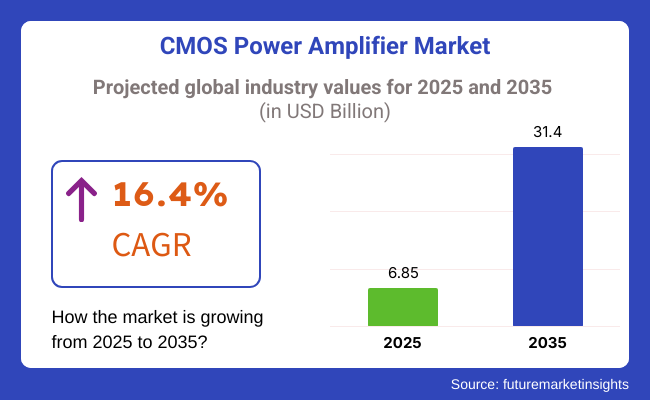

The market will grow to USD 6.85 billion in 2025 and further grow to USD 31.40 billion by 2035, at a CAGR of 16.4% over the forecast period. They are being used more and more by companies because they are highly efficient, cost-effective, and can be integrated into contemporary wireless communication systems. Investment in 5G infrastructure, IoT use cases, and upcoming RF technology will also drive the industry.

These are central to enhancing signal transmission, conserving power, and enhancing device miniaturization. As AI-optimized network performance combines with the top-of-the-line semiconductor production and IoT-enabled connectivity, subsequent performance will be optimized even further, and industry applications will be expanded.

In addition to increasing demand for power-efficient, high-data-rate wireless communications, they are increasingly utilized in smartphones, connected tablets, and IoT devices. RF front-end design advancements, improved semiconductor materials, and AI-optimized signal optimization further drive amplifier performance.

Explore FMI!

Book a free demo

The Industry possesses the driving force of the rise in demand for efficient, compact, and cost-effective power amplifiers in various relevant sectors. In the case of consumer electronics, miniaturization is the main issue and cost is the most important factor, so the manufacturers are enabled to make both the size and cost of their devices smaller while achieving greater energy efficiency.

In contrast to that, the automotive industry is mostly concerned with the power-saving aspect and the reliability have a prominent role in that drivers need these two in quantitative and qualitative terms whether systems (ADAS) or vehicle-to-everything (V2X) communication.

Industrial activities pay heed mostly to the performance and dependability factor, which after all becomes the basis for secure operation in automation and IoT-networks. With the rise of 5G and other advanced wireless systems, the telecommunication sector has emerged as a significant growth area that has to deal with problems like ranges of higher frequencies and bandwidth.

Certainly, protocols are utilized in high-tech medical technology that seeks to comply with the relevant standard deviations and equipment that proves its reliability by ensuring the security of the patients and their treatment in the health care establishments.

The continuing progress of technology creates the path for trends such as higher integration with RF front-end modules, better thermal management, and less energy usage that will not let the Industry to remain stagnant, thus, making it a core component in electronic systems.

| Company | Contract Value (USD Million) |

|---|---|

| Qualcomm Technologies | Approximately USD 500 - USD 550 |

| Skyworks Solutions | Approximately USD 300 - USD 350 |

| Broadcom Inc. | Approximately USD 400 - USD 450 |

In March 2024, Qualcomm Technologies announced a strategic partnership valued at approximately USD 500 - USD 550 million with a leading smartphone manufacturer to supply these amplifiers for their upcoming 5G devices. This collaboration aims to enhance the performance and efficiency of next-generation smartphones.

From 2020 to 2024, the demand for this industry grew exponentially with the spread of 5G networks, IoT devices, and wireless communication technologies. They gained popularity due to their low power consumption, cost-effectiveness, and compatibility with system-on-chip (SoC) designs.

Smartphone vendors, automotive connectivity solution providers, and IoT device makers embraced CMOS amplifiers to enhance wireless communication and battery life in significant quantities. The technology evolved from GaAs-based conventional amplifiers to CMOS technology to shrink and scale up.

Despite this, constraining factors such as thermal concerns, efficiency limitations at higher frequencies, and GaN-based amplifier competition constrained broader usage. Because of this, companies invested capital in adaptive biasing technology, artificial intelligence-driven circuit design, and high-end semiconductor processing to enable the ability of CMOS amplifiers to enhance.

Between 2025 and 2035, the Industry will undergo a revolution with AI-optimized RF optimization, quantum signal processing, and ultra-high frequency applications. AI-tuned power will ensure real-time power tuning to maximize efficiency in dynamic networks.

Quantum computing will boost signal amplification with noise cancellation and spectral efficiency gain, whereas blockchain will ensure secure wireless communication for autonomous vehicles and smart cities. The increase in future 6G networks, satellite nets, and IoT will demand ultra-efficient, high linearity, multi-band CMOS amplifiers and signal integrity.

Predictive diagnosis using AI will improve fault detection, lower downtime, and boost reliability. Sustainability will be the primary focus with power-conscious designs, recyclable semiconductor materials, and AI-optimized power reduction reducing environmental footprint. Edge AI processing and fusion of these amplifiers will further facilitate real-time transmission of data, with wireless technology speeding up for telemedicine, intelligent manufacturing, and other high-end usage.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Tighter energy efficiency standards (FCC, ETSI, 3GPP) forced CMOS power amplifiers to improve power efficiency and reduce RF emissions. | Software-defined, AI-enabled These amplifiers provide real-time adaptive power control, regulatory compliance automation, and dynamic spectrum optimization for future wireless networks. |

| AI-powered Amplifiers enhanced signal processing, minimized distortion, and increased energy efficiency for wireless applications. | AI-born, self-adaptive Amplifiers automatically adjust gain, reduce signal interference, and maximize efficiency for ultra-low-power, high-performance RF applications. |

| 5G-capable Amplifiers demand increased, fueled by high-frequency mmWave applications and large-scale MIMO deployment. | AI-powered, 6G-capable CMOS PA solutions take advantage of real-time beamforming, AI-based frequency hopping, and THz spectrum support for ultra-fast, low-latency wireless communication. |

| Amplifiers emerged as the go-to option for smartphones, IoT devices, and wearables because of low power consumption and affordability. | Energy-efficient, AI-optimized CMOS PAs support seamless IoT connectivity, ultra-low-power smart sensors, and AI-based adaptive amplification for next-generation mobile and wearable applications. |

| Automakers incorporated these amplifiers into vehicle-to-everything (V2X) communication systems to advance connected car technology. | Artificial intelligence-based, real-time CMOS PA automotive solutions offer predictive signal processing, self-optimizing RF amplification, and ultra-reliable vehicle communication for autonomous and smart transportation systems. |

| Edge computing needed these amplifiers to meet high-efficiency performance demands in distributed wireless networks. | AI-native, edge-native CMOS PA architectures take power allocation on themselves, provide real-time edge AI processing, and enable AI-based, decentralized wireless infrastructures. |

| AI-driven security mechanisms thwarted RF jamming, interference attacks, and illicit signal breaches in defence communications. | AI-born, quantum-secure CMOS PA technology automatically identifies RF anomalies, initiates self-healing encryption, and ensures tamper-proof real-time signal integrity for defence and secure communications. |

| PA power and efficiency were tailored to extend the battery life in handheld electronics by producers. | Carbon-efficient, AI-based CMOS PA designs adopt smart power scaling, energy-harvesting capability, and environmentally friendly semiconductor materials for sustainable RF amplification in next-generation technologies. |

| These amplifiers were popular in satellite communications due to their low weight, power efficiency, and scalability. | Space-optimized, AI-enhanced CMOS PAs enable real-time satellite beamforming, adaptive signal routing, and AI-driven autonomous frequency management for future aerospace communications. |

| Companies tested blockchain-based frequency assignment for increasing spectrum efficiency and wireless security. | Decentralized spectrum management with artificial intelligence-infused abilities offers real-time dynamic frequency assignment, RF leasing based on smart contracts and trust less AI-powered wireless communication networks. |

The industry is exposed to several risks that are able to majorly affect the industry, such as changes in technology, supply chain disruptions, increased industry competition, and regulatory compliance.

Technological obsolescence is one of the main risks. Power amplifier producers have to constantly work on advancements that will support networks of 5G, Wi-Fi, and other technologies due to the continuous changing of wireless communication standards. Companies which are unable to keep in touch with these improvements risk to lose industry shares.

Supply chain instability, on the other hand, is a different risk. The semiconductor sector is usually no stranger to chip shortages, geopolitical tensions, or high rates for raw materials. Any disruption in the delivery chain of the required high-performance CMOS chips may lead to a delayed production that can cause revenue loss and lead to the loss of customer trust.

The fierce industry competition in the field is another major problem. CMOS PAs face competition from GaAs (Gallium Arsenide) and SOI (Silicon-on-Insulator) technologies that on some applications participate even better. Thus, manufacturers have to take care that their CMOS products are cost-effective, energy-efficient, and offer integrating benefits to make sure they are competitive.

On the last note, it should be outlined that regulatory compliance is a must. CMOS PAs are frequently used in areas such as RF communication, mobile devices, and IoT applications; therefore, they have to follow the spectrum regulations, power efficiency mandates, and environmental protection laws. If noncompliance happens, there would be possible product recalls, lawsuits, and financial consequences.

| Countrirs/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 8.7% |

| UK | 8.4% |

| European Union | 8.5% |

| Japan | 8.6% |

| South Korea | 8.9% |

The USA industry grows exponentially as wireless communication, IoT devices, and 5G infrastructure expand. Companies innovate high-efficiency Amplifiers for better signal transmission, reduced power consumption, and increased connectivity. Industry growth comes from the growing demand for efficient, compact, and affordable amplifiers.

The USA telecommunications, consumer electronics, and defense industries use these amplifiers to optimize wireless performance and battery life in mobile devices. Additionally, regulatory regulations encourage firms to invest in superior RF technology for better connectivity solutions. FMI is of the opinion that the USA industry is slated to grow at 8.7% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| 5G Infrastructure Expansion | Increasing 5G network deployment necessitates RF components with high efficiency. |

| IoT and Smart Devices Adoption | The growing adoption of IoT solutions drives demand for small, power-friendly amplifiers. |

| Regulatory Policies | Government policies promote investment in RF technology to improve connectivity. |

The UK industry increases as businesses adopt high-performance RF solutions for mobile networks, smart devices, and IoT. Through these amplifiers, businesses improve energy efficiency, signal integrity, and 5G deployments.

Increasing demand for power-saving high-frequency amplifiers and a transition towards innovative wireless communication drive industry growth. Additionally, policies favoring next-generation connectivity stimulate the use of these amplifiers. FMI is of the opinion that the UK industry is slated to grow at 8.4% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Next-Generation Wireless Communication | A 5G network adoption fuels the demand for power-saving amplifiers. |

| Integration with IoT | Smart city project development increases demand for low-power RF solutions. |

| Trends in Government Connectivity Initiatives | Government policies encourage next-generation wireless infrastructure deployment. |

The European Union industry grows as firms integrate RF power solutions into telecommunications, automotive, and industrial IoT applications. Germany, France, and Italy are industry leaders in the installation of CMOS amplifiers in 5G infrastructure, smart grids, and connected vehicles.

The EU mandates stringent energy efficiency and spectrum management laws, which induce manufacturers to design green and high-efficiency amplifiers. Also, technological advancements in semiconductors and RF optimization with AI spur the use of CMOS amplifiers in multiple industries. FMI is of the opinion that the European Union industry is slated to grow at 8.5% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| Energy Efficiency Laws | Tighter regulations encourage environment-friendly and high-efficiency power amplifiers. |

| 5G Rollouts and Smart Grids | An increase in connected infrastructure boosts RF component demand. |

| AI in RF Optimization | Power amplifier performance is improved by greater automation. |

The Japanese industry increases as businesses implement next-generation RF technologies in mobile communications, automotive radar, and industrial automation. Companies develop new CMOS amplifiers to improve wireless efficiency, minimize power loss, and facilitate high-speed data transmission.

Japan's focus on high-end semiconductor manufacturing and smart connectivity drives the application of these amplifiers. Additionally, industries such as robotics, telecom, and consumer electronics invest in low-power, high-performance amplifier technology to improve connectivity and operational performance. FMI is of the opinion that the Japanese industry is slated to grow at 8.6% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Sophisticated Semiconductor Manufacturing | Chip manufacturing leadership enables RF innovation. |

| Smart Connectivity Solutions | The rise of IoT and automation increases the need for power-efficient amplifiers. |

| Automotive Radar and Wireless Tech | There is a higher need for high-speed RF communication in vehicles. |

The South Korean industry grows at a rapid rate as businesses embrace AI-based RF technologies, ultra-low power amplifiers, and emerging wireless solutions. The government supports 5G infrastructure growth, which accelerates the uptake of these amplifiers in mobile networks and IoT environments.

Companies include high-speed, power-efficient CMOS amplifiers in smartphones, base stations, and smart home products to optimize wireless connectivity. In addition, the expansion of semiconductor production and miniaturized RF components also fuels industry growth. FMI is of the opinion that the South Korean industry is slated to grow at 8.9% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Government 5G Investments | Policies encourage the adoption of next-generation wireless technology. |

| AI-Powered RF Solutions | AI integration enhances signal efficiency and reliability. |

| Semiconductor Advancements | Miniaturized components improve device performance. |

The LTE (Long-Term Evolution) module is the largest segment of the Industry, with a total industry share of 23.4% in 2025. With LTE networks becoming increasingly widespread across the globe, the demand is growing for high-performance, power-efficient amplifiers to underpin mobile communication and IoT applications.

CMOS-based power amplifiers allow for significant advantages such as lower heat dissipation, lower manufacturing costs, and better energy efficiency, which makes them gain traction in LTE-enabled smartphones and other connected devices.

A handful of leading tech companies are also pouring money into next-generation LTE power amplifiers, including Qualcomm, Broadcom Skyworks Solutions, and Qorvo. They are trained in signal quality improvement, signal loss mitigation, and promoting smooth data functioning in areas with high-density networking.

As the penetration of 5G gradually increases, LTE infrastructure will be the basic pillar for backward compatibility and stable mobile communication, which will promote the growth of LTE power amplifier industry demand.

Nonetheless, including the UMTS (Universal Mobile Telecommunications System) module is still necessary as LTE penetration is not advanced on the entire globe. Even today, with data access, essentially since the introduction of 4G networks, UMTS power amplifiers remain critical components that enable ubiquitous connectivity in many of the regions with sparse 4G and even sparse 5G.

Although UMTS power amplifier industry share is expected to decrease slowly, NXP Semiconductors and Murata Manufacturing still provide UMTS amplifiers for high-efficiency mid-range and entry-level mobile products. Mobile power amplifiers are increasingly popular in many developing countries where vast numbers of consumers are still upgrading their mobile networks to deliver voice and data more cost-effectively to millions of consumers.

This segment will have the largest industry share, 34.2%, in these amplifiers industry in 2025. With each increase in global smartphone penetration, manufacturers will also include These amplifiers, which will improve network reception, battery efficiency, and overall power consumption.

Prominent phone manufacturers like Apple, Samsung, Xiaomi, and OnePlus all utilize these amplifiers to improve signal quality, accommodate multiple frequency bands, and provide high-speed internet access. As the demand for 5G-supported devices continues to climb, innovation in this industry is rapidly intensifying, with emphasis placed on reduced power loss, heat dissipation, and better RF (radio frequency) performance.

Despite the fast adoption of smartphones from their inception, feature phones haven’t gone out of fashion, especially in developing economies and rural and low-income regions. For example, low-power UMTS and LTE amplifiers are used to provide basic mobile services on feature phones at a low cost.

For feature phones, companies like MediaTek, UNISOC, and Skyworks Solutions typeset and produce power amplifiers to ensure stable voice and data connection. The share of feature phones in the industry is falling, however, they remain a necessary means of communication in emerging industries where LTE is still expanding, but smartphones are not yet widely adopted.

The Industry is growing rapidly because of the increased demand for power-efficient, high-performance RF amplification in smartphones, IoT devices, and 5G communication. CMOS technologies are known to be inexpensive and scalable, and they have integration capabilities compared to GaAs-based amplifiers, thus driving the transition to CMOS-based power amplifiers.

Key industry leaders include Skyworks Solutions, Qorvo, Broadcom, and Analog Devices Inc. They focus on AI-driven optimization of power for 5G-ready CMOS designs and high-end RF front-end modules. Start-ups and specialist suppliers are developing very compact and ultra-low-power amplifiers specifically designed for operating with IoT and wearables applications.

The evolution of the industry is characterized by growth in mmWave technology, envelope tracking, and digitally assisted power amplifiers, which enable superior efficiency, linearity, and battery life extension in connected devices. Some of the strategic factors that fuel competition include the expansion of 5G networks, rising smartphone penetration, and demand for ever more energy-efficient RF components.

As the industry moves toward higher frequency bands and AI-driven power management, miniaturization, enhanced thermal management, and integration with advanced semiconductor processes are some of the factors companies are paying attention to in order to gain a competitive advantage.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Skyworks Solutions | 20-25% |

| Qorvo Inc. | 15-20% |

| Broadcom Inc. | 12-17% |

| Analog Devices Inc. | 8-12% |

| Murata Manufacturing Co. | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Skyworks Solutions | Develops high-performance Amplifiers for 5G, Wi-Fi, and IoT applications. |

| Qorvo Inc. | Provides RF front-end solutions, low-power CMOS amplifiers, and AI-driven signal processing technologies. |

| Broadcom Inc. | Specializes in 5G-compatible Amplifiers, high-efficiency RF components, and wireless communication chips. |

| Analog Devices Inc. | Focuses on power-efficient CMOS amplifiers, high-frequency RF signal processing, and compact integration. |

| Murata Manufacturing Co. | Offers CMOS-based power amplification for mobile devices, wearables, and automotive applications. |

Key Company Insights

Skyworks Solutions (20-25%)

Skyworks Solutions tops the market in CMOS power amplification by supplying the most sophisticated RF amplification solutions for 5G, Wi-Fi, and the Internet of Things.

Qorvo Inc. (15-20%)

Qorvo Inc. further creates and complements wireless communication through low-power CMOS amplifiers and AI-optimized RF processing solutions while confirming executions in various 5G-compatible systems.

Broadcom Inc. (12-17%)

Broadcom Inc. involves itself in Amplifiers with high efficiency, with RF front-end components enhanced with the latest 5G connectivity solutions.

Analog Devices Inc. (8-12%)

Hexempore has focused on discovering novel designs in RF signal processing that are highly efficient in energy as well as high-frequency CMOS amplification and done with integration into next-gen communication devices.

Murata Manufacturing Co. (5-9%)

Murata Manufacturing Co. optimizes CMOS-based power amplifiers for mobile, IoT wearable, and automotive applications.

Other Key Players (20-30% Combined)

The industry will continue to grow as industries integrate AI-driven power management, 5G advancements, and energy-efficient RF amplification to enhance wireless communication, mobile connectivity, and IoT performance.

The industry is projected to reach USD 6.85 billion in 2025.

The market is expected to grow significantly, reaching USD 31.40 billion by 2035.

South Korea is poised to grow fastest, with a CAGR of 8.9% from 2025 to 2035.

Key players in the industry include Toshiba Corporation, QUALCOMM, ACCO Semiconductor, Broadcom Ltd., DSP Group, Skyworks Solutions, Texas Instruments Inc., Qorvo, Inc., and Murata Manufacturing.

Smartphones are the most widely used application in the market.

The industry is segmented into GSM/EDGE, UMTS, LTE, CDMA 2000, TD-SCDMA, and FOMA/Others.

By application, the industry is categorized into smartphones, feature phones, connected tablets, and others.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.