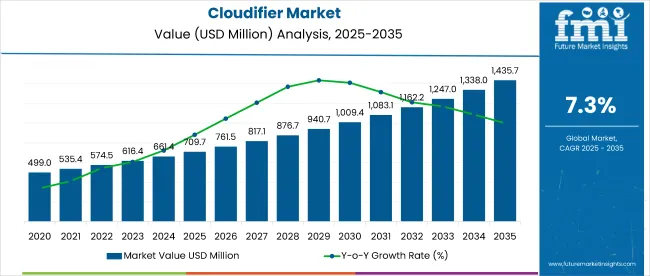

The global cloudifier market is valued at USD 709.7 million in 2025 and is slated to reach USD 1,435.7 million by 2035, reflecting a CAGR of 7.3%. Consumers are increasingly demanding natural food additives in beverages and processed foods, which drives market expansion.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 709.7 million |

| Market Size (2035) | USD 1,435.7 million |

| CAGR (2025 to 2035) | 7.3% |

Health-conscious lifestyles, rising consumption of packaged products, and continuous innovation in natural ingredients are fueling the market. Moreover, favorable regulations across developed regions are encouraging food manufacturers to adopt cloudifiers across various end-use applications.

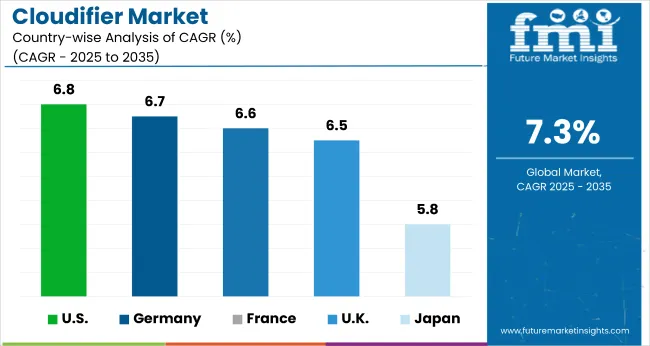

The USA is projected to lead the global market with the highest CAGR of 6.8% between 2025 and 2035, fueled by strong demand for functional beverages and continuous innovation. Germany ranks second with a 6.7% CAGR, driven by clean-label preferences and growing alcohol-based drink consumption.

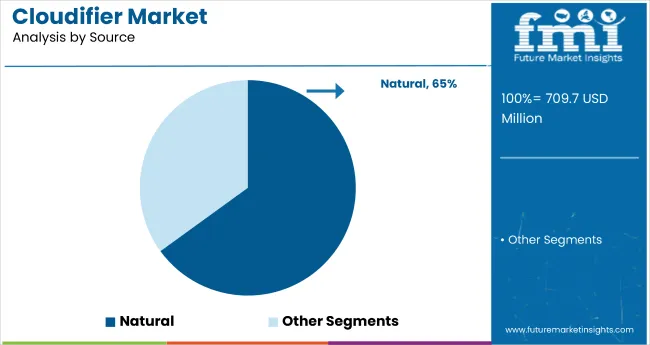

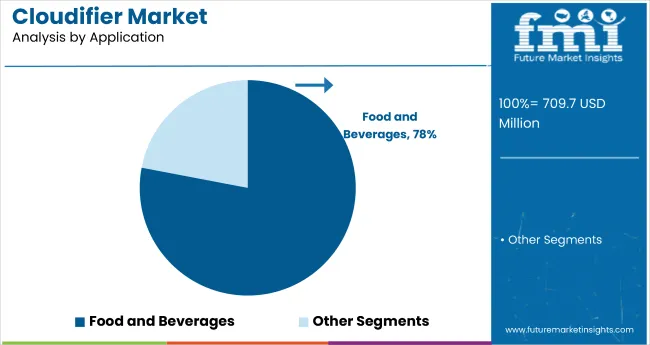

France follows with a 6.6% CAGR, supported by regulatory push and organic trends. By application, food and beverages will dominate the market in 2025 with a 78% share. By nature, natural cloudifiers will hold the second-largest share at 65%, reflecting the growing preference for clean-label opacity and texture enhancers.

Governments in North America, Europe, and Asia Pacific are promoting clean-label regulations, encouraging the use of natural additives like cloudifiers. Regulatory bodies such as the FDA and EFSA are restricting synthetic ingredients, pushing manufacturers toward plant-based solutions.

Innovations like BrightSeed’s AI-driven Forager platform help discover functional plant compounds, while FLAVORWATCH™ offers advanced weighting agents to enhance beverage stability. These developments support consumer demand for natural, transparent, and sustainable food products, driving growth in the market.

The market holds a niche yet growing share within its parent markets. As of 2025, it accounts for approximately 4.5% of the global food additives market, and around 6.2% of the functional food ingredients market, reflecting rising demand for visual and sensory enhancements in beverages.

Within the beverage additives market, cloudifiers represent a more significant share of about 9.8%, driven by their widespread use in juices and carbonated drinks. In the clean label ingredients segment, cloudifiers contribute nearly 3.5%, supported by their natural origin. These figures are expected to rise steadily through 2035 with innovation and regulatory support.

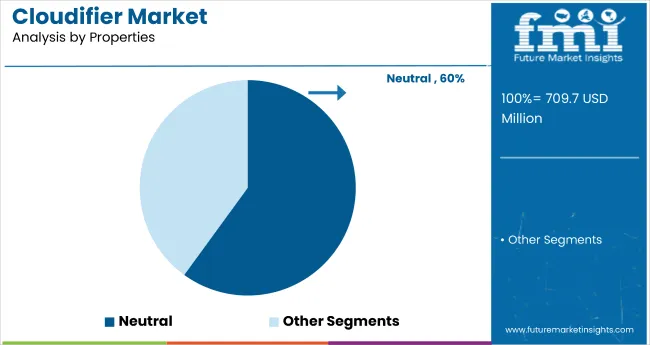

The global market is segmented by source, properties, form, application, and region. By source, the market is classified into natural and synthetic or non-natural cloudifiers. Based on properties, the market is segmented into neutral and non-neutral.

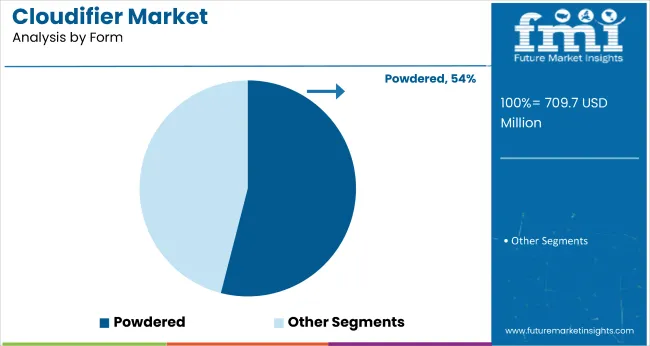

By form, the marketcovers powdered and oil-based liquid. Based on application, the market is segmented into food and beverages, cosmetics, and pharmaceuticals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The natural segment is projected to account for over 65% of the total market share in 2025, with significant growth driven by beverage applications. This trend is supported by increasing consumer preference for clean-label and non-synthetic ingredients in functional drinks, smoothies, and wellness beverages.

The segment also benefits from regulatory support for natural colorants, rising vegan and organic product launches, and broader application in health-oriented formulations targeting detox, immunity, and energy enhancement.

The neutral cloudifiers segment is projected to hold around 60% of the market share in 2025, driven by their ability to maintain the original flavor, color, and clarity of beverages and food products. Their compatibility with a wide range of formulations, including juices, carbonated drinks, dairy-based beverages, and flavored waters, enhances their adoption across global F&B manufacturing.

Additionally, the segment benefits from rising demand for visual appeal in premium beverages, minimal flavor interference, and improved dispersion properties, making them a preferred choice in both natural and synthetic product lines.

The powdered cloudifiers segment is expected to hold 54% of the market share in 2025, driven by its superior stability, ease of storage, and cost-effectiveness in large-scale food and beverage manufacturing. These cloudifiers offer longer shelf life, better solubility in dry mixes, and reduced transportation costs, making them ideal for instant beverage powders, dry drink mixes, and processed food applications.

Their growing use in emerging markets, where cold-chain infrastructure is limited, further accelerates adoption. Additionally, manufacturers favor powdered formats for their flexibility in formulation, consistent quality, and compatibility with high-speed industrial processing lines.

The food and beverages segment will dominate with a 78% share in 2025, driven by strong demand for turbidity in juices, dairy products, and carbonated drinks. Increased consumer preference for visually appealing, natural-looking beverages, along with rising use in plant-based alternatives, flavored waters, and ready-to-drink formulations, is fueling segment growth. Manufacturers are also incorporating cloudifiers to enhance mouthfeel, simulate pulp presence, and differentiate products in competitive retail environments.

The market is growing steadily, driven by rising demand for clean-label ingredients, increasing consumer focus on natural additives, and advancements in plant-based emulsifier technologies for use across food, beverage, pharmaceutical, and personal care industries.

Recent Trends in the Cloudifier Market

Key Challenges in the Cloudifier Market

Among the top five countries, the USA leads the cloudifier market with the highest projected CAGR of 6.8% from 2025 to 2035. Growth is driven by robust demand for functional beverages, increased R&D in emulsification technologies, and a strong presence of plant-based drink manufacturers. Germany follows closely with a CAGR of 6.7%, fueled by clean-label preferences, premium juice consumption, and innovation in alcoholic beverages like beer-mix drinks and flavored spirits.

France and the UK also demonstrate strong potential with respective CAGRs of 6.6% and 6.5%, attributed to rising organic beverage adoption, regulatory approvals for natural ingredients, and demand for aesthetic clarity in wellness drinks. Japan, while comparatively moderate at 5.8% CAGR, continues to advance due to its growing focus on elderly nutrition and visually enhanced beverages for the health-conscious segment. Together, these nations represent over half of the global cloudifier consumption, shaping market direction through regulation, innovation, and evolving consumer preferences.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

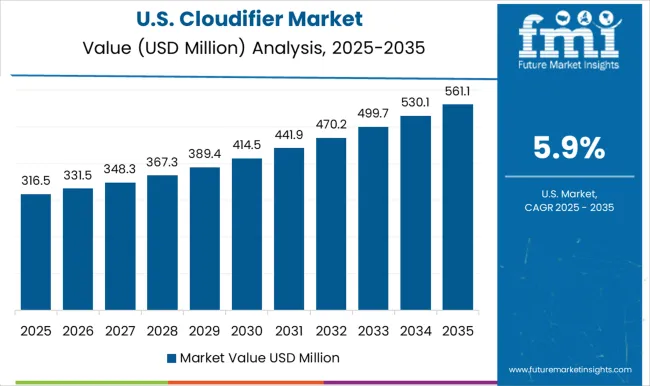

The USA cloudifier market is projected to expand at a CAGR of 6.8% from 2025 to 2035, driven by high consumption of packaged and functional beverages. The country benefits from a proactive regulatory environment, with FDA approvals facilitating natural food additive use.

Major players such as Cargill and ADM continue to invest in cloud emulsion technology and beverage stabilization platforms. R\&D-driven innovation in natural emulsifiers is on the rise, targeting clean-label formats. Market growth is supported by a wide network of retail and foodservice channels seeking premium-quality clouding agents.

The UK cloudifier revenue is forecasted to grow at a CAGR of 6.5% between 2025 and 2035, supported by rising demand for no-/low-calorie and plant-based beverages. The market is shaped by post-Brexit regulatory alignment with EU food safety standards, encouraging natural additive use.

The growth in oat milk, almond milk, and dairy alternatives has also boosted demand for cloudifiers, especially citrus and starch-based types. Consumer interest in transparency and sustainability is guiding formulation decisions across beverage categories.

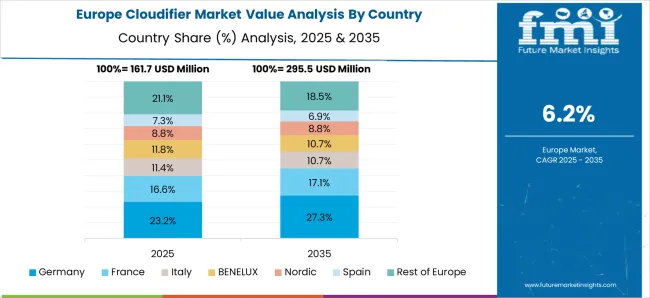

Sales of cloudifiers in Germany are projected to grow at a CAGR of 6.7% from 2025 to 2035. Germany’s mature beverage sector and focus on organic, clean-label formulations support cloudifier adoption in both alcoholic and non-alcoholic products.

Cloudifiers are increasingly integrated into beers, fruit nectars, and fortified wellness drinks. German manufacturers also lead in food additive processing technology, contributing to higher stability and visual quality. Citrus-based emulsions remain highly preferred for organic certification compliance.

The French cloudifiers market is expected to grow at a CAGR of 6.6% from 2025 to 2035, supported by a growing appetite for natural and gourmet beverage formats. Regulatory backing for clean-label ingredients and botanical emulsifiers is helping cloudifiers gain traction across premium juice, flavored water, and herbal tea segments. French consumers are particularly responsive to food transparency and natural sourcing, which has bolstered demand for plant-based clouding agents. The rise of gourmet and fortified beverage lines is expanding the addressable market.

Sales of cloudifiers in Japan are forecast to grow at a CAGR of 5.8% through 2035. While growth is slightly slower than Western peers, Japan’s robust RTD segment and emphasis on aesthetic appeal in beverages remain key drivers.

Cloudifiers are widely used in nutraceutical drinks, herbal elixirs, and vitamin-enriched waters. Domestic companies are advancing formulation technologies to meet high standards of clarity, stability, and shelf life. An aging population is also boosting demand for functional beverages, further expanding the cloudifier market.

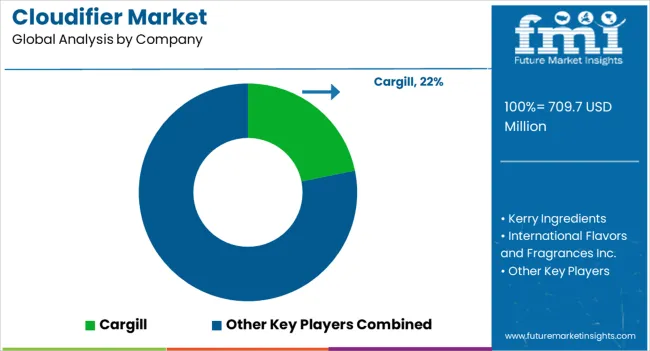

The market is moderately fragmented, with a mix of global giants and niche innovators competing through pricing strategies, innovation pipelines, strategic partnerships, and regional expansion. Top players such as Cargill, Kerry Ingredients, and International Flavors and Fragrances Inc. hold significant market shares due to their wide product portfolios and established distribution networks.

Leading companies are prioritizing natural ingredient development, expanding production capacities, and forming joint ventures to strengthen their positions in the functional beverage and additive space. For example, Cargill has actively enhanced its natural additive portfolio through acquisitions, while IFF and Chr. Hansen have invested in R&D to meet demand for high-performance emulsifiers and turbidity agents.

Recent Cloudifier Industry News

| Report Attributes | Details |

| Current Total Market Size (2025) | USD 709.7 million |

| Projected Market Size (2035) | USD 1,435.7 million |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/(Volume in Metric Tons) |

| By Source | Natural, Synthetic or Non-Natural |

| By Properties | Neutral and Non-Neutral |

| By Form | Powdered and Oil-based Liquid |

| By Application | Food and Beverages, Cosmetics, and Pharmaceuticals |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players | Cargill, Kerry Ingredients, International Flavors and Fragrances Inc., Gat Foods, Chr. Hansen Holding A/S, ADM Wild Flavours, Danisco (DuPont), Eastman Chemical Company, Alano, GLCC Co., eSense Flavors & Fragrances, Chemeka |

| Additional Attributes | Dollar sales by value, market share by country and region, competitive landscape |

The global cloudifier market is estimated to be valued at USD 709.7 million in 2025.

The market size for the cloudifier market is projected to reach USD 1,387.6 million by 2035.

The cloudifier market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in cloudifier market are natural and synthetic or non-natural.

In terms of properties, neutral segment to command 62.7% share in the cloudifier market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA