Between 2025 and 2035, the astronomical growth of the global clinical nutrition market shall be fuelled by the increasing incidence of chronic diseases, growing geriatric population mine, and growing awareness . However, an increasing prevalence of malnutrition, gastrointestinal diseases, and metabolic disorders has translated the demand for clinical nutrition across various mid-age and geriatric patient population as well as surgical and disease recovery. Increasing premature births and paediatric malnutrition are further driving the demand for specialized infant and enteral nutrition products.

The hospitals, long-term care facilities (LTC), and home healthcare service providers will adopt these clinical nutrition solutions in a big way in order to address the dietary requirements of the patients . Condition-specific nutritional offerings, such as protein-powder boosters, lipid-based products, and micronutrient-fortified supplements are being sought after in the market. Moreover, the incorporation of dietary therapy into disease management plans, especially for diabetes, cancer, and renal diseases, is also boosting the market growth.

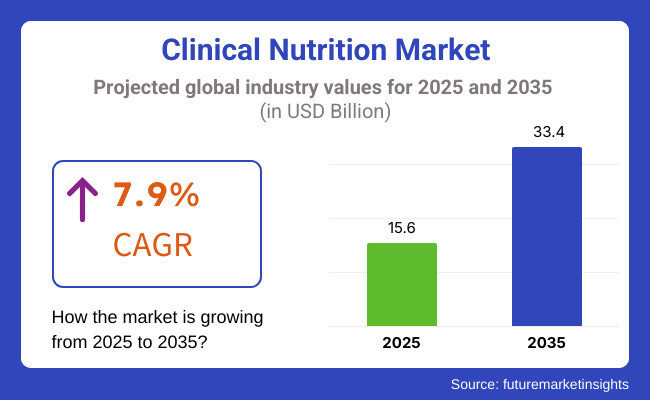

Healthcare costs are expected to be on the rise leading to project market growth of CAGR 7.9% and enrichment of needed for the global scramble to meet the requirements for nutritional formulations trend. This growing consumer base is further contributing to an expansion in the scope of these products, which now include plant-based and allergen-free clinical nutrition products designed to appeal to individuals with restricted diets.

Explore FMI!

Book a free demo

Pushed by high healthcare expenditure, advanced medical infrastructure, and rising awareness regarding nutrition-based disease management, North America is the leading region in the clinical nutrition market. The enteral and parenteral nutrition products market in US and Canada is polarized on the basis of applications and geographies, the demand is high, specifically in the geriatric and critical care fatigue's. Growing consumption of medical nutrition therapies in outpatient and home care practice in this region is also further propelling growth. The increasing incidence of obesity and diabetes has resulted in rising demand for products directed at clinical nutrition, including weight management and metabolic health.

Europe is a mature clinical nutrition market, spearheaded by Germany, France, and the United Kingdom. Initiatives undertaken by the government for the reduction of malnutrition among the geriatric population and strong reimbursement policies for medical nutrition are the factors expected to drive growth. The expanding market is fuelled by the focus of big pharma and nutrition companies present and research on sophisticated formulations. Consumer demand for organic and plant-based clinical nutrition solutions is increasing as European consumers prioritize sustainability and demand for clean-label products grows.

Market in Asia-Pacific is projected to grow at a considerably higher rate due to increasing demand from China, India and Japan. In an insect-based diet, proteins from insects can provide sufficient nutrients so that supplementing with protein-rich food such as soybeans and wheat with such large protein-rich diets isn't necessarily required Factors such as infant malnourishment are a significant problem in certain parts of South Asia, which is partly why clinical nutrition programs are funded by governments and global organizations in such regions. The region is also seeing rising interest in functional food-based clinical nutrition, particularly for preventive care.

Increasing access to healthcare and growing awareness regarding malnutrition and crop diseases is bolstering the growth of the Latin America clinical nutrition market. Initial key markets included Brazil and Mexico, both of which have governments that have pushed for better nutritional standards within their healthcare systems. At the same time, there is increasing demand for specialty nutrition products across the Middle East, owing to the region's high incidence of metabolic diseases such as diabetes and obesity. Furthermore, the increasing number of hospitals and home healthcare services in the Gulf countries is propelling the consumption of clinical nutrition products.

Challenges

Rising Prevalence of Malnutrition and Disease-Related Nutritional Deficiencies

During the last two decades and with the emergence of the new pandemic, this has led to a high demand for clinical nutrition market due to the continued global crisis such as malnutrition and chronic diseases particularly among older adults and patients with implication of underlying disease. Certain disease states, namely: diabetes, cancer, gastro intestinal disorders and neurological diseases, need specific nutrition solutions to complement and aid in the treatment and recovery process. Despite the growing need, access to high-quality clinical nutrition products remains difficult in many parts of the world, particularly in most newly developed economies. The high cost of advanced formulations and a limited understanding of clinical nutrition benefits and restraining reimbursement policies are hindering market growth.

Clinical nutrition products have to go through strict approval processes that vary depending on the region and the company struggles with the regulatory environment. Costs aside, the manufacturers struggle to deliver calorically adequate enteral and parenteral nutrition solutions that minimally violate dietary and medical needs, yet also guarantee both palatability and usability. Equally, innovation will have to be balanced with cost to ensure clinical nutrition is more affordable for healthcare providers and patients alike and this is an ongoing challenge.

Investing in nutrition research and adapt patient-specific, affordable, evidence-based nutrition solutions to meet these challenges is the job of the industry. To help speed to market, nutrition companies should partner with health care providers and regulatory bodies to acquire a smoother approval process and continue providing quality products to consumers. Educating healthcare professionals and caregivers on the role of clinical nutrition benefits may aid in uptake increase and improve patient outcomes even more.

Opportunity

Growing Demand for Personalized and Disease-Specific Nutrition

An emerging field in genomics and metabolomics can usher in a new era in which personalized clinical nutrition solutions are developed to fit individual health profiles, genomic conditions and metabolic requirements. The increasing trend of personalized health care approaches allows manufacturers to deliver infectious disease targeted maternal nutrition plans. Focus on senior nutrition products targeting mobility, cognition, and immune health is on the rise, thanks to the steady growth of the geriatric population across the world.

Advancing nutritional genomics, the microbiome and precision medicine are driving the development of functional and therapeutic food products that can be used as adjunctive therapy to many medical treatments. The growing demand for plant-based, allergen-free and fortified nutritional formulas is urging the companies to come up with innovative solutions which can cater to a broad spectrum of patient groups. Other factors such as technological advancements in home healthcare solutions like nutritional supplements and meal replacements will drive the market, in terms of easy delivery formats, such as ready-to-drink nutritional supplements and meal replacements will positively impact the patient compliance and patient availability.

Joint ventures between pharma companies with nutrition brands or healthcare-based organizations will be key to stimulating new research and products. With the industry catching up to this increasing desire for educated consumerism, companies that prioritize science-backed formulations, ethical ingredient sourcing, and transparent labelling practices will absolutely lead the charge of this new market.

North American clinical nutrition market was dominated by the growing demand for clinical nutrition during 2020-24 driven by the increasing incidence of chronic diseases and a rising emphasis on nutritional support in healthcare. Enteral and parenteral nutrition products were more hospital-based, while nutrition solutions were more home-based. Updated regulatory approvals and guidelines were also brought forth to guarantee improved labelling and formulation standards. But supply-chain disruptions and volatility in raw-ingredients prices posed challenges to manufacturers.

Even having not been studied further, nutrition as a significant area the landmark market of 2025 to 2035 that will join the application of nutritional science, greater penetration of precision medicine and greater sustainability of plant-based formulations in a reswitching of live. The keys to successful clinical nutrition in the future include digital health solutions for tracking nutrition intakes, an increase in nutrition market share of disease-specific segments and a shift towards more personalized dietary measures.

Shifts in the Clinical Nutrition Market from 2020 to 2024 and Future Trends 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strengthening of dietary supplement regulations and clinical nutrition approvals |

| Technological Advancements | Growth of functional and fortified clinical nutrition products |

| Industry Adoption | Increasing use of medical nutrition in chronic disease management |

| Supply Chain and Sourcing | Rising demand for ethically sourced ingredients and sustainable packaging |

| Market Competition | Presence of major pharmaceutical and nutrition brands alongside emerging start-ups |

| Market Growth Drivers | Increased prevalence of malnutrition and chronic illnesses |

| Sustainability and Energy Efficiency | Initial efforts to reduce carbon footprint in production and packaging |

| Integration of Smart Monitoring | Introduction of digital tracking for patient adherence to nutrition plans |

| Advancements in Experiential Travel | Growth of home-based and outpatient nutrition therapies |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined regulatory pathways for condition-specific nutrition, harmonized global standards |

| Technological Advancements | Expansion of AI-assisted personalized nutrition solutions based on real-time health data |

| Industry Adoption | Widespread integration of clinical nutrition into mainstream preventive healthcare programs |

| Supply Chain and Sourcing | Full-scale adoption of plant-based, lab-grown, and precision-fermented ingredients |

| Market Competition | Dominance of personalized nutrition brands with a focus on targeted health benefits |

| Market Growth Drivers | Surge in demand for condition-specific and senior-focused clinical nutrition products |

| Sustainability and Energy Efficiency | Large-scale transition to eco-friendly, waste-free clinical nutrition manufacturing |

| Integration of Smart Monitoring | Use of remote health monitoring and AI-driven nutrition recommendations for personalized care |

| Advancements in Experiential Travel | Expansion of clinical nutrition programs integrated into holistic wellness and longevity clinics |

In the USA, the clinical nutrition market is growing rapidly as the elderly population, awareness of chronic disease management and malnutrition rises. Enteral and parenteral nutrition are the main consumers in hospitals and long-term care facilities, and the adoption of home healthcare is expected to rise, owing to the convenience of personalized nutrition solutions at home.

The increasing incidence and prevalence of metabolic disorders, diabetes, and gastrointestinal diseases are also boosting the demand for clinical nutrition products that can meet specialized health requirements. Moreover, regulatory progress supporting use of evidence based nutrition interventions is also motivating pharmaceutical products to diversify their product lines.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

United Kingdom

Within a disease management paradigm, hospitals across the UK are treating clinical nutrition as a fundamental pillar of healthcare, with clinical workforces now recognizing the morbidity associated with chronic health conditions can often be ameliorated through nutritional interventions.

The National Health Service (NHS) has also become major sponsor and standardizer of clinical programs in nutrition. Also, the increasing prevalence of malnutrition in geriatric population and rise in the occurrence of cancer and gastrointestinal disorders will fuel the demand for enteral and parenteral nutrition products. Furthermore, personalized nutritional supplements targeting consumers with given dietary shortfalls are emerging in the UK market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.5% |

The European clinical nutrition market is growing, driven by countries like Germany, France, and Italy, which have robust healthcare systems and a rapidly aging population. Rising demand for, such as malabsorption disorders,inflammatory diseases, and post-surgical recovery among patients is expected to drive the medical nutrition products demand in the EU market.

Additionally, government initiatives, such as promoting hospital-based nutrition programs and home based enteral feeding solutions, are can be a key growth driver. Organic and plant-based medical nutrition trends are taking foothold as well, leading to similar calls when it comes to product innovation throughout the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.8% |

Japan's clinical nutrition business is growing in response to its quickly aging demographic and a greater occurrence of age-related ailments, including sarcopenia, dysphagia, and osteoporosis. Nutritional therapy is crucial for elderly healthcare, and studies have shown the advantages of functional foods and enteral feeding solution. Hospital and Long-Term Care Nutrition Policies in Japan the Japanese government has also invested in nutrition policy for long-term care and hospitals. Moreover, several domestic organizations are formulating sophisticated liquid diet products and easily consumable supplements to meet the needs of the aging population.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.6% |

The South Korean clinical nutrition market is on a steady growth trajectory, supported by increasing awareness regarding nutrition as a possible option for chronic disease prevention. The urban areas with aging demographics are increasingly focusing on paediatric and geriatric nutrition: In line with such plans, the South Korean government encourages health and wellness activities, stimulating heightened interest in nutritional approaches in hospital settings. Moreover, the increasing popularity of functional foods and dietary supplements that are tailored to address particular health concerns is propelling the growth of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.1% |

The clinical nutrition market is broadly classified into two categories, namely enteral nutrition and parenteral nutrition, which addresses the vital dietary needs of patients with poor intake or absorption caused by chronic diseases, post-operative recovery period, and critical care settings. The global market scale and key drivers also include the rising prevalence of malnutrition, increasing geriatric population, and burden of digestive disorders, which has been contributing to the demand for the medically formulated nutritional solutions.

The enteral nutrition segment holds the largest market share by product type,as tube-feeding solutions become standardized in enteral nutrition therapy across different patients health conditions.

Enteral nutrition segment accounted for the highest revenue share in the clinical nutrition market as healthcare professionals are increasingly focusing on recommending tube-feeding solution for patients for whom eating regular food is impractical. Enteral nutrition is the delivery of his or her nutrients, macronutrients, vitamins and minerals directly for the body through the GI tract, optimizing nutrient absorption and recovery for your patient.

According to studies, approximately more than 60% of patients receiving enteral nutrition in critical care units leading to continued market demand due to rising rates of any chronic diseases, such as cancer, stroke, neurological diseases. In addition, as they delivered nutritional equilibrium and averted complications arising from malnutrition, enteral feeding systems are emerging as popular among patient population in gastrointestinal disorders like as Crohn's disease and short bowel syndrome.

The diversification of disease specific enteral nutrition products such as high protein low carb, and immune boosting enteral nutrition formulations for diverse geographical regions of Patients with different medical disorders is also further driving market acceptance. In addition, the emergence of various novel enteral feeding devices like portable pumps and ready-to-use liquid formulas has increased convenience and patient compliance, enabling patients to have convenient access to meet their prescribed nutrition.

But while shortening recovery times, shortening hospital length of stay and preventing malnutrition are all good things giving it also comes with risks related to tube feeding, the cost of specialized formulas and limited insurance coverage in the enteral nutrition category. However, ongoing innovations in formulation technology, improved safety protocols, and an increasing amount of government support for enteral nutrition programs are expected to alleviate these concerns and enable sustainable market growth.

The clinical nutrition market is principally driven by parenteral nutrition as parenteral IV feeding solutions are relied on by parents whose patients cannot tolerate an enteral feeding solution, and these segments remain growth drivers. Enteral nutrition requires functioning gastrointestinal tract while in parenteral nutrition all the fluid is injected directly into circulation with rapid absorption and metabolic use.

As per our analysis, higher prevalence of cystic fibrosis, post-surgical recovery cases, and neonatal complications have fuelled up the market adoption as around 40% of critically sick (ICU) cases require parenteral nutrition to sustain further recovery. In addition, parenteral feeding solutions play a significant role in meeting nutritional needs in growth of premature infants and new born with congenital digestive disorder during the early growth phase which directly associated with improved health condition and its probability of survival.

Advancements in lipid-based and amino acid-enriched formulations have resulted to an increased need for tailored parenteral nutrition solutions that meets patient’s metabolic demand. Advances like sterile packaging, multi-chamber bags and automated infusion systems have further enhanced safety by reducing infection rates and streamlining the delivery of medications.

Currently, parenteral nutrition according to infection risk and the prohibitively high pricing of parenteral products, along with government regulations on intravenous (IV) nutrition delivery, pose significant hurdles to such strategy. Overcoming these limitations, through the evolution of personalized parenteral formulations, comprehensive monitoring systems, and a stronger healthcare infrastructure will act as a force that propels the market forward.

The clinical nutrition market is driven by factors such as the increasing in the prevalence of chronic disorders, growing demand for personalized nutrition, along with increasing awareness about appropriate diet and nutrition in treating medical conditions. Some of the key areas of transformation one can notice in this segment are enteral and parenteral nutrition, disease-specific formulations, and emerging plant-based/organic clinical nutrition solutions. Companies are concentrating on enhancing their offering of products for patients diagnosed with diabetes, cancer, GI (gastrointestinal) disorders and malnutrition while incorporating technologies that boost nutrient absorption and sustainable packaging solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories | 22-26% |

| Nestlé Health Science | 18-22% |

| Danone S.A. | 14-18% |

| Baxter International Inc. | 10-14% |

| Fresenius Kabi | 8-12% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Abbott Laboratories | Leading provider of clinical nutrition solutions, including Ensure and Glucerna, designed for patients requiring specialized dietary support. |

| Nestlé Health Science | Offers a broad portfolio of medical nutrition products, including Peptamen and Boost, catering to patients with gastrointestinal and metabolic disorders. |

| Danone S.A. | Produces Nutricia-branded clinical nutrition solutions for patients with malnutrition, metabolic conditions, and dysphagia. |

| Baxter International Inc. | Specializes in intravenous and parenteral nutrition therapies for critically ill patients and hospital-based nutritional support. |

| Fresenius Kabi | Focuses on enteral and parenteral nutrition solutions for oncology, intensive care, and paediatric patients. |

Key Company Insights

Abbott Laboratories (22-26%)

A leader in clinical nutrition at a global level, recognized for its quality nutritional formulas intended for older adults, diabetes, and post-surgical recovery.

Nestlé Health Science (18-22%)

Patient Access: Supporting hospital- and home-based patients with tailored clinical nutrition solutions

Danone S.A. (14-18%)

In Europe, they have leading positions in personalized nutrition Joshi.

Baxter International Inc. (10-14%)

Research to improve nutrient bioavailability and safety for parenteral nutrition in critical care settings.

Fresenius Kabi (8-12%)

One of the leading companies in medical nutrition, specializing in offering advanced enteral & parenteral nutrition solutions for patients in hospitals and at home.

Other Key Players (20-30% Combined)

It consists of a few smaller regional and specialty clinical nutrition players who offer innovative formulations and disease-specific solutions that spillet multiple segments of the market. These include:

The Clinical Nutrition Market was valued at approximately USD 15.5 billion in 2025.

The market is projected to reach USD 33.4 billion by 2035, growing at a compound annual growth rate (CAGR) of 7.9% from 2025 to 2035.

The demand for Clinical Nutrition Market is expected to be driven by increasing prevalence of chronic diseases, rising geriatric population requiring specialized nutritional support, growing adoption of enteral and parenteral nutrition in hospitals and home care settings, and advancements in formulation techniques enhancing nutrient bioavailability.

The top 5 countries contributing to the Clinical Nutrition Market are the United States, Germany, China, Japan, and France.

The Enteral and Parenteral Nutrition segments are expected to lead the Clinical Nutrition market, driven by increasing use of tube feeding in critically ill patients, growing demand for intravenous nutrition solutions, and rising focus on personalized nutrition plans in healthcare settings.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.