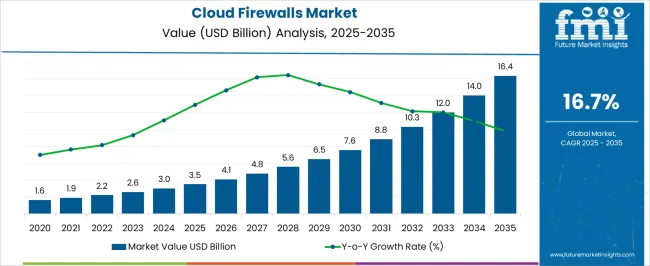

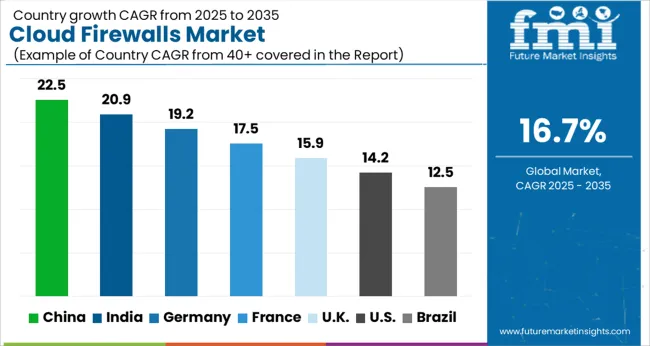

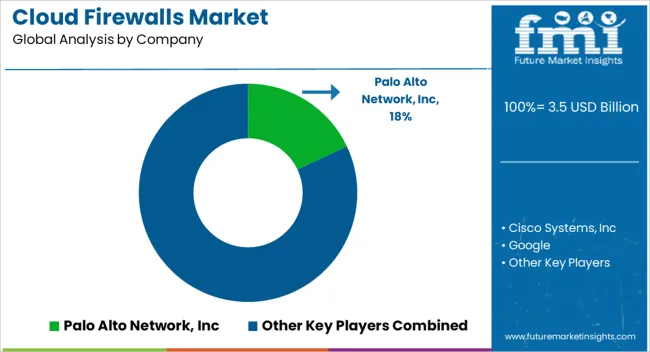

The Cloud Firewalls Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 16.4 billion by 2035, registering a compound annual growth rate (CAGR) of 16.7% over the forecast period.

| Metric | Value |

|---|---|

| Cloud Firewalls Market Estimated Value in (2025 E) | USD 3.5 billion |

| Cloud Firewalls Market Forecast Value in (2035 F) | USD 16.4 billion |

| Forecast CAGR (2025 to 2035) | 16.7% |

The cloud firewalls market is experiencing significant expansion, driven by the surge in cloud-native application deployment, increasing sophistication of cyber threats, and stricter data privacy regulations worldwide. As enterprises migrate from traditional on-premises infrastructure to hybrid and multi-cloud environments, demand for scalable, policy-driven security solutions has intensified.

Cloud firewalls are being adopted to protect workloads at the edge, ensure regulatory compliance, and enable micro-segmentation. Technological advancements such as AI-driven threat detection, automated rule configuration, and containerized firewall deployments are reshaping security frameworks across sectors.

Vendor investments in secure access service edge (SASE) integration and zero trust architecture are expected to influence future market direction. Rising enterprise awareness around attack surfaces in distributed environments continues to elevate cloud firewall adoption as a strategic priority in digital transformation agendas.

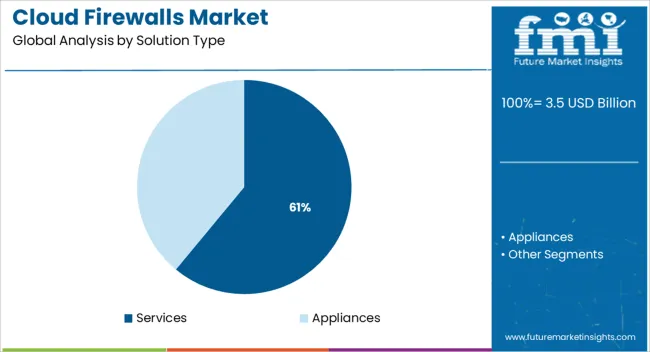

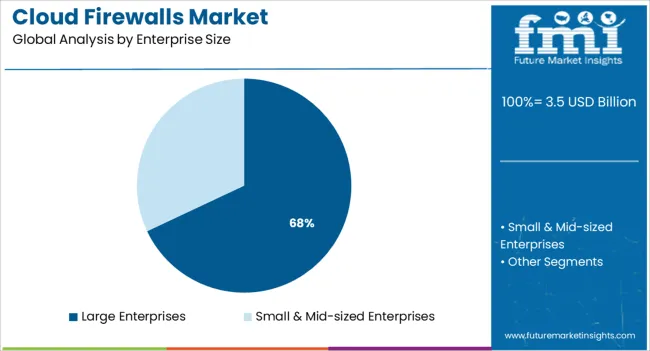

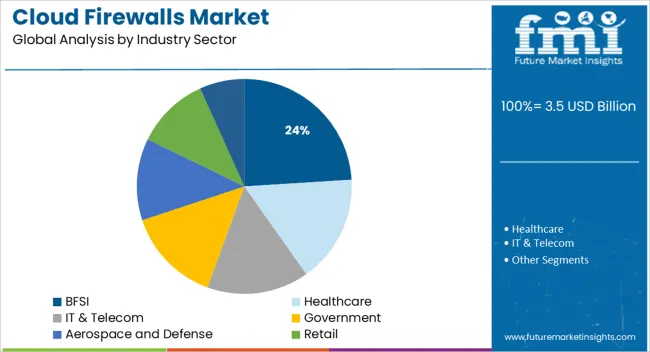

The market is segmented by Solution Type, Enterprise Size, and Industry Sector and region. By Solution Type, the market is divided into Services and Appliances. In terms of Enterprise Size, the market is classified into Large Enterprises and Small & Mid-sized Enterprises. Based on Industry Sector, the market is segmented into BFSI, Healthcare, IT & Telecom, Government, Aerospace and Defense, Retail, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Services are projected to account for 61.0% of the total revenue share in the cloud firewalls market by 2025, establishing them as the leading solution type. This dominance is being driven by increasing reliance on managed and professional security services for configuring, maintaining, and updating firewall environments in complex multi-cloud architectures.

Businesses are outsourcing firewall management to ensure around-the-clock monitoring, compliance auditing, and timely patching, which has reduced internal IT burden and enhanced threat response capabilities. The rise of DevSecOps and dynamic workload protection has further heightened the demand for continuous, service-based security models that can adapt to evolving infrastructure.

As organizations face skill shortages in cybersecurity, the services segment is positioned to remain critical for operational efficiency and resilience.

Large enterprises are expected to contribute 68.0% of the cloud firewalls market revenue in 2025, making them the dominant enterprise size category. Their leadership is being reinforced by complex IT ecosystems, extensive regulatory exposure, and high-value digital assets that require advanced and layered security postures.

These organizations typically operate across multiple geographic regions and cloud platforms, necessitating centralized control and visibility over network traffic and application security. Investment capacity in scalable, AI-enabled firewall solutions and customized rule sets has enabled large enterprises to deploy comprehensive protections at scale.

Additionally, the need to ensure business continuity amid rising cyberattacks and ransomware threats has made cloud firewalls indispensable across core operations.

The banking, financial services, and insurance (BFSI) sector is forecast to hold 24.0% of the total market share in 2025, ranking it as the top industry vertical in the cloud firewalls market. This segment’s dominance is being driven by the sector’s strict regulatory environment, high transaction volume, and sensitivity of stored data, which demand robust perimeter and internal network protection.

BFSI institutions are adopting cloud firewalls to enforce zero trust policies, detect anomalies in real time, and prevent lateral movement of threats within cloud-native infrastructure. Integration with identity and access management (IAM) systems and real-time analytics platforms has enhanced security orchestration and reduced risk.

As digital banking expands and mobile-first services proliferate, the need for resilient, cloud-based security solutions is expected to remain high in the financial domain.

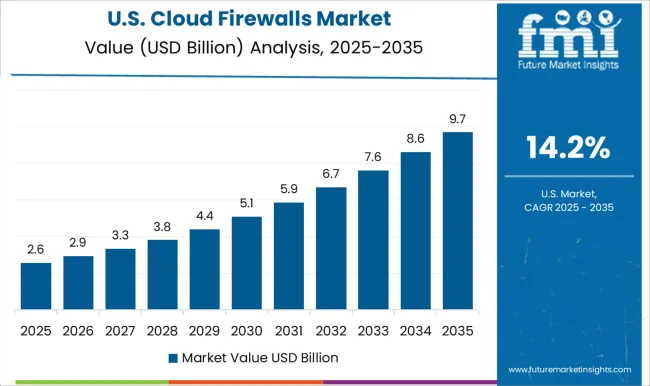

The USA is currently the largest market in the North American region, and during the forecast period, it is expected that the USA would have a share of nearly 71% in North America.

There has also been an increase in the capacity of confidential data in the country. This would mean the seamless storage of this ever-increasing data. The specialty of employing cloud firewalls is that this scale up rapidly to handle more traffic.

Apart from that, the ability to seamlessly integrate with the cloud infrastructure is something that has made the process of storing this data highly efficient.

There have been increasing cases of cyber-attacks that have been reported from the United Kingdom Because of the increased demand for robust IT infrastructure, organizations have started making use of cloud firewalls.

Apart from that, there is also an increasing demand for maintaining data integrity throughout the region. This might as well increase the cloud firewalls market in the United Kingdom.

The sales of cloud firewalls are expected to grow at a CAGR of nearly 24.4% in India during the period 2025 to 2035. India has always been a huge telecom market. The telecom sector is meant to make use of a huge amount of data, and with the penetration of the internet in the region, the demand for data storage is greater than ever before.

India has also been engaged in cyber wars at times with its neighbors. This makes data security extremely useful, as a result of which India is currently one of the largest markets for cloud firewalls.

Asia Pacific is all set to be the most significant market for cloud firewalls during the forecast period. Increasing technological advancements, coupled with the initiatives taken by the government and other ruling authorities to maintain data security, make the Asia Pacific the largest market.

Apart from that, a huge population in the region would mean potential choke points. However, there are hardly any chances for the development of choke points by making use of cloud firewalls. The reason is that the traffic need not be funneled through a hardware appliance.

The key players are taking steps to layer more systems into their IT networks. Right now, the aim is to develop an internet secure, fast, private, and reliable internet. This is expected to be achieved by deflecting large DDoS attacks through the distributed global network.

The key players are also developing gateway support for the Microsoft platform, which also includes troubleshooting and scalability enhancements. For example, in September 2025, Sophos launched ZTNA v1.1. This version comes with Hyper-V support and SaaS application access with synchronized security.

The cloud firewalls market currently accounts for around 9.4% of the total network security market. The rising need for preventing cyber-attacks or mitigating unwanted access to private networks is pushing the sales of cloud firewall solutions.

In the recent era, cloud firewalls, also called next-generation firewalls, have gained a lot of traction as they provide advanced threat prevention, intrusion prevention systems, DNS security, and protect cloud infrastructure. They have now become essential components of a cloud-delivered security service.

Firewall-as-a-service assists organizations and businesses in eliminating firewall appliances and simplifying their IT infrastructure. In contrast to using hardware, cloud firewalls bring extensive firewall capabilities to the cloud and centralize security inspection to a single, easily accessible panel.

Cloud firewalls are cloud-deployed network devices that are designed to prevent or mitigate unauthorized access to private networks. They are a new technology that is designed for modern business needs and can be found in online application environments.

The working of a cloud firewall is similar to that of a traditional firewall, the only difference is the cloud firewall is being hosted in a cloud environment.

Unlike hardware firewalls, cloud firewalls can easily distinguish between different programs on a computer system. This feature allows them to send data to one application or program while blocking access to other applications or programs.

Cloud firewall solution offers cloud firewall services without the need for physical or virtual appliances to be deployed, maintained, and upgraded at each site.

The growing popularity of these solutions for improving cybersecurity across industries will therefore continue to boost the market growth.

Similarly, IoT-cloud convergence or integration of the IoT and cloud computing is likely to provide a strong thrust to the growth of the cloud firewalls market over the next decade.

One response to the needs that have arisen as a result of the global epidemic is the Internet of Things (IoT). The IoT seems to be a great fit in a world of remote settings and social estrangement because it minimizes human involvement while fulfilling a variety of activities. However, it is because of cloud computing that businesses can install the IoT on a big scale without any problems.

The combination of IoT and cloud computing, which is most visibly demonstrated by the abundance of cloud services that underpin IoT and are generally referred to as the IoT cloud, opens up new possibilities for how businesses are conducted.

Although it is true that the cloud has solutions that can close some of the IoT's security vulnerabilities, combining the two does not immediately eliminate the risks that both technologies confront. By forcing all incoming and outgoing traffic to travel via the cloud's API gateway, the integration of the IoT and the cloud considerably decreases the attack surface.

To protect the flow of data through this gateway, high-end cloud firewall appliances and services are required. Thus, this will boost the adoption of cloud firewalls and eventually expand the global market size during the forecast period.

The cloud firewalls demand is estimated to grow at a CAGR of 16.7% between 2025 and 2035 in comparison with the historical period CAGR of around 15.0%.

One of the main reasons for this market growth is that cloud-delivered firewalls have attracted the attention of different industries by providing effective security for the cloud-first and work-from-anywhere services

Traditional firewalls require extra hardware capabilities, such as memory and disc space, which can raise costs. Also, technical expertise is required for the configuration and setup of traditional firewalls and cannot effectively manage internet traffic.

To overcome this challenge, the adoption of cloud firewalls is increasing as it is based on a URL filtering system that aids in the protection of the data set against false and malicious practices. It is a technological system that protects businesses from cyber-attacks and provides 24-hour security for cloud components.

Regionally, South Asia and the Pacific are estimated to be the fastest-growing market for next-generation firewalls and are expected to grow by 7.0X during the forecast period.

The demand for cloud firewalls is being driven by the acceleration of economic growth, rising information, and communication technology spending, the surge in cyber threats, and the adoption of advanced security solutions in South Asia and Pacific countries.

Rising Demand for Advanced Security Solutions to Mitigate the Emerging Cyber Threats

The information and communication technology industry has a lot of room to grow as the global economy improves. Cyber security is more important than ever in today's world. As the volume of organizational data grows, so does the number of cyber-criminal activities. This could compromise an organization's goodwill and distort the records. With ever-increasing threats to businesses, having a solid security solution is critical.

Advanced threat prevention necessitates a multilayered, integrated approach to security due to the growing number of threats, including malware and ransomware. Tools for advanced malware protection, extra endpoint security threat prevention, intrusion threat detection, and intrusion prevention system may be included in this.

A firewall is used in a cloud environment to prevent unauthorized network access. A cloud firewall is a protective barrier that can keep unauthorized users out of your network. Additionally, for smooth application processing, market vendors are offering enhanced versions of cloud firewalls.

Developed countries around the world are embracing next-generation firewalls as a must-have service to protect their cloud environment and supplement overall business functions.

Increasing Adoption of Cloud Firewalls by Organizations Driving Growth

As per FMI, the United Kingdom cloud firewalls market is predicted to create an absolute USD opportunity of USD 16.4 Million by the end of 2035.

With the rise in cyber-attacks, there has been a sharp increase in adoption rates of advanced security solutions by organizations in the United Kingdom to strengthen their IT infrastructure.

The majority of the enterprises in the country are aggressively implementing security solutions to ensure the safety and integrity of critical information pertaining to citizens. Additionally, organizations are frequently updating security tools like network security, and other security procedures to enhance data integrity via the cloud.

Implementation of Government Regulations to Curb Cyber Attacks Boosting Sales

The demand for cloud firewalls in the USA is expected to account for nearly 71.1% of the North American market by 2035. Due to enterprises' strong preference for the security of the significant amount of sensitive and critical data they utilize, as well as their ongoing adoption of high-performing network security solutions, the USA currently dominates the global market.

Recently, some of the firms in the USA suffered from ransomware attacks, exposing the data of millions of customers. As a result, the government imposed stringent consumer privacy regulations. Due to this, large businesses in this region have adopted next-generation firewall solutions and become more aware of them, which has contributed to the market's expansion.

Similarly, the strong presence of leading cloud firewall providers such as Plato Alto Network, Fortinet, and Cisco along with the easy availability of next-generation cloud firewalls is playing a key role in boosting the market growth in the USA

These leading players are constantly launching new firewalls to help end users improve their cloud security and secure their sensitive data. For instance, in 2025, Plato Alto Network launched a managed next-generation firewall service for AWS.

Rapid Shift Towards Cloud Services by Organizations Generating Demand for Cloud Firewalls

The sales revenue in India is estimated to grow at an impressive rate of around 24.4% CAGR between 2025 and 2035, which is the highest CAGR as compared to the other countries in South Asia & Pacific.

The growing shift towards cloud services, the surge in cyber-attacks, and the increasing adoption of advanced cybersecurity solutions are some of the factors driving growth in India’s market.

India has always been a lucrative market for telecom service providers and has seen rapid adoption of cutting-edge technologies. With constantly changing network operators, the Indian telecom market has expanded significantly. Various companies are adopting cloud firewalls to get complete network security.

Network dependency is increasing in India, which has caused a boom in the usage of network security solutions. The demand for secure cloud data protection among small, medium, and big businesses and government organizations is anticipated to expand the market for cloud firewalls in India.

Adoption of Cloud Firewall Services in Small and Mid-Sized Organizations to Surge

The cloud firewall services segment is expected to showcase higher CAGR in the coming years, creating an absolute USD opportunity of USD 3,705.2 Million by the end of 2035. Small and mid-sized organizations are increasingly adopting cloud firewall services as these significantly lower costs by simplifying security administration and removing complications.

The pay-as-you-go (PAYG) model's increased flexibility has made small and mid-sized organizations most likely use cloud firewall services. Cloud firewall services help to provide a solid foundation for automated, round-the-clock management security in the cloud that guards against threats and cyberattacks.

Limited Budget and Growing Cyber Threat Concerns Prompting Small and Mid-Sized Enterprises to Employ Cloud Firewalls

The sales revenue in small and mid-sized enterprises is estimated to grow at an impressive rate of around 17.7% CAGR between 2025 and 2035, owing to the rapid adoption of cloud firewalls across these enterprises.

SMEs are using cloud solutions to satisfy their expanding company requirements because they have a restricted budget to manage different business functions and activities.

As cyber threats are more frequent, particularly in SMEs, next-generation firewalls enhance the security levels of the company’s data by securing it from the reach of hackers.

Because they lack authentication, many cloud-based applications are occasionally vulnerable to risk. As a result, small and medium-sized businesses are compelled to adopt network security tools like cloud firewalls to protect their cloud-based identities.

Most of the Cloud Firewalls Demand to Emerge from BFSI Sector

As per FMI, the BFSI segment is expected to create an absolute USD opportunity of USD 1,169.0 Million by the end of 2035. The rising adoption of next-generation firewalls across sectors like banks and financial institutions is driving the growth of this segment.

The enterprises that execute a significant volume of sensitive transactions and important data in daily operations are intended for cloud firewall security. Throughout the day, banking and financial organizations work with clients’ transaction data. Their requirements to sustain uptime as well as to protect crucial business activities and data are supported by cloud firewall protections.

Global usage of digital currency is accelerating due to the development of blockchain technologies. Due to the fact that these transactions are entirely web-based, it is crucial to safeguard these gateways right now. Thus, this trend has increased the adoption of next-generation firewalls in the BFSI sector.

Cloud firewall providers are developing tactics like product innovation to increase their service offerings and technology portfolios to better satisfy customer needs. In order to match end-user expectations and increase their client base, many companies are also working with technology experts to develop their own cutting-edge solutions.

For instance

Cloud Firewalls for Enhanced Cybersecurity: Google, Cisco, and Sophos Bringing in Innovation to Maintain their Reign

Cloud firewalls, also known as ‘next-generation firewalls’ have garnered considerable interest and investment from leading tech companies. Google has taken the lead in cloud firewall innovation and continues to make it easier for businesses to have the security of a firewall for their network devices.

Google’s cloud firewalls rely on multiple data sources and take reference from a vast database of previously identifiable threats. Considering the growing competition in maintaining cloud firewalls, Google is also offering users added advantage of in-house activity to analyze past patterns and draw inferences from them.

As security norms continue to change, Google’s strategy is to have flexibility and agility so its cloud firewalls can be deployed on the networking devices of the future.

The global search engine giant is also ramping up its defense mechanism to avert attacks of a massive scale. For instance, in August 2025, Google reported it had stopped a cyberattack which had grown from 100,000 reps to a peak of 46 million reps.

Further, Google also announced changes to its Play Store to counter the growing threat of misinformation and enhance the security of its users.

Cisco is also upping its cloud firewalls game by providing users with a variety of features at affordable prices. It is the leading manufacturer of physical firewalls and as the tech world moves to the cloud, it is investing in next-generation firewalls.

Cisco is also keeping a close watch on the reduction in prices of firewalls and making adjustments to its own offerings. For instance, in April 2025, the company announced it will be launching a range of mid-priced firewalls to capitalize on the shift toward hybrid environments.

Similarly, in June 2025, Cisco announced that it is designing the Cisco Security Cloud that will secure and connect organizations of all shapes and sizes.

The company is also focusing on patching its high-severity vulnerability that has affected its ASA and firepower solutions. Through timely patches and vulnerability detection, the company is boosting the confidence of its end-users about overall security.

Sophos, a leading cybersecurity firm, offers a wide range of cloud firewall solutions. It is actively working towards creating solutions that support the growing cloud infrastructure.

For instance, in July 2025, Sophos announced cloud-native security for creating comprehensive cybersecurity coverage. Cloud-native security comes with protection and detection for host and container workload security.

Similarly, in April 2025, the company introduced a new version of Sophos Firewall with Xstream software-defined wide area network capabilities and best-in-class VPN enhancements that effectively boost network performance and flexibility.

| Attributes | Details |

|---|---|

| Market value in 2025 | USD 3.5 billion |

| Projected Market Valuation (2035) | USD 16.4 billion |

| Market CAGR 2025 to 2035 | 16.7% |

| Share of top 5 players | Around 33% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, United Kingdom, Germany, France, Italy, Spain, Benelux, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, South Africa |

| Key Segments Covered | The solution, Enterprise Size, Industry, and Region |

| Key Companies Profiled | Google; Cisco Systems, Inc; Palo Alto Networks Inc; Juniper Networks; Sophos Ltd.; Check Point Software Technologies; Barracuda Networks; WatchGuard Technologies; Cloudflare; Imperva; Zscaler Inc; Fortinet Inc |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and ThreatsAnalysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global cloud firewalls market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the cloud firewalls market is projected to reach USD 16.4 billion by 2035.

The cloud firewalls market is expected to grow at a 16.7% CAGR between 2025 and 2035.

The key product types in cloud firewalls market are services and appliances.

In terms of enterprise size, large enterprises segment to command 68.0% share in the cloud firewalls market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA