The expansion of e-commerce coupled with the globalization of trade and increasing complexity in logistics networks has resulted in a greater dependency on cloud-based solutions for real-time tracking, route optimization, and inventory management.

With the growth of e-commerce, cloud-based logistics management system is becoming more and more popular in many industries because of its scalability, flexibility, and better data analytics capabilities available from these cloud-based platforms lead to better decision-making and operational efficiency. With logistics companies shifting towards on-demand logistics services such as Software-as-a-Service (SaaS) solutions, the logistics market is experiencing further growth through a transformation that allows companies in the industry to speed up process automation, improve transparency, and lower expenses associated with on-premises infrastructure.

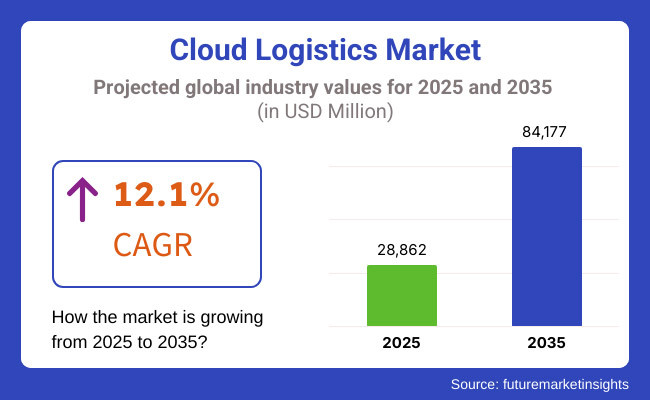

Moreover, growing cloud computing adoption by logistics service provider, third-party logistics (3PL) firms and freight management solution, is anticipated to grow the cloud logistics market at a CAGR of 12.1%, during the forecast period (2025 to 2035).

Cloud computing along with real-time analytics, predictive modelling, and automation tools will further enable logistics operations to streamline processes, improve efficiency, and become cost-effective. Additionally, the ever-growing international trading routes and the rise of e-commerce are driving the demand for these solutions, as the need for worldwide electronic tracking, compliance management, and electronic documentation grows.

Cloud logistics can be segmented in terms of service types into transportation management, warehouse management, and fleet management, among others, and are extensively adopted by logistics service providers, e-commerce companies, and manufacturers. Cloud Transportation Management System, TMS for seamless movement of freight reducing transit time and enhancing delivery performance.

WHM.scan warehouse management solutions equipped with advanced inventory tracking, automated replenishment, and real-time stock visibility feature helps companies improve efficiency and minimize wastage. On top of this, cloud-based delivery management systems continue to grow in popularity as organisations seek to cut down on fuel costs, maximise delivery routes and improve the performance of their drivers via data-driven insights. The increasing adoption of cloud logistics in freight forwarding, cross-border trade, and multimodal transportation also facilitates its deployment in the networks of the global supply chain.

Explore FMI!

Book a free demo

Owing to the strong presence of logistics service providers, rising adoption of digital supply chain solutions, and growing e-commerce sector in North America, the region has been a major contributor to the global cloud logistics market. Cloud-based logistics adoption has seen exponential growth particularly in the USA and Canada, especially among 3PL companies and freight management firms within organisations aiming to optimise supply chain operations. The emphasis on automation, real-time analytics, and AI-driven logistics solutions in the region is further bolstering the demand for cloud-based platforms. Moreover, favourable regulatory policies supporting digital transformation in logistics is enhancing the market growth.

Europe, with Germany, France and the UK as the main cloud logistics leaders, is already a mature market. The region's focus on smooth supply chain operations, sustainability, and cost control have led to strong investments in cloud-based logistics systems. Cloud computing is being highly adopted by European logistics companies to improve warehouse automation, transportation planning, and last-mile delivery optimization. Demand for cloud-integrated fleet management solutions is also driven by the region's commitment to green logistics, manifesting itself in the implementation of electric and autonomous vehicles in supply chain networks.

The Asia-Pacific region is projected to have the highest growth rate, led by China, India, and Japan in the cloud logistics market. Key drivers facilitating growth of cloud logistics market in South-East Asia be the rise of e-commerce, growing urbanization, and the growing complexity of supply chain networks. Businesses are spending billions on digital logistics infrastructure to gain visibility into inventory, improve transportation and optimize delivery routes. The growth of cross-border trade in Southeast Asia and the integration of cloud technologies in last-mile delivery service further boost the regional market.

Cloud Logistics in Latin America: The Latin America cloud logistics market is steadily growing, due to rising digitalization of supply chain operations and government efforts to upgrade logistics infrastructure. Brazil and Mexico are leading the way in warehouse and fleet management solutions underpinned by the cloud to become more efficient and reduce logistics costs.

The Middle East continues to see cloud logistics gaining momentum, especially in the Gulf countries, and companies are investing more in smart logistics hubs, as well as automated supply chain solutions, to drive operational efficiency and cost optimization. Free trade zones and logistics corridors continuing to be set up in the area are also accelerating cloud adoption for the logistics industry.

Challenges

Data Security and Integration Complexities

Data Security and system integration acts as a challenge for cloud logistics market. While cloud-based logistics solutions are delivering unprecedented value, the threat of cyber-attacks and data breaches is ever-present. Logistics providers deal with huge amounts of sensitive information, including supply chain data, customer data and financial transaction data, so make them attractive targets for cyberattacks. Inadequate cybersecurity can result in service interruptions, economic losses, and reputational harm.

One more different yet intricate challenge is to integrate cloud logistics solutions with existing legacy systems. Most logistics providers used on premise solutions and legacy infrastructure, which makes it challenging to adapt to cloud-based platforms. Overlapping of different systems can result in delays, inconsistent data, and increased implementation costs. The last financial leveraging for small and medium sized enterprises (SMEs) is often daunting with even an initial investment in 'cloud-based logistics' with ongoing subscription fees.

These challenges may be mitigated by implementing encryption, multi-factor authentication, and real-time threat monitoring to meet cybersecurity requirements for logistics companies. Moreover, transitions can also become easier by using cloud logistics platforms that feature API integrations with existing systems, resulting in less fragmented systems and better digital transformation overall.

Opportunity

Online Shopping Boom and need for Real-Time Supply Chain Visibility

The cloud logistics market has huge opportunities for growth due to the fast growth of the e-commerce industry and the demand for real-time supply chain visibility. Cloud-based solutions are becoming more and more crucial in optimizing inventory, delivery speed and efficiency for online retail giants, third-party logistics providers and global supply chains. The power to retrieve live data anywhere enables logistics solutions providers to leverage data for decision-making, optimize fleet management, and cost-effectively streamline operations.

Increased usage of Cloud based transportation management systems (TMS) and warehouse management systems (WMS) is other major factor fuelling the market. The demand for these solutions includes automated route optimization, predictive analytics to forecast demand, and end-to-end visibility throughout the supply chain. Cloud logistics platforms also provide scalability, enabling companies to scale up operations without large infrastructure costs.

Cloud adoption in logistics is further catalysed by regulatory compliance and sustainability initiatives. Including Efforts by Governments and Industry Regulators to Reduce Environmental Footprint - Governments and industry regulators are putting in a much more stricter environmental sanction, driving logistics providers to implement cloud-based solutions to optimize fuel consumption, thereby reducing their overall carbon footprints and increasing the performance of the overall supply chain. Businesses that plug in to cloud-based sustainability trackers and carbon-offsetting programs have a competitive advantage in the new logistics era.

While the cloud logistics market was growing between 2020 and 2024, it grew significantly due to the growth of e-commerce, enhanced digitization in supply chains, and need for contactless operations. Logistics providers rushed to the cloud to speed up delivery speed, increase visibility into inventory across the supply chain, and mitigate supply chain disruptions. Despite this, barriers such as cyber-security threats, integration hurdles, and hefty implementation costs were deterrents against widespread adoption.

Then, from 2025 to 2035, the sky seems to be the limit with cloud logistics technology. AI-optimized forecasting, decentralized ledgers facilitating real-time shipment tracking, and cloud-based process automation will transform logistics operations. Corporate supply chains will be re built as many will take advantage of risk assessment and contingency apps in the cloud. In the next phase of cloud logistics evolution, digital freight marketplaces and autonomous solutions will further revolutionize the paradigm.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Implementation of digital supply chain reporting and compliance regulations |

| Technological Advancements | Growth of cloud-based TMS and WMS adoption |

| Industry Adoption | Increased migration to cloud logistics platforms by large enterprises |

| Supply Chain and Sourcing | Enhanced supply chain visibility and predictive analytics for demand planning |

| Market Competition | Dominance of major cloud logistics providers and software-as-a-service (SaaS) platforms |

| Market Growth Drivers | E-commerce expansion, demand for real-time tracking, and cost optimization |

| Sustainability and Energy Efficiency | Initial adoption of cloud-based carbon tracking tools |

| Integration of Smart Monitoring | Development of real-time shipment tracking and cloud-based fleet management systems |

| Advancements in Cloud Infrastructure | Increased reliance on SaaS logistics solutions and hybrid cloud models |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of cloud-based sustainability tracking, green logistics mandates, and stricter cybersecurity laws |

| Technological Advancements | Integration of block chain, AI-driven analytics, and autonomous cloud logistics solutions |

| Industry Adoption | Widespread adoption by SMEs and the rise of industry-wide cloud-based collaborations |

| Supply Chain and Sourcing | Fully automated cloud-driven logistics ecosystems with real-time inventory tracking |

| Market Competition | Increased competition from new cloud-native logistics start-ups and decentralized logistics networks |

| Market Growth Drivers | AI-powered logistics automation, sustainability-driven cloud logistics, and global supply chain resilience initiatives |

| Sustainability and Energy Efficiency | Large-scale deployment of cloud-enabled green logistics, carbon-neutral freight networks, and eco-optimized route planning |

| Integration of Smart Monitoring | AI-powered smart monitoring with predictive risk assessment and block chain-backed supply chain security |

| Advancements in Cloud Infrastructure | Transition to fully cloud-native logistics ecosystems with edge computing capabilities for real-time processing |

The USA cloud logistics market is expanding at a notable rate owing to the growing adoption of digital supply chain solutions and increasing need for real time logistics tracking. More and more, businesses are upgrading to cloud logistics management systems as e-commerce and Omni channel fulfilment continues to grow. Cloud-based transportation management system (TMS) and warehouse management solutions are allowing logistics providers to improve their efficiencies, lower operational costs, and better last-mile delivery performance.

Moreover, a cloud-based solution is an essential thing for 3PL service providers, as they are driven to implement automation and data-driven logistics mainly. The top players in the industry are taking advantage of cloud platforms for the optimization of the movements of fleets, route planning, and monitoring inventory. Advanced analytics and predictive maintenance solutions are also gaining traction and positively influencing logistics operations. Rising need to ensure sustainability and reducing carbon footprints is fuelling the demand for cloud-based logistics optimization tools.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.4% |

Cloud logistics The United Kingdom’s cloud logistics market is rapidly developing due to the digital transformation of the supply chain industry Cloud-based solutions among retailers, manufacturers, and logistics service providers are increasingly adopted due to the growing demand for real-time visibility and automated logistics processes. The acceleration of cloud logistics platforms benefits from the UK s growing e-commerce sector, as well as increased cross-border trade and takes advantage of the infrastructure of the e-comm business.

The trend towards data-driven decision making and demand forecasting is propelling adoption of cloud logistics even more. Smart logistics and digital freight platforms are a significant focus for the UK government, prompting companies to move away from legacy systems to cloud-based logistics solutions. Moreover, cybersecurity is a top concern for logistics and supply chain firms, leading to the prioritization cloud adoption in cloud storage of data.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.8% |

Nowhere is the rise of cloud logistics more apparent than in the European Union (EU), as regulatory support for the transition of the digital supply chain and efficiency improvements in logistics drive rapid adoption of the cloud. Leaders: Countries like Germany, France, and Netherlands embrace the adoption of integrated cloud-based transportation and warehouse management systems for logistics optimizations. Cloud technology is also big in the European logistics industry, with major investments made to ensure freight tracking, fleet monitoring, and supply chain automation.

The implementation of the European Green Deal and sustainability regulations are also driving logistics providers into the arms of services that enable the cloud-based reduction of fuel consumption and optimization of route planning. Furthermore, growth of cross-border e-commerce in the EU is demanding real-time logistics tracking, which is made possible by adoption of cloud-based platforms. The rising demand for AI-enabled logistics analysis or automation is driving the cloud logistics adoption in the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.2% |

Japan Cloud Logistics Market has observed government initiatives to encourage enterprise resource planning and cloud enabling of 10184 customers. Given the country’s emphasis on precision and automation, logistics firms are investing in agile, cloud-based platforms to streamline transportation, inventory and warehousing operations. Japan’s logistics companies are combining cloud computing with robotics and automated storehouses to speed up delivery times and improve accuracy.

Japan’s evolving e-commerce landscape and cross-border trading activities are also fuelling demand for cloud logistics solutions. Cloud-based freight management systems are being adopted by companies to improve supply chain visibility and real-time shipment tracking. In addition the government of Japan is pursuing the digital transformation of logistics infrastructure via smart logistics initiatives which is adding growth opportunities to the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.0% |

The advanced technology infrastructure and digitalization strategies of South Korea are contributing to the rapid development of the cloud logistics market. The growth in e-commerce and cross-border trade is driving logistics providers to adopt cloud-based solutions that automate inventory tracking, order fulfilment, and last-mile delivery management. Cloud-based logistics platforms are enabling South Korean firms to enhance logistical nimbleness and cut down on operating expenses.

Platforms that are used in smart logistics in the country (supported with government budget) are promoting the cloud logistics technology. South Korean delivery companies are using cloud-based AI analytics to optimize delivery routes and improve transportation efficiency. Moreover, investments in next-gen supply chain solutions among cloud logistics market players, such as block chain-integrated logistics platforms are improving data security and transparency in cloud based logistics operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.5% |

Transportation management systems (TMS) dominate the cloud logistics according to the requirement of supply chain optimization, real-time freight tracking, and reduction in operational cost. Cloud TMS solutions are further enabling transporters to streamline route planning, carrier selection, and freight auditing allowing enterprises and logistics companies to coordinate with multi-modal transport through complex global supply chains. The growing prevalence of e-commerce, cross-border trade, and just-in-time delivery models has driven demand for agile and scalable cloud-based logistics solutions that provide real-time visibility into shipments and optimize transportation workflows.

Cloud-based TMS solutions provide better flexibility, scalability, and integration capabilities with other logistics applications, minimizing reliance on legacy systems. By using predictive analytics and AI-driven route optimization, businesses can also take the opportunity in making their operation more efficient by cutting down fuel costs, avoiding delivery delays, and improving customer satisfaction. With sustainability being a high priority for many businesses, cloud TMS solutions are also contributing to a lower carbon footprint through data-driven route optimization and alternative fuel management strategies.

While the TMS segment offers advantages, challenges such as integration complexities with existing enterprise resource planning (ERP) systems and concerns over data stored in the cloud from a cyber-security stand point remain. Yet, with ongoing improvements in encryption, extensive multi-cloud security frameworks, and API-fuelled integrations, these concerns are being alleviated, leading to the increased adoption of cloud TMS solutions.

Warehouse Management Systems (WMS) Gain Traction as Automation and Inventory Optimization Become Priorities

As one of the most transformative trends enhancing customer recognition, Cloud WMS is experiencing rapid growth with the demand for inventory accuracy and effective warehouse management and order fulfilment. Traditional warehouse management methods use outdated, manual systems that often result in inefficiencies in stock tracking, order processing, and space utilization. Inventory: Cloud WMS solutions facilitate real-time inventory tracking, automated stock replenishment, and laying out the warehouse for maximum efficiency to help businesses decrease their storage costs and prevent stock outs.

The growing adoption of automated storage and retrieval systems (AS/RS), robotics and IoT-enabled sensors within warehouses has added to the demand for cloud-based WMS platforms. These solutions help retailers, manufacturers, and third-party logistics (3PL) providers to improve warehouse productivity and adapt to increased demands of Omni channel distribution.

Data synchronization solutions across multiple warehouse locations and the expensive implementation of advanced cloud-based WMS platforms continues to be critical challenges for businesses. Nonetheless, for various organizations, the capacity to scale, be accessed from any location, and the subscription-based pricing model have made cloud-options far more appealing than the traditional solutions.

The order management systems (OMS) component is booming, as the construction of e-commerce and complexity of Omni channel fulfilment rises. Businesses are adopting cloud-based OMS solutions to consolidate all order processing, inventory across all sales touchpoints, and improve order accuracy. With cloud WMS and TMS platforms pre-integrated with OMS, businesses can achieve visibility at every stage of their supply chain, minimizing errors with seamless order fulfilment and stock accuracy.

Since consumers now demand faster time-to-delivery and flexible return policies, the businesses are opting for OMS solutions that enable real-time order tracking, automated order allocation, and demand forecasting. Cloud-based OMS with artificial intelligence (AI) based analytics integrates with the data on demand for precise prediction of consumption, which allows organizations to change inventory levels dynamically and reduce the level of excess stock.

Although OMS helps, it also faces challenges in the form of data inconsistency across multiple sales channels, integration issues with legacy systems, and cybersecurity concerns. Nevertheless, ongoing improvements in cloud-native security protocols, block chain-based transaction authentication, and AI-driven automation are addressing these issues, allowing for continued market growth.

Small and Medium Enterprises (SMEs) Drive Adoption of Cloud Logistics Solutions for Cost Efficiency and Scalability

Tap Increase for Cloud Logistics Market Highlights on the Cloud Logistics Market Window Size market: SME Are Becoming Major Rivals in Cloud Logistics For example, cloud-based logistics platforms provide SMEs with access to advanced features like predictive analytics, real-time shipment tracking, and automated inventory management, all of which can be availed without the need to make large up-front investments in IT infrastructure.

While large enterprises tend to invest in complicated, on premise logistics management systems, SMEs are taking advantage of cloud-based solutions and their subscription-based pricing models, allowing for flexible scalability. Furthermore, SMEs can leverage the simplicity of integrating with a range of third-party applications and digital marketplaces to optimize supply chain processes and improve customer service.

Nevertheless, data security concerns, lack of digital transformation awareness, and a general shortage of in-house IT experts are preventing SMEs from widely adopting next-gen technologies. Vendors are meeting these challenges with user-friendly interfaces, solid cybersecurity measures, and customized support services to drive broader adoption.

Cloud Logistics Solutions Market Is Driven by Retail and E-Commerce Sectors

The cloud logistics market end-user segments which receive the highest contribution share for its growth are retail and e-commerce industries as, these industries are the key for end-users as the cloud logistics systems assist in instant inventory track, efficient last-mile delivery and seamless returns management. As online shopping and DTC models continue to grow rapidly, realized businesses are turning to cloud logistics platforms to drive speed and accuracy in their order fulfilment operations.

Retailers are now combining cloud-based logistics platforms with AI-driven demand forecast and automated restocking features, which help keep inventory levels optimal and minimize overstocking or stock-outs. Increased focus on same-day and next-day delivery services has also catalysed the uptake of cloud-based TMS, WMS & OMS solutions across retail.

Nonetheless, the retail industry has enjoyed logistical solutions for supply chain disruptions, unpredictability of consumer needs, and peak operation costs. Cloud-based logistics solutions are alleviating these challenges by providing dynamic pricing models, automated decision-making tools, and AI-driven supply chain risk management capabilities.

Market Innovations Driven: Regulatory Compliance and Data Security

With the growing adoption of cloud logistics, regulatory compliance and data security have emerged as the most important factors in driving growth in this market. Governments are imposing strict data protection regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), putting pressure on logistics services to adopt effective cybersecurity practices. Another key priority for businesses utilising cloud logistics solutions has been ensuring compliance with trade regulations, customs documentation and cross-border shipping requirements.

Meanwhile, to combat these obstacles cloud logistics suppliers forking over money on block chain supply chain authentication, AI for anomaly detection, and more secure encryption techniques to protected information integrity and compliance with regulations. As welfare data and sector-specific compliance tools for things such as Cybersecurity frameworks continually evolve, they will contribute to further enhancing the market adoption and the innovation in the cloud logistics industry.

The increasing demand for real-time supply chain visibility, cost efficiency, and scalability in logistics operations are a few factors contributing to the growth of the cloud logistics market. To streamline freight management, warehouse automation, and demand forecasting, companies are integrating cloud-based solutions. Factors propelling the transition from legacy on premise logistics management to cloud-based platforms include the increasing complexity of global supply chains, regulatory compliance, and shorter delivery timelines.

There were also key areas of transformation such as Cloud transportation management system (TMS), warehouse management systems (WMS) and freight tracking solutions. AI-powered analytics, block chain-based shipment tracking, and automated tools enterprises are all-in for effective supply chain management.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SAP SE | 18-22% |

| Oracle Corporation | 15-19% |

| Microsoft Corporation | 12-16% |

| Infor | 10-14% |

| Manhattan Associates | 8-12% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| SAP SE | Provides cloud-based logistics and supply chain management solutions, including SAP Transportation Management and SAP Extended Warehouse Management. |

| Oracle Corporation | Offers Oracle Cloud SCM, which integrates real-time transportation and warehouse management with AI-driven predictive analytics. |

| Microsoft Corporation | Delivers cloud logistics solutions through Azure-based platforms, enabling real-time shipment tracking and logistics automation. |

| Infor | Specializes in cloud-driven supply chain planning and execution, focusing on digital freight networks and warehouse automation. |

| Manhattan Associates | Develops advanced cloud-native logistics and distribution software, emphasizing supply chain optimization and inventory visibility. |

Key Company Insights

SAP SE (18-22%)

A market leader in cloud logistics, SAP integrates AI-driven predictive analytics and machine learning into its logistics platforms to improve freight management and warehouse efficiency.

Oracle Corporation (15-19%)

Expanding its Oracle Cloud SCM solutions, the company enhances transportation planning, order fulfilment, and logistics execution through cloud-based automation tools.

Microsoft Corporation (12-16%)

Provides a scalable cloud logistics infrastructure through Azure, supporting real-time shipment tracking, inventory forecasting, and warehouse management solutions.

Infor (10-14%)

Focuses on digital supply chain transformation by integrating AI-powered route optimization, dynamic pricing models, and automated freight tracking within its cloud logistics suite.

Manhattan Associates (8-12%)

Enhancing warehouse and transportation management solutions with cloud-native capabilities, the company optimizes supply chain execution and demand forecasting.

Other Key Players (25-35% Combined)

Several cloud logistics providers contribute to the market with specialized solutions for freight management, warehouse automation, and supply chain analytics. These include:

The overall market size for the Cloud Logistics Market was USD 28,862 million in 2025.

The Cloud Logistics Market is expected to reach USD 84,177 million in 2035.

The increasing adoption of digital supply chain solutions, the need for real-time tracking and visibility, and cost-efficiency benefits fuel the Cloud Logistics Market during the forecast period. The shift toward automation and cloud-based transportation management further accelerates market growth.

The top 5 countries driving the development of the Cloud Logistics Market are the United States, China, Germany, Japan, and India.

On the basis of application, Transportation Management Systems are expected to command a significant share over the forecast period, driven by their ability to optimize route planning, enhance fleet management, and improve overall supply chain efficiency.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.