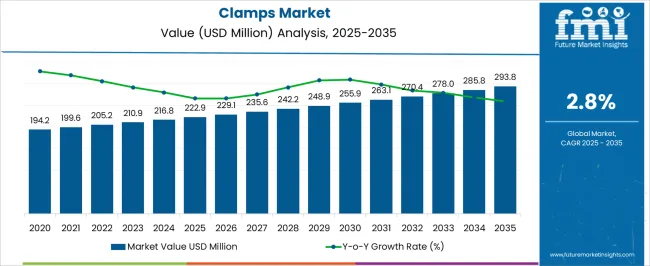

The Clamps Market is estimated to be valued at USD 222.9 million in 2025 and is projected to reach USD 293.8 million by 2035, registering a compound annual growth rate (CAGR) of 2.8% over the forecast period.

| Metric | Value |

|---|---|

| Clamps Market Estimated Value in (2025 E) | USD 222.9 million |

| Clamps Market Forecast Value in (2035 F) | USD 293.8 million |

| Forecast CAGR (2025 to 2035) | 2.8% |

The clamps market is experiencing robust growth fueled by rising surgical volumes, advancements in cardiovascular procedures, and increased demand for precision surgical instruments across healthcare institutions. The expanding geriatric population and prevalence of chronic cardiac conditions are intensifying the need for reliable hemostatic control during operative interventions.

Technological innovations in clamp design, including ergonomic features and biocompatible materials, are contributing to improved procedural outcomes and clinician satisfaction. Moreover, global investments in upgrading surgical infrastructure and the expansion of multispecialty hospitals are supporting widespread adoption of specialized surgical clamps.

As healthcare delivery becomes increasingly complex and minimally invasive surgery gains traction, the market outlook remains positive with significant opportunities in innovation, performance enhancement, and surgeon training.

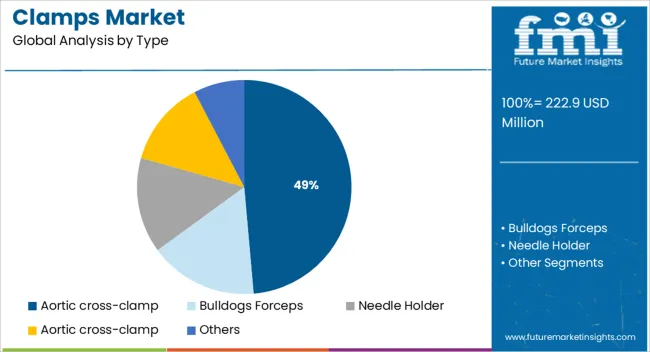

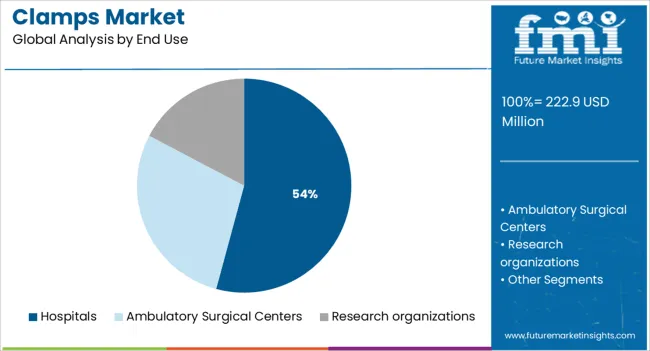

The market is segmented by Type and End Use and region. By Type, the market is divided into Aortic cross-clamp, Bulldogs Forceps, Needle Holder, Aortic cross-clamp, and Others. In terms of End Use, the market is classified into Hospitals, Ambulatory Surgical Centers, and Research organizations. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aortic cross clamp segment is anticipated to account for 48.60% of the total market revenue by 2025 within the type category, establishing it as the dominant segment. This leadership is supported by its critical role in open heart and cardiovascular surgeries, where controlled blood flow management is essential.

The clamp is specifically designed to temporarily block blood circulation in the aorta, enabling safe and effective surgical intervention. Surgeons rely on its precision, grip strength, and non traumatic closure to minimize vascular injury during complex procedures.

The widespread use of aortic cross clamps in cardiac bypass and valve repair operations has reinforced its prominence in hospitals and specialty cardiac centers. Ongoing developments in lightweight materials and improved handle designs are further enhancing the adoption of this type across global surgical settings.

The hospitals segment is projected to represent 54.20% of the total market revenue by 2025 under the end use category, making it the leading user segment. This dominance is attributed to the large volume of surgical procedures conducted in hospital settings, particularly those involving complex cardiovascular and thoracic interventions.

Hospitals maintain comprehensive surgical units with specialized teams trained in advanced procedures that require dependable clamping devices. Additionally, hospitals are more likely to invest in high performance and reusable instruments due to their broader patient base and procedural diversity.

The availability of funding for infrastructure, surgical tools, and staff training further supports the preference for hospitals in adopting premium grade clamps. As the number of surgeries continues to rise and patient care standards evolve, hospitals remain the cornerstone of demand in the clamps market.

The global market for Tumor marker is segmented on basis of type and end use:

The global clamps market is estimated to be valued at USD 222.9 million in 2025.

The market size for the clamps market is projected to reach USD 293.8 million by 2035.

The clamps market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in clamps market are aortic cross-clamp, bulldogs forceps, needle holder, aortic cross-clamp and others.

In terms of end use, hospitals segment to command 54.2% share in the clamps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cranial Clamps Market

Subsea Umbilical Clamps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA