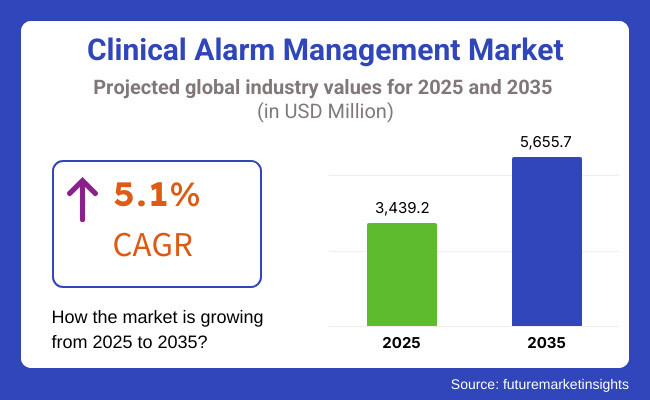

In the coming years, the clinical alarm management market is expected to reach USD 3,439.2 million by 2025 and is expected to steadily grow at a CAGR of 5.1% to reach USD 5,655.7 million by 2035. In 2024, cluster headache syndrome generated roughly USD 3,286.0 million in revenues.

Clinical Alarm Management Alarms are an essential part of not only care but patient safety, as they are crucial in warning clinicians of subtle changes in patient health. Hospitals and clinic must depend on medical devices like ventilators, infusion pumps, and patient monitors that trigger alarms to signal perceived risks to patients. A number of factors is driving the need for the Clinical Alarm Management solution.

Medical technologies are advancing, which contributes to the increasing number of medical alarms, but more optimized management systems are needed. Regulatory bodies stress alarm standardization and patient safety protocols, driving healthcare facilities towards new strategies for alarm management.

The increasing number of preventable hospital-acquired conditions and adverse events prompted the American Hospital Association (AHA) to issue a consensus statement on improving alarm management in order to improve patient care.

Healthcare providers are also working on integrated alarm systems with centralized monitoring and EHRs, which can help with more targeted alarm filtering and escalation protocols. The proliferation of telehealth and home-based care has also added demands for effective alarm management in remote environments.

The Clinical Alarm Management market has nurtured the new market on many grounds and is expected to grow with new smart monitoring systems within hospitals and long-term care facilities, as well as the need for improved issues with increased efficiency, reduced burden on clinicians, and improved patient outcomes.

The Clinical Alarm Management market is expected to witness substantial growth from 2020 to 2024, as the landscape has been dominated by evolving healthcare technology in conjunction with rising multipoint patient safety measures. Data had existed since before 2020 when COVID-19 tested healthcare systems and caused a rise in devices like ventilators and patient monitors to help patients.

This caused an inordinate number of alarms, which further propagated alarm fatigue throughout the healthcare system. As a result, alarm management solutions became an increasing priority for hospitals and clinics looking to improve patient monitoring without needlessly distracting medical staff.

With the operational landscape of healthcare having changed post-pandemic, investment in digital health infrastructure increased. To maximize efficiency, many hospitals implemented alarm management systems that interface with their electronic health records (EHRs) or centralized monitoring systems.

There was also an increasing focus on regulatory compliance, with directives encouraging hospitals to implement strategies to reduce alarm fatigue and increase response times to important alerts.

The North American clinical alarm management is expected to be the biggest market owing to the well-established healthcare system and better regulatory standards. Alarm fatigue and patient safety spurred broad adoption of sophisticated alarm management solutions across the region's hospitals and healthcare facilities.

The existence of dynamic technology providers and robust investment in digital healthcare transformation make the industry stronger. The rising prevalence of chronic diseases, as well as the growing population ages, have led to increased demands for continuous monitoring, thus propelling the demand for intelligent alarm systems.

Better integration with electronic health records and interoperability standards has further streamlined alarm response, improving overall care delivery. This has also led to further investment in innovative predictive alarm technologies to improve clinical workflows, all while producing the highest levels of R&D output.

Europe is a close second to North America, driven by increasing government initiatives and healthcare policies targeting patient safety improvement. Much of the work has been concentrated on alarm fatigue minimization through the establishment of hospital and long-term care facility standards.

European healthcare providers combine alarm management solutions into their centralized monitoring platforms for timely intervention and optimized workflow. The increasing need for remote patient monitoring has also driven adoption, especially in regions such as Europe with ageing populations and great demand for homecare solutions.

AI-powered alarm filtering and escalation mechanisms have emerged in response to the interplay of clinical need, technological development, and an emphasis on decreasing clinician fatigue. Longstanding regulation has resulted in consistent growth within the region, compelling service providers to embrace next-generation solutions that favor alarm prioritization and patient outcomes.

With growing healthcare digitization and rising cognizance about patient safety, Asia Pacific has a key region with rapidly expanding clinical alarm management. Companies are investing greatly in alarm management solutions and healthcare technology in countries such as China, India, and Japan.

The increasing prevalence of chronic diseases and the rising middle-class population have propelled the usage of monitoring systems in hospitals and in-home healthcare settings across the globe. Moreover, government initiatives to promote the digital transformation of healthcare have propelled the implementation of intelligent alarm management platforms.

The variations in healthcare systems offer varied opportunities and challenges as developed countries design increasingly advanced infrastructures while developing countries seek cost-efficient alarm systems. For example, the growing trend of smart hospitals and telemedicine only increases the demand for alarm interoperability, as care spans many different practice settings.

Challenges: Alarm Fatigue is Set to be the Key Barrier in the Clinical Alarm Management Market

Despite significant technological advancements, alarm fatigue remains one of the biggest obstacles in the industry. Systems with excessive alarms desensitize healthcare workers to alarms present, delaying response to potentially crucial treatment for patients. This issue is closely linked to the lack of standardization among alarm systems, as different manufacturers use various protocols, which complicates integration.

Another obstacle is the expense of implementation, especially in smaller healthcare systems and third-world nations, where limited budgets prevent adoption. Resistance from medical personnel, who have been used to monitoring staff at all positions of the organization, also halts the application of advanced monitoring alarm solutions.

Risks to cybersecurity also hinder adoption due to networks of alarm systems that can be compromised by data breaches, leading to the requirement of robust systems to ensure security.

Apart from this, there is Limited awareness regarding alarm optimization and the unavailability of skilled professionals trained to manage complex alarm systems. Overcoming these challenges will require concerted actions from regulators, clinicians, and technology developers to improve interoperability, cost-effectiveness, and cyber security.

Opportunities: Expansion of Home Healthcare and Remote Patient Monitoring Opportunities for the Clinical Alarm Management Industry

One of the most significant opportunities is the development of predictive analytics of alarm management solutions that can deliver alarm prioritization in real time. These innovations help hospitals minimize false alarms and enhance staff workflow.

Another key opportunity lies in the increasing adoption of cloud-based monitoring platforms, which allow for centralizing alarm data and provide opportunities to harmonize responses across different facilities within healthcare organizations.

As home healthcare and remote patient monitoring have expanded, the need for continuous care outside of hospitals has driven further demand for such smart alarm systems. They develop voice recognition and natural language processing in alarm systems, which leads to better communication among clinicians, resulting in more effective care as a result of the improvement of response time and coordination.

Moreover, the move towards personalized patient monitoring creates new opportunities for alarm customization, which produces alerts based on patients rather than topical thresholds. Sustained market growth will benefit companies that create intelligent, mutually communicative, and cost-effective alarm solutions as healthcare personnel increase their investments in digital transformation.

From 2020 to 2024, the clinical alarm management market grew rapidly in response to the widespread adoption of digital health solutions powered in large part by the COVID-19 pandemic. Various methodologies were used to overcome alarm fatigue in hospitals across the world, leading to investments in advanced filtering mechanisms and workflow automation—the development of regulatory guidelines in the industry to regulate alarm practices and reduce alarm fatigue.

The trend towards remote monitoring also broadened the concept of alarm management solutions. AI-driven predictive analytics will become mainstream from 2025 to 2035, and that will be the tipping point for further transformation of the industry.

Old legacy systems versus new technology the next age of alarm integration systems integrated with IoT capable medical manufacturing unit will facilitate data exchange for real time operational and decision making process-saving a life and a routine process; growing your business rapidly. Stronger regulations by governing bodies will be released, creating unified alarm management expectations in healthcare settings.

Personalized medicine will fuel the demand for alarm settings customized to individual patients. With continued technological advancements, the industry is poised to shift from reactive alarm responses to proactive patient monitoring, enhancing overall care delivery.

Shifts in the Clinical Alarm Management Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased focus on standardization and compliance |

| Technological Advancements | Integration of AI and cloud-based monitoring |

| Consumer Demand | Growing need for efficient alarm management |

| Market Growth Drivers | Digital transformation and workflow optimization |

| Sustainability | Focus on reducing clinician burden and alarm fatigue |

| Supply Chain Dynamics | Increased reliance on connected alarm systems |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global regulations ensuring uniform alarm management protocols |

| Technological Advancements | Widespread adoption of predictive analytics and smart alarms |

| Consumer Demand | Expansion of personalized alarm solutions tailored to patient needs |

| Market Growth Drivers | Expansion of IoT-enabled real-time monitoring solutions |

| Sustainability | Adoption of eco-friendly, low-energy alarm management technologies |

| Supply Chain Dynamics | Integration of blockchain for enhanced data security and traceability |

Market Outlook

As hospital automation shapes the USA clinical alarm management landscape, so do stringent regulations governing patient safety. The approval of wise health and wellness innovation frameworks, as well as federal government motivations encouraging digital health improvement, has actually sped up the implementation of alarm administration systems.

The growing number of chronic illnesses has increased the need for continuous monitoring in hospitals and home healthcare. Indeed, technological improvements such as AI-based alarm filtering have improved efficiency in alarm responses. Moreover, a thriving presence of key technology suppliers has been instrumental in making growth intelligent alarm solutions across healthcare facilities.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.0% |

Market Outlook

Germany has a significant focus on reducing clinician burnout, and this is translated in the investment in alarm management systems for Germany’s healthcare industry. The data is quality from October 2023. AI-based monitoring solutions have come through in their resolution of alarm validation.

Mandates of data security of alarm systems from government regulators have driven the installation of many cybersecurity-enhanced solutions. Moreover, continued research initiatives have enabled ongoing improvements to alarm management tools and systems.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.8% |

Market Outlook

Growing investments made to modernize hospitals in India have been supporting the growth of clinical alarm management in the country's healthcare landscape. The adoption of intelligent alarm systems is propelled by growing awareness regarding patient safety.

The proliferation of private healthcare suppliers has driven the need for affordable caution software. Support from government programs that promote a digital transformation of healthcare has further fueled the growth of the industry. Moreover, affordable monitoring solutions have made alarm management available to a greater number of hospitals.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.8% |

Market Outlook

China, with its growing smart hospital initiatives, is leading in clinical alarm management. Moreover, the scroll on IoT-driven healthcare solutions and AI in the country has opened up the doors for rapid deployment of alarm systems.

Real-time patient monitoring is in high demand owing to the high prevalence of chronic diseases. In addition, the alarm system new features for telemedicine platforms have improved integration, making them more efficient and widespread in remote areas. In addition, alarm management technologies for hospitals have gained traction as government-led digital health initiatives have validated their use.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.4% |

Market Outlook

The clinical alarm management industry is growing in Brazil in response to increased attention to ensuring patient safety in public and private healthcare facilities. The increase in telemedicine adoption has led to a rise in demand for remote alarm management solutions.

Efforts to regulate alarm management protocols have enhanced interoperability across various healthcare systems. Growing investments in connected healthcare infrastructure are translating into the adoption of smart alarms. Partnerships with tech companies have yielded the next generation of alarm management within hospital systems.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 2.7% |

Solutions Leading Due to Advanced Automation and Integration

The largest share of the solution segment of the clinical alarm management market is attributed to their ability to improve the efficiency of the workflow by reducing alarm fatigue among healthcare providers. These solutions include advanced filtering capabilities and customizable alert sets so that clinicians only respond to the alarms that require action.

Alarm management solutions seamlessly integrate with hospital information systems (HIS) and electronic health records (EHR), allowing for real-time data synchronization, and has further accelerated adoption. Solutions also include predictive features that look at alarm trends to help healthcare providers mitigate potential risks to patients before they happen.

Because of their scalability and flexibility, these systems can be deployed in a variety of healthcare settings, from large hospitals to ambulatory care centers. Healthcare facilities are responding to the growing demand for enhanced patient safety and compliance to rigorous regulations by making alarm management solution investments a top priority. Solutions are showing their convenience even in a decade-long pursuit.

Services Expanding Due to Demand for Continuous Optimization

The services segment accounted for a larger share of the overall clinical alarm management market, as the services are required on an ongoing basis for the maintenance of these systems and training staff members to use these alarm management services and also to customize them accordingly.

Expert guidance is needed to assist healthcare facilities with alarm optimization efforts and streamline unnecessary notifications. Constant updates and technical support ensure alarm management solutions stay in step with developing hospital protocols and regulatory requirements.

Moreover, medical staff personnel training to use alarm management systems are improving response efficiency and preventing patient safety events as well. They conduct regular performance assessments as part of their services to unveil any areas of improvement, thus improving the overall dependability of alarm systems.

The complexity of healthcare technology has grown, increasingly driving dependence on managed services so that institutions can focus on caring for patients while ensuring continuous operation of alarms. However, as alarm systems evolve in complexity, services significantly contribute to maintaining, upgrading, and customizing these solutions, leading to a growth in demand for expert resources in this space.

Hospitals Dominating Due to High Patient Volume and Complex Infrastructure

Owing to a large patient base, sophisticated medical facilities, and high safety standards, hospitals hold the largest share in the clinical alarm management market. Such well-organized alarm management systems prevent overuse of alarms and fatigue by proper early detection of alarms in patients in surgical wards, emergency rooms, and critical care units.

Hospitals use various monitoring devices that raise many alerts, requiring effective filtering and prioritization of alarms to ensure patient safety. Besides that, the need to comply with regulatory mandates and accreditation requirements compels hospitals to adopt standardized alarm management solutions that improve clinical workflows.

The largest healthcare institutions are paying billions to integrate alarm software with patient monitoring and hospital information systems so that every department, from radiology to emergency care to intensive care, can talk to each other about the state of patients.

Advanced alarm solutions are being increasingly adopted in hospitals for this purpose, ensuring that patients are safe while not overburdening the clinician with alarm fatigue, due to the necessity for 24/7 monitoring and emergency medical care in the event of an emergency/complications.

Clinics Gaining Traction Due to Increased Outpatient Care Demand

The clinical alarm management market is majorly driven by clinics, in line with the global expansion of outpatient care. Growing preference for minimally invasive surgeries and shorter hospital stays have led to an increase in patient visits to clinics, therefore requiring effective monitoring and alarm management solutions.

Clinics, especially sentinel centers that handle cardiology, pulmonology, and chronic diseases, use alarm systems to watch patients at the bedside in real-time. Clinics operate with very few teams because they lack staff compared to hospitals, so deploying automated alarm filtering crucial for effective workflow management.

Moreover, regulatory compliance and accreditation bodies also encourage clinics to implement structured recommendation practices for alarms toward better patient outcomes. The incorporation of alarm systems into telehealth platforms has also accelerated adoption, enabling clinics to monitor patients further than the four walls of their buildings.

With a move towards decentralized healthcare delivery from the providers towards the patients, the clinics are adopting alarm management solutions to improve their safety and operational efficiency.

There is extreme competitive rivalry among all the vendors in the clinical alarm management market due to the increasing demand for efficient alarm management solutions in the healthcare industry. Data is available till Oct 2023You can analyze the whole report with all your statistics/ by which the Global Smart Retail Market is well ranked on the system.

With the growing use of tools that leverage AI to accelerate data-driven analytics and automation and support workflow efficiency while decreasing alarm fatigue, the competitive landscape has also been evolving at a fast pace.

The competitive edge for the market is acquired through strategic collaborations, product innovations, and expansions of the services. Furthermore, the ever-increasing demand for personalized solutions specific to various healthcare settings is influencing this competition and leading to continuous market development.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic | (16-17)% |

| GE Healthcare | (14-15)% |

| Koninklijke Philips N.V. | (13-14)% |

| Baxter | (11-12)% |

| Other Companies (combined) | (41-42)% |

| Company Name (Year) | Key Company Offerings and Activities |

|---|---|

| Medtronic (2025) | Medtronic plans to integrate alarm management with its advanced patient monitoring systems to enable seamless interoperability with hospital networks so that real-time clinical decision-making and patient protection can be realized in full. |

| GE Healthcare (2024) | GE Healthcare has an intelligent alarm solution to reduce non-critical alarms so clinicians are not unnecessarily interrupted while increasing response time and workflow efficiency in critical care settings. |

| Koninklijke Philips N.V. (2024) | Patient and alarm management is a strong focus, and Philips offers flexible solutions that fit into patient-specific workflows and integrates seamlessly with a number of HIS systems to optimize clinical workflows. |

| Baxter International (2024) | Baxter specializes in alarm management in infusion therapy, delivering precise medication with a low rate of false alarms, which is vital for patient safety, especially when healthcare professionals are operating in a high-pressure environment in critical care. |

Key Company Insights

Medtronic (16-17%)

Developing the market segments and intensively innovating their product portfolio. Strategic acquisitions are mainly in line with enhancing existing segments of its portfolio and helping drive growth across its segments in healthcare.

GE Healthcare (14-15%)

GE HealthCare seeks to use innovation as a primary growth driver, investing in research and development to develop new medical technologies. We're Schreiner MediPharm | Focus on Digital Solutions & Efficiency schreiner-group.com

Koninklijke Philips N.V. (13-14%)

Its growth strategy focuses on reinforcing its leadership position in health technology through innovation and expanding its portfolio. The company also intends to enable growth through targeted investments and optimize its digital and connected care solutions.

Baxter International (11-12%)

A main focus of Baxter's growth plan is to accelerate growth across its portfolio, upping its presence throughout the healthcare spectrum. This company's key product pipeline is being developed to meet the healthcare needs of diverse global communities.

Other Key Players (41-42% Combined)

A number of other companies are major contributors to the clinical alarm management market through innovative technologies and increased distribution networks. They include:

With the demand for clinical alarm management procedures growing unabated, firms are focusing on expansion, accelerating research and development activities, regulatory clearances, and strategic partnerships to reinforce their market positions and enhance surgical outcomes.

Table 1: Global Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Value (US$ Million) Forecast by Component, 2017 to 2033

Table 3: Global Value (US$ Million) Forecast by End-User, 2017 to 2033

Table 4: North America Value (US$ Million) Forecast by Country, 2017 to 2033

Table 5: North America Value (US$ Million) Forecast by Component, 2017 to 2033

Table 6: North America Value (US$ Million) Forecast by End-User, 2017 to 2033

Table 7: Latin America Value (US$ Million) Forecast by Country, 2017 to 2033

Table 8: Latin America Value (US$ Million) Forecast by Component, 2017 to 2033

Table 9: Latin America Value (US$ Million) Forecast by End-User, 2017 to 2033

Table 10: Europe Value (US$ Million) Forecast by Country, 2017 to 2033

Table 11: Europe Value (US$ Million) Forecast by Component, 2017 to 2033

Table 12: Europe Value (US$ Million) Forecast by End-User, 2017 to 2033

Table 13: APEJ Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: APEJ Value (US$ Million) Forecast by Component, 2017 to 2033

Table 15: APEJ Value (US$ Million) Forecast by End-User, 2017 to 2033

Table 16: Japan Value (US$ Million) Forecast by Country, 2017 to 2033

Table 17: Japan Value (US$ Million) Forecast by Component, 2017 to 2033

Table 18: Japan Value (US$ Million) Forecast by End-User, 2017 to 2033

Table 19: MEA Value (US$ Million) Forecast by Country, 2017 to 2033

Table 20: MEA Value (US$ Million) Forecast by Component, 2017 to 2033

Table 21: MEA Value (US$ Million) Forecast by End-User, 2017 to 2033

Figure 1: Global Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Value (US$ Million) by End-User, 2023 to 2033

Figure 3: Global Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 5: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 8: Global Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 9: Global Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 10: Global Value (US$ Million) Analysis by End-User, 2017 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 13: Global Attractiveness by Component, 2023 to 2033

Figure 14: Global Attractiveness by End-User, 2023 to 2033

Figure 15: Global Attractiveness by Region, 2023 to 2033

Figure 16: North America Value (US$ Million) by Component, 2023 to 2033

Figure 17: North America Value (US$ Million) by End-User, 2023 to 2033

Figure 18: North America Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 20: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 23: North America Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 24: North America Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 25: North America Value (US$ Million) Analysis by End-User, 2017 to 2033

Figure 26: North America Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 27: North America Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 28: North America Attractiveness by Component, 2023 to 2033

Figure 29: North America Attractiveness by End-User, 2023 to 2033

Figure 30: North America Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Value (US$ Million) by Component, 2023 to 2033

Figure 32: Latin America Value (US$ Million) by End-User, 2023 to 2033

Figure 33: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 35: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 38: Latin America Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 39: Latin America Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 40: Latin America Value (US$ Million) Analysis by End-User, 2017 to 2033

Figure 41: Latin America Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 42: Latin America Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 43: Latin America Attractiveness by Component, 2023 to 2033

Figure 44: Latin America Attractiveness by End-User, 2023 to 2033

Figure 45: Latin America Attractiveness by Country, 2023 to 2033

Figure 46: Europe Value (US$ Million) by Component, 2023 to 2033

Figure 47: Europe Value (US$ Million) by End-User, 2023 to 2033

Figure 48: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 50: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 53: Europe Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 54: Europe Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 55: Europe Value (US$ Million) Analysis by End-User, 2017 to 2033

Figure 56: Europe Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 57: Europe Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 58: Europe Attractiveness by Component, 2023 to 2033

Figure 59: Europe Attractiveness by End-User, 2023 to 2033

Figure 60: Europe Attractiveness by Country, 2023 to 2033

Figure 61: APEJ Value (US$ Million) by Component, 2023 to 2033

Figure 62: APEJ Value (US$ Million) by End-User, 2023 to 2033

Figure 63: APEJ Value (US$ Million) by Country, 2023 to 2033

Figure 64: APEJ Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 65: APEJ Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: APEJ Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: APEJ Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 68: APEJ Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 69: APEJ Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 70: APEJ Value (US$ Million) Analysis by End-User, 2017 to 2033

Figure 71: APEJ Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 72: APEJ Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 73: APEJ Attractiveness by Component, 2023 to 2033

Figure 74: APEJ Attractiveness by End-User, 2023 to 2033

Figure 75: APEJ Attractiveness by Country, 2023 to 2033

Figure 76: Japan Value (US$ Million) by Component, 2023 to 2033

Figure 77: Japan Value (US$ Million) by End-User, 2023 to 2033

Figure 78: Japan Value (US$ Million) by Country, 2023 to 2033

Figure 79: Japan Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 80: Japan Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: Japan Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: Japan Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 83: Japan Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 84: Japan Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 85: Japan Value (US$ Million) Analysis by End-User, 2017 to 2033

Figure 86: Japan Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 87: Japan Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 88: Japan Attractiveness by Component, 2023 to 2033

Figure 89: Japan Attractiveness by End-User, 2023 to 2033

Figure 90: Japan Attractiveness by Country, 2023 to 2033

Figure 91: MEA Value (US$ Million) by Component, 2023 to 2033

Figure 92: MEA Value (US$ Million) by End-User, 2023 to 2033

Figure 93: MEA Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 95: MEA Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: MEA Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 98: MEA Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 99: MEA Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 100: MEA Value (US$ Million) Analysis by End-User, 2017 to 2033

Figure 101: MEA Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 102: MEA Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 103: MEA Attractiveness by Component, 2023 to 2033

Figure 104: MEA Attractiveness by End-User, 2023 to 2033

Figure 105: MEA Attractiveness by Country, 2023 to 2033

The overall market size for clinical alarm management market was USD 3,439.2 million in 2025.

The clinical alarm management market is expected to reach USD 5,655.7 million in 2035.

Increasing focus on mobile-based alarm notification systems, and growing public health concerns has significantly increased the demand for clinical alarm management.

The top key players that drives the development of clinical alarm management market are Medtronic, GE Healthcare, Koninklijke Philips N.V., Baxter and Mindray Medical International Limited

Solutions is by component leading segment in clinical alarm management market is expected to command significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA