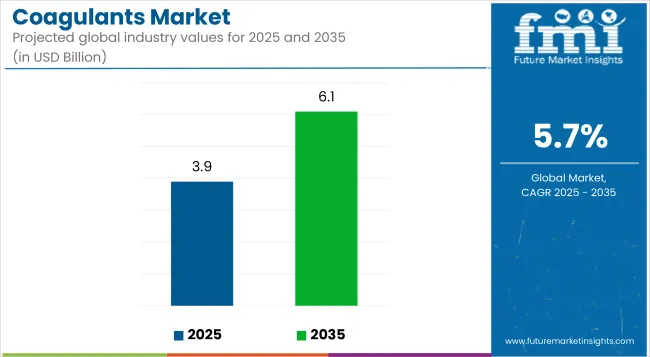

The global coagulants market is worth USD 3.9 billion in 2025 and is expected to reach USD 6.1 billion by 2035, reflecting a CAGR of 5.7%.

| Metric | Values |

|---|---|

| Estimated Size (2025E) | USD 3.9 billion |

| Projected Value (2035F) | USD 6.1 billion |

| CAGR (2025 to 2035) | 5.7% |

Factors driving this expansion include increased demand for clean water, rising urban populations, and stricter environmental regulations worldwide. Rapid industrialization in emerging economies, along with the growing need for efficient wastewater treatment technologies, is further accelerating market growth.

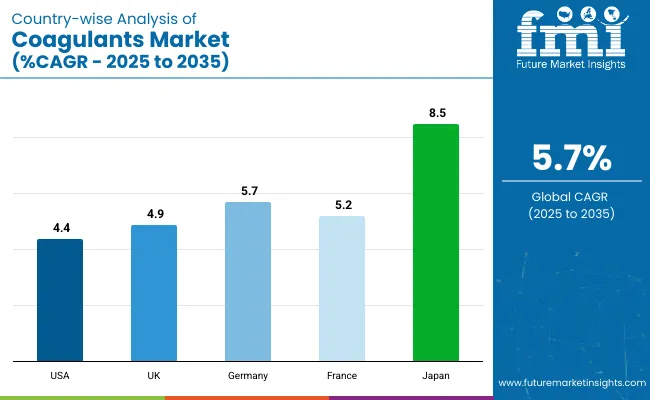

The USA is anticipated to hold the largest market share by 2035, growing at a CAGR of 4.4%, driven by its oil and gas industry expansion. Japan is expected to register the fastest growth at a prominent CAGR of 8.5%.

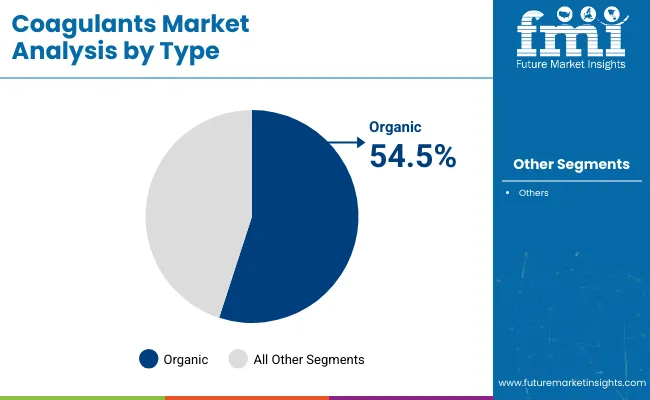

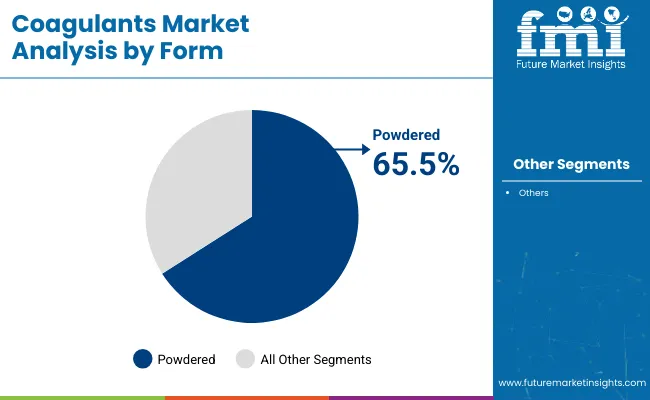

Germany and France are forecasted to grow at significant rates, with respective CAGRs of 5.7% and 5.2%, driven by rising urban populations and increased government focus on water quality. The powder form of coagulants is projected to hold 65.5% of the market share, while organic coagulants by type segment accounts for a share of 54.5% in 2025.

The market holds a significant share within the broader water treatment and specialty chemical sectors. It is estimated to account for approximately 18-22% of the Water treatment chemicals market, given its essential role in primary treatment stages. Within the wastewater treatment market, coagulants contribute nearly 15-18%, as they are fundamental in industrial and municipal effluent processing.

In the specialty chemicals market, coagulants represent a more niche portion, contributing around 5-7%. Within the industrial water management market, their share ranges from 10-12%, especially in sectors like oil & gas and pulp & paper that demand continuous water purification processes.

The global coagulants market is segmented by type, end-use, form, and region. By type, it is segmented intoorganic, inorganic, and organic-inorganic blends. Byend-use, it includes water & wastewater treatment, pulp and paper, oil & gas, agriculture and others (includes textiles, food processing, chemical manufacturing). By form, it is segmented into powder and liquid. By region, it covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia,the Pacific, the Middle East and Africa.

Organic coagulants are projected to lead the coagulant type segment with a 54.5% market share in 2025, driven by their biodegradable properties and lower sludge production. Among them, PolyDADMACs are widely used in municipal and industrial water treatment due to their high charge density and effectiveness across a broad pH range.

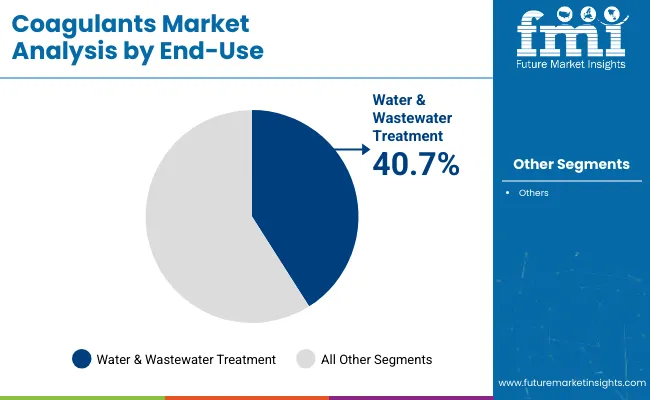

Water & wastewater treatment is expected to maintain dominance with a 40.7% share in 2025, underpinned by rising urbanization and municipal infrastructure investments. Coagulants are essential in removing solids, heavy metals, and organic pollutants, particularly in densely populated countries like India and China. The increasing stringency of effluent discharge standards and the need to reuse treated water are key contributors to sustained demand in this segment.

Powdered coagulants are projected to account for 65.5% of the market in 2025, thanks to their stability, ease of transportation, and superior shelf life. Their versatility in dosing and faster dissolution rate makes them suitable for both batch and continuous operations across industries. They are especially preferred in remote or infrastructure-poor regions where liquid handling systems are limited.

Recent Trends in the Coagulants Market

Key Challenges Impacting Market Growth

Among the top five countries, Japan is projected to witness the fastest growth in the coagulants market with a CAGR of 8.5% from 2025 to 2035, driven by advanced wastewater recycling and AI-based treatment systems.

Germany and France follow with CAGRs of 5.7% and 5.2%, respectively, supported by strong environmental regulations and innovations in coagulant formulations. The United Kingdom is expected to expand at a CAGR of 4.9%, driven by aging infrastructure upgrades. The United States, despite its market size, will grow at a relatively modest CAGR of 4.4%, primarily influenced by its oil & gas sector needs.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA coagulants revenue is projected to grow at a CAGR of 4.4% from 2025 to 2035, driven by the increasing need for effective wastewater treatment in the oil & gas sector. As one of the world’s top oil producers, the country generates vast volumes of produced water that require advanced separation and purification technologies. Demand for organic coagulants is increasing due to their environmental compatibility and performance benefits.

The coagulants market in the UK is expected to expand at a moderate CAGR of 4.9% during the forecast period, bolstered by stringent water quality regulations and the country’s emphasis on sustainable water treatment.

The UK’s aging water infrastructure requires frequent upgrades, pushing demand for high-efficiency coagulants. Industrial sectors like food processing and pharmaceuticals are key contributors to wastewater volumes.

The revenue from coagulants in Germany is forecasted to rise at a CAGR of 5.7% between 2025 and 2035. Advanced coagulants, especially those based on nanotechnology and hybrid organic-inorganic blends, are seeing rapid adoption.

Germany’s strong environmental regulations and its leadership in industrial water treatment make it a hotspot for innovation. Power generation and municipal utilities are the leading application areas, especially in regions facing persistent groundwater contamination.

The sales of coagulants in France are projected to experience a steady CAGR of 5.2% over the 2025-2035 period, supported by rising environmental consciousness and government mandates on pollution control. The country is investing in decentralized water treatment facilities, particularly in rural areas, to improve access to clean water. The demand for organic coagulants is increasing, especially in the agriculture and food processing sectors.

The coagulants industry in Japan is estimated to register a robust CAGR of 8.5% from 2025 to 2035, driven by urban density, industrial complexity, and limited freshwater availability. Advanced wastewater recycling technologies are heavily deployed in metropolitan areas. Japan is investing in AI-integrated water treatment systems, where coagulants play a vital role in smart dosing and flocculation processes.

The global market is moderately fragmented, with a mix of multinational corporations and regional specialists shaping competitive dynamics. Prominent suppliers such as BASF SE, SNF Group, Solenis, and Kemira lead the industry, leveraging economies of scale, product innovation, and integrated service models. These Tier-1 companies maintain dominance by investing in R&D, offering customized formulations, and building robust supply chains to serve both municipal and industrial customers globally.

Strategic initiatives among leading players include pricing competitiveness in emerging markets, sustainability-focused innovations like bio-based and hybrid coagulants, and inorganic growth through acquisitions. For instance, SNF Group continues to expand production capabilities, while Ecolab and Kemira are focusing on digital monitoring systems for dosing accuracy.

Companies like Mitsubishi Chemical and Feralco are forging long-term partnerships with government and private sector utilities to increase their footprint in Asia and Europe, respectively. Meanwhile, USA-based players such as Solenis and ChemTreat are enhancing service models with real-time analytics and automation integration.

Recent Coagulants Market News

In November 2024, BASF inked a deal with Acies Bio to advance sustainable production in personal and home care ingredients.

| Report Attributes | Details |

| Current Total Market Size (2025) | USD 3.9 billion |

| Projected Market Size (2035) | USD 6.1 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in metric tons |

| By Type | Organic (Polyamines, PolyDADMACs, Melamine Formaldehyde, Others), Inorganic (Aluminum Sulfate, Ferric Chloride, PAC, PAS, Ferric Sulfate, Others), Organic & Inorganic Blend |

| By End-Use | Water & Wastewater Treatment, Pulp and Paper, Oil & Gas, Agriculture, Others (Food Processing, Textiles, Chemicals) |

| By Form | Powder, Liquid |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | BASF SE, SNF Group, Solenis, Kemira, Mitsubishi Chemical Holding Company, Feralco AB, Avista Technologies Inc., ChemTreat Inc., Buckman, Ecolab, SUEZ, GE Water & Process Technologies, AkzoNobel, Ashland, Italmatch Chemicals, Kurita Water Industries Ltd., Nalco Water, an Ecolab Company, Accepta, SNF Floerger, Aries Chemical |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

By Type, the segment has been categorized into Organic (PolyDADMACs, Polyamines, Formaldehyde Melamine and Others) and Inorganic (Polyaluminum Chloride, Ferric Chloride, Aluminum Sulfate, PolyaluminumSulfate, Ferric Sulfate, and Others)

By end use, industry included Water & Wastewater Treatment, Pulp, and Paper, Oil & Gas, Agriculture, and others

The form includes powder and Liquid

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market size is valued at USD 3.9 billion in 2025.

The market is forecasted to reach USD 6.1 billion by 2035, reflecting a CAGR of 5.7%.

Powdered coagulants are expected to lead with a 65.5% market share in 2025.

Water & wastewater treatment is projected to account for 40.7% of the market in 2025.

Japan is anticipated to grow at the fastest pace with a CAGR of 8.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oral Anticoagulants Market

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Direct Oral Anticoagulants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA