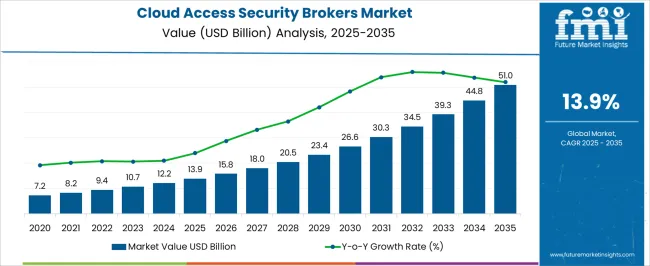

The Cloud Access Security Brokers Market is estimated to be valued at USD 13.9 billion in 2025 and is projected to reach USD 51.0 billion by 2035, registering a compound annual growth rate (CAGR) of 13.9% over the forecast period.

| Metric | Value |

|---|---|

| Cloud Access Security Brokers Market Estimated Value in (2025 E) | USD 13.9 billion |

| Cloud Access Security Brokers Market Forecast Value in (2035 F) | USD 51.0 billion |

| Forecast CAGR (2025 to 2035) | 13.9% |

The cloud access security brokers market is experiencing strong momentum as enterprises accelerate cloud adoption while prioritizing data security, compliance, and governance. The expansion of hybrid work models and growing use of multiple cloud platforms have heightened the demand for solutions that offer visibility, risk management, and policy enforcement across applications.

Vendors are integrating artificial intelligence, behavioral analytics, and zero trust frameworks to strengthen threat detection and response capabilities. Regulatory requirements around data protection and privacy are further encouraging enterprises to invest in advanced CASB solutions.

The market outlook remains favorable as businesses continue to shift mission critical workloads to the cloud, necessitating tools that deliver both security assurance and operational agility. Continuous innovation in integration with identity and access management systems and endpoint security platforms is expected to fuel adoption across diverse industries.

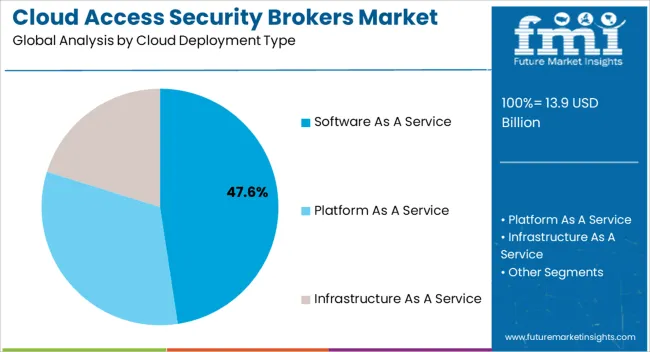

The software as a service deployment type is projected to account for 47.60% of the overall market revenue by 2025, making it the leading segment within deployment models. This dominance is supported by the flexibility, scalability, and cost effectiveness associated with SaaS platforms, which are preferred by enterprises managing distributed workforces and multiple applications.

Rapid onboarding, minimal infrastructure requirements, and seamless integration with existing security ecosystems have further reinforced its adoption.

Growing demand for centralized visibility and dynamic policy enforcement across diverse cloud environments has positioned SaaS as the most practical and future ready option for organizations seeking both security and operational efficiency.

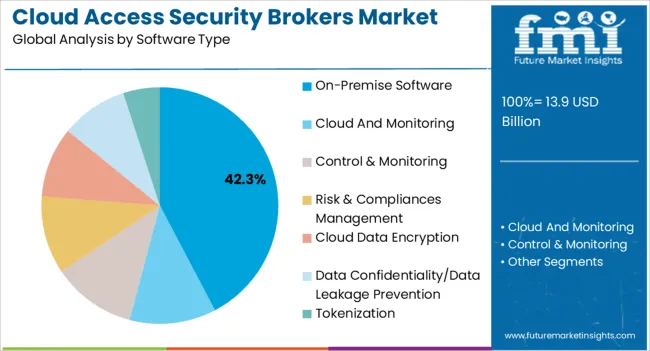

The on premise software type segment is expected to represent 42.30% of total market revenue by 2025, reflecting its significance among enterprises with strict data residency and compliance requirements. Adoption has been driven by sectors such as banking, healthcare, and government where sensitive information necessitates in house infrastructure and greater control over deployment.

This model is preferred for organizations that prioritize customization, system level integration, and enhanced oversight of security protocols.

Although SaaS models are expanding rapidly, the continued reliance on on premise deployments demonstrates the market’s balance between flexibility and stringent regulatory demands.

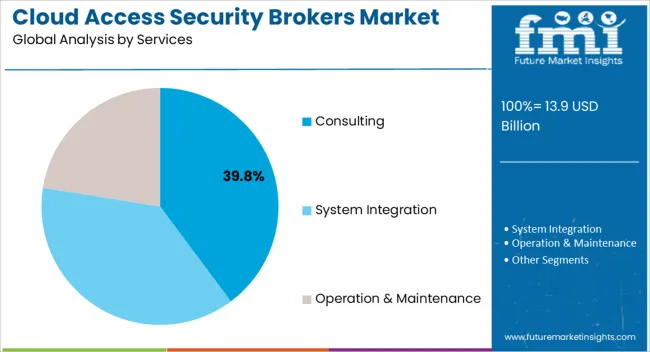

The consulting services segment is anticipated to hold 39.80% of the total market share by 2025, positioning it as the leading service type. Growth has been fueled by the increasing complexity of hybrid and multi cloud environments, which require expert guidance to design, implement, and optimize CASB solutions.

Organizations are relying on consulting services to assess risks, define governance frameworks, and ensure compliance with evolving global data protection regulations. The need for tailored solutions, workforce training, and strategic planning has further reinforced the importance of consulting.

As enterprises navigate cloud transformation journeys, the role of consulting services remains critical to unlocking the full value of CASB deployments while minimizing security gaps.

Due to the rapid digitization in corporate sector, the businesses are adopting technologies with integration capabilities eventually demanding the need of secure platforms. Hence, there is a high rise witnessed in the implementation of cloud access security brokers solutions in the last 5 to 10 years.

The major driver behind the growth of the market is the increasing need for cloud access security brokers in small and medium-sized businesses. Small startups that don’t have cloud storage support take the help of third-party cloud support systems.

These companies hold data related to HR and critical data related to their employees’ accounts. Small and medium-sized enterprises lack the capital and structural strength to implement cloud storage and ensure that level of security.

Rising data breaches all around the world are also pushing corporations to safeguard their data by using tools like cloud access security broker solutions, ensuring multilayered security that doesn’t let any ransomware affect the data. It also helps in recognizing any suspicious activity happening within the data sources, providing real-time monitoring to the end users, and increasing the risk and fraud management level.

The availability of real-time data monitoring makes the end user aware of the data processing and dimensions of multiple funnels, including sales and marketing. This gives a proportional idea to the end user that can be used in the predictive decision marking.

Integrating the cloud access security brokers' solution to the latest technology like artificial intelligence Internet of Things (IoT) pushes the market upward, securing the data from any type of threat. Better segmentation of critical and complex data provides a balanced outlook to the end user that can be utilized in data dashboards and analytical planning.

Overall, cloud access security broker solutions are easily manageable, customized solutions that provide inward and outward safety to the data, ensuring that the stored information is secure when any malicious activity occurs.

The major restraint of the cloud access security broker market is the lack of awareness amongst corporate spaces as they still use old-fashioned security solutions.

Organizations are not aware of the advantages and efficiency of cloud access security broker solutions. Another factor that restricts the growth of the market is less awareness of threat management, compliance management, and data monitoring.

The report covers several regions that includes North America, Latin America, Asia Pacific, the Middle East and Europe. Meanwhile, the USA is leading the market growing with the CAGR of 15.9% during the forecasting period.

In 2025, the United States had 19.4% of the market, while North America held 29.4%. The growing worry about data and information security due to fraud and data breaches is driving sales of cloud access security broker solutions.

Another factor driving the rapid expansion of the cloud access security broker solution market in the region is intense competition and the emergence of new private companies in the industry. Australia has the market's highest CAGR of 16.7%, owing to its significant capital expenditure in markets.

Aside from that, China is the third-fastest expanding market in the cloud access security broker industry. With rising at a CAGR of 14.2%, the market holds the potential to reach USD 51 Billion by 2035.By 2035, Japan is expected to be the second-largest market in terms of revenue, with a CAGR of 14.2%.

| Countries | Revenue Share % (2025) |

|---|---|

| United States | 24.2% |

| Germany | 8.2% |

| Japan | 4.2% |

| Australia | 2.9% |

| North America | 36.3% |

| Europe | 21.1% |

| Countries | CAGR % (2025 to 2035) |

|---|---|

| China | 14.9% |

| India | 17.8% |

| United Kingdom | 15.1% |

| Category | By Cloud Deployment Type |

|---|---|

| Leading Segment | Software as a Service |

| Market Share (2025) | 38.1% |

| Category | By Technologies |

|---|---|

| Leading Segment | On-premise Software |

| Market Share (2025) | 21.39% |

Cloud access security holds different categories; cloud deployment type, software type, and services. These categories have small segments that expand their roots in new regions, connecting the distribution channels to enhance the supply chains.

Cloud deployment type is segmented by software as a service (SaaS), platform as a service (PaaS), and infrastructure as a service (IaaS). Similarly, services segment is divided into consulting, system integration and operation & maintenance. Meanwhile, the software type segment is categorized into On-premise software and Cloud-based software.

In the context of cloud deployment, SaaS segment is leading in the cloud access security brokers market. The software as a service segment is growing at 14.2% CAGR, while holding a market share of 38.1% in the year 2025.

The factors behind the growth of this segment are the easy installation of software as a secure solution to cloud storage. Other driving factors are faster deployment, mobility, reduced cost, and scalability than software as a service provides to its end users. This pushes the sales of cloud access security broker solutions.

By software type, the on-premises software is the largest segment in the market that is booming at a CAGR of 12.4% and has held the major portion of 21.39% in 2025.

The factors behind the excessive growth of this segment are reliability and customer behavior around the on-premises software type. On-premises software secures individual systems, safeguarding the data and information.

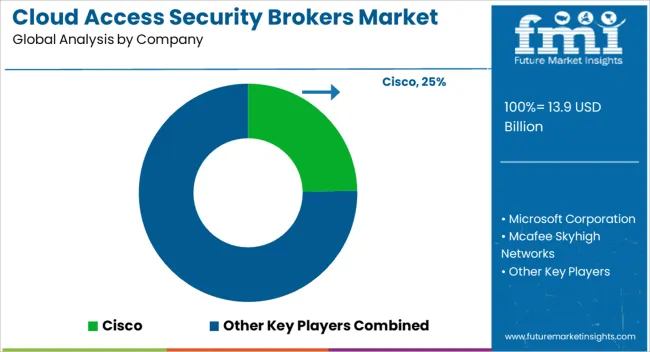

The competitive analysis explains how the cloud access security brokers market is dynamic. The key players are experimenting and adding more layers to the software in order to provide security from all kinds of advanced threats, including fraud and spam strikes. The major competitors also focus on collaborations and seasonal discounts on sales. The market is currently under an ongoing development process where vendors add new components to it.

Market Developments:

The global cloud access security brokers market is estimated to be valued at USD 13.9 billion in 2025.

The market size for the cloud access security brokers market is projected to reach USD 51.0 billion by 2035.

The cloud access security brokers market is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in cloud access security brokers market are software as a service, platform as a service and infrastructure as a service.

In terms of software type, on-premise software segment to command 42.3% share in the cloud access security brokers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Data Encryption Solutions Market Size and Share Forecast Outlook 2025 to 2035

Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Telephony Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Field Service Management (FSM) Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Professional Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Printing Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Migration Service Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud Database and DBaaS Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA