought-resistant product types. |

The cocoa butter segment growth is due to the increasing demand for high-end chocolate formulations, plant-based confectioneries, and functional food products. Cocoa butter, a solid fat with an incredibly smooth texture and melting properties unlike any other fat or oil, makes up a large portion of high-end chocolates (and, of course, high-end chocolate applications to confectionery, bakery and dairy alternatives, and so forth). Leading producers such as Cargill and Barry Callebaut are ramping up their investments in fair-trade and organic-certified butter to match the values of the ethical consumer.

The natural method is the most commonly utilized process for product production because it has the capability of retaining the original flavor and aroma of beans. In this method, beans are dried in the sun without washing or fermenting them, thus maintaining their natural state. It is especially preferred by producers who want to create high-quality products with a stronger and more pronounced flavor profile. The natural process adds to the richness of the product, making it suitable for use in artisanal chocolates, specialty drinks, and high-quality confectionery items.

Organic product is the most preferred because it resonates with increasing consumer demand for healthier, more sustainable, and ethically produced goods. With heightened health and wellness awareness, consumers are moving toward organic-certified product that contains no synthetic pesticides, chemicals, and genetically modified organisms (GMOs). Organic product does not lose its natural nutritional content, providing a richer flavor and greater antioxidant levels, and hence is the first choice for premium chocolates, drinks, and confectionery products.

Confectionery becomes the leading use of product, fueled by the immense demand for chocolates and other sweets worldwide. Cocoa is one of the major ingredients in chocolate bar production, pralines, and coated sweets, hence becoming a staple in the confectionery industry. The increased demand for high-cocoa-content premium chocolates and organic ones has further fueled product consumption in this sector. Moreover, growing consumer demand for dark chocolates, which are reputed to have positive health implications, drives product consumption in confectionery uses.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

| Germany | 2.8% |

| China | 5.9% |

| Japan | 6.8% |

| India | 5.5% |

As per FMI, the USA industry will expand at 3.9% CAGR between 2025 and 2035. Increasing awareness of the health benefits of product, such as its antioxidant content and cardiovascular benefits, is propelling demand. The product is increasingly utilized in functional foods and beverages, further propelling industry growth. Product innovation is the path manufacturers follow, and organic and fair-trade products are being launched to meet changing customer needs. Buying decisions are driven by sustainability and fair-trade labeling, forcing companies to establish clear supply chains with ethical sourcing.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Growing Demand for Dark Chocolate | Consumers are choosing high-cocoa-content items for their health value. |

| Growing Demand for Functional Foods | Product is being added to health-oriented snacks, protein bars, and drinks. |

| Ethical and Sustainable Sourcing Trends | Transparency of the supply chain and fair-trade certification are gaining prominence. |

China's industry will grow at 5.9% CAGR during 2025 to 2035. Rising demand for chocolate and product is an indicator of changing consumers' trends fueled by Western food trends and rising disposable incomes. Rising middle-class consumers with enhanced purchasing power have fueled international and premium chocolate demand. Consciousness of the health benefits of product is also boosting industry opportunity, with consumers searching for functional chocolate products.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Growing Demand for High-End Chocolates | Middle-class consumers are demanding imported as well as good-quality products. |

| Westernization of Food Habits | Urban food habit changes are creating the demand for chocolates. |

| Government Effort towards Product Processing | Investment in domestic product production is declining dependence on imports. |

Germany's chocolate industry is expected to grow at CAGR of 2.8% from 2025 to 2035 with the rising consumer demand for organic, sustainable, and high-quality chocolates. The country's rigorous food quality and sustainability regulations have compelled businesses to use product that is sustainably cultivated. German consumers prefer high-quality and craft chocolate products, which require single-origin product and bean-to-bar manufacturing. The industry also witnesses joint ventures between chocolate firms and fair-trade organizations, whose environmental and social sustainability requirements the latter must meet. Presence of leading brands like Lindt and Ritter Sport also benefits the industry.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Strong Demand for Premium and Organic Chocolates | German consumers prefer sustainably sourced and single-origin products. |

| Tight Food Quality and Sustainability Regulations | Production and sourcing adhere to fair-trade and sustainability criteria. |

| Increased Ethical Consumerism | Consumers actively seek out environmentally friendly chocolate brands. |

Japan's industry is expected to record 6.8% CAGR from 2025 to 2035. The nation's rising demand for premium and specialty chocolate flavors, coupled with abundant demand for quality confectionery, is driving industry growth. Japanese consumers are especially interested in artisanal and limited-run chocolate, with types flavored by matcha, sake, and other domestic flavorings. There is also demand for functional chocolate, where collagens and probiotics are added to extend the nutritional value. Top candy companies such as Meiji and Lotte also study products tailored to local tastes. FMI is of the opinion that the Japanese industry is slated to grow at 6.8% CAGR throughout the study period. Producers are using innovative processing technologies to improve the flavor and texture of products to satisfy the country's high-quality requirements and customer demands.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Growing Demand for Handmade and Exotic Chocolates | Local-flavor chocolates and specialty and limited-edition chocolates are extremely popular. |

| Functional Chocolate Products Expansion | The growing health-conscious segment is fueling demand for nutrient-enhanced chocolate. |

| Advanced Methods of Chocolate Processing | Japanese firms focus on the quality, finishing chocolate texture, and flavor. |

FMI states that Indian industry is expected to expand at 5.5% CAGR between 2025 and 2035, backed by urbanization, increasing disposable incomes, and the spread of Western food culture. Middle-class growth has led to an increase in demand for chocolates, especially premium and artisanal chocolates. Expanding online sales of items has also widened the consumer base. Firms are investing in indigenous product production and streamlining supply chains to address increasing demand. Mergers between Indian and global chocolate brands are widening industry opportunities, and product innovation consistent with native preferences further stimulates growth.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Growing Demand for Chocolate | Rising demand for cocoa-related products, such as high-end chocolates. |

| Expansion of E-commerce Platforms | Increasing online availability of a variety of products. |

| Increased Domestic Product Cultivation | Investment in local product cultivation is enhancing supply chains. |

The global industry exhibits a structured competitive landscape, categorized into Tier 1, Tier 2, and Tier 3 players based on production scale, industry influence, and regional dominance.

Tier 1 players include large multinational companies with extensive product processing capabilities and direct sourcing networks. These players dominate the global supply chain, controlling significant product production, processing, and trade. Their presence spans multiple regions, allowing them to influence pricing trends and industry availability. They invest heavily in research and development, sustainability programs, and farmer support initiatives to maintain supply chain resilience and meet regulatory compliance.

Tier 2 players consist of mid-sized regional manufacturers that focus on product sourcing and processing within specific geographical markets. These companies often supply product derivatives to confectionery, bakery, and beverage industries at a national or regional level. They emphasize product innovation, origin-specific sourcing, and customization to cater to local consumer preferences. Their industry strategies revolve around premiumization and functional product applications.

Tier 3 players are small-scale product producers and processors, often concentrated in product-producing regions such as West Africa, Latin America, and Southeast Asia. These companies primarily cater to niche markets, supplying specialty and organic product to artisanal chocolate brands and specialty food manufacturers. Their industry share is influenced by direct trade models and fair-trade certifications, which help them appeal to ethical consumers.

The global competitive industry is largely driven by sustainability efforts, regulatory pressures, and shifting consumer needs. High-quality, ethically sourced product is in increasing demand; thus, the industry players will tend to consolidate their operations vertically, upgrade processing capabilities, and adopt responsible sourcing practices. Current initiatives by companies involve tracking the traceability of product, gaining fair trade certification, and implementing climate-resilient agriculture to comply with the new regulations, most significantly, the European Union deforestation rule. Industry giants such as Barry Callebaut, Cargill, Olam Food Ingredients, Mondelez International, and Nestlé enhance their competitive advantage through greater supply chain transparency and process innovation. Innovation of the processes of fermentation, flavor contribution, and value-added ingredients is altering competition patterns. At the same time, start-ups and small players take advantage of the rising demand for premium, organic, and functional products.

Strategic collaboration between local suppliers, governments, and research centers is central to driving sustainable product productivity and sourcing. With a growing emphasis on sustainability and responsible sourcing, companies that lead innovative processing as well as embrace open supply chain practices will gain a sustainable competitive advantage in the evolving global industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Barry Callebaut | 20-25% |

| Olam International | 15-20% |

| Cargill Inc. | 12-16% |

| Ecom Agroindustrial Corp. | 8-12% |

| Touton S.A. | 6-10% |

| Other Companies (combined) | 25-35% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Barry Callebaut | A world leader in cocoa and chocolate solutions with an emphasis on sustainability, traceability, and high-quality chocolate manufacturing. |

| Olam International | Has a large supply chain network with a sharp emphasis on ethical sourcing and electronic traceability. |

| Cargill Inc. | It is an expert in product processing, providing a wide range of ingredients with sustainable sourcing programs. |

| Ecom Agroindustrial Corp. | Emphasizes direct farm interaction, enhancing yield efficiency, and putting in place sustainability programs. |

| Touton S.A. | Significant product trader and processor, promoting transparency and ethically sourced operations to meet standards of regulation. |

Barry Callebaut (20-25%)

The world leader in cocoa and chocolate production, investing in cutting-edge processing technology and sustainability initiatives.

Olam International (15-20%)

Extends industry reach through direct farm interaction and blockchain-based traceability solutions.

Cargill Inc. (12-16%)

Innovates in cocoa ingredients and premium chocolate while having a robust sustainability agenda.

Ecom Agroindustrial Corp. (8-12%)

Uses direct farmer networks and responsible trade initiatives to gain industry share.

Touton S.A. (6-10%)

Improves processing capacity as well as collaborates closely with local farmers to ensure ethical sourcing.

Other Key Players (25-35% Combined)

The industry is set to reach USD 16.6 billion in 2025.

The industry is predicted to reach USD 26.2 billion by 2035.

Key players include Barry Callebaut, Olam International, Cargill Inc., Ecom Agroindustrial Corp., Touton S.A., Blommer Chocolate Company, Guan Chong Berhad, JB Cocoa, Cemoi Group, and Transcao.

Japan, slated to grow at 6.8% CAGR during the forecast period, is poised for the fastest growth.

Cocoa butter is being widely used.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.