This sprawling international medico-pharmaceutical industry focused on treating and alleviating disorders of the central nervous system will be poised for monumental expansion from now until the middle of the next century. Fueled at the time by a growing prevalence of neurological diseases, burgeoning advances in treatment modalities, and generous investments in neuroscience research, the field seemed primed for growth in the near term.

Chronic disorders of the central nervous system, including Alzheimer's, Parkinson's, epilepsy, multiple sclerosis, and depression, remain concerns requiring continuous remediation and novel agents. On the other hand, the growing implementation of personalized therapeutic methodologies specific to the individual patient and technological innovations in neurostimulation, directed delivery of medicaments and regeneration techniques, drive market expansion.

And other factors like the expansion of digital health technologies, increased clinical trials of new CNS therapies, and greater attention to mental health issues are all propelling the fast evolution of the industry in the coming decades.

The integration of artificial intelligence powered diagnostics, enhanced neuroimaging techniques providing more details than ever before, and the rise of more cost effective biologic treatments will only further propel the marketplace forward.

Additionally, the advancement of gene therapies tailored for individuals, personalized medicine approaches considering one's unique genetic makeup, and noninvasive neuromodulation techniques that avoid surgery are playing a pivotal role in this market penetrating deeper and gaining greater adoption among those it can help.

Explore FMI!

Book a free demo

North America has managed to preserve its dominance in the agitation of central nervous system disorders due to its impressive healthcare infrastructure and significantly high investments in research. “Just as discover more effective treatments depend on new therapies that you can only find up north like biologics to treat auto-immune diseases, gene editing techniques for genetic disorders, and brain-computer interface strategies for combatting neurodegenerative disease and mental health, the United States is fortunate to be on the frontier of developing these therapies.”

Government support for mental health programs in these nations has lent support to growing adoption of cutting-edge medical technologies. The market is being further consolidated by regulatory approval of new CNS drugs and increasing use of telemedicine for neurological conditions.

Newer digital technologies, such as wearable solutions to monitor cognition, are being created and adopted more frequently -spurring innovation in products and services. At the same time, demand for psychiatric care has spurred the commercialization of next-generation solutions as technology advances and awareness grows. The advancement of digital therapeutics is also responsible for continuous product updates and adoption across the region.

Europe’s neuropharmacology scene bears an increasing call for innovations, state-backed medical drives, and concerted lab undertakings meant to further CNS medication progression. Nations like Germany, France, and the UK are zeroing in on crafting high-precision, focused-on-the-patient remedies for neural shrinkage and mental issue amid their subjects.

The developing spotlight on early finding, clinical preliminaries for medications intended to change maladies, and man-made brainpower in neurology are adding to more extensive acknowledgment of options.

Additionally, extending applications in geriatric human services, rehab advancements, and neuromodulation treatments are making more open doors for pharmaceutical and biotech organizations. Individuals pursue wellbeing with expanding longing, while specialists chase new roads with enduring trust.

The CNS treatment and therapy market is projected to grow at the fastest rate in the Asia-Pacific region due to an increase in elderly populations, tidal volume and enhancing access to advanced healthcare. Top countries are China, India and Japan investing in CNS Innovations in Neuroscience Research, Precision Medicine and Digital Health.

Strengthened government healthcare spending and increased number of neuropsychiatric treatment centers and evolving regulatory is paving way for regional market growth along with investments made by pharmaceutical industry for CNS drug development.

In addition, growing prevalence rates of neurological and mental health conditions, coupled with demand for affordable therapies is further driving market penetration. The growing number of domestic pharmaceutical manufactures and tie-ups with foreign biotech companies is also adding to the growth of the market.

The Latin America Neurological Device market is driven by the growing awareness of neurological disorders, the increasing demand for treatment of psychiatric and neurodegenerative diseases, and the expanding investment in healthcare infrastructure. Brazil and Mexico are important regional players, with efforts toward increasing the accessibility of high efficacy CNS medications, such as antidepressants, antiepileptic medications, and neurostimulation devices.

Market growth is also being propelled by the merging of government healthcare programs, cost-efficient treatment alternatives, and public health efforts for mental wellness. Increasing clinical trials, significant funding in neurology developmental research, and consumer-driven demand for increased access to neurological care are contributing towards improved treatment accessibility across the region.

9.7.3 Middle East & Africa CNS treatment and therapy market, by country. The UAE and South Africa are spearheading initiatives to improve accessibility to neurological treatment and innovations in the field. Increasing market growth is due to the rising acceptance of digital mental health platforms, the growing demand for advanced neurodiagnostics, and collaboration between global pharmaceutical companies and domestic healthcare service providers.

Robust government policies for bettering the mental healthcare infrastructure, innovations in brain imaging technologies, and smoothing the path of consumer-driven demand for cognitive health solutions will drive long-term industry growth. Continuous growth of mental health awareness initiatives and the presence of pharmaceutical R&D centers globally are also creating demand for CNS treatment across the region.

Ongoing development in neuropharmacology, gene therapy, and AI-driven diagnostics ensure steady growth of CNS treatments & therapies market over the forecast period. Innovation in disease-modifying drugs, precision medicine approaches, and non-invasive neuromodulation therapies allow companies to enhance functionality, market appeal, and long-term patient outcomes.

Consumer Awareness In Mental Wellness. Digitalization In Healthcare Solutions. Emerging Treatments Methodologies Are Reinventing The Landscape Of The Sector. Furthermore, The global application of AI-powered diagnostics, virtual reality-based cognitive therapy, and personalized neurology treatments is further enhancing therapeutic outcomes and guaranteeing high-quality patient care.

Challenge

High Drug Development Costs and Regulatory Hurdles

High expenditure requirements for CNs treatment and therapy are another factor for the growth of this market sector and in addition, drug combine dares, clinical tests and regulatory filtration are key problems for CNS treatments and likewise therapy segment. Drugs for central nervous system (CNS) disorders such as Alzheimer's, Parkinson's, epilepsy, depression and others require extensive research and testing to determine their efficacy and safety.

Moreover, strict regulations by agencies such as the FDA and EMA, in addition to the challenge in CNS drug mechanisms, further lead to prolonged approval timelines and high failure rates. By focusing on these aspects and embracing new technologies, pharmaceutical companies can overcome these challenges and ultimately improve the success rates and reduce the costs associated with drug development.

Limited Treatment Efficacy and Side Effects

While CNS therapies have progressed, many treatments available do not have high efficacy, do not provide prolonged relief, or result in considerable side-effects. The management of conditions such as multiple sclerosis, schizophrenia, and chronic pain are often lifelong processes, so the development of treatments that improve patient quality of life becomes paramount. The blood-brain barrier (BBB) also presents another challenge in terms of drug delivery, limiting the effectiveness of many CNS medications. How to do this is to concentrate on the development of targeted, drug delivery systems, innovative biologics, and gene therapies that can be clinically223-used to improve treatment outcomes while limiting adverse effects.

Opportunity

Growth in Neuromodulation and Personalized Medicine

Additionally, neuromodulation techniques are an emerging opportunity area with therapies involving deep brain stimulation (DBS), transcranial magnetic stimulation (TMS), and vagus nerve stimulation (VNS) emerging as key therapies. Offering these patients an alternative to their drug resistant CNS disorders, these therapies are minimally invasive or non-invasive and minimize the use of pharmaceuticals.

New technologies in personalized medicine, including pharmacogenomics and AI-driven diagnostics, enable the development of customized treatment regimens according to an individual’s genetic and neuropathological disposition. Innovations like AI-enabled patient tracking systems, wearable bio-sensors, and neurological stimulation devices will give companies a competitive advantage in the growing CNS treatment space.

Advancements in Biologics, Gene Therapy, and Regenerative Medicine

The CNS treatment and therapy market is being transformed as novel biologics, gene therapy, and stem cell therapies emerge. These new therapeutic modalities are being suggested to target neuronal structures and recover chronic neurodegeneration and therefore, produce disease-modifying effects in neurodegenerative disorders such as amyotrophic lateral sclerosis (ALS), spinal cord injury as well as neurodegenerative diseases rather than just alleviating symptoms.

Moreover, novel CRISPR gene editing technology, neurotrophic factor therapies, and processes that make induced pluripotent stem cells (iPSCs) are opening up new frontiers in regenerative medicine.The next generation of CNS treatment innovations will be powered by companies that harness these advanced technologies, collaborate with academic institutions, and obtain regulatory fast-track approvals.

CNS Treatment and Therapy Market Dynamics and Future Trends 2025 to 2035 Between 2020 and 2024, there were remarkable advances in the CNS treatment and therapy sector, focusing on areas like digital therapeutics, artificial intelligence-driven drug discovery, and neuromodulation therapies.

But instead, high prices and R&D costs or drug development failures, as well as accessibility, remained ongoing threats. And biopharma companies stepped up, developing artificial intelligence tools for clinical trials, repurposing existing pharmaceuticals and improving collaboration between biotech companies and research institutes to speed up innovation.

For 2025 to 2035, the market will see transformative advancements in precision neurology, brain-computer interfaces (BCIs), and regenerative CNS therapies. Innovations like AI-driven cognitive assessment tools, wearable neuro monitors for cognition, and neuroimaging will enable early diagnosis and treatment of disease.

Elsewhere, uses of blockchain in protecting clinical data, telemedicine in delivering neurological services remotely, and nanotechnology for drug delivery will transform CNS treatment paradigms. The next wave of CNS innovations will be driven in large part by companies that embrace digital transformation, regenerative medicine, and patient-centric care models.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter drug approval processes and compliance requirements |

| Technological Advancements | Growth in digital therapeutics and AI-assisted drug discovery |

| Industry Adoption | Increased use of neuromodulation and targeted biologics |

| Supply Chain and Sourcing | Dependence on traditional pharmaceutical supply chains |

| Market Competition | Dominance of large pharmaceutical companies |

| Market Growth Drivers | Rising prevalence of neurodegenerative and psychiatric disorders |

| Sustainability and Energy Efficiency | Initial focus on reducing waste in drug manufacturing |

| Integration of Smart Monitoring | Limited AI-driven patient monitoring systems |

| Advancements in Treatment Innovation | Development of novel small molecules and biologics |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven regulatory frameworks, accelerated approvals for breakthrough CNS therapies, and blockchain-enabled data transparency |

| Technological Advancements | Expansion of brain-computer interfaces, nanotechnology-based drug delivery, and bioelectronic medicine |

| Industry Adoption | Mainstream adoption of gene therapy, regenerative CNS treatments, and AI-powered precision medicine |

| Supply Chain and Sourcing | Shift toward localized biotech manufacturing, 3D-printed drug formulations, and decentralized clinical trials |

| Market Competition | Rise of biotech startups, AI-driven drug discovery firms, and personalized medicine providers |

| Market Growth Drivers | Growth in neuroprotective therapies, brain health optimization, and predictive analytics for early disease detection |

| Sustainability and Energy Efficiency | Adoption of green chemistry, biodegradable drug carriers, and energy-efficient biopharmaceutical production |

| Integration of Smart Monitoring | Widespread implementation of wearable neurotech, real-time cognitive tracking, and remote AI-assisted therapy |

| Advancements in Treatment Innovation | Introduction of gene-editing therapies, neuroplasticity-enhancing drugs, and bioengineered neural tissue implants |

Strong healthcare infrastructure, higher prevalence of CNS disorders and advancements in drug development are primely responsible for the USA being the major contributor towards CNS treatment and therapy market. The market growth is attributed due to the presence of multinational pharmaceutical organizations and ongoing work in neurodegenerative diseases.

The market also anticipates the increase in demand for biologics and gene therapies as innovative CNS therapies, the growing role of AI in drug discovery, and precision medicine. Moreover, rising acceptance of digital therapeutics, neurostimulation devices, and individualized treatment strategies are improving treatment outcome.

Companies are also concentrating on new small-molecule drugs and targeted therapies for diseases like Alzheimer’s, Parkinson’s and multiple sclerosis. In the USA, the market is further driven by government funding for mental health research and CNS disorder treatment.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

This is attributed to the major investments in neuroscience research, rising demand for mental health solutions, and improved accessibility to novel therapeutics are driving the market growth of CNS in the UK. Also driving demand is the emphasis on early diagnosis and intervention.

Government initiatives supporting mental health awareness are expected to aid the market growth along with advancements in neuroimaging and biomarker-based diagnostics. Stem Cell Therapy CNS/Germline Tailored Therapies: Modulating CNS Disorders: The data also showed burgeoning interest in disease-modifying treatments, stem cell therapy, and regenerative medicine addressing CNS disorders. Other companies are also developing the use of AI powered designs for clinical trials to staff on to drug approvals and improve efficacy of the treatments.

The growing trend of telemedicine and remote patient management for neurological diseases is also fueling the market growth in the UK. Moreover, the emergence of both personalized medicine and cognitive rehabilitation therapies is enhancing patient management.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

The European CNS therapies and treatment market is being ruled by Germany, France, and Italy, which has a well-established healthcare infrastructure, steady government investment in neuroscience support, and rising prevalence of targeted neurological therapies.

The aggressive growth in the European CNS market is due to the research focus on CNS therapies along with an interest in neuropharmacology. The use of AI-powered diagnostics, efficient neurostimulation techniques, and biomarker-based drug development is also making therapies more effective.

This is further propelling the market growth attributed to increasing demand for non-invasive brain stimulation, cognitive behavioral therapy, and digital health solutions for CNS disorders. The growing number of clinical research partnerships, alongside the launch of innovative biosimilars for neurodegenerative conditions, are driving the uptake of CNS therapies throughout the EU. Moreover, regulatory incentives around orphan drugs and rare neurological diseases are speeding up drug development efforts.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

The Japan CNS treatment and therapy market is growing due to the aging population, increased prevalence of neurodegenerative disorders in the country, and advancements in drug discovery. Increasing emphasis on neuroprotection and intervention in the early stages is expected to propel market expansion.

Godoy covered how the nation’s focus on high-tech research and the coupling of AI-driven drug discovery and wearable neurological monitoring gadgets drives innovation in the nation. Additionally, solid government backing for dementia and Parkinson’s disease research, in tandem with rising investment for gene and cell therapies, is providing impetus to work on next-generation CNS treatments.

Additionally, the increasing prevalence of non-invasive brain stimulation, cognitive training program, and mindfulness-based therapies is propelling the market growth in Japan healthcare sector. Further, partnerships between academic institutions and biotech companies are bolstering research on the management of neurodegenerative diseases.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The market for CNS treatment and therapy can also flourish in South Korea, owing to the rising awareness regarding neurological disorders, increasing investments in the mental health sector, and increasing demand for advanced therapeutics.

The market is expanding due to supportive government regulations for brain health research and increasing implementation of digital therapeutics. Moreover, the national focus on increasing the efficiency of treatment through AI-based, drug discovery, neurotechnology and brain-computer interface research is bolstering competitiveness.

Additionally, the rising need for novel CNS therapies in psychiatry, neurodegenerative diseases, and sleep disorders is driving market adoption. Time autonomy of patients' performance can be recorded and used in the design of clinical trials based on artificial intelligence.

The increasing number of government-backed mental health campaigns and establishment of neuroscience research institutes in South Korea are also propelling the demand for CNS treatments and therapies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

Given their high specificity, efficacy, and targeted mechanisms of action in the treatment of complex neurological disorders, biologics represent an attractive solution to CNS treatment challenges. These therapies consist of monoclonal antibodies, recombinant proteins, and gene-based therapies, aiming to modulate immune responses, dampen inflammation, and recover neurological activities.

Biologics used for neurodegenerative diseases, multiple sclerosis & neurovascular disease are being incorporated at a growing rate, stimulating investment in research and development. Moreover, delivery methods for biologic drugs have made great strides, enabling longer-acting injectable formulations and nanoparticles enabling delivery across the blood-brain barrier, thereby enhancing treatment efficacy and patient compliance.

Non-biologics have continually been staple molecules in the CNS due to their low cost, simple delivery, and known safety profiles independent of structure. These drugs are critical to treating mental health disorders and chronic pain as well as infectious diseases of the nervous system.

The increasing prevalence of depression, epilepsy, and Parkinson’s disease has maintained demand for non-biologic CNS drugs. Further, the development of second-generation small-molecule drugs with better receptor selectivity and lower side effects also shapes the market growth.

The CNS treatment market is dominated by antidepressants, which represent the most prescribed drug classes as the rate of depression, anxiety disorders, and post-traumatic stress disorder (PTSD) are increasing.

Medications that enhance the serotoninergic syste as SSRIs, SNRIs and new therapies as ketamine-based antidepressants and psychedelic-assisted therapies have been more prominence in mental health. The ongoing destigmatization of mental illness, coupled with increased funding for psychiatric care, has only added to the demand for new formulations of antidepressants, the drug company said.

Immunomodulators may be of particular relevance for CNS associated neuroinflammatory and autoimmune disorders [e.g. multiple sclerosis, Guillain-Barré syndrome, neuromyelitis optica]. Such therapies regulate the immune response and consequently avoid excessive inflammation (and consequent neuronal damage).

With ongoing research into neuroinflammation in neurodegenerative disease, immunomodulatory drugs are being trialed in a context of disease that perhaps expands beyond autoimmunity, and into Alzheimer’s disease and Parkinson’s disease. Biosimilar immunomodulators as well as various combination regimens further solidified this class of medication’s leg in CNS therapy.

Neurovascular diseases (NVDs)-including stroke, cerebral aneurysms, and vascular dementia-constitute a significant share of the burden HEU (health-care economics unit) of CNS (central nervous system)-related health disorders. Growing prevalence of hypertension, diabetes, and other lifestyle-related cardiovascular risk factors is the major factor for the growing incidence of neurovascular disorders.

The pharmacological treatment of these conditions includes thrombolytics, anticoagulants and neuroprotective agents. These factors have created robust demand for CNS therapies, bolstered by new endovascular therapies and neurorestorative drugs that enhance patient outcomes.

Degenerative CNS diseases, such as Alzheimer’s, Parkinson’s disease and Huntington’s disease, are a growing focus of CNS therapeutic development. The increasing age of the world population, together with an understanding of the potential benefit of early diagnosis and therapeutic interventions, has prompted the exploration of disease-modifying therapies.

Emerging modalities of therapy including anti-amyloid monoclonal antibodies, gene therapy and neurotrophic factor based medications have changed the landscape of neurodegeneration. Owing to advancements in precision medicine and biomarker-based therapeutic approaches, the market will expand over time.

The hospital-based pharmacies act as high-distribution-clearing points for CNS drugs, especially those used for acute and specialized treatment, including intravenous biologics, agents that protect the nervous system, and emergency neurovascular drugs.

Centralized pharmaceutical services are crucial for hospitals and specialized neurology centers to provide timely access to high-cost precision-based therapies. The role of hospital-based pharmacies in CNS treatment distribution is further supported by the growing adoption of companion diagnostics and hospital-led clinical trials.

Being an allied channel, online pharmacies have gained importance, especially for CNS drugs, as it provides an easy and accessible means of distribution for chronic mental health medications, pain management drugs as well as long-term neurodegenerative treatments. For example, the expansion of digital health platforms and telemedicine services have increased access to psychiatric and neurological medications, enabling patients to adhere to their treatment plans.

AI technology-focused online pharmacy services have reinforced the already strong support for individuals managing CNS disorders through AI-driven prescription management, digital therapeutics, and automated medication refills.

The CNS Treatment and Therapy Market is driven by the rising prevalence of neurological disorders, fast-paced development of biotechnology, and increasing industry-wide investment in drug observance.

To address this issue, organizations focused on enhancing patient outcomes are increasingly leveraging biologics, targeted therapies and neurostimulation devices. This encompasses AI driven drug discovery, precision medicine, and discovery of new therapeutic entities for neurodegenerative diseases, psychiatric diseases and neurovascular diseases.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Biogen Inc. | 18-22% |

| Novartis AG | 14-18% |

| Johnson & Johnson | 11-15% |

| Eli Lilly and Company | 8-12% |

| Pfizer Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Biogen Inc. | Leading provider of innovative CNS drugs, focusing on neurodegenerative diseases such as Alzheimer’s and multiple sclerosis. |

| Novartis AG | Develops targeted CNS therapies, including biologics and precision medicine approaches for neurological disorders. |

| Johnson & Johnson | Specializes in psychiatric and neurovascular treatments, integrating AI-driven research for enhanced drug development. |

| Eli Lilly and Company | Offers breakthrough CNS drugs, including monoclonal antibodies for Alzheimer’s and neurodegenerative conditions. |

| Pfizer Inc. | Focuses on CNS pain management, neuropsychiatric drugs, and innovative biologics for neurological disorders. |

Key Company Insights

Biogen Inc. (18-22%)

Biogen dominates the CNS treatment sector, thanks to an enviable portfolio of drugs countering neurodegenerative diseases, such as Alzheimer’s and multiple sclerosis. The Company focuses on novel biologics and gene therapy with strong research.

Novartis AG (14-18%)

This industry-leading CNS player is leveraging biologics, precision medicine, and AI-enabled drug development with the aim of improving treatment outcomes.

Johnson & Johnson (11-15%)

Thanks to Johnson & Johnson's leadership in psychiatry and neurovascular treatment, they are bringing the latest R&D and digital health technologies.

Eli Lilly and Company (8-12%)

Eli Lilly, particularly its CNS research unit which has historically focused on breakthrough CNS therapeutics, especially in neurodegenerative disease such as Alzheimer’s disease and Parkinson’s disease.

Pfizer Inc. (6-10%)

Pfizer focuses on biologics to develop central nervous system (CNS) treatments with an emphasis on pain management, neuropsychiatric conditions, and neurological disorders.

Other Key Players (30-40% Combined)

Many international and local companies are engaged in CNS development, focusing on R&D-driven innovation and personalized medicine. Key players include:

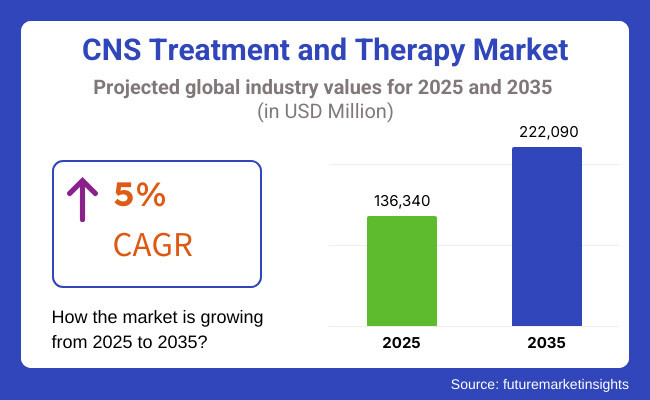

The overall market size for CNS treatment and therapy market was USD 136,340 Million in 2025.

The CNS treatment and therapy market expected to reach USD 222,090 Million in 2035.

Factors such as the growing number of neurological disorders, growing aging population and advancements in drug delivery and neuro technology, rising investment in the treatment of mental health and the expanding access to innovative therapies for diseases such as Alzheimer’s, Parkinson’s disease, and epilepsy will promote the demand for CNS treatment and therapy market.

The top 5 countries which drives the development of CNS treatment and therapy market are USA, UK, Europe Union, Japan and South Korea.

Biologics and non-biologics growth to command significant share over the assessment period.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.