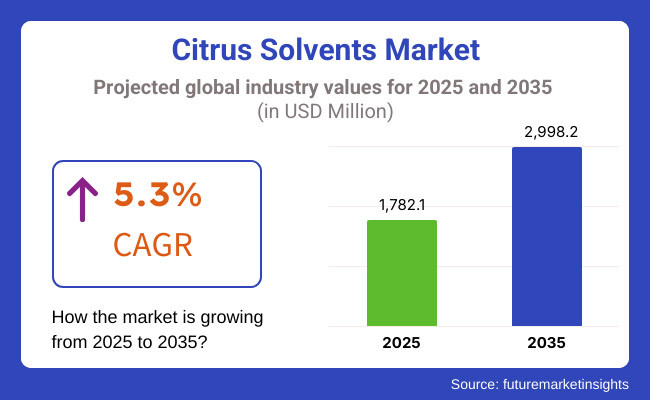

The Citrus Solvents market will have huge growth from 2025 to 2035 with growing demand in applications like cleaning and degreasing, food processing, cosmetics, and coatings. The market will rise to around USD 1,782.1 million in the year 2025 and up to USD 2,998.2 million in the year 2035 with 5.3% compound yearly development rate (CAGR) during the duration of the analysis period.

There are many reasons behind the expansion of this market. The largest single reason is increasing demand for green, bio-based solvents that are replacing dangerous man-made chemicals. Citrus extract-based solvents such as orange and lemon peels are rapidly gaining popularity at large scale levels as well because they are biodegradable and of general use in industrial and domestic cleaning applications.

Automotive and manufacturing sectors, for instance, use citrus solvents to degrease metal parts without VOC release. Volatility in the market, however, is caused by unstable raw material prices and supply chains to justify investing in manufacture value chain and sustainability.

Solvents from citrus are classified based on occurrence or application into classes. Common product classes are d-limonene, citrus terpenes, and concentrate citrus oil. D-limonene orange peel is employed at a widespread level as paint thinner and adhesive stripper and industrial solvents. Terpenes of citrus oils are employed as printing ink and coating and petroleum solvent-free cleaners.

Personal care and cosmetic chemicals formulated from broad-range citrus oils are used owing to the natural fragrance and antibacterial activities. Uses of such solvents are controlled in comparatively cleaner environment areas such as food and beverage sectors using citrus solvents for replacement of synthetic additives used for stripping flavor as well as sanitizing food items.

Explore FMI!

Book a free demo

North America is also a market leadership position in terms of availability of stringent regulation that detests synthetic solvents and growing demand for environmentally friendly solutions.United States and Canada are also among the largest consumers, i.e., in the automotive and industrial cleaning industry. The stringent VOC regulation brought into the market by the Environmental Protection Agency (EPA) has compelled firms to use plant-based solvents like d-limonene.

Aside from that, the bio-based solvents market for cosmetics and personal care is increasing with local players laying great emphasis on green sourcing of ingredients. US players are spending on R&D to purify and upgrade citrus solvents at the expense of not compromising on green chemistry principles.

Europe has the largest market share of citrus solvents because regulatory bodies have been encouraging minimization of pollution and green consumers are demanding so. France, Germany, and the UK dominate the industry and home cleaning market because citrus products are being used on a mass level as a replacement for traditional solvents.

French and Italian pharmaceuticals and cosmetics market is employing the citrus solvents primarily for antibacterial purposes as well as moisturizing the skin. EU REACH regulation is also encouraging production of citrus-solvent products compositional eco-friendly but highly concentrated for applications in coatings, paints, and adhesives.

The maximum growth in the citrus solvent market will be experienced by Asia-Pacific because of industrialization, an increased level of ecological awareness, and greater usage of green solutions by industries. Indian, Japanese, South Korean, and Chinese auto, textile, and food processing industries are monolithic industries and thus hugelike markets.

Citrus solvents are used in Indian and Chinese defatting, surface washing, and food extraction. Their being faced with higher industrial detergent demand from citrus owing to the regulation of solvent emissions in South Korea and Japan owing to the same is something concerning. Ambiguity on their part with respect to citrus fruit production to raw material altering prices is something concerning them.

In response to the same, the firms are turning green and recycling citrus wastage to allow stable raw material supply.

Challenge

Raw Material Price Volatility

Production of citrus solvent is dependent largely on the peels of citrus fruits, i.e., oranges and lemons.

Raw material prices are typically seasonally fluctuating rates, weather disruptions, and world markets trade volatilities, thereby making supply chains unreliable. Second, competition in food and beverages of citrus fruits again focuses on available current production of solvents. Firms are to implement stable sourcing practices, e.g., by collaborating with organizations that manufacture citrus juice in an attempt to utilize peel waste effectively.

Opportunity

Development of Sustainable and Bio-Based Solvents

Higher requirements for sustainability offer a viable alternative to citrus solvents. Industrial processes for circular economy are under investigation whereby wastes citrus from food processing plants are being diverted as value-added materials as solvents. Also, progress in biotechnology also offers the technology to produce citrus solvents of purity and quality specifications for industrial applications as well as domestic consumption.

Increase in demand for e-label certification and consumer recognition of natural products are also fueling demand for citrus solvents in personal care, pharmaceuticals, and home cleaning. New formulation technologies, such as emulsified citrus solvents with enhanced solubility and ease of use, will propel the market.

In 2020 to 2024, the citrus solvents market grew because petrochemical solvent replacement by industries using bio-degradable and natural solvents accelerated. Demand from the end-user for non-toxic and organic products necessitated VOC emissions to be minimized, thus growing the market. Use of citrus adhesives, coatings, and cleaners was more innovative in industry.

Sustainability will be an iconoclastic movement from 2025 to 2035 due to the fact that industries will be propelling waste valorization, solvent efficiency, and formulation sustainability.

The future technology with citrus-based bio-solvents will drive citrus-based bio-solvents of higher solvency strength, expanded applications in motor care, pharmaceutical formulation, and cleaning computer hardware. The company will develop general uses of citrus solvents in industrial cleaning, agrochemicals for protection, and organic pesticide control and thereby create a gigantic majority of green chemistry activity globally.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory frameworks for minimizing petroleum solvent use for industrial and cleaning applications. VOC restrictions resulted in more extensive use of citrus alternatives. |

| Technological Advancements | Innovations in extraction processes improved the effectiveness of citrus solvent manufacture with increased yield and purity. Engineered blends of higher solvency potential grew more popular. |

| Industrial Cleaning Applications | Citrus solvents became recognized as environmentally friendly substitutes for conventional degreasers in industrial cleaning operations. Cost and supply chain dependability issues, however, stifled large-scale adoption. |

| Paints & Coatings Sector | Growing demand for low-VOC coatings stimulated use of citrus-based solvents, especially in consumer paints and varnishes. |

| Adhesives & Sealants Industry | Use of citrus solvents was moderate because of limited performance in some adhesive applications. Specialty forms, however, carved out niches in the market. |

| Aromatherapy & Personal Care | Citrus solvents had wider uses in fragrance materials and natural cosmetics, stimulated by consumer demand for plant-derived ingredients. |

| Agricultural Applications | Citrus oil derivatives were investigated as natural pesticide adjuvant chemicals and farm cleaners. Large-scale usage was minimal. |

| Supply Chain Dynamics | Fluctuations in citrus fruit yields affected the supply and price of citrus solvents. Relying on large production regions presented supply chain risks. |

| Market Growth Drivers | Spurred by sustainability concerns, greater regulation of toxic solvents, and growing consumer demand for natural ingredients. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent environmental regulations mandate reduced VOC limits, driving further demand for citrus solvents that are biodegradable. Plant-based solvents are encouraged by governments in coatings, paints, and cleaning agents. |

| Technological Advancements | Green chemistry innovation leads to more efficient distillation processes with reduced energy consumption and enhanced sustainability. Nano-structured citrus solvent formulations deliver higher performance in specialty coatings and precision cleaning. |

| Industrial Cleaning Applications | Increased demand for non-toxic and biodegradable degreasers propels citrus solvent usage in industrial markets. Improved formulations meet the need for high-performance cleaning applications in aerospace and electronics production. Technological development in bio-based solvents leads to a further turn toward citrus-derived products in industrial and architectural coatings. Increasing emission controls continue to drive the trend. |

| Paints & Coatings Sector | Citrus-based solvent blends benefit from advances in efficacy in adhesive applications. Eco-labeling patterns stimulate uptake in construction and packaging adhesives. |

| Adhesives & Sealants Industry | Increased knowledge of synthetic chemical hazards stimulates demand for natural solvents in perfumes, skincare, and haircare products. New biotechnology facilitates customization of citrus-based solvent blends. |

| Aromatherapy & Personal Care | Growth in organic agriculture and biopesticide sectors consolidates demand for citrus-based agricultural solvents. New emulsification technologies increase effectiveness in pest control applications. |

| Agricultural Applications | Investments in diversified sourcing and better waste valorization strategies improve supply stability. Circular economy practices maximize citrus peel use for solvent manufacturing. |

| Supply Chain Dynamics | Green chemistry applications expansion, increasing investments in bio-based solvents, and regulatory drives for low-VOC products drive long-term market expansion. |

| Market Growth Drivers | More stringent environmental regulations mandate reduced VOC limits, driving further demand for citrus solvents that are biodegradable. Plant-based solvents are encouraged by governments in coatings, paints, and cleaning agents. |

United States United States solvent demand for citrus is increasing as increasing demand for biodegradable coating, paint, and cleaning solutions is on the rise. Restrictions on VOC emissions are causing companies to switch over to plant solvents to a degree that citrus derivatives are the best available substitute. Home and industrial cleaning is one of the largest users, and there is big growth in environmentally friendly surface cleaners and degreasers.

The expansion of the cosmetics and personal care market also drives the market growth. The shift towards natural ingredients in perfumes and skincare is driving the demand for citrus-based solvents in perfumes. Additionally, formulation innovations in citrus solvents blends increase their applications in coatings and adhesives, thereby increasing the market as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

United Kingdom citrus solvents market is fueled by the going green trend in industrial processes, with normative policies such as REACH driving the adoption of bio-based solvents. Increased demand from the paints, coatings, and adhesives sector is improving market penetration. The driver for green cleaning products for industrial and commercial use also positively influences growth.

UK fragrance and cosmetics markets are also witnessing rising demand for citrus solvents, particularly in organic and natural product lines. Investment in solvent technology based on bio-based technology is also driving innovation, which allows citrus solvents to be utilized more extensively in various industrial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

European Union citrus solvents market is moving very well with the help of strict environmental laws making it easy to use low petrochemical-based solvents. The strong market demand for citrus products is fueled by the dominance of the coatings, adhesives, and personal care segments in Europe. Germany, France, and Italy are key drivers, utilizing innovation in green chemistry to boost capacity.

The food and drink industry of the European continent also finds uses in citrus solvents in natural reclamation of flavors and in cleansing, whose non-industrial application is growing by the day. Compliance with VOC regulations and the need for being environment-friendly means that increased demand is continuously observed in citrus-based solvents across various industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.5% |

Japan's solvent market for citrus is expanding with expanding applications in precision industries like automobile and electronics. The nation maintains a healthy environment and hence the industries are promoting the use of bio-based solvents as metal cleaners, surface treatment chemicals, and as coating chemicals.

Higher demand for natural fragrance and biobased cleaning chemicals is also stimulating the market. Better solvent-refining technology provides enhanced performance attributes, which drive higher application in specialty industrial applications such as coating optical lenses and semiconductor cleaning.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

South Korea's citrus solvents market is expanding with the fast growth of the automotive, electrical, and chemicals sectors. Favorable government policies promoting green manufacturing propel the use of bio-based solvents in industrial cleaning and coating. The market also witnessing growing use of citrus solvents in the household products and personal care category.

Better formulation technology and extraction technology is reducing the cost of citrus solutions and making them more cost-effective, keeping the market growing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Conventional citrus solvents lead in the market as they are conveniently cheap to obtain. Citrus solvents, in traditional form, derived from orange peels and other citrus fruit peel, are used extensively in industries and domestic purposes due to their phenomenal power of solvency and natural degreasing action.

Domestic paints and coatings, printing ink, and cleaning products are some of the businesses that have been using traditional citrus solvents extensively as these provide an acceptable yet more affordable option compared to synthetic solvents like mineral spirits.

Apart from this, traditional citrus solvents are used in large-scale production in uses where the cost sensitivity comes first. An example is where it is being used in industry for degreasing, which is being replaced by petroleum solvents since it is biodegradable. The organic citrus solvents are popularly being requested despite their cost since the incredibly high price coupled with the currently low volume of production makes it the largest group in the entire world.

Natural citrus solvents that come from GMO-free and pesticide-free citrus extracts are increasingly favored with markets that include skin care, hair care, cleaning applications, and pesticide usage. Natural citrus solvents because they are harmless and easy to biodegrade in form have been labeled by the businessperson and ecologist as the top-priority item.

There is a complementary brand movement of the sustainable kind from Europe and North America that has engendered demand for the kind of organic citrus solvents as an alternative to the conventional petrochemical solvent.

Organic citrus solvents became an appropriate consumer for the cosmetic and the personal care business in addition to serving as a natural emollients and carrier of the essential oils. Organic citrus solvents are, for instance, utilized in cleansers by companies producing skin care and in remove-up. Further, the regulation of green chemicals will spur the market of organics irrespective of elevated manufacturing cost when contrasted with standard citrus solvents.

The domestic and industrial cleaners category remains the biggest demand driver for citrus solvents because of their grease-cutting nature and odor profile. Citrus solvents are used extensively across multi-purpose cleaners, degreasers, and floor care goods, particularly in green products that have replaced traditional chemical-based cleaners.

The demand for environmentally friendly cleaning products in domestic houses and commercial premises has witnessed increasing utilization of citrus cleaners, particularly those with stringent environmental conservation regulations such as the EU and California, USA.

In industrial applications, citrus solvents are the primary preference of choice in heavy equipment machinery and car part degreasers, boasting a robust secondary option to standard petroleum-based solvents. To illustrate, manufacturing plants in North America and vehicle repair shops increasingly utilize citrus-derived cleaning solutions as they are very efficient in dissolving oil residues without weakening metallic surfaces. As such, an emphasis on sustainable use further extends the dominance of this application area in the global market.

The paint and coatings business is increasingly turning to citrus solvents as a replacement for traditional VOCs, driven by environmental regulatory limits on emissions of environmentally hostile solvent vapors. Citrus solvents are used as paint thinners, varnishes, and graffiti removers and offer low-toxicity and biodegradable alternatives with no sacrifice of performance.

Particularly, waterborne and low-VOC coatings are gaining popularity in the architectural coatings and automotive coatings industries, to which citrus solvents play a critical role of delivering the necessary solvent compatibility and drying characteristics. Greater use of green coatings on commercial, residential, and restoration projects, such as restoration of heritage buildings, has also increased demand for citrus solvent solutions.

Among all the sales channels, web retailers are experiencing rapid growth in the sales of citrus solvents. Customers are increasingly asking for direct-to-consumer (DTC) types of sales more and more. Web sites offer the convenience of a shopping experience for independent buyers and small-volume manufacturers looking for specialty solvents in large or small volumes.

Green chemical and environmentally friendly home product Web sites also contributed to the surge online. For instance, specialty e-retailers dealing in eco-friendly items and huge e-retailers such as Amazon provide the chemical industry a diverse range of citrus solvents ideal for uses such as application in cleaning agents, personal care applications, and use in an industrial setting.

North America and the European continent witness the greatest level of online market trend replacement of traditional sale medium, and customer demand here for purchasing product goods online played the most instrumental factor in impelling the chemistry buy trend by industries.

Though direct selling and specialty stores are old-fashioned channels that continue to be major sources of industrial bulk purchases, e-commerce and electronic marketing strategies have transformed the means through which citrus solvents reach end-users in different markets of application.

The competitive landscape of citrus solvents is an oligopoly-dominated market led by the presence of giant multinational manufacturers and networks of local manufacturers leading the expansion of industry. Market share is dominated by market players with green chemistry, innovative solutions to industries such as industrial cleaning, degreasing, adhesives, coatings, and personal care.

Businesses are concentrated on sustainable sourcing, bio-based chemistry, and enhanced extraction technologies in order to be competitive. There are established companies and start-ups within the industry, both of which drive dynamism in the market as well as product innovation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Florida Chemical Company | 15-20% |

| Citrus and Allied Essences | 10-14% |

| LemonConcentrate S.L. | 7-11% |

| Citrosuco | 5-9% |

| Ventura Coastal LLC | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Florida Chemical Company | Manufactures high-purity citrus terpenes and d-Limonene for industrial degreasing and cleaning applications. Specializes in environmentally friendly and biodegradable solvent solutions. |

| Citrus and Allied Essences | Expert in citrus-derived aroma chemicals and essential oils for fragrance, flavor, and natural solvents. Invests in high-technology extraction processes. |

| LemonConcentrate S.L. | Creates citrus-based products, such as d-Limonene, for food, beverages, and cosmetics applications. Excels at end-user-industry-specific customized solutions. |

| Citrosuco | Provides citrus oils and terpenes to the agricultural, industrial, and personal care sectors. Known for its vertically integrated citrus processing facilities. |

| Ventura Coastal LLC | Produces citrus-based solvents for coatings, paints, and cleaners. Is an expert in organic and environmentally friendly substitutes for petroleum-based solvents. |

Key Company Insights

Florida Chemical Company (15-20%)

Being the market leader in citrus solvents, Florida Chemical Company is a d-Limonene specialist of high quality and citrus terpenes for industrial degreasing, cleaning, and adhesives. The company is committed to sustainable solutions with a predominant focus on biodegradable formulation to replace conventional petroleum-based solvents. With its international distribution network and R&D expenditure, it leads the way in citrus solvent innovation.

Citrus and Allied Essences (10-14%)

Citrus and Allied Essences is a premier manufacturer of citrus-flavored aroma chemicals, natural solvents, and essential oils. It is a leader in the market for flavors and fragrances and has special orders with customized citrus extract for specific purposes. It renovates its extraction plants from time to time with the latest technology available in the market for improving the purity, effectiveness, and recovery in producing citrus solvents.

LemonConcentrate S.L. (7-11%)

LemonConcentrate S.L. is a worldwide citrus-based ingredient leader with solutions for the food, beverage, and cosmetics markets. It produces higher-quality d-Limonene and other citrus solvents for various industrial uses. It is recognized as having the ability to provide customized solutions depending on the unique processing requirements of its customers while holding the concept of sustainability in its heart.

Citrosuco (5-9%)

Citrosuco is a major producer of citrus terpenes and citrus oils for use in agriculture, personal care, and industry. Citrosuco's vertically integrated citrus processing plants supply regular sources of citrus solvents of high quality. Citrosuco is best known for maximizing citrus by-products to minimize waste and maximize sustainability in solvent production.

Ventura Coastal LLC (3-7%)

Ventura Coastal LLC is a premier producer of citrus-derived solvents applied in coatings, paints, and cleaning agents. Ventura Coastal has gained wide recognition for its green and organic products, which offer effective substitutes for petroleum solvents. Ventura Coastal applies its expertise in citrus processing to deliver high-performance bio-based solvent solutions.

Other Key Players (45-55% Combined)

Several companies collectively hold a substantial market share, contributing to product innovation, cost competitiveness, and sustainability initiatives. These include:

The overall market size for the citrus solvents market was USD 1,782.1 million in 2025.

The citrus solvents market is expected to reach USD 4,562 million by 2035.

The increasing consumer demand for eco-friendly products, preference for safer alternatives to traditional chemicals, and diverse applications across industries like manufacturing and automotive are expected to drive the demand for the citrus solvents market during the forecast period.

The top 5 countries contributing to the development of the citrus solvents market are the United States, China, India, Brazil, and Germany.

Based on application, the industrial and domestic cleaners segment is projected to capture higher growth over the forecast period in the global citrus solvents market.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.