The Citrus Pulp Market will show consistent growth from 2025 to 2035 as the animal feed industry and food and beverage sector along with biofuel segment increase their demand. Citrus juice processing generates pulp through residue which serves as a feed ingredient that contains abundant fiber content as well as a natural sweetener and fermentation base.

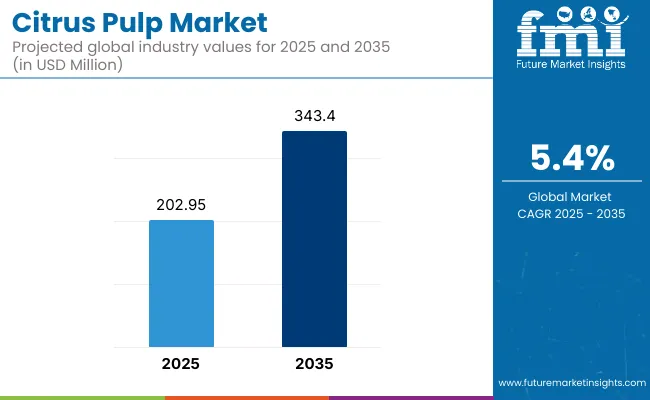

Between 2025 and 2035 the market expects it will grow from USD 202.95 million to USD 343.40 million at a 5.4% compound annual growth rate.

The market extends because producers focus on both affordable and environmentally friendly feed solutions and consumers desire natural food substances with functional properties. The markets value citrus pulp for its nutritious value as well as its ease of digestion and its potential use for green fuel creation.

Market expansion for citrus pulp is faced with control issues stemming from variable citrus fruit yields together with transportation expenses and requirements for proper by-product usage management. Profit enhancement strategies involve manufacturers who direct their efforts toward process improvements and new application research along with waste reduction efforts.

By product type, the citrus pulp market is segmented into citrus pulp pellets and dry citrus pulp. Dried citrus pulp, fresh citrus pulp, the various types of products are as follows: Due to its high energy and longer shelf life, dried citrus pulp is commonly employed in animal feed formulations, while raw citrus pulp is preferred for direct livestock feeding and fermentation-based applications.

By application, the animal feed segment holds the largest market share, where citrus pulp is used as a fiber-rich, energy-dense ingredient for cattle and poultry feed. The food and beverage industry uses citrus pulp as a natural sweetener and texture-improving ingredient in processed food and bakery food. It is also used in the biofuel industry, in this case, as raw material for the production of ethanol.

High demand for both livestock feed and for the production of sustainable biofuels drives North America to be a key market for citrus pulp. Citrus pulp is increasingly being adopted as a low-cost, nutrient dense alternative feed ingredient in the United States and Canada. In addition, government backing of agricultural by-product utilization is stimulating innovation in how citrus waste is processed, and applications of alternative energy.

Europe accounts for a large share of the citrus pulp market, thanks to the high demand for organic and high-fiber animal feed. EU manufacturers are incorporating citrus pulp into premium feed formulations and are at the forefront of ensuring sustainable livestock nutrition across countries like Germany, France and the Netherlands.

Moreover, rising regulations by the European Union related to the reduction of food waste and the promotion of sustainable agriculture across the region are encouraging market participants to find novel applications of citrus pulp in food and industrial applications.

The Asia-Pacific region will be position for the greatest growth of the citrus pulp market owing to an expanding agricultural industries, rising demand for cost-effective feed solutions as well as growing awareness regarding natural food ingredients. Aside from that, nations such as China, India, Japan and Australia are investing in sustainable feed production, which promotes the use of citrus pulp in dairy and poultry cattle.

Meanwhile, the food processing industry in the region also uses citrus pulp in several products, which is bolstering the market growth.

Perishability and Storage Limitations

Citrus by-products are prone to perishability, and the need for storage and processing capabilities to avoid spoilage poses a key challenge to the citrus pulp market. The high moisture content of citrus pulp promotes microbial growth and renders long-term preservation complicated without specialized drying or fermentation processes.

Another challenge faced by the citrus juice processing industries is the disciple in the supply which creates the impact in the market as well. To overcome these challenges, manufacturers should adopt advanced dehydration techniques, effective preservation methods, and optimized logistics to increase the shelf life of citrus pulp without sacrificing its nutrition.

Expanding Applications in Animal Feed and Functional Foods

Citrus pulp is a source of fiber, antioxidants, and nutrient and is therefore beneficial in animal feed formulations, and functional food. These foods are being used in province for livestock because they are a cheap source of high-energy feed that aid in digestion and overall animal health.

Moreover, citrus pulp is being investigated as a natural source of dietary fibers, polyphenols, and prebiotics in the human food industries to promote gut health. Consumer trends for clean-label and plant-based foods continue to propel suppliers toward functional ingredients from citrus, thus tantalizing opportunities for product diversification and penetration into new markets.

The citrus pulp market showed stable growth from 2020 to 2024 owing to its growing consumption in animal feed, organic fertilizers, and food processing applications. Improvements in drying and fermentation methods also helped with storage stability, but supply chain volatility and perishability remained top of mind.

Market growth will be fuelled by processing innovations, sustainability efforts, and wider applications in functional food and nutraceuticals between 2025 and 2035. It can boost its market potential as they must adopt circular economy principles and integrate citrus pulp into health-oriented products.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Raw Material Utilization | Dependent on citrus juice industry by-products, with fluctuations in supply. |

| Animal Feed Applications | Used primarily as a high-fiber, cost-effective ingredient for livestock feed. |

| Food & Beverage Industry | Limited use in fiber-enriched processed foods and bakery items. |

| Sustainability & Waste Reduction | Initial efforts to upcycle citrus pulp into fertilizers and biodegradable materials. |

| Processing & Preservation | Storage and transportation were difficult because of high moisture content. |

| Consumer Awareness | Recognized mainly for animal feed and agricultural use. |

| Regulatory Landscape | Compliance with agricultural and food safety standards. |

| Market Shift | 2025 to 2035 |

|---|---|

| Raw Material Utilization | Diversified sourcing strategies and improved processing efficiency for year-round availability. |

| Animal Feed Applications | Enhanced formulations with prebiotics and fermented citrus pulp to improve animal digestion and immunity. |

| Food & Beverage Industry | Increased integration into functional foods, plant-based protein alternatives, and prebiotic supplements. |

| Sustainability & Waste Reduction | Full adoption of zero-waste processing and advanced bio refining techniques to extract valuable nutrients. |

| Processing & Preservation | Each of these technologies has advanced the shelf life and usability of food, from drying to dehydration and fermentation. |

| Consumer Awareness | Growing demand in the health and wellness sector for citrus-derived fiber and antioxidants. |

| Regulatory Landscape | Stricter sustainability regulations and organic certification requirements for citrus-based ingredients. |

The United States citrus pulp market is accelerating, due to the increasing adoption in animal feed, food & beverage, and biofuel. The increasing demand for ingredients based on natural fiber in food goods and dietary supplements is also contributing to the growth of the market.

The high fiber and energy provided by citrus pulp has resulted in its use in formulations specifically for livestock and even pet feed, therefore making citrus pulp an interesting feed supplement to use in dairy and poultry diets. Further, the growing transition to sustainable and biodegradable products is expected to create a requirement for citrus pulp in compostable packaging solutions and biodegradable biopolymers.

| country | CAGR (2025 to 2035) |

|---|---|

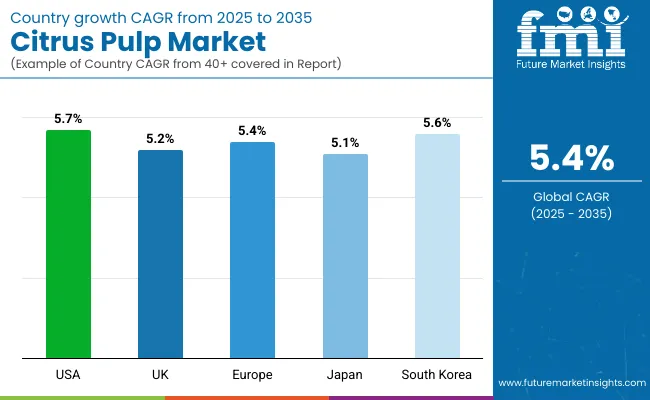

| USA | 5.7% |

Demand from functional food and beverage segment are contributing towards the growth of the UK's citrus pulp market. The increasing acceptance of clean-label and natural ingredients in food processing is driving the application of citrus pulp in juices, smoothies, and bakery items as a natural thickener and stabilizer.

Feed supplements based on citrus pulp are being introduced in the livestock sector not only as a product from the processing of citrus wastes but also as a cheap and nutrient-dense substitute for regular grain-based feed. Another application of increasing interest are the use of citrus pulp as biodegradable and organic fertilizers, which can be attributed to the country's concern for sustainable agriculture.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

Citrus pulp is in high demand in the European Union, with markets growing in Germany, France and Spain. Citrus pulp is a common, digestion-friendly feed additive, particularly for the region’s livestock and dairy industries, which account for a substantial proportion of its use.

Rising consumer interest in sustainable and functional ingredients is leading the food industry to adopt citrus pulp as an ingredient in plant-based meat alternatives and high-fiber processed foods. Moreover, the increasing emphasis on minimizing waste and adopting circular economy principles is driving the utilization of citrus pulp for organic compost and biodegradable packaging.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.4% |

Demand for natural dietary fibers, food applications of fermented food, and feed additives are also driving the Japan citrus pulp market growth. Citrus pulp is being used as a texturizing agent by the functional beverage segment for probiotic drinks and energy beverages. In the pet food sector, citrus pulp is gaining popularity due to its digestive and nutritional advantages for companion animals.

Native starch and its derivatives, such as polylactic acid, and starch blends such as starch-coated corn, have also been studied as packaging materials.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The citrus pulp market in South Korea is growing, due to boost obtained from its broader usage in health-oriented food products, livestock feed, and biodegradable materials. The increasing traction of gut-health beverages is driving the demand for citrus pulp in fermented beverages and fiber-enriched juices.

Moreover, with the trend continuing towards providing sustainable, and even plant-based, pet food, the demand for orange pulp, in particular, is buoying the premium end of the pet food market. Furthermore, improving bio-based materials as well as compostable packaging stimulating the incorporation of citrus pulp in sustainable consumer goods.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

The citrus pulp market is driven by the demand for natural, fibre-rich, and functional citrus-derived food, beverage, and personal care industry ingredients. These pulps which are derived from citrus act as key functional ingredients to offer better texture, increased nutritional content and improved stability and help manufacturers in producing beverage, functional food and natural ingredient systems.

In conclusion, as consumer preferences evolve towards clean-label, plant-based, and functional food ingredients, manufacturers are prioritizing the optimization of citrus pulp extraction, development of its application across diverse industries, and enhancement of compatibility with beverage formulations to stay relevant in the dynamic market landscape.

The segment of oranges has been one of the extensively utilized raw materials in the citrus pulp market, providing an excellent source of fiber, increased water holding capacity, and increased viscosity of food and beverages. Orange has the best textural properties, gelling properties, just right acidity levels, providing the greater functionality compared to pulp of other citruses.

The increasing adoption of standardized fiber composition, of optimized levels of Pulp, and of solubility to meet the demand for high purity orange pulp has fuelled adoption. More than 60% of citrus pulp processors rely on orange, owing to its easy availability, cost-effectiveness, and pulp yield, as a segment, hence, there is strong market demand for it.

Market demand has been reinforced by the development of sustainable techniques for citrus pulp extraction, environmentally sound processing, enzymatic fibre recapture, and citrus waste valorisation optimised by artificial intelligence, resulting in less waste, and better circulation to a circular economy in the citrus processing industries.

Such have been the gains of the AI-powered raw material optimization that automated orange peel sorting, real-time pulp composition analysis and AI-powered tracking of supply chain have each played a part in improving adoption rates from agriculture through to the citrus pulp extraction process, ensuring better control and more efficient workflow.

Customized orange pulp liquid formulations, such as those with high-fiber ingredients, pH-balanced mixes, and sugar-reduced combinations, have expanded market outreach and enhanced compatibility with ever-changing clean-label and functional food formulations.

The orange-derived pulp segment of the global citrus-derived pulp market is challenged by seasonality in commercial production of citrus species, volatility in the prices of raw materials, and changing regulatory landscape around standardization of natural ingredient standards, despite its relative advantages of improving food structure, increasing fiber intake, and compatibility with clean-label formulations.

Yet, advancements such as innovations in enzyme-modified pulp processing, new block chain-enabled traceability solutions, along with an implementation of AI-driven citrus sourcing analytics, are enhancing production and procurement cost-efficiency, product consistency, and market scalability, which promise to catapult the market for orange-derived citrus pulp, across the globe.

Many companies consuming the product segment include, but are not limited to, functional food brands, beverage manufacturers, and product developers focusing on dietary fiber enrichment. As industries adopt the use of orange-derived pulp to enhance product texture, boost nutritional appeal, and facilitate digestive health, the oranges segment witnessing strong adoption.

Compared to synthetic thickeners and stabilizers, pulp derived from orange also provides higher acceptability among consumers, more health benefits, and better hydration-enhancing properties, leading to better market positioning in clean label and natural ingredient formulations.

Revolutionization in molecular fiber structures of your next-generation citrus pulp has fostered adoption owing to the exclusive demand for AI-based enhanced hydration capacity and real-time textural analysis. Over 70% of functional food and beverage brands incorporate orange pulp, as it helps optimise mouthfeel, enhances viscosity, and creates sensory appeal, which guarantees sustained demand for this segment.

For instance, citrus pulp alternatives drop in the class of sustainable citrus pulp applications, including upcycled citrus fibers, biodegradable food packaging films, and plant-based alternatives to emulsifiers, have significantly aided market adoption, Integrating much better to global food sustainability goals and circular economy models.

The upcoming trends in precision fermentation techniques like AI-based microbial pulp modification, IoT-enabled enzymatic degradation control, and custom fiber modification have fuelled the acceptance by ensuring better product consistency and functionality in higher food and beverage applications.

While the segment offers benefits to food formulation stability, nutritional value, and sustainable sourcing of raw materials, the orange derived pulp segment boasts increased competition with alternative plant-based fiber sources, shifting consumer demand for sugar-free formulations, and supply chain limitations in citrus processing.

Nonetheless, future-focused advances in innovations, such as AI-powered formulation adaptation, enzymatic structuring of fibers, and advanced next-gen high-yield citrus pulp extraction, are enhancing product performance, competitive positioning in the market, and formulation scalability, paving the way for sustained growth of orange-derived citrus pulp globally.

The beverages, flavourings, and coatings sub-segment is one of the most adopted application categories in the citrus pulp market and is facilitating beverage brands, functional drink manufacturers, and food coating producers to stabilise formulations, improve mouthfeel and increase fibre content of beverages and food products. Additionally, citrus pulp offers better hydration capability, retention of nutrients, and sensory appeal compared to those of conventional additives, hence a better product and sustainable market in the long run.

Since this product can stabilize low-calorie beverages or act as a high-hydration emulsifier or a fiber fortifier, high-performance citrus pulp has led to increased adoption. According to studies, more than two-thirds of beverage manufacturers prefer the use of pulp derived from citrus instead of synthetic stabilizers, owing to the clean-label appeal and improved digestibility of pulp compared to synthetic stabilizers, as well as its ability to enhance texture naturally, which augurs well for the growth of this segment.

The introduction of a wide range of plant-based alternative beverage products such as citrus-infused hydration beverages, fiber-rich juices and naturally derived emulsions of citrus pulp for flavouring function has driven market demand even higher, fuelling a wider acceptance of citrus pulp as a functional food and beverage ingredient.

AI and its solution to formulation customization which includes machine learning (ML) and viscosity prediction, automated beverage texture modelling, and AI-assisted flavour optimization has further fuelled adoption resulting in better consumer satisfaction and process quality.

Tailored formulations of pulp solutions for beverages and coatings, with natural clouding agents, plant-based texture enhancers, and functional emulsifier networks, have ensured optimal market growth with evolving clean-label and functional food trends.

However, the beverages, flavourings and coatings segment is facing challenges including cost sensitivity in mass-market beverage formulations, increased regulatory scrutiny alongside ingredient labelling, and changing consumer demand for lower-calorie offerings.

Nevertheless, at the other end of the spectrum, innovations in enzyme-modified structuring of citrus fiber, advancements in AI-enabled beverage fortification, and hybrid polysaccharide-stabilizer formulations will further expand product differentiation, cost-effectiveness, and clean-label compliance, safeguarding robust growth in global citrus pulp demand for beverages and coatings.

In this regard, the beverages, flavourings and coatings segment has witnessed considerable adoption, especially amongst brands in the functional beverage, manufacturers of plant-based hydration products, and producers of clean-label food coatings, with the industry witnessing a notable shift towards citrus pulp based stabilization for texture optimization, sensory enhancement and superior product shelf stability.

At the same time, citrus pulp acts as a natural emulsifier/stabilizer, offering superior consumer perception and digestion, as well as natural hydration performance, leading to its better acceptance for health-oriented and premium category products compared to synthetic emulsifiers and stabilizers.

With the balanced formulation driven by AI, enzymatically modified pulp blends, and sugar-free texture enhancers, the adoption of next-gen beverage stabilizers surged high during the forecast period. According to the study, more than three-quarters of beverage brands adding clean-label stabilization currently use citrus pulp for its natural thickening properties, as well as enhanced suspension stability, which helps make this segment one of the most in-demand.

However, considering its benefits for beverage texture, maintaining a stable formulation, and enabling plant-based innovation, various factors such as supply chain fluctuations, regulatory complexity involving claims related to the ingredients, and competitive threats from alternate gelling agents will restrain the beverages, flavourings and coatings segment.

Nonetheless, emerging breakthroughs in precision-formulated hydrocolloids, AI-based sensory modelling, and sustainable citrus pulp sourcing are moving the needle on relative market positioning, cost-competitiveness and consumer acceptance, securing prospects for continued citrus pulp expansion globally.

The citrus pulp market demonstrates steady expansion because it finds essential use in animal feed production and food & beverages manufacturing and biofuel manufacturing. With origins from juice processing Citrus pulp serves as animal feed component and natural food ingredient material and biodegradable package component.

The market expands because consumers require both high-fiber additives and nutrient-rich feed products and plant-based dietary fibers are gaining importance while circular economy waste utilization initiatives receive rising investments. Manufacturers at the forefront focus on developing organic transformation methods while they create personalized ingredients and extend their usage for dietary supplements and biodegradable products.

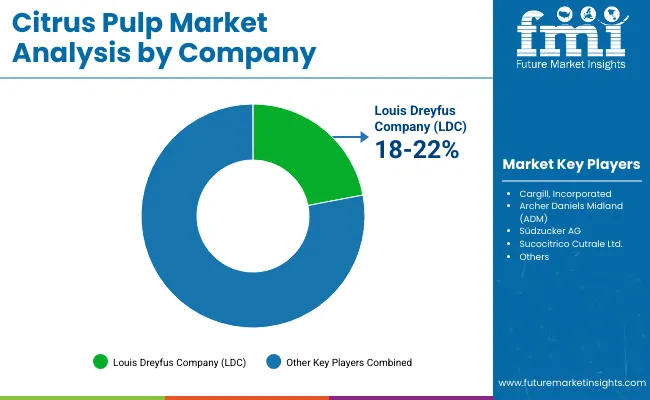

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Louis Dreyfus Company (LDC) | 18-22% |

| Cargill, Incorporated | 15-19% |

| Archer Daniels Midland (ADM) | 12-16% |

| Südzucker AG | 9-13% |

| Sucocitrico Cutrale Ltd. | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Louis Dreyfus Company (LDC) | Produces citrus pulp as a high-fiber animal feed ingredient and biofuel additive. |

| Cargill, Incorporated | Specializes in citrus pulp-based livestock feed solutions, focusing on sustainable agricultural applications. |

| Archer Daniels Midland (ADM) | Develops citrus pulp for functional food ingredients, dietary fiber supplements, and animal nutrition. |

| Südzucker AG | Offers citrus pulp extracts for food processing, pet food formulations, and bio-based industrial applications. |

| Sucocitrico Cutrale Ltd. | Focuses on citrus pulp processing for animal feed, organic fertilizers, and fruit-based ingredient solutions. |

Key Company Insights

Louis Dreyfus Company (LDC) (18-22%)

LDC is a major player in citrus pulp production, offering high-nutrient feed additives and sustainable biofuel solutions derived from citrus processing by-products.

Cargill, Incorporated (15-19%)

Cargill specializes in citrus pulp-based livestock feed, promoting its high-fiber and digestibility benefits for dairy and beef cattle.

Archer Daniels Midland (ADM) (12-16%)

ADM integrates citrus pulp into functional food products, utilizing its natural fiber content for dietary and industrial applications.

Südzucker AG (9-13%)

Südzucker focuses on citrus pulp-based formulations for pet food, organic fiber enrichment, and sustainable packaging materials.

Sucocitrico Cutrale Ltd. (7-11%)

Sucocitrico Cutrale is a key supplier of citrus pulp for feed and organic fertilizer applications, supporting circular economy initiatives in agriculture.

Other Key Players (30-40% Combined)

Several additional firms supply the citrus pulp market through their production of sustainable fiber-rich materials that use bio-based components. Notable players include:

The overall market size for Citrus Pulp Market was USD 202.95 Million in 2025.

The Citrus Pulp Market is expected to reach USD 343.40 Million in 2035.

The demand for the citrus pulp market will grow due to increasing use in animal feed for its high fiber content, rising demand for natural food additives in the food and beverage industry, expanding applications in biofuel production, and growing consumer preference for sustainable and organic ingredients.

The top 5 countries which drives the development of Citrus Pulp Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Oranges and Beverages, Flavourings, and Coatings Desserts Form to command significant share over the forecast period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Citrus Molasses Market Size and Share Forecast Outlook 2025 to 2035

Pulp Roll Cradle Market Forecast and Outlook 2025 to 2035

Pulp Molding Tooling Market Size and Share Forecast Outlook 2025 to 2035

Citrus Seeds Market Size and Share Forecast Outlook 2025 to 2035

Citrus Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulp Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pulpwood Market Size and Share Forecast Outlook 2025 to 2035

Pulp Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Citrus Fiber Market Trends - Functional Applications & Growth 2025 to 2035

Citrus Pectin Market Size, Growth, and Forecast for 2025 to 2035

Citrus Crop Nutrition Market Analysis by Product Type, Application, Sustainability Practices, and Regional Forecast from 2025 to 2035

Pulp Drying Equipment Market Trend Analysis Based on Type, End-Use, Region 2025 to 2035

Citrus Water Market Trends – Growth & Consumer Insights 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Citrus Flavors Market Report – Trends & Innovations 2025 to 2035

Citrus Alcohol Market Trends - Flavor Innovations & Demand 2025 to 2035

Citrus Solvents Market Insights Trends & Forecast 2025 to 2035

Citrus Powder Market Outlook – Growth, Demand & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA