The global market for clad pipes is expanding, driven by rising demand for corrosion-resistant materials in oil and gas, chemical processing, and marine industries. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5%, with sales reaching USD 5,427.8 million by 2035.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 5,427.8 million |

| CAGR (2025 to 2035) | 5.5% |

Top competing organizations like Tenaris SA, The Japan Steel Works, Ltd., and BUTTING Group leverage their expertise in the design and manufacturing of durable, high-performance clad pipes. Leading companies in the clad pipe market are focused on technological advancements, such as developing new welding techniques and enhancing corrosion resistance.

They are also expanding their product offerings to meet the growing demand for specialized pipes in the oil and gas, chemical, and marine sectors. These initiatives are aimed at improving operational efficiency and addressing customer requirements for reliable, long-lasting piping solutions.

In the global clad pipe market, the leading companies have effectively segmented the market. The top three-Tenaris SA, The Japan Steel Works, Ltd., and BUTTING Group-hold 30% of the market by leveraging innovation and maintaining a strong industry presence. Tenaris SA is known for its high-quality, corrosion-resistant clad pipes, primarily used in the oil and gas sector.

The Japan Steel Works specializes in advanced, durable clad pipes for subsea pipeline projects. BUTTING Group excels in offering customized solutions for the chemical and petrochemical industries, ensuring superior durability and performance.

The other two companies in the top five, EEW Group, Inox Tech S.p.A, together capture a 25% market share by focusing on the production of seamless, high-strength clad pipes for industrial applications. The remaining companies, including Proclad, Gulf Specialized Works, account for 45% of the market, concentrating on sustainable solutions and incorporating advanced manufacturing techniques.

The market remains steady, with key companies emphasizing technological advancements and expanding their product portfolios. North America and Europe remain dominant markets for clad pipes, while the Asia-Pacific region is witnessing significant growth driven by infrastructure developments and increased energy sector investments.

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Tenaris SA, The Japan Steel Works, Ltd., and BUTTING Group) | 30% |

| Rest of Top 5 (EEW Group, Inox Tech S.p.A) | 25% |

| Rest of Top 10 | 45% |

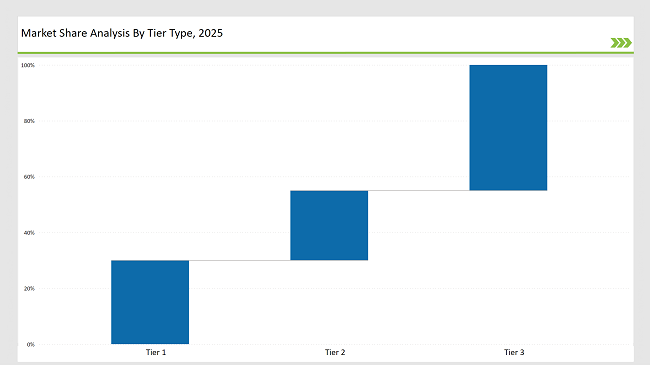

The clad pipe market is fairly consolidated, with dominant Tier-I players focusing on producing high-performance, corrosion-resistant pipes using advanced manufacturing technologies. Leading companies prioritize long lifespan and reliability for critical industries like oil and gas, petrochemical, and marine. Tier-II and Tier-III operations compete by offering more cost-effective, application-specific solutions. These players focus on niche markets and regions, delivering tailored, competitive products to meet growing industry demand.

Explore FMI!

Book a free demo

In the market for clad pipe, metallurgical bonded comprise 46.1% of the total. Steel bonded clad pipes are propelling a demand for higher mechanical strength, a greater degree of durability, and improved corrosion resistance. The metallurgical bond allows establishing a powerful permanent connection between the base metal and the cladding layer, enhancing manufacturing performance even in challenging environments such as offshore oil and gas exploration.

This bond allows such a pipe to withstand high pressure and withstand high temperature, which is very useful in critical applications. Add to that metallurgical bonding's substantial enhancement of welding and fabricability properties, and it translates directly into reduced costs and shortened installation times, which are important in reliability or efficiency-driven industries.

Alloy 625 made up the significant part of the market, with 25% of sales. Alloy 625 has proved to be the key for the clad pipe market by having outstanding corrosion, oxidation, and high-temperature resistance. It is an extremely durable nickel-based alloy suitable for applications in the most demanding and harsh oil and gas, petrochemical, and shipping industries.

Due to its resistant ability to these extreme conditions, Alloy 625 ensures the use of strategic infrastructure, such as submarine pipelines and reactors, including seawater and severe thermal conditions. Its excellent weldability and mechanical properties make it an attractive choice to the manufacturers looking for high quality, cost-effective clad pipe solutions for extreme environments.

Tenaris SA

Tenaris S.A. is a prominent global producer of steel pipes for the energy market, particularly clad pipe high-performance options. They manufacture a wide range of metallurgically bonded, mechanically lined and weld-overlay clad pipes.

These pipes have been designed to meet severe service conditions such as corrosion, high pressure, and high temperatures-each applied in critical applications within the oil and gas, petrochemical, and marine industries. With the latest in advanced manufacturing technology, Tenaris combines an unparalleled global supply chain to provide long-lasting, cost-effective clad pipe solution to meet the varied needs of different industries.

The Japan Steel Works, Ltd.

The Japan Steel Works, Ltd. is a mainstay in the steel industry. Their long history of producing high-performance clad pipes for the oil and gas, chemical, and marine industries is unmatched. The metallurgical bond in their clad pipes offers higher corrosion resistance and more exceptional strength.

Known for their quality, Japan Steel Works' pipes have found application in critical areas like subsea pipelines and reactors. With advanced manufacturing technology and immense emphasis on innovation, the company provides specially designed clad pipe customized in accordance with stringent international energy sector demands.

BUTTING Group

BUTTING Group is famous as a manufacturer of steel pipes and pipe systems further, it specializes in producing clad pipes of high quality for industries with requirements for increased corrosion resistance such as oil and gas, chemical processing, and marine applications.

The clad pipe of BUTTING possesses a metallurgical bond, providing safety and performance against challenging environments. This company offers tailor-made solutions with a greater emphasis on precision, toughness, and innovation. On account of its many decades of experience, the BUTTING Group is a trusted name generation of advanced clad pipe technology for global industrial applications.

| Tier | Examples |

|---|---|

| Tier 1 | Tenaris SA, The Japan Steel Works, Ltd., and BUTTING Group |

| Tier 2 | EEW Group, Inox Tech S.p.A |

| Tier 3 | Regional and niche players |

| Company | Key Focus |

|---|---|

| Aasia Steel Co. Ltd | Specializes in producing high-quality clad pipes for oil, gas, petrochemical, and marine industries with corrosion-resistant solutions. |

| Eisenbau Krämer | Focuses on high-performance clad pipes with metallurgical bonding, designed for the oil, gas, and petrochemical industries. |

| EEW Group | Known for providing high-performance clad pipes for oil, gas, and petrochemical sectors, with advanced manufacturing and a global presence. |

| BUTTING Group | Specializes in producing durable clad pipes for oil and gas, chemical processing, and marine applications, with metallurgical bonding for strength. |

| Gieminox Tectubi | Focuses on high-quality clad pipes offering corrosion resistance and mechanical strength for critical industries like oil, gas, and marine. |

| Tenaris SA | A global leader in manufacturing steel pipes, including clad pipes, offering metallurgically bonded and weld-overlay solutions for energy sectors. |

| Inox Tech S.p.A | Specializes in stainless steel and alloy-based clad pipes for challenging industries like petrochemical, oil, and gas. |

| The Japan Steel Works, Ltd | Offers innovative clad pipe solutions, known for their high-quality performance in the energy sector, with a focus on corrosion resistance and durability. |

| Proclad | Known for producing high-quality welded and metallurgically bonded clad pipes for demanding applications in the oil, gas, and chemical industries. |

The clad pipe market in the global level will grow steadily, as industries would prefer more durable and corrosion-resistant pipelines for critical operations. Customization, advanced cladding technologies, and regional expansion would be key factors to compete with each other. 12 to 24-inch pipes will remain the leading pipes, while oil & gas is likely to dominate. Opportunities in water infrastructure and power generation will also continue to increase. Strategic partnerships with EPC contractors and localized production will capture long-term market opportunities.

Tenaris SA, The Japan Steel Works, Ltd., and BUTTING Group command about 30% share in the overall market.

Metallurgical Bonded comprise nearly 46.1% of the overall market.

Regional and domestic companies hold nearly 35% of the overall market.

Market is fragmented, representing top 10 players commanding significant share in the market.

Oil and gas end use is offering significant growth prospects to market players.

Electric Winch Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Commercial RAC PD Compressor Market Growth - Trends & Forecast 2025 to 2035

Commercial Induction Cooktops Market Growth - Trends & Forecast 2025 to 2035

Echo Sounders Market Insights - Demand, Size & Industry Trends 2025 to 2035

Electric Hedge Trimmer Market Insights Demand, Size & Industry Trends 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.