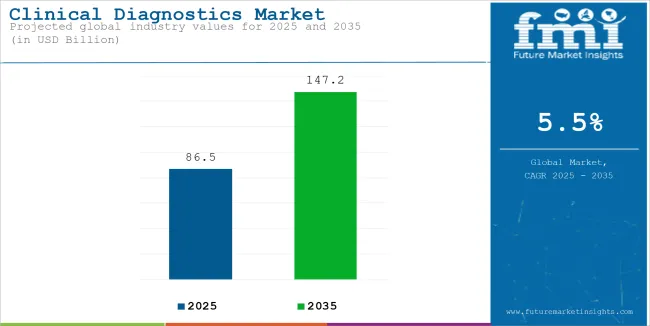

The global sales of clinical diagnostics is estimated to be worth USD 86.5 billion in 2025 and anticipated to reach a value of USD 147.2 billion by 2035. Sales are projected to rise at a CAGR of 5.5% over the forecast period between 2025 and 2035. The revenue generated by clinical diagnostics in 2024 was USD 82.6 billion.

The clinical diagnostics market is an extremely essential segment of the healthcare industry and comprises vast solutions, technologies, and tools specially designed to detect, monitor, and manage diseases. As science in medicine is advancing and emphasis on early disease detection is growing, the significance and usage of clinical diagnostics have greatly increased.

This market is driven by ever-increasing incidences of chronic diseases and infectious diseases combined with a surge in personalized medicine requirements.The primary ideology of clinical diagnostics involves examination samples of biological fluids such as blood, urine, tissues, and so forth as well as its products for marking the existence of the related disease's signs.

It is divided further into more sub-segments classified as clinical chemistry, immunoassays, molecular diagnostics, hematology, microbiology, and coagulation testing. Each of these segments uniquely contributes to the process of being diagnosed; hence giving the healthcare provider crucial insights needed in guiding treatment decisions.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 82.6 billion |

| Estimated Size, 2025 | USD 86.5 billion |

| Projected Size, 2035 | USD 147.2 billion |

| CAGR (2025 to 2035) | 5.5% |

One of the primary trends behind the clinical diagnostics market involves precision medicine, which offers treatment based on genetic makeup for individual patients. In this regard, very sophisticated diagnostic instruments must be employed that can provide very specific insights strongly actionable in nature.

Additionally, the ever-increasing need for home-based and remote diagnostics is fueling demand for market growth, primarily because of the patient's quest for convenient delivery and the rapid rise of telemedicine.

Such trends are further supported by advancements in molecular diagnostics, biomarker discovery, and AI-enabled diagnostic tools, which are all moving toward providing ever more accurate, fast, and affordable diagnostic solutions.

Geographically, the clinical diagnostics market is growing at a very significant rate in both developed and emerging markets. North America and Europe have been the largest markets so far because of the well-established healthcare infrastructure, high healthcare expenditure, and presence of leading diagnostic companies.In addition to the rise of advanced diagnostic technologies, regulatory and reimbursement, changes are reshaping the clinical diagnostics market.

Governments are instead paying more attention to increasing availability through better reimbursements and revised regulatory frameworks particularly for critical illnesses such as cancers, cardiovascular illnesses, and infections.The policies and regulatory revisions will likely better position innovation to gain more success and expand in market penetration.

The global clinical diagnostics market compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 6.4%, followed by a slightly lower growth rate of 6.1% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 6.4% (2024 to 2034) |

| H2 | 6.1% (2024 to 2034) |

| H1 | 5.5% (2025 to 2035) |

| H2 | 5.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.5% in the first half and remain relatively lower at 5.1% in the second half. In the first half (H1) the industry witnessed a decrease of 90 BPS while in the second half (H2), the industry witnessed a decrease of 100 BPS.

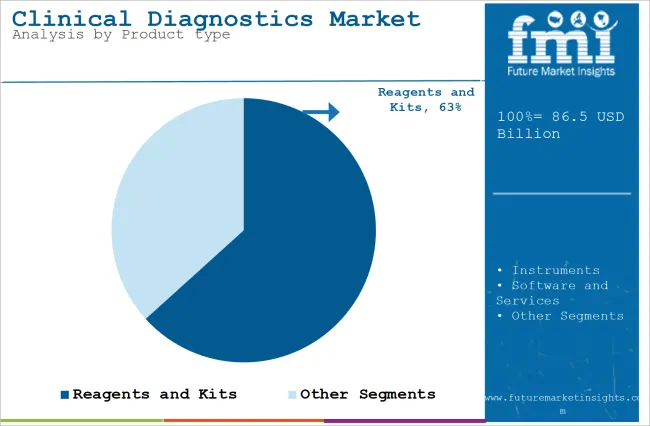

The section contains information about the leading segments in the industry. Based on product type, the reagents and kits segment is expected to account for 63.3% of the global share in 2025.

| By Product type | Reagents and Kits |

|---|---|

| Value Share (2025) | 63.3% |

The reagents and kits products segment is projected to be a dominating segment in terms of revenue, accounting for almost 63.3% of the market share in 2025.

Reagents and kits form the backbone of numerous clinical diagnostic tests. Biochemical reagents, immunoassays, molecular reagents, and enzymes are used to detect and quantify many biomarkers, pathogens, genetic material, or diseases in patient samples (e.g., blood, urine, or saliva).

These reagents are engineered to bind with biological material to allow the detection of a specific marker related to a disease or condition.

As there is hardly any diagnostic procedure (from clinical chemistry to molecular diagnostics) that does not involve reagents and kits, their higher consumption in various diagnostic platforms consequently makes them a leader in the market.

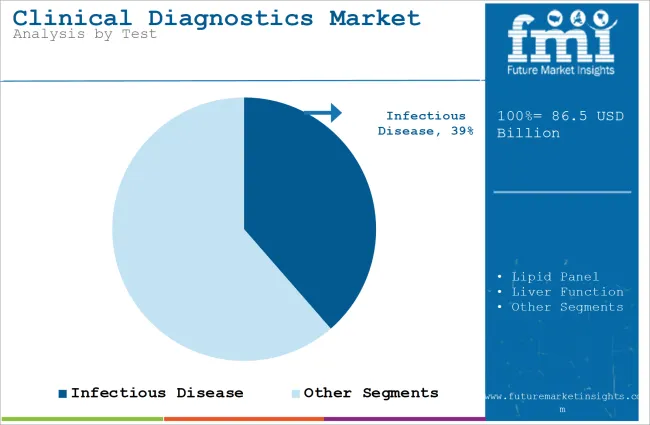

| By Test | Infectious Disease |

|---|---|

| Value Share (2025) | 38.6% |

Infectious diseases continue to be a significant threat globally and therefore constitute the first concern of diagnostic products. Diseases caused by tuberculosis, hepatitis, HIV/AIDS, malaria, and the new entrant COVID-19 still present enormous morbidity and mortality worldwide.

Global epidemiological burdens of such diseases, especially in developing and low-middle income countries, contribute to an enormous need for more precise and quick diagnosis for better control and management and to halt their transmission.

The new infectious diseases evolving, such as novel viruses (e.g., SARS-CoV-2), antimicrobial-resistant pathogens, and zoonotic diseases, are other approaches in continuing to challenge global health.

The hazard of pandemics and epidemics continues to pose a threat; therefore, strong and reliable diagnostic solutions, leading to fast identification of the infection, prevent outbreaks and help in timely intervention.

Increasing Prevalence of Chronic Diseases and Aging Populations is driving the Clinical Diagnostics Market Growth

A rise in the chronic diseases, combined with a world aging population, creates a big thrust in clinical diagnostics. Increasing incidences of chronic conditions, like diabetes, cardiovascular diseases, cancer, and respiratory disorders, mainly as a result of lifestyle and environmental changes and due to demographic ageing, make their continuous monitoring and early detection critical for controlling the symptoms and the long-term consequences.

For example, blood glucose testing should be conducted at regular intervals by patients with diabetes, and diagnostic procedures for cancer also involve biomarker tests and genetic examinations to establish whether a tumor exists and which intervention would be appropriate. As such, chronic illnesses require proper detection tools that should help in their prevention, diagnosis, and even follow-up and monitoring.

The world population is aging faster than ever in human history; projections show that, by 2050, people aged 60 years and above will nearly double. Age, as a natural part of life, goes with it increased vulnerability to developing chronic diseases or conditions such as Alzheimer's, arthritis, or hypertension. Such increases enhance the demand for clinical diagnostics.

Old-aged patients usually demand regular health checks, early diagnosis of diseases, and treatments accordingly, leading to the demand for diagnostic equipment that can identify diseases at an initial stage. Such changes are pressurizing the health systems around the globe to upgrade and provide better and efficient diagnostic technology.

Increased burden of chronic diseases and an aging population are fast giving growth to the clinical diagnostics market, as healthcare service providers now strive hard to meet the increasing demand for more sophisticated testing methods that improve patient care.

Technological Advancements and Innovation in Diagnostic Tools is driving Revenue Growth for Clinical Diagnostics

The continuous introduction of innovations in diagnostic tools and techniques is majorly driving the market of Clinical Diagnostics. However, over the last few years, considerable shifts have been introduced in the present landscape of diagnostic, which involved molecular diagnostics, next-generation sequencing (NGS), point-of-care (POC) testing, and artificial intelligence (AI) diagnostic solutions.

Such advances enhance the pace, accuracy, and cost-effectiveness of diagnostics and make early disease detection more accessible, therefore, allowing more informed clinical decision-making. For example, molecular diagnostics makes it possible to conduct specific genetic testing, including identification of predispositions, infections, and cancer at the molecular level.

Comprehensive genome analysis via technologies such as NGS facilitates identification and is most crucial for personalizing medicine and targeted therapies with enhanced treatment outcome.

Laboratory automation has improved throughput, minimized human error, and enhanced consistency in testing. As diagnostic tools begin to be cheaper in price, the patient begins to opt for home-based testing and remote monitoring platforms, driving market growth.

Further advancements of technology will enhance the development of high-quality diagnostics with increasing accuracy, resulting in improved detection at an earlier stage of the disease, offering personal care for individuals, and improving the effective interventions in various treatments of disease.

Growth of Personalized Medicine and Point-of-Care Testing is Creating Opportunities in the Market

One potential growth opportunity lies in the upcoming personalized medicine and point-of-care (POC) testing opportunity in the Clinical Diagnostics market. Personalized medicine is targeted at patients where treatment plans for patients are matched to genetic makeup, lifestyle, and environment in order to obtain the best-fit therapies, where precise and timely diagnostic data help ensure that they receive the appropriate therapies.

With the rising demand for precision health care, more and more will be needed diagnostic tools that can deliver personalized insights. Advances in genetic testing, biomarker discovery, and liquid biopsy technologies enable clinicians to identify the best therapeutic options for patients, especially for oncology where treatments can often be highly individualized based on their tumor's genetic profiles.

POC diagnostic instruments provide fast test capabilities outside a standard laboratory and report results within hours, enabling a quicker turnaround on decision-making and treatment. The escalating adoption of mobile technologies and telemedicine increases demand for POC testing, enabling patients and care providers to monitor and manage health conditions from remote locations.

High Costs and Regulatory Barriers may Restrict Market Growth

Despite the growth potential in the clinical diagnostics market, one of the biggest drawbacks is that advanced diagnostic equipment is costly and has intricate regulatory issues that often lead to a lengthy delay in new product launches. It would make these technologies prohibitively expensive for smaller health care providers and patients, mainly in low resource settings.

With many diagnostic innovations promising better accuracy and speed, a high initial investment in procuring, implementing, and maintaining them is a reason for limited widespread adoption. For example, complex molecular diagnostic instruments require highly specialized training for their operators and involve significant capital investments, thus limiting their use to large, well-funded healthcare facilities.

Moreover, regulatory complexities in various locations, such as the USA and Europe, can further hamper the diagnostic devices' access to the marketplace, especially on newer technologies and AI-based products for diagnostics. Regulatory bodies are stringent in making their guidelines such as the USA Food and Drug Administration (FDA), the European Medicines Agency of Europe, require extensive testing methods before a product makes it to market.

The global clinical diagnostics industry recorded a CAGR of 6.3% during the historical period between 2020 and 2024. The growth of clinical diagnostics industry was positive as it reached a value of USD 82.6 billion in 2024 from USD 313.7 billion in 2020.

Historically, the clinical diagnostics market was primarily centered around traditional laboratory tests that involved manual processes and relatively slow turnaround times. In the early stages, diagnostic technologies relied heavily on microscopic analysis and biochemical assays to detect diseases. The most common diagnostic tests involved blood tests, urine tests, and imaging methods.

These were not only limited in scope but also in precision. This innovation increased testing efficiency, reduced human error, and laid the ground for the more sophisticated systems that followed.

Presently, the market of clinical diagnostics involves a host of advanced technologies and methodologies applied within different health facilities. The foundations of clinical diagnostics revolve around three major diagnostic principles: molecular diagnostics, point-of-care (POC) testing, and immunoassays. Such tests are generally rapid, highly accurate, and invasive.

Some such diseases are genetic disorders, cancer, and infections. Such technologies promise earlier detection and the possibility of more proper treatment plans. This is increasingly important as health care evolves toward preventive and personalized care.

The clinical diagnostics market is headed toward further expansion as several new trends are likely to be seen impacting it in the coming years. An emerging trend currently, which stands to significantly revolutionize the clinic, is personalization in medical treatments.

Increased implementation of precision medicine in the health sector implies more genetic testing and analysis of potential biomarkers coupled with companion diagnostics, which inform a patient that can be more customized according to individual characteristics to treatment.

The potential for significant growth in the oncology diagnostics market will come through revolutionizing oncology diagnostics through liquid biopsy technology, a technology that would help diagnose and monitor cancer without requiring invasive procedures.

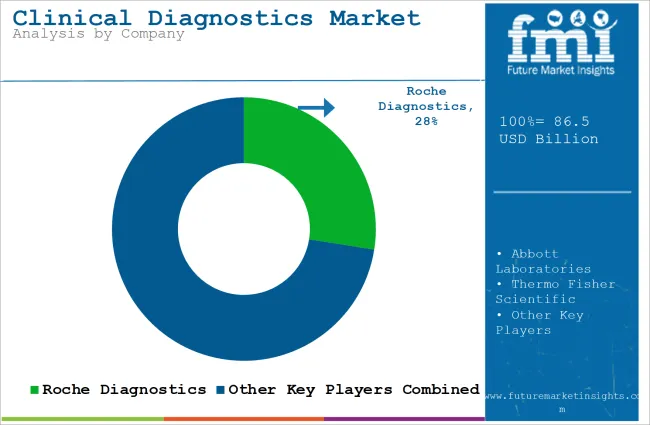

Tier 1 companies are the industry leaders with 55.4% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. Prominent companies within tier 1 include Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, and Siemens Healthineers.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 27.2% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets.

Key Companies under this category include Danaher Corporation, Bio-Rad Laboratories, Becton, Dickinson and Company, Quest Diagnostics, bioMérieux among others.

Compared to Tiers 1 and 2, Tier 3 companies offer clinical diagnostics, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. They specialize in specific products and cater to niche markets, adding diversity to the industry.

The market analysis for clinical diagnostics in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below.

It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 91.2%. By 2035, China is expected to experience a CAGR of 5.6% in the Asia-Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.4% |

| Germany | 3.9% |

| UK | 3.7% |

| France | 4.2% |

| China | 5.6% |

| South Korea | 5.1% |

| India | 6.0% |

Germany’s clinical diagnostics market is poised to exhibit a CAGR of 3.9% between 2025 and 2035. The Germany holds highest market share in European market.

Germany is one of the most developed and complete healthcare systems in Europe, thereby directly contributing to the growth of the clinical diagnostics market. This is due to a well-structured hospital infrastructure along with networks of diagnostic centers and research institutes, which have high-tech diagnostic technologies.

In such a set-up, various modern diagnostic technologies, such as molecular diagnostics, genetic testing, and NGS, are likely to be embraced across the market.A high commitment to standards, coupled with good reimbursement, from Germany drives a demand for new diagnostic equipment that is not inferior. Germany also spends heavily on medical research and development (R&D), which influences diagnostic technology.

The government and private enterprise have been particularly active in furthering biotechnology, biomarker discovery, and precision medicine-all requiring sophisticated platforms for testing.Significant investment by the country in medical technology companies and clinical trials fuels innovation and leads to the creation of novel diagnostic tools that quickly emerge within the healthcare system.

United States is anticipated to show a CAGR of 3.4% between 2025 and 2035.

Robust healthcare infrastructure coupled with major research and development spending remains an important force of the United States Clinical Diagnostics market. No other healthcare system is quite at par to what exists within the United States: cutting-edge hospitals, a lot of in-country research centers and diagnostic labs across the world.

The United States hosts some of the biggest players in healthcare provider companies and diagnostics firms, heavily investing in diagnostic innovation. Such investment allows for innovative development and deployment of top-notch tools that range from molecular diagnostics, genetic testing, to NGS and AI-based systems for diagnosis.

Besides funding for research, the USA private sector also greatly contributes to the expansion of clinical diagnostics with the advancement.

The market of the country contains leading diagnostic companies such as Thermo Fisher Scientific, Abbott Laboratories, Roche Diagnostics, and Quest Diagnostics, who advance their diagnostic technology and add on to their existing product portfolios regularly.

India is anticipated to show a CAGR of 6.0% between 2025 and 2035.

India is experiencing a monumental shift in its health care system that has been characterized with an ever-expanding burden of non-communicable diseases as well as an ageing population.Chronic diseases such as diabetes, cardiovascular diseases, hypertension, chronic respiratory diseases and cancer have increased globally over time, attributed largely to wide urbanization, lifestyle, unhealthy diet and inactivity.

India has second highest diabetic population in the world, with more than 77 million bad patient suffering from it. Since they are chronic in nature and require frequent monitoring and management, regular diagnostic testing plays a crucial role in improving patient outcomes and decreasing related complications.More importantly, and perhaps more alarmingly, there is a vast ageing population in India that is only going to grow; it is projected to expand exponentially for the older populations those over 60 years of age in the coming decades.

Neurodegenerative disorders (Alzheimer's and Parkinson's disease), cancers, and musculoskeletal disorders are abundant in the older group of women and men.As population ages, there is a growing need for diagnostic technologies that can identify disease at the earliest stages, and monitor its progression.

In terms of this market, the companies involved are resorting to multiple strategies to retain a competitive position. Strategic partnerships and collaborations with research institutions and healthcare providers are being utilized to broaden their product portfolio.

Geographical expansion into the emerging markets, particularly United States and Asia Pacific countries, has been another strategic priority for these companies, where growth in the healthcare infrastructure and awareness is strong.

Recent Industry Developments in Clinical Diagnostics Industry Outlook

In terms of product type, the industry is divided into instruments, reagents and kits, software and services.

In terms of test, the industry is segregated into lipid panel, liver function, kidney function, complete blood count, infectious disease, thyroid function, glucose monitoring, and cancer diagnostics among others.

In terms of end user, the industry is divided into hospitals, specialty clinics, diagnostic laboratories, point-of-care settings, research institutes and academic centers.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

Table 01: Global Market Value (US$ Bn), By Test, 2015 – 2021

Table 02: Global Market Value (US$ Bn), By Test, 2022 – 2032

Table 03: Global Market Value (US$ Bn), By End-user, 2015 – 2021

Table 04: Global Market Value (US$ Bn), By End-user, 2022 – 2032

Table 05: Global Market Value (US$ Bn), By Product, 2015 – 2021

Table 06: Global Market Value (US$ Bn), By Product, 2022 – 2032

Table 07: Global Market, By Region, 2015 – 2021

Table 08: Global Market, By Region, 2022 – 2032

Table 09: North America Market Value (US$ Bn), By Test, 2015 – 2021

Table 10: North America Market Value (US$ Bn), By Test, 2022 – 2032

Table 11: North America Market Value (US$ Bn), By End-user, 2015 – 2021

Table 12: North America Market Value (US$ Bn), By End-user, 2022 – 2032

Table 13: North America Market Value (US$ Bn), By Product, 2015 – 2021

Table 14: North America Market Value (US$ Bn), By Product, 2022 – 2032

Table 15: North America Market, By Country, 2015 – 2021

Table 16: North America Market, By Country, 2022 – 2032

Table 17: Latin America Market Value (US$ Bn), By Test, 2015 – 2021

Table 18: Latin America Market Value (US$ Bn), By Test, 2022 – 2032

Table 19: Latin America Market Value (US$ Bn), By End-user, 2015 – 2021

Table 20: Latin America Market Value (US$ Bn), By End-user, 2022 – 2032

Table 21: Latin America Market Value (US$ Bn), By Product, 2015 – 2021

Table 22: Latin America Market Value (US$ Bn), By Product, 2022 – 2032

Table 23: Latin America Market, By Country, 2015 – 2021

Table 24: Latin America Market, By Country, 2022 – 2032

Table 25: Europe Market Value (US$ Bn), By Test, 2015 – 2021

Table 26: Europe Market Value (US$ Bn), By Test, 2022 – 2032

Table 27: Europe Market Value (US$ Bn), By End-user, 2015 – 2021

Table 28: Europe Market Value (US$ Bn), By End-user, 2022 – 2032

Table 29: Europe Market Value (US$ Bn), By Product, 2015 – 2021

Table 30: Europe Market Value (US$ Bn), By Product, 2022 – 2032

Table 31: Europe Market, By Country, 2015 – 2021

Table 32: Europe Market, By Country, 2022 – 2032

Table 33: Asia Pacific Market Value (US$ Bn), By Test, 2015 – 2021

Table 34: Asia Pacific Market Value (US$ Bn), By Test, 2022 – 2032

Table 35: Asia Pacific Market Value (US$ Bn), By End-user, 2015 – 2021

Table 36: Asia Pacific Market Value (US$ Bn), By End-user, 2022 – 2032

Table 37: Asia Pacific Market Value (US$ Bn), By Product, 2015 – 2021

Table 38: Asia Pacific Market Value (US$ Bn), By Product, 2022 – 2032

Table 39: Asia Pacific Market, By Country, 2015 – 2021

Table 40: Asia Pacific Market, By Country, 2022 – 2032

Table 41: MEA Market Value (US$ Bn), By Test, 2015 – 2021

Table 42: MEA Market Value (US$ Bn), By Test, 2022 – 2032

Table 43: MEA Market Value (US$ Bn), By End-user, 2015 – 2021

Table 44: MEA Market Value (US$ Bn), By End-user, 2022 – 2032

Table 45: MEA Market Value (US$ Bn), By Product, 2015 – 2021

Table 46: MEA Market Value (US$ Bn), By Product, 2022 – 2032

Table 47: MEA Market, By Country, 2015 – 2021

Table 48: MEA Market, By Country, 2022 – 2032

Table 49: Global Market Incremental $ Opportunity, By Test, 2015 - 2021

Table 50: Global Market Incremental $ Opportunity, By End-user, 2022 – 2032

Table 51: Global Market Incremental $ Opportunity, By Product, 2015 - 2021

Table 52: Global Market Incremental $ Opportunity, By Region, 2022 – 2032

Table 53: North America Market Incremental $ Opportunity, By Test, 2015 - 2021

Table 54: North America Market Incremental $ Opportunity, By End-user, 2022 – 2032

Table 55: North America Market Incremental $ Opportunity, By Product, 2015 – 2021

Table 56: North America Market Incremental $ Opportunity, By Country, 2022 – 2032

Table 57: Latin America Market Incremental $ Opportunity, By Test, 2015 - 2021

Table 58: Latin America Market Incremental $ Opportunity, By End-user, 2022 – 2032

Table 59: Latin America Market Incremental $ Opportunity, By Product, 2015 - 2021

Table 60: Latin America Market Incremental $ Opportunity, By Country, 2022 – 2032

Table 61: Europe Market Incremental $ Opportunity, By Test, 2015 - 2021

Table 62: Europe Market Incremental $ Opportunity, By End-user, 2022 – 2032

Table 63: Europe Market Incremental $ Opportunity, By Product, 2015 - 2021

Table 64: Europe Market Incremental $ Opportunity, By Country, 2022 - 2032

Table 65: Asia Pacific Market Incremental $ Opportunity, By Test, 2015 - 2021

Table 66: Asia Pacific Market Incremental $ Opportunity, By End-user, 2022 – 2032

Table 67: Asia Pacific Market Incremental $ Opportunity, By Product, 2015 - 2021

Table 68: Asia Pacific Market Incremental $ Opportunity, By Country, 2022 – 2032

Table 69: MEA Market Incremental $ Opportunity, By Test, 2015 - 2021

Table 70: MEA Market Incremental $ Opportunity, By End-user, 2022 – 2032

Table 71: MEA Market Incremental $ Opportunity, By Product, 2015 - 2021

Table 72: MEA Market Incremental $ Opportunity, By Country, 2022 - 2032

Figure 01: Global Market Value (US$ Bn) and Year-on-Year Growth, 2015-2032

Figure 02: Global Market Absolute $ Historical Gain (2015 - 2021) and Opportunity (2022 – 2032), US$ Bn

Figure 03: Global Market Share, By Test, 2022 & 2032

Figure 04: Global Market Y-o-Y Growth Projections, By Test – 2022-2032

Figure 05: Global Market Attractiveness Index, By Test – 2022-2032

Figure 06: Global Market Share, By End-user, 2022 & 2032

Figure 07: Global Market Y-o-Y Growth Projections, By End-user – 2022-2032

Figure 08: Global Market Attractiveness Index, By End-user – 2022-2032

Figure 09: Global Market Share, By Product, 2022 & 2032

Figure 10: Global Market Y-o-Y Growth Projections, By Product – 2022-2032

Figure 11: Global Market Attractiveness Index, By Product – 2022-2032

Figure 12: Global Market Share, By Region, 2022 & 2032

Figure 13: Global Market Y-o-Y Growth Projections, By Region – 2022-2032

Figure 14: Global Market Attractiveness Index, By Region – 2022-2032

Figure 15: North America Market Value (US$ Bn) and Year-on-Year Growth, 2015-2032

Figure 16: North America Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Bn

Figure 17: North America Market Share, By Test, 2022 & 2032

Figure 18: North America Market Y-o-Y Growth Projections, By Test – 2022-2032

Figure 19: North America Market Attractiveness Index, By Test – 2022-2032

Figure 20: North America Market Share, By End-user, 2022 & 2032

Figure 21: North America Market Y-o-Y Growth Projections, By End-user – 2022-2032

Figure 22: North America Market Attractiveness Index, By End-user – 2022-2032

Figure 23: North America Market Share, By Product, 2022 & 2032

Figure 24: North America Market Y-o-Y Growth Projections, By Product – 2022-2032

Figure 25: North America Market Attractiveness Index, By Product – 2022-2032

Figure 26: North America Market Share, By Country, 2022 & 2032

Figure 27: North America Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 28: North America Market Attractiveness Index, By Country – 2022-2032

Figure 29: Latin America Market Value (US$ Bn) and Year-on-Year Growth, 2015-2032

Figure 30: Latin America Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Bn

Figure 31: Latin America Market Share, By Test, 2022 & 2032

Figure 32: Latin America Market Y-o-Y Growth Projections, By Test – 2022-2032

Figure 33: Latin America Market Attractiveness Index, By Test – 2022-2032

Figure 34: Latin America Market Share, By End-user, 2022 & 2032

Figure 35: Latin America Market Y-o-Y Growth Projections, By End-user – 2022-2032

Figure 36: Latin America Market Attractiveness Index, By End-user – 2022-2032

Figure 37: Latin America Market Share, By Product, 2022 & 2032

Figure 38: Latin America Market Y-o-Y Growth Projections, By Product – 2022-2032

Figure 39: Latin America Market Attractiveness Index, By Product – 2022-2032

Figure 40: Latin America Market Share, By Country, 2022 & 2032

Figure 41: Latin America Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 42: Latin America Market Attractiveness Index, By Country – 2022-2032

Figure 43: Europe Market Value (US$ Bn) and Year-on-Year Growth, 2015-2032

Figure 44: Europe Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Bn

Figure 45: Europe Market Share, By Test, 2022 & 2032

Figure 46: Europe Market Y-o-Y Growth Projections, By Test – 2022-2032

Figure 47: Europe Market Attractiveness Index, By Test – 2022-2032

Figure 48: Europe Market Share, By End-user, 2022 & 2032

Figure 49: Europe Market Y-o-Y Growth Projections, By End-user – 2022-2032

Figure 50: Europe Market Attractiveness Index, By End-user – 2022-2032

Figure 51: Europe Market Share, By Product, 2022 & 2032

Figure 52: Europe Market Y-o-Y Growth Projections, By Product – 2022-2032

Figure 53: Europe Market Attractiveness Index, By Product – 2022-2032

Figure 54: Europe Market Share, By Country, 2022 & 2032

Figure 55: Europe Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 56: Europe Market Attractiveness Index, By Country – 2022-2032

Figure 57: MEA Market Value (US$ Bn) and Year-on-Year Growth, 2015-2032

Figure 58: MEA Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Bn

Figure 59: MEA Market Share, By Test, 2022 & 2032

Figure 60: MEA Market Y-o-Y Growth Projections, By Test – 2022-2032

Figure 61: MEA Market Attractiveness Index, By Test – 2022-2032

Figure 62: MEA Market Share, By End-user, 2022 & 2032

Figure 63: MEA Market Y-o-Y Growth Projections, By End-user – 2022-2032

Figure 64: MEA Market Attractiveness Index, By End-user – 2022-2032

Figure 65: MEA Market Share, By Product, 2022 & 2032

Figure 66: MEA Market Y-o-Y Growth Projections, By Product – 2022-2032

Figure 67: MEA Market Attractiveness Index, By Product – 2022-2032

Figure 68: MEA Market Share, By Country, 2022 & 2032

Figure 69: MEA Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 70: MEA Market Attractiveness Index, By Country – 2022-2032

Figure 71: Asia Pacific Market Value (US$ Bn) and Year-on-Year Growth, 2015-2032

Figure 72: Asia Pacific Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Bn

Figure 73: Asia Pacific Market Share, By Test, 2022 & 2032

Figure 74: Asia Pacific Market Y-o-Y Growth Projections, By Test – 2022-2032

Figure 75: Asia Pacific Market Attractiveness Index, By Test – 2022-2032

Figure 76: Asia Pacific Market Share, By End-user, 2022 & 2032

Figure 77: Asia Pacific Market Y-o-Y Growth Projections, By End-user – 2022-2032

Figure 78: Asia Pacific Market Attractiveness Index, By End-user – 2022-2032

Figure 79: Asia Pacific Market Share, By Product, 2022 & 2032

Figure 80: Asia Pacific Market Y-o-Y Growth Projections, By Product – 2022-2032

Figure 81: Asia Pacific Market Attractiveness Index, By Product – 2022-2032

Figure 82: Asia Pacific Market Share, By Country, 2022 & 2032

Figure 83: Asia Pacific Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 84: Asia Pacific Market Attractiveness Index, By Country – 2022-2032

Figure 85: US Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 86: US Market Share, By Test, 2021

Figure 87: US Market Share, By End-user, 2021

Figure 88: US Market Share, By Product, 2021

Figure 89: Canada Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 90: Canada Market Share, By Test, 2021

Figure 91: Canada Market Share, By End-user, 2021

Figure 92: Canada Market Share, By Product, 2021

Figure 93: Brazil Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 94: Brazil Market Share, By Test, 2021

Figure 95: Brazil Market Share, By End-user, 2021

Figure 96: Brazil Market Share, By Product, 2021

Figure 97: Mexico Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 98: Mexico Market Share, By Test, 2021

Figure 99: Mexico Market Share, By End-user, 2021

Figure 100: Mexico Market Share, By Product, 2021

Figure 101: Germany Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 102: Germany Market Share, By Test, 2021

Figure 103: Germany Market Share, By End-user, 2021

Figure 104: Germany Market Share, By Product, 2021

Figure 105: U.K. Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 106: U.K. Market Share, By Test, 2021

Figure 107: U.K. Market Share, By End-user, 2021

Figure 108: U.K. Market Share, By Product, 2021

Figure 109: France Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 110: France Market Share, By Test, 2021

Figure 111: France Market Share, By End-user, 2021

Figure 112: France Market Share, By Product, 2021

Figure 113: Italy Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 114: Italy Market Share, By Test, 2021

Figure 115: Italy Market Share, By End-user, 2021

Figure 116: Italy Market Share, By Product, 2021

Figure 117: BENELUX Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 118: BENELUX Market Share, By Test, 2021

Figure 119: BENELUX Market Share, By End-user, 2021

Figure 120: BENELUX Market Share, By Product, 2021

Figure 121: Nordic Countries Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 122: Nordic Countries Market Share, By Test, 2021

Figure 123: Nordic Countries Market Share, By End-user, 2021

Figure 124: Nordic Countries Market Share, By Product, 2021

Figure 125: China Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 126: China Market Share, By Test, 2021

Figure 127: China Market Share, By End-user, 2021

Figure 128: China Market Share, By Product, 2021

Figure 129: Japan Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 130: Japan Market Share, By Test, 2021

Figure 131: Japan Market Share, By End-user, 2021

Figure 132: Japan Market Share, By Product, 2021

Figure 133: South Korea Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 134: South Korea Market Share, By Test, 2021

Figure 135: South Korea Market Share, By End-user, 2021

Figure 136: South Korea Market Share, By Product, 2021

Figure 137: GCC Countries Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 138: GCC Countries Market Share, By Test, 2021

Figure 139: GCC Countries Market Share, By End-user, 2021

Figure 140: GCC Countries Market Share, By Product, 2021

Figure 141: South Africa Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 142: South Africa Market Share, By Test, 2021

Figure 143: South Africa Market Share, By End-user, 2021

Figure 144: South Africa Market Share, By Product, 2021

Figure 145: Turkey Market Value (US$ Bn) and Forecast, 2022 - 2032

Figure 146: Turkey Market Share, By Test, 2021

Figure 147: Turkey Market Share, By End-user, 2021

Figure 148: Turkey Market Share, By Product, 2021

The global clinical diagnostics industry is projected to witness CAGR of 5.5% between 2025 and 2035.

The global clinical diagnostics industry stood at USD 82.6 billion in 2024.

The global clinical diagnostics industry is anticipated to reach USD 147.2 billion by 2035 end.

China is expected to show a CAGR of 5.6% in the assessment period.

The key players operating in the global clinical diagnostics industry are Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Siemens Healthineers, Danaher Corporation, Bio-Rad Laboratories, Becton, Dickinson and Company, Quest Diagnostics, bioMérieux, among others.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.