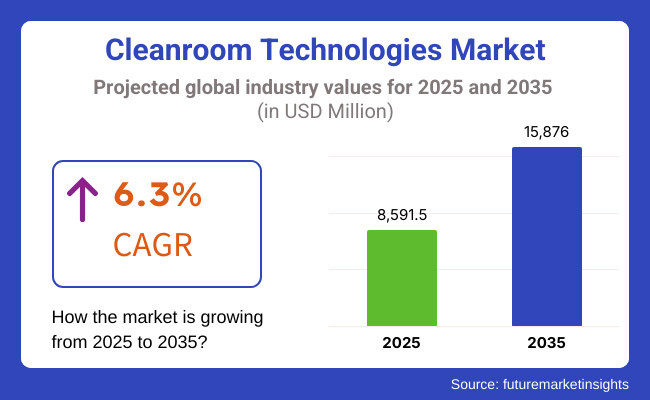

Cleanroom Technologies Market will be in the high growth stage in 2025 to 2035 following increased demand in the pharmaceutical, biotechnology, electronics, and medical devices industries. Cleanroom Technologies Market will be USD 8,591.5 million in 2025 and USD 15,876 million in 2035 with a compound annual growth rate (CAGR) of 6.3% for the forecast period. The following are some other reasons behind this market trend.

There are quite a few of them. The most significant among them is the higher need for cleanliness in manufacturing, especially in medicine and semiconductors. Cleanroom technologies provide sterility and quality and thus are pioneers to produce high-precision electronic devices and life-critical medicines.

To take an example, Intel and TSMC, who are making semiconductors, use very clean environments to make microchips of nanometer precision. But it is power-hungry and expensive to operate such facilities, an operational disadvantage for business which boasts itself to be low-cost.

Cleanroom technology is also varied in contents and uses from equipment, consumables, to services. HEPA filters, laminar airflow units, and HVAC equipment are the cleanroom equipment employed in trying to control airborne contamination. Glove boxes, gowns, and disinfectants are typical consumables used for the biotech and pharma industries.

For instance, disposable cleanroom apparel has also been wildly popular in recent years since it is cost-effective with no risk of cross-contamination. Validation, monitoring, and maintenance services are also very crucial in an attempt to satisfy the rigid regulatory standards released by associations like the FDA and ISO.

Explore FMI!

Book a free demo

North America is still a solid market for cleanroom technology owing to a massively dominant pharma industry and highly regulatory markets. Having all of these pharma titans like Pfizer, Johnson & Johnson, and Moderna in the region is a big plus to demand for cleanroom space to make aseptic biologics and vaccines. And as more and more biologics plants are being produced, there also has been increasing demand for higher-containment items like isolators and Restricted Access Barrier Systems (RABS) to be able to maintain sterility and yet provide maximum people safety.

The USA semiconductor industry also takes the lead with Intel's massive investment in cleanroom facilities to produce top-of-the-line microchips. Further investment in nanotechnology and precision manufacturing also fuels cleanroom technology to propagate across North America.

Europe possesses the largest market for cleanroom technology due to the gigantic demand from industries like pharmaceutical, healthcare, and automotive.The continent's three largest nations are Germany, France, and the United Kingdom, and among the most powerful drivers is the huge biotech industry in Germany.The firms in the continent have very strict European Medicines Agency (EMA) regulations to abide by and need extremely high-quality cleanroom equipment to be compliant and to have the capacity to produce very highly purified products.

Automotive companies like BMW and Mercedes-Benz are investing in cleanroom technology to put sensitive electronic components into electric vehicles (EVs) in the correct manner. Cleanroom space development in the health care industry, especially intensive care units and operating rooms, has broadened applications of cleanroom technology in the health care industry.

The Asia-Pacific region will be the most rapidly expanding cleanroom technology market due to unregulated industrialization, expanded drug production, and a robust semiconductor industry. China, India, Japan, and South Korea are among the biggest producers and consumers of cleanroom products, and China is the world's largest semiconductor producer.

India's generic manufacturing-driven pharmaceutical sector, among others, is investing more and more in high-tech cleanrooms to international regulatory requirements, i.e., the USA FDA and WHO. Similarly, South Korea's Samsung-LG dominated electronics industry also finds keeping conditions very clean extremely appealing to high-precision manufacturing. Both cases have obscenely high costs of infrastructure and very stringent environmental regulations on the disposal of cleanroom waste haunting the region.

Challenge

Unnecessary Excessive Operating and Maintenance Costs

Special maintenance, power, and maintenance are addressed by cleanroom technologies. High operating expense is mandated by innovative climate control and advanced air cleaning technology. Ongoing conformance with shifting guidelines and regulation also entails sporadic upgrades and training of the personnel, to the pool expense. Pharmaceutical companies, for instance, tend to require better-to-GMP grades of cleanroom facilities with constant capital cost inflation.

Opportunity

Advancements in Modular and Smart Cleanrooms

Increased demand for efficient and universal cleanroom solutions holds good promise for the company. Ease of reconfiguration and flexibility of expandable modular cleanrooms increases their attractiveness across many industries. Modular cleanrooms minimize construction lead time and capital investment necessary without sacrificing compliance regulations.

Aside from this, integration with smart cleanroom technology like IoT-based sensors and AI-based contamination control is transforming the sector. For instance, automated environment monitoring systems capable of controlling humidity level and airflow to optimize processes with less energy consumption. The transition towards sustainability also included energy-efficient HEPA filtration and recyclable cleanroom consumables in achieving worldwide environmental objectives.

During 2020 to 2024, the cleanroom technology industry evolved at a very rapid pace with COVID-19 subjected to higher regulatory standards being put in place for contamination control to produce vaccines and healthcare services. Demand for biologics combined with the expansion of semiconductor production to be utilized in consumer electronic gadgets and automobiles was the major driver of cleanroom technology adoption on a global level.

In the direction of 2025 to 2035, digitalization and sustainability will be the prime trends for the cleanroom technology market. Eco-friendly cleanroom technologies such as low-energy air filtration technology and biodegradable consumables will become popular in organizations.

Industry 4.0 will adopt automation and web-based monitoring of cleanroom processes in the spirit of efficiency as well as regulatory compliance. With continuing R&D activities in semiconductor production, nanotechnology, and biotechnology, increasing demand for new cleanroom technology will arise within the forecasting period.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Strict regulations aimed at contamination control and sterility assurance in pharmaceutical and semiconductor manufacturing. GMP (Good Manufacturing Practices) and ISO 14644 compliance became a major requirement. |

| Technological Advancements | HEPA and ULPA filtration technology advanced to enhance particulate control. Modular cleanroom design became popular for industrial applications' flexibility. |

| Healthcare & Pharma Sector Trends | Cleanroom demand increased with the growth of biopharmaceutical production and vaccine manufacturing. Single-use cleanroom consumables became popular for sterility assurance. |

| Semiconductor & Electronics Growth | Semiconductor manufacturing facilities invested in ultra-clean environments to accommodate growing chip complexity. ISO Class 1-3 cleanroom demand grew for nanotechnology applications. |

| Food & Beverage Industry Trends | Expansion in cleanroom usage for high-risk food production, especially in dairy and ready-to-eat segments. Hygiene certifications became mandatory for regulatory purposes. |

| Environmental Sustainability | Transition to energy-efficient HVAC systems and less operational waste. Use of cleanroom garments composed of recycled materials. |

| Production & Supply Chain Dynamics | Global supply chain interruptions as a result of pandemic-related demands resulted in added investment in local manufacturing facilities. Cleanroom-grade material shortages affected project schedules. |

| Market Growth Drivers | Pharmaceutical, biotechnology, and semiconductor industry expansion accelerated demand for cleanroom technologies. Growing recognition of contamination control in industrial applications. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulatory frameworks become more stringent, incorporating AI-driven monitoring for real-time contamination tracking. Global standards align towards sustainability, enforcing energy-efficient cleanroom operations. |

| Technological Advancements | AI-powered automation and robotics streamline contamination control. Next-gen antimicrobial coatings integrated into cleanroom walls, reducing microbial growth and ensuring prolonged sterility. |

| Healthcare & Pharma Sector Trends | Personalized medicine and cell & gene therapy drive expansion in high-containment cleanrooms. Real-time air quality monitoring systems using IoT-enabled sensors become a standard practice. |

| Semiconductor & Electronics Growth | Transition to sub-3nm chip production necessitates even stricter contamination controls. Extreme Ultraviolet (EUV) lithography cleanrooms require advanced molecular filtration to mitigate particle contamination. |

| Food & Beverage Industry Trends | AI-powered predictive maintenance and automated sanitation systems optimize cleanroom efficiency in food processing. Sustainable HVAC solutions reduce operational energy costs. |

| Environmental Sustainability | Circular economy practices dominate, with cleanroom waste recycling programs gaining industry-wide adoption. Smart air filtration systems optimize airflow while reducing energy consumption. |

| Production & Supply Chain Dynamics | Supply chains become more resilient through onshore production strategies. Investment in 3D-printed cleanroom materials reduces lead times and enhances customization. |

| Market Growth Drivers | Growth in precision manufacturing, quantum computing, and advanced medical treatments drives the next phase of cleanroom evolution. Expansion of microgravity cleanrooms for space-based research and bioprinting applications. |

The United States cleanroom technology industry continues to grow, fueled by booming demand from the semiconductor, pharmaceutical, and biotechnology industries. Increased manufacturing sophistication of biopharmaceuticals and advancements in cell and gene therapy are propelling investment in high-containment cleanroom facilities. Semiconductor firms are bringing in cleanroom facilities to address next-generation chip manufacturing requirements with high-standards of contamination control procedures being a competitive necessity.

Pharma industry is also among the drivers of growth because FDA regulations require high sterility levels to make vaccines and personalized medicine. Modular cleanrooms are becoming popular, allowing scalability and efficiency for the manufacturers. The USA food processing industry also is adopting cleanroom technologies for the prevention of contamination for high-risk types of foodstuffs, e.g., nutraceuticals and milk products. The automation and AI-based air monitoring trends persist to thrive, improving compliance, and reducing the cost of operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

United Kingdom cleanroom technology market is increasing on the back of pharma and high-technology manufacturing firm support. UK Medicines and Healthcare Products Regulatory Agency (MHRA) regulation is highly stringent and follows EU GMP, enabling continuous demand for high-precision cleanroom space. Trended real-time monitoring systems are in high demand to enable industries to keep up with changing regulatory expectations.

Aerospace cleanroom application is increasing with increasing demand for contamination-controlled satellite part and aircraft part manufacturing. Increasing emphasis on sustainability in the UK has also prompted investment in low-power consumption cleanroom solutions, such as low-power HVAC and antimicrobial surface coating. Increasing demand for semiconductor manufacturing for military and automotive industries is also propelling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.3% |

European Union cleanroom technology is governed under stringent manufacturing and environmental regulations to meet ISO and GMP standards. Germany, France, and the Netherlands are among the major contributors with advanced pharmaceutical and semiconductor industries leading demand.

EU investment in new-generation semiconductor fabs also fuels market growth with aerospace and defense industries also adopting advanced contamination control techniques on large scale. Rising need for green manufacturing has led to increased use of cleanroom energy recovery systems and low-emission building materials. Industry 4.0 and smart factory environments are propelling cleanroom automation and contamination detection with AI.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

The Japanese market for cleanroom technology is transforming more and more with demand from semiconductor manufacturing, precision optics, and pharmaceutical sectors. The cutting-edge semiconductor sector in Japan that manufactures chips with sub-5nm process nodes demands ultra-clean environments, and this has induced investment into high-end air circulation and filtration systems.

Other than that, pharma and biotech companies are ramping up cleanroom facility build-outs for vaccine production and regenerative medicine. AI-driven cleanroom monitoring is also gaining traction, with much improved performance and little human interaction. The push towards green processes in manufacturing also promotes cleanrooms to implement more efficient HVAC systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

South Korea's cleanroom market is expanding with increasing semiconductor and display panel manufacturing. Sophisticated chip manufacturing has placed South Korea at the forefront, and cleanrooms are essential to sustaining high-yield manufacturing. Manufacturing of next-generation memory chips and AI chips is driving investments in ultra-low particulate cleanrooms. Besides, cleanroom use is gaining traction in the biotechnology sector, with more focus on cleanroom utilization for vaccine production and biologics manufacturing.

Automation and smart manufacturing initiatives sponsored by the government are fueling the adoption of AI-driven contamination control solutions. South Korea's focus on sustainability has also introduced advancements in energy-efficient HVAC and waste reduction in cleanroom operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Equipment segment dominates the cleanroom technologies market with HEPA filters, fan filter units, and HVAC systems at the forefront of high-risk use contamination control. HVAC systems are at the forefront due to the preservation of optimal air pressure and filtering levels, which are most critical in pharmaceutical and biotechnology manufacturing applications where airborne contaminants can lead to product failure.

Expansion in biopharmaceutical manufacturing facilities has generated interest in cutting-edge HVAC technology that includes automated monitoring.

HEPA filters are the focal point in creating sterile spaces in hospitals and cleanroom research centers with minimal particle penetration. With increasing regulatory requirements such as ISO 14644 and cGMP, companies are increasingly turning to more efficient HEPA filters coupled with real-time air monitoring.Laminar air flow systems and biosafety cabinets are also becoming huge hits ever more in vaccine production and cell therapy research as much as ultra-clean environment requirements in handling biological material are involved.

Consumables are propelling growth in the cleanroom technologies market at an aggressive pace, primarily safety consumables such as coveralls, masks, and gloves. Medical devices and pharmaceutical industries spearhead the demand with stringent contamination control protocols. Demand for PPE in cleanrooms also increases with increasing biological research activities and stringent biosafety measures in post-pandemic periods.

Disinfectants, mops, and wipes are cleaning consumables needed to be utilized to meet the requirements in ISO-qualified cleanrooms. Hydrogen peroxide sterilization and alcohol disinfectants will probably be utilized by companies to attain better decontamination of microbes. With more intense use of cleanrooms in the semiconductor and electronics industries, there is greater use of specialty, non-shedding fiber cleaning products to prevent static discharge and particulate contamination.

Control systems are also becoming part of cleanroom technology, for instance, real-time monitoring, auto air flow control, and monitoring of environmental parameters. They play a particularly vital role in pharmaceutical and biotech production, where regulatory specifications require strict control over humidity, temperature, and particulate levels.

Companies are adopting IoT-based control systems for remote monitoring and predictive maintenance that reduce operational downtimes. In industries such as medical device manufacturing, FDA 21 CFR Part 11 compliance is driving the adoption of digital logging and intelligent sensor technologies to deliver consistent environmental control.

Pharmaceuticals are still the largest end-user of cleanroom technology due to severe regulation of manufacturing aseptic and drug processing. The booming need for injectable sterile drug products and biologics has fuelled expansion in cleanrooms across the globe, particularly the developing world such as India and China.

The biotechnology industry is also among the biggest customers of cleanroom technologies, particularly for cell and gene therapy investigation, monoclonal antibody preparation, and the production of vaccines. The requirements for highly regulated environments in the above industries have been responsible for propelling the use of hybrid and modular cleanroom technologies in cost-effective levels.

The second largest driving market is in the production of medical devices, where the emphasis is placed on compliance with ISO 13485 and FDA production standards for sterilization. Contamination control is an area for development investment in manufacturing with greater research in microelectronics and implantable medical devices. The mini-cleanrooms are being used in the hospitals for use in surgery room procedures and infectious disease isolation, widening the user base for end-users.

The largest market share of all the forms of cleanroom construction is that of standard/drywall cleanrooms due to their cost-effectiveness and durability. They are employed in the production of pharmaceuticals, semiconductor manufacturing, and research laboratories where structural stability over an extended period is highest.

Hardwall cleanrooms are increasingly being employed in biotechnology and nanotechnology applications, where high particle control and even air distribution are required. Hardwall cleanrooms have more control over airborne particles, humidity, and pressure differential than any other cleanroom design, making them ideally suited for very sensitive production environments.

Softwall cleanrooms are being used more and more in applications that need flexible and modularity-based solutions like medical device assembly and precision optics production. Their ease of installation at a low cost and flexibility are justification in themselves for organizations to opt for them as a temporary or quick-deployable cleanroom solution.

Concurrently, terminal boxes functionally also make a contribution to regulated airflow delivery in the case of retrofit buildings as well as of renovating an existing old cleanroom structure. With backup from already installed HVAC as well as HEPA filtering system systems, affordability becomes the inexpensive way out in systems that will integrate newer cleanrooms without performing extensive alteration in the case of structure of existing entities.

Cleanroom technologies market is a competitive market with huge international players and local players fueling market growth. The leading players have large stakes with an emphasis on innovative cleanroom solutions, modularity, and contamination control technology.

The companies are indebted to industry growth due to regulatory compliance, technological innovation, and increasing application across industries such as pharmaceuticals, biotechnology, semiconductors, and healthcare. The industry has incumbent as well as new entrant players who fuel industry trends through innovative cleanroom solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Azbil Corporation | 10-15% |

| Kimberly-Clark Corporation | 8-12% |

| Illinois Tool Works (ITW) | 6-10% |

| Terra Universal, Inc. | 4-8% |

| Clean Air Products | 3-7% |

| Other Companies (combined) | 50-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| Azbil Corporation | Makes advanced technology HVAC and contamination control solutions for cleanrooms. Offers specialization in automation and smart cleanroom solutions. |

| Kimberly-Clark Corporation | Offers high-quality cleanroom apparel, gloves, and sterilization products. Specializes in sustainability and low-particulate contamination control. |

| Illinois Tool Works (ITW) | Produces cleanroom consumables including wipes, mats, and filtration systems. Offers electrostatic discharge (ESD) control solutions. |

| Terra Universal, Inc. | Specialization in turnkey and modular cleanroom systems, such as HEPA filtration, pass-through chambers, and airflow technology. |

| Clean Air Products | Produces laminar flow clean benches, fume hoods, and softwall cleanrooms. Excels at cost-effective contamination control solutions. |

Key Company Insights

Azbil Corporation (10-15%)

Azbil Corporation is the pioneer of cleanroom technology with its innovative HVAC, airflow monitoring, and automation technology. It is a contamination control expert for pharmaceutical and semiconductor applications. Azbil maximizes cleanroom operation through artificial intelligence-based automation with rigorous regulatory compliance. The company has a robust global network with a firm presence in Asia, Europe, and North America.

Kimberly-Clark Corporation (8-12%)

Kimberly-Clark Corporation is among the top manufacturers of cleanroom clothing, gloves, and protective clothing for controlled environments. It emphasizes sustainability, manufacturing biodegradable and low-linting products to reduce the risk of contamination. Its disposable cleanroom clothing and filter products have wide-ranging applications in pharmaceutical and biotechnology sectors. Kimberly-Clark has a large distribution network in North America, Europe, and emerging nations.

Illinois Tool Works (ITW) (6-10%)

ITW Cleanroom Technologies is a top manufacturer of consumables such as wipes, mats, and air filtration media. ITW specializes in electrostatic discharge (ESD) control solution formulation needed in semiconductor manufacturing and sensitive electronics. ITW products ensure ISO cleanroom compliance with focus on efficiency and minimized contamination.

Terra Universal, Inc. (4-8%)

Terra Universal is a leading supplier of cleanroom solutions constructed in modular and custom. Terra Universal provides HEPA filtration, pass-through chambers, and cleanroom specialty furniture. Terra Universal's emphasis on pre-engineered and modular solutions provides immediate deployment of cleanroom facilities for pharmaceutical, aerospace, and research laboratories.

Clean Air Products (3-7%)

Clean Air Products produces laminar flow benches, softwall cleanrooms, and containment enclosures of quality for many industries. Clean Air Products has earned its reputation as an efficient and cost-saving contamination control technology company for the production of medical devices, electronics, and industrial labs. Clean Air Products continuously incorporates newer airflow and filtration technologies in its product line.

Other Key Players (50-60% Combined)

Beyond these leading companies, several other firms contribute significantly to the cleanroom technologies market through innovations, cost-effective solutions, and regulatory compliance efforts.These include:

The global cleanroom technologies market size was valued at approximately USD 8,591.5 million in 2025 and is anticipated to grow at a CAGR of 6.3% from 2025 to 2035.

The cleanroom technologies market is expected to reach approximately USD 15,876 million by 2035, growing at a CAGR of 6.3% from 2023 to 2035.

The increasing demand for contamination-free environments in industries such as biotechnology, electronics, healthcare, and pharmaceuticals is driving the cleanroom technologies market. Stringent regulatory standards and a focus on quality control to ensure patient safety and product integrity further fuel this demand.

The top 5 countries driving the development of the cleanroom technologies market are the United States, Germany, China, Japan, and South Korea.

Based on product type, the consumables segment dominated the market with a share of 55.2% in 2024 and is witnessing a CAGR of 5.4% during the forecast period.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.