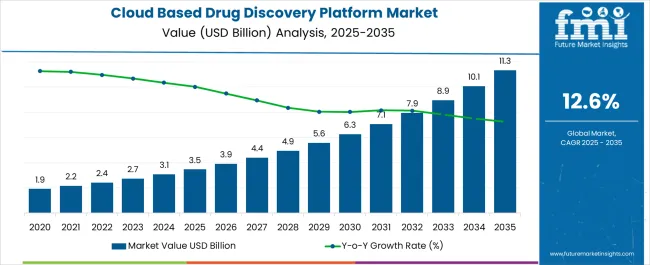

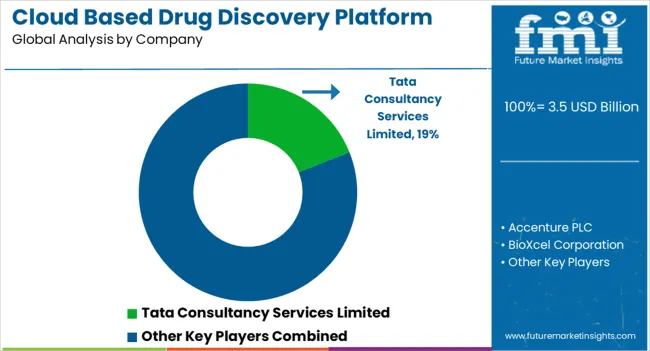

The Cloud Based Drug Discovery Platform Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 11.3 billion by 2035, registering a compound annual growth rate (CAGR) of 12.6% over the forecast period.

| Metric | Value |

|---|---|

| Cloud Based Drug Discovery Platform Market Estimated Value in (2025 E) | USD 3.5 billion |

| Cloud Based Drug Discovery Platform Market Forecast Value in (2035 F) | USD 11.3 billion |

| Forecast CAGR (2025 to 2035) | 12.6% |

The cloud based drug discovery platform market is undergoing accelerated adoption as pharmaceutical and biotech firms seek digital-first solutions for rapid molecule screening, real-time data sharing, and collaborative R&D. The growing complexity of drug pipelines, coupled with pressure to reduce time-to-market, has compelled organizations to leverage cloud infrastructure for scalability, data security, and computational power.

The shift from traditional, siloed systems to interoperable, cloud-native platforms has enabled faster data integration across genomic, proteomic, and clinical datasets. Regulatory encouragement of digital transformation, along with growing support for remote collaboration among global research teams, has further reinforced this trend.

Cloud platforms are increasingly being used to optimize lead generation, virtual screening, target validation, and AI-driven predictive modeling, streamlining critical stages of drug development. Continued investment in data governance, cross-platform interoperability, and real-world evidence integration is expected to shape the next wave of growth in the industry.

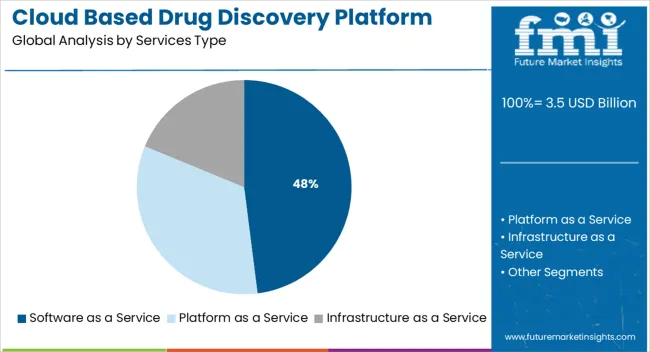

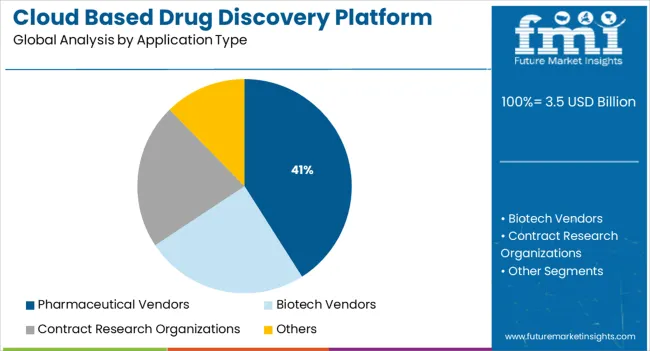

The market is segmented by Services Type and Application Type and region. By Services Type, the market is divided into Software as a Service, Platform as a Service, and Infrastructure as a Service. In terms of Application Type, the market is classified into Pharmaceutical Vendors, Biotech Vendors, Contract Research Organizations, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Software as a Service (SaaS) is projected to hold 48.0% of the total market share in 2025, positioning it as the leading services type in the cloud based drug discovery platform landscape. This dominance is being driven by the ability of SaaS-based tools to deliver scalable, subscription-based access to high-performance analytics, workflow automation, and molecular modeling capabilities.

SaaS platforms are reducing infrastructure costs while offering seamless updates, strong compliance frameworks, and customizable modules tailored to specific therapeutic areas. The low entry barriers and faster deployment timelines of SaaS offerings are particularly attractive to small and mid-sized biotech firms, which often lack in-house IT capacity.

As organizations seek rapid deployment of informatics tools across global R&D networks, SaaS continues to emerge as the preferred delivery model for agile, cloud-native drug discovery environments.

Pharmaceutical vendors are expected to contribute 41.0% of the total revenue in the market by 2025, establishing them as the largest end-user segment. This leadership is being reinforced by the pharmaceutical industry’s increasing reliance on digital platforms to manage large-scale clinical data, accelerate compound optimization, and facilitate cross-border collaboration.

Cloud platforms enable real-time access to datasets and predictive modeling tools, significantly improving decision-making in early-stage discovery. The demand for regulatory-compliant environments, audit-ready data logs, and AI-integrated analytics has made cloud-based platforms essential to pharmaceutical R&D strategies.

Moreover, the scalability and data integrity offered by cloud ecosystems are supporting multi-center trials and continuous innovation pipelines. As major pharmaceutical vendors continue to shift toward virtualized infrastructures, the segment is anticipated to maintain its lead in platform adoption and investment.

North America is projected to dominate the global cloud based drug discovery platform market during the estimated period of study. Currently, this region is accountable for a market share of 37.5% in 2025 and is likely to exert dominance throughout.

It is estimated that the biotech and pharmaceutical vendors in this region are focusing on boosting their drug development process using cloud platforms. Without compromising on safety, these platforms are providing better access to data from healthcare companies, along with contact research organizations during the R&D processes.

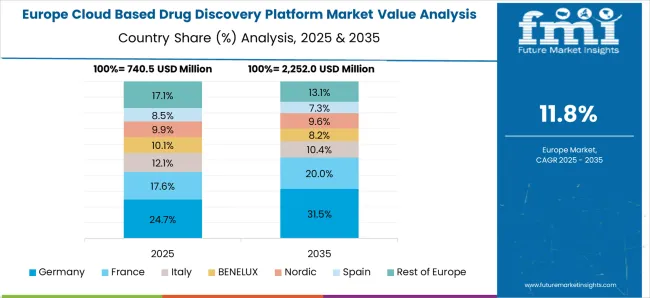

Additionally, the European region is also having a steady growth pace, accounting for a market share of 22.1% in 2025. Healthcare companies in Europe are implementing advanced cloud technologies such as machine learning and artificial intelligence platforms to gain optimized R&D outcomes. AI algorithms are being used to design bi-specific drugs that can be used simultaneously to bind more than one target.

The key players are continually making efforts to strengthen their foothold in the global cloud based drug discovery platform market. They are adopting organic growth strategies like mergers and acquisitions, collaborations, product launches, and more, to further expand the global share of the forum in the upcoming years.

For instance, Benevolent AI, technically reached its ‘unicorn status’ recently, when it achieved a valuation of USD 1.7 billion. The firm is working on its drug candidates, along with various partnerships with big pharma companies like AstraZeneca and Novartis.

Therefore, it is anticipated while analyzing the market in depth that the demand for cloud-based drug discovery platforms is likely to witness an upsurge during the forecast period.

Currently, the drug discovery platform is witnessing massive adoption of digital technologies such as publishing and sharing services are being offered to users, which in turn is shaping the cloud based drug discovery platform market future trends.

Moreover, cloud-based drug discovery platforms are gaining traction as it gives key players the opportunity of storing huge data conveniently and in a cost-effective manner.

The benefits of cloud-based drug discovery platforms are enormous, and this is one of the key factors why it is gaining traction among end-users, in turn enhancing the overall market. Cloud based drug discovery platform adoption trends are swayed by the security and collaborative project management and the ability provided by it to share project information. Moreover, the cloud-based drug discovery platform is flexible to offer end-users to customise it according to their projects.

Cloud-based drug discovery platform is accessible through computers, notebook, and mobiles, and it is secure and can be maintained by a third party as well, encouraging many to opt for the same. In addition, this platform helps customers overcome many challenges by leveraging a network of web and mobile-accessible applications, thereby spurring the demand for cloud based drug discovery platform.

Data management is a critical issue for the pharmaceutical industry and the industry is rapidly restructuring its discovery business model to completely networked and integrated research and development in order to manage the huge data it generates. Storing this data on cloud not only offers cost savings, but also improved accessibility, which is likely to positively impact the market outlook.

Graphical representation, a dynamic and quick form of getting results, helps in decision-making at a management level. Keeping the needs of consumers in mind, key players in the cloud-based drug discovery platform are offering flexible, cost-effective, and highly secure cloud-based storage options to consumers, boosting the cloud based drug discovery platform market.

Cloud-based drug discovery platform runs at zero lag time, saving time and giving real-time access to users. This is another reason for the growing adoption of cloud based drug discovery platforms globally.

However, confidentiality and privacy issues continue to impede the growth of the cloud-based drug discovery platform market. Although many improvements have been made in the recent past, cyber hacks continue to create apprehension among many pharma players, leading to stifled adoption.

By 2025, North America is likely to capture cloud based drug discovery platform market share of 37.5%.

The market in the region is enhanced by pharmaceutical and biotech companies that are concentrating on adopting cloud platforms to speed up their drug development process without compromising safety.

Cloud systems make it simple for businesses to acquire real-time data anywhere in the world. During the R&D process, these platforms help improve access to data from healthcare organisations and contract research organisations.

Europe cloud based drug discovery platform market is expected to get hold of 22.1% in 2025.

The adoption of cloud-based technology to support scientists and their work, as well as the study of human genome alterations for enhancing the drug development process for cancer research, is becoming a growing trend among European pharmaceutical companies.

Additionally, to achieve optimal R&D results, European healthcare organizations are using cutting-edge cloud technologies, including platforms for machine learning and artificial intelligence.

Bi-specific medications that can bind to multiple targets concurrently are being created using AI algorithms. This platform can help businesses increase the effectiveness of their drug discovery optimization and enhance difficult biological issues, and the same is likely to expand the cloud based drug discovery platform market size in the near future.

Various cloud based drug discovery platform market trends are elicited by innovative start-ups taking birth in the market.

Examples:

This start-up allows for the differentiation of biomarkers, recruitment of suitable patients, and identification of the most advantageous chances for companion diagnostics.

This start-up allows for the elimination of research blind spots, the identification of competitive white space, and the discovery of disease phenotypic commonalities for clinical trial design.

Major players in the cloud based drug discovery platform market are involved in various strategies such as mergers & acquisitions, partnerships, collaborations, etc., thereby consolidating their market position.

One of the recent developments in the cloud based drug discovery platform market is when the provider of SaaS solutions for clinical data fitness, regulatory compliance, and submission preparedness, Pinnacle 21, was acquired by Certara, Inc., the world leader in bio-stimulation. This acquisition aids Certara in having an impact on the medication development process.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 12.6% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025-2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

Types of Services, Region |

| Regions Covered |

North America; Latin America; The Asia Pacific; Middle East and Africa; Europe |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled |

IBM Corp.; Accenture PLC; BioXcel Corporation; Cloud Pharmaceuticals, Inc.; WuXi AppTec (Shanghai) Co., Ltd; Dassault Systemes; BIOVIA Ltd. |

| Customization | Available Upon Request |

The global cloud based drug discovery platform market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the cloud based drug discovery platform market is projected to reach USD 11.3 billion by 2035.

The cloud based drug discovery platform market is expected to grow at a 12.6% CAGR between 2025 and 2035.

The key product types in cloud based drug discovery platform market are software as a service, platform as a service and infrastructure as a service.

In terms of application type, pharmaceutical vendors segment to command 41.0% share in the cloud based drug discovery platform market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Telephony Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Field Service Management (FSM) Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Professional Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Printing Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Migration Service Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud Database and DBaaS Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Billing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Access Security Brokers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA