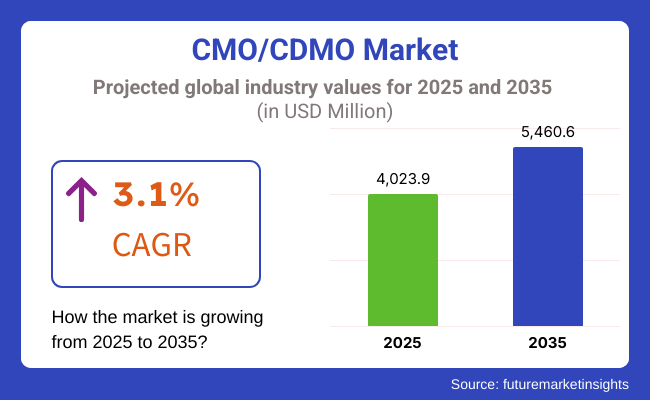

The global market for CMO/CDMO is forecasted to attain USD 4,023.9 million by 2025, expanding at 3.1% CAGR to reach USD 5,460.6 million by 2035. In 2024, the revenue of CMO/CDMO was around USD 3,871.9 million.

A contract development and manufacturing CDMO provides development and manufacturing services to biotechnology/biopharmaceuticals companies. Pharma/biopharma and biotechnology company’s partners with the CDMOs as way to outsource drug development as well as contract drug manufacturing. Development Services, bio manufacturing services, analytical testing, fill finishing, packaging, and clinical supply services are some of the services provided by the biotechnology CDMO/CMO.

The leading global CDMOs are focusing on expansion of their manufacturing capabilities with high flexibility and rapid operation. With the help of advanced single-use technologies, the companies are able to cut batch manufacturing and cleaning time from 7 days to 1 day. This is expected to give competitive-edge to the companies in terms of high capacity, low cost, convenience and operational efficacy.

With advancements in contract solutions offering, leading CDMOs are focusing on the expansion of their integrated capabilities from molecule-to-finished product. The trend is significant as the acceleration of development and speed to market is becoming more crucial for the biopharmaceutical and biologics developers.

Historically, CMO-CDMO markets went through deep transformation that redefines their existence and engage in reshaping the future. The principal drivers of the transformation are changing pharmaceutical needs and worldwide health issues. The COVID-19 pandemic has finally accelerated the trends already established. During this time, different biopharma firms relied heavily on CMOs and CDMOs for quick scale-up of production, particularly in the case of vaccines and therapeutics.

True innovative pharmaceutical discovery-with the tremendous expansion of personalized medicine and the advent of sophisticated biologics-strongly fuels the requirement for specialized manufacturing know-how. CMOs and CDMOs would spend in versatile manufacturing platforms and ongoing manufacturing technologies to enable this. They would provide more integrated models of service too, which married drug development, clinical trial services, and commercial-scale manufacture.

For legislated pressures and time-to-market requirements, the pharma sector forms more strategic alliances with the CMOs/CDMOs. These are more likely to be long-term commitment rather than just transactional agreements. With the increasing tendency of outsourcing value-added, complicated projects, agility, quality, and scalability have emerged as key considerations when it comes to drug production.

Explore FMI!

Book a free demo

The North American CMO/CDMO industry is expanding with pharma companies looking for economical drug production solutions, making huge investments in R&D, and acting on increased demand for biologics and biosimilars. The United States dominates the market, and leading pharmaceutical and biotech organizations outsource development and production to experienced CDMOs to save costs and expedite product launch.

Increased demand for injectable biologics of high potency, targeted therapies, and gene therapies has boosted investment in advanced biomanufacturing plants. The regulatory actions of the FDA to allow rapid fast-track approval of drugs also assist CDMOs with specialized business models.

Growth challenges, however, include supply chain exposures, compliance issues, and labor shortage in the production of biopharmaceuticals. Across North America, companies are rapidly adopting AI-based process automation and digital manufacturing capabilities to drive efficiencies and reduce risks in operations.

In Europe, a robust regulatory environment guarantees high-quality pharmaceutical manufacturing, and it is a mature CMO/CDMO market. Germany, Switzerland, and the UK are leading as CDMO centers, especially in the manufacture of complex biologics, sterile injectables, and specialty drugs.

European CDMOs are growing under the stimulus of EU financing for innovative therapeutics and an increasing emphasis on sustainable pharmaceutical production. Nevertheless, pricing pressures caused by stringent government healthcare policies and economic uncertainty in some areas cut into profitability. Post-Brexit trade shifts have also compelled UK-based CDMOs to move more into line with EMA guidelines.

The Asia-Pacific region is becoming the fastest-growing CMO/CDMO market, increasing due to the cost-efficient production capacity, accelerated biopharmaceutical research growth, and increasing adherence to global GMP standards. China, India, and South Korea are setting themselves up as significant contract manufacturing centers, facilitated by highly trained personnel, effective government incentives, and increasing healthcare infrastructure.

Demand for biosimilars, vaccines, and API manufacturing is fueling investment in large-volume GMP-validated plants. But regulatory harmonization issues, intellectual property safeguard issues, and logistics remain thorns in the flesh of market development. Besides, international pharmaceutical corporations are also entering strategic alliances with Asian CDMOs to increase their production bases within the region.

Challenges

High Cost Manufacturing Pose a Challenge to the Market

High costs associated with investment of Contract manufacturing poses a challenge in the growth of this market. For instance, Biopharmaceuticals manufacturing capacity is tight across the industry regardless of the location. Globally, biopharma companies have spent over USD 50 Billion in just past five years on setting up new plants and procuring equipment.

Much of that has been in tax havens, like Ireland and Singapore, and in emerging markets. Lack of highly skilled and experienced professional hampers the CMOs growth. In order to develop the economy, the emerging region requires skilled professionals. Many companies have reported a sizable gap between the skilled professionals and the current workforce.

Opportunities

Manufacturing Facilities of Biologics and Biosimilar Opens up the Market Opportunity

Novel biologic and biosimilar manufacturing present strong growth opportunities. In addition, scientific advancements in the biopharmaceuticals are boosting the opportunities for the technologically advanced CDMOs with potential capabilities.

Moreover, adoption of CDMO and CMO business model in terms of product offering and reduction in operational cost is likely to provide opportunity to grow. Focusing on reduction in operating costs through outsourcing of R&D and commercialization of biopharmaceuticals to CMOs/CDMOs could increase operational efficiency.

Scaling up Flexible and Modular Manufacturing Facilities: To survive in the market, CMOs and CDMOs are adopting modular, flexible cleanroom layouts and single-use bioprocessing equipment. These arrangements make it simpler to scale up manufacturing in a rapid way, especially for small-volume biologics and customized medications, to assist manufacturers in addressing evolving market requirements more effectively.

Regulatory and Policy Developments: With regulatory bodies such as the FDA, EMA, and WHO cracking down, CMOs and CDMOs are going all out to comply. They're leveraging blockchain and digital manufacturing records to enhance transparency, integrity of data, and compliance with tighter supply chain demands.

Increased Outsourcing Manufacturing: Pharmaceutical and biotech firms are increasingly contracting out their production and development work to CMOs and CDMOs in order to reduce costs, tap into specialized know-how, and concentrate on core business. Through collaborations with contract manufacturers, these firms escape the large capital outlays needed to establish and run their own plants while enjoying cutting-edge manufacturing capability without shouldering the entire financial load.

Sustainability in Pharmaceutical Manufacturing: CMOs and CDMOs are also focusing on sustainability in pharmaceutical production. They are adopting green chemistry, carbon-neutral bioprocessing, and waste reduction techniques to meet worldwide environmental objectives.

Most firms are also investing in sustainable process technologies, energy-efficient cleanrooms, and reusable single-use bioprocessing materials. They are also incorporating renewable energy sources into manufacturing facilities to reduce carbon footprints and encourage environmentally friendly manufacturing processes.

Between 2020 and 2024, large contracts with local and global pharmaceutical companies were created during the decade, resulting in a flourishing market for drug development and manufacturing outsourcing. With time, such advancements led to reduced market times for new products and cost savings in operations. Growing demand for biologics and biosimilars, along with their complexity, presented newer business opportunities for CDMOs capable of manufacturing such biologics.

Alternatively, the demand for adaptable manufacturing solutions grew stronger with the newer trend of high-value small batch drugs like orphan drugs and personal medicines. Therefore, anticipating towards the year 2025 and beyond to 2035, the market is likely to be supported even more by the commercialization of precision medicine and gene therapies. The emerging technologies will challenge CDMOs to adopt new manufacturing processes and to keep up with even more evolving regulatory requirements.

Growing markets will also play an important role as pharma companies will seek to diversify their supply chains and expand access to quality medicines worldwide. Further, sustainability will receive more attention, and CDMOs will transition to greener methods such as carbon-neutral production and environmentally friendly ways of producing to address mounting demands from both regulators and environmentally aware consumers in common.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with Good Manufacturing Practices (GMP) and quality control measures for large-scale drug production. |

| Technological Advancements | Adoption of modular facilities and single-use technologies for greater manufacturing flexibility. |

| Consumer Demand | Growing demand for biosimilars, generics, and high-volume drug production. |

| Market Growth Drivers | Outsourcing by pharmaceutical companies to reduce costs and accelerate time-to-market. |

| Sustainability | Initial efforts toward eco-friendly manufacturing and reduction of pharmaceutical waste. |

| Supply Chain Dynamics | Dependence on regional manufacturing hubs to mitigate global supply chain risks. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulatory requirements for personalized medicine, gene therapies, and advanced biologic manufacturing. |

| Technological Advancements | Integration of AI, automation, and continuous manufacturing for improved efficiency and quality control. |

| Consumer Demand | Increased focus on personalized therapies, small-batch manufacturing, and complex biologics. |

| Market Growth Drivers | Expansion of cell and gene therapy development, requiring specialized CDMO capabilities. |

| Sustainability | Full-scale implementation of carbon-neutral facilities and green chemistry practices. |

| Supply Chain Dynamics | Strengthening localized manufacturing capabilities to enhance supply chain resilience. |

Marek Outlook

Mergers and acquisitions activities among USA manufacturers play a major role to expand the business in the region which will create opportunities in the forecast period. Moreover, the growing trend headed for multi‑drug manufacturing facilities with the production of different biopharmaceutical therapeutics will leads to increase preference of the single -use (disposable) bioreactors in the biopharmaceutical CDMOs industry in the region.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 1.8% |

Market Outlook

The market in the Germany is set to witness an increase in demand due to rising areas for gene and cell therapy. Moreover, manufacturers focus on strategic global presence, specialized expertise with exclusive technological capabilities and deliver world-class biopharmaceuticals contract development and manufacturing services to pharmaceutical and biotechnology industry.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.2% |

Market Outlook

China is expected to be the most lucrative country in East Asia market due to wide range of developmental services from cell line development to initial clinical trials including cell line development, process development, and formulation analysis methodology.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.8% |

Market Outlook

The current growth of India's CMO/CDMO industry is heightened by the burgeoning pharmaceutical sector in the country complemented by inexpensive manufacturing sites and skilled manpower resources so that both local and international pharmaceuticals would flock to this place. This nation has been established as a global hub for API production, generic, and bio-similars.

An ongoing trend that fuels the development of advanced manufacturing services is the increased focus on biologicals, cell, and gene therapies. To make their ground stronger in high-value drug production, Indian CMOs and CDMOs are investing in new world-class facilities and implementing global GMP standards.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.6% |

Market Outlook

The market of Brazil CMO/CDMOs is booming and a vast area of development as demand for biosimilars, biologics, and complicated formulations grows. Improving health infrastructure in Brazil is coupled with government incentives affecting investments into biopharmaceutical manufacturing facilities. Brazilian CDMOs and CMOs are augmenting their capacity for developing cell and gene therapies alongside international regulatory standards compliance.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 1.2% |

Stand-alone Services Fuel Market Growth with Demand for Adaptive Manufacturing Solutions

Stand-alone services currently dominate the CMO/CDMO market, as cosmetic and personal care brands increasingly outsource individual phases of product development and manufacturing. Brands employ these services-such as product testing, packaging, quality assurance, labeling, and regulatory compliance assistance-to optimize processes without investing in full end-to-end solutions.

Increased demand for specialized expertise, continues to fuel the popularity of stand-alone services. North America and Europe lead this market with stringent regulatory requirements and the strong premium, compliant beauty products demand.

In contrast, Asia-Pacific is growing significantly, driven by affordable service offerings and increasing exports of beauty products. In the future, companies will embrace blockchain-based traceability for clean beauty assertions, sophisticated sustainability analysis, and AI-assisted quality control to maintain product consistency and safety.

Scale-Up and Tech Transfer Drive Innovation with Smooth Lab-to-Manufacturing Transitions

Personal care and cosmetic manufacturers are increasingly reliant on scale-up and tech transfer services to propel product development from a lab-scale stage to commercial scale production. The services facilitate optimization of formulation operations, guarantee reproducibility, and bring manufacturing practices up to international regulatory requirements.

With clean beauty and biotechnology-based cosmetics becoming increasingly sophisticated, brands require superior scale-up and glitch-free tech transfer solutions. North America and Europe dominate this sector, due to strong R&D and high emphasis on innovation, while Asia-Pacific witnesses exponential growth fueled by fresh contract manufacturing alliances and growing beauty markets.

Emerging trends will be centered on the use of digital twins for simulating processes, AI-driven predictive modeling to maximize scale-ups, and improved tech transfer regimes that enhance efficiency, minimize costs, and hasten time-to-market.

API Substrate Dominates Industry with Brands Competing for High-Quality Raw Materials

Pharmaceutical and cosmetics firms are putting more focus on using high-quality API substrates to produce products that are safe, effective, and meet stringent regulatory standards. With more consumers looking for clean-label products and sustainably sourced ingredients, demand for tailored API substrates is growing.

North America and Europe continue to be leaders in the market based on their high manufacturing standards and advanced facilities. But Asia-Pacific is rapidly catching up with low-cost production and surging export markets. In the future, look for more biobased APIs, greener synthesis processes, and the application of blockchain to enhance supply chain transparency and product integrity.

Small Molecule Innovation Gains Momentum as Demand Increases for Flexible Solutions

Small molecules are the buzz in the CMO/CDMO industry, due to their versatility and importance in drug development as well as cosmetic formulation. Companies adore them because they're simple to tweak, cheap to manufacture, and play nicely in anything from pharmaceuticals to active skincare agents. As interest in targeted treatments, powerful skincare, and anti-aging products increases, small molecule research and manufacturing are thriving.

North America and Europe are pioneering in terms of innovation and regulation compliance, and Asia-Pacific is rapidly developing its manufacturing capabilities and making large investments in R&D. Future directions such as AI-assisted molecule design, novel synthesis for increased purity and strength, and sustainable manufacturing processes will dominate this industry's future.

The CMO/CDMO (Contract Manufacturing Organization/Contract Development and Manufacturing Organization) market is very competitive, fueled by growing pharmaceutical outsourcing demand, technological improvements in biopharmaceutical manufacturing, and increasing drug development complexity.

Businesses are spending money on versatile manufacturing capabilities, innovative biologics manufacturing, and end-to-end development capabilities to stay ahead of the competition. The market is influenced by established global CDMOs, niche biotech manufacturers, and new contract service providers, all of which contribute to the changing landscape of outsourced drug production.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lonza Group | 6.6% |

| Catalent, Inc. | 13.4% |

| WuXi AppTec | 6.3% |

| Samsung Biologics | 9.4% |

| Thermo Fisher Scientific (Patheon) | 10.6% |

| Other Companies (combined) | 53.7% |

| Company Name | Key Offerings /Activities |

|---|---|

| Lonza Group | Market leader offering comprehensive CDMO services, including biologics, cell and gene therapy, and API manufacturing. |

| Catalent, Inc. | Provides end-to-end drug development, advanced delivery technologies, and large-scale pharmaceutical manufacturing. |

| WuXi AppTec | Specializes in integrated contract services, covering small molecules, biologics, and cell therapy development. |

| Samsung Biologics | Focuses on large-scale biologics manufacturing, biosimilar production, and CDMO services for monoclonal antibodies. |

| Thermo Fisher Scientific (Patheon) | Offers pharmaceutical development, clinical trial manufacturing, and commercial production solutions. |

Key Company Insights

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing service diversity and technological advancements. These include:

The overall market size for CMO/CDMO market was USD 4,023.9 million in 2025.

The CMO/CDMO Market is expected to reach USD 5,460.6 million in 2035.

Growing demand for biologics and complex therapies has driven pharmaceutical companies to increasingly rely on specialized CDMO services.

The top key players that drives the development of CMO/CDMO market are Qiagen, Thermo Fisher Scientific, Promega Corporation, Takara Bio Inc., and Bioneer Corporation

API Substrate in product type of CMO/CDMO market is expected to command significant share over the assessment period.

Stand-Alone Services, Integrated Development, Scale-Up and Tech Transfer, Technology and Innovation, Quality Control and Quality Assurance, Regulatory Assistance

API substrate, Large Molecule and Small Molecule

Mammalian, and Microbial

Small, Mid sized, Large and Very Large

Preclinical, Clinical and Commercial

North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.