The coagulation markers industry is valued at USD 1.37 billion in 2025. As per FMI's analysis, the coagulation markers industry will grow at a CAGR of 5.3% and reach USD 2.47 billion by 2035. The global coagulation markers industry will be driven by increasing demand for advanced diagnostics and a rising prevalence rate of conditions such as venous thromboembolism (VTE), particularly in surgical and orthopedic procedures.

In 2024, the industry for coagulation markers was characterized by high growth and diversification, which was stimulated by expanded clinical applications in post-surgical care and the management of chronic diseases. This increase was partly due to better diagnostic procedures for disorders such as venous thromboembolism (VTE) and disseminated intravascular coagulation (DIC) and the greater inclusion of coagulation panels in standard check-ups for high-risk patients.

This growth can be credited to increased awareness about coagulation disorders, advancements in laboratory testing, and a rising geriatric population that is more prone to clotting disorders. Additionally, technological advancements in point-of-care testing and rising healthcare expenditure in developed and emerging economies drive the growth of this sector.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.37 billion |

| Industry Size (2035F) | USD 2.47 billion |

| CAGR (2025 to 2035) | 5.3% |

The segment for coagulation markers is growing steadily with increased demand for the early diagnosis of clotting disorders and rising use within surgery and chronic care environments. Innovation in point-of-care testing and greater access to diagnostics are quickening pace worldwide. Diagnostic firms and healthcare practitioners will gain the most, while legacy firms with legacy technologies are at risk of losing industry share.

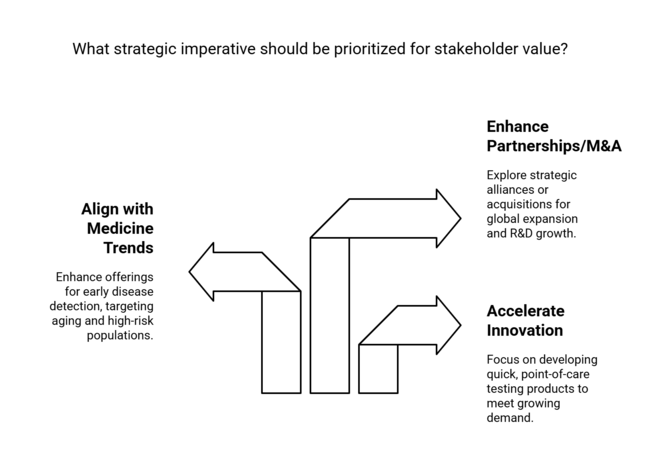

Accelerate Innovation in Point-of-care Testing

Executives ought to invest in creating or obtaining quick, point-of-care coagulation testing products to address increasing demand in emergency departments, outpatient clinics, and home health.

Align Offerings with Preventive and Personalized Medicine Trends

Enhance product portfolios and marketing initiatives favoring early disease detection and patient-directed diagnostic routes, with a particular focus on aging and high-risk populations.

Enhance Global Partnerships and M&A Activity

Investigate strategic alliances or acquisitions to increase geographic penetration, increase R&D capacity, and access developing sectors with growing healthcare infrastructure investments.

| Risk | Probability-Impact |

|---|---|

| Regulatory delays or shifting compliance standards | Medium-High |

| Slower-than-expected adoption of point-of-care tech | High-Medium |

| Supply chain disruptions affecting test kit delivery | Medium-High |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Expand point-of-care testing footprint | Run feasibility study on portable device integration in outpatient settings |

| Improve product-market fit | Initiate clinician and OEM feedback loop on coagulation panel performance |

| Boost channel effectiveness | Launch distributor and lab partner incentive pilot in high-growth regions |

To stay ahead as the coagulation markers industry evolves, the company must given its attractiveness and the ongoing industry shifts, the client must focus on both accelerating innovation in point-of-care diagnostics while at the same time addressing access in underpenetrated, high-growth areas. This sector intelligence also indicates a transition towards accelerated and decentralized testing paradigms and points to nascent prospects in preventative healthcare and personalized medicine.

This roadmap now needs to reflect near-term investment in agile R&DA, targeted partnerships with regional distributors and realign the company’s regulatory risk framework with evolving standards. Whereas the differentiation will be based on providing quicker, more accessible, and clinically actionable testing, the company will not just be viewed as a product provider, but as a diagnostic solutions partner for next-gen healthcare ecosystems.

Regional Variance

High Variance Observed

ROI Perception Gap

69% of USA stakeholders felt AI-enabled coagulation tools provided clear clinical ROI; only 33% in Japan agreed.

Consensus

Plasma-based assays: Preferred by 68% due to global validation and scalability.

Regional Nuances

Shared Challenges

85% cited rising costs of reagents and analyzer maintenance as significant pain points.

Regional Differences

Manufacturers

Distributors

End-Users (Clinicians/Lab Directors)

Global Alignment

76% of diagnostic manufacturers intend to invest in automation and AI integration over the next 12-18 months.

Divergence by Region

Strong Consensus: Speed, accuracy, and reagent cost containment are critical global concerns.

Notable Variances:

Strategic Insight: A globally uniform product offering will likely miss regional needs. Companies must adopt a regionally nuanced go-to-segment strategy: AI-integrated systems for the USA, sustainable platforms for Europe, and compact, cost-effective analyzers for Japan and South Korea.

| Country/Region | Regulatory Impact & Certifications |

|---|---|

| United States | CLIA (Clinical Laboratory Improvement Amendments) and FDA oversight heavily influence product development and segmen t entry. POC tests must meet FDA EUA or 510(k) clearance. CAP accreditation is often required for labs. |

| Canada | Health Canada requires Class III or IV medical device licensing for coagulation analyzers. MDEL registration and bilingual labeling (English/French) are mandatory. |

| European Union | IVDR (In Vitro Diagnostic Regulation) has significantly tightened requirements since 2022. CE-IVD marking is now mandatory, with increased clinical evidence and post- sector surveillance requirements. |

| United Kingdom | Post-Brexit, UKCA marking is required for coagulation markers. MHRA regulates diagnostics under new transitional rules; stricter documentation and performance evaluations are now expected. |

| Germany | As part of the EU, follows IVDR, but additionally enforces strict environmental standards. Digital Health Act is pushing for EHR-integrated diagnostics. |

| France | Must comply with both IVDR and French National Health Agency (ANSM) review. Favorable reimbursement policies for tests meeting national early detection priorities. |

| Japan | Regulated by the PMDA. Requires extensive local clinical validation even for CE/FDA-cleared products. Pharmaceuticals and Medical Devices Act mandates pre-market approval for Class II and III diagnostics. |

| South Korea | Overseen by MFDS. Devices must meet Korean Good Manufacturing Practice (KGMP) standards. Local trials are often required. Importers need a specialized license. |

| China | NMPA approval is mandatory, with increasing focus on data localization and cybersecurity compliance for diagnostics. Local clinical trials are often enforced for imported products. |

| India | CDSCO regulates diagnostics as of 2020 under the Medical Device Rules. Class C devices (e.g., coagulation markers) need mandatory registration and periodic quality audits. |

| Australia | TGA requires inclusion on the ARTG (Australian Register of Therapeutic Goods). Must meet ISO 13485 and performance validation per local conditions (e.g., heat, humidity). |

The United States coagulation markers sector is estimated to grow at a CAGR of 7.3% during the forecast period, 2025 to 2035. The sector growth is attributed to the growing incidence of coagulation disorders, for instance, venous thromboembolism (VTE) and atrial fibrillation, particularly among the geriatric population.

The USA health care system's focus on early diagnosis and preventive care has resulted in greater uptake of coagulation markers in the health care environment. Furthermore, the development of advanced technologies and the application of artificial intelligence in diagnostic tools are making coagulation testing more accurate and efficient.

The United Kingdom coagulation markers sector is projected to record a CAGR of 9.4% between 2025 and 2035. The reason behind this strong growth is the increasing aging population in the country that is more vulnerable to coagulation disorders.

Early diagnosis and management of such conditions has been prioritized by the UK's National Health Service (NHS), which is surging the demand for coagulation markers. Moreover, the UK’s sustainability-driven patient care movement is boosting the adoption of green diagnostic solutions in the country. UKCA Mark regulates medical devices post-Brexit and the comprehensive guidelines issued by the MHRA (Medicines and Healthcare products Regulatory Agency) that all companies need to follow.

The coagulation markers sector in France is projected to record a CAGR of 8.5% during the period 2025 to 2035. The national health care system promotes preventive medicine, resulting in more frequent use of diagnostic tools, among them coagulation parameters.

The demand for these diagnostics is driven by France's aging demographic and increasing prevalence of lifestyle-related diseases. Combined with compliance with the European Union’s In Vitro Diagnostic Regulation (IVDR) and closer scrutiny from the French National Health Agency (ANSM), this translates to high standards for diagnostic tools. Expansion and favorable reimbursement policies for tests corresponding to the national health priorities add to the sector growth.

The Germany coagulationmarkers sector is estimated to record the CAGR of 7.8% over the forecast period. The established healthcare infrastructure across the country, and also the balanced focus on research and development, promote miniaturization of diagnostics.

Increasing incidence of coagulation disorders with an ageing population fuels the demand for coagulation markers. Germany's compliance with the EU's IVDR and strict environmental policies impact the growth and penetration of advanced diagnostics solutions. The Digital Health Act further drives sector expansion by supporting the integration of electronic health records.

The sector is expected to grow at a CAGR of 6.5% between 2025 and 2035. Growth is driven by a rising population and increasing awareness of coagulation disorders over the forecast period.

Rising demand of coagulation markers in Italy due to enhanced diagnostic capacity of healthcare system. Registering diagnostic tools according to the standards for the EU'sIVDR confirms quality. Nonetheless, economic barriers and geographic variations in healthcare availability could limit the growth of the sector.

The South Korea coagulation markers sector is anticipated to witness a CAGR of 5.9% over the forecast period. The industry demand for diagnostic markers is driven by the country's advanced healthcare system, while the increasing prevalence of coagulation disorders also contributes to industry growth.

Medical device regulation is under the responsibility of the Ministry of Food and Drug Safety (MFDS), which requires the manufacturer to comply with Korean Good Manufacturing Practice (KGMP) standards with advanced diagnostics often piloted in Seoul before broader rollout to rural regions. On the other hand, potential barriers to industry penetration include logistical hurdles in rural areas as well as price sensitivity.

The Japan coagulation markers sector is expected to accommodate a CAGR of 6.6% during the period 2025 to 2035. Industry demand is primarily driven by the rapidly aging population of the country having a high susceptibility to coagulation disorders. Even for an already-approved diagnostic tool in other regions, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) demands significant local clinical validation before acceptance, making excellent quality and efficacy the expectation.

Research institutes and healthcare providers collaborate to develop innovative tests of coagulation markers. Nevertheless, the high cost of the solutions and a preference for cost-effective solutions may affect purchasing decisions.

China coagulation markers sector is anticipated to retain a significant growth at a CAGR of 9.0% during the forecast period. Wide population base, growing healthcare spending, as well as government initiatives to support research and development in medical technologies are expected to spur growth in the country.

The National Medical Products Administration (NMPA) requires approval procedures of both local clinical trials for imported products, as well as approval for new diagnostic tools to ensure safety and efficacy. In its five-year plans, China has emphasized scientific innovation, creating a favorable policy environment for the development and application of advanced coagulation markers.

The Australia and New Zealand coagulation markers sector is expected to grow at a CAGR of 6.8% during the forecast period of 2025 to 2035. This growth is attributed to the increasing awareness about thrombotic disorders, an aging population, as well as the increasing prevalence of chronic diseases such as cardiovascular and cancer-related complications. Countries have mature, publicly funded health systems that prioritize early diagnostics and evidence-based medicine.

This includes the potential adoption of more sophisticated coagulation-based biomarker assays, especially D-dimer, PT, and fibrinogen assays. There are also thriving academic and clinical research environments that foster innovation and local clinical validation in the sector.

India's coagulation markers sector is expected to grow at a CAGR of 8.2% during 2025 to 2035. This significant growth is due to the increasing number of chronic diseases, such as diabetes, cardiovascular disease, and cancer, all of which hugely elevate the risk of thromboembolic occurrences.

Rising health awareness, middle-class expansion, and public investment in diagnostics are also fueling sector growth. The Medical Device Rules, diagnostic products are regulated by the Central Drugs Standard Control Organization (CDSCO).

The D-dimer Assay segment is expected to be the most lucrative between 2025 and 2035 in the coagulation markers segment. The segment has a CAGR of 8.1%, with strong demand attributed tothe wide application of the assay for the diagnosis of venous thromboembolism (VTE)-associated diseases, particularly Deep Venous Thrombosis (DVT) and Pulmonary Embolism (PE).

The segment offers a great advantage due to the necessity for a noninvasive, highly sensitive, and cost-effective assay in critical clinical scenarios, making the assay currently a widely used laboratory method.

The market is segmented by sample type into Plasma, Serum, Whole blood, and others. The Plasma segment is anticipated to be the most lucrative sample type for the coagulation markers market exhibiting a CAGR of 7.0% during the forecast period. Plasma is still preferred as a sample type, with high compatibility with novel assay technologies, such as ELISA, immunoturbidimetric assays, and fluorescence-based diagnostics.

Plasma samples are devoid of cells and provide higher accuracy and reproducibility, which makes them superior samples for quantitative evaluation of clotting parameters like D-dimer, fibrinogen, etc., in critical care, trauma, and thrombotic disorder assessment.

The coagulation markers industry in 2025 and 2035 will be dominated by the Particle-enhanced Immunoturbidimetric Assay (PEITA) technology segment. The growth of this segment is primarily attributed to the fast turnaround time, high throughput capacity, and automation compatibility of these systems.

Immunoturbidimetric assays have become increasingly preferred for high-volume coagulation testing, particularly for D-dimer and fibrinogen testing, in hospitals and diagnostic laboratories worldwide as these assays are cost effective and readily scalable on fully automated clinical chemistry instrumentation.

Coagulation markers by their individual uses indicate that DVT is poised to be the most profitable application between 2025 and 2035, growing at a Compound Annual Growth Rate (CAGR) of 7.6%. The DVT industry is being propelled by the growing incidence of thrombotic events globally, particularly among elderly, post-surgical, and bedridden patients or patients with chronic illnesses like cancer.

Coagulation marker tests, particularly D-dimer tests, are frontline diagnostics for the detection of DVT. They are being rapidly adopted in emergency rooms, surgical recovery units and outpatient facilities, resulting in an application that is high-volume and high-priority.

From 2025 to 2035, the purpose segment for clinical use is anticipated to be the most profitable in the coagulation markers sector, with an estimated CAGR worth 6.9%. This increase in demand has been attributed to the advent of coagulation marker testing as a standard component of hospital and diagnostic procedures for managing cardiovascular risk, surgical recovery, and oncology-related thrombotic events and in acute situations such as deep venous thrombosis (DVT) and pulmonary embolism (PE).

Reliableand fast coagulation screening in clinical settings is a core requirement for patient management both pre- and post-surgery in light of the growing prevalence of chronic diseases and surgical procedures, especially in aging populations.

The Hospital end user segment is anticipated to emerge as the most lucrative category in global coagulation markers and is expected to grow at a Compound Annual Growth Rate (CAGR) of7.1% during the forecast period between 2025 and 2035. Hospitals are the main locations for acute care, surgery, and emergency, they all require rapid and reliable coagulation diagnostics.

Coagulation markers are incorporated as part of everyday evaluations in cardiovascular events, trauma, orthopedics, and thrombosis screening in oncology. Hospital-based automated analyzers, real-time point-of-care setups, and high-throughput laboratory functions are widely deployed, allowing scalable testing volumes and better patient monitoring.

The industry for coagulation markers has created a consolidated environment with limited players controlling the sector, adding to their share through strategic pricing, targeted innovation, and international outreach. Cost pressures rising throughout healthcare systems, leading manufacturers will refine their pricing strategies to reconcile affordability with sustainable margins.

Sector leaders are increasingly pursuing multi-pronged growth strategies. They are also working through strategic partnerships, especially with hospital networks, diagnostic labs, and academic institutions, to enable us to deploy new diagnostic technologies more rapidly.

Market Share Analysis

Key Developments

The industry is segmented into D-dimer Assay, and Fibrinogen Assay

The industry is segmented into Plasma, Whole Blood Sample, and Other

The industry is segmented into Fluorescence Immunoassay, ELISA, Rapid Test, and Particle-enhanced Immunoturbidimetric Assay

The industry is segmented into Deep Venous Thrombosis (DVT), Pulmonary Embolism (PE), Disseminated Intravascular Coagulation (DIC), and Trauma, and Others

The industry is segmented into Clinical Use, and Research Use Only

The industry is segmented into Hospitals, Specialty Clinics, Academic & Research Institutes, and Diagnostics Laboratories

The industry is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa

These are biological markers that help to assess blood’s ability to clot. They are essential for diagnosing conditions including deep vein thrombosis (DVT), pulmonary embolism (PE), and disseminated intravascular coagulation (DIC) and are found particularly useful in surgical, trauma, and oncology care environments.

Relevant technologies are ELISA, fluorescence immunoassays, rapid tests, and particle-enhanced immunoturbidimetric assays. The selection is based on considerations such as speed, throughput, sensitivity, and point-of-care versus laboratory-based settings.

Increasing numbers of cardiovascular diseases, surgical procedures, and post-COVID complications have heightened the demand for rapid and accurate assessment of coagulation. This AI-Startups Disrupting Healthcare Industry with Automated Diagnosis.

Tightening regulatory standards regarding thrombosis management and clinical guideline updates (from organizations like WHO, American Heart Association) are driving companies to develop more accurate, validated and compliant diagnostic tools.

Hospitals are the principal end user, followed by diagnostic laboratories and specialty clinics. These settings are key adoption hubs due to high patient volumes, the need for urgent diagnostics, and integrated care models.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample Type

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 06: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Purpose

Table 07: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 08: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Region

Table 09: North America Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 11: North America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 12: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample Type

Table 13: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 14: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 15: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Purpose

Table 16: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 17: Latin America Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 18: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 19: Latin America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 20: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample Type

Table 21: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 22: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 23: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Purpose

Table 24: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 25: Europe Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 26: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 27: Europe Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 28: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample Type

Table 29: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 30: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 31: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Purpose

Table 32: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 33: South Asia Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 34: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 35: South Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 36: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample Type

Table 37: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 38: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 39: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Purpose

Table 40: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 41: East Asia Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 42: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 43: East Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 44: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample Type

Table 45: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 46: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 47: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Purpose

Table 48: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 49: Oceania Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 50: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 51: Oceania Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 52: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample Type

Table 53: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 54: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 55: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Purpose

Table 56: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 57: Middle East & Africa Market Value (US$ Million) Analysis 2012-2022 and Forecast 2023 to 2033, by Country

Table 58: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 59: Middle East & Africa Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 60: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample Type

Table 61: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 62: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 63: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Purpose

Table 64: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Figure 01: Global Market Volume (Units), 2012 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 03: Pricing Analysis per unit (US$), in 2023

Figure 04: Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ Million) Analysis, 2012 to 2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023 to 2033

Figure 08: Global Market Value Share (%) Analysis 2023 and 2033, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, by Sample Type

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Sample Type

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, by Sample Type

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, by Technology

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Technology

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, by Technology

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by Application

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Application

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by Application

Figure 20: Global Market Value Share (%) Analysis 2023 and 2033, by Purpose

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Purpose

Figure 22: Global Market Attractiveness Analysis 2023 to 2033, by Purpose

Figure 23: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 24: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by End User

Figure 25: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 26: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 27: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Region

Figure 28: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 29: North America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 30: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 31: North America Market Value Share, By Product (2023 E)

Figure 32: North America Market Value Share, by Sample Type (2023 E)

Figure 33: North America Market Value Share, by Technology (2023 E)

Figure 34: North America Market Value Share, by Application (2023 E)

Figure 35: North America Market Value Share, by Purpose (2023 E)

Figure 36: North America Market Value Share, by End User (2023 E)

Figure 37: North America Market Value Share, by Country (2023 E)

Figure 38: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 39: North America Market Attractiveness Analysis by Sample Type, 2023 to 2033

Figure 40: North America Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 41: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 42: North America Market Attractiveness Analysis by Purpose, 2023 to 2033

Figure 43: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 44: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 45: USA Market Value Proportion Analysis, 2022

Figure 46: Global Vs. USA Growth Comparison

Figure 47: USA Market Share (US$ Million) Analysis, 2012 to 2022

Figure 48: USA Market Share (US$ Million) Forecast, 2023 to 2033

Figure 49: USA Market Share, By Product (2023 E)

Figure 50: USA Market Share, by Sample Type (2023 E)

Figure 51: USA Market Share, by Technology (2023 E)

Figure 52: USA Market Share, by Application (2023 E)

Figure 53: USA Market Share, by Purpose (2023 E)

Figure 54: USA Market Share, by End User (2023 E)

Figure 55: USA Market Share, by Country (2023 E)

Figure 56: Canada Market Value Proportion Analysis, 2022

Figure 57: Global Vs. Canada. Growth Comparison

Figure 58: Canada Market Share Analysis (%) by Product, 2023 & 2033

Figure 59: Canada Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 60: Canada Market Share Analysis (%) by Technology, 2023 & 2033

Figure 61: Canada Market Share Analysis (%) by Application, 2023 & 2033

Figure 62: Canada Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 63: Canada Market Share Analysis (%) by End User, 2023 & 2033

Figure 64: Latin America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 65: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 66: Latin America Market Value Share, By Product (2023 E)

Figure 67: Latin America Market Value Share, by Sample Type (2023 E)

Figure 68: Latin America Market Value Share, by Technology (2023 E)

Figure 69: Latin America Market Value Share, by Application (2023 E)

Figure 70: Latin America Market Value Share, by Purpose (2023 E)

Figure 71: Latin America Market Value Share, by End User (2023 E)

Figure 72: Latin America Market Value Share, by Country (2023 E)

Figure 73: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 74: Latin America Market Attractiveness Analysis by Sample Type, 2023 to 2033

Figure 75: Latin America Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 76: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Attractiveness Analysis by Purpose, 2023 to 2033

Figure 78: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 79: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 80: Mexico Market Value Proportion Analysis, 2022

Figure 81: Global Vs Mexico Growth Comparison

Figure 82: Mexico Market Share Analysis (%) by Product, 2023 & 2033

Figure 83: Mexico Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 84: Mexico Market Share Analysis (%) by Technology, 2023 & 2033

Figure 85: Mexico Market Share Analysis (%) by Application, 2023 & 2033

Figure 86: Mexico Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 87: Mexico Market Share Analysis (%) by End User, 2023 & 2033

Figure 88: Brazil Market Value Proportion Analysis, 2022

Figure 89: Global Vs. Brazil. Growth Comparison

Figure 90: Brazil Market Share Analysis (%) by Product, 2023 & 2033

Figure 91: Brazil Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 92: Brazil Market Share Analysis (%) by Technology, 2023 & 2033

Figure 93: Brazil Market Share Analysis (%) by Application, 2023 & 2033

Figure 94: Brazil Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 95: Brazil Market Share Analysis (%) by End User, 2023 & 2033

Figure 96: Argentina Market Value Proportion Analysis, 2022

Figure 97: Global Vs Argentina Growth Comparison

Figure 98: Argentina Market Share Analysis (%) by Product, 2023 & 2033

Figure 99: Argentina Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 100: Argentina Market Share Analysis (%) by Technology, 2023 & 2033

Figure 101: Argentina Market Share Analysis (%) by Application, 2023 & 2033

Figure 102: Argentina Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 103: Argentina Market Share Analysis (%) by End User, 2023 & 2033

Figure 104: Europe Market Value (US$ Million) Analysis, 2012 to 2022

Figure 105: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 106: Europe Market Value Share, By Product (2023 E)

Figure 107: Europe Market Value Share, by Sample Type (2023 E)

Figure 108: Europe Market Value Share, by Technology (2023 E)

Figure 109: Europe Market Value Share, by Application (2023 E)

Figure 110: Europe Market Value Share, by Purpose (2023 E)

Figure 111: Europe Market Value Share, by End User (2023 E)

Figure 112: Europe Market Value Share, by Country (2023 E)

Figure 113: Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 114: Europe Market Attractiveness Analysis by Sample Type, 2023 to 2033

Figure 115: Europe Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 116: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 117: Europe Market Attractiveness Analysis by Purpose, 2023 to 2033

Figure 118: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 119: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 120: UK Market Value Proportion Analysis, 2022

Figure 121: Global Vs. UK Growth Comparison

Figure 122: UK Market Share Analysis (%) by Product, 2023 & 2033

Figure 123: UK Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 124: UK Market Share Analysis (%) by Technology, 2023 & 2033

Figure 125: UK Market Share Analysis (%) by Application, 2023 & 2033

Figure 126: UK Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 127: UK Market Share Analysis (%) by End User, 2023 & 2033

Figure 128: Germany Market Value Proportion Analysis, 2022

Figure 129: Global Vs. Germany Growth Comparison

Figure 130: Germany Market Share Analysis (%) by Product, 2023 & 2033

Figure 131: Germany Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 132: Germany Market Share Analysis (%) by Technology, 2023 & 2033

Figure 133: Germany Market Share Analysis (%) by Application, 2023 & 2033

Figure 134: Germany Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 135: Germany Market Share Analysis (%) by End User, 2023 & 2033

Figure 136: Italy Market Value Proportion Analysis, 2022

Figure 137: Global Vs. Italy Growth Comparison

Figure 138: Italy Market Share Analysis (%) by Product, 2023 & 2033

Figure 139: Italy Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 140: Italy Market Share Analysis (%) by Technology, 2023 & 2033

Figure 141: Italy Market Share Analysis (%) by Application, 2023 & 2033

Figure 142: Italy Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 143: Italy Market Share Analysis (%) by End User, 2023 & 2033

Figure 144: France Market Value Proportion Analysis, 2022

Figure 145: Global Vs France Growth Comparison

Figure 146: France Market Share Analysis (%) by Product, 2023 & 2033

Figure 147: France Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 148: France Market Share Analysis (%) by Technology, 2023 & 2033

Figure 149: France Market Share Analysis (%) by Application, 2023 & 2033

Figure 150: France Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 151: France Market Share Analysis (%) by End User, 2023 & 2033

Figure 152: Spain Market Value Proportion Analysis, 2022

Figure 153: Global Vs Spain Growth Comparison

Figure 154: Spain Market Share Analysis (%) by Product, 2023 & 2033

Figure 155: Spain Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 156: Spain Market Share Analysis (%) by Technology, 2023 & 2033

Figure 157: Spain Market Share Analysis (%) by Application, 2023 & 2033

Figure 158: Spain Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 159: Spain Market Share Analysis (%) by End User, 2023 & 2033

Figure 160: Russia Market Value Proportion Analysis, 2022

Figure 161: Global Vs Russia Growth Comparison

Figure 162: Russia Market Share Analysis (%) by Product, 2023 & 2033

Figure 163: Russia Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 164: Russia Market Share Analysis (%) by Technology, 2023 & 2033

Figure 165: Russia Market Share Analysis (%) by Application, 2023 & 2033

Figure 166: Russia Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 167: Russia Market Share Analysis (%) by End User, 2023 & 2033

Figure 168: BENELUX Market Value Proportion Analysis, 2022

Figure 169: Global Vs BENELUX Growth Comparison

Figure 170: BENELUX Market Share Analysis (%) by Product, 2023 & 2033

Figure 171: BENELUX Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 172: BENELUX Market Share Analysis (%) by Technology, 2023 & 2033

Figure 173: BENELUX Market Share Analysis (%) by Application, 2023 & 2033

Figure 174: BENELUX Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 175: BENELUX Market Share Analysis (%) by End User, 2023 & 2033

Figure 176: East Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 177: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 178: East Asia Market Value Share, By Product (2023 E)

Figure 179: East Asia Market Value Share, by Sample Type (2023 E)

Figure 180: East Asia Market Value Share, by Technology (2023 E)

Figure 181: East Asia Market Value Share, by Application (2023 E)

Figure 182: East Asia Market Value Share, by Purpose (2023 E)

Figure 183: East Asia Market Value Share, by End User (2023 E)

Figure 184: East Asia Market Value Share, by Country (2023 E)

Figure 185: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 186: East Asia Market Attractiveness Analysis by Sample Type, 2023 to 2033

Figure 187: East Asia Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 188: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 189: East Asia Market Attractiveness Analysis by Purpose, 2023 to 2033

Figure 190: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 191: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 192: China Market Value Proportion Analysis, 2022

Figure 193: Global Vs. China Growth Comparison

Figure 194: China Market Share Analysis (%) by Product, 2023 & 2033

Figure 195: China Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 196: China Market Share Analysis (%) by Technology, 2023 & 2033

Figure 197: China Market Share Analysis (%) by Application, 2023 & 2033

Figure 198: China Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 199: China Market Share Analysis (%) by End User, 2023 & 2033

Figure 200: Japan Market Value Proportion Analysis, 2022

Figure 201: Global Vs. Japan Growth Comparison

Figure 202: Japan Market Share Analysis (%) by Product, 2023 & 2033

Figure 203: Japan Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 204: Japan Market Share Analysis (%) by Technology, 2023 & 2033

Figure 205: Japan Market Share Analysis (%) by Application, 2023 & 2033

Figure 206: Japan Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 207: Japan Market Share Analysis (%) by End User, 2023 & 2033

Figure 208: South Korea Market Value Proportion Analysis, 2022

Figure 209: Global Vs South Korea Growth Comparison

Figure 210: South Korea Market Share Analysis (%) by Product, 2023 & 2033

Figure 211: South Korea Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 212: South Korea Market Share Analysis (%) by Technology, 2023 & 2033

Figure 213: South Korea Market Share Analysis (%) by Application, 2023 & 2033

Figure 214: South Korea Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 215: South Korea Market Share Analysis (%) by End User, 2023 & 2033

Figure 216: South Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 217: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 218: South Asia Market Value Share, By Product (2023 E)

Figure 219: South Asia Market Value Share, by Sample Type (2023 E)

Figure 220: South Asia Market Value Share, by Technology (2023 E)

Figure 221: South Asia Market Value Share, by Application (2023 E)

Figure 222: South Asia Market Value Share, by Purpose (2023 E)

Figure 223: South Asia Market Value Share, by End User (2023 E)

Figure 224: South Asia Market Value Share, by Country (2023 E)

Figure 225: South Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 226: South Asia Market Attractiveness Analysis by Sample Type, 2023 to 2033

Figure 227: South Asia Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 228: South Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 229: South Asia Market Attractiveness Analysis by Purpose, 2023 to 2033

Figure 230: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 231: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 232: India Market Value Proportion Analysis, 2022

Figure 233: Global Vs. India Growth Comparison

Figure 234: India Market Share Analysis (%) by Product, 2023 & 2033

Figure 235: India Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 236: India Market Share Analysis (%) by Technology, 2023 & 2033

Figure 237: India Market Share Analysis (%) by Application, 2023 & 2033

Figure 238: India Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 239: India Market Share Analysis (%) by End User, 2023 & 2033

Figure 240: Indonesia Market Value Proportion Analysis, 2022

Figure 241: Global Vs. Indonesia Growth Comparison

Figure 242: Indonesia Market Share Analysis (%) by Product, 2023 & 2033

Figure 243: Indonesia Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 244: Indonesia Market Share Analysis (%) by Technology, 2023 & 2033

Figure 245: Indonesia Market Share Analysis (%) by Application, 2023 & 2033

Figure 246: Indonesia Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 247: Indonesia Market Share Analysis (%) by End User, 2023 & 2033

Figure 248: Malaysia Market Value Proportion Analysis, 2022

Figure 249: Global Vs. Malaysia Growth Comparison

Figure 250: Malaysia Market Share Analysis (%) by Product, 2023 & 2033

Figure 251: Malaysia Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 252: Malaysia Market Share Analysis (%) by Technology, 2023 & 2033

Figure 253: Malaysia Market Share Analysis (%) by Application, 2023 & 2033

Figure 254: Malaysia Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 255: Malaysia Market Share Analysis (%) by End User, 2023 & 2033

Figure 256: Thailand Market Value Proportion Analysis, 2022

Figure 257: Global Vs. Thailand Growth Comparison

Figure 258: Thailand Market Share Analysis (%) by Product, 2023 & 2033

Figure 259: Thailand Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 260: Thailand Market Share Analysis (%) by Technology, 2023 & 2033

Figure 261: Thailand Market Share Analysis (%) by Application, 2023 & 2033

Figure 262: Thailand Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 263: Thailand Market Share Analysis (%) by End User, 2023 & 2033

Figure 264: Oceania Market Value (US$ Million) Analysis, 2012 to 2022

Figure 265: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 266: Oceania Market Value Share, By Product (2023 E)

Figure 267: Oceania Market Value Share, by Sample Type (2023 E)

Figure 268: Oceania Market Value Share, by Technology (2023 E)

Figure 269: Oceania Market Value Share, by Application (2023 E)

Figure 270: Oceania Market Value Share, by Purpose (2023 E)

Figure 271: Oceania Market Value Share, by End User (2023 E)

Figure 272: Oceania Market Value Share, by Country (2023 E)

Figure 273: Oceania Market Attractiveness Analysis by Product, 2023 to 2033

Figure 274: Oceania Market Attractiveness Analysis by Sample Type, 2023 to 2033

Figure 275: Oceania Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 276: Oceania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 277: Oceania Market Attractiveness Analysis by Purpose, 2023 to 2033

Figure 278: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 279: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 280: Australia Market Value Proportion Analysis, 2022

Figure 281: Global Vs. Australia Growth Comparison

Figure 282: Australia Market Share Analysis (%) by Product, 2023 & 2033

Figure 283: Australia Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 284: Australia Market Share Analysis (%) by Technology, 2023 & 2033

Figure 285: Australia Market Share Analysis (%) by Application, 2023 & 2033

Figure 286: Australia Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 287: Australia Market Share Analysis (%) by End User, 2023 & 2033

Figure 288: New Zealand Market Value Proportion Analysis, 2022

Figure 289: Global Vs New Zealand Growth Comparison

Figure 290: New Zealand Market Share Analysis (%) by Product, 2023 & 2033

Figure 291: New Zealand Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 292: New Zealand Market Share Analysis (%) by Technology, 2023 & 2033

Figure 293: New Zealand Market Share Analysis (%) by Application, 2023 & 2033

Figure 294: New Zealand Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 295: New Zealand Market Share Analysis (%) by End User, 2023 & 2033

Figure 296: Middle East & Africa Market Value (US$ Million) Analysis, 2012 to 2022

Figure 297: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 298: Middle East & Africa Market Value Share, By Product (2023 E)

Figure 299: Middle East & Africa Market Value Share, by Sample Type (2023 E)

Figure 300: Middle East & Africa Market Value Share, by Technology (2023 E)

Figure 301: Middle East & Africa Market Value Share, by Application (2023 E)

Figure 302: Middle East & Africa Market Value Share, by Purpose (2023 E)

Figure 303: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 304: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 305: Middle East & Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 306: Middle East & Africa Market Attractiveness Analysis by Sample Type, 2023 to 2033

Figure 307: Middle East & Africa Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 308: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 309: Middle East & Africa Market Attractiveness Analysis by Purpose, 2023 to 2033

Figure 310: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 311: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 312: GCC Countries Market Value Proportion Analysis, 2022

Figure 313: Global Vs GCC Countries Growth Comparison

Figure 314: GCC Countries Market Share Analysis (%) by Product, 2023 & 2033

Figure 315: GCC Countries Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 316: GCC Countries Market Share Analysis (%) by Technology, 2023 & 2033

Figure 317: GCC Countries Market Share Analysis (%) by Application, 2023 & 2033

Figure 318: GCC Countries Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 319: GCC Countries Market Share Analysis (%) by End User, 2023 & 2033

Figure 320: Türkiye Market Value Proportion Analysis, 2022

Figure 321: Global Vs. Türkiye Growth Comparison

Figure 322: Türkiye Market Share Analysis (%) by Product, 2023 & 2033

Figure 323: Türkiye Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 324: Türkiye Market Share Analysis (%) by Technology, 2023 & 2033

Figure 325: Türkiye Market Share Analysis (%) by Application, 2023 & 2033

Figure 326: Türkiye Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 327: Türkiye Market Share Analysis (%) by End User, 2023 & 2033

Figure 328: South Africa Market Value Proportion Analysis, 2022

Figure 329: Global Vs. South Africa Growth Comparison

Figure 330: South Africa Market Share Analysis (%) by Product, 2023 & 2033

Figure 331: South Africa Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 332: South Africa Market Share Analysis (%) by Technology, 2023 & 2033

Figure 333: South Africa Market Share Analysis (%) by Application, 2023 & 2033

Figure 334: South Africa Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 335: South Africa Market Share Analysis (%) by End User, 2023 & 2033

Figure 336: Northern Africa Market Value Proportion Analysis, 2022

Figure 337: Global Vs Northern Africa Growth Comparison

Figure 338: Northern Africa Market Share Analysis (%) by Product, 2023 & 2033

Figure 339: Northern Africa Market Share Analysis (%) by Sample Type, 2023 & 2033

Figure 340: Northern Africa Market Share Analysis (%) by Technology, 2023 & 2033

Figure 341: Northern Africa Market Share Analysis (%) by Application, 2023 & 2033

Figure 342: Northern Africa Market Share Analysis (%) by Purpose, 2023 & 2033

Figure 343: Northern Africa Market Share Analysis (%) by End User, 2023 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coagulation Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Coagulation Disorders Market

Blood Coagulation Analyzers Market Growth – Trends & Forecast 2025 to 2035

Rapid Coagulation Testing Market

Special Coagulation Tests Market Size and Share Forecast Outlook 2025 to 2035

Retinal Laser Photocoagulation Market Size and Share Forecast Outlook 2025 to 2035

Disseminated Intravascular Coagulation (DIC) Treatment Market Analysis – Size, Share & Forecast 2025 to 2035

EPO Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Hepatic Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Imaging Markers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Diabetic Markers Market Size and Share Forecast Outlook 2025 to 2035

Fiducial Markers Market - Demand, Growth & Forecast 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Electrolyte Markers Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Inflammatory Markers Market

Chronic Phase Markers Market Size and Share Forecast Outlook 2025 to 2035

Prognostic Biomarkers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA