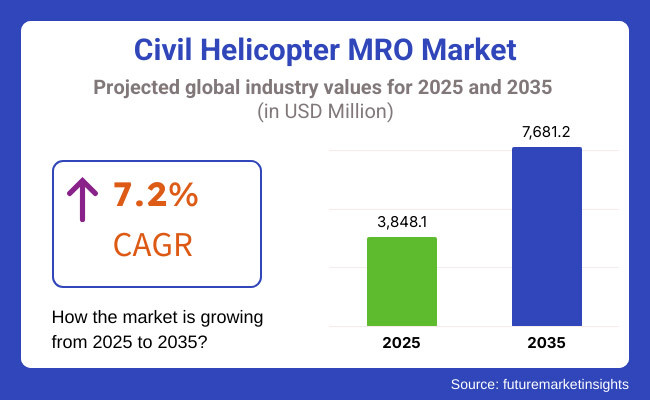

The Civil Helicopter MRO market will continue growing between 2025 and 2035 as commercial airlines, police units, and emergency medic squadrons make higher demands for MRO solutions. The estimated market size of USD 3,848.1 million in 2025 is forecasted to develop into USD 7,681.2 million by the year 2035 at a compound annual growth rate (CAGR) of 7.2% in the forecast years.

Some of the key drivers of market growth for this segment are many. The most important among them is increasing helicopter usage in search and rescue missions, urban air mobility, and offshore missions. Helicopters need to be maintained from time to time to maintain safety of operation along with complying with regulatory needs.

For instance, helicopters that transport crew to platforms in offshore oil and gas industry have stringent MRO processes because of bad weather conditions.Yet, high maintenance cost and lack of experienced technicians are serious issues, which lead MRO providers to embrace digital solutions like predictive maintenance and automated diagnosis.

Market is segmented depending on the character of MRO services, i.e., avionics upgrade, component repair, engine overhaul, and airframe maintenance. Engine overhaul carries the biggest chunk because of its exorbitant price and level of replacement.

For example, major engine vendors such as Safran and Pratt & Whitney provide service packages only to fleet operators to prevent downtime.

Avionics upgrade is becoming increasingly popular with the installation of high-end flight systems into helicopters to improve navigation, connectivity, and pilot-assist functions.

Explore FMI!

Book a free demo

North America is a large market for MRO services for civil helicopters due to a high density of large helicopter operators in business markets like emergency medical services (EMS), law enforcement, and corporate aviation.

Even the United States has one of the world's largest fleets of civil helicopters with stringent maintenance standards required by Federal Aviation Administration (FAA) regulations. This requires constant MRO services to remain in compliance and airworthy.

Companies such as StandardAero and Heli-One lead the way with enhanced capability, and the combination of faster turn time and cost-effective maintenance. Predictive maintenance is also becoming the norm as technology improves, allowing operators to make informed choices that allow them to schedule maintenance more readily, as well as prevent jolting breakups.

Besides, increased UAM demand in cities like Los Angeles and Dallas will additionally fuel MRO investment, with a more mature and diversified MRO landscape coming to light.

Europe is a very vast market for the civilian helicopter MRO sector because countries like France, Germany, and the UK have vast demands for the maintenance requirement. France is unique because the headquarters of Airbus Helicopters are based here, which is a rarity for H145 and H175 model helicopters being used most frequently in emergency medical transport services and corporate flights.

Due to the stringent green legislation of the European Union, the agenda of the MRO suppliers is also shifting in orientation towards going green, for example, incorporating environmentally clean and recycle elements into it as a carbon-reduction strategy for maintenance activity.

Further, the expansion of helicopter leasing in Europe is driving the requirement for high-end MRO services, in the guise of lease-return check and overhaul to a large extent, prior to sale to new owners. This presents new opportunities to MRO providers since the companies leasing require immediate and good quality maintenance so that they can place their fleet for sale on the market for deployment by new clients.

The Asia-Pacific is to see prolific growth in civil helicopter MRO business with intensified offshore oil and gas exploration, large volumes of tourists, and growing law enforcement requirements. Countries that lead with leadership positions are China, India, Japan, and Australia, where China dominates the region's market with expansion in its fleet.

Helicopters employed for disaster response, medevac, and search-and-rescue operations in India and Japan must perform frequent, high-level maintenance to keep them prepared in emergency response scenarios. China, however, is investing heavily in cutting-edge MRO facilities, next-generation hangars, and integrated engineer training programs, further solidifying the market's strengths.

The presence of local MRO providers such as ST Aerospace in Singapore is also creating regional maintenance support for services. All these along with increasing use of helicopters for numerous different purposes are turning the Asia-Pacific region into a dominant force in the helicopter MRO market globally.

Challenge

High Maintenance Costs and Technician Shortages

Helicopter MRO service is extremely expensive because of the complexity of helicopter equipment and helicopter maintenance regulatory requirements. The parts are overhauled as normal, and part replacement and long checks add to the expense. The high level of equipment and accuracy required by each process make it expensive and time-consuming.

Operators have to weigh the demands of ensuring quality against their capital. Added to the complexity is the growing scarcity of skilled MRO technicians, particularly in the new market niches where air operations are growing phenomenally quickly.

Longer turnaround service time results in more flight delays and more helicopter downtime. Pressure on MRO suppliers to meet such requirements also at an increased cost affects profitability and operating performance within the industry.

Opportunity

Digitalization and Predictive Maintenance

Digitalization of helicopter MRO business has immense potential for cost savings, as well as improved operating performance. Predictive maintenance with data analytics and artificial intelligence-based technology allow for improved monitoring of the helicopter condition by the operators. With AI-driven onboard sensors and algorithms, faults can be anticipated in advance, thereby minimizing unscheduled downtime and expensive emergency maintenance.

These technologies are used already by big corporations such as Honeywell and Rolls-Royce in their maintenance processes, which result in more efficient procedures as well as major cost reductions.

Again, a new innovation here is utilizing 3D printing technology for manufacturing spare parts. This speeds up part manufacturing, decreasing lead times as well as inventory expense. MRO service providers who adopt these emerging technologies will be ready to capitalize on the competition in the marketplace, fulfilling demand earlier and at lower cost.

During 2020 to 2024, the civil helicopter MRO industry witnessed growing investments in digitization, sustainability, and automation. The activities were impacted short-term by the COVID-19 pandemic but bounced back as emergency medical services, law enforcement, and offshore operations picked up at full capacity. Fleet modernization also came to the forefront by operators, leading to growing demand for avionics and structural changes.

Predictive maintenance, eco-friendly MRO procedures, and hybrid-electric propulsion technology will dominate the market in 2025 to 2035. Once urban air mobility solutions become ever more accessible, demand for resource-efficient and cheap maintenance procedures will rise even stronger, fueling future market growth.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory authorities laid down strict maintenance and safety guidelines for civil helicopters with mandatory routine inspection and follow-through on maintenance routines. |

| Technological Advancements | Use of digital resources like predictive maintenance software and analytics began to support improvement in the efficiency of maintenance as well as lessening of downtime. |

| Fleet Demographics | The overall civil helicopter fleet globally registered modest growth while ensuring replacement of ageing aircraft in a bid to ensure better performance as well as enhanced safety. |

| MRO Business Models | Maintenance was generally outsourced using either in-house mechanics or legacy MRO contracts. |

| Supply Chain Dynamics | Supply chain disruptions prompted MRO providers to encounter challenges, including delays in acquiring spare parts and components. |

| Environmental Sustainability | The first steps were initiated to implement greener practices, which included correct disposal of hazardous materials. |

| Market Growth Drivers | Routine maintenance requirements as well as regulatory compliance needs drove the demand for MRO services. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulators are also laying down tougher environmental regulations, compelling MRO service providers to implement green technology and minimize carbon footprints on maintenance activities. |

| Technological Advancements | Emerging technologies such as artificial intelligence (AI) and Internet of Things (IoT) are transforming the MRO operations, allowing real-time monitoring and pre-failure maintenance, thus improving the level of operational effectiveness. |

| Fleet Demographics | The fleet is growing at a rapid rate driven by growing demand in emergency medical services and offshore that results in a greater extent of MRO activity. |

| MRO Business Models | Power-by-the-hour contracts and total service agreements are also becoming increasingly popular to leverage cost predictability as well as to align MRO service goals with the goal of operators. |

| Supply Chain Dynamics | The supplier base is being diversified and buffers of inventories are being established in a bid to reduce risks of exposure towards developing a better supply chain system. |

| Environmental Sustainability | MRO providers are going greener by adopting material and energy saving processes that can make them fit into global environment standards. |

| Market Growth Drivers | Growth is being spurred by the evolving technology, increased helicopter fleet, and escalating complexity of helicopters, which require skilled MRO services. |

United States has a large commercial helicopter MRO market through a high level of mission-critical utilizations including emergency medical services (EMS), law enforcement, and tourism. Helicopter operations in such markets must incorporate periods for safety and reliability. Technological developments in the application of Artificial Intelligence (AI) and the Internet of Things (IoT) are transforming maintenance activities through predictive maintenance, whereby one is able to forecast failure and reduce downtime.

This technology not only improves the cost of operation but also improves the degree of safety within the industry. Environment sustainability is also becoming an increasingly popular issue with environmentally friendly habits adopted by the providers of the MRO for matching the regulatory trend at a national level with lower environmental loads.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

Civil helicopter maintenance, repair and overhaul (MRO) in the European Union is expanding healthily on the back of demand growth fueled by helicopter demand in segments like offshore wind power and emergency medical services (EMS). Germany, France, and Italy are leading the growth, with their established aviation industries driving the growth.

The environmental policies of the EU have compelled MRO companies to incorporate sustainability into their business core. Therefore, there is a clear trend towards green processes, materials, and carbon reduction in maintenance processes. This is consistent with the broad EU mandate for environmental prints reduction in industries, and this has ensured that sustainability is a top priority while setting up the MRO industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.5% |

Japan's helicopter MRO industry for civilian use is expanding due to greater reliance on helicopters for disaster rescue, news gathering, and business use. The industry is highly boosted by Japan's drive for technology innovation and growth. This investment has called for the adoption of new maintenance methods such as predictive analysis and IoT monitoring systems that lower the cost of maintenance optimization at.

This use of technology also results in enhanced safety through the identification of faults at an early stage to avoid system failure. Aside from that, Japan's rigorous emphasis on environmental sustainability has forced MRO vendors to be green-friendly,i.e., go for green technology, such as green processes and materials, in attempting to establish the industry benchmark with world-class sustainability actions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

South Korea's helicopter civil MRO sector is increasing incrementally primarily because of increased demand for helicopters in segments such as emergency healthcare services, police force, and business transportation. Government spending on the establishment of aerospace infrastructure and technological development is driving the expansion of advanced MRO centers in the country.

The South Korean government has assigned immense importance to the growth of aviation technology, which has helped advance the creation of new forms of maintenance. Apart from this, more emphasis is being laid on sustainability in development, and South Korean MRO players are taking up green technology and processes as per international environmental standards. This symbiotic combination of innovation and sustainability is pushing the country's future helicopter maintenance business.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.0% |

India's commercial sector helicopter MRO industry will grow manyfold with expanding demand for helicopters in tourism, medical evacuation, and offshore sectors. Efforts by the Indian government to support the aerospace sector, such as the setting up of MRO facilities and industry-friendly policies, are channeling investments in and increasing maintenance capacity.

With economic growth and helicopter fleet expansion on a rising trend, the nation needs advanced MRO services to keep flying effectively and safely. India is also embracing sustainability for the MRO market with the suppliers embracing green practices and technology in order to curb environmental effects. The transition positions India at the forefront of the new market because it is on the international forefront of going green with helicopter overhauls.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.1% |

Engine maintenance dominates the largest percentage of the civil helicopter MRO market because the helicopter engine has a high performance-critical and operating requirement. It needs to be inspected, overhauled, and replaced with parts in order to remain airworthy, particularly in high-demand business segments such as EMS and oil & gas offshore transportation.

Operators will do it again and again with engine maintenance services so that they could experience maximum fuel efficiency and lifespan, and hence a very important factor.

Turboshaft engines in the majority of commercial helicopters are overhauled with hot section inspection and total overhaul repeatedly after every flying hours specified. It is highly in demand in Europe and North America, and following regulations demands absolute control over engine performance.

In addition, the growing trend towards predictive maintenance technology using real-time data analysis and artificial intelligence is also improving efficiency in engine maintenance operations.Component Maintenance Gains Traction Amid Growing Avionics and Rotor System Upgrades.

Component overhauling is in great demand, particularly with the growing focus on avionics overhauls and rotor system overhauls. Corporate helicopter passenger transport and business passenger transport involve continuous overhauling of components such as flight control systems, hydraulic assemblies, and communication systems.

While sophisticated avionics overhauls such as glass cockpits and real-time monitoring systems for flight are recent MRO service needs in this industry,.

Areas such as Asia-Pacific and the Middle East are experiencing increasing demand for component maintenance, primarily due to increasing civil aviation fleets and helicopter existing upgrades. With composite material use becoming more prevalent on rotor blades, maintenance providers also look for specialized repair techniques to enhance durability and reduce operating costs for operators.

Commercial Helicopter is the biggest source of income for the civil helicopter MRO industry because airlines, tour operators, and air ambulance groups continually upgrade and refurbish their fleets. Helicopters used for charter flights and air evacuation by health care providers are overhauled every few years by frame, avionics replaced, and interior refurbished in an effort to meet high safety standards.

In regions like Europe and North America, regulatory authorities like EASA and FAA regulations necessitate stringent maintenance schedules, thereby generating continuous demand for MRO services. Growing utilization of long-range helicopters for intercity routes and VIP services are likely to influence demand for preventive and corrective maintenance solutions as well.

As the popularity of urban air mobility (UAM) concepts rises, so too will the business helicopter market feel the effects of growing expansion, thereby leading to ongoing MRO market growth.

The corporate helicopter market is in top gear with business aviation and luxury services air transport demand rising. Ultra-high-net-worth individuals and senior CEOs of blue-chip firms are dependent on private helicopter fleets that call for single-instance solutions in maintenance, i.e., cosmetic touch-up, avionics upgrade, and interior refit.

North America, Asia-Pacific, and the Middle East are all witnessing record growth of private helicopter MRO services with increased ingress of high-end US helicopter charter businesses and private air mobility businesses. Expansion in web-based monitoring of maintenance and on-call availability of services is also increasing increasingly to make private helicopter ownership possible, relentlessly driving private helicopter expert MRO service demand.

The international business commercial helicopter MRO market is a competitive industry with large foreign companies and an interdependent network of domestic MRO facilities providing fleet availability. Large organizations have sizeable market shares that enable innovative preventive maintenance, electronic diagnostics, and regulatory compliance.

Large organizations desire to innovate service capability, turnaround reduction, and analytics for data analysis to experience optimum working efficiency. The sector is composed of long-established MRO providers and independent new service providers, all of whom make valuable contributions to the airworthiness of civilian helicopters worldwide.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Airbus Helicopters MRO | 14-19% |

| Leonardo Helicopters MRO | 10-15% |

| StandardAero | 9-13% |

| Heli-One | 6-10% |

| Honeywell Aerospace MRO | 4-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Airbus Helicopters MRO | Provides full-spectrum MRO services, including avionics upgrades, component repairs, and airframe inspections. Integrates digital solutions to enhance predictive maintenance. |

| Leonardo Helicopters MRO | Specializes in in-house maintenance support for AW-series helicopters, offering comprehensive service packages tailored to fleet operators. Expands global service centers. |

| StandardAero | Offers engine overhauls, avionics retrofits, and structural repairs for multiple helicopter platforms. Known for fast turnaround and extensive OEM partnerships. |

| Heli-One | Delivers customized MRO solutions, including component support, modifications, and performance upgrades. Strong presence in offshore and emergency medical services sectors. |

| Honeywell Aerospace MRO | Focuses on engine maintenance, avionics integration, and reliability improvements. Invests in AI-driven diagnostics and fuel-efficiency enhancements. |

Key Company Facts

Airbus Helicopters MRO (14-19%)

Airbus Helicopters MRO is the market leader in civil helicopter maintenance with the full range of services from component support to heavy overhaul and digital health monitoring. Predictive analysis is applied across the organization in order to lower maintenance schedules and maintain operating downtime. Strategically located across the globe are the MRO centers of Airbus that offer quick service support to operators worldwide.

Leonardo Helicopters MRO (10-15%)

Leonardo has developed MRO services distinct to its AW-series helicopters, which it sells to government and commercial customers. It is expanding its global maintenance presence, locating servicing capacity in target niches like VIP transportation and emergency services. Leonardo is investing in automation and remote diagnostics to streamline service making.

StandardAero (9-13%)

StandardAero is a premium independent MRO, with heavy overhaul and repairing capability of helicopter engines and accessories. As an enterprise with the ability to converse with engine OEMs such as Pratt & Whitney and Rolls-Royce, StandardAero is capable of offering quick turnaround time and tailor-made packages of maintenance. With its technical support and reliability, it's the operator's first preference choice across the world.

Heli-One (6-10%)

Heli-One is a specialized MRO services company offering overhaul of civil helicopter structure and parts. It maintains heavy helicopter platforms for search and rescue, offshore oil & gas, and emergency medical transport operations. Heli-One offers modification and upgrade to satisfy mission-upgrade requirements for which operators need.

Honeywell Aerospace MRO (4-8%)

Honeywell Aerospace manufactures high-criticality helicopter flight control systems, helicopter avionics, and maintenance helicopter engines. Honeywell invests in fuel optimization and diagnostic technologies with artificial intelligence to support improved aircraft performance at lower maintenance costs. Honeywell MRO is used on business aviation and law enforcement helicopters.

Other Key Players (40-50% Combined)

Apart from the dominant players, several other MRO providers contribute to the market’s growth, focusing on regional and specialized maintenance solutions. These include:

The global Civil Helicopter MRO market was valued at approximately USD 3,848.1 million in 2025.

The Civil Helicopter MRO market is projected to reach approximately USD 7681.2 million by 2035.

The increasing demand for helicopter services in commercial and private applications, coupled with the growing need for airframe maintenance and upgrades, is propelling the market growth.

The top 5 companies driving the development of the Civil Helicopter MRO market are Airbus Helicopters, GE Aviation, Leonardo S.p.A, Turbomeca (Safran), and Rolls Royce Holdings PLC.

On the basis of type, engine maintenance is expected to command a significant share over the forecast period.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.