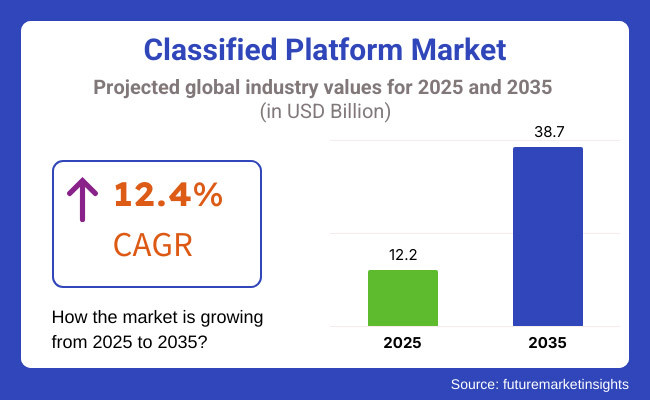

The global classified platform market is expected to witness USD 12.2 billion in 2025 and USD 38.7 billion by 2035, at a significant CAGR of 12.4% during the forecast period. The industry for 2025 to 2035 is on the way for substantial growth, with the rising industry digitization, mass reception of the portable web, and posting upgrades through man-made brainpower.

As the world continues to digitize everything, they become a core component of the world’s digital economy, as an increasing volume and value of the digital economy and everyday business and consumer transactions are conducted for products and services across a broad range of categories via online marketplaces for buyers, sellers and renters.

Mobile applications, AI-powered personalization, or secure block chain transactions are all advances that such platforms are constantly improving to further enhance user experience engagement and revenue optimization. In addition, digital transactions are easier to carry out, increasing the likelihood of peer to peer (P2P) trading, bringing the industry's stronghold as a leader in contemporary commercial activity.

The rapid growth of e-commerce, P2P transactions and local digital advertising is also contributing to the growth of the industry. Online marketplaces provide a viable alternative for consumers to browse real estate listings, buy cars, find available jobs, and exchange consumer products on online classified websites. The ease of having access to a range of goods and services and being able to interact directly with buyers and sellers, is driving demand.

Furthermore, professional and personal entities are leveraging restricted portals to extend their outreach-target audience pay per click advertising high quality listing choices to maximize visibility and leads. AI-powered recommendation systems, predictive analytics, and automation are in turn revolutionizing how this industry operates, enabling optimized listing and user interaction. Platforms use AI-based algorithms to personalize user experiences by showing them relevant ads, enhancing search results, and predicting buying behaviors.

The integration of block chain technology is also transforming the industry by providing secure transactions, reducing fraud, and creating transparency. Mobile app development plays an important role in improving the usability of classified portals as it allows users to buy or sell products on-the-go directly from their smartphones.

Subscription-based approaches and monetization models - such as paid listings and promoted listings - are also helping platforms generate revenue while providing users with increased visibility and credibility. As digital commerce goes on evolving, they are going to play an ever more influential part of the environment in the digital marketplace.

AI-driven personalization, safe digital transactions, and innovative brand advertising will only further the hold of these platforms as indispensable pieces of the global economy, the grease and glue that enable dynamic and cost-effective multi-horizon buying and selling across sectors. While there are innumerable examples of imitation, the rise of online these platforms is likely to continue as companies and customers alike embrace the services for their efficiency, affordability, and security.

Explore FMI!

Book a free demo

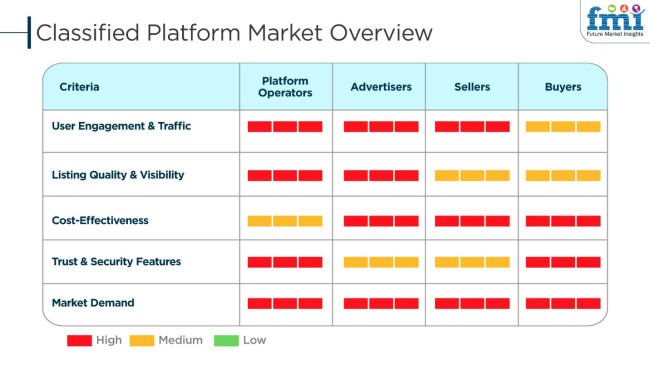

The industry is undergoing the transformation amid rapid digitalization and a growing desire of consumers for the easier, close by, and site-friendly marketplaces. Main optimal purchase elements differ from one consumer segment to another, where the buyers first count trust, security, and ease of navigation, but sellers on the other hand regard low-cost listing, visibility, and transaction speed as primary factors.

The marketers hand-in-hand seek high participation, targeted user reach, and ROI-based placements of ads, whereas the operators of platforms speak of user retention, scalability, and fraud control. For instance, AI-driven recommendations, bargain-making via chat, and verification system based on the blockchain are the tools for enhancing the credibility and efficiency of platforms.

Adding hyperlocal and niche products to the industry is diverting it anew as they target specific branches like real estate, automotive, and job recruitment. Since mobile-first is the primary trend; in-app transactions, digital wallets, and subscription-based premium listings are now joining the key revenue streams for the company. Continuous challenges of cybersecurity and regulatory hurdles, alongside, the efforts in AI moderation and targeting enhancements, are the factors that improve user satisfaction and industry growth.

| Company | Craigslist |

|---|---|

| Contract/Development Details | Craigslist secured a multi-year contract with a regional real estate firm to integrate AI-driven classified listing solutions, enhancing property search and lead generation. |

| Date | March 15, 2024 |

| Contract Value (USD Million) | Approximately USD 50 - USD 60 |

| Estimated Renewal Period | 4 years |

| Company | OLX Group |

|---|---|

| Contract/Development Details | OLX entered into an agreement with a global automotive marketplace to provide data-driven classified ad optimization and fraud detection tools for vehicle listings. |

| Date | July 22, 2024 |

| Contract Value (USD Million) | Approximately USD 60 - USD 70 |

| Estimated Renewal Period | 5 years |

| Company | Facebook Marketplace |

|---|---|

| Contract/Development Details | Facebook expanded its classified platform offerings through a strategic partnership with an e-commerce company, focusing on AI-powered product recommendations and transaction security. |

| Date | October 10, 2024 |

| Contract Value (USD Million) | Approximately USD 80 - USD 90 |

| Estimated Renewal Period | 6 years |

| Company | eBay Classifieds |

|---|---|

| Contract/Development Details | eBay announced a collaboration with a major recruitment agency to enhance job classifieds with automated matching algorithms and verified employer credentials. |

| Date | January 5, 2025 |

| Contract Value (USD Million) | Approximately USD 70 - USD 80 |

| Estimated Renewal Period | 5 years |

The industry grew between 2020 and 2024, and a major leap was experienced in the industry mainly due to an increased digitization in commerce, and as more people bought smartphones. With time, it became an avenue where more businesses and consumers could turn to for their buying, selling, and renting tasks across various categories such as the buying and selling of real estate, the trading of automobiles, and job seeking.

A better experience for customers was brought about through the use recommendations given by the AI. Moreover, the verification processes have helped to reduce fraud across users. Of course, issues like concerns around data privacy, fake listings, and questions about regulatory scrutiny with respect to consumer protection all had certain implications for platforms in operation.

This is how the industry will be from 2025 to 2035. New automated listings that will use artificial intelligence and base transactions on blockchain will shift industries to peer-to-peer decentralized marketplaces. Channeling the buy-sell node for communicating with the user will be made easy by using AI-powered chatbots and virtual assistants.

Secure and transparent transactions will be enabled by smart contracts. Enhanced user privacy and fraudulent activities reduce with the emergence of Web3 and decentralized identity solutions. There will also be a few that will focus on sustainability as part of the circular economy trend that will encourage the reuse of goods and reduction in environmental waste.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments made regulations more strict on online classified platforms to stop frauds and keep user information safe. | Regulatory compliance models based on AI mandate automated fraud prevention, digital identity verification, and real-time content moderation to make platforms more secure. |

| The use of AI and machine learning for intelligent applications like improving search relevance, recommending personalized listings, and automating listing optimization. | In real-time, AI-hyper-personalized listings dynamically tweak values associated with behaviors of users, their intentions, and current industry conditions, with the explicit expectation of maximizing conversions. |

| An increase in mobile usage was seen, and classified platforms responded by optimizing mobile apps with AI-based chatbots, voice search, and frictionless in-app purchases. | Classified applications created using AI and powered by voice and AR offer very engaging browsing experiences with compelling applications for permitting virtual product purposive testing and real-time development negotiation. |

| These platforms incorporated escrow services along with digital wallets to create a bridge of trust and ensure security in transactions between buyers and sellers. | By using smart contracts in blockchain and fraud-detection platforms based on artificial intelligence, payment disputes can be solved and security can be ensured. |

| Specialized classified platforms became popular, targeting specific industries such as real estate, cars, and freelancing. | AI-based, hyperlocal classified ecosystems optimize listings according to real-time location analytics, demand forecasting, and community-driven marketplace trends. |

| Verified platforms incorporated AI-driven user authentication and ratings to fight scams and improve transparency. | Biometric proof and blockchain-authenticated reputation systems make sure that the users and postings are original, stopping fake accounts and fraud. |

| Property and vehicle listings included AR/VR-enabled virtual tours to maximize user engagement and decision-making. | Artificial intelligence-powered augmented reality classified platforms allow interactive, live product previews for remote viewing by the user of goods and property. |

| Platforms moved away from purely ad-based monetization to premium listing services, membership levels, and advanced promotion tools. | AI-assisted dynamic pricing algorithms and predictive analytics power unparalleled ad placements, ensuring visibility and engagement for premium listings. |

| AI-enabled chatbots created an environment for real-time interaction between buyers and sellers, boosting lead conversion and response. | AI-enabled virtual assistants and predictive chatbots autonomously negotiate on price and pricing strategy, automating customer engagement in classified transactions. |

| Increased demand for second-hand items and resale platforms was generated by sustainability initiatives and a more environmentally aware consumer. | AI-supported resale platforms forecast demand and automate refurbishment to enable sustainable consumption and maximize circular economic systems. |

The primary risk in the industry is related to fraud and security breaches. Online classified platforms are prone to scams, fake listings, and fraudulent trading. Lack of strong verification and moderation tools may lead users to identity theft, payment fraud, or counterfeiting of products, which may in turn cause the platform to suffer reputational damages.

Moreover, regulatory compliance and legal challenges form other major threats to the success of these platforms. They are required to comply with local laws that pertain to data privacy (i.e. GDPR in Europe and CCPA in California), tax regulations, and advertising standards. Noncompliance can attract penalties, platform restrictions, or legal actions. Additionally, some industries, for example, real estate and automotive, may require adherence to stricter compliance measures to hinder the posting of illegal listings.

Differences in industry competition and user acquisition costs are evident in the scenario. The industry is characterized by stiff competition with established players like Craigslist, OLX, Facebook Marketplace, and regional competitors. Gaining and retaining users becomes harder due to continuous marketing, SEO projects, and mobile app upgrades required for development, which linearly results in the rise of operational costs.

The monetization process also faces challenges especially since a considerable number of classified platforms operate on an ad revenue or listing fee basis. In the event of users shifting to alternative free platforms, the revenue sources would be negatively impacted. Consequently, the platforms must find a way to maintain involvement by allowing some features to be billed while still providing good user experience.

The pure B2C segment includes these platforms listing businesses directly to consumers. This simplifies categories across anything, from real estate to jobs to cars to whatever else. It enables organizations to discover target clients and improves online sales in exchange for quicker commercials and lower costs through them.

A few examples are seen in the B2C classified marketplace for platforms like Craigslist and OLX Group, which contain the potential for paid listings or featured ads for local businesses targeting customers through machine learning and AI.

Utilization of machine learning and artificial intelligence for personalization, integration of secure payment gateways & channels for payment processing, location-based targeting, etc., augments consumer engagement and conversion rates. When mobile commerce made great leaps, it fine-tuned its apps with chatbots and instant messaging and touted augmented-reality-based product visualization to facilitate transactions like never before.

The C2C segment is propelled by peer-to-peer buying and selling that allows users to buy and sell second-hand goods, electronics, furniture, etc. C2C classified platforms offer a convenient way for individuals to buy, sell, and negotiate with one another directly, making it an attractive option for small transactions.

Facebook marketplace, eBay Classifieds, and similar companies dominate the C2C scene with secure transaction features, user verification, and AI-propelled fraud detection. By implementing digital escrow services, integrated shipping solutions, and user rating systems, we can enhance trust and security in transactions. As sustainability and circular economy practices become increasingly prevalent, C2C platforms are on the rise, allowing consumers to recycle, resell, and build wealth out of waste via online classifieds.

The commercial segment in the industry is driven by businesses and service providers leveraging digital classifieds to expand outreach to potential customers. These platforms enable businesses to promote office space, professional services, and retail stores and are thus an important component of brand visibility and lead generation. Commercial online classified ads have been witnessing growing demand as they are cost-effective, help in real-time engagement, and allow for AI-driven ad-targeting.

Players like Gumtree and Locanto dominate the commercial classified space, offering premium listing options, banner advertisements, and geolocation-based targeting. AI-driven analytics, keyword targeting, and automated responses work together to improve ad performance and customer interaction. E-commerce technology has grown, and more businesses are using classified sites to showcase online stores, professional services, and even real estate.

The manufacturing segment utilizes classified platforms by allowing firms to purchase and sell industrial equipment, raw materials, and surplus stock efficiently. These same platforms are used by manufacturers to source their suppliers, lowering inventory costs and growing their industry share without the use of expensive sales companies.

Some companies like TradeIndia and Machinio focus on listings of classified industrial machinery, Spare parts, and Heavy equipment while providing secure transaction options, detailed information about products, and AI-based price recommendations. Due to digitalization, manufacturers are also seeking online classified portals to ease the process of procurement, automate the inquiry flow, and reach verified buyers and suppliers worldwide with cost-effective solutions.

| Countries | CAGR (%) (2025 to 2035) |

|---|---|

| USA | 9.5% |

| China | 10.1% |

| Germany | 8.7% |

| Japan | 8.9% |

| India | 10.5% |

| Australia | 8.4% |

The USA platform economy is expanding with online marketplaces, mobile-driven classified services, and online advertisements becoming increasingly popular, as well as classified platforms utilized by companies to enhance consumer engagement, enhance listings visibility, and streamline transactions.

AI-driven recommendation engines, cybersecurity solutions, and mobile-first approaches fuel the country's digital economy. Spending on online marketing infrastructure and digital advertising was USD 15 billion in 2025, reflecting the industry's growth.

Growing demand for AI-based personalization and secure payments integrated into the platform is fueling the development of the industry. The United States industry is also expected to grow at 9.5% CAGR during the forecast period, as per FMI.

| Growth Drivers in the USA | Details |

|---|---|

| Growth of Information in E-Commerce | E-commerce websites and sales platforms see rising consumer adoption. |

| AI-Powered Personalization | Companies utilize AI for recommendations and search optimization. |

| Industry-Wide Uses | Platform-based companies thrive on job posting, auto, and reality. |

| Secure Digital Transactions | Security innovation with payments fuels consumer trust. |

China's underground platform industry is expanding at a high pace with the changing scenario fueled by internet shopping, mobile penetration, and policy. China, home to the world's largest online consumer retail industry, is witnessing a gigantic demand for classified services in car buying and selling categories, real estate, jobs, and second-hand products.

The government is also encouraging the digital economy through initiatives that facilitate online payments securely and AI-driven content moderation. China invested in the online marketplace and classified technology for USD 18 billion in 2025. FMI is confident that the Chinese industry will grow at 10.1% CAGR during the study period.

| Growth Drivers in China | Details |

|---|---|

| E-Commerce Growth | Government policies are supportive of digital transactions and platform economies. |

| Mobile-Based Marketplaces | Increased penetration of smartphones fuels the usage of mobile apps for classifieds. |

| AI-Powered Advertising | AI-powered targeted advertising maximizes user satisfaction and engagement. |

| Interoperability of Digital Payments | Efficient and secure payments fuel the growth of classified marketplaces. |

Germany traditionally has been behind but is increasingly picking up speed with growing online ad spending and industries embracing digital marketplaces. Germany is an industrial and automotive giant building an emerging demand for property, auto sales, and recruitment-based classifieds.

Data protection regulations such as GDPR force platforms to develop safe, user-focused classified products. Search optimization expenditure with AI and fraud prevention drive business growth. FMI forecasts the German industry to achieve an 8.7% CAGR during the forecast period.

| Germany Growth Drivers | Details |

|---|---|

| Automotive & Real Estate Integration | Car transactions and real estate transactions are conducted via classified websites. |

| Digital Ad Growth | Niche classified advertisement expenditure develops businesses. |

| Compliance with GDPR | GDPR's strict privacy rules encourage secure, user-centric classified sites. |

| AI-Accelerated Search | High-end-level search functionality fuels user activity and ad sensitivity. |

Japan is growing with AI-optimized search, C2C platforms, and second-hand buying/selling of the newest stylish commodity. Companies utilize them for online staffing, car sales, and local advertisement promotion.

Japan's fintech and mobile app development leadership fuels online marketplace adoption. AI-driven ad ranking and user recommendations fuel usage, fueling resale and thrift marketplace expansion. FMI is of the opinion that Japan's industry will expand at 8.9% CAGR over the forecast period.

| Growth Drivers in Japan | Details |

|---|---|

| AI-Optimized Classified Listings | AI-driven search and ad ranking optimize marketplace efficiency. |

| Second-Hand Commerce Expansion | Resale and thrift sites are fueled by increasing consumer demand. |

| Secure Digital Transactions | Payment security is improved with fintech integration for classified marketplaces. |

| Mobile-First Strategy | Firms value app-based classified services that are convenient to use. |

India is growing robustly as mobile-first digital commerce, government policy, and increasing internet penetration reshape the industry. Firms use them for job listings, property listings, and second-hand sales.

The government promotes digital payments and marketplace expansion through initiatives such as Digital India. Regional language-based classifieds fuel the upward proliferation of online advertisements. FMI estimates the Indian industry to grow at 10.5% CAGR during the research period.

| India Growth Drivers | Details |

|---|---|

| Government Support for Digital Commerce | The policy makes digital payments and mobile transactions popular. |

| Expansion of Online Job & Real Estate Listings | Companies utilize recruitment and property listing websites. |

| Hyperlocal & Regional Language Platforms Growth | Growing demand for local language classifieds makes it even more reachable. |

| Growing Smartphone Penetration | More consumers access classified websites via mobile applications. |

Australia is growing with more usage of online marketplaces, online advertising, and consumer-to-consumer (C2C) transactions. Real estate agents, automobiles, and recruitment agencies use them to maximize customer interaction and generate leads.

The country emphasizes safe online purchasing, protection against fraud, and AI-based personalization to enhance the classified marketplace experience. Government policies enable digital business expansion, promoting industry growth in the long term.

| Australia Growth Drivers | Details |

|---|---|

| Digital Business Growth | Government policies enable secure transactions and protection against fraud. |

| AI-Powered Personalization | AI-based personalization boosts user engagement and conversion rates. |

| New Age C2C & Peer-to-Peer Marketplaces | Users are increasingly using classifieds for used goods and services. |

| Enhanced Mobile Accessibility | Websites like their mobile-friendly interfaces better. |

The global classified platform industry has become increasingly competitive, driven by a rapid shift to online marketplaces, intensive penetration of smartphones, and increasing peer-to-peer trade transactions. More improvements in the area of AI-driven search, automated listing recommendation, and integrated payment solutions that improve user experience and security fuel further the expansion of the industry.

Craigslist, OLX Group, eBay Classifieds, Facebook Marketplace, and Gumtree are the top players in the industry because they all feature an extensive range of listings-from real estate to automotive, employment, and even personal services. The common trait is that these enterprises employ artificial intelligence and machine learning to make their ads more relevant, fraud detection, and customer engagement.

Modern industry and regional players succeed due to specialized listings, local services, and special trust measures, such as proven sellers and buyer protection policies. Moreover, the payment technologies' security in transactions through the implementation of blockchain and the idea of augmented reality (AR) viewing a property or product before purchase is shaping a competitive landscape. As digital commerce continues to evolve, future enterprises that would excel in the industry's battle are those that prioritize convenience in use, transaction security, and personalized engagement.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Craigslist | 20-25% |

| Facebook Marketplace | 15-20% |

| eBay Classifieds | 10-15% |

| OLX Group | 8-12% |

| Gumtree | 5-10% |

| Letgo | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Craigslist | Peer-to-peer classifieds for jobs, housing, goods, and services with a simple interface. |

| Facebook Marketplace | Social media-integrated marketplace offering localized buying and selling. |

| eBay Classifieds | Online classified ads for secondhand goods, vehicles, and real estate transactions. |

| OLX Group | Global classified network provides AI-driven ad recommendations and secure transactions. |

| Gumtree | Localized classified platform with an emphasis on community-driven transactions. |

| Letgo | AI-powered mobile marketplace for buying and selling secondhand items easily. |

Key Company Insights

Craigslist (20-25%)

Craigslist remains a giant in the classified platform industry, its minimalistic structure and vast category offerings serving as its strengths. This is enforced by organic user engagement and brand recall.

Facebook Marketplace (15-20%)

Facebook Marketplace allows users to make social media transactions easily. Its AI recommendation and messaging features serve as additional conveniences, cementing its place in the industry.

eBay Classifieds (10-15%)

eBay Classifieds is all about buying and selling anything secondhand, such as goods, vehicles, and real estate. With a trusted platform, secure payments, and a simple interface, its use is gradually increasing.

OLX Group (8-12%)

OLX is a global leader in online classified marketplaces, using AI analytics to provide personalized recommendations and fraud detection. The company continues to scale into emerging industries and grow its user base.

Gumtree (5-10%)

Gumtree does an excellent community affair in the local context, focusing on local-centric classifieds and ease of use. It well-entrenches itself in the UK and Australia, thereby consolidating its position in its niche industry.

Letgo (4-8%)

Letgo has received acclaim for its mobile-first approach and AI image recognition for listing items. It further provides a good user experience through automated recommendations and selling process steps.

Other Key Players (30-38% Combined)

The industry is slated to reach USD 12.2 billion in 2025.

The industry is predicted to reach USD 38.7 billion by 2035.

The key companies in the industry include Craigslist Inc., Finn.no, Gumtree (eBay), Quikr India Private Limited (CommonFloor.com), OLX Inc., Rightmove plc, Backpage.com, Trovit Search, ClickIndia, and Zoopla.

India, slated to grow at 10.5% CAGR during the forecast period, is poised for the fastest growth.

B2C classified platforms are being widely used.

In terms of type, the industry is divided into business to consumer (B2C) and consumer to consumer (C2C).

By application, the industry is segregated into commercial, manufacturing, services, and others.

In terms of region, the industry spans key global regions, including North America, Latin America, Asia Pacific, the Middle East & Africa, and Europe.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.