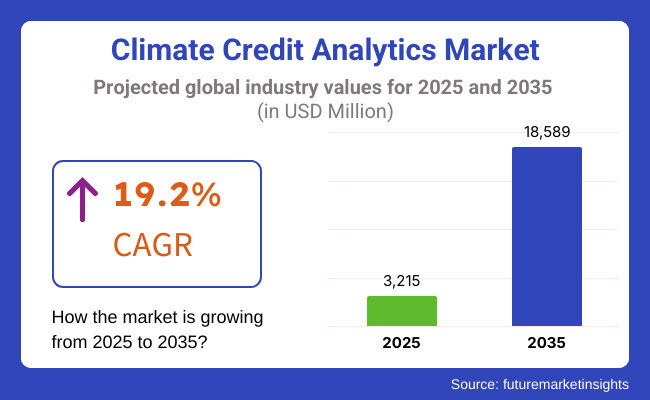

The Climate Credit Analytics Market will register high growth in 2025 to 2035 driven by growing utilization of carbon credit trade, carbon neutralisation regulation, and business sustainability. The market will reach a level of USD 3,215 million by 2025 and is poised to grow up to USD 18,589 million in 2035, growing at a CAGR of 19.2% in 2025 to 2035.

A number of drivers support this market shift. One of them is the continued strengthening of global emission reduction targets, which pressures companies to integrate climate credit analytics into their sustainability and finance strategies. For example, large energy majors like ExxonMobil and Shell are using sophisticated climate credit analytics to maximize their carbon offset portfolios and remain compliant with regulation.

Yet, the market is also full of some issues of standardization and openness since variation of carbon credit value calculation and verification procedures is a major hindrance. The company is busy refuting such glitches with blockchain technology as well as verification tools on the basis of AI to spearhead authenticity and scalability.

Climate credit analytics solutions are found in different categories depending on usage as well as end-user companies. Some of the most prominent analytics solutions involve observing real-time emissions, AI-powered credit risk assessment, and carbon pricing forecasting models. Climate credit analytics is employed by financial institutions like Goldman Sachs and JPMorgan Chase to evaluate investment risk and seek sustainable assets.

The manufacturing and energy sectors in the industrial sector depend on analytics for planning carbon credit purchases and decarbonization strategies. Moreover, climate credit analytics are being incorporated into ESG reporting software systems by multinational corporations to assist in meeting investor demands and regulatory obligations.

North America holds a dominant share of the climate credit analytics market due to high emissions standards, corporate sustainability efforts, and carbon trading platforms expansion. The United States is spearheading the region with projects such as the Inflation Reduction Act, which rewards companies for carbon accounting and offsetting.

Microsoft and Google, among other technology giants, are using AI-based climate credit analytics to meet their aggressive net-zero ambitions. Additionally, the use of advanced predictive analytics and blockchain-based verification platforms is improving the quality of carbon credit transactions.

Europe is still a strong leader in the climate credit analytics market, with Germany, France, and the UK leading the curve in implementing elaborate carbon pricing mechanisms and digital monitoring systems. The European Union's Emissions Trading System (EU ETS) is a major demand generator for accurate climate credit analytics solutions.

Aviation and heavy industries are making significant investments in carbon credit models driven by analytics to meet changing regulatory environments. European sector financial institutions are also constructing advanced ESG investment models with real-time climate credit analytics.

The Asia-Pacific will witness the highest growth in the climate credit analytics market as a result of the increasing rate of industrialization, regulatory innovation, and transformation of carbon markets in China, Japan, and South Korea. China, being the largest greenhouse gas emitter, has launched a national carbon market, and this has prompted corporate giants to adopt analytics-driven solutions to control emissions.

Government encouragement of carbon neutrality in the form of offering incentives to renewable energy is also pushing market growth. However, inconsistent regulatory policy concerns and market fragmentation remain the largest deterrents to the region.

Challenge: Standardization and Transparency Issues

One of the biggest challenges in the climate credit analytics sector is a non-standardization of credit validation and pricing mechanisms. The existence of different carbon markets with different validation standards creates uncertainty among market players.

Accurate monitoring of emissions data and carbon credit prices demands enormous technological advancements and regulatory harmonization. Moreover, over-claimed or defrauded carbon offsetting erodes market integrity, and more stringent monitoring and use of blockchain-based verification tools are needed.

Opportunity: Integration of Blockchain and AI

Growing dependence upon predictive modeling by AI and blockchain-based credit authentication creates a great opportunity for expansion in the market. AI-based analytics can be utilized to improve credit risk measurement through carbon credit price trends and market behavior.

Blockchain technology, in contrast, provides transparency with irreversible, verifiable carbon credit transaction records. Firms like IBM and Salesforce are already utilizing these technologies to create advanced climate credit analytics platforms that bring carbon markets to investors and businesses and make them more predictable.

From 2020 to 2024, climate credit analytics underwent tremendous breakthroughs as large corporations and banks began integrating carbon risk assessment functionalities into their choice architectures. The adoption of AI-facilitated carbon tracking products grew by leaps and bounds as firms endeavored to bridge the sustainability targets gap and stress of regulation. Voluntary carbon markets also widened, opening new avenues for investment approaches driven by analytics.

During the period from 2025 to 2035, the market will continue to advance with increased global carbon trading platforms, tougher climate regulations, and the advent of next-generation analytics solutions. Automated, AI-driven emissions tracking and blockchain-secured carbon credit validation will be prioritized by companies more than ever before.

With heightened investor examination of ESG compliance, climate credit analytics will become a crucial business resource for firms in dealing with the complex carbon credit market environment.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments and financial regulators started incorporating climate risk into financial evaluations, and they stimulated voluntary disclosure of climate-related financial risks. |

| Technological Advancements | Financial institutions used simple climate scenario analysis tools to estimate potential effects on credit risk, mainly in high-carbon industries. |

| Integration in Credit Risk Assessment | Climate factors were increasingly integrated into credit risk measurement, usually depending on qualitative analysis and sparse quantitative information. |

| Market Growth Drivers | Demand for Climate Credit Analytics was underpinned by growing recognition of climate risk and investor demands for enhanced transparency within financial institutions' climate exposures. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulatory authorities globally required extensive climate risk disclosures by requiring financial institutions to include climate scenario analyses within their credit risk evaluation. An example is that the European Central Bank introduced rules requiring banks to analyze and report on the effects of different climate scenarios on their loan books. |

| Technological Advancements | Sophisticated Climate Credit Analytics platforms came into being, which allowed institutions to perform sophisticated, sector-based analyses. The platforms combined comprehensive datasets, such as emissions data and physical asset risks, enabling accurate evaluations of how various climate scenarios might influence the creditworthiness of a specific counterparty. |

| Integration in Credit Risk Assessment | Financial institutions entirely incorporated the analysis of climate scenarios into their credit risk management systems. They used quantitative models to assess potential effects of transition and physical climate risks on the borrowers' financial condition, resulting in better loan pricing and enhanced risk management. |

| Market Growth Drivers | The market saw large growth as a result of severe regulatory demands on climate risk disclosure and the need for financial institutions to effectively deal with and curb climate-related credit risks. Climate-related natural disaster increases also placed emphasis on mainstreaming climate risk in credit risk assessment. |

United States Climate Credit Analytics market grew exponentially between 2025 and 2035. Regulation defined the market, with instances such as the Securities and Exchange Commission (SEC) requiring disclosure of climate risks in listed firms.

Financial institutions and banks utilized sophisticated analytics solutions to maintain regulation compliance, besides quantifying climate risks affecting portfolios. For instance, the major banks hired Climate Credit Analytics to quantify their potential credit exposure to the energy sector under various different climate conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 19.1% |

European Union's Climate Credit Analytics market significantly grew following the European Central Bank's strong climate risk regulation guideline for banking firms.

EU banks in member states employed advanced Climate Credit Analytics technology to meet regulators' demands. For instance, the top German bank's request to install and model probable effect of peer climate transition assumptions on its motor vehicle manufacturing lending book to facilitate improved credit judgment.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 19.2% |

In Japan, the market for Climate Credit Analytics was steadily increasing after the Financial Services Agency (FSA) had forced the financial regulation process to integrate climate risk. Japanese banks started using Climate Credit Analytics platforms to quantify the credit risk effect of climate change on their manufacturing and energy sector business clients.

For instance, a major bank in Japan applied such analytics to project the influence of varied climate change scenarios on the creditworthiness of its manufacturing borrowers and consequently enhance their credit portfolio stability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 18.9% |

The Climate Credit Analytics market in South Korea increased considerably with Financial Supervisory Service (FSS) focus on integrating climate risk into financial business. South Korean banks utilized Climate Credit Analytics solutions to analyze how climate risks will affect lending business. For example, South Korea's largest banking group utilized the solutions to approximate the credit risk of infrastructure financing programs in different climates, hence a best practice to handle risk.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 19.1% |

Carbon footprint management solutions dominate the climate credit analytics market with increasing corporate sustainability initiatives and regulatory pressure. The solutions allow companies to accurately measure their carbon footprint, track, and manage it. IBM and Microsoft are two companies that use carbon footprint management platforms to monitor supply chain emissions under their net-zero initiative.

Increased focus on sustainability reporting on the basis of such guides as the Task Force on Climate-related Financial Disclosures (TCFD) speeds up the pace at which such solutions become imperative. Carbon-producing industries like manufacturing and energy are spearheading the demand for carbon footprint management solutions.

Governments across the globe placing more requirements on carbon reporting are forcing companies to adopt sophisticated analytics to track and lower their green footprint. The move of consumerism towards becoming green is also encouraging brands to come forward and position themselves as sustainable, something that needs to be proven by them in the public eye again, making brands embrace carbon footprint management tools.

Carbon footprint tracking and reporting software evolves with more government regulations. Carbon footprint reporting and tracking software is needed because there has been mounting pressure from governments and investors on companies to report their carbon footprint.

With regulation from the likes of the European Union's Corporate Sustainability Reporting Directive (CSRD) and the USA's climate risk disclosure rules. Securities and Exchange Commission (SEC), companies are under pressure to disclose their carbon footprint. For this, companies are making investments in high-quality continuous emission monitoring systems.

These solutions are most relevant for BFSI and IT & telecommunication sectors, where global ESG standards compliance is mandated. Banks, asset managers, and financial institutions utilize emission monitoring and reporting analytics to measure climate risk in investment portfolios.

IT organizations use such technologies to monitor data center emissions and optimize energy efficiency too. Integration of artificial intelligence and blockchain technology in emission reporting further drives regulatory compliance and accuracy, hence making this segment a market growth driver for the climate credit analytics market.

Renewable Energy Certificates (RECs) Analysis Witnesses Gigantic Growth After Corporate Renewable Commitments Renewable Energy Certificates (RECs) analysis service receives a big push as companies increase the scope of commitment towards renewable energy buying.

Google, Amazon, and Apple are pumping giganitic amounts into RECs to cut carbon footprint and realize 100% renewable commitments. REC analytics help organizations maximize the usage of clean energy purchases through trends in the market, price uncertainty, and certificate suppliers' authenticity.

Utilities and electric power corporations have an important role to play here by adequately utilizing REA analytics in such a way that they are able to sell and purchase RECs. In a global setting where green energy markets are unfolding in every direction, analytics software enables tracking and authentication of RECs in the best possible way to fulfill commitments towards green energy.

Virtual power purchase agreements (VPPAs) usage also increases, and best-fit REC analytics solutions need to authenticate clean energy transactions.

Carbon offsetting analytics solutions are gathering pace as companies purchase carbon credits to achieve net-zero. Multinationals and banks are also entering the carbon markets, purchasing offsets for challenging-to-abate emissions.

Shell and Delta Airlines utilize carbon offsetting analytics to invest wisely in high-quality carbon credits with tangible, measurable climate benefits. The manufacturing and transport industries that are facing a threat of an imminent decarbonization greatly depend on carbon offsetting analytics for balancing their carbon emissions.

Advanced analytics platforms maintain the genuineness of the carbon offset schemes like afforestation schemes and carbon capture schemes by verifying them to international standards like the Verified Carbon Standard (VCS) and Gold Standard. Mounting pressure on the integrity of carbon offsets also fuels innovation in the area with increasing transparency and confidence in voluntary carbon markets.

The utilities and energy sector is a significant driver of the use of climate credit analytics since companies apply them for carbon management, regulatory reporting, and renewable energy trading. Overall energy transition strategies forcing companies to decarbonize have utilities using analytics to seek out maximum abatement of emissions and underpinning carbon credit markets with efficiency.

Utilities such as Enel and NextEra Energy apply climate credit analytics to quantify the green footprint of energy generation and increase their value for sustainability. Utilities also utilize such tools to comply with local carbon pricing regimes such as the EU Emissions Trading System (EU ETS) and California's Cap-and-Trade Program.

The digitalization of the sector also integrates climate credit analytics with the second generation of smart grid technology, enabling better emissions forecasting and management.

The BFSI sector sees faster adoption of climate credit analytics solutions because there is more demand from investors for sustainable finance. Banks, asset managers, and insurers utilize climate risk assessment solutions to evaluate exposure to carbon in investment portfolios. BlackRock and HSBC, among others, place climate credit analytics on ESG platforms to ensure conformity with global sustainability targets.

Regulatory progress, such as the Basel Committee's guidelines for climate risk and central bank stress-testing, still fuels carbon analytics solutions for BFSIs. Such solutions help measure transition risks, quantify emissions in loan books, and identify sustainable investment prospects. As green bonds and carbon-linked financial instruments gain popularity, the BFSI sector continues to be a major growth driver for providers of climate credit analytics.

The climate credit analytics market is a global competition with master global firms and local firms contributing to its shaping. The leaders of the market are excelling in carbon risk quantification, financial modeling, and embedding sustainability.

The firms deal with high-precision climate risk analytics, regulatory compliance offering solutions, and innovative solutions to carbon credit impact measurement of financial portfolios. The sector is composed of new players and existing players, and both influence industry patterns through technological innovation and strategic partnerships.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| S&P Global Sustainable1 | 15-20% |

| MSCI ESG & Climate Solutions | 12-16% |

| Moody’s ESG Solutions | 10-14% |

| ISS ESG | 8-12% |

| Equifax Climate Risk Solutions | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| S&P Global Sustainable1 | Offers climate credit risk analytics integrating scenario modeling, regulatory compliance support, and portfolio carbon exposure assessment. Focuses on AI-driven risk evaluation. |

| MSCI ESG & Climate Solutions | Provides ESG data and analytics, climate stress testing, and carbon credit valuation tools. Invests heavily in machine learning for predictive risk modeling. |

| Moody’s ESG Solutions | Specializes in carbon credit risk assessments and financial impact evaluations. Leverages partnerships with climate data providers for enhanced analytics. |

| ISS ESG | Develops frameworks for corporate climate disclosures, carbon neutrality strategies, and climate stress testing. Strong presence in regulatory advisory services. |

| Equifax Climate Risk Solutions | Focuses on climate-adjusted credit scoring, industry-specific exposure analysis, and risk mitigation strategies. Uses proprietary datasets for financial institutions. |

Key Company Insights

S&P Global Sustainable1 (15-20%)

S&P Global Sustainable1 is the leading firm in climate credit risk analysis with AI-powered solutions for portfolio risk analysis and scenario modeling. The firm integrates climate information with traditional credit analysis to offer precision-driven insights.

It collaborates with regulatory bodies to create more stringent climate disclosure norms and pledge financial institutions to global carbon-reduction goals. S&P Global is well established in North America, Europe, and Asia and is the most influential institution promoting global climate finance activities.

MSCI ESG & Climate Solutions (12-16%)

MSCI ESG & Climate Solutions offers best-in-class ESG and climate risk data, allowing financial institutions to quantify carbon credit exposure. The company applies machine learning models to leverage predictive analytics in stress testing and long-term investment.

Its solutions are targeted towards asset managers, banks, and insurance firms looking to quantify climate-related financial risk with data-driven approaches. MSCI deepened emerging market coverage to allow institutions to stay ahead of changing regulatory landscapes.

Moody's ESG Solutions (10-14%)

Moody's ESG Solutions is a climate credit risk analysis market leader by leveraging data partnerships with global climate researchers. Moody's provides carbon pricing financial impact analysis, transition risks, and environmental rule changes.

It leverages its credit risk legacy and climate analytics to offer solutions to banks, insurers, and institutional investors. It has recently added capabilities to enable net-zero financial commitments with innovative risk assessment models.

ISS ESG (8-12%)

ISS ESG is a pioneer in climate stress testing solutions and regulatory compliance frameworks. The firm is an expert in quantifying business exposure to climate risks and helping businesses integrate carbon neutrality strategies into their financial planning.

ISS ESG collaborates with policymakers and multinational corporations in creating improved standards for climate risk disclosure. It has a strong presence in North America and Europe and plays a key role in promoting sustainable finance efforts.

Equifax Climate Risk Solutions (5-9%)

Equifax Climate Risk Solutions combines climate-driven credit scoring and financial risk analysis to help manage business of climate-driven economic shifts. The company utilizes proprietary databases to evaluate borrower-level climate risks in order to enable lenders to optimize underwriting. Equifax has built industry-leading climate exposure models, thus making it the financial institution's preferred solution for embedding climate into credit risk.

Other Key Players (40-50% Combined)

Beyond these major players, several companies contribute significantly to innovation, regulatory compliance, and risk mitigation in the climate credit analytics market. These include:

The overall market size for the Climate Credit Analytics Market was USD 3,215 million in 2025.

The Climate Credit Analytics Market is expected to reach USD 18,589 million by 2035.

The increasing need for organizations to assess climate-related financial and credit risks, coupled with regulatory requirements for climate risk disclosure, is expected to drive the demand for Climate Credit Analytics during the forecast period.

The top 5 countries contributing to the development of the Climate Credit Analytics Market are the United States, the United Kingdom, China, Japan, and Germany.

On the basis of industry, the Banking, Financial Services, and Insurance (BFSI) sector is expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Analysis (2018 to 2022) By Solution Type

Table 2: Global Market Value (US$ Million) Forecast (2023 to 2033) By Solution Type

Table 3: Global Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 4: Global Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 5: Global Market Value (US$ Million) Analysis (2018 to 2022) By Region

Table 6: Global Market Value (US$ Million) Forecast (2023 to 2033) By Region

Table 7: North America Market Value (US$ Million) Analysis (2018 to 2022) By Solution Type

Table 8: North America Market Value (US$ Million) Forecast (2023 to 2033) By Solution Type

Table 9: North America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 10: North America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 11: North America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 12: North America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 13: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Solution Type

Table 14: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Solution Type

Table 15: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 16: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 17: Latin America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 18: Latin America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 19: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Solution Type

Table 20: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Solution Type

Table 21: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 22: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 23: Europe Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 24: Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 25: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Solution Type

Table 26: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Solution Type

Table 27: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 28: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 29: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 30: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 31: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Solution Type

Table 32: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Solution Type

Table 33: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 34: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 35: East Asia Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 36: East Asia Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 37: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Solution Type

Table 38: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Solution Type

Table 39: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 40: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 41: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 42: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) by Country

Figure 1: Global Market Size (US$ Million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 2: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 3: Global Market Value (US$ Million), 2018 to 2022

Figure 4: Global Market Value (US$ Million), 2023 to 2033

Figure 5: Global Market Value Share Analysis (2023 to 2033) By Solution Type

Figure 6: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution Type

Figure 7: Global Market Attractiveness By Solution Type

Figure 8: Global Market Value Share Analysis (2023 to 2033) By Industry

Figure 9: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 10: Global Market Attractiveness By Industry

Figure 11: Global Market Value Share Analysis (2023 to 2033) By Region

Figure 12: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Region

Figure 13: Global Market Attractiveness By Region

Figure 14: North America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 15: Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 16: Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 17: East Asia Market Absolute $ Opportunity (US$ Million), 2018- 2033

Figure 18: South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 19: Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 20: North America Market Value (US$ Million), 2018 to 2022

Figure 21: North America Market Value (US$ Million), 2023 to 2033

Figure 22: North America Market Value Share Analysis (2023 to 2033) By Solution Type

Figure 23: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution Type

Figure 24: North America Market Attractiveness By Solution Type

Figure 25: North America Market Value Share Analysis (2023 to 2033) By Industry

Figure 26: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 27: North America Market Attractiveness By Industry

Figure 28: North America Market Value Share Analysis (2023 to 2033) by Country

Figure 29: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 30: North America Market Attractiveness by Country

Figure 31: U.S. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 32: Canada Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 33: Latin America Market Value (US$ Million), 2018 to 2022

Figure 34: Latin America Market Value (US$ Million), 2023 to 2033

Figure 35: Latin America Market Value Share Analysis (2023 to 2033) By Solution Type

Figure 36: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution Type

Figure 37: Latin America Market Attractiveness By Solution Type

Figure 38: Latin America Market Value Share Analysis (2023 to 2033) By Industry

Figure 39: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 40: Latin America Market Attractiveness By Industry

Figure 41: Latin America Market Value Share Analysis (2023 to 2033) by Country

Figure 42: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 43: Latin America Market Attractiveness by Country

Figure 44: Brazil Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 45: Mexico Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 46: Rest of Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 47: Europe Market Value (US$ Million), 2018 to 2022

Figure 48: Europe Market Value (US$ Million), 2023 to 2033

Figure 49: Europe Market Value Share Analysis (2023 to 2033) By Solution Type

Figure 50: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution Type

Figure 51: Europe Market Attractiveness By Solution Type

Figure 52: Europe Market Value Share Analysis (2023 to 2033) By Industry

Figure 53: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 54: Europe Market Attractiveness By Industry

Figure 55: Europe Market Value Share Analysis (2023 to 2033) by Country

Figure 56: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 57: Europe Market Attractiveness by Country

Figure 58: Germany Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 59: Italy Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 60: France Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 61: U.K. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 62: Spain Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 63: BENELUX Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 64: Russia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 65: Rest of Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 66: South Asia & Pacific Market Value (US$ Million), 2018 to 2022

Figure 67: South Asia & Pacific Market Value (US$ Million), 2023 to 2033

Figure 68: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Solution Type

Figure 69: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution Type

Figure 70: South Asia & Pacific Market Attractiveness By Solution Type

Figure 71: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Industry

Figure 72: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 73: South Asia & Pacific Market Attractiveness By Industry

Figure 74: South Asia & Pacific Market Value Share Analysis (2023 to 2033) by Country

Figure 75: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 76: South Asia & Pacific Market Attractiveness by Country

Figure 77: India Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 78: Indonesia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 79: Malaysia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 80: Singapore Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 81: Australia& New Zealand Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 82: Rest of South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 83: East Asia Market Value (US$ Million), 2018 to 2022

Figure 84: East Asia Market Value (US$ Million), 2023 to 2033

Figure 85: East Asia Market Value Share Analysis (2023 to 2033) By Solution Type

Figure 86: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution Type

Figure 87: East Asia Market Attractiveness By Solution Type

Figure 88: East Asia Market Value Share Analysis (2023 to 2033) By Industry

Figure 89: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 90: East Asia Market Attractiveness By Industry

Figure 91: East Asia Market Value Share Analysis (2023 to 2033) by Country

Figure 92: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 93: East Asia Market Attractiveness by Country

Figure 94: China Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 95: Japan Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 96: South Korea Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 97: Middle East and Africa Market Value (US$ Million), 2018 to 2022

Figure 98: Middle East and Africa Market Value (US$ Million), 2023 to 2033

Figure 99: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Solution Type

Figure 100: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution Type

Figure 101: Middle East and Africa Market Attractiveness By Solution Type

Figure 102: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Industry

Figure 103: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 104: Middle East and Africa Market Attractiveness By Industry

Figure 105: Middle East and Africa Market Value Share Analysis (2023 to 2033) by Country

Figure 106: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 107: Middle East and Africa Market Attractiveness by Country

Figure 108: GCC Countries Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 109: Turkey Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 110: South Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 111: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Climate resilient Coffee Beans Market Size and Share Forecast Outlook 2025 to 2035

Climate Tech Market by Hardware, by Software, By End User & Region Forecast till 2035

Automotive Climate Control Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Trading Platform Market Trends – Growth & Forecast 2024-2034

Voluntary Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Compliance Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Analytics as a Service (AaaS) Market - Growth & Forecast 2025 to 2035

Analytics Sandbox Market

Ad Analytics Market Growth - Trends & Forecast 2025 to 2035

HR Analytics Market

AI-Powered Analytics – Transforming Business Intelligence

NFT Analytics Tools Market Size and Share Forecast Outlook 2025 to 2035

App Analytics Market Trends – Growth & Industry Forecast 2023-2033

Dark Analytics Market Size and Share Forecast Outlook 2025 to 2035

Text Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA