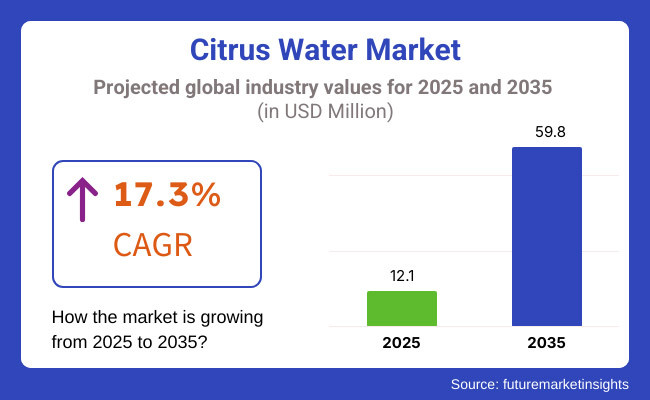

Citrus Water Market will see wondrous growth in 2025 to 2035 with customers increasingly demanding flavored hydration and functional drinks. The market will stand at approximately USD 12.1 million in 2025 and reach USD 59.8 million in 2035 at a compound annual growth rate (CAGR) of 17.3% in the years.

Several key drivers are revolutionizing the market dynamics. Among the key drivers is growing demand for low-calorie and natural beverages with customers growing more health-conscious. Citrus-flavored water, giving the hydration with clean taste along with the nutritional boost, is on the rise with sportsmen as well as the general populace.

Notably, premium citrus water brands are testing organic ingredients, immune system-boosting additives like vitamin C and electrolytes, and environmentally friendly packaging options to attract green consumers.

Volatile raw material costs and seasonal fluctuations in citrus fruit production, however, are manufacturers' worst nightmares in maintaining supply chains and prices stable. Citrus water falls under a variety of categories depending on its formulation and composition.

They comprise citrus water, sparkling citrus water, and functional citrus-flavored water. Still citrus water is the choice due to its cleanliness as a light-tasting clean hydration beverage. Citrus water sparkling is well-liked among consumers seeking improved-for-you versions of carbonated drinks, especially among millennials and Gen Z.

Functional citrus water with the inclusion of electrolytes, probiotics, or vitamins is growing rapidly with popularity in the health and wellness category. Large applications range across the retail channel, foodservice, and sports nutrition markets where consumers seek healthy refreshing drinks.

Explore FMI!

Book a free demo

North America is the largest market for citrus water with the United States and Canada dominating consumption because of elevated levels of awareness of healthy hydration beverages.

Demand is propelled by increased demand for sugar-free and clean-label beverages, particularly by urban and health-oriented consumers. Beverage companies and conventional businesses are launching new citrus water flavors such as calamansi, blood orange, and yuzu in an effort to attract the public eye during a very competitive market.

Greater mobility towards green and eco-friendly packaging contributes even more to market growth as the market trends towards biodegradable bottles and minimal plastic consumption. In addition, premium segmenting and identification with fitness clubs, health brands, and natural food stores are also propelling increased market penetration in the market.

Europe is a leading market for the citrus water category, with leading markets being Germany, France, and the United Kingdom. Europe's health trend has created demand for functional foods and beverages, such as vitamin, mineral, and detoxifying effects from citrus-flavored waters.

Upscale European city cafes, gym clubs, and boutiques stock premium citrus water brands within easy reach. Furthermore, European Union laws on synthetic preservatives and additives offer incentives to produce natural brands to guarantee authenticity. The increasing popularity of Mediterranean diets with a focus on fresh citrus fruits and water consumption also serves to drive regional market growth.

Asia-Pacific will witness the highest rate of growth in the market for citrus water due to increased disposable income, awareness of health, and thirst for cooling beverages. China, India, Japan, and South Korea are experiencing more demand for citrus hydration products in metropolitan and urban cities.

Citrus water is also becoming the first choice for sparkling beverages in India and China, with Indian and Chinese consumers opting to drink more functional and natural beverages in greater quantities.

Internet stores and retail modernization outlets are also making citrus water products available to consumers at their convenience. Besides that, the incorporation of citrus flavors from local sources like Indian mosambi (sweet lime) and Japanese yuzu in citrus water products gives a competitive advantage in the market.

Challenge

Raw Material Volatility and Seasonal Dependency

Citrus water business is prone to fluctuations in the price of citrus fruits and seasonally unstable supplies.

The price of raw materials and supply may be affected by climate change, unexpected weather patterns, and disease attacks on the citrus crop. Maintaining the taste and consistency of the product in terms of quality is also challenging since manufacturers are working with natural materials.

Because of such limitations, organizations are turning towards diversification of procurement and investing in technology in order to save citrus.The progress in cold-pressed and concentrated citrus concentrates delivers the product quality as well as withstands the unpredictable seasons.

Opportunity

Functional Beverage Development

The demand for functional beverages from consumers represents the largest opportunity for the citrus water business.Businesses more and more are adding other added health benefits to citrus water such as electrolytes for hydration, antioxidants for immune health, and collagen for skin. The diversification speaks to the new wellness trends and a broad range of consumers from athletes to white-collar workers.

Green packaging technology, such as plant-based and biodegradable cans and aluminum content bottles that are produced using recyclables, benefits the citrus water industry. Additionally, alliances with sport brands, wellness influencers, and social marketing efforts are also likely to create even higher consumer demand and market growth.

During 2020 to 2024, the market for citrus water expanded with increasing health awareness, product availability in stores and online, and flavored and sparkling water category trends. Demand for organic and non-GMO citrus water also picked up among consumers, which prompted manufacturers to enhance sourcing and formulation strategies.

Forward. 2025 to 2035, the segment will continue to gain traction coupling functional ingredients, increasingly sustainable packaging options, and growth on lines. Citrus water, targeting on-trend leadership in health, hydration, and convenience drivers, will be among the best beverage choices, with global mass-market and premium segments evolving.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulations of food and beverages concentrated mainly on artificial additives and added sugars, which forced producers to recreate products using natural components. |

| Technological Advancements | Cold-press technology and microfiltration methods enhanced nutrient and flavor retention. Smart packaging with indicators for freshness was introduced. |

| Consumer Preferences | More health-aware consumers sought out low-calorie, natural drinks. There was huge demand for functional citrus water flavored with vitamins and electrolytes. |

| Flavor Innovation | Lemon, lime, and orange were still top flavors, with a few brands playing around with exotic citrus combinations such as yuzu and calamansi. |

| Sustainability Practices | Recyclable PET bottles and BPA-free packaging became the norm. Biodegradable packaging alternatives were adopted by some companies. |

| Production & Supply Chain Dynamics | Seasonal nature of citrus fruits led to supply fluctuations, impacting consistency in production. Import reliance on major citrus-producing areas such as Spain and Brazil had an impact on costs. |

| Market Growth Drivers | Growing awareness of the benefits of hydration and the move away from sweetened sodas fueled market expansion. Social media trends emphasizing detox and health drinks fueled greater demand. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments implement stronger labeling and ingredient disclosure regulations, promoting the trend towards organic and non-GMO citrus water. Artificial flavors and sweeteners are more discouraged. |

| Technological Advancements | Sophisticated enzymatic extraction technologies improve flavor concentration and stability. AI-driven formulation software maximizes ingredient synergy, allowing customized citrus water formulations based on consumer taste. |

| Consumer Preferences | The popularity of biohacking and customized nutrition drives demand for adaptogenic citrus water, with botanicals and nootropic infusions going mainstream. Consumers look for drinks that promote hydration, immunity, and cognitive function. |

| Flavor Innovation | Hybrid citrus fusion beverages, e.g., bergamot-pomelo and blood orange-grapefruit, become popular. Flavor layering processes increase complexity, appealing to discerning palates. |

| Sustainability Practices | Circular economy efforts translate to mass uptake of compostable packaging. Secondary products utilize upcycled peels and seeds from citrus, cutting down on food waste while optimizing sustainability. |

| Production & Supply Chain Dynamics | Vertical farming and controlled-environment agriculture guarantee production of citrus on a year-round basis. Supply chain diversification reduces dependence on certain regions, making production and pricing stable. |

| Market Growth Drivers | Increased incorporation of citrus water into fitness and well-being regimens, supported by influencer support for health, drives growth. Increased product availability at convenience stores and e-commerce sites maximizes market penetration. |

The USA market of citrus-flavored water is experiencing gradual growth with increased demand for functional water with clean-label ingredients from the customers. The customers are searching for healthy and refreshing drinks, and therefore there is growing demand for citrus-flavored waters. The millennials and Gen Z generation are particularly the drivers of this trend through the consumption of plant-based products for hydration and elimination of sweetened drinks.

The trend of premiumization in the USA beverage industry also drives this trend, wherein companies promote craft citrus waters based on locally grown and organic products. Convenience through the subscription citrus water scheme is also a common driving growth force in the business due to online retailing.

Functional waters with added electrolytes and antioxidants have particularly become trendy among wellness-conscious and health-conscious athletes, thereby making such drinks mainstream in a hub of healthier lifestyle. Convergence of functionality, convenience, and health-friendliness is driving the USA citrus water market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

In the United Kingdom, the demand for citrus water is expanding, as the nation's stringent measures to cut down on sugar and rising consumer trend towards natural low-calorie beverages over sweetened ones drive demand.The introduction of the Soft Drinks Industry Levy on sweetened beverages pushed businesses to create healthier options,including citrus-flavored waters with no added sugar or artificial sweetener. As urban consumers increasingly looked for substitutes for sweet sodas, bubbly citrus water was number one.

Drinkability in the sense of drinking on the move, particularly in the city, has also increased demand for convenience store- and supermarket-dispensed citrus water. The green brands are also doing well with their customers. They also invest in green packaging material such as biodegradable packs or glass containers because of increasing awareness regarding the environment.

Because of increasing awareness regarding health and reverting back to health and the environment, UK citrus water is still a growing market as well as following health trends and green trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

EU water business in citrus relies on the cross between premium consumer demand for organic and natural products and regulation. EU labeling transparency policy is trendy for increased production of citrus water, particularly in Italy, Germany, and France. Locally sourced citrus fruits such as Sicilian blood oranges and Mediterranean lemons have appeal as premium drinks.

Functional hydration is trendy too, from citrus-flavored waters that are probiotic and adaptogen, and other wellbeing-enhancing choices. EU consumers care more about the world and want companies to care about sustainable packaging and sourcing. That has led brands to embrace more use of recyclable materials and the provision of organic certification.

Also propelling expansion in the European sale of citrus water is expansion in channels of sales in health food stores and on-line specialty store sales, both of which are complementary to consumers' desire for all-natural and healthy foods."

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.5% |

The Japanese market for citrus water is booming as a result of Japanese beverage functional culture as well as tremendous consumer demand within the nation for high-quality and premium drinks. Citrus is a favorite Japanese consumer option with yuzu and sudachi varieties driving demand and growing in popularity as citrus water drink flavorings.

They are long-time favorites and most sought after for their intense, aromatic characteristics that the discerning market for Japanese beverages is so well placed to supply. Japanese focus on health and longevity is also complemented by increased drinking of vitamin-fortified citrus water that delivers health benefit and hydration in a bottle.

Convenience is a ginormous growth factor because citrus water products are normally put in resealable single-serve containers to accommodate Japan's fast-paced, busy lifestyle. Vending machines and convenience stores are primary distribution channels for citrus water so it is actually made available to consumers. With its increasing market growth, Japan's citrus water market is now even focusing on conventional flavors as well as modern-day convenience trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

South Korea's citrus water market is developing at a very rapid rate with the country's expanding health and wellbeing industry at the center. With increasingly Korean consumers becoming health-conscious, diet and healthy foods such as detox water have an empty space of trend in the market. There is higher demand for zero-sugar versions of citrus water because consumers seek beverages that suit their healthy lifestyle choice.

In addition to the health benefit, South Korean consumers also demand beauty-elevating beverages, and to this end, they have on hand new such products such as citrus water with collagen. It is a product of the prevalent robust beauty culture here that combines health with skincare and anti-aging. The fashion-forward soft drink market and coffee culture of South Korea also support the sustainability of craft citrus water.

Native brands are experimenting with new and foreign flavors like honey citron and ginger lemon to reach the more exotic flavor segments of the market. South Korea's citrus water market has a future perspective of sustained growth and expansion with the future drivers of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Premium citrus water is the biggest market segment of citrature water due to customers demanding more premium, health-focused hydration drinks. Premium citrus water brands such as Sanpellegrino and Perrier have sophisticated recipes with organic ingredients, cold-pressed citrus oils, and functional ingredients such as electrolytes and antioxidants.

This segment is driven by increased health awareness, particularly among urban-based consumers seeking alternatives to added-sugar soft drinks. The economic segment, though with secure demand, is for value shoppers who care less about price versus premium attributes. Private labels and regional brands are fighting hard in this segment, which enables greater distribution in value shopper markets.

Lemon and Citrus Blend Flavors Reign Supreme Because of High Demand from Consumers Lemon-flavored citrus water reigns supreme, thanks to sour taste, detoxing perceived traits, and dieter popularity. Global players such as Hint and Vitamin Well have capitalized on this by introducing lemon-flavored varieties targeting health-conscious consumers.

Citrus fruit mixes, wherein it involves over a single citrus item like grapefruit, orange, and lime, are gaining increasing popularity broader on the premise of its multi-faceted purpose in the mouthfeel in conjunction with greater nutrition.

Experience shoppers like such a segment high in hopes that it is going to comprise greater depths in terms of taste complexity levels. Or grapefruit and lime taste profiles also niche with others who need enriched, stinging tastes which is traditionally deemed to be included with craft, specialty drinks.

Glass packaging is leading in the packaging of citrus water with the brands' and consumers' demand for sustainability through environmentally friendly packaging. Glass packaging is applied mainly by high-end brands such as VOSS and Topo Chico simply to emphasize premium status and minimize the use of plastic.

Plastic bottles are still market leaders based on market share owing to lightness and convenience, particularly within the on-the-go segment. Tins are gaining momentum with their recyclability and increasing use in functional and sparkling citrus water brands, particularly in North America and Europe. Cartons and biodegradable pouches are among the new packaging types as eco-friendly alternatives for green consumers.

New retail outlets, hypermarkets, and supermarkets remain the largest channel of distribution for citrus water with increased promotion and variety being offered to the consumer. Retail chains such as Walmart, Tesco, and Carrefour offer premium and economy brands of citrus water for different segments of consumers. Internet stores are expanding at a very fast rate with online-based grocery shopping becoming popular.

Channels like Amazon, Instacart, and specialty health-oriented online stores provide direct-to-consumer channels, which will probably package citrus water with other health beverages. HoReCa like hotels, restaurants, and bars also play an important role in the market, as citrus water is utilized in cocktail mixers, wellness menus, and upscale hospitality. Specialty stores like organic and health food stores target the niche consumer for organic or additive-free citrus water.

The citrus water category is a dynamic and competitive market with international players and regional giants driving its growth. Market leadership is characterized by market-driven formulations, natural sourcing, and trends in branding. Clean labeling, eco-friendly packaging, and new-age flavor infusions are the trends being adopted by companies to differentiate themselves.

Multinational beverage major players have the maximum market share, but small craft brands and new entrants are not behind as they are emphasizing organic and functional health benefits.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| PepsiCo, Inc. | 18-23% |

| The Coca-Cola Company | 15-20% |

| Nestlé S.A. | 10-14% |

| Danone S.A. | 7-11% |

| Spindrift Beverage Co. | 4-8% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| PepsiCo, Inc. | Offers citrus-infused sparkling and still waters under brands like Bubly and Aquafina. Invests in sustainable packaging and reduced sugar content. |

| The Coca-Cola Company | Markets citrus-flavored enhanced waters through brands like Dasani and Smartwater. Expands into functional beverages with added vitamins. |

| Nestlé S.A. | Provides citrus-infused mineral water through brands like Perrier and San Pellegrino. Focuses on premium and organic sourcing. |

| Danone S.A. | Develops flavored water under Evian and Volvic, integrating natural fruit extracts. Commits to carbon-neutral production. |

| Spindrift Beverage Co. | Pioneers real fruit-infused sparkling water, using fresh citrus juices. Emphasizes transparency with no artificial flavors or sweeteners. |

Key Company Insights

PepsiCo, Inc. (18-23%)

Its Bubly brand leads the citrus water segment with a number of natural citrus flavors like lime, grapefruit, and lemon. It is also an ad investment firm as well as a sustainability company that utilizes 100% recyclable aluminum cans.It is attempting to reduce reliance on artificial sweeteners and expand its portfolio of hydration products even further.

The Coca-Cola Company (15-20%)

The Coca-Cola Company utilizes its leading brand position by marketing citrus-flavored waters under Smartwater and Dasani. Recent additions have been vitamin-enriched citrus water for health-oriented consumers. The company has pushed its product lines deeper into zero-calorie citrus in an attempt to stay ahead of shifting consumer trends.

Nestlé S.A. (10-14%)

Nestlé is high-end positioned in the citrus water segment with Perrier and San Pellegrino brands. The mineral waters have faint traces of citrus, which appeal to high-end consumers. Nestlé continues to improve its processes of water sourcing and sustainability, such as carbon-neutral processes in operations.

Danone S.A. (7-11%)

Danone focuses on wellness and simplicity through the spotlighting of its citrus-flavored water lines, most notably Evian+ and Volvic Touch of Fruit. The firm invests in carbon-neutral accreditation as well as responsible water management with a focus on environmental sustainability. Its citrus-flavored water pack lines appeal to consumers seeking healthier, naturally flavored beverage experience.

Spindrift Beverage Co. (4-8%)

Spindrift upset the citrus water category by delivering products made using real squeezed citrus juice. As a contrast to industry standard usage of flavor essences, Spindrift stands out as the company that does juice content opaque and no added artificial sweetener. The company has built a committed consumer customer base looking for new, pure taste experiences.

Other Key Players (30-40% Combined)

In addition to the dominant brands, several regional and niche companies play a significant role in market growth, emphasizing innovation, organic sourcing, and sustainable packaging. Key contributors include:

The overall market size for the citrus water market was USD 12.1 million in 2025.

The citrus water market is expected to reach USD 59.8 million by 2035.

The increasing consumer inclination towards healthier alternatives to sugary soft drinks is a key factor driving the citrus water market's growth.

The top 5 companies driving the development of the citrus water market are PepsiCo Inc., Suntory Beverages & Food Ltd., Super Bock Bebidas, Mountain Valley Spring Company, and Nestlé S.A.

On the basis of source, lemon-based citrus water commanded a significant share over the forecast period, holding over 36.3% market share in 2023.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.