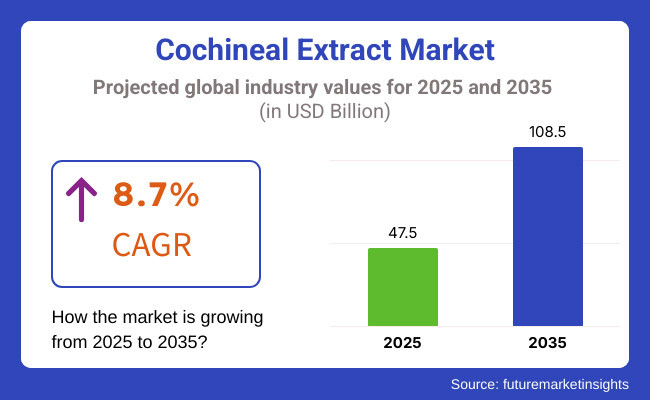

The cochineal extract market is set to register USD 47.5 billion in 2025. The industry is set to witness 8.7% CAGR from 2025 to 2035, reaching USD 108.5 billion by 2035.

Cochineal extract is a natural pigment from dried female Dactylopius coccus insects that are fed on prickly pear cacti. The most widespread use of the product is as a red food and beverage colorant, cosmetic, and pharmaceutical. The stable and enduring color is derived from the principal pigment in the product, carminic acid, and thus is an effective synthetic dye alternative. The product is applied in an array of applications such as lipsticks, dairy products and fruit-flavoured beverages due to its natural origin, non-toxicity and strong intensity of color. Not with-standing certain ethical and allergenic issues, its popularity is high, particularly in clean label and natural product applications.

As limitations on man-made food colourings are tightened internationally, food manufacturers are turning to the product, which is naturally occurring, as a less controversial alternative for use in foodstuffs, cosmetics and pharmaceuticals.

As global demand for Korean products continues to rise, producers are also expanding their production capabilities. Several key market players have been investing in sustainable cochineal insect farming to secure reliable supply and quality. New extraction methods are being developed to make the product more intense and stable, as well as more suitable for different applications. Strategic collaborations between raw material manufacturers and end-product manufacturers, on the other hand, are improving the efficiency of the supply chain and paving the way for upscaling.

Growth of premium and organic product lines is also adding strength to the market. Companies marketing ethically produced, green colorants are positioning the product as an eco-friendly option, winning over sensitive buyers. As research and development outlays and technological advances in the extraction methods accelerate, the market will keep growing continuously to meet changing needs for secure and natural colours.

Explore FMI!

Book a free demo

The following table provides comparative analysis of semi-annual variations in CAGR for the market at the global level between the base year (2024) and the current year (2025). The comparison identifies changes in growth patterns and provides useful insight into patterns in revenue realization as well as direction in the market. The period from January through June is termed as the first half of the year (H1), whereas the period covering July through December is referred to as the second half (H2).

| Particular | H1 |

|---|---|

| Year | 2024 to 2034 |

| CAGR | 9.0% |

| Particular | H2 |

|---|---|

| Year | 2024 to 2034 |

| CAGR | 9.5% |

| Particular | H1 |

|---|---|

| Year | 2025 to 2035 |

| CAGR | 9.1% |

| Particular | H2 |

|---|---|

| Year | 2025 to 2035 |

| CAGR | 9.6% |

During the first half (H1) of the ten-year period between 2024 and 2034, the market is expected to expand at a CAGR of 9.0%, followed by a better growth rate of 9.5% during the second half (H2) of the same ten-year period. Carrying over into the next period, between H1 2025 and H2 2035, the CAGR will grow to 9.1% during the first half and go even faster at 9.6% in the second half. The industry saw a 10 BPS rise in H1, and a 10 BPS increase in H2.

Expansion of Clean-Label and Transparent Ingredient Sourcing

The increasing consumer demand for clean-label products is driving manufacturers to enhance transparency in sourcing and production processes. Consumers are more aware of food and cosmetic ingredients, leading to a growing preference for natural colorants such as cochineal extract over synthetic dyes. Manufacturers are responding by investing in sustainable and traceable sourcing of cochineal insects, ensuring ethical harvesting methods and compliance with global food safety standards. This trend is pushing brands to disclose origin details, purity levels, and processing techniques on product labels. Companies are also focusing on third-party certifications such as organic, non-GMO, and allergen-free to build consumer trust. As regulatory bodies continue tightening restrictions on artificial colors, clean-label positioning is becoming a key differentiator in the market, reinforcing its adoption in the food, beverage, cosmetics, and pharmaceutical industries.

Fluctuating Availability of Raw Material and Price Volatility

The production of the product depends on cochineal insect farming, which is highly sensitive to climatic conditions, disease outbreaks, and agricultural disruptions. This dependency results in periodic supply shortages and price fluctuations, affecting manufacturers and end-users reliant on stable ingredient costs. To mitigate these risks, companies are expanding their supply chain networks by partnering with multiple regional producers, diversifying cultivation areas, and investing in controlled farming methods to improve yield consistency. Additionally, advancements in extraction techniques are being explored to enhance pigment concentration, allowing for lower usage per product without compromising quality. Price volatility is further addressed by long-term procurement contracts and strategic inventory management to buffer against unexpected disruptions. While demand continues to rise, ensuring a stable and cost-effective supply remains a priority for manufacturers in the industry.

Increasing Demand for Natural Colorants in Functional Foods and Beverages

The functional food and beverage industry is witnessing rapid growth, with consumers seeking healthier, naturally formulated products. The product is gaining traction as a preferred natural red colorant in dairy, plant-based meat, confectionery, and functional drinks due to its stability and safety. The shift away from artificial colors, driven by concerns over synthetic additives’ impact on health, has accelerated its adoption. Manufacturers are leveraging this trend by developing innovative formulations that enhance the stability of the product in acidic and high-heat applications. Companies are also targeting sports nutrition and wellness beverages, where natural ingredients align with consumer expectations for clean, health-driven formulations. As the demand for functional and fortified foods expands, the product manufacturers are adapting their products to meet industry-specific formulation needs, further driving industry growth.

Regulatory Shifts Impacting Labeling and Product Positioning

Regulatory frameworks worldwide are evolving to impose stricter guidelines on food additives, including colorants. Many countries are implementing clearer labeling requirements, mandating that brands explicitly mention the origin and processing of food dyes. This shift is significantly influencing how manufacturers position cochineal extract in their product portfolios. The increasing scrutiny of synthetic dyes has prompted food, beverage, and cosmetic companies to reformulate existing products with natural alternatives, leading to heightened demand for the product. To align with regulations, manufacturers are ensuring compliance with food-grade and pharmaceutical-grade quality standards, enhancing purification methods to eliminate impurities, and meeting regional certification requirements. Additionally, brands are focusing on educational marketing to inform consumers about the safety and benefits of the product. As regulatory pressures continue to rise, the industry is expected to see more stringent quality control measures and greater alignment with global food safety standards.

The demand for the product has increased over the years 2020 to 2024. The next decade (2025-2035) is expected to spur the demand for the product by a natural colorant trend for food, beverage, and cosmetics. Increasing regulatory constraints on synthetic dyes and growing consumer concerns regarding synthetic additives have created a favorable environment for products, thus propelling the industry growth.

Investments in improved agricultural methods and more efficient extraction methods have also increased in recent years to keep pace with demand. The cosmetics industry, particularly with natural lipsticks and blushes, has played a major role in the rapidly expanding industry. Advances in formulation stability and organic certification will guarantee the uptake of the products. The industry possesses great potential for steady growth with various uses and keeping up with the clean-label trend and use of naturally derived ingredients.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for natural colorants in food and beverages due to clean-label trends. | Regulatory support and technological advancements drive widespread adoption of the product in diverse applications, including plant-based and functional foods. |

| High use in dairy, confectionery, and beverages as synthetic dye alternatives. | Expansion into pharmaceuticals, cosmetics, and nutraceuticals due to rising consumer preference for natural ingredients. |

| Supply chain disruptions and climate variations impacted cochineal farming and pricing. | Innovations in sustainable cochineal farming and biotechnological extraction methods improve yield and cost efficiency. |

| Strict labeling regulations and allergen concerns influenced industry dynamics. | Reducing allergenicity with advanced processing techniques has opened doors for the global industry. |

| Control over production was in Latin America, while demand increased in Europe and North America. Production area diversity and investment in local cochineal farm initiatives expanded in Asia and Africa. | The supply chain is clear with the aid of AI and blockchain traceability systems in ethical and sustainable sourcing. |

| Fair-trade labels and ethical sourcing became popular among producers. | The supply chain is clear with the aid of AI and blockchain traceability systems in ethical and sustainable sourcing. |

The share of food grade segment is driven by the broadening application scope of natural food colorants as substitutes to synthetic dyes in particular for the food and beverage industry. With concerns about artificial additives, health-conscious consumers are pushing brands to reformulate products with clean-label ingredients. For example, large food manufacturers such as Danone and Nestlé have been transitioning to natural colorants, such as cochinilla extract, to comply with regulations and satisfy consumer preferences.

Food-grade carmine, or specifically used as a cochineal extract, is a widely applied food industry coloring agent extensively used in bakery, confectionery, dairy and meat processing, owing to its heat stability, excellent solubility, and pH stability—rendering it an exquisite red and pink colorant, particularly for processed products. Due to growing regulatory oversight, manufacturers are working on advanced extraction techniques to achieve superior pigment concentration and global safety standards like that of the FDA, EFSA, and FSSAI. Moreover, the increasing number of organic and ethically sourced certifications is also acting as a significant growth factor for the industry.

The growing popularity of plant-based, cruelty-free, and natural beauty products has notably driven the product’s adoption in lipsticks, blushes, and facial cosmetics. Unlike synthetic dyes, the product is a safe and vibrant red pigment for skin products, making it a favorite in lip and blush products. In response to growing consumer concerns about artificial colorants and allergens, leading beauty brands like L’Oréal and Estée Lauder are using the product in their lines of organic and clean beauty products.

Due to the increasing vegan and ethical beauty movements, manufacturers are now focusing on sustainable sourcing. Business are introducing novel extraction processes to enhance pigment quality and stability for the natural cosmetic premium brands demanding such materials. The increasing regulatory controls on synthetic dyes imposed by authorities such as the FDA and the EU Cosmetics Regulation are anticipated to drive demand for the product in the cosmetics industry at a steady rate.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.3% |

| China | 9.7% |

| Germany | 9.5% |

| Brazil | 9.2% |

| Japan | 9.0% |

The food and beverage sector of the country has been robust, and demand for natural colorants has grown as consumers are moving toward clean-label and naturally derived ingredients. The cosmetics industry also plays a part in this trend, with the product as a common ingredient for lipsticks and other cosmetics. FMI states that the U.S. cochineal extract market is expected to grow at 9.3% CAGR throughout the study period. Organizations are spending on sustainable supply chains and sourcing to keep pace with increasing demand, and innovations in extraction technologies improve product quality and extent of application.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Consumer Trend Towards Clean-Label Products | Increased trend towards using naturally sourced colorants for food, drinks, and cosmetics. |

| Regulatory Support for Natural Additives | FDA regulations on artificial coloring promote the product uptake. |

| Growing Applications in the Cosmetics and Food Industry | Growing application of the product in cosmetics and natural food production. |

China's strong food processing and cosmetic industries have been leading the demand for natural additives, especially by consumers with a health orientation. Domestic capacity and policy in China promoting the use of natural ingredients have made it an important supplier of the product. The industry is expected to expand at CAGR of 9.7% from 2025-2035, with increasing demand within the textile industry, for which the product is a natural alternative to dyes.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Government Support for Natural Ingredients | Organic and plant-based food additives are promoted by policies, driving industry uptake. |

| Surge in Cosmetics and Textile Sectors | The product is extensively used in cosmetics and fabrics, thus spurring consumption. |

| Increased Local Capacity to Produce | Domestic production investment mitigates import dependency and secures supply chains. |

Due to the stringent regulatory framework and high-end consumer inclination toward natural and organic products in Germany, the adoption of the product by various industries such as food, beverages, and cosmetics has been promoted. FMI is of the opinion that the German industry is expected to expand at 9.5% CAGR throughout the study period. Manufacturers keep pushing the boundaries in sustainable sourcing and adherence to EU environmental regulations, while industry stakeholders and research organizations work together to propel technological innovations in extraction technologies.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| High Regulatory Requirements for Natural Additives | Investment in EU and German food regulations requires safe, organic pigments. |

| Growing Demand for Organic Products | Customers prefer naturally obtained colorants for foods and beverages. |

| Development of Extraction Technologies | Science-based breakthroughs improve the efficacy and shelf life of the product. |

Brazil is an emerging industry, which is forecast to grow at CAGR of 9.2% between 2025 and 2035. Increased demand has been driven by the country's extensive agricultural base and enhanced awareness about natural food ingredients. Brazil's food processing sector has adopted natural coloring agents as part of a global shift toward sustainability, and domestic cosmetic companies are using cochineal extract in their products.

Growth Drivers in Brazil

| Key Drivers | Details |

|---|---|

| Growing Organic Food Industry | Growing utilization of natural color in food and beverages. |

| Growing Local Cosmetics Production | The application of cochineal extract in cosmetics products continues to grow. |

| Growing Interest in Sustainability | Growing demand for plant-based and sustainable coloring by consumers drives industry growth. |

Japan's industry is anticipated to expand at CAGR of 9.0% over the forecast period due to growing demand from the food, pharmaceutical, and cosmetic sectors. The country's focus on quality and innovation has spurred development in purification techniques, enhancing the purity and stability of the product for diverse applications. The growing popularity of traditional food products with natural ingredients also adds to industry potential.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Growing Demand for Traditional Food | The product is traditionally utilized in traditional Japanese sweets and drinks. |

| Emphasis on High-Purity Natural Ingredients | Impact of industry innovation to improve extraction methods, which ensures product purity. |

| Growing Applications in Pharmaceuticals | Growing application of cochineal extract in pharmaceutical products. |

The global cochineal extract market is structured with a mix of multinational corporations (MNCs), regional players, and Chinese manufacturers, creating a diverse competitive landscape. Each category of players contributes to the industry’s growth through different strategies, ranging from large-scale production to specialized supply chains.

MNCs dominate the high-value segment, focusing on premium-quality, food-grade, and pharmaceutical-grade extract. These companies have well-established global distribution networks and invest in advanced extraction technologies to improve pigment concentration, stability, and purity. Their emphasis on meeting international food safety regulations and sustainability practices has helped them secure long-term contracts with major food and beverage brands.

Regional players, particularly in Latin America and Peru, play a crucial role as primary suppliers of cochineal insects. These producers focus on sustainable farming and local processing, catering to the increasing demand for organic and traceable ingredients. They often partner with global firms to supply raw materials while maintaining competitive pricing for small-scale industries and local manufacturers.

Chinese manufacturers are gaining industry share by offering cost-effective cochineal extract solutions. Their competitive advantage lies in large-scale processing capabilities and access to a rapidly expanding domestic industry. However, regulatory scrutiny and quality concerns continue to pose challenges to their international expansion.

As demand for natural colorants continues to rise, competition among these players is intensifying. MNCs are expanding their sourcing strategies, regional producers are focusing on quality improvements, and Chinese manufacturers are enhancing their production efficiency. This evolving landscape is expected to shape the future growth of the cochineal extract industry globally.

The global cochineal extract market is competitive because of the increase in the demand for natural and sustainable colorants across food, beverages, cosmetics, and textiles. The tightening of regulatory restrictions on synthetic dyes pushes manufacturers to advanced extraction technology, supply chain transparency, and sustainable sourcing for clean-label products.

Companies like DDW The Color House, Chr. Hansen, BioconColors, Sensient Technologies, and ColorMaker Inc. are investing in production expansion and R&D as well as strategic acquisitions to be at the forefront of industry positioning. Innovations in formulation techniques, such as microencapsulation for enhanced stability and solubility, are shaping competition, while ethical sourcing of cochineal insects remains an essential factor for differentiation in brands.

The increase in plant-based cosmetics and green dyes in textiles is becoming an adopting factor so that firms that meet regulations, along with quality assurance and traceability, may have a competitive edge. Businesses that are merging sustainability initiatives with enlarged global distribution networks will likely succeed in the industry in the long term.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Biocon Del Peru | 18-22% |

| DDW The Color House | 12-16% |

| Chr. Hansen Holding A/S | 10-14% |

| Sensient Technologies Corporation | 9-13% |

| Naturex | 8-12% |

| Other Companies (combined) | 25-35% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Biocon Del Peru | Incredibly high-purity cochineal extracts are manufactured, marketed, and sold to food and cosmetic industries. |

| DDW The Color House | It develops natural color solutions like cochineal extract with a special interest in clean-label and organic products. |

| Chr. Hansen Holding A/S | Investing in sustainable and traceable production of cochineal extracts for a wide range of industries. |

| Sensient Technologies Corporation | Offers a wide range of natural colorants, including carmine, for food and beverage applications. |

| Naturex | A worldwide leader in plant-based extracts, moving towards natural red pigments in areas of food, cosmetics, and textiles. |

Biocon Del Peru (18-22%)

A major player in the cochineal extract market, supplying high-quality carmine for food and personal care industries.

DDW The Color House (12-16%)

Focuses on expanding natural color offerings with sustainable cochineal sourcing and advanced formulation techniques.

Chr. Hansen Holding A/S (10-14%)

Leads in R&D, offering innovative solutions for natural food colorants, emphasizing traceability and compliance.

Sensient Technologies Corporation (9-13%)

Strengthens its market position with a diverse natural colorant portfolio, catering to multiple industries.

Naturex (8-12%)

Specializes in botanical and natural extracts, providing sustainable cochineal-based dyes for various applications.

Other Key Players (25-35% Combined)

The industry is slated to reach USD 47.5 billion in 2025.

The industry is predicted to reach USD 108.5 billion by 2035.

Key companies include Biocon Del Peru, DDW The Color House, Chr. Hansen Holding A/S, Sensient Technologies Corporation, Naturex, Roha Dyechem Pvt. Ltd., Xian LiSheng-Tech Co. Ltd., ColorMaker Inc., Proagrosur Perú, and Natcolor Peru.

China, slated to grow at 9.7% CAGR during the forecasted period, is poised for the fastest growth.

Food-grade cochineal extracts are widely being used.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.