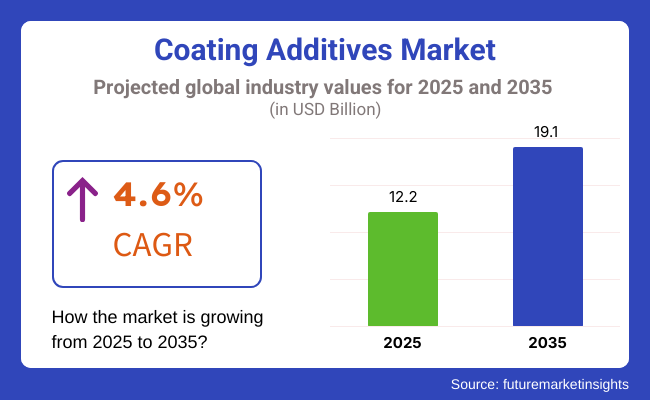

The coating additive market is poised to register high growth during 2025 to 2035 with increased demand within the purview of various industries such as automobile, architecture, and wood & furniture. During 2025, the market for coating additives was close to USD 12.2 billion and is set to increase to a value of USD 19.1 billion in 2035 at a compound annual growth rate (CAGR) of 4.6% during the forecast period.

Such growth is primarily triggered by advances in coating technology that enhance the performance and shelf life of the product. Growth in the application of green and sustainable additives, driven by stringent environmental regulations, also drives the market growth further. Furthermore, the emerging automobile and construction industries in emerging economies also drive demand for high-performance coatings.

The anticipated CAGR of 4.6% is supported by the growing application of coating additives in various sectors, including automotive, construction, and industrial applications. The increasing focus on enhancing the aesthetic appeal and functional properties of products further fuels the demand for advanced coating additives.

Moreover, the development of multifunctional additives that offer properties such as improved dispersion, rheology modification, and surface protection is expected to drive higher adoption in coating formulations. The integration of nanotechnology in additive manufacturing also contributes to the market's positive outlook.

Explore FMI!

Book a free demo

North America dominates the market for coating additives due to its industrially advanced manufacturing capacity and focus on sustainability. It has some of the world's leading industrial producers, who lead the demand for high-end coating additives.

The United States, for instance, is a leading consumer of such additives due to its massive automotive and construction sectors. The nation's focus on green policies has resulted in the use of green additives, thus driving market trends.

Europe is unique because it concentrates on environment sustainability as well as being in tandem with the growing need for sustainable coating additives. The draconian EU regulations have led to increased application of green coating additives.

Germany, France, and the United Kingdom are driving the adoption of green practices, driving the demand for high-tech additives that are environmentally compliant. The region's focus on reducing the environmental impact of industrial processes is a major driver of market growth.

Asia-Pacific will be growing the most swiftly in the coating additives market from the growth spurred by an improving pace of industrialization, automotive manufacturing rising high, and growing construction business. China, India, and Japan are some among the strongest proponents of growth here.

China, as one of the world's biggest automotive manufacturers, has a massive demand for coating additives to meet its extensive production activities. India's increasing infrastructure plans and Japan's technology-oriented industries further support the regional market size.

Challenges

One of the greatest challenges confronting the coating additives industry is the environmental regulatory demands from different governments. The regulations demand the manufacture of low-VOC and green additives, which contribute to higher research and development expenses for manufacturers.

In addition to that, raw material price volatility would also affect profitability in coating additive manufacturers. As they are based on petrochemical derivatives, the industry is exposed to price volatility in oil, affecting the production cost and pricing strategy.

Opportunities

In spite of all these obstacles, the market is very promising for development, particularly in the development of bio-based and sustainable additives. Green chemistry innovations are producing additives from renewable resources that meet increasing consumer demand for green products.

Growing economies have plenty of opportunities, especially in sectors where industrial production is on the rise. The market for efficient coating additives will grow, providing room for expansion.

On top of that, coating formulation complexity is growing and demands for multi-function additives able to enhance greater than one feature at once are growing. That provides a competitive advantage to suppliers who can deliver such items.

From 2020 to 2024, the coating additive market experienced gradual growth as the demand increased for automotive, construction, packaging, industrial, and furniture sectors. Demand for aggressive, high-performance coatings increased and that compelled companies to develop next-generation additives to enhance adhesion, corrosion protection, surface look, and chemical stability.

Low-VOC and environmentally friendly products were more popular as governments legislated tougher environmental laws, prompting the use of waterborne and bio-based paints.

Advances in nanotechnology and multi-functional additives enhanced coating performance, and demand for high-performance industrial and architectural applications increased. Greater emphasis on sustainable raw materials and biodegradable products resulted in investment in next-generation coatings that are less environmentally demanding with improved performance. Increased customer knowledge about environmentally friendly products also encouraged companies to produce low-emission and non-toxic coatings that adhere to global regulation standards.

Additionally, as business moved towards tougher emissions standards, manufacturers concentrated on creating improved coatings that would yield performance without hurting the environment. Long-term longevity, weather ability, and energy conservation needs for coatings increased with it more developments of coating additives for product life improvement and sustainability.

The automotive industry played a major role in the market growth, with coatings formulated to enhance scratch resistance, UV stability, and self-cleaning. The industry of construction relied on additives for enhancing weather resistance, mold resistance, and long-term durability of coatings applied to surfaces inside and outside. The augmented awareness of hygiene as a result of the pandemic and antimicrobial coatings enhanced the need for specialty additives for healthcare and public infrastructure applications.

The elevated application of smart coatings with the characteristics of self-healing and anti-fouling enabled manufacturers to respond to high-performance applications in industrial and aerospace sectors. Amidst the growth, the market was challenged by supply chain disruptions, volatile raw material prices, and regulatory issues, which affected manufacturing costs and production capacities.

Nevertheless, the consistent growth of green coatings and performance-improving additives placed the market for long-term growth over the next decade. The transition to circular economy practices, with an emphasis on reusable and recyclable coatings, is likely to continue fueling innovation in the market. The manufacturers also intensified the research into coatings that can offer thermal insulation, energy saving, and higher material flexibility, which made coatings more efficient in a range of industrial uses.

The period between 2025 and 2035 will see the coating additives market transform based on sustainability objectives, smart coatings, and advancements in nanotechnology. Companies will concentrate on creating biodegradable, non-toxic, and multi-functional coating additives that are performance-enhancing with minimized environmental effects.

AI and machine learning will also be crucial in formulating optimized formulations such that manufacturers can create tailored coatings with increased durability and adaptive properties. The requirement for self-healing, self-cleaning, and temperature-sensitive coatings will rise as industries require coatings that provide longer longevity and greater resistance.

Moreover, digitalization of manufacturing processes will propel the use of automated quality control systems to ensure product performance consistency and cost-effectiveness. Lightweight coatings for energy savings will become more prominent in aerospace, automotive, and industrial uses, lowering overall carbon footprints.

The development of new nanocoating technologies will allow coatings to provide better thermal stability, chemical corrosion resistance, and optical properties, which will open up their use in various industries. Additionally, hybrid polymer coatings and high-performance composite materials will define the future of coatings by providing higher strength, flexibility, and sensitivity to dynamic environmental factors.

The move towards self-healing coatings that can react to temperature, moisture, and pressure variations will further redefine performance parameters in the coatings industry so that products remain durable for a longer period and need fewer repairs.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments enforced low-VOC and solvent-free coatings. |

| Technological Advancements | Companies introduced nanoparticle-enhanced and high-durability additives. |

| Industry Applications | Additives were used in automotive, construction, and packaging. |

| Environmental Sustainability | The sector moved to waterborne and bio-based coatings. |

| Market Growth Drivers | Demand was fueled by durability, performance, and low-VOC compliance. |

| Production & Supply Chain Dynamics | Supply chains experienced variations in raw material availability. |

| End-User Trends | Consumers demanded hygienic and high-performance coatings. |

| Investment in R&D | Funding was given priority to low-VOC coatings and anti-corrosion technologies. |

| Infrastructure Development | Coating additives were used for durability and surface enhancement. |

| Global Standardization | Regulations differed by region and industry. |

| Smart Coating Technologies | Early-stage research emphasized anti-fouling, anti-graffiti, and UV-resistant coatings. |

| Water-Resistant & Anti-Corrosion Innovations | Additives aimed at weather resistance and prevention of oxidation. |

| Lightweight and Energy-Efficient Solutions | Automotive coatings improved fuel efficiency and aerodynamics. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter mandates will require fully biodegradable, eco-friendly additives and VOC elimination. |

| Technological Advancements | AI-driven formulations and self-repairing coatings will become mainstream, improving lifecycle sustainability. |

| Industry Applications | Increasing use in electronics, biomedical, aerospace, and defense coatings will reshape demand. |

| Environmental Sustainability | Full adoption of circular economy processes, carbon-free coatings, and zero-waste products will kick in. |

| Market Growth Drivers | The emphasis will be on intelligent, adaptive coatings with multifunctional attributes and AI-based |

| Production & Supply Chain Dynamics | Businesses will localize manufacturing, combining sustainable sourcing, AI-based supply chain monitoring, and digitalized manufacturing. |

| End-User Trends | Future demand will emphasize self-cleaning, temperature-adaptive, antimicrobial, and intelligent coatings. |

| Investment in R&D | Increased investment in AI-driven material science, energy-efficient additives, and waste-reduction technologies will characterize future research. |

| Infrastructure Development | The industry will concentrate on energy-efficient coatings for smart buildings, advanced insulation coatings, and self-regulating materials. |

| Global Standardization | Unified global standards for sustainable and AI-optimized coatings will simplify compliance, enhancing efficiency. |

| Smart Coating Technologies | Future coatings will integrate real-time surface diagnostics, self-regulating chemical properties, and responsive coatings. |

| Water-Resistant & Anti-Corrosion Innovations | Next-generation coatings will have long-term hydrophobic, anti-erosion, and smart moisture control. |

| Lightweight and Energy-Efficient Solutions | Ultra-light coatings with thermal control, heat-reflective, and self-repairing nano-coatings will propel next-generation applications. |

The USA coating additives market is witnessing consistent growth based on increasing demand from the construction, automotive, and industrial sectors. As the nation continues to update its infrastructure and adopt sustainable building materials, demand for coating additives that improve durability, corrosion, and weather resistance is growing.

The building and construction sector worth more than USD 1.9 trillion is also a significant factor in this need, especially for low-VOC and eco-friendly additives that support EPA emissions standards.

The automotive coatings market is also experiencing significant growth with the growing use of waterborne and powder coatings that employ dispersing agents, wetting agents, and defamers to provide easy application and durability. Moreover, technological innovation in self-healing and anti-microbial coatings is driving the demand for advanced additives in niche applications like healthcare, aerospace, and consumer electronics.

Another major driver of the market is industrial coatings growth, especially in the oil & gas and maritime industries where anti-corrosion additives are central to extending the lives of pipelines, vessels, and industrial machinery. Apart from this, the increasing demand for nanotechnology-based coating is triggering a boom in demand for functional additives improving adhesion, scratch resistance, and UV protection.

With the dominance of top coating industry players and persistent R&D focus on smart coatings and bio-based additives, the USA market will be poised to achieve remarkable progress in coating performance, sustainability, and regulatory compliance through the next ten years.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The UK market for coating additives is expanding with strong demand from construction, industrial, and aerospace sectors, coupled with mounting environmental regulation driving sustainable formulation. With the net Zero 2050 commitment by the UK government, more focus is being laid on low-VOC and eco-friendly coatings, triggering demand for non-toxic and biodegradable coating additives.

The domestic and commercial construction industry of the UK, its growth being driven by surge housing and urban renewal schemes, is among the largest users of additives for enhanced durability, stain resistance, and water protection. Further, the robust automotive industry of the UK, especially the luxury and high-performance motor vehicle segment, is driving the demand for advanced coatings with superior gloss, scratch resistance, and life span.

One of the top upcoming trends is the application of smart coatings in aerospace and defence, with self-healing, anti-icing, and anti-corrosion coatings witnessing extensive use. Furthermore, Brexit-induced supply chain reconfigurations have resulted in numerous coating businesses in the UK concentrating on raw material sourcing within the local market as well as sophisticated additive formulating to preserve competitive edge.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

European Union coating additives market is growing rapidly with stringent environmental laws, high construction activities, and higher usage of high-performance coatings in industries. With the EU Green Deal and the Circular Economy Action Plan, green and non-toxic paint technologies are a key area of interest, which is boosting the demand for water-based, solvent-free, and bio-based additives.

The market is dominated by countries such as Germany, France, and Italy that have a prominent automotive, aerospace, and manufacturing industry sector which demands technologically superior and long-lasting coatings. The building and construction sector in Europe is also transforming rapidly with superior weather-resistant and energy-saving coatings becoming ever more in demand for both residential and commercial building projects.

Apart from that, use of smart coatings in electronic, health care, and renewable energy markets is generating higher demand for multifunctional additives with improved thermal insulation, UV resistance, and self-healing capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

The Japanese market for coating additives is increasingly growing because of next-generation smart coatings, fast industrialization, and high demand from the automobile and electronics industries. Japan leads in high-technology coatings of anti-corrosion, self-cleaning, and Nano-coatings of a performance enhancement type in robotics, aerospace, precision manufacturing applications at the upper-end segment.

The increasing demand for protective coatings in consumer goods is also stimulating demand for scratch-resistant, water-repellent, and UV-stable additives. Furthermore, Japan's green chemistry and sustainability initiatives are fuelling the growth of environmentally friendly, low-VOC additives that comply with stringent environment regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The South Korean market for coating additives is developing at a great rate with growth driven by growth in the automotive, electronics, construction, and marine sectors. As South Korea has prominent automobile manufacturers like Hyundai, Kia, and Genesis, there is immense demand for high-performance coating additives with improved durability, scratch resistance, and fuel efficiency for auto paint. The nation's booming semiconductor and electronics sector, led by the likes of Samsung and LG, is also creating demand for protective coating additives.

South Korea's government programs and green initiatives are driving the market's transition to low-VOC, water-based, and eco-friendly coatings. Moreover, the need for smart city and urban infrastructure advanced functional coatings is driving demand for coating additives like anti-corrosion, heat resistance, and self-cleaning. With research and development in nanotechnology coatings gathering momentum, the nation is turning out to be a front-runner market for high-tech industrial coatings like aerospace, medical devices, and robotics.

The second of the two largest industries of the South Korean economy, the shipbuilding and marine industry, is also driving the growth of the demand for high-performance anti-fouling and corrosion-resistant paint. Due to the harsh coastal climate of the nation, shipbuilders need protective coatings that are seawater degradation-, humidity-, and weather-resistant.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Acrylic and urethane additives enjoy a dominant market share as coating additives due to increasing demand from high-performance coating applications for construction, automotive, industrial, and packaging applications. Acrylic and urethane additives play significant roles in contributing to durability, adhesion, weatherability, and surface appearance and are a crucial component in protective and decorative coatings.

Acrylic-type coating additives are in high demand since they provide superior gloss retention, UV, and drying resistance. The additives contribute to film forming, dispersion, and control of rheology in such a manner that the coatings are stable in adhesive and color when subjected to severe weather conditions. Waterborne acrylic coating additives have gained popularity due to the fact that industries nowadays prefer low-VOC formulations based on regulatory requirements.

The acrylic-based coating additives remain a large consumer in the construction sector, particularly in architectural coatings, exterior paints, and industrial coatings. The additives enhance weatherability and prevent discoloration, cracking, and chalking and are therefore ideal for residential and commercial infrastructure projects.

Apart from constructing, automotive paints have also seen rising applications of acrylic-based additives by manufacturers in order to introduce scratch resistance, gloss retention, and corrosion resistance. This evolution towards environmentally safe and sustainable car paints has impacted the use of water-based acrylic paint formulations too, thereby propelling demand for new acrylic flow control and dispersing additives.

At the same time, urethane-type paint additives have become in vogue with their excellent abrasion resistance, flexibility, and chemical resistance. They are a critical component of industrial coatings, wood finishes, and auto clearcoats where toughness and protection of the surface are necessary. urethane-type paint additives have become extremely popular with their high abrasion resistance, flexibility, and chemical resistance. They are used as a main ingredient in commercial clearcoats for automobiles, wood finishes, and industrial paint where hardness and protection of surfaces are needed.

Urethane additives are highly appreciated in high-performance applications like marine coating, aircraft coating, and heavy machinery coating, where the surface needs to be able to resist mechanical stress, moisture exposure, and chemical exposure. Increased demand for industrial coatings with a longer durability and less maintenance cost has heavily boosted urethane-based coating additives growth.

Also, urethane additives have been extensively used in furniture and flooring markets, where they offer improved scratch resistance, gloss control, and slip resistance. With interior design trends focusing on matte and satin finishes with extended durability, companies have continued to invest in urethane-modified additives to match consumer demand.

Although they have been extensively utilized, availability of raw materials and cost fluctuations pose serious issues for both urethane and acrylic additives. Nonetheless, bio-based coating additive advancements and hybrid offerings have made it possible for producers to develop cost-effective and environmentally friendly products so that market growth remains unimpeded.

Waterborne coating additives are the preferred formula these days since industries are making a transition to low-VOC and eco-friendly coatings. Governments and regulatory bodies such as the USA Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have also set stringent emission standards, and thus manufacturers have been making a transition from solvent-based to water-based products.

The water-based coating additives market has dominated the architectural coatings sector, with companies and end-users demanding environmentally friendly paints that are odorless, less toxic, and air-quality friendly. The paints have better adhesion, color retention, and hardness that are ideal for use in homes and businesses.

Furthermore, the automotive market has seen a shift towards waterborne coatings, particularly in OEM coatings and automotive refinishing. Surface wetting, flow control, and leveling properties are enhanced through water-based coating additives to leave a high-gloss, smooth surface with minimal defects. Since global automobile makers are aiming for environmental footprints without any sacrifice in the levels of performance, the use of water-based dispersing agents, defoamers, and rheology modifiers has increased.

Water-borne coating additives have been in increasing demand throughout the packaging sector as increasingly food-contact safe, BPA-free, and odorless coatings are being required by consumers. Water-borne coatings are best suited for resistance to moisture barrier, grease, and printability and best suited for paperboard packaging, soft drink cans, and flexible packs.

Despite growing water-based coating popularity, disadvantages continue to exist in longer drying times, sensitivity to humidity, and manipulation of surface tension that have led formulators to develop high-end water-based additives that promote film formation, drying time, and substrate wetting. Advances in nano-based dispersants and multifunctional additives have reduced these disadvantages so that waterborne formulations can continue to enjoy their competitive edge over solvent-based competitors.

Even though water-based formulations are now the accepted norm, solvent-based coating additives remain an integral part of industrial and heavy-duty applications, where coatings must be able to withstand extreme environmental and mechanical conditions. These coatings provide improved adhesion, chemical resistance, and durability and are therefore a necessity for marine coatings, oil & gas infrastructure, and metal coatings.

Solvent borne additives enhance flow properties, wetting behaviours, and formability of the film, meeting uniform coverage and long-term durability. High-performance coatings for applications involving harsh chemicals, ultraviolet, and extremes of temperature still rely on solvent borne chemistry in spite of regulative pressures.

The defence and aerospace industries are major consumers of solvent-based coatings because these coatings are highly resistant to corrosion, fuel exposure, and high-altitude environments. Moreover, marine coatings, which are used to cover ships, oil rigs, and underwater structures from saltwater corrosion and biofouling, rely on solvent-based additives for long-term performance and durability.

While regulatory constraints have prompted many producers to phase out conventional solvent-based additives, the creation of low-VOC, high-solid solvent formulations has enabled industries to maintain their advantages while minimizing environmental footprint. The hybridization of solvent-based and water-based technologies has also opened doors to more sustainable solvent-borne coatings with enhanced environmental profiles.

The coating additives market is highly competitive, driven by global manufacturers and regional players specializing in performance-enhancing additives for paints, coatings, and surface treatments. Key companies focus on improving durability, corrosion resistance, and environmental compliance. The market is expanding due to increasing demand for eco-friendly and high-performance coatings in construction, automotive, and industrial sectors.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 10-15% |

| Evonik Industries AG | 9-13% |

| Dow Chemical Company | 7-11% |

| Arkema Group | 5-8% |

| Clariant AG | 3-6% |

| Other Companies (combined) | 50-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Creates multifunctional coating additives enhancing durability, adhesion, and weather resistance. High emphasis on water-based and low-VOC solutions. |

| Evonik Industries AG | Develops high-performance industrial and decorative coatings additives with a focus on sustainability and efficiency. |

| Dow Chemical Company | Produces additives for improving flow, surface properties, and UV resistance in coatings. Invests in nanotechnology and polymer science. |

| Arkema Group | Supplies a series of rheology modifiers, dispersants, and surface-active additives to improve performance and sustainability. |

| Clariant AG | Develops specialty additives for coatings with emphasis on high durability and environmental friendliness. Dominant presence in specialty chemicals. |

Key Company Insights

BASF SE (10-15%)

BASF SE leads the coating additives market with a diverse product portfolio catering to industrial, automotive, and decorative coatings. The company prioritizes sustainability, offering low-VOC and water-based additives. Its global R&D network drives innovation in coating performance enhancement.

Evonik Industries AG (9-13%)

Evonik Industries specializes in high-performance coating additives designed to improve adhesion, water resistance, and durability. The company invests heavily in developing bio-based and sustainable coating solutions, aligning with increasing environmental regulations.

Dow Chemical Company (7-11%)

Dow Chemical focuses on innovative solutions, including surface modifiers and dispersants that enhance coating longevity and performance. The company integrates nanotechnology and polymer advancements to develop next-generation coating additives.

Arkema Group (5-8%)

Arkema provides a broad range of coating additives, including dispersants and rheology modifiers that improve coating stability and application. The company emphasizes sustainability through eco-friendly formulations and recyclable coatings.

Clariant AG (3-6%)

Clariant AG is a leading provider of specialty additives, focusing on high-performance and environmentally friendly coating solutions. The company actively develops innovative chemical formulations to meet evolving industry requirements.

Many regional and niche players contribute significantly to the coating additives market, driving innovation, cost optimization, and regulatory compliance. These include:

The overall market size for Coating Additives Market was USD 12.2 Billion in 2025.

The Coating Additives Market is expected to reach USD 19.1 Billion in 2035.

Increasing demand for high-performance coatings and enhanced surface properties in various industries will propel the coating additives market. Expanding applications in automotive, construction, and industrial coatings further boost market growth. Moreover, advancements in additive technology and rising investments in eco-friendly and sustainable formulations will accelerate market expansion.

The top 5 countries which drives the development of Coating Additives Market are USA, UK, Europe Union, Japan and South Korea.

Water-Based Coating Additives to command significant share over the assessment period.

Aluminum Phosphide Market Growth - Trends & Forecast 2025 to 2035

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.