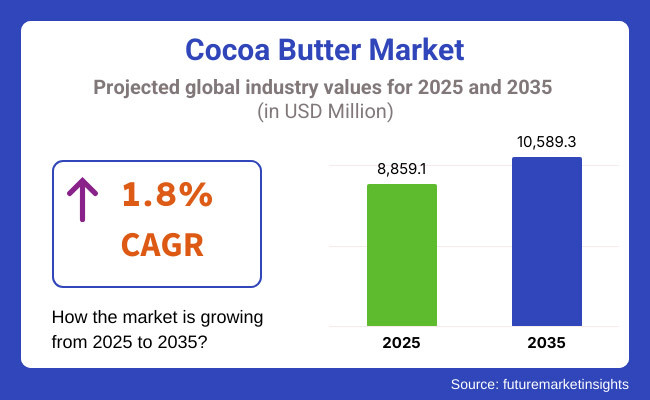

The global cocoa butter market is estimated to be worth USD 8,859.1 million in 2025 and is projected to reach a value of USD 10,589.3 million by 2035, expanding at a CAGR of 1.8% over the assessment period of 2025 to 2035.

The escalating consumer preference for natural and organic materials is the leading factor in the growing need for cocoa butter, especially in food, confectionery, and cosmetic industries. With consumers increasingly being more dietary-conscious, the processed but plant-based alternatives are the ones that have mostly brought to life the appeal of cocoa butter as a natural fat source.

Producers have turned their attention to increasing their production capacity since the need for cocoa butter is rising across various sectors. Industrial leaders such as Cargill, Olam International, and Barry Callebaut are making investments in processing plants for the stability of the supply chain and product quality.

Moreover, companies are doing even more by setting up sustainability initiatives through which they get cocoa from certified farms and practice fair trade, thus enhancing both their brand value and consumer trust. For example, Barry Callebaut has a plan to source 100% sustainably grown cocoa by 2025, which is a move to keep pace with the global ethical consumption trends.

The cosmetics and personal care sector has now become a very lucrative business for cocoa butter. Major cosmetic brands are using cocoa butter in their products as a moisturizer and as an anti-aging product because of the growing demand for natural skin ingredients. Companies like Lush and The Body Shop have used cocoa butter's natural factor in marketing to the environment-loving clients.

Furthermore, the confectionery industry is continually relying on cocoa butter in the process of manufacturing high-quality chocolate. With a growing number of clients prepared to pay for better-quality chocolate, the brands are coming up with innovative single-origin and constructor cocoa butter goods. At present, the market expansion is the result of factors like increased output, ethically sourced materials, and changing customer preferences for natural, high-quality products.

The table supports the comparative assessment of the change in CAGR over a six-month period for both the base year (2024) and the current year (2025) for the global cocoa butter market. This evaluation reflects the crucial performance shifts and points out the regulatory revenue patterns which help the stakeholders in presenting a better idea about the growth scenarios during the year.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.6% |

| H2 (2024 to 2034) | 1.8% |

| H1 (2025 to 2035) | 1.7% |

| H2 (2025 to 2035) | 1.9% |

The first half (H1) is from January through June, and the second half (H2) is from July through December. The market is expected to see a growth of 1.6% CAGR during the first half (H1) of the decade from 2024 to 2034 and then 1.8% in the second half (H2). The following period, from 2025 H1 to 2035 H2, is considered to be the rise of 1.7% in the first half alongside 1.9% in the second half of the year. In H1, the sector added 10 BPS, while in H2,2, the business is up by 10 BPS.

Premiumization of Cocoa Butter in Artisanal Chocolates

Shift: The premium concentrates made from the finest quality and single-origin cocoa butter now attract more and more consumers. Customers want ultra-fine texture, elevated flavor choices, and ingredients that are ethically sourced. The bean-to-bar trend and gourmet candies surge mainly in Europe and North American regions. The health-oriented audience could also save cocoa butter from industrial processing, allowing it to keep most of the beneficial nutrients.

Strategic Response: For this reason, top chocolatiers are going to the source - by obtaining cocoa butters from defined terroirs - each one of them pledges traceability, greater goo,d and higher environmental quality. Lindt and Godiva brands have stepped up the scene by the addition of single-origin and high-percentage cocoa butter chocolate, introducing a taste benefit for people like connoisseurs. Meanwhile, the other newcomers such as Amedei and Valrhona have supplied the organic and cold-pressed cocoa butter to the growing artisan chocolate market instead of the high-quality products.

Rising Popularity of Cocoa Butter in Clean Beauty

Shift: The personal care industry is seeing a transition to clean beauty formulations, with consumers preferring skincare products that do not include synthetic chemicals. Cocoa butter is famed to be a deep hydration providing element & an anti-oxidant and is a known ingredient in natural cosmetics. It has been mostly needed this way everywhere, especially in North America and Europe, as the clarity of the source of ingredients has been a major reason for purchasing.

Strategic Response: The beauty brand, ds in the course of introducing products with cocoa but,ter are also stressing their purity and ethical source. The Lush and The Body Shop add their fair-trade cocoa butter in their moisturizers and body lotions. However, the high-end skincare brands not only pay attention to trendy formulations going high with ingredients such as unrefined cocoa butter in their anti-aging products, but they do it this way as well- allowing the consumers to choose the more natural sourced skincare alternatives. In addition, the growth of organizations that promote organic cocoa butter certification contributes to this market's expansion.

Supply Chain Volatility and Price Fluctuations

Shift: The Cocoa butter market is going through a rough patch caused by fluctuations in cocoa bean yields, the repercussions of climate change, and geopolitical unrest in major producing areas like West Africa. Unrest is causing price fluctuations, which affect the manufacturers, especially the confectionery and cosmetic ones, which are heavily dependent on the consistency of the cocoa butter supply in this case. It is no wonder that some of the firms are rewiring their procurement strategies in a bid to restructure the risk connected to the supply chain hazards.

Strategic Response: To cope with volatility, the manufacturers are exploring different sources to minimize single-supplier risk. Some brands, like Mars and Nestlé, are working with cocoa farmers directly through a program to guarantee that their supply will be stable over time. Others are looking into using different fats, like shea butter, in their formulas without sacrificing quality or texture. Futures contracts and hedging strategies will be active in this venture and will be used to deal with pricing risks.

Functional Cocoa Butter for Nutraceutical Applications

Shift: The cocoa butter is explored not only in confectionery but also as a possible solution for health benefits due to increasing consumer interest in functional foods. Dietary supplements, meal replacements, and beverages are mostly fortified, and cocoa butter is being sought as an ingredient for them. The rise is particularly felt in Japan and the United States, where the nutraceuticals market is rapidly developing.

Strategic Response: Nutraceutical product lines picked up cocoa butter making bars, keto-chocola,e and brain boost supplements. Companies like Bulletproof and Garden of Life are coming up with MCT cocoa butter blends, which will be for the customers who are on a low-carb and keto diet. Pharmaceutical companies are investigating the knowledge-enhancing properties of cocoa butter from the aspect of drug-released systems, so they are laying out the foundation for more uses in the nutraceutical sector.

Global Cocoa butter market is 5.3% fragmented market. Cocoa butter market participants are developed with Chinese manufacturers, multinational corporations (MNCs), and local firms. Large cocoa butter units are those multinationals who control the market share, through their presence in the supply chain, advanced processing technologies, and their brands.

These units are the economies of scale enablers and hence they are supplying a high standard of cocoa butter to key food, confectionery, and cosmetics sectors globally. Through a long-term deal made with cocoa producers, they have an advantage in price and constant product specifications.

Local players, particularly in West Africa and Latin America, are important market players by sourcing and processing cocoa locally. Fair trade, organic and single origin cocoa butter are the often-niche segments that these companies deal with, meeting the growing demand for sustainability and ethically produced ingredients. Their flexibility in adapting to the demands of the local market ensures their sustainability in their respective regions.

The Chinese manufacturers are set to drive price increases through their entry into the cocoa butter market by providing cheaper alternatives to the budget-conscious customers and industrial buyers. The sector has recorded noticeable growth, thanks to flourishing demand among the local firms and the construction of the new cocoa processing capacity supported by government campaigns and agreements with the bean-producing states.

The surge in the number of profile firms from China is the reason for heightening competition especially in the budget segment. Even though the chain of MNCs runs through the premium priced and large distributors, the regional and Chinese companies gain their part by the vertical just focuses on issues like sustainability, affordability, and regional preferences.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Country | United States |

|---|---|

| Market Volume (USD Million) | 1,010.00 |

| CAGR (2025 to 2035) | 3.70% |

| Country | Germany |

|---|---|

| Market Volume (USD Million) | 735.8 |

| CAGR (2025 to 2035) | 2.70% |

| Country | China |

|---|---|

| Market Volume (USD Million) | 857.4 |

| CAGR (2025 to 2035) | 5.60% |

| Country | Japan |

|---|---|

| Market Volume (USD Million) | 402.7 |

| CAGR (2025 to 2035) | 6.80% |

| Country | United Kingdom |

|---|---|

| Market Volume (USD Million) | 735.8 |

| CAGR (2025 to 2035) | 2.70% |

The USA is going to set the pace for the cocoa butter market with a staggering market volume of USD 1,010 million by 2025. It will remain in the lead as the market will have a CAGR of 3.7% from 2025 to 2035. The primary drivers of this growth are the increasing demands of consumers for premium and organic chocolate products along with the increasing applications of cocoa butter in the cosmetics and personal care industries.

The Cocoa butter product market of the USA is thriving because of the developed confectionery sector and the rising interest in natural and organic personal care products that now use cocoa butter for its moisturizing qualities. Furthermore, cocoa butter has been used with antioxidant effects and this is one of the reasons why it is being consumed more in different sectors.

The cocoa butter market of China is experiencing boom-time, and experts predict a market volume of USD 857.4 million for the year 2025 with a phenomenal CAGR of 5.6% from 2025 to 2035. Such robust expansion could be traced back to a greater number of people joining the middle class and the corresponding increase disposable income, the final result being the big demand for premium products like chocolates and candy.

Moreover, the increase in the awareness of the Western eating habits and launching of international chocolate brands are the reasons for consumption of cocoa butter in China. Also, the cocoa butter sector in cosmetics is a keen driver of this process, since it is being applied more on skincare because of its emollient natural effects.

2025 sees the cocoa butter sales in Japan hitting USD 402.7 million with the impressive CAGR of 6.8% from 2025 to 2035. The cocoa butter market in Japan it is known for its strong interest in premium quality chocolates most of which are produced with single-origin cocoa butter.

This demand is the result of selective consumers who appreciate good taste and handcrafted confectionery. Another case in point is that Japan's cosmetics line is also distinguished for its creativity where cocoa butter's benefits have increased its use in cosmetics and beauty products. The combination of high-end customer taste and the flourishing beauty market is putting Japan as the significant player in the global cocoa butter market.

| Segment | Value Share (2025) |

|---|---|

| Natural Cocoa Butter (By Product Type) | 54.3% |

Natural cocoa butter is estimated to account for a substantial percentage, precisely 54.3%, of the global cocoa butter market by 2025, with a whopping valuation of USD 4,250.8 million. This sub-segment commands the first position as a result of escalating consumer demand for high quality and minimally processed cocoa butter in premium chocolates, confectionery, and personal care products.

The food industry displays paramount significance to natural cocoa butter due to its characteristic aroma, difficulty in texture, but then a positive effect in chocolate production and the stability in chocolate manufacturing.

Furthermore, the cosmetics sector gives preference to natural cocoa butter for the added benefit of unrefined moisturizing, which is the secret behind the formulation of lotions and skincare products. Therefore, the key players are now focusing on sustainable sourcing and ethical production to respond to the customers' interest in ingredient purity and environmental impacts.

| Segment | Value Share (2025) |

|---|---|

| Food & Beverage (By End Use) | 62.1% |

The food & beverage sector will be responsible for 62.1% of the overall cocoa butter demand across the globe and will achieve this with a valuation of USD 4,860.5 million in 2025. Cocoa butter is a signature ingredient in chocolate production, where it gives the product's texture, stability, and taste a good finish. The shift in customer preferences towards organic and premium products is the major driving force behind this segment's growth in cocoa butter.

In addition to the traditional cocoa products, cocoa butter has been recently introduced to new markets such as bakery, dairy alternatives, and functional beverages, which are getting popular because of their unique flavor and creamy texture.

The producers are addressing the issue of extendingthe shelf life of cocoa products by developing products with improved stability. The world's top names, like Mondelez and Nestlé,é are making commitments toward sustainable sourcing of high-grade cocoa butter in the context of growing consumer demands for indulgent, clean-label, and ethically sourced food products.

The cocoa butter market on a global stage is going through modifications brought about by supply chain issues and changing consumer choices. Detrimental weather phenomena and plant disease outbreaks in significant cocoa-exporting nations, especially those in West Africa, have caused a drop in the cocoa harvest, thus raising the prices to historic levels.

This market price instability is making the producers attempt to discover other obtainable oils and keeping costs under control via strategic measures. Moreover, there is an upsurge in the demand for cocoa that is neither exploited nor manufactured at the cost of workers' rights, which forced companies to be more transparent while sourcing.

The market is segmented into natural, deodorized, and semi-deodorized cocoa butter types.

Segments include organic and conventional cocoa butter.

The market is divided into blocks, powder, and liquid forms.

Key end-use industries are food & beverage, pharmaceuticals, and personal care & cosmetics.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and the Middle East & Africa.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Product Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Product Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Product Form, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Product Form, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by Product Form, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by Product Form, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by Product Form, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Product Form, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Product Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Nature, 2023 to 2033

Figure 28: Global Market Attractiveness by Product Form, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Product Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Nature, 2023 to 2033

Figure 58: North America Market Attractiveness by Product Form, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Product Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Product Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by Product Form, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Product Form, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by Product Form, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Product Form, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by Product Form, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Product Form, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by Product Form, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Product Form, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by Product Form, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Product Form, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The global cocoa butter market is expected to grow at a CAGR of 1.8% during the forecast period from 2025 to 2035.

The market is projected to reach a value of USD 10,589.3 million by 2035.

The organic cocoa butter segment is expected to witness significant growth due to increasing consumer demand for natural and sustainably sourced products.

Key drivers include rising demand for premium and organic chocolate products, expanding applications in the cosmetics and personal care industries, and growing consumer awareness of the health benefits associated with cocoa butter.

Leading companies include Barry Callebaut AG, Cargill Incorporated, Olam International Limited, The Hershey Company, Nestlé S.A., and Mars, Incorporated.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA