Performance monitoring for the cloud infrastructure is a market space that has been on the up and up in the past couple of years. Increasing complexity of network infrastructures, rising adoption of cloud-based applications and demand for real-time network performance analysis are some factors anticipated to push the overall cloud network monitoring market growth during the period 2025 to 2035.

This is driven by the fact that enterprises across various verticals are fast adopting cloud solutions to enhance their overall scalability, flexibility, and operational efficiency, thereby increasing the demand for advanced monitoring tools that facilitates tracking performance, detecting anomalies, and optimizing network resources.

The increasing demand for continuous network visibility also along with increasing cybersecurity issues is also increasing the adoption of cloud network monitoring solutions with enhanced security, proactive threat detection and automated remediation capabilities in organizations. Portals for multi-cloud, hybrid networks are making network monitoring platforms a priority for businesses looking to drive high connectivity and uptime in distributed networks.

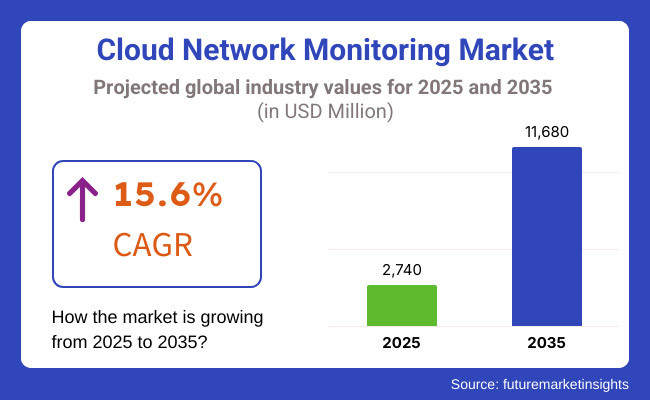

With the growing usage of cloud-native technologies, edge computing, and the increasing need for AI-powered analytics for network management, the market is projected to register a compound annual growth rate (CAGR) of 15.6% for the period from 2025 to 2035. With the proliferation of remote work and digital business came the demand for powerful cloud monitoring tools that watched network traffic, identified performance chokepoints, and empowered operations.

To minimize downtime and make effective use of resources, enterprises are increasingly utilizing cloud network monitoring with predictive analytics, ML and automation. Another factor increasing the adoption of cloud-based network monitoring solutions across industries is the growing regulatory requirements around data security and compliance.

For instance, cloud network monitoring solutions may include features such as network traffic analysis, performance monitoring, security monitoring, and fault detection. Cloud-based monitoring tools are used by organizations to gain deep insights into network behaviour, maximize effective bandwidth management, and troubleshoot issues as and when they arise.

Cloud network monitoring is even more popular in the current era of enterprise IT owing to its integration with software defined networking (SDN) and network function virtualization (NFV). Largescale enterprises and small-to-medium businesses are deploying cloud-based network monitoring in order to ensure network reliability, optimize application performance and guarantee seamless connectivity across cloud and on-premises infrastructures. The market section also reflects the strong demand witnessed by sectors such as banking, financial services and insurance (BFSI), healthcare, retail and telecommunications for uninterrupted network performance to drive business operations.

Explore FMI!

Book a free demo

The North America region dominates the cloud network monitoring market, due to high adoption of cloud technologies, presence of number of cloud service providers, and increasing focus on cybersecurity. DHCP and DNS issues are among the most prevalent problems related to hybrid and multi-cloud management that enterprises face in this cloud-dominant age that draws performance, control, and network management challenges with it, but the solution to manage them well lies in the active use of network monitoring tools The United States and Canada are experiencing incredible demand for these tools This is also encouraging greater adoption of proactive advanced network monitoring tools owing to the rapid expansion of cloud-based data centres along with strict regulatory compliance requirements. Furthermore, the implementation of AI-powered analytics and automation is revolutionizing network management approaches in various sectors.

Europe is a mature cloud network monitoring market, and countries including Germany, the United Kingdom (UK), and France have a strong demand for such solutions. Increasing focus on data privacy aligned with the implementation of regulations such as General Data Protection Regulation (GDPR) is driving enterprises to adopt network monitoring solutions for supporting security and compliance. European businesses are increasingly leveraging cloud-based networking solutions to enhance operational efficiency, reduce IT infrastructure expenses and improve network security. The demand for software-defined networking and network function virtualization solutions in the region is also contributing to driving the market growth.

The Asia-Pacific region is projected to be the fastest-growing cloud network monitoring market, with China, India, Japan, and South Korea being the fastest growing countries in this space. The growth of the overall market in the region can be attributed to the higher adoption of cloud computing, digital transformation projects, and investments in 5G infrastructure. Different sectors including IT, telecommunication, and banking enterprises are adopting cloud network monitoring solutions to enhance their network visibility and security. Number of data centres is increasing, and the complexity of cloud infrastructures is also increasing which is driving the Adoption of brain-based monitoring platforms out there. Moreover, in the Western Balkan region, the governments are emphasizing mount cybersecurity measures, resulting in investing into network security and monitoring technologies.

The cloud network monitoring market in Latin America and the Middle East is steadily growing owing to accelerating digitalization, rising cloud adoption, and increasing investments in IT infrastructure. Significantly, Brazil and Mexico are the most advanced markets in Latin America with enterprises focusing on their network security and performance optimization requirements. Digital transformation programs across Gulf States are further fuelling demand for cloud-based traffic monitoring solutions in the Middle East. The growth of smart cities and the government-driven cloud adoption initiatives also propel the market growth in these regions.

Challenges

Complexity of Multi-Cloud Environments and Data Overload

Cloud network monitoring market is not without its challenges, given the multi-cloud and hybrid cloud environments are becoming the norm. As organizations embrace a multi-cloud strategy to fine-tune cost, performance, and reliability, managing and monitoring these interconnected networks is becoming more intricate. This geometry makes for a more difficult arrangement to accomplish consistent visibility across cloud network environment, especially as each cloud platform works on contrasting conventions, security features, and setups.

The amount of data is a great difficulty for Cloud network monitoring systems. Organizations have an overwhelming amount of network performance metrics, security logs, and system alerts in order to monitor and manage their resources. Without advanced filtering, analysis, and prioritization, IT teams have difficulty identifying critical network issues, impairing troubleshooting timelines and service delivery. False positives and redundant alerts can bring inefficiencies and also rob attention of real threats/performance bottlenecks.

The solution to these pain points lies in extended cloud monitoring with AI-driven analytics, automation capabilities, and centralized dashboards that provide visibility across heterogeneous cloud platforms. By employing intelligent filtering systems and predictive observation utilities, organizations can mine extensive datasets to carry out network operations Alice can dial their call-attentive network to detect problems before they arise.

Opportunity

Demand for Real-Time Network Visibility and Cybersecurity Enhancements

The cloud network monitoring market also has a significant growth opportunity, given the growing dependency on cloud infrastructure across industries. To ensure minimum downtime, facilitate better security detection, and enhance overall performance, enterprises are focusing on real-time network visibility. With organizations moving to remote and hybrid work models, cloud-based network monitoring solutions assist IT teams with ensuring continuous connectivity and tracking the traffic performance in distributed locations.

Real-time detection and mitigation are essential for dealing with cybersecurity threats like Distributed Denial of Service (DDoS) attacks, data breaches, and attempts at unauthorized access. Aspiring to improve their security posture, businesses will gravitate toward cloud network-monitoring platforms that provide features such as anomaly detection, automated threat response and end-to-end encryption.

Moreover, compliance with data protection regulations, including GDPR, HIPAA, and CCPA, requires monitoring and reporting of continuous network activity. "Enterprises interested in cloud network monitoring with compliance features will see reduced manual reporting and increased compliance within regulatory frameworks."

The period from 2020 to 2024 experienced rapid growth in the cloud network monitoring market due to the widespread adoption of cloud computing, digital transformation initiatives, and the rise of remote work. Large amounts of money were spent on monitoring tools so organizations could see in real-time how the network was performing and where security issues potentially lurked. Fragmentation of monitoring tools, a lack of standardization, and an expanded attack surface resulting from distributed cloud environments continued to pose challenges.

From a future perspective of 2025 to 2035, AI-driven network analytics companies and cloud-native security frameworks predictive monitoring capabilities will dominate. Autonomous network monitoring solutions that leverage AI and machine learning to identify and resolve issues will rank higher in importance for enterprises. The use of block chain to provide verified and secure cloud traffic coupled with an expansion of edge computing will also change how cloud network monitoring is approached.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with GDPR, HIPAA, and industry-specific security standards |

| Technological Advancements | Adoption of AI-driven network analytics and cloud traffic monitoring |

| Industry Adoption | Growth in cloud monitoring adoption by large enterprises |

| Network Visibility and Control | Development of real-time cloud traffic analysis tools |

| Market Competition | Dominance of established cloud monitoring providers and cybersecurity firms |

| Market Growth Drivers | Expansion of remote work, increased cloud adoption, and cyber threat mitigation |

| Sustainability and Energy Efficiency | Initial efforts to optimize cloud network resource usage |

| Integration of Smart Monitoring | Deployment of real-time network anomaly detection systems |

| Advancements in Network Security | Increased focus on cloud firewall solutions and endpoint security |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of global cloud security mandates, stricter compliance automation |

| Technological Advancements | Widespread implementation of autonomous network monitoring with AI and ML |

| Industry Adoption | Increased deployment by SMEs, cloud-native start-ups, and IoT networks |

| Network Visibility and Control | Predictive monitoring with self-healing cloud networks |

| Market Competition | Rise of AI-powered monitoring start-ups and block chain-based security solutions |

| Market Growth Drivers | Adoption of 5G, IoT-driven cloud monitoring, and zero-trust security frameworks |

| Sustainability and Energy Efficiency | Large-scale adoption of energy-efficient cloud monitoring tools and green data centres |

| Integration of Smart Monitoring | AI-powered automated threat response and proactive network diagnostics |

| Advancements in Network Security | Expansion of block chain-secured cloud traffic verification and decentralized monitoring systems |

The USA cloud network monitoring market has been growing tremendously with the increasing adoption of cloud computing across enterprises. Cloud based network monitoring also aids businesses in achieving better network visibility, improved performance, and enhanced cybersecurity. With the increase of hybrid and multi-cloud environments, there is demand for advanced network-monitoring tools that provide real-time insights, automated detection of anomalies and compliance management.

Request Sample Report at (Bulk orders will be discounted)One of the primary factors driving the market growth include strict data protection regulations (Eg: CCPA) and rising focus on cloud security in federal agencies Market drivers include strict data protection regulations such as CCPA and the growing focus on federal agencies about cloud security.

Major cloud service providers such as AWS, Microsoft Azure, and Google Cloud are constantly enhancing their network monitoring capabilities, thus driving the market growth. Cloud monitoring tools with AI-powered analytics and automation are helping businesses to quickly identify and fix any network problems, preventing downtime. The continued digital transformation initiatives among the U.S. government, especially in defence, healthcare, and financial services, are further fuelling the growth of cloud network monitoring solution investments.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 16.8% |

The UK cloud network monitoring market is also growing at a great pace owing to the adoption of the cloud services in the sectors such as banking, financial services, insurance (BFSI), healthcare, and telecom. Network monitoring solutions for improved cloud performance, cyber threat detection, and compliance with data privacy law, including GDPR, are also preferred by businesses. Most remote work environments, along with wide-ranging digital banking services from banks and financial institutions, have driven a significantly increasing demand for real-time cloud network monitoring tools.

In addition, government-driven projects for digital transformation, such as smart city initiatives and public cloud adoption in healthcare and defence, are expected to drive the market. If you are a UK-based corporate, then you are investing in AI-powered network analytics that ensure seamless cloud connectivity and reduce disruption. Several leading cloud providers are establishing local data centres, which is further driving the demand for cloud monitoring solution across multiple business verticals.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 15.2% |

Cloud Network Monitoring Market in Europe is classified through Regions, Applications, and Type - A European Cloud Network Monitoring Market is to grow at a Highest CAGR in the growth by end 2030. Sixth, innovative organizations and other nations, such as Germany, France, and the Netherlands, are investing in cloud-based network monitoring solutions to boost security, increase performance, and guarantee regulatory compliance. The growing complexity of cloud environments and the increasing deployment of 5G and edge computing systems are also driving up demand for AI- powered cloud monitoring tools.

The European Commission’s drive for digital sovereignty and cybersecurity plans is also increasing market growth. Machine learning and automation are being incorporated into network monitoring solutions by enterprises throughout the European Union, enabling them to better understand cloud traffic patterns, identify security breaches, and improve cloud operations. As the demand for cloud-based applications continues to rise, and DevOps practices become more prevalent among European enterprises, there is a need for comprehensive cloud monitoring solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 15.9% |

Japan: Japan is the fastest growing market cloud network monitoring in this region due to the burgeoning innovations of 5G technology, Iota adoption, and smart infrastructure usage. Japanese organizations are increasingly adopting cloud monitoring solutions to enhance network security, optimize cloud performance, and meet strict data privacy regulations. Japan’s widespread adoption of cloud services platforms have fuelled the need for real-time monitoring and AI-enabled network analytics across its key sectors, including manufacturing, finance and healthcare.

The Japanese government’s push for digital transformation initiatives, , is accelerating the adoption of cloud-based monitoring solutions. Japan's leading cloud providers and telecoms are incorporating automation and AI-driven analytics into their networks being-networks-for-stop too-and cloud computing security. Moreover, the rising uptake of SaaS-enabled network monitoring systems by SMEs in Japan, will also accelerate the size management market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 15.4% |

The growth in the cloud network monitoring market in South Korea is attributed to the country’s advanced IT infrastructure and higher adoption of cloud computing. Furthermore, the increased deployment of 5G networks and digital enterprises is allowing for demand for monitoring solutions to be provided through the scope of the cloud ensuring real-time visibility, high-performance optimization, and better cybersecurity measures. AI-powered network analytics help South Korean companies detect anomalies, optimize cloud traffic and mitigate security breaches.

Market growth is also accelerated by government initiatives designed to reinforce cloud security and increase the scope of digital services. One sector that is particularly focused on cloud network monitoring is the South Korean financial sector, which is currently making major investments in this space to satiate both data security and regulatory compliance needs. Moreover, the growing dependence on e-commerce, online education, and telehealth services in the nation is also accelerating the need for scalable and automated cloud monitoring solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 16.1% |

The cloud network monitoring market is segmented on the basis of organizational deployment type into public cloud and private cloud; the portion of the public cloud segment continues to dominate the market share due to the growing adoption of cloud infrastructure, with organizations moving their workloads to the cloud in order to gain scalability, flexibility, and cost benefits. With packages provided by public cloud providers, enterprises have the option to monitor network traffic, detect performance bottlenecks, and ensure that data is securely transmitted, all without incurring excessive capital expenditures on premise. Are a strong need for real-time network analytics, automatic troubleshooting and traffic optimization have led to the widespread acceptance of public cloud network surveillance solutions.

The integration of advanced monitoring tools in cloud management platforms, like AWS, Microsoft Azure or Google Cloud, was feasible and provides enterprises with the opportunity of having insights into the cloud environment down to a fine-grained normal level. This allows for improved bandwidth allocation, cybersecurity threat identification and compliance with data payment policies like HIPAA, GDPR, etc. With the rise of multi-cloud strategies, public cloud network monitoring demand continues to grow, which is particularly the case in streaming applications that need end-to-end insight across their distributed cloud networks.

Public cloud network monitoring, while beneficial, poses concerns like data privacy issues, vendor lock-in risks, and dependency on third-party providers for security and compliance. Nevertheless, data security issues with sensitive information, and challenges posed by segregation of multicycle workloads pose a serious threat to market growth, but increasing encryption technologies, machine learning-based anomalies detection, and hybrid cloud monitoring tools help in tackling these concerns.

Private Cloud Network Monitoring Sees Adoption in Security-Conscious Industries

The private cloud network monitoring section is growing there is a steady growth, especially in industries such as finance, healthcare, applicators, and manufacturers with strict security and compliance requirements. Enterprises in these industries favour private cloud implementations given better data security, lesser vulnerability to cybersecurity attacks, and improved governance of network environments.

Private cloud specific network monitoring solutions allow companies to monitor the traffic running over their servers, identify security hotspots, and optimize resource usage in their home-grown cloud services. One particular example that incorporates such tools in security is the financial institutions that are used to track transaction flows, block unauthorized access and meet various financial regulations including PCI DSS. Healthcare organizations also leverage private cloud monitoring solutions to protect patient information, maintain HIPAA compliance, and reduce data breach risks.

However, while the security and customization of private cloud deployments are superior, operational costs are significantly higher, and management of infrastructure requires dedicated IT teams. With hybrid cloud strategies, organizations use private and public cloud environments side by side, driving a rise in the adoption of integrated solutions for cloud network monitoring.

As organizations look to maintain seamless visibility across multi-cloud and on premise infrastructures, hybrid cloud network monitoring is emerging as a significant growth segment across the landscape. As hybrid cloud strategies become more prevalent, organizations have begun to leverage advanced tools that give them real-time visibility into network traffic, application performance, and security events across different environments.

Hybrid cloud model organizations need network monitoring solutions that can integrate with public and private cloud providers while providing unified dashboards, automated alerts, and AI-driven analytics. Such solutions enable enterprises to identify unusual network behaviour, improve resource allocation in the cloud and bolster overall IT resiliency.

Hybrid cloud architectures are noted for the challenges posed by data synchronization between cross-service architectures, interoperability between cloud providers and potential performance bottlenecks from moving large data sets between environments. Nonetheless, ongoing developments in cloud-native monitoring, container-based network analysis, and AI-enabled predictive analytics are combating these hurdles to facilitate strong and effective hybrid cloud management.

This provides the foundation for accelerating productivity and innovative capabilities of businesses, while including large enterprises leading market adoption. In recent years initiatives towards digital transformation have been accelerated to enhance the productivity of business functions.

The cloud network monitoring market is segmented into large enterprises and small to medium enterprises, with large enterprises holding a leading position due to their volume of multi-platform network management, optimization, and security requirements. As global organizations become responsible for huge IT infrastructures across various cloud providers, data centres, and branch offices, they also increasingly need scalable and AI-based network monitoring systems.

Large enterprises benefit from cloud network monitoring as it allows for proactive detection of network congestion, cybersecurity risk mitigation, as well as compliance with industry regulations. By combining machine learning algorithms with real-time traffic analysis tools, enterprises can now predict when a network failure is likely to occur, automate the remediation of problems, and enhance bandwidth utilization.

However, large enterprises are challenged with the high costs for example implementation, data confidentiality concerns, and the complexities of multi-cloud network management. Nonetheless, digital transformation initiatives, Iota adoption, and shift towards cloud-based cybersecurity measures will continue to enhance refocus on cloud network monitoring technologies.

SMEs Accelerate Adoption of Cost-Effective Cloud Monitoring Solutions

The cloud-centric approach to the SME data centre world: Cloud network monitoring solutions are gaining traction amongst small to medium enterprises (SMEs) to improve the reliability of IT infrastructures, security posture and optimizing cloud resources usage. Way different than large enterprises, SMEs are not big enough to have dedicated IT teams and need automated monitoring tools that are easy to use, require less operational overhead.

Chartered against on-premises accomplice or a distributed set of suppliers, cloud-based system checking stages for SMEs offer a membership based value model, guaranteeing that SMEs can use this with the most financially savvy execution, without the need of introducing enormous equipment. The advent of remote work, digital business models, and e-commerce platforms has also triggered a surge in demand for cloud monitoring solutions among SMEs, allowing them to further ensure a seamless connectivity while fighting against cyber threats.

Limited IT budgets, insufficient in-house technical expertise, and cloud data security concerns continue to restrict adoption. Despite the challenges, cloud service providers are stepping in to fill these gaps with managed monitoring services, AI-driven network automation, and pre-configured security policies suitable for SMEs.

As cyber threats have evolved to become more sophisticated, security and compliance have emerged as key drivers in the cloud network monitoring market. Companies in various sectors are investing in advanced threat detection, real-time incident response, and automated compliance monitoring to protect their cloud networks.

Data privacy and access controls will be enforced by regulatory frameworks including GDPR, HIPAA, and SOC 2, forcing organizations to strengthen their cloud network monitoring solutions. Cloud security tools have commonly adopted AI-based security analytics, behavioural anomaly detection, as well as zero-trust network architectures.

Cloud network monitoring vendors are investing in advanced encryption techniques, network segmentation strategies, and AI-powered predictive threat intelligence to address evolving cybersecurity threats. These innovations will further propel the adoption of cloud network monitoring solutions, assuring resilient and secure cloud infrastructure management.

With growing demand for real-time network visibility, security and performance optimization in cloud based infrastructure, cloud network monitoring market continues to grow. As network architectures shift to hybrid and multi-cloud environments, the demand for smarter monitoring solutions that guarantee uninterrupted performance is higher than ever. This is driving a move to AI-powered network analytics, automated diagnosis, and predictive maintenance in organizations. Cloud-native watering holes, deep packet inspection, and end-to-end traffic analysis are all key transformation areas. Multi-tenant infrastructure also makes enterprises rely on scalable and API-enabled monitoring platforms able to deal with dynamic workloads and emerging cybersecurity threats.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cisco Systems, Inc. | 20-24% |

| Broadcom Inc. (DX NE tops) | 15-19% |

| IBM Corporation | 12-16% |

| Microsoft Corporation | 10-14% |

| Solar Winds Corporation | 8-12% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cisco Systems, Inc. | Provides AI-powered network monitoring solutions, including Cisco Thousand Eyes, to enhance cloud visibility and application performance. |

| Broadcom Inc. (DX NetOps) | Specializes in network performance monitoring and analytics with cloud-native capabilities for enterprise IT infrastructures. |

| IBM Corporation | Delivers cloud network observability solutions with AI-driven insights, automated alerts, and security-focused monitoring. |

| Microsoft Corporation | Offers Azure Network Watcher, enabling real-time network performance diagnostics and security monitoring in cloud environments. |

| SolarWinds Corporation | Develops scalable cloud network monitoring tools, focusing on performance optimization and multi-cloud management. |

Key Company Insights

Cisco Systems, Inc. (20-24%)

A leader in cloud network monitoring, Cisco integrates AI-driven traffic analysis, real-time threat detection, and application performance monitoring through its ThousandEyes platform.

Broadcom Inc. (DX NetOps) (15-19%)

Expanding its cloud monitoring capabilities, Broadcom provides enterprise-grade solutions for performance management, automated troubleshooting, and network security.

IBM Corporation (12-16%)

Offers AI-powered network analytics and observability tools, focusing on hybrid and multi-cloud infrastructures for enhanced security and performance optimization.

Microsoft Corporation (10-14%)

Provides end-to-end network monitoring solutions through Azure, integrating advanced diagnostics, anomaly detection, and traffic analysis for cloud-based applications.

Solar Winds Corporation (8-12%)

Specializing in cloud-native network monitoring, the company offers tools for performance tracking, troubleshooting automation, and multi-cloud optimization.

Other Key Players (25-35% Combined)

Several companies contribute to the cloud network monitoring market by offering specialized solutions for network performance management and cybersecurity. These include:

The overall market size for the Cloud Network Monitoring Market was USD 2,740 million in 2025.

The Cloud Network Monitoring Market is expected to reach USD 11,680 million in 2035.

The increasing adoption of cloud-based services, the growing need for real-time network performance monitoring, and rising cybersecurity concerns fuel the Cloud Network Monitoring Market during the forecast period. The demand for scalable and automated network visibility solutions further accelerates market growth.

The top 5 countries driving the development of the Cloud Network Monitoring Market are the United States, China, Germany, Japan, and the United Kingdom.

On the basis of application, Public Cloud Solutions are expected to command a significant share over the forecast period, driven by increasing enterprise adoption of public cloud infrastructure, cost efficiency, and improved scalability.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.