The global demand for Coal briquettes is expected to rise in the upcoming years, between 2025 and 2035. Coal briquettes are in fact, compressed coal fines combined with suitable binders. The increasing adoption of smokeless coal briquettes, coupled with developments in briquetting technologies, is driving the growth of the market.

In addition, the sustained development of the industry is also helped by the expansion of industrial manufacturing, rising demand for alternative solutions space heating, and government action that promotes the adoption of clean fuel.

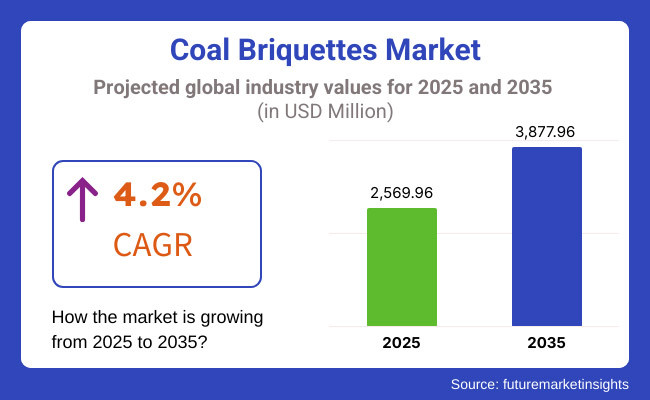

The Coal briquettes market was valued at about USD 2,569.96 Million in 2025. It is anticipated to reach USD 3,877.96 Million by 2035 at a CAGR of 4.2%. This market is positioned to grow owing to rising energy requirements, advancements in coal processing technologies, and growing investments in green fuel alternatives.

Advancements in automated briquetting systems, improved combustion severities, and economical production processes are also contributing to market growth. Furthermore, the rise of bio-coal briquettes and other hybrid fuel products is an important component for market penetration and end-user adoption.

Explore FMI!

Book a free demo

North America is another key area for this type of solid fuel owing to the strengthening demand for alternative heating fuels, rising applications in industries and recent investments in low-emission coal technologies. High performance briquettes, smokeless briquettes, and bio-coal briquettes are leading in USA and Canadian companies dominating the development and commercialization.

The increasing establishment of environment-friendly solid fuels and regulatory measures by government bodies toward the use of clean energy alternatives are expected to drive the market over the forecast period. Furthermore, product innovation and adoption are further fueled by the incorporation of automated briquetting plants and novel binder technology.

The Europe market is driven by rising demand for sustainable fuel solutions, government policies that limit coal usage and improvements in briquette production technologies. For example, Germany, Poland, and the UK are developing high-efficiency, low-emission coal briquettes for industrial and residential heating applications.

An increasing focus on reducing carbon footprint, integrating renewable energy, and exploration of coal substitution fuels through research is also propelling the market adoption. Increasing applications in steel production, thermal power plants and combined heat and power (CHP) systems further present opportunities for manufacturers.

The Asia-Pacific region is further anticipated to be the fastest growing region on account of burgeoning industrialization, increasing energy consumption, and rising demand for low-cost heating solutions. As a direct response to this challenge, countries such as China, India and Indonesia are investing heavily in briquetting with the aim of increasing domestic supply and enhancing the efficiency of fuels in industrial energy processes.

Besides, the trampling of the appliances leads to the growth of the residential heating market, shifting regulatory policies towards cleaner burning of coal, and initiatives by the government to improve energy security are pushing up the expansion of the regional market.

Moreover, raising knowledge of pollution control methods and alternatives in the manufacturing of carbonized coal briquettes boosts market penetration. The establishment of domestic fuel producers and partnerships with international industry leaders is also fostering growth in the market.

This market is growing steadily in Latin America due to the growing demand for low-cost solid fuels, rising attention to rural electrification, and expanding industries for manufacturing operations. Brazil and Mexico have become major players, working to extend access to high-quality coal briquettes for everything from residential heating to steel smelting to brick making.

Other growth drivers include the incorporation of local raw materials, affordability of production methods, and advertisements to promote sustainable energy alternatives. Moreover, the emergence of clean fuel initiatives, and increased allocation of funds for energy infrastructure development coupled with government incentives for emissions reduction, are making the product more accessible throughout the region.

The Middle East & Africa Coal briquettes market is approaching a significant expansion due to developments in essential economic aspects - industrialization, alternative fuels, power generation efficiency, and investments. A new generation of hubs is currently emerging in the UAE and South Africa, and is helping to drive product availability and the latest types of technology.

Demand for industrial heating solutions is driving the growth of energy diversification strategies and partnerships between international and local fuel suppliers. Long-term industry growth is augmented by government policies to support energy-saving fuel sources, innovation in briquette composition, and consumer-driven demand for high-efficiency solid fuels. Increasing efforts to ensure energy security and a growing number of sustainable fuel-producing facilities geographically in the region further drive the demand for coal briquettes.

The Coal briquettes market is likely to grow steadily for over the next 10 years, with the constant progress of briquetting technologies, emission reduction strategies and sustainable fuels. To enhance functionality, marketability, and end-user utilization, enterprises are working towards developing novelty in compositions of binder, automated production methods, and other formulations of coal.

Furthermore, the growing consumer focus on clean solid fuels, the incorporation of digital technology in fuel distribution, and changing patterns of energy consumption are influencing the industry's future. With the adoption of AI-powered fuel efficiency analysis, carbon offset initiatives, and cleaner combustion methods, energy usage and emissions are continuously minimizing, while quality fuel options are consistently maintained globally.

Challenge

Environmental Concerns and Regulatory Restrictions

There are potential factors that may restrain the growth of the Coal briquettes market such as rising environmental issues and strict regulations imposed to decrease carbon emissions. Governments are currently cracking down on coal based fuels to help control air pollution and facilitate cleaner alternatives.

Moreover, carbon taxes, emissions trading systems, and industrial decarbonization mandates have curtailed the coal briquette adoption across sectors. Even more so, they need to develop new formulas for lower carbon briquettes, invest in cleaner production technologies, and find new approaches for carbon capture and storage (CCS) in order to keep up with increasing regulations around pollution and carbon emissions.

Competition from Renewable and Alternative Energy Sources

Challenge- One of the biggest obstacles for the Coal briquettes market is growing renew sources of energy like wind, solar and biomass. To reduce reliance on fossil fuels, industries and households are increasingly moving towards sustainable energy alternatives.

Furthermore, recent progress in the production of bio-briquettes, hydrogen fuel as well as natural gas are creating competitive alternatives. The coal briquette manufacturers to stay in the analysis would like to boost energies efficiency, alternative gas solutions and mixing renewable additives to produce eco-friendly briquettes according to worldwide durability trends.

Opportunity

Growing Demand in Emerging Economies

Coal briquettes are still in great demand in emerging economies where people do not have access to alternative energy sources despite environmental concerns. Asia, Africa, and Latin America developing states still use coal briquettes for residential heating, industrial applications and electricity generation.

The demand in these regions is further driven by economic growth and urbanization and growing energy needs. Producers who learn to maximize efficient combustion and localized supply chain networks will benefit from continued demand to October 2023.

Advancements in Clean Coal Technologies

On the upside the form of clean coal technologies can all be incorporated into this while on the up-side the Coal briquettes market. Low-sulfur coal briquettes, smokeless briquettes, and bio-coal blends are among some of the innovations helping reduce environmental issues at the same time as reaching energy efficiency.

Moreover, emerging technologies, such as gasification carbon capture utilization and storage (CCUS) and waste-to-energy (WtE) solutions are driving the sustainability credentials of coal briquettes. Companies that make significant investments in research and development to improve briquette performance and reduce emissions will be well-positioned in the market.

Foresight in the Coal briquettes market for 2025 to 2035 between 2020 and 2024, shifts in the Coal briquettes market were propelled by regulatory pressures, technological advancements, and changing consumer preferences. Indeed, in places where environmental policies have diminished demand for unprocessed coal, other areas still use coal briquettes to ensure energy security.

In response, businesses turned to cleaner production processes, better energy efficiency, and hybrid fuel options that could help them remain economically sustainable while being environmentally friendly.

The market will evolve, including further changes as clean energy legislation tightens and alternative fuels continue to gain hold. These may include higher combustion technologies, further investment in carbon offset initiatives, and the incorporation of renewable biomass constituents in briquette recipes.

Digitalization and AI driven optimizing of the supply chain will also enable highly efficient processes and sustainability. The companies that have already adopted the innovation-driven, sustainable, and adaptive business strategy are expected to spearhead the next growth phase of the Coal briquettes market.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter emissions regulations and carbon taxes |

| Technological Advancements | Growth in smokeless and low-sulfur briquettes |

| Industry Adoption | Continued use in emerging economies and industrial applications |

| Supply Chain and Sourcing | Dependence on traditional coal supply networks |

| Market Competition | Growing competition from bio-briquettes and natural gas |

| Market Growth Drivers | Energy demand in developing regions and affordability |

| Sustainability and Energy Efficiency | Initial focus on reducing sulfur and particulate emissions |

| Integration of Smart Monitoring | Limited implementation of IoT and digital tracking |

| Advancements in Fuel Innovation | Development of high-energy, low-emission briquettes |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of carbon-neutral policies, mandatory CCUS adoption, and clean coal incentives |

| Technological Advancements | AI-driven combustion optimization, bio-coal hybrid fuels, and waste-to-energy briquette solutions |

| Industry Adoption | Transition toward sustainable fuel blends, carbon offset strategies, and alternative energy integration |

| Supply Chain and Sourcing | Diversification into sustainable coal mining, biomass co-firing, and decentralized briquette production |

| Market Competition | Rise of hydrogen-based energy, carbon-negative fuels, and hybrid coal-renewable energy solutions |

| Market Growth Drivers | Innovations in clean coal technology, regulatory incentives, and strategic partnerships for low-emission energy |

| Sustainability and Energy Efficiency | Full-scale adoption of CCUS, carbon-neutral production, and AI-powered energy efficiency monitoring |

| Integration of Smart Monitoring | Real-time emissions monitoring, blockchain-enabled carbon credit tracking, and predictive maintenance solutions |

| Advancements in Fuel Innovation | Breakthroughs in synthetic coal, nanotechnology-enhanced combustion, and energy-dense hybrid fuel solutions |

The Coal briquettes market in the United States is one of the largest in the world and is driven by high demand for industrial fuel, growing include usage in metallurgical applications, and increase use in power generation. Market growth nevertheless is attributed to the presence of key coal producers and development of clean coal technologies.

Increasing investments in eco-friendly coal briquetting processes, coupled with innovations associated with low-emission combustion technologies, continues to drive market progress. Moreover, automation of briquette production, the adoption of AI-based energy-efficient technology, and the advanced carbon capture methods are increasing the sustainability of the products.

Manufacturers are also innovating in the field of high-density, moisture-proof coal briquettes to improve their combustion efficiency and lower their pollution. The growing demand for oxygen for cost-effective and high-energy fuel sources for industrial and residential heating applications is further propelling the us market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

UK, a significant market for coal briquettes, attributed to growing preference for efficient solid fuels, government measures in encouraging cleaner energy alternatives and energy security. Also, the shift towards sustainable heating solutions is further driving demand.

With growing government regulations promoting carbon reduction policies and increasing usage of smokeless coal briquettes and bio-coal alternatives, the market is anticipated to flourish during the forecast period. In addition, there are advances in ultra-low sulfur coal briquettes, better binding agents, and high-efficiency combustion technology, all of which are now coming into play.

As another fresh alternative, companies are investing in hybrid fuel, where coal is mixed with biomass and pressed into eco-friendly briquettes. In the UK, rising consumer trends toward using high-calorific, low-emission briquettes for heating purpose whether household or industrial is contributing significantly to the growth of the market. The adoption is further fueled by the increasing implementation of waste-to-energy projects and alternative solid fuel developments.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

Industrial demand from emerging economies along with robust industrial demand, increasing deployment of alternative fuel sources, and carrying out the implementation of clean coal technologies are expected to create lucrative growth opportunity for coal briquettes market across the globe.

Impact of European Union carbon emission reduction through cleaner fuel applications and thriving investments in high-efficiency solid fuel production will promote steady market growth. And the prevalence of low-emission coal briquettes, innovative carbon capture and storage (CCS) technologies and waste-derived solid fuels are increasing sustainability.

Market growth has also been fueled by the increasing popularity of briquettes in steel production, district heating, and power generation. Another factor driving innovation in the coal briquette industry across the EU is the government-supported research into carbon-neutral briquetting methods and the use of renewable binders. Emission tax incentive and regulatory compliance programs; is further accelerating the shift to cleaner briquette fuel.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

Japan coal briquettes market is developing, driven by the country's energy security goal, the need for high-performance industrial fuels and new low-emission coal technologies. In heavy industries, energy-dense solid fuels are being preferred more and more, which is also a reason for the growth of the market.

Innovation is being driven by the country's focus on technological advancements and the integration of AI-driven combustion optimization and carbon capture systems. In addition, stringent government regulations to reduce air pollution along with rising acceptance of alternative binding materials, is prompting companies to manufacture low-sulfur, eco-friendly briquette solutions.

Volatile prices of oil & LPG, along with shifting trends of dependency from these resources, are also some of the factors driving the demand for smokeless coal briquettes in urban heating applications, and industrial steam generation, thereby further boosting the market growth in Japan's energy sector. Japan doctoral research on carbon-neutral fuels and clean energy transition programs have positive influence on future of Coal briquettes demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

Rising demand for energy and consumption of industrial fuels along with government trends towards clean coal technology are bolstering the coal briquettes market in South Korea.

Key Drivers: Stringent government regulations for enhancing air quality and increasing use of High-efficiency solid fuels are likely to drive the growth of the market. Furthermore, the country’s emphasis on bettering combustion efficiency by means of high-pressure briquetting, the upgraded binding formulations of coal, and smart monitoring techniques are increasing competitiveness. The rising usage of coal briquettes in steel production, home warming, and industrial furnaces is additionally driving adoption in the market.

Emphasizing energy efficiency and deploying hybrid fuel solutions that use biomass and alternative carbon sources will also help these companies reduce emissions. This trend has also been coupled with increasing energy diversification strategies and the growth of waste-derived fuel technologies in South Korea which in turn has contributed to the growth of the high-performance coal briquettes market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

Pillow-shaped coal briquette remains a model with options in many factories due to the burning efficiency and difficulty characteristics in thus compares to the hand tool and allows using of one simple, color and the wide line of the field of the cooking for food supplying or industry. Their uniform shape allows for even combustion, making them optimal for high industrial use where controlled heating is required.

Furthermore, their stackable nature enables superior storage and transport efficiency, lowering logistics expenses for both producers and end-users. The cushioning briquette industry has been supported further with an increase in demand for environment-friendly fuel in the market as a convertible energy source where coal-based energy is a vital portion of energy manufacture.

Hexagonal coal briquettes are widely used in the food industry and in small industrial applications due to their ability to produce limitless heat with very little smoke. They hold better heat, and their compact burning time makes them a superior new strain of lump charcoal if you will.

Hexagonal briquettes are increasingly being recognized as an alternative sustainable means of achieving more environmentally sustainable fuel use for household and commercial cooking, with increasing focus on cleaner energy solutions.

Wood charcoal briquettes have the highest market share when compared to other segment types due to their extensive use in grilling, barbecuing, and artisanal cooking. These briquettes leave little ash, little smoke and lots of heat, which is why they are the fuel of choice in restaurants, catering companies and at home grilling.

The growing trend toward healthier and environmentally sustainable fuel options has paved the way for innovation in additive-free, chemical-free wood charcoal briquettes targeted at health-conscious individuals and environmentally aware enterprises. High-grade wood charcoal briquettes can now be made with more sustainable and available resources due to improved biomass recycling systems.

Due to their high energy density and cost, coal dust briquettes are used widely for industrial heating, power plants, and metallurgical applications. Refectory’s briquettes utilize fine particles of coal that could be regarded as waste and achieves energy efficiency by improving the utilization of resources.

Low-emission coal dust briquettes, pelletized and molded using binders, have emerged as a viable alternative for industries adopting cleaner energy options. In addition, government incentives for the use of reclaimed coal dust have also stimulated their application to manufacturing applications.

By far, the industrial sector is the largest consumer of coal briquettes for power generation, metal smelting, cement production, and steam generation. For industries, high-Calorific-value briquettes are required to provide continuous heat and fuel saving.

Because of increasing coal prices and greater environmental requirements, various manufacturers make briquettes with low sulfur and high efficiency for industrial use; low-freezing solid alternative fuels are in demand. Moreover, the growth of automated combustion systems on briquettes in large industries has helped in the effective utilization of fuel and reduced energy wastage, thus improving the efficiency of operations.

Coal briquettes market has gained a high traction in food preparation applications across various end use industries, especially restaurant, commercial kitchen, and street food stall. Ranging from compressed wood charcoal, hexagonal coal dust briquettes to smokeless, odorless, and high-heat briquettes, innovations are being driven to offer maximum cooking experience.

Moreover, the surging popularity of outdoor grilling coupled with the growing trend of eco-friendly fuel alternatives as well as sustainable cooking practices has driven the demand from this segment further. To appeal to environmentally conscious consumers, manufacturers are also developing coconut shell dark-colored briquettes and briquettes infused with sawdust.

The Coal briquettes industry is witnessing growth owing to rising demand for low-cost and high energy-efficient fuel alternatives across industries such as electricity generation, residential heating, and metallurgy. A few companies are increasingly developing high-quality briquettes, featuring optimized burning efficiency, reduced emissions, and better binding agents.

Our analysts have regularly monitored the industry for updates, here are some key trends shaping the global fuel market for Aidil Coal Beneficiation, which shall continue to prevent coronary disease in people who regularly consume coal, such as coal briquettes. (eco-friendly) briquettes, biomass-coal hybrid briquettes and government policies that support the use of clean fuels.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| China Coal Energy Company | 18-22% |

| Sinopec Limited | 14-18% |

| Zhengzhou Boiler Co., Ltd. | 11-15% |

| Mitsui & Co., Ltd. | 8-12% |

| Sree Engineering Works | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| China Coal Energy Company | Leading producer of high-calorific coal briquettes for industrial and domestic applications. |

| Sinopec Limited | Specializes in clean coal briquette technology and low-emission fuel solutions. |

| Zhengzhou Boiler Co., Ltd. | Develops advanced coal briquetting equipment and high-efficiency fuel briquettes. |

| Mitsui & Co., Ltd. | Focuses on sustainable coal briquette production with hybrid biomass-coal fuel solutions. |

| Sree Engineering Works | Offers customizable briquetting solutions for residential and industrial heating needs. |

Key Company Insights

China Coal Energy Company (18-22%)

China Coal Energy Company is a major global player in this field, offering a wide selection of high-quality coal briquettes tailored to meet industrial and household needs.

Sinopec Limited (14-18%)

Low-emission coal briquettes is one of the core businesses of Sinopec, which utilizes cutting-edge fuel processing technology to optimize energy utilization.

Zhengzhou Boiler Co., Ltd. (11-15%)

Zhengzhou Boiler focuses on the production of assets energy-saving coal briquetting high-performance equipment, suitable for power plant, heating and other occasions.

Mitsui & Co., Ltd. (8-12%)

Mitsui's target: Hybrid briquettes (biomass-coal) that can be used as clean alternatives to energy in developing markets

Sree Engineering Works (6-10%)

Sree Engineering Works If you are looking to buy or manufacture custom made coal briquettes for industrial use or for domestic use, Sree Engineers works.

Other Key Players (30-40% Combined)

International and regional players undertake innovations by coal briquettes, emphasizing sustainability by emissions control, improved fuel efficiency and regulatory compliance. Key players include:

The overall market size for Coal briquettes market was USD 2,569.96 Million in 2025.

The Coal briquettes market expected to reach USD 3,877.96 Million in 2035.

Factors like rising industrial applications, increasing use in residential heating and cooking along with growing need for cost-effective and energy-efficient fuel sources are likely to propel the demand for global coal briquettes market.

The top 5 countries which drives the development of Coal briquettes market are USA, UK, Europe Union, Japan and South Korea.

Pillow-shaped and hexagonal-shaped coal briquettes growth to command significant share over the assessment period.

Precipitation Hardening Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Plywood Market Growth - Innovations, Trends & Forecast 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.