The global clinical next-generation sequencing (NGS) data analysis industry is valued at USD 3.17 billion in 2025. It is expected to grow at a CAGR of 17.4% and reach USD 15.77 billion by 2035. Key trends in global clinical NGS data analysis reflect how next-generation sequencing (NGS) has significantly impacted molecular biology. However, the most difficult and time-consuming part of this progress is analyzing the clinical data that comes with NGS.

The rising use of NGS in oncology, rare disease research, and clinical diagnostics drives the majority (91%) of this growth.

Furthermore, the continuous progress in bioinformatics tools, cloud computing solutions, and AI-based analytics is enhancing the efficiency and scalability of the NGS data economy.

In 2024, the industry for clinical NGS data analysis saw significant growth due to the rising use of AI-enabled bioinformatics software, cloud-based data analysis solutions, and the broadening of clinical genomics applications.

Additionally, improvements in technology and government funding programs are helping to make NGS more acceptable in clinical settings, which is expanding the segment as a whole.

With the increasing need for tailored therapies, the clinical NGS data analytics segment is expected to be critical in ensuring a stronger future of genomics-based healthcare and an area for investment and innovation.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.17 billion |

| Industry Size (2035F) | USD 15.77 billion |

| CAGR (2025 to 2035) | 17.4% |

Explore FMI!

Book a free demo

The landscape for clinical NGS (Next-Generation Sequencing) data analysis is expanding rapidly. This is due to improvements in AI-powered bioinformatics and the use of cloud-based analytics. Genomics is being increasingly adopted in precision medicine, which boosts this growth. Key players in this field are biotech firms, pharmaceutical companies, and healthcare providers. They use NGS to improve diagnostic techniques and to develop new drugs.

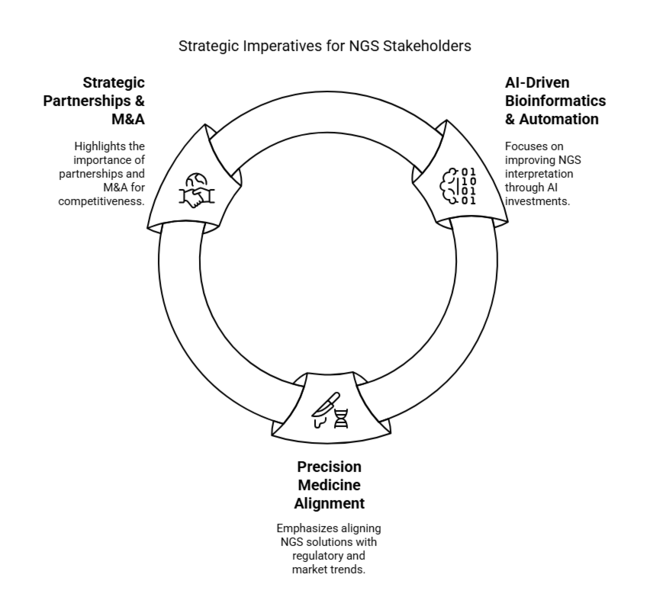

Invest in AI-Driven Bioinformatics & Automation

Investments in AI-based data analysis software and automation should be the top priority for executives to improve the speed, accuracy, and scalability of NGS interpretation. The integration of machine learning algorithms will simplify variant detection, lower costs, and enhance clinical decision-making.

Align with Precision Medicine & Regulatory Trends

Companies must align their NGS solutions with evolving regulatory needs and growing demand for precision medicine. Increased competency in whole-genome sequencing (WGS) and pharmacogenomics will allow companies to capitalize on new business opportunities while staying compliant with global healthcare regulations.

Enhance Strategic Partnerships & M&A Activities

To remain competitive, companies should seek partnerships with biotech start-ups, cloud providers, and pharma companies. Strategic M&A can fuel innovation, expand service portfolios, and bolster sector positions within the fast-changing NGS ecosystem.

| Risk | Probability & Impact |

|---|---|

| Regulatory & Compliance Challenges-Stricter regulations or delays in approvals for clinical NGS applications may slow industry adoption. | Medium Probability, High Impact |

| Data Security & Privacy Concerns-Increasing volumes of genomic data raise cybersecurity risks and compliance challenges (e.g., GDPR, HIPAA). | High Probability, High Impact |

| High Cost & Reimbursement Barriers-Limited insurance coverage for NGS-based diagnostics may restrict patient access and slow industry growth. | Medium Probability, Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| AI & Automation in NGS Analysis | Invest in AI-driven bioinformatics tools to enhance accuracy and efficiency. |

| Regulatory Compliance & Sector Access | Establish a dedicated team to track evolving FDA, EMA, and global NGS regulations. |

| Strategic Partnerships & M&A | Identify and engage with biotech startups and cloud providers for potential collaborations. |

To stay ahead, company must analysis segment for clinical NGS data is advancing rapidly, and the company should focus on AI-based automation, regulatory compliance, and targeted partnerships in order to maintain leadership.

Their new positioning in the sector will be assured through efficient bioinformatics tools and engaging proactively with regulatory authorities.

Collaboration with biotech companies, cloud vendors and pharmaceutical companies will create rapid innovations and extend industry access.

This information establishes the new road map with a focus on technology-based scalability, compliance agility, and the integration within the ecosystem.

Regional Variance

High Variance

Convergent and Divergent Perspectives on ROI

73% of USA stakeholders determined automation to be worth the investment , while only 33% in Japan believed automation provided significant cost savings.

Consensus

Cloud-based storage: Chosen by 69% overall due to scalability and real-time accessibility, especially in high-throughput labs.

Variance

Shared Challenges

92% of stakeholders cited rising cloud computing and software licensing costs as a major financial burden.

Regional Differences

Software & Bioinformatics Providers

Clinical Laboratories & Hospitals

Alignment

77% of global biotech firms plan to invest in AI-driven automation for faster genomic data processing.

Divergence

USA

70% of stakeholders said evolving FDA requirements for clinical NGS were significantly disruptive to their operations.

Western Europe

84% viewed the EU’s Genomic Data Protection Framework as a growth enabler, despite compliance costs.

Japan/South Korea

Only 35% felt regulations had a major impact on their adoption strategies, citing weaker enforcement and slower policy updates.

High Consensus

AI-driven automation, data security, and cost pressures are universal concerns.

Key Variances

Strategic Insight: A one-size-fits-all approach will not succeed. Regional adaptation (AI in the USA, compliance-focused solutions in Europe, cost-efficient models in Asia) is key to market adoption.

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States (USA) | The FDA regulates clinical NGS under the 21st Century Cures Act, ensuring analytical and clinical validity. Laboratory Developed Tests (LDTs) for NGS must comply with CLIA (Clinical Laboratory Improvement Amendments). |

| European Union (EU) | The EU IVDR (In Vitro Diagnostic Regulation 2017/746) mandates CE-IVD certification for NGS-based clinical applications, significantly increasing compliance costs. The General Data Protection Regulation (GDPR) governs genomic data storage and sharing, requiring encryption and patient consent for cross-border data transfers. |

| United Kingdom (UK) | Post-Brexit, the UK Medical Device Regulations (UK MDR 2002, amended 2021) mirror EU IVDR but offer a grace period for CE-IVD certified products until 2028. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) classifies NGS as a medical device, requiring regulatory approval under the Pharmaceutical and Medical Device Act (PMD Act). |

| South Korea | The Ministry of Food and Drug Safety (MFDS) mandates NGS-based tests to be registered as IVDs, requiring MFDS GMP (Good Manufacturing Practice) certification. Personal Information Protection Act (PIPA) imposes strict patient data regulations for genomic research. |

| China | The National Medical Products Administration (NMPA) requires all NGS diagnostic kits to obtain Class III medical device registration. China’s Cybersecurity Law restricts the export of genomic data, impacting international research collaborations. |

| India | The Central Drugs Standard Control Organization (CDSCO) categorizes NGS-based diagnostic kits under Class C & D IVDs, requiring licensing and clinical validation. |

The USA continues to lead both in size and growth of the clinical NGS analysis industry owing to high penetration levels in precision medicine, oncology and rare disease diagnostics. Investments in sequencing and data analytics only continue to increase, aided by initiatives funded by the government.

The USA landscape is supported on the one hand by an advanced healthcare infrastructure and thriving biotech ecosystem, and on the other hand by major NGS technology providers like Illumina, Thermo Fisher, and Pacific Biosciences. The trend for automation of NGS workflows in clinical labs is set to accelerate, with over 60% estimated to adopt automated NGS workflows, cloud-based platforms and AI-powered bioinformatics taking a foothold.

FMI opines that the United States clinical next-generation sequencing (NGS) data analysis sales will grow at nearly 18.2% CAGR through 2025 to 2035.

The growth of the UK's clinical NGS data analysis sector will be driven by Genomics England and the NHS Genomic Medicine Service (GMS). As a key driver of industry expansion, the NHS has implemented policies to improve genomic data sharing and AI-based diagnostics.

The UK Medical Device Regulations following Brexit maintain alignment with the EU but also afford a degree of regulatory flexibility for NGS developers. In the UK, breakthroughs in genomics-based cancer diagnosis, rare disease detection, and pathogen surveillance are all powered by AI-based analytics.

The cloud-based bioinformatics pipeline solutions are booming, and Oxford Nanopore Technologies is at the forefront of sequencing revolution.

FMI opines that the United Kingdom clinical next-generation sequencing (NGS) data analysis sales will grow at nearly 16.7% CAGR through 2025 to 2035.

France is building its clinical NGS roadmap through initiatives like France Genomic Medicine 2025, a concerted effort to incorporate whole-genome sequences (WGS) into routine diagnostics.

The French government has invested strongly in bioinformatics infrastructure, building national genomic data centers to improve interoperability between hospitals and research institutions.

NGS-based diagnostics are regulated in France by the French National Authority for Health (HAS) and by ANSM (the National Agency for the Safety of Medicines and Health Products), mandating that any commercial assay comply with IVDR for CE marking.

Industry-leading research-based biotech companies, including Integragen and Biomérieux Solutions, are a hallmark of French enterprise, particularly in cancer genomics, hereditary disease screening, and microbial sequencing.

FMI opines that the France clinical next-generation sequencing (NGS) data analysis sales will grow at nearly 15.8% CAGR through 2025 to 2035.

Germany is one of the leaders in precision medicine and clinical genomics, with governmental initiatives such as the German National Genome Initiative (GenomDE) supporting progress. Germany follows IVDR regulations for IVDs, alongside stringent data protection laws under GDPR compliance, which remain a priority for NGS companies.

Germany’s Fraunhofer Institutes and Max Planck Institutes are at the forefront of AI-led research into genomics and computational biology. Complex tests such as NGS in oncology, rare diseases, and reproductive health are also gaining traction, with many hospitals embedding sequencing-based diagnostics in electronic health records (EHRs).

FMI opines that the Germany clinical next-generation sequencing (NGS) data analysis sales will grow at nearly 17.0% CAGR through 2025 to 2035.

Clinical genomics in Italy is progressing rapidly, particularly in oncology and infectious disease sequencing. In Italy, NGS-based diagnostics are regulated under the Italian Medicines Agency (AIFA) and are subject to the EU IVDR regulation.

Public health systems encourage genetic tests, but reimbursement can take a long time and budgets are limited. Although there are increasing investments in bioinformatics training programs in Italy, a lack of skilled professionals is still problematic.

Italy is likely to improve its precision medicine capabilities by 2035, investing more funds in cloud-based NGS platforms and AI solutions for genome analytics.

FMI opines that the Italy clinical next-generation sequencing (NGS) data analysis sales will grow at nearly 14.9% CAGR through 2025 to 2035.

South Korea's clinical NGS data analysis sector is growing quickly. This is because the government is funding precision medicine programs and the private sector is heavily investing in genomic studies.

With the help of the Korean Precision Medicine Initiative and the Korean Genome Project, NGS technologies are being used more and more to diagnose cancer, find rare diseases, and keep an eye on infectious diseases.

The South Korean Ministry of Health and welfare is actively funding bioinformatics solutions that use AI to make it easier to understand sequencing data and use it in clinical practice.

The Ministry of Food and Drug Safety (MFDS) is in charge of approving NGS-based in vitro diagnostics (IVDs) for use in businesses. Companies like Macrogen, DNA Link, and Clinomics are major players in the sector.

FMI opines that the South Korea’s clinical next-generation sequencing (NGS) data analysis sales will grow at nearly 16.4% CAGR through 2025 to 2035.

A robust regulatory environment and government-supported genomic programs guarantee steady growth in Japan's established clinical NGS data analysis sector. Whole-genome sequencing (WGS) has become an important part of medical research in large part to the Tohoku Medical Megabank Project.

WGS is especially useful for studying cancer and diagnosing rare diseases. Japan's Moonshot R&D Program is also putting a lot of money into bioinformatics solutions that are powered by AI, which is speeding up sector growth even more.

The Pharmaceuticals and Medical Devices Agency (PMDA) has strict rules about how NGS-based clinical diagnostics can be approved. These rules include high standards for analytical and clinical validation. Japanese businesses such as Riken, Takara Bio, and M3 Inc. are putting money into AI-based diagnostics and cloud-based analysis of sequencing data.

FMI opines that the Japan clinical next-generation sequencing (NGS) data analysis sales will grow at nearly 15.3% CAGR through 2025 to 2035.

China is one of the sectors for clinical NGS data analysis that is growing the fastest. This is because the government is funding genomic programs, healthcare is becoming more digital quickly, and a lot of money is being put into sequencing analytics that are run by artificial intelligence (AI).

The National Genomics Initiative is helping to find new ways to treat cancer, check for reproductive health problems, and figure out what diseases are going on in rare cases.

Furthermore, the push for integrating precision medicine in public healthcare by the Chinese government is significantly driving NGS adoption.

Big names in the local bioinformatics industry, like BGI Genomics, WuXi NextCODE, and Novogene, are taking over the sector with cheap sequencing solutions and AI-powered bioinformatics platforms.

FMI opines that the China clinical next-generation sequencing (NGS) data analysis sales will grow at nearly 18.0% CAGR through 2025 to 2035.

The clinical NGS data analysis sector in Australia and New Zealand is changing quickly. This is because genomics programs government-initiated genomics programs are making it easier for people to use NGS in research and clinical settings. Australia's Genomics Health Futures Mission to sequence more than 200,000 genomes is leading to new ideas in oncology, reproductive health, and keeping an eye on infectious diseases.

New Zealand is also funding NGS-based rare disease research through Genomics Aotearoa and government health organizations. To make sure that NGS-based clinical use follows international rules, the Australian Therapeutic Goods Administration (TGA) needs IVD registration. However, high sequencing costs constrain small labs and hospitals, restricting broad implementation.

FMI opines that the Australia & New Zealand clinical next-generation sequencing (NGS) data analysis sales will grow at nearly 15.5% CAGR through 2025 to 2035.

The landscape of NGS data analysis in India is growing at a fast pace due to growing government investments in genomics, expansion of private healthcare infrastructure and rising demand for precision medicine.

The Genome India Project, which is led by the Department of Biotechnology (DBT), is set to sequence 10,000 genomes to improve diagnostics for rare diseases, cancer and population genomics. Infectious diseases and recently pathogenic diseases have also received attention for diagnostic applications using next-generation sequencing (NGS) based in vitro diagnostics (IVDs).

NGS-based in vitro diagnostics (IVDs) are regulated by the Central Drugs Standard Control Organization (CDSCO), which requires compliance with the Medical Device Rules (MDR) for commercial applications.

FMI opines that the India clinical next-generation sequencing (NGS) data analysis sales will grow at nearly 17.2% CAGR through 2025 to 2035.

NGS data analysis solution and services segment are expected to give high growth at a CAGR of 17.9% between 2025 and 2035.

To provide a clear picture across all the segments, the clinical NGS data analysis sector is divided into clinical NGS data analysis tools, platforms, sequencing services, and cloud computing solutions.

Bioinformatics tools balance the processing of sequencing data into a final result, such as sequence alignment tools, alignment visualization tools, gene prediction tools, and variant analysis tools that are essential for sequencing data interpretation for clinical uses.

The main parts are Discovery and Development Platforms, which are made up of Next-generation Sequencing (NGS) Platforms and Clinical Informatics Platforms. These help with high-throughput sequencing and bioinformatics processing, respectively.

NGS data analysis by technology segment is expected to grow at a CAGR of 17.7% between 2025 and 2035. Sequencing techniques include sequencing by synthesis (SBS), nanopore sequencing, single-molecule real-time (SMRT) sequencing, and other innovative sequencing methodologies.

Most platforms, like Illumina's sequencers, still use SBS as their main technology. However, Nanopore and SMRT sequencing are becoming more popular for real-time, long-read sequencing tasks.

NGS data analysis by application segment is projected to expand at a CAGR of 17.2% between 2025 and 2035. There are many uses for the clinical NGS data analysis segment, which is split into diagnostics, drug discovery and design, and medical research.

NGS changes diagnostics by finding diseases early, allowing personalized medicine, and helping to find rare diseases. It also becomes a long-awaited game-changer in drug discovery by being used for target identification, biomarker discovery, and pharmacogenomics. Medical research also widely uses it to investigate genetic differences, disease pathways, and therapeutic development.

NGS data analysis by end user segment is projected to expand at a CAGR of 17.1% between 2025 and 2035. Various end-users, including hospitals & clinics, academic institutes & research centers, biotechnology companies, and life science technology vendors, use clinical NGS data analysis solutions.

Precision medicine, oncology diagnostics, and genetic counseling are all done in hospitals and clinics with NGS. Sequencing is used in universities and research centers for genomics studies and translational research.

Biotechnology companies and companies that sell life science products are putting money into clinical research, bioinformatics research, and the development of NGS-based products.

The big players in the sector for clinical NGS data analysis are competing by lowering prices, innovating, forming strategic partnerships, and going global. Companies like Illumina, Thermo Fisher Scientific, and Qiagen are prioritizing the provision of cost-effective and high-performance sequencing solutions to increase their adoption in clinical and research applications.

Key strategies for growth are mergers and acquisitions, R&D spending, and partnerships with healthcare organizations.

A lot of money is being put into precision medicine programs, and the biggest players are teaming up with hospitals, biotech companies, and research institutions to get more people to use them in real life.

Market Share Analysis

Key Developments

Improvements in sequencing technologies, rising use in clinical diagnostics, and AI-enabled bioinformatics platforms are the prime drivers of growth.

Firms are adopting cloud computing, AI, and machine learning algorithms to enhance variant interpretation and lower analysis turnaround time.

Oncology, rare genetic disease diagnosis, infectious disease detection, and pharmacogenomics are the areas with the most rapid expansion.

Regulatory complexities, data privacy issues, high costs, and the necessity for expert bioinformaticians are some of the key issues.

North America is the leader in innovation, with Asia-Pacific, especially China and India, growing fast with government support and growing clinical use.

It is segmented into NGS Data Analysis Tools (Sequence Alignment Tools, Alignment Visualization Tools, Gene Prediction Tools, Variant Analysis Tools, and Others), Platforms (Next-Generation Sequencing (NGS) Platforms, Clinical Informatics Platforms), NGS Data Analysis & Sequencing Services (Whole-Genome Sequencing (WGS), Whole Exome Sequencing (WES), Comprehensive genomic profiling (CGP), Custom Panels, RNA Sequencing, and Other Sequencing Services), NGS Storage, Management & Cloud Computing Platform

It is segmented into Sequencing by Synthesis (SBS), Nanopore Sequencing, Single-Molecule Real-Time (SMRT) Sequencing, and Others

It is segmented into Diagnostics, Drug Discovery & Designing, Medical Research, and Others

It is segmented into Hospitals & Clinics, Academic Institutes & Research Centers, Biotechnology Companies, Life Science Technology Vendors, and Others

It is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and The Middle East and Africa (MEA)

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Venous Ulcer Treatment Market Overview - Growth, Trends & Forecast 2025 to 2035

Leukocyte Adhesion Deficiency Management Market - Innovations & Treatment Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.